Stock Picks Recap for 2/18/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MITK triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's TLT triggered long (ETF, so no market support needed) and worked:

BIIB triggered short (with market support) and didn't work:

TWTR triggered short (with market support) and I eventually posted to close it where we opened it as it went too long:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not. TWTR was a wash.

Futures Calls Recap for 2/18/16

The markets gapped up a little and filled quickly, giving us nice Opening Range plays (in sync with the Value Areas). The rest of the day was fairly unexciting, trading about half of a normal range and the NQ staying mostly inside the Value Area on a weak 1.6 billion NASDAQ shares (with an early volume warning). There might have been a slight boost in that volume number due to a minor options unravel, but it didn't add up to much. No other calls again based on the setups. Slow week, but nice OR plays, see that section below.

Net ticks: +21.5 ticks.

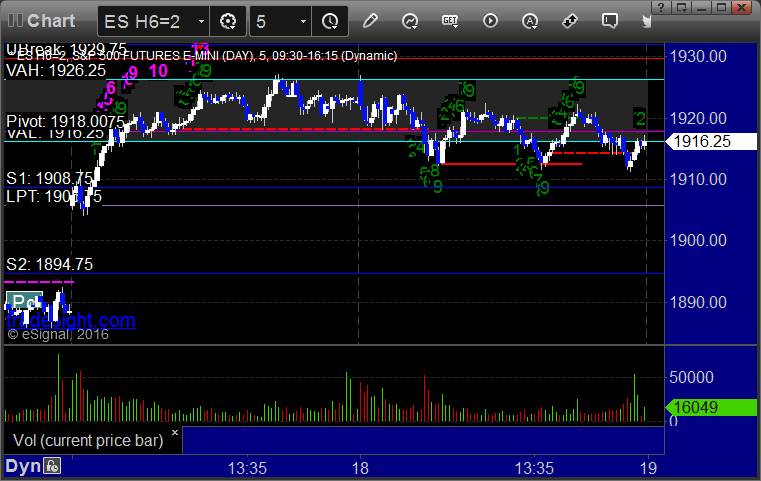

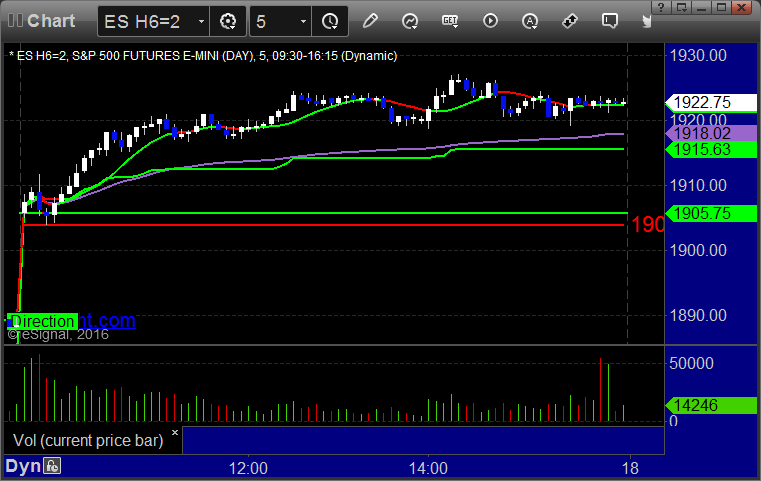

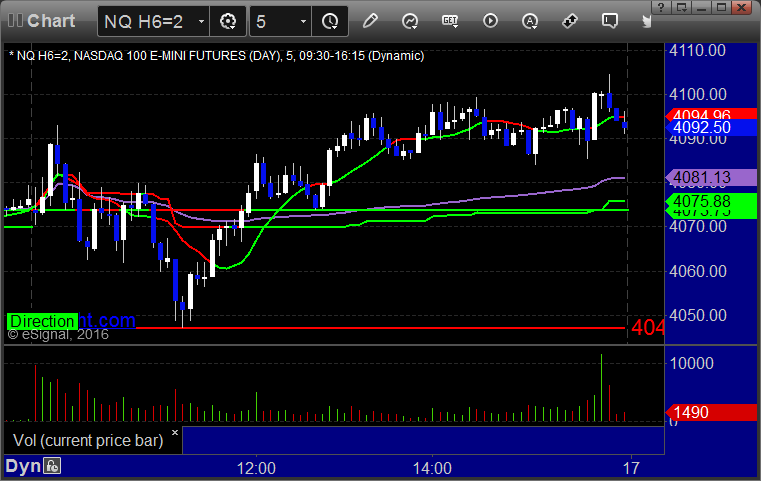

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

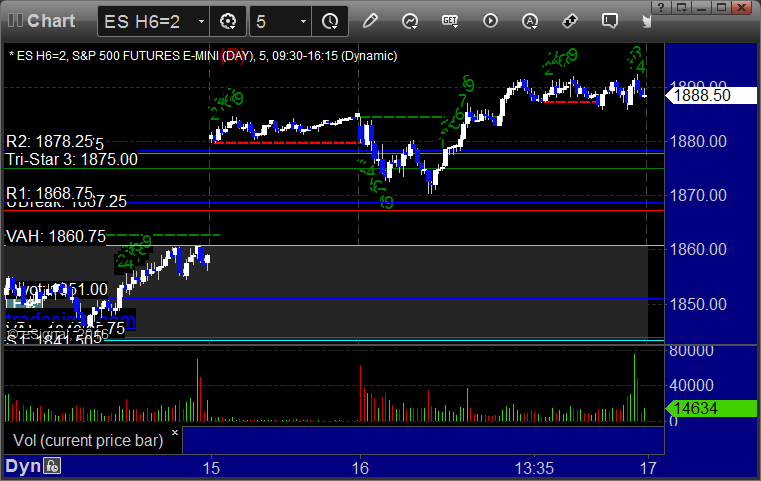

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 2/18/16

Pretty much a wash day with a loser and then a winner. See GBPUSD section below.

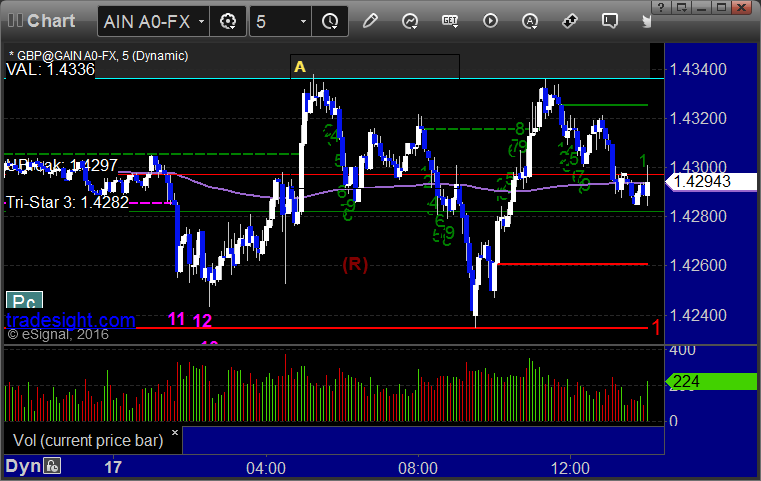

Here's a look at the US Dollar Index intraday with our market directional lines, 13 sell signal was the high:

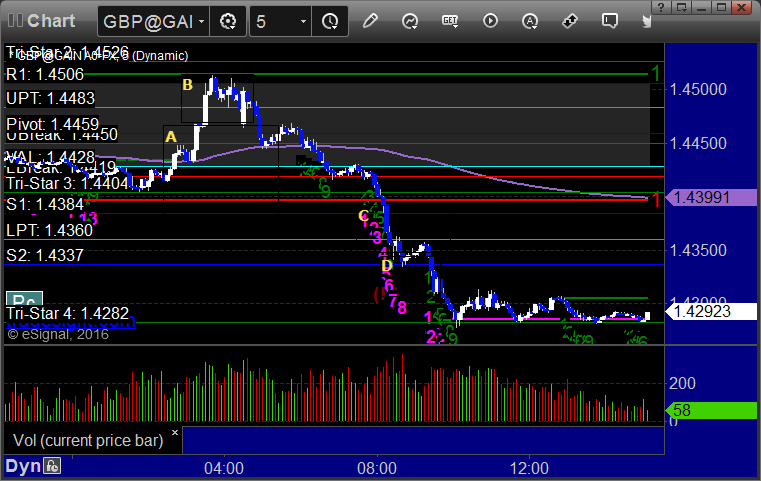

GBPUSD:

Triggered short at A and stopped. Triggered long at B, went to the first target for a nice partial at C, stopped second half under entry at D:

Stock Picks Recap for 2/17/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no triggers.

From the Messenger/Tradesight_st Twitter Feed, SNDK triggered long (with market support) and worked:

GPRO triggered long (with market support) and worked great:

Mark's LRCX triggered long (with market support) and worked:

His TSLA triggered long (with market support) and worked:

COST triggered long (with market support) and worked:

Mark's VRTX triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 2/17/16

Another big gap up in the markets that didn't fill and took us away from most of the key levels for the session. Mixed results on the Opening Range Plays. The afternoon was dead flat, and the high of the session was a Comber 13 sell signal on the 5 minute chart. NASDAQ volume improved to 2.1 billion shares.

Net ticks: -9 ticks.

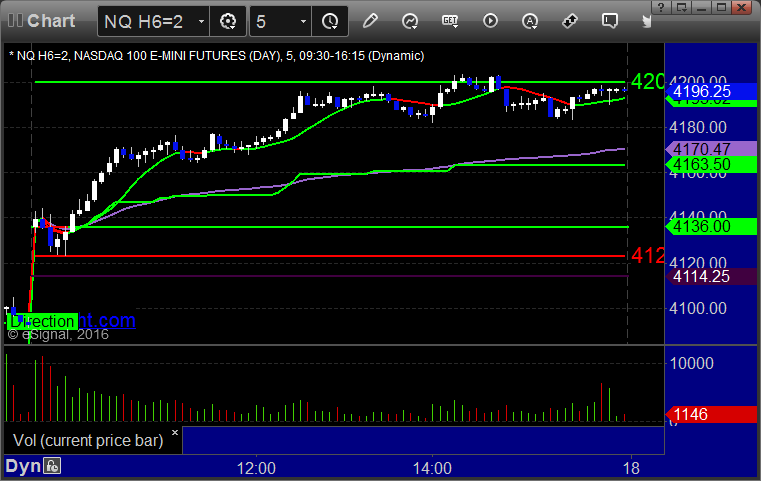

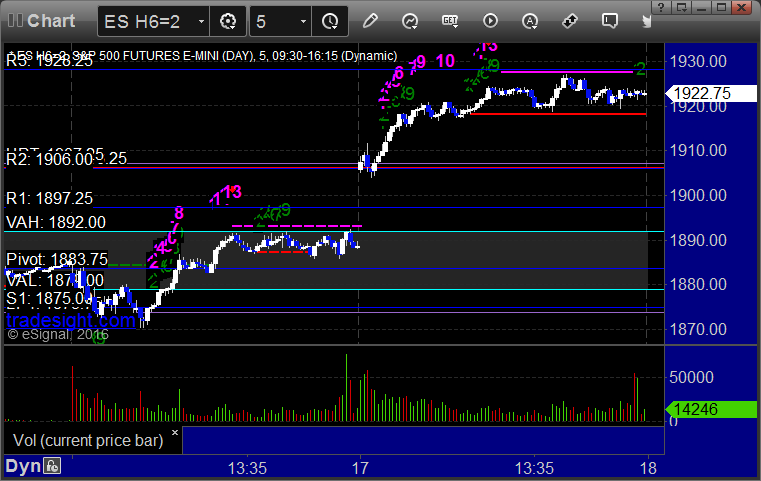

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked a little:

NQ Opening Range Play triggered long at A and didn't work, triggered short at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 2/17/16

We stopped out of the second half of the prior day's GBPUSD short well in the money. Strangely, we almost had no triggers overnight. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

If you followed our order staggering rules, 1 piece out of 3 of the long trade triggered at A and stopped. Note how well the GBPUSD used the VAL:

Stock Picks Recap for 2/16/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ORBC gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Mark's TSLA triggered long (with market support) and worked:

TEVA triggered short (with market support) and worked:

BIDU triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 of them worked.

Futures Calls Recap for 2/16/16

The markets gapped up big to start the week, never filled, and didn't trade close to average range on 1.9 billion NASDAQ shares. The afternoon was a complete waste of time. Opening Range plays worked, and with the gap, the ES never really touched a key level in a way that gave us a setup. We did stick to 1875 for a bit.

Net ticks: +19 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered long at A and worked, triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 2/16/16

A nice session for us. Two winners to start the short week, one of which is almost 100 pips in the money and still going. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, second half stopped. Triggered short at C, hit first target at D, still holding second half 90 pips in the money with a stop over S2:

Stock Picks Recap for 2/12/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's OIH triggered long (ETF, so no market support needed) and didn't work:

His PRU triggered long (with market support) and worked:

His HLF triggered short (with market support) and worked enough for a partial (but on a spike):

Mark's C triggered long (with market support) and worked great:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.