Tradesight Recap Report for 2/25/22

Overview

The markets gapped up, went flat for an hour, moved up into lunch, and that was it for the day on 5.1 billion NASDAQ shares.

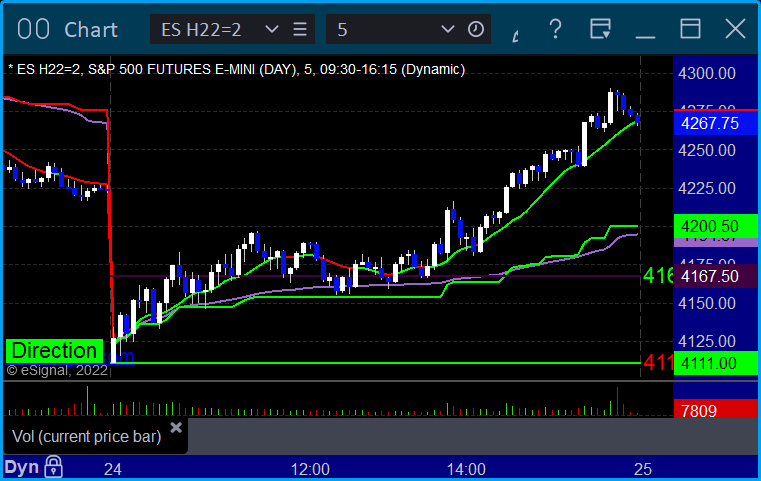

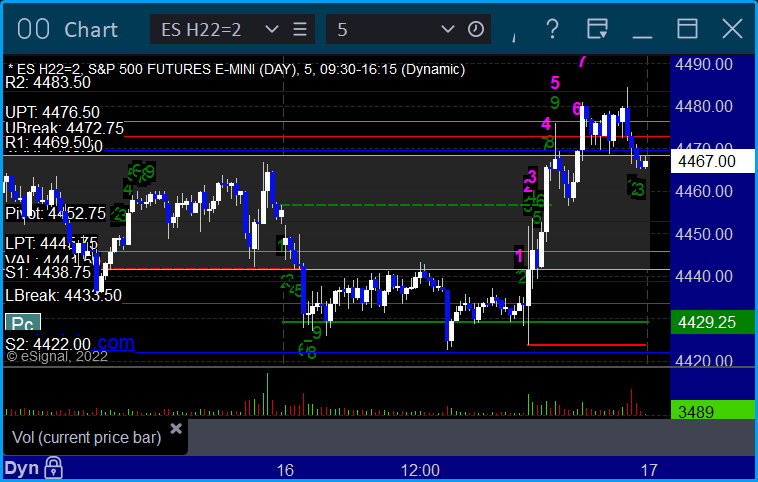

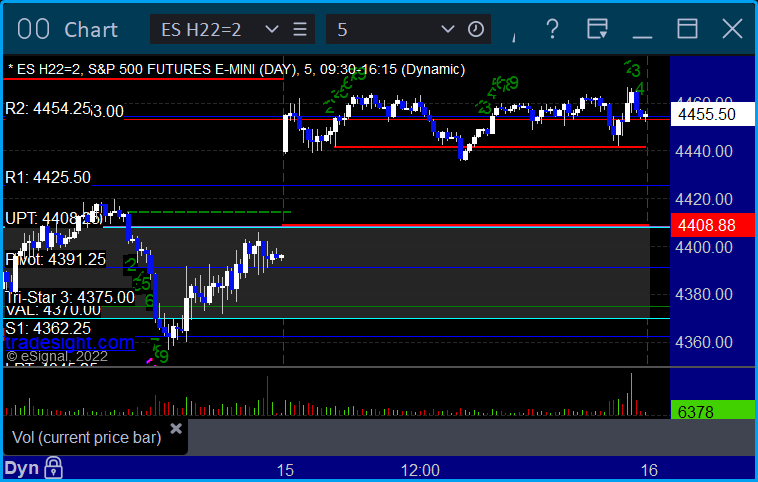

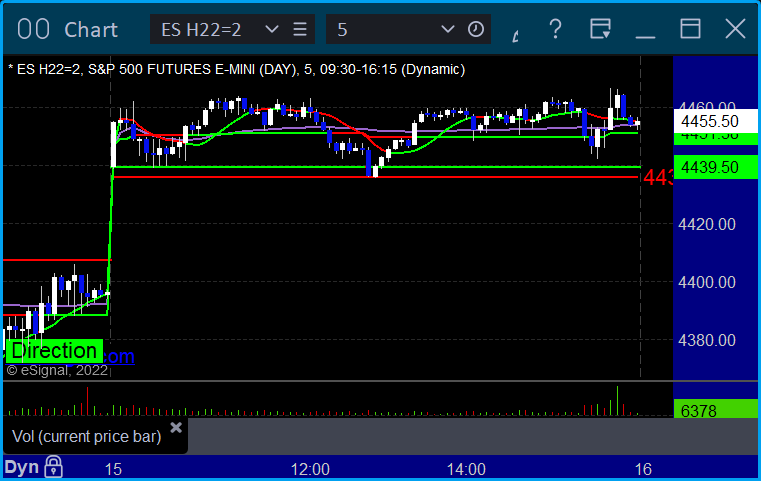

ES with Levels:

ES with Market Directional:

Futures:

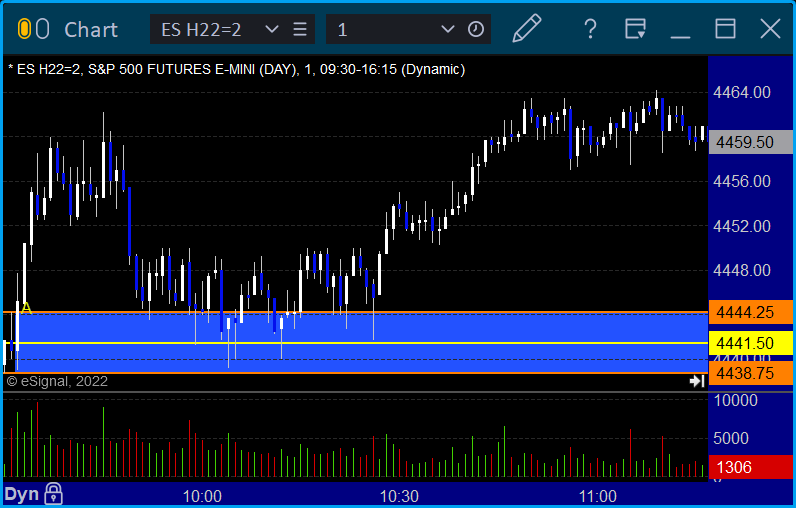

ES Opening Range Play both triggers were too far out of range to take:

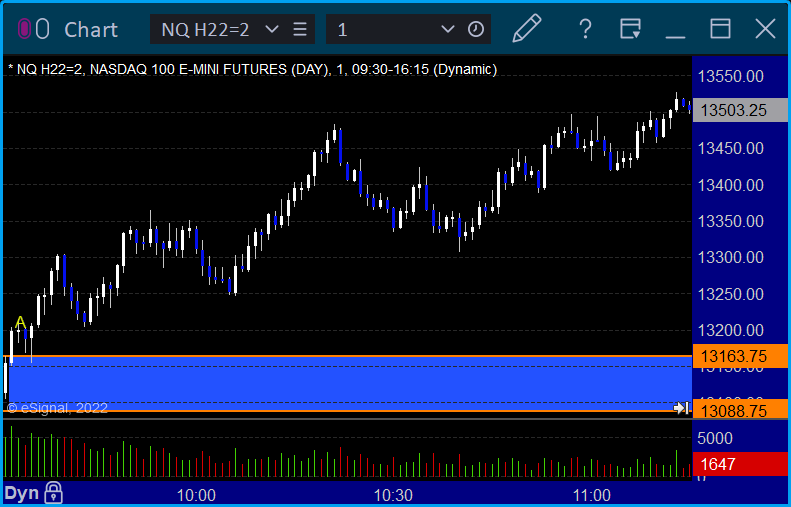

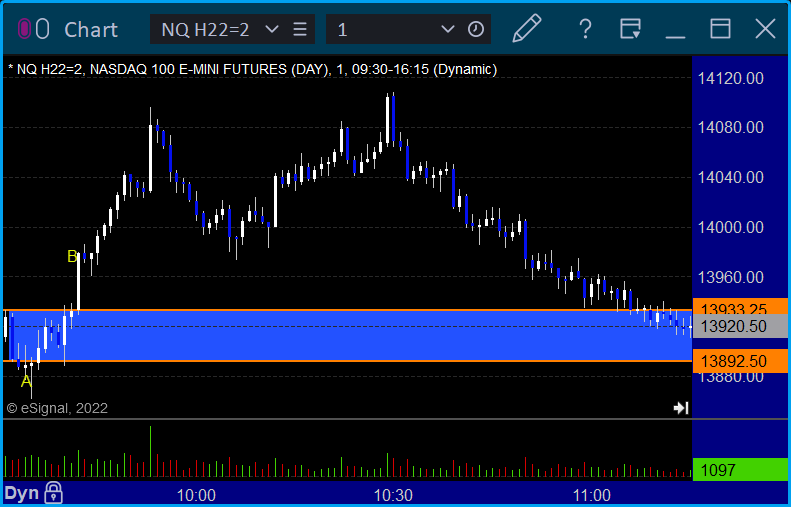

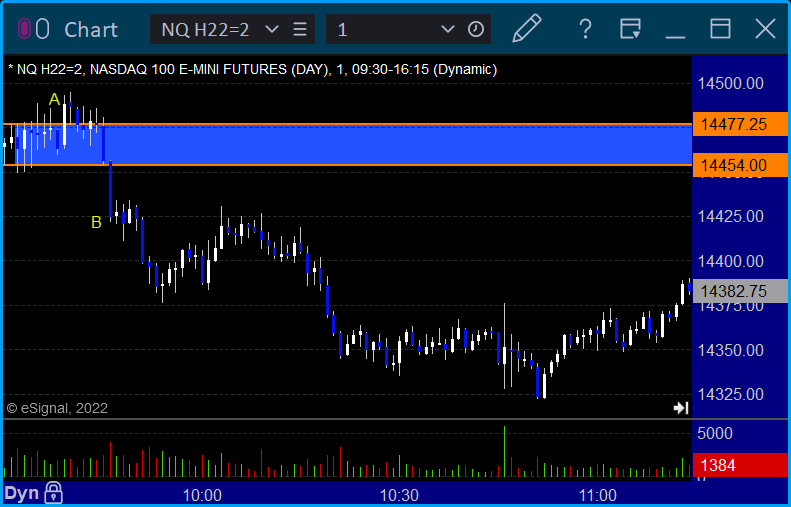

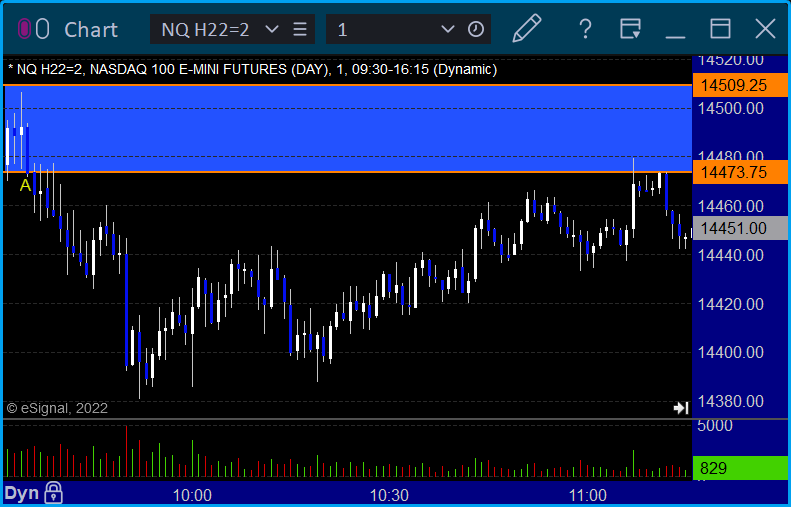

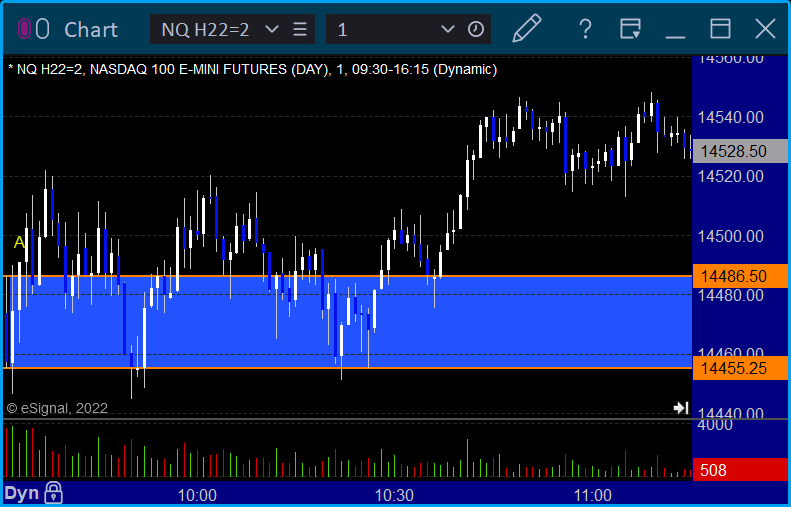

NQ Opening Range Play:

Results: +0 ticks

Forex:

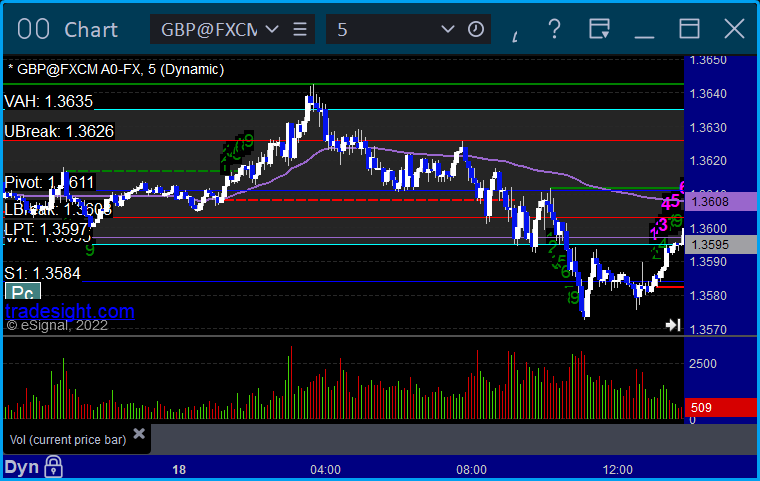

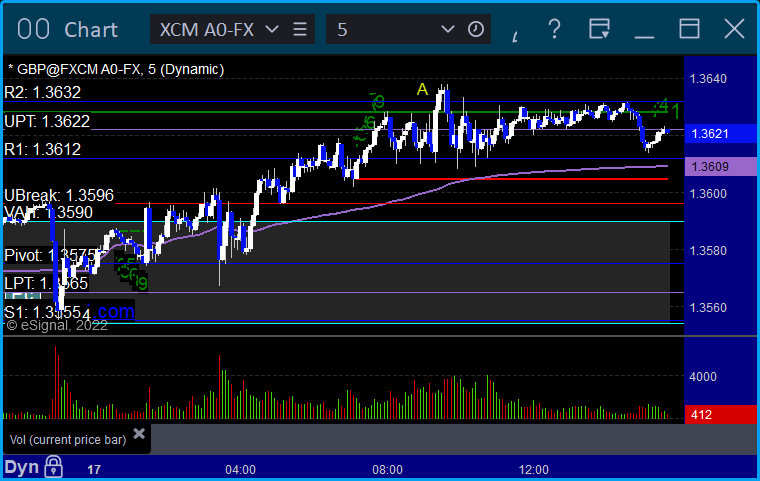

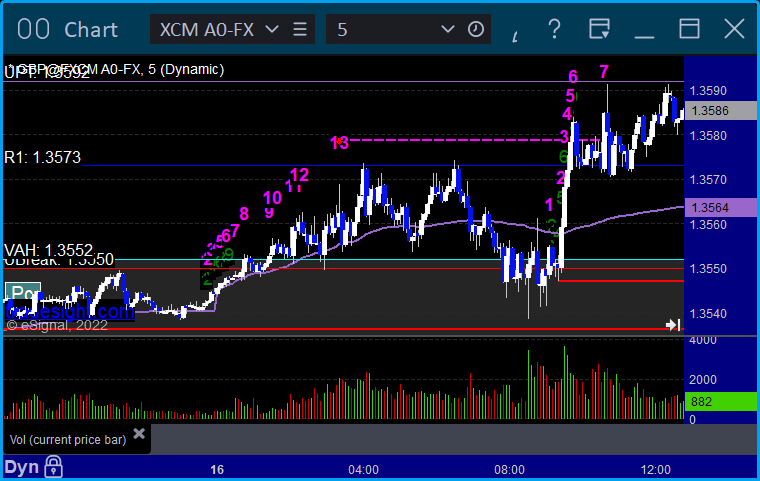

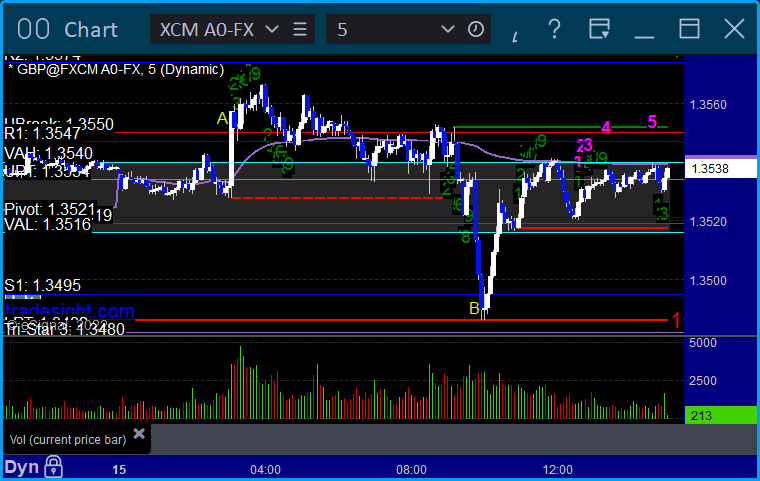

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Let's just wrap up the week.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, PANW triggered long (with market support) and worked:

That’s 1 triggers with market support, and it worked.

Tradesight Recap Report for 2/24/22

Overview

The markets gapped down when Russia attacked Ukraine and then rallied into the green on 6.2 billion NASDAQ shares.

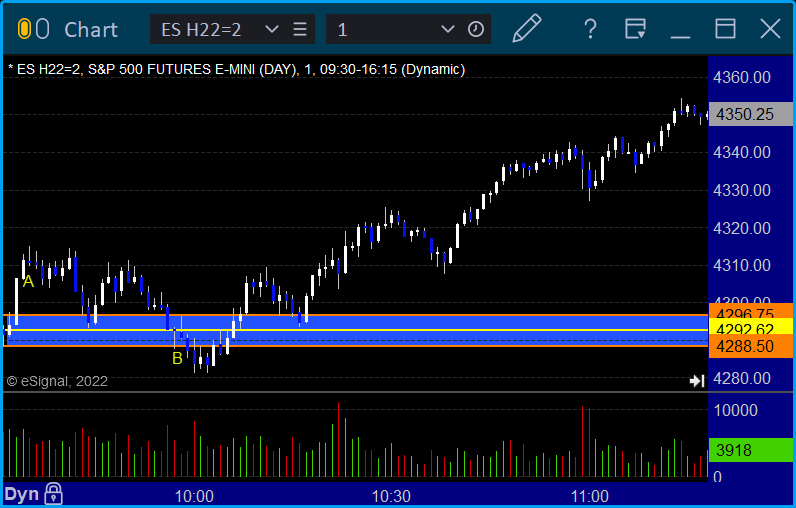

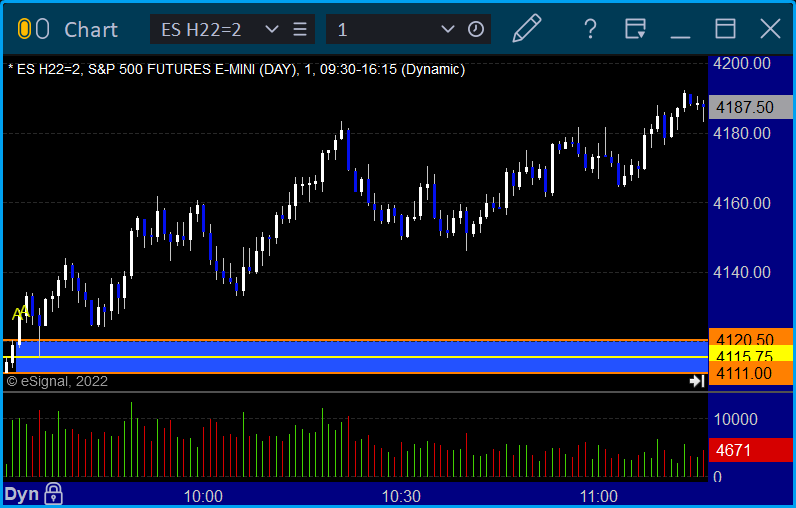

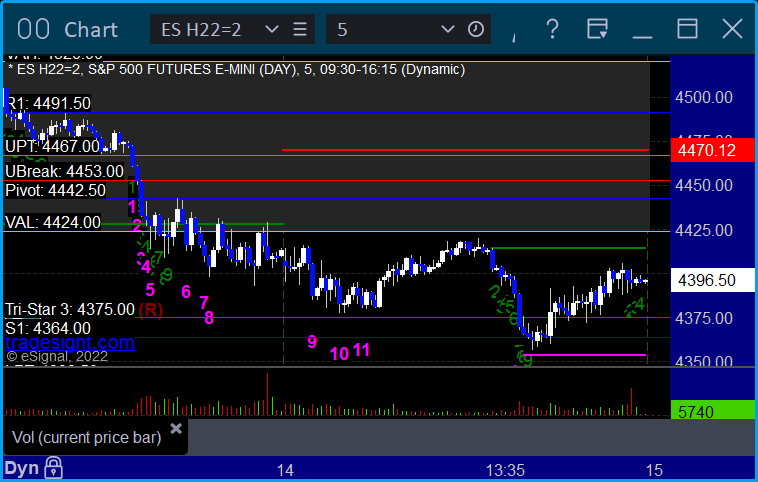

ES with Levels:

ES with Market Directional:

Futures:

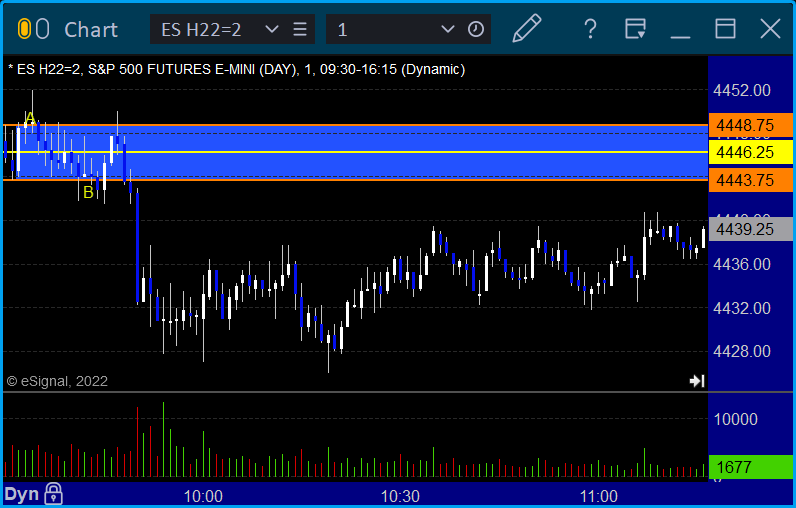

ES Opening Range Play triggered long at A but too far out of range to take:

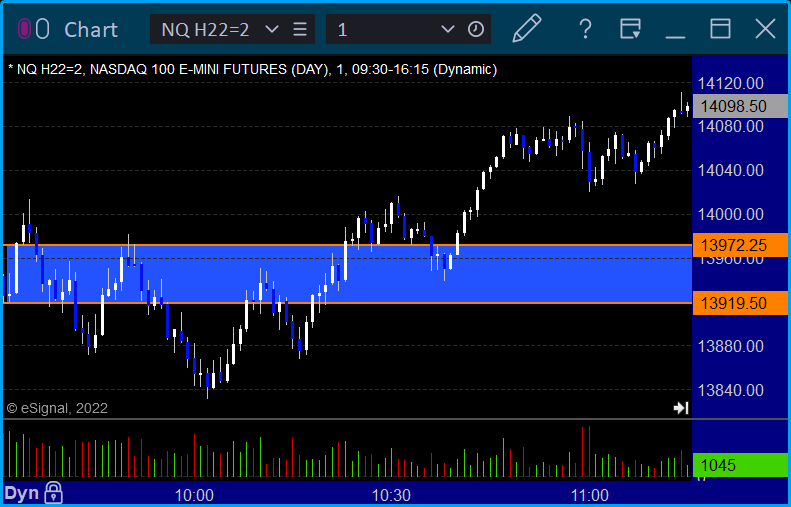

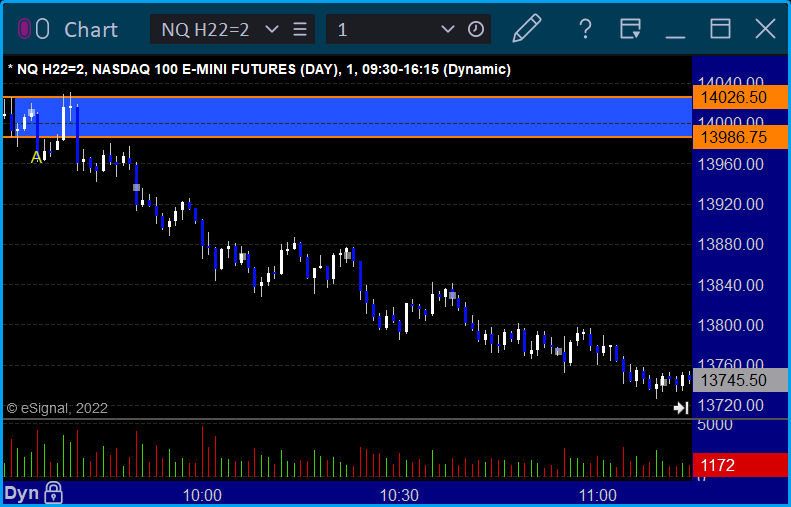

NQ Opening Range Play:

Results: +0 ticks

Forex:

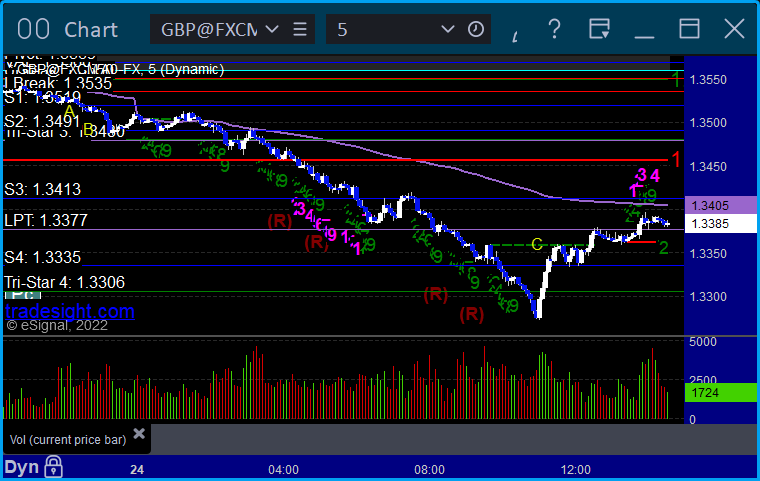

GBPUSD triggered short at A, hit first target at B, finally stopped second half at C well in the money:

Results: +85 pips

Stocks:

The market reaction ended up being a little different than expected. Cautious times and not much to do.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, AAPL triggered long (with market support) and technically worked under the rules, but we stopped it out quicker on a weird day:

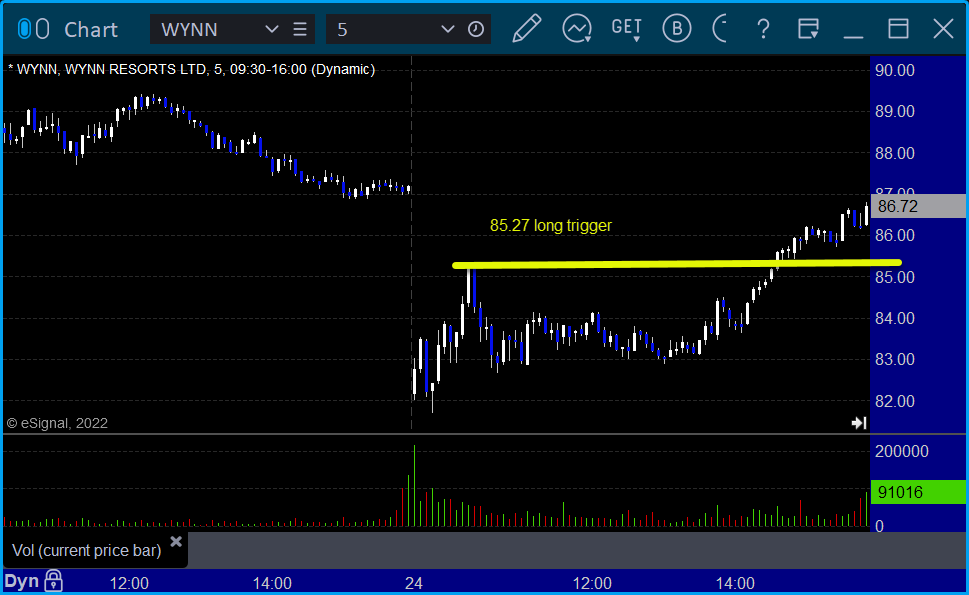

Rich's WYNN triggered long (with market support) and worked:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 2/23/22

Overview

The markets gapped up small, filled and went a little lower, and then recovered to around even at the start of lunch, and then the rest of the day was a slow slide on 4.6 billion NASDAQ shares.

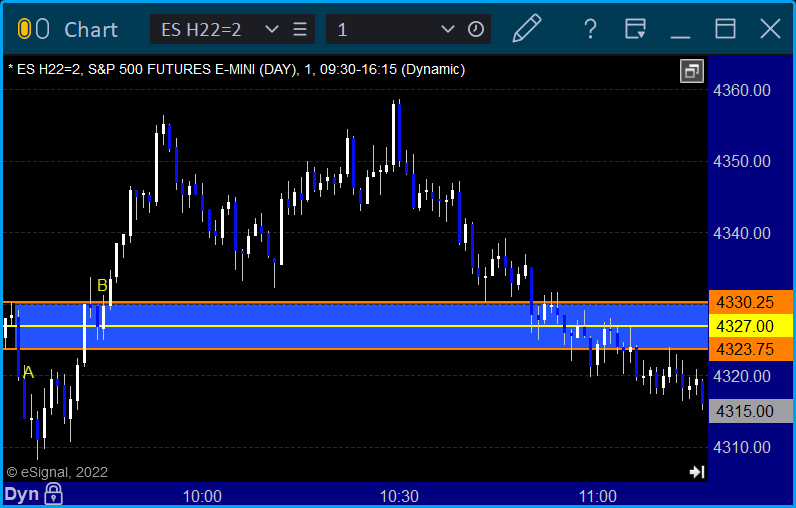

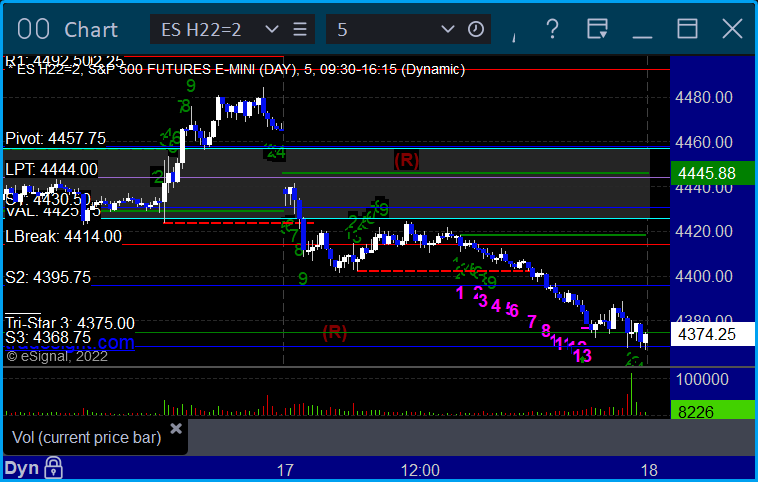

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and stopped, triggered short at B but too far out of range to take:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: -17 ticks

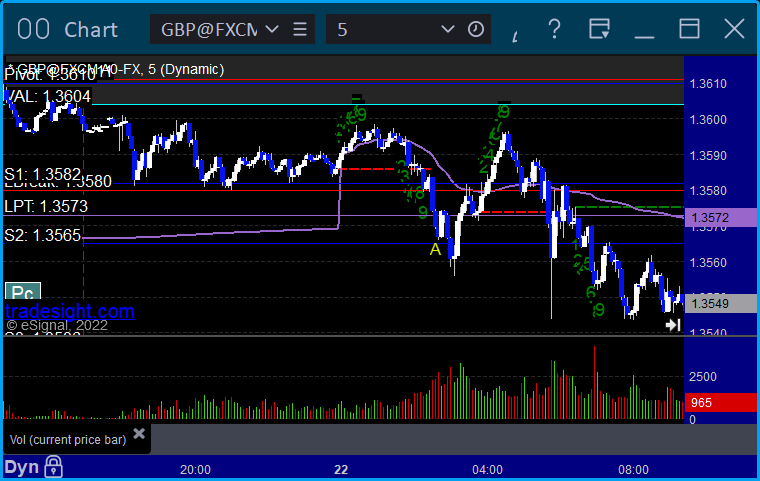

Forex:

GBPUSD, no calls:

Results: +0 pips

Stocks:

As we brace for the likely attack, there's not a lot of low risk stuff to do.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's CAT triggered short (with market support) and worked:

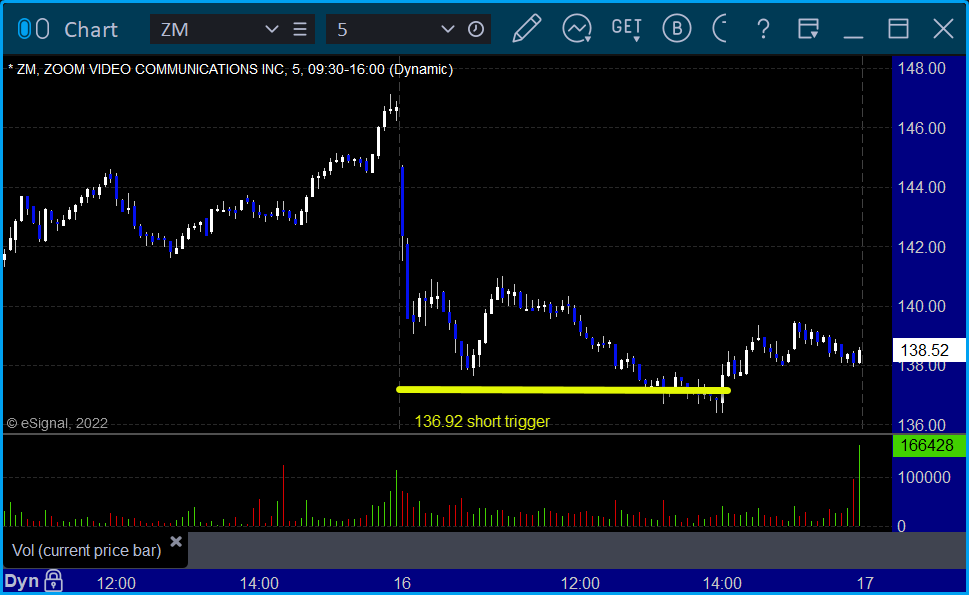

His ZM triggered short (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 2/22/22

Overview

The markets gapped up, went higher, then drifted back to fill the gap and closed about even on 4 billion NASDAQ shares.

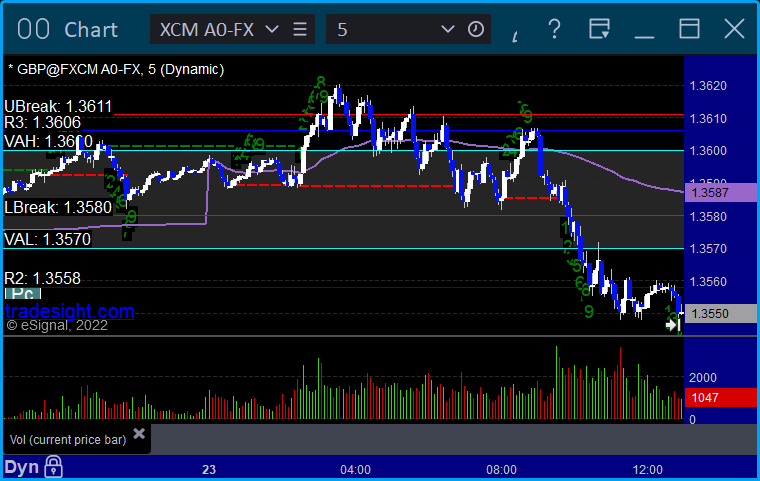

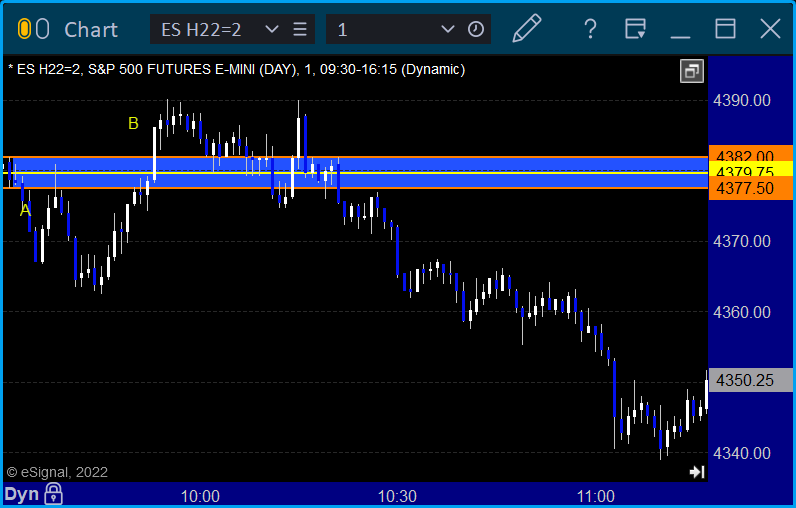

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, both triggers were too far out of range to take:

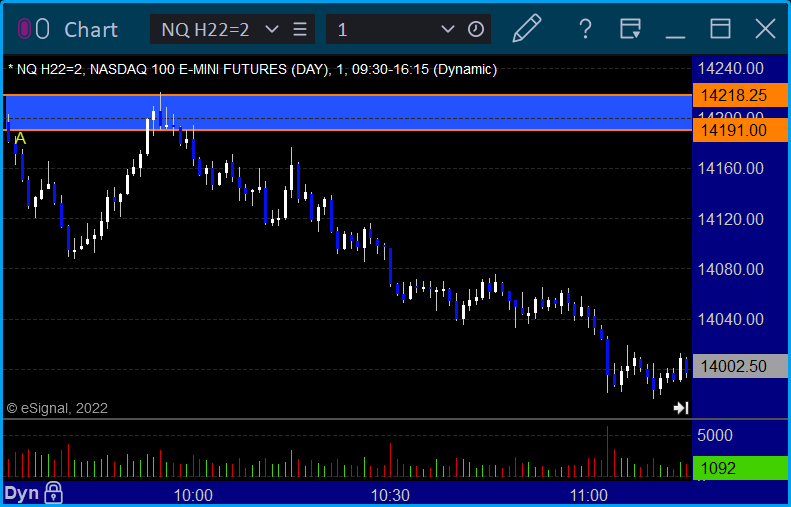

NQ Opening Range Play, both triggers were too far out of range to take:

Results: +0 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Not a ton of action.

From the Tradesight Plus Report, no calls.

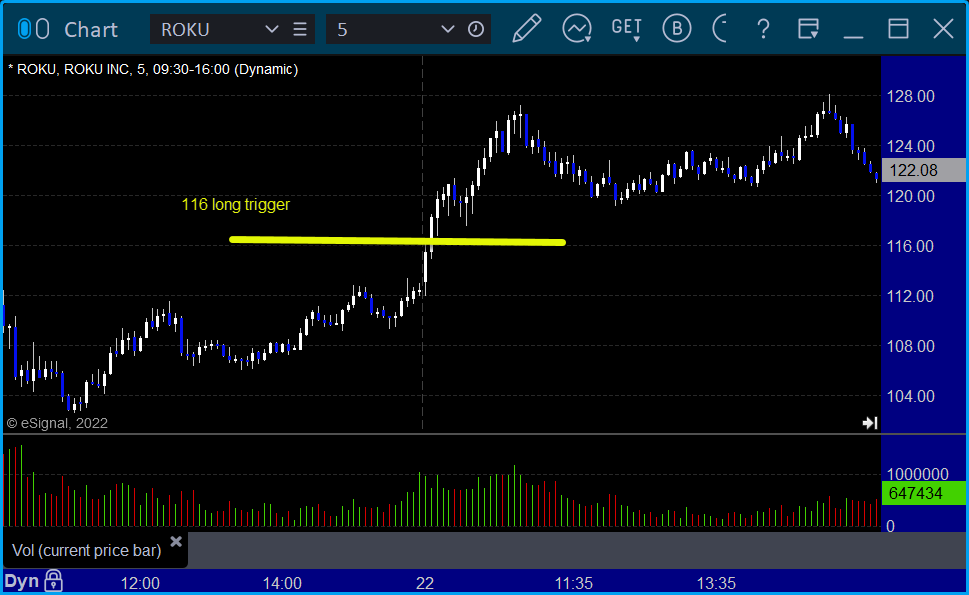

From the Tradesight Plus Twitter feed, Rich's ROKU triggered long (without market support due to opening 5 minutes) and worked:

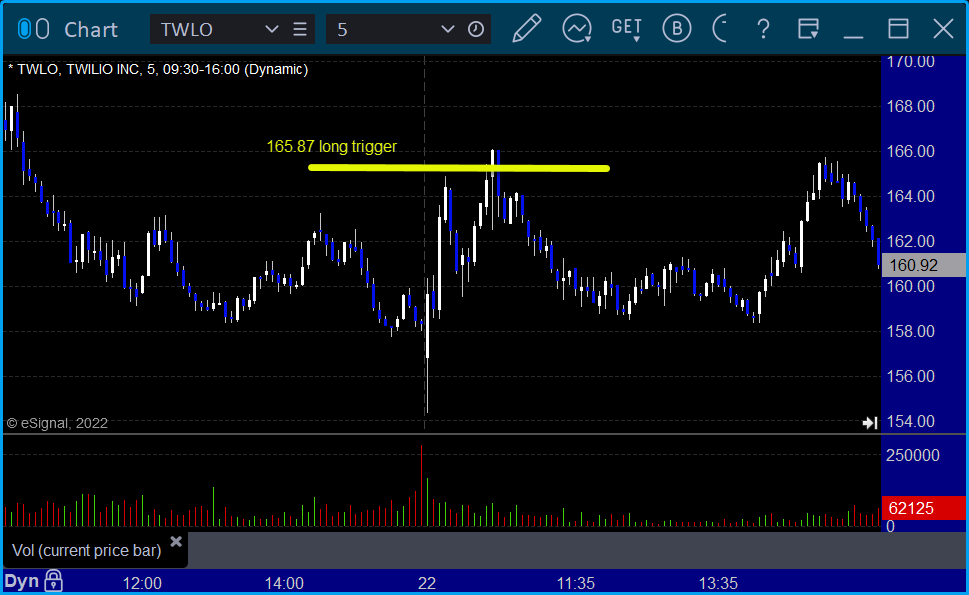

His TWLO triggered long (with market support) and didn't work:

That’s 1 trigger with market support, and it didn't work.

Tradesight Recap Report for 2/18/22

Overview

The markets opened fairly flat and drifted lower until after lunch then came back a bit for options expiration Friday on 4.4 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked, triggered long at B but too far out of range to take:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +10.5 ticks

Forex:

GBPUSD, nothing triggered:

Results: +0 pips

Stocks:

A couple of winner again on options expiration Friday.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's AMD triggered short (with market support) and worked:

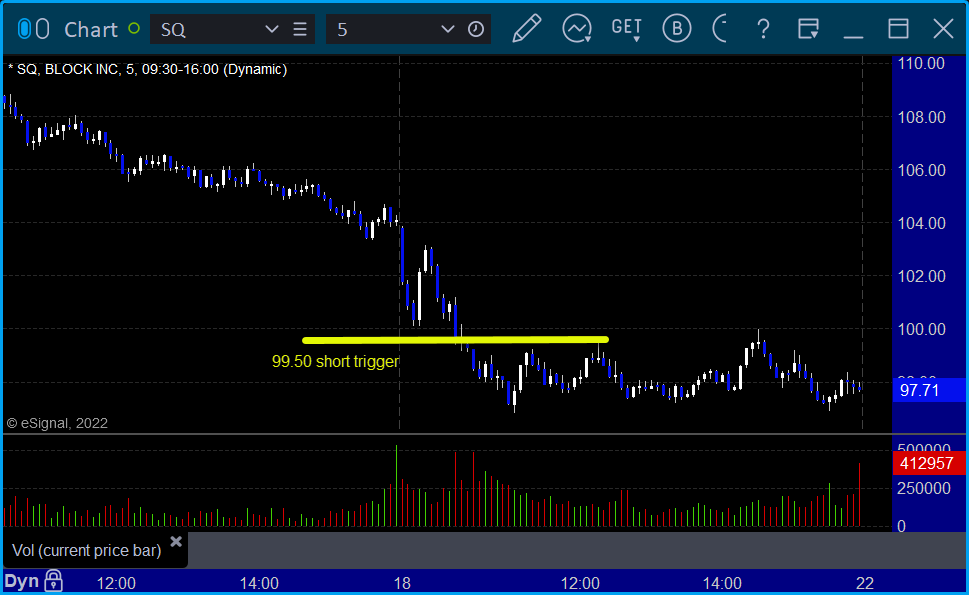

His SQ triggered short (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 2/17/22

Overview

The markets gapped down a little, went a bit lower early, stayed mostly flat until after lunch, and then sold off more in the afternoon on 4 billion NASDAQ shares as the world continues to watch the situation in the Ukraine. Because it was a mostly clean move, we had some nice winners.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered long at A and short at B, both too far out of range to take:

Results: +4 ticks

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

A very nice day, all thanks to Rich.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's WDAY triggered short (with market support) and worked:

His ZM triggered short (with market support) and worked:

His CROX triggered short (with market support) and worked:

That’s 3 triggers with market support, all of them worked.

Tradesight Recap Report for 2/16/22

Overview

The markets gapped down small and went a little lower for a few minutes but then sat dead flat again for hours until the Fed minutes from the last meeting came out at 2 pm EST, then we pushed up to green territory on 4.1 billion shares. Everyone is still watching the situation in Ukraine.

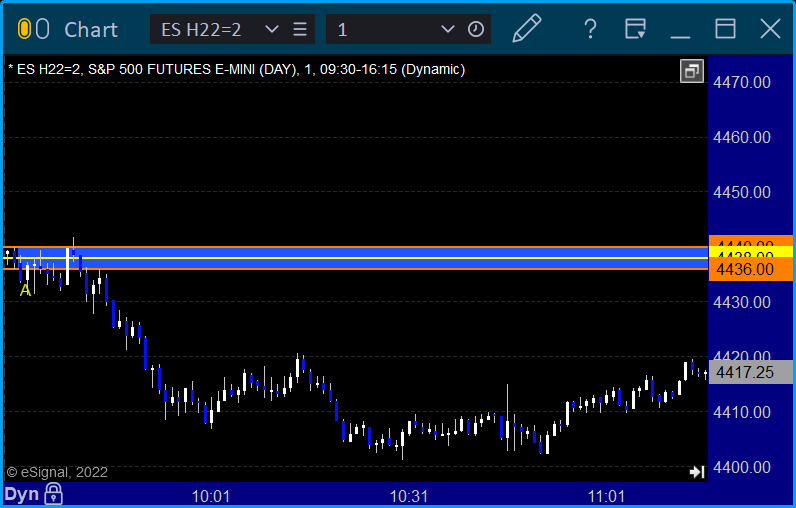

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial, triggered short at B and stopped over the midpoint:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: -9 ticks

Forex:

GBPUSD triggered long at A and closed at end of chart for end of session:

Results: +10 pips

Stocks:

After 4 and a half hours of nothing, we spiked up on news.

From the Tradesight Plus Report, again, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's ZM triggered short (with market support) and didn't work:

TGT triggered short (with market support) and didn't work:

That’s 2 triggers with market support, neither of them worked.

Tradesight Recap Report for 2/15/22

Overview

The markets gapped up and just went completely dead flat on 3.9 billion NASDAQ shares as the world waits to see what happens in Ukraine.

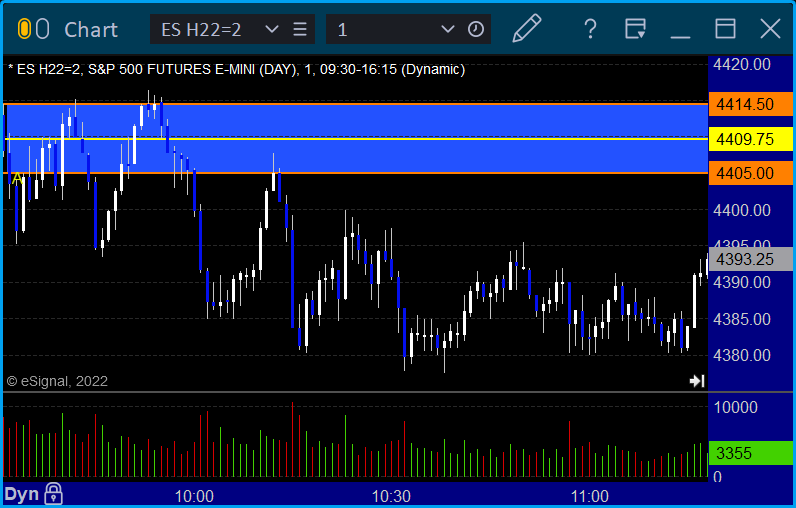

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked great:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +23.5 ticks

Forex:

GBPUSD triggered long at A and stopped, triggered short at B and stopped:

Results: -50 pips

Stocks:

A total waste of a day with a winner.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's UBER triggered long (with market support) and worked:

That’s 1 trigger1 with market support, and it worked.

Tradesight Plus Report for 2-14-22

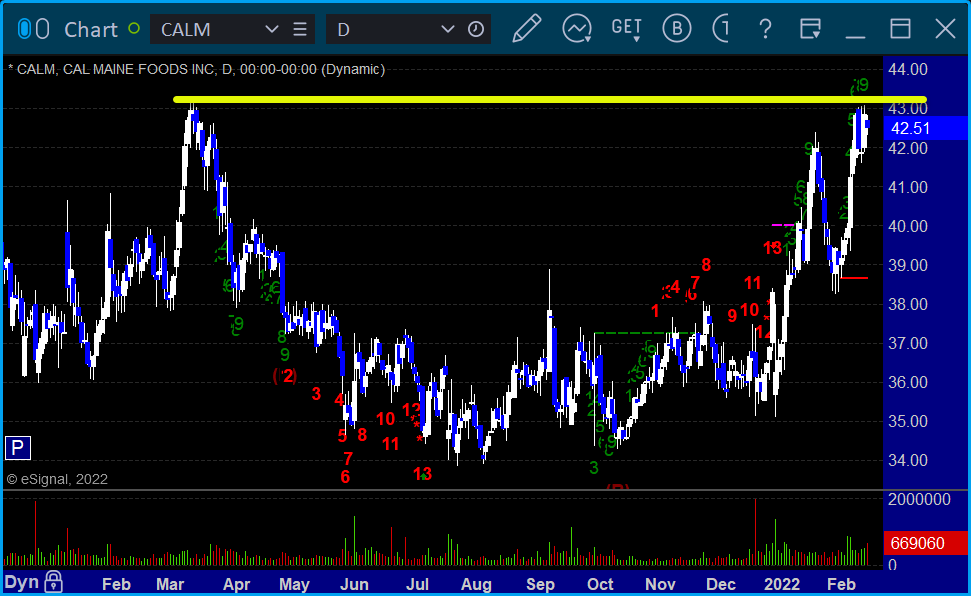

Opening comments posted to YouTube. Only a few daily chart plays found. I don't love that they are both long ideas, but they are great patterns.

Longs first, in order of best chart construction, starting with CALM > 43.23:

Shorts next, just one, MRNA < 138.17:

That's it.

Tradesight Recap Report for 2/14/22

Overview

The markets opened flat and just meandered all day and closed where they opened on 3.9 billion NASDAQ shares.

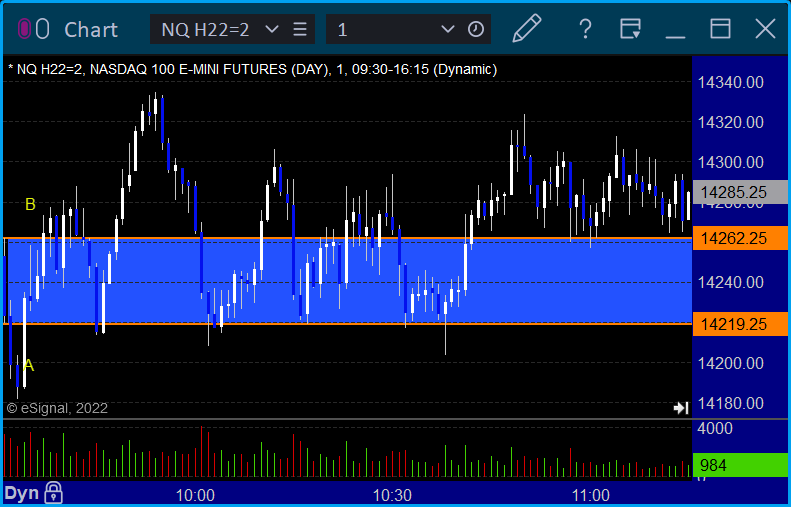

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play both triggers were too far out of range to take:

Results: +4 ticks

Forex:

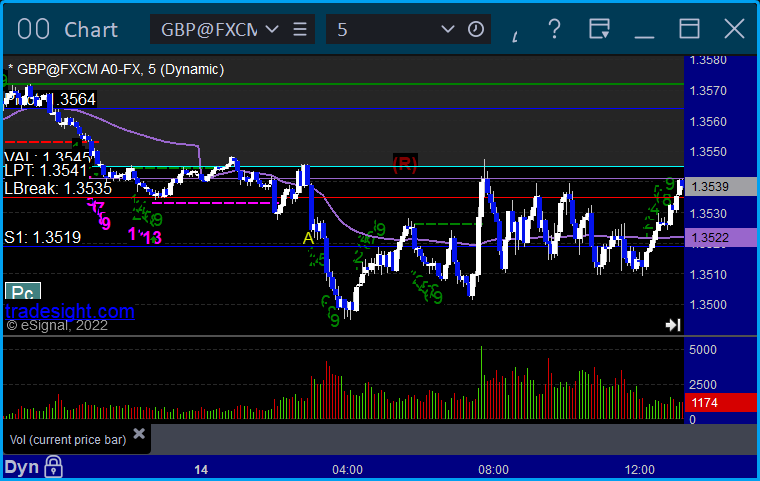

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

A very uninteresting day.

From the Tradesight Plus Report, nothing triggered.

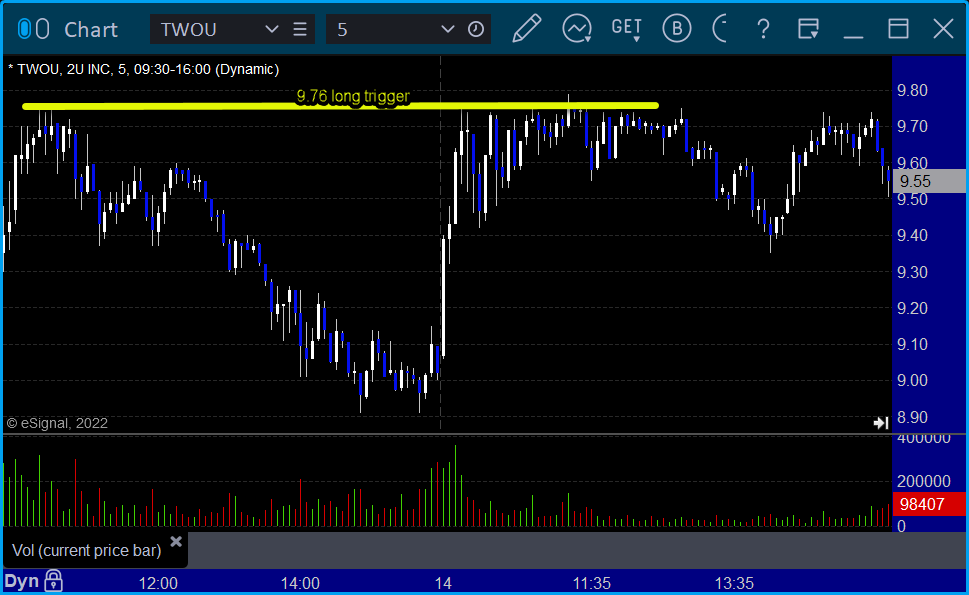

From the Tradesight Plus Twitter feed, Rich's TWOU triggered long (without market support) and didn't do anything:

GS triggered short (with market support) and worked enough for a partial:

That’s 1 trigger with market support, and it worked.