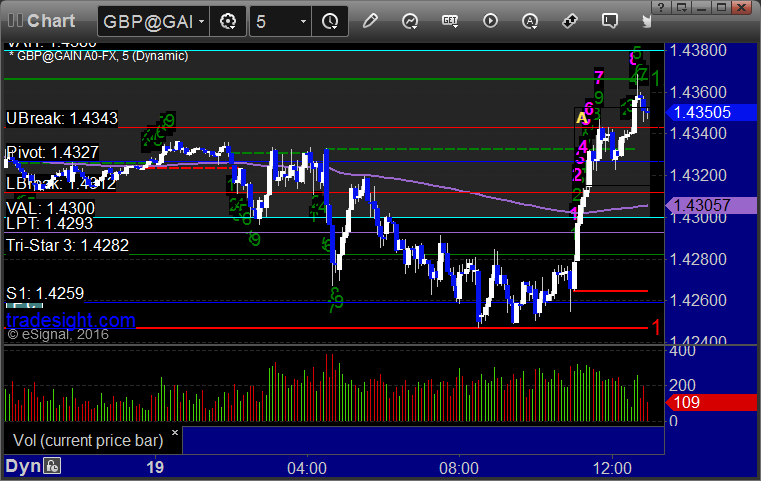

Forex Calls Recap for 2/24/16

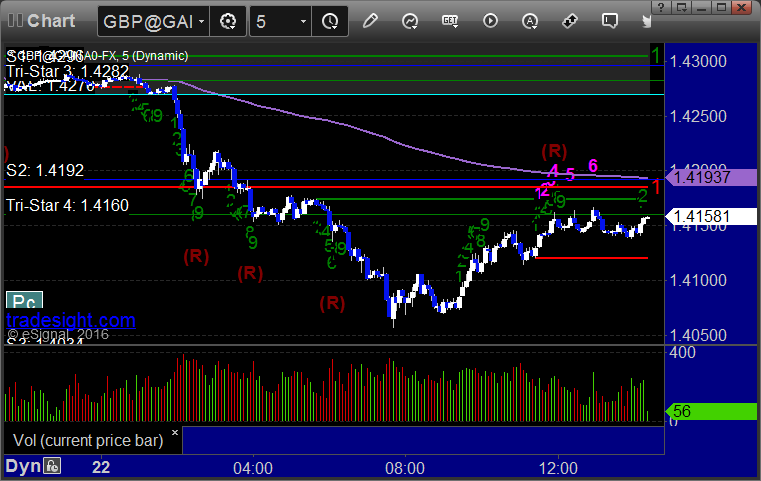

A loser (that ended up working on the second try if you were around to take it again) in the GBPUSD section. See that section below.

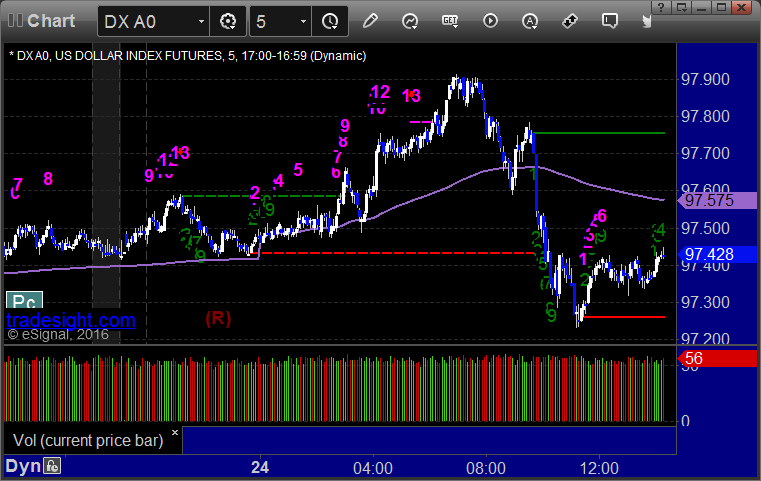

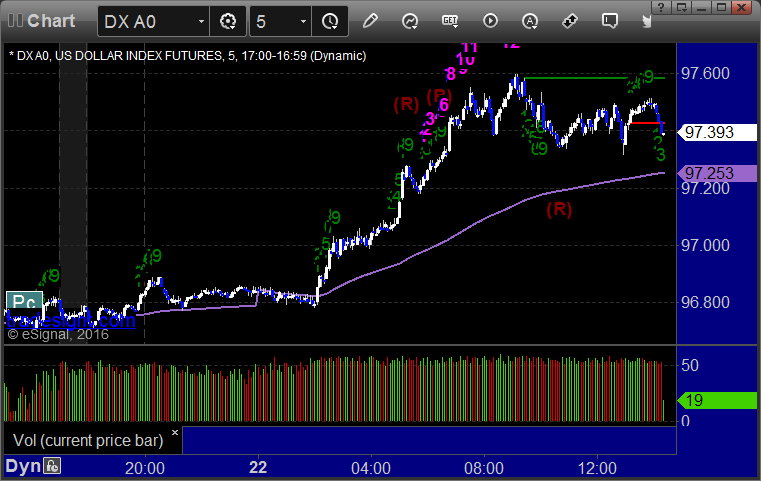

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped at B. If you put it back in, it worked:

Stock Picks Recap for 2/23/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, HIMX triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's APC triggered short (with market support) and worked:

TWTR triggered long (with market support) and didn't work:

BABA triggered short (with market support) and worked:

Rich's PTCT triggered long (without market support) and didn't work:

Rich's GS triggered short (with market support) and worked:

His TSLA triggered long (without market support) and worked:

His AMZN triggered short (with market support) and worked enough for a partial:

His AMGN triggered short (with market support) and worked enough for a partial:

His FB triggered short (with market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

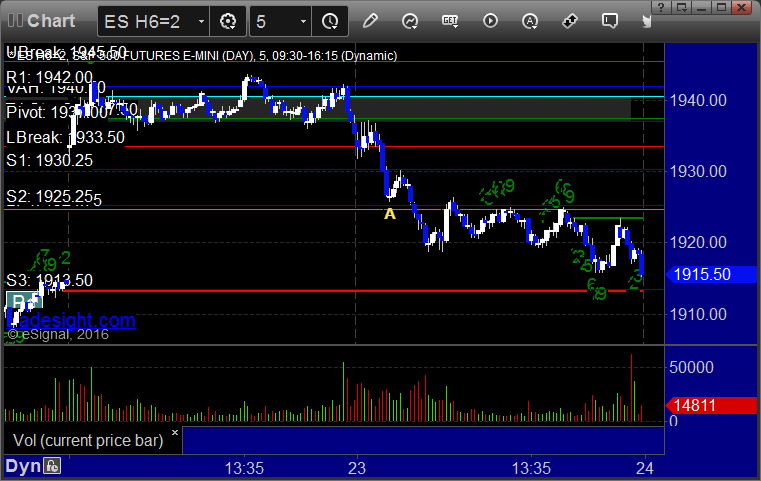

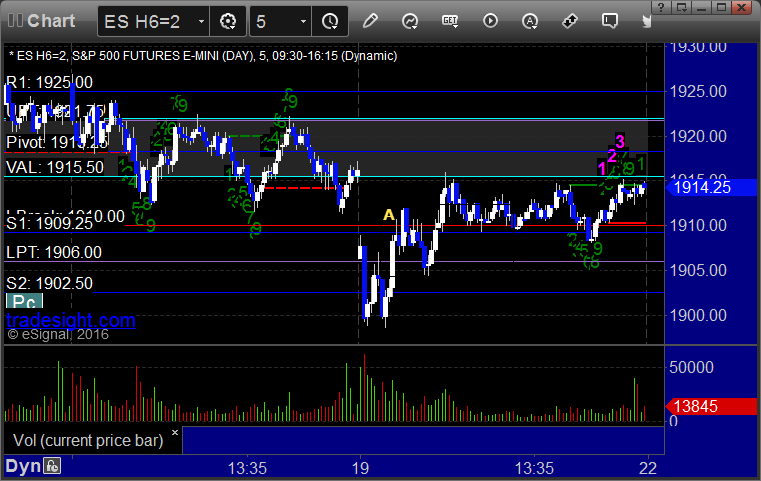

Futures Calls Recap for 2/23/16

One of the flattest opening 30 minutes I can recall in the markets. We opened with a small gap down and did absolutely nothing. Then the Consumer Confidence number came out and the market started to head lower, but we had worse volume than even Monday. There were some nice setups on the ES and NQ, see that section below. Opening Ranges didn't work out given the flatness. NASDAQ volume closed at 1.5 billion shares, horrible.

Net ticks: -9 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work:

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Nice setup short under LPT after setting the level at A:

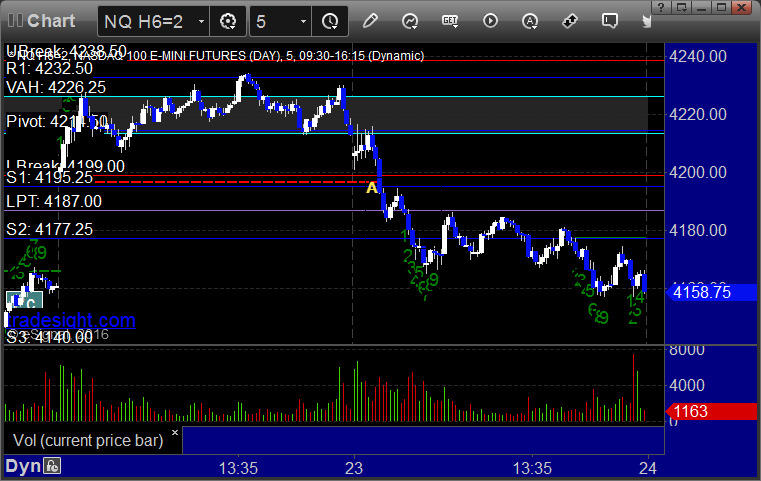

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Nice setup short under S1 at A, breaking under the base and into the gap from Monday:

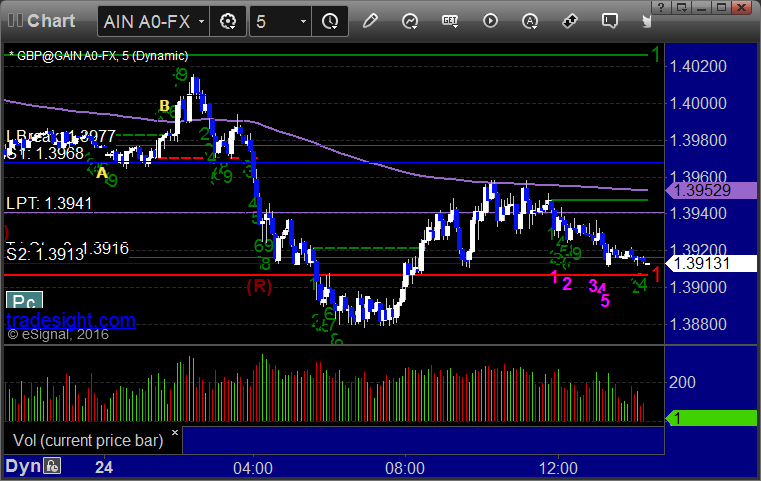

Forex Calls Recap for 2/23/16

After a big gap and drop to start the week, things flattened out a bit. See EURUSD section below.

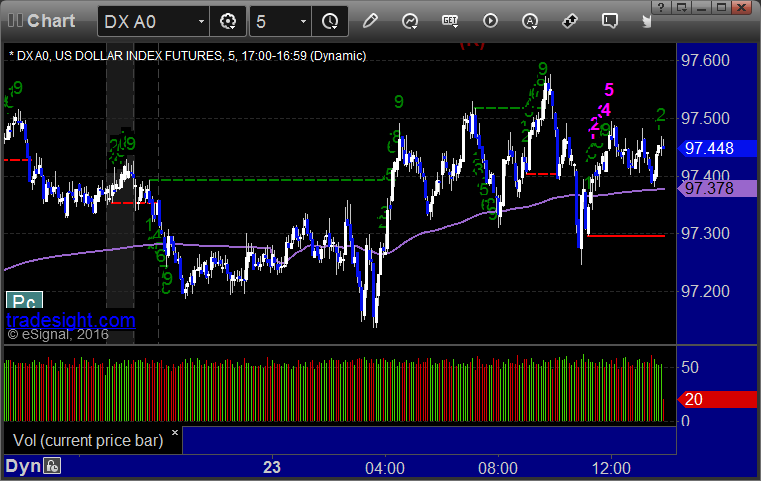

Here's a look at the US Dollar Index intraday with our market directional lines:

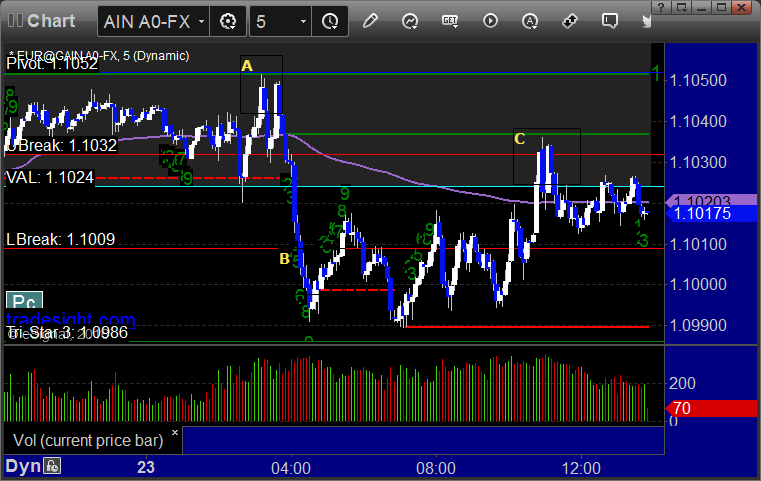

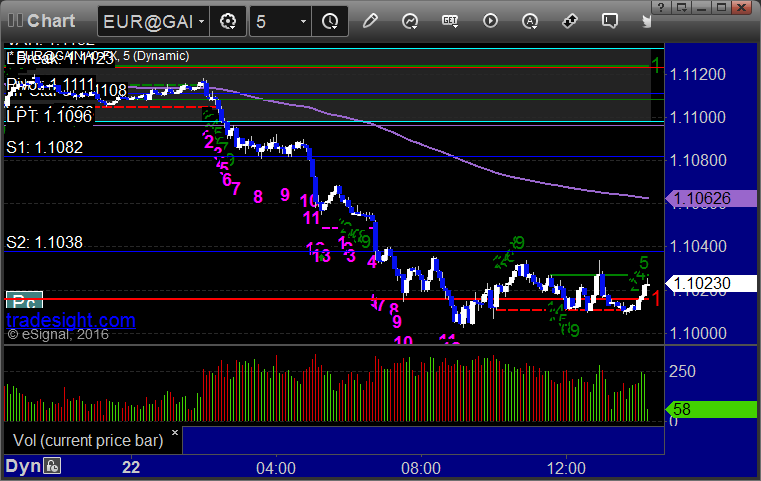

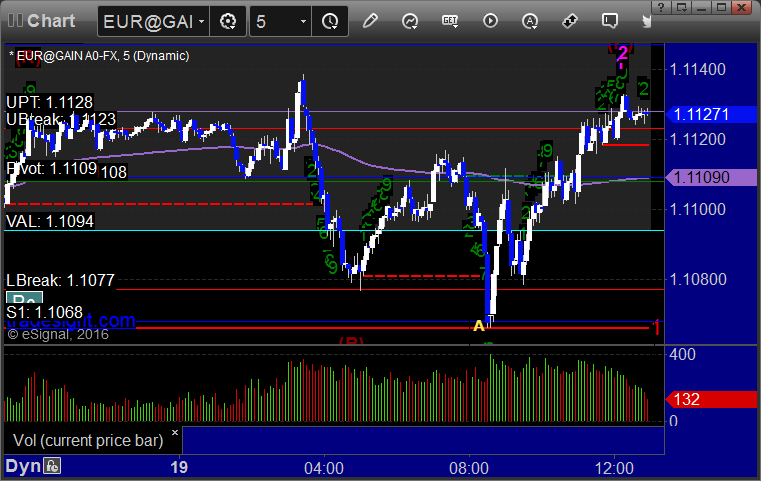

EURUSD:

Came up exactly to our long trigger at A and didn't trigger. Triggered short at B, gave it hours to do anything, finally stopped just barely at C:

Stock Picks Recap for 2/22/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FISV triggered long (with market support) and worked great:

CONE triggered long (with market support) and worked:

TRMB triggered long (without market support due to opening 5 minutes) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, SWKS triggered long (with market support) and worked enough for a partial:

Rich's VRX triggered short (without market support) and worked great:

Mark's TLT triggered short (ETF, so no market support needed) and didn't work:

GS triggered short (without market support) and worked:

Rich's MNK triggered short (without market support) and worked enough for a very quick partial:

His FB triggered short (in the one 10 minute window of the day where market direction was red) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 2/22/16

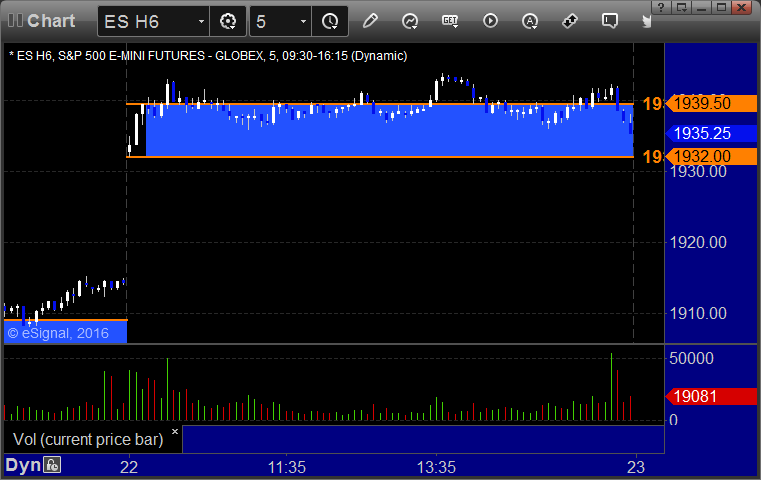

Well, we talk about the importance of tri-star levels as magnets or targets. The markets gapped up and the ES was very near the key 1937.50 level at the open, and basically sat on it all day without touching another level. The Opening Range plays worked. A really boring session otherwise. NASDAQ volume was 1.6 billion shares.

Net ticks: +11 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked, if you were willing to take it since the trigger was a bit outside of the range:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 2/22/16

A rare gap in the Forex markets as the GBPUSD opened about 150 pips on Sunday lower than where it closed Friday. It gapped well past our trigger. I gave it some time to try to head back into the range of play and it didn't. There was a nice trade on EURUSD short under S1 after it set the level for those that know our system, but it was overnight.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

GBPUSD:

Stock Picks Recap for 2/19/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TECD triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's TLT triggered long (ETF, so no market support needed) and worked:

NTAP triggered long early (without market support, and was only meant for with market support) and didn't work:

I reposted NTAP long over the new high and that triggered (with market support) and eventually worked:

AAPL triggered long (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 2/19/16

Mixed results on the Opening Range plays with a winner and a loser. Another nice setup for the gap fill triggered and stopped on the ES, and since it was options expiration Friday, I didn't put it back in like I usually would, and it ended up working. The markets closed dead flat (S&P literally down 0.05) on 1.7 billion shares, which is horrible for options expiration.

Net ticks: -9 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked great:

NQ Opening Range Play triggered long at A, used the 50% for the stop since the OR was over 10 points and stopped. The entry at B would have been too far below the lower boundary to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 1911.00 and stopped:

Forex Calls Recap for 2/19/16

Closed out the week with not much for trades. A partial trigger on EURUSD and a tiny winner on GBPUSD because we ran out of time. See those sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

If you use proper order staggering, a piece of this triggered at A and stopped, but not the other two:

GBPUSD:

Triggered long at A and closed it 5 pips in the money for end of week: