Forex Calls Recap for 3/11/16

A nice winner to close out the week. First, we closed the second half of the prior day's long GBPUSD call in the money, then a new call triggered long in the morning and worked (after a horribly flat overnight). See that session below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered long at A, hit first target at B, closed second half at C for end of week:

Stock Picks Recap for 3/10/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's SLB triggered short (without market support) and worked enough for a partial:

His OIH triggered short (ETF, so no market support needed) and didn't work:

Mark's ASML triggered long (with market support) and worked:

COST triggered long (with market support) and worked enough for a partial:

SRPT triggered long (with market support) and worked:

Rich's CMG triggered short (with market support) and worked:

His MU triggered long (with market support) and didn't work:

His KLAC triggered long (with market support) and didn't work:

His GOOGL triggered long (with market support) and didn't work:

In total, that's 8 trades triggering with market support, 4 of them worked, 4 did not.

Futures Calls Recap for 3/10/16

The markets gapped up a little, pushed a little higher, the Opening Range plays led to small gains, and then dropped to fill the gap and more before returning to the VWAP area for the close, which is no surprise on contract roll. Friday should be a bust. NASDAQ volume was 1.7 billion shares.

Net ticks: +6 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play:

NQ Opening Range Play:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

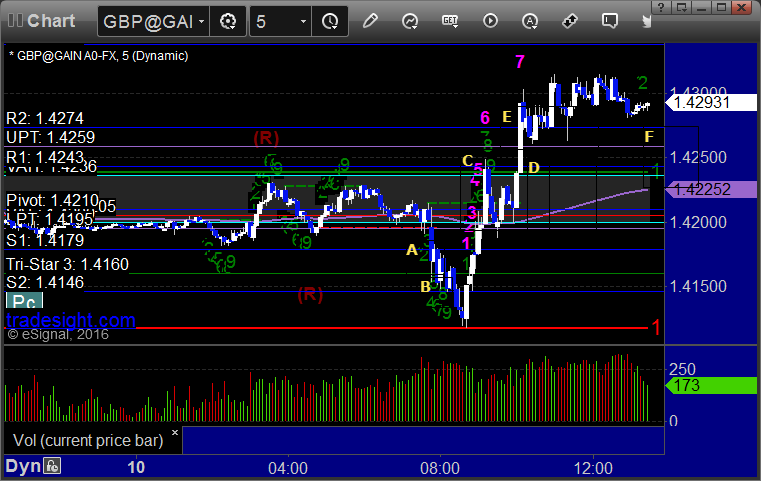

Forex Calls Recap for 3/10/16

A wild ride with the ECB announcement. Two winners and a loser. See the GBPUSD section below.

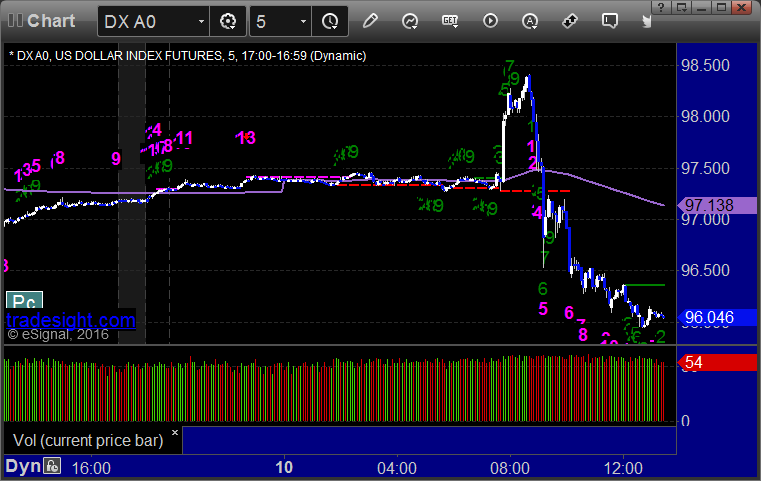

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, stopped second half over entry. Triggered long at C and stopped. Triggered long at D, hit first target almost immediately at E, and still holding second half with a stop under R2 at F:

Stock Picks Recap for 3/9/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QURE triggered short (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's NFLX triggered short (with market support) and worked enough for a partial:

Rich's APC triggered short (with market support) and didn't work:

His BTU triggered short (with market support) and worked enough for a partial:

His AMZN triggered long (with market support) and worked:

His IBM triggered long (with market support) and didn't work:

His NKE triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

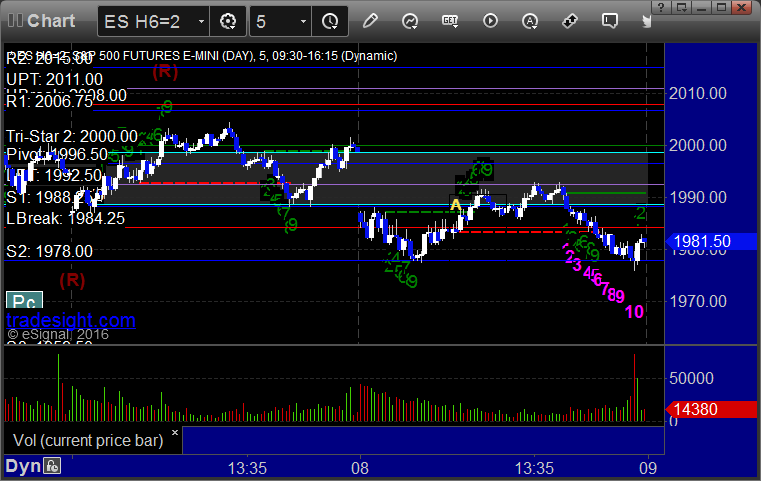

Futures Calls Recap for 3/9/16

The markets gapped up and filled, then rallied back up, then plunged mid morning unexpectedly, then got back to highs and then settled into the middle of the range for the rest of the day on 1.6 billion shares. WE HAVE QUARTERLY FUTURES CONTRACT ROLL starting tomorrow. Opening Range plays worked, and the additional call never triggered on the NQ.

Net ticks: +14.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 3/9/16

Wow, what a flat session. The GBPUSD stuck in a 60 pip range. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Note the Comber 13 sell signal at the UPT was the high:

GBPUSD:

Triggered short very early to the left of A on the chart (should be half size that early) and stopped. Triggered long at B and stopped. Put it back in in the morning and triggered at C, did nothing for hours, and closed it even at the end of the chart:

Stock Picks Recap for 3/8/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed,

Rich's FEYE triggered short (with market support) and worked:

GILD triggered long (without market support) and didn't work:

FSLR triggered short (with market support) and worked great:

Mark's TLT triggered long (ETF, so no market support) and worked enough for a partial:

GILD triggered long again on higher trigger (without market support) and worked enough for a partial:

Rich's URBN triggered long (with market support) and worked:

BMRN triggered short (without market support) and didn't work:

Rich's FB triggered short (without market support) and worked:

His NFLX triggered short (with market support) and worked a little:

In total, that's 5 trades triggering with market support, all 5 of them worked.

Futures Calls Recap for 3/8/16

The markets gapped down and were mixed in terms of direction (ES versus the NASDAQ) for the second day in a row. Ultimately, the NASDAQ side filled the gap. Opening Range plays were mixed and we had a small winner on the ES from another call. NASDAQ volume closed at 1.8 billion shares.

Net ticks: +6.5 ticks.

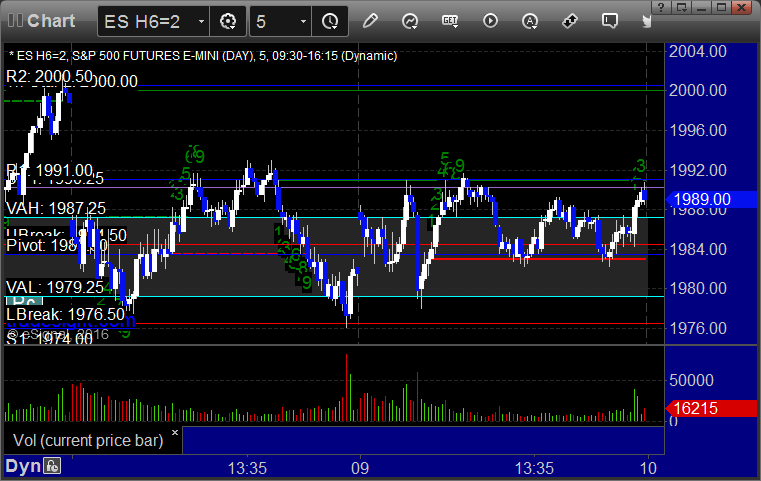

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and stopped:

NQ Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

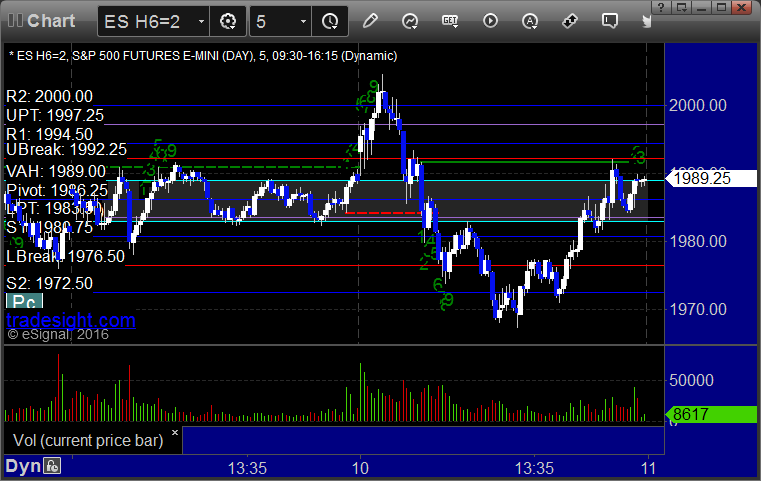

ES:

My call triggered long at A at 1989.00, hit first target for 6 ticks, stopped second half under the entry:

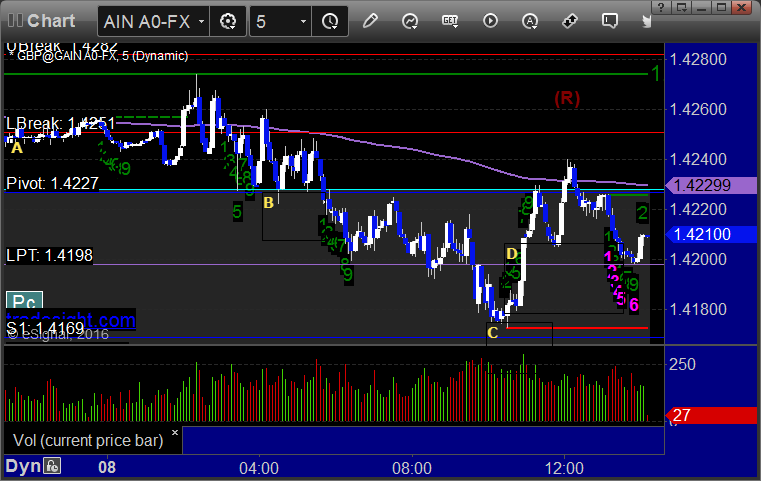

Forex Calls Recap for 3/8/16

We stopped out of the second half of the prior day's GBPUSD trade in the money and then had a winner on the new short. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stopped out of the second half of the prior day's trade under LBreak to the left of the chart at A. New trade triggered short at B, hit first target at C, stopped out of the second half at D: