Futures Calls Recap for 3/3/16

Another slow start as the markets gapped down a little, filled, and then stuck in a narrow range for quite a while. The NASDAQ side closed the day red while the S&P gained a couple of points. Opening Range Plays were mixed. NASDAQ volume was 1.7 billion shares.

Net ticks: -12 ticks.

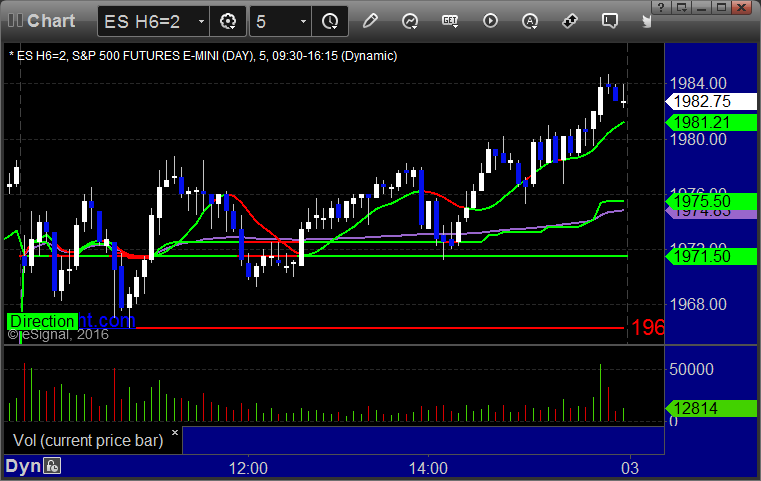

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and stopped:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 3/3/16

Two unfortunate sweeps and then a trigger that is still working, all on GBPUSD, see that section below.

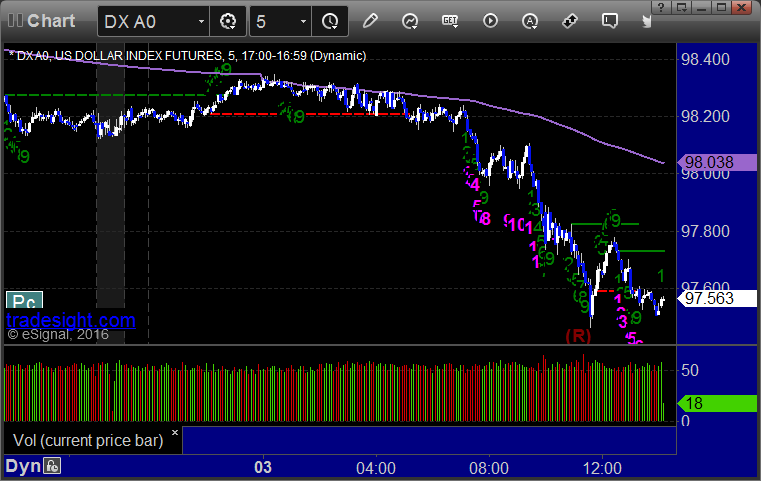

Here's a look at the US Dollar Index intraday with our market directional lines:

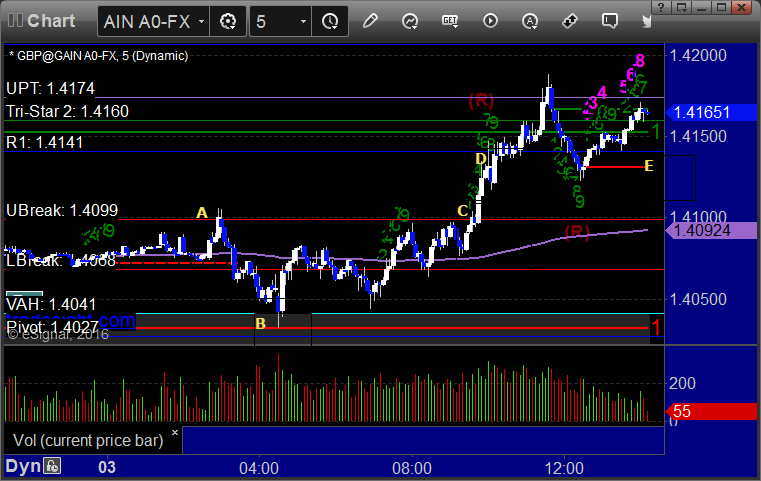

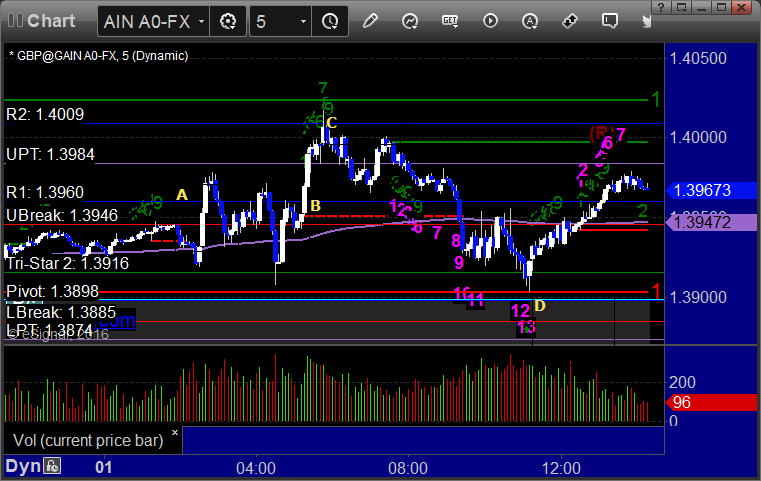

GBPUSD:

Triggered long at A and stopped, triggered short at B and stopped, put it back in in the morning, triggered long at C, hit first target at D, holding second half with a stop under R1 at E:

Rich Derrick’s List of 18 Trading Rules

This is a list of tips for traders from our own Rich Derrick:

1 – Never ever add to a losing position.

2 – Trade like a mercenary soldier.

3 – Mental capital trumps real capital.

4 – We are not in the business of buying low and selling high.

5 – In bull markets, one must only be long or neutral.

6 – Markets can remain illogical far longer than you or I can remain solvent.

7 – Buy that which shows the greatest strength and short that which shows the greatest weakness.

8 – Think like a fundamentalist but trade like a technician.

9 – Trading results cycle and it’s mostly mental.

10 – KISS: Keep It Simple ______.

11 – Understanding mass psychology is always more important than understanding economics.

12 – There is never just one cockroach.

13 – Be patient with winning trades. Be very impatient with losing trades.

14 – Do more of that which is working and less of that which is not.

15 – Fix ALL errors immediately.

16 – Our job is setting alerts and taking losses. The rest will take care of itself.

17 – Amateurs open markets. Professionals close them.

18 - Never, EVER fight a VIX divergence.

Stock Picks Recap for 3/2/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CGNX triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked:

Mark's WDAY triggered short (with market support) and didn't work:

Rich's NFLX triggered long (with market support) and didn't work:

His WYNN triggered short (without market support) and didn't work:

Mark's SNDK triggered long (without market support) and didn't work:

Rich's AMBA triggered short (with market support) and didn't work:

His SLB triggered short (with market support) and didn't work:

His FB triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 3 of them worked, 4 did not.

Futures Calls Recap for 3/2/16

A boring day in the markets with a small gap down that ultimately filled after several back and forth sweeps of highs and lows. We closed mixed with the ES up and the NQ down on 1.7 billion shares. Opening Range Plays were dead.

Net ticks: -23 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and missed the partial by a tick, then triggered short at B and did the same:

NQ Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

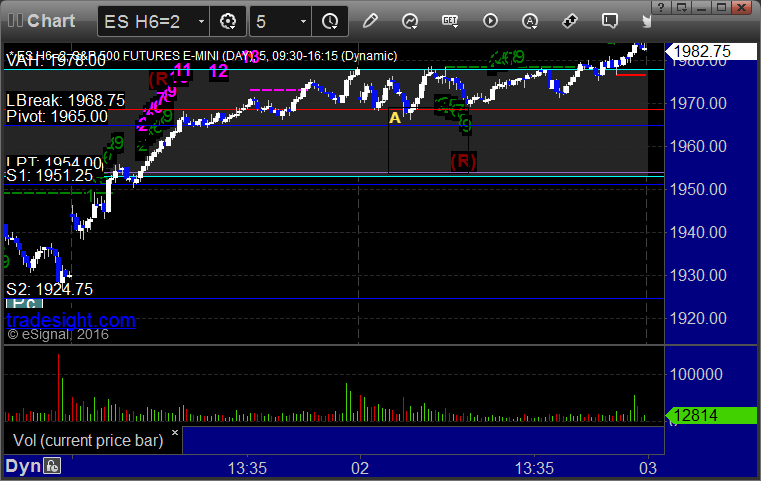

ES:

Mark's call triggered short at A at 1968.00 and stopped. Given the bad volume, he did not re-enter:

Forex Calls Recap for 3/2/16

A small stop out for the session to start the month, which was dull overnight in the European hours and finally moved a bit in the North American hours. See GBPUSD section below.

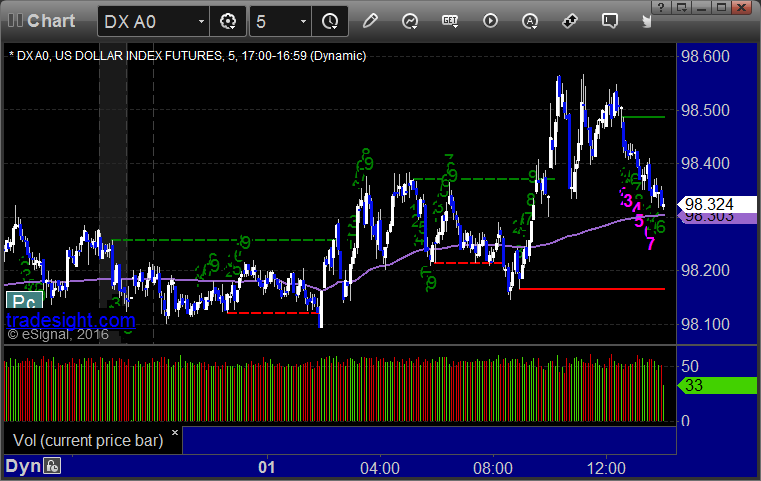

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. If you were awake around the globe to put it back in at B, it worked to the first target and beyond:

Stock Picks Recap for 3/2/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TTWO triggered long (with market support) and worked great:

RUTH triggered long (with market support, by a penny) and didn't work:

SIMO triggered long (with market support) and didn't go enough either direction to count, closed around trigger:

From the Messenger/Tradesight_st Twitter Feed, Rich's VRX triggered short (without market support due to opening 5 minutes) and worked:

His PCLN triggered loing (with market support) and didn't work, but was meant as an opening play, not an hour later:

GS triggered short (without market support, strangely also by a penny) and didn't work:

GS triggered long (with market support) and worked great:

His FSLR triggered short (without market support) and ultimately worked but shouldn't have been taken with market support completely the other way:

Rich's AMZN triggered long (with market support) and worked great:

His NFLX triggered long (with market support) and worked:

His WYNN triggered short (without market support) and worked:

His VRX triggered long (with market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Futures Calls Recap for 3/2/16

The markets gapped up, didn't do much in the first hour, then pushed higher, then completely went flat for hours, and then pushed up more after lunch into the close on 1.9 billion NASDAQ shares. We had winners in Opening Range plays and more.

Net ticks: +24 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked enough for a partial:

NQ Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

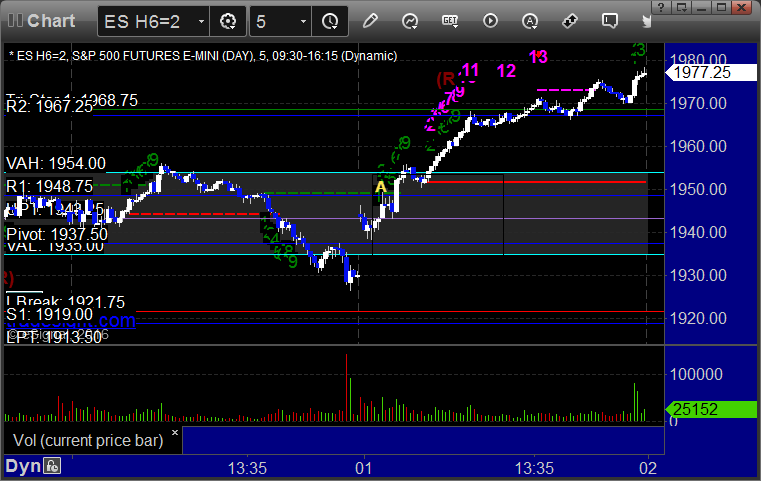

ES:

My call triggered long at A at 1949.50, hit first target for 6 ticks, and closed the final at 1952.00:

Forex Calls Recap for 3/2/16

Another dull session with a stop out on the GBPUSD that worked later if you were awake to retake it, but also a nice 13 buy signal on GBPUSD as well. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

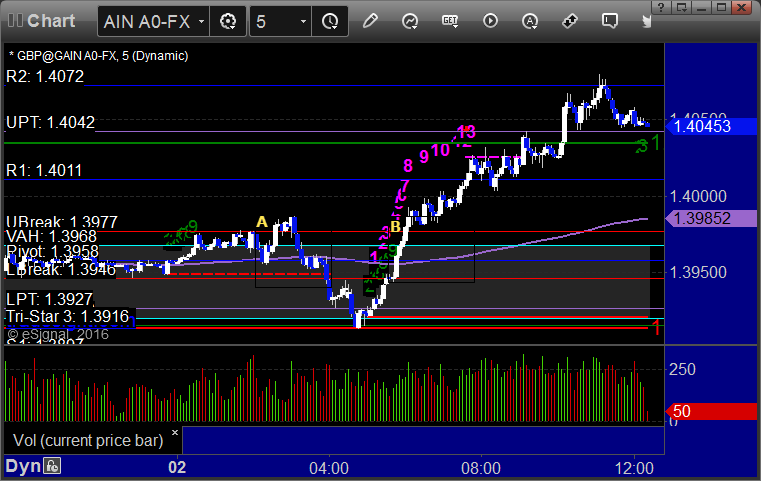

GBPUSD:

Triggered long at A and stopped. Later, triggered again at B, would have gone straight to first target at C if you were awake. Also, note the 13 buy signal at D worked great:

Stock Picks Recap for 2/29/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PYPL triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Mark's CREE triggered long (with market support) and worked great:

TEVA triggered short (with market support) and worked:

Rich's COST triggered short (with market support) and worked:

His FB triggered short (without market support) and worked:

His AAPL triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, all 5 of them worked.