Futures Calls Recap for 2/12/16

A fairly dull session as expected heading into the long weekend. The markets gapped up and never filled, staying fairly flat for most of the session and drifting higher late in the day on only 1.9 billion NASDAQ shares.

Net ticks: +8.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 1838.00 and stopped. Put it back in, triggered, hit first target, second half stopped over entry:

Forex Calls Recap for 2/12/16

A loser and a winner to wrap up the week. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

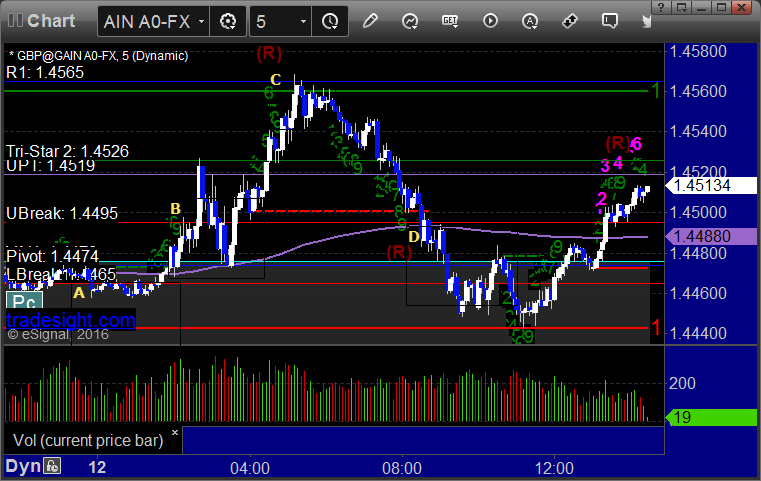

GBPUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, closed second half under entry in the morning at D:

Stock Picks Recap for 2/11/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered short (without market support) and didn't work:

His AMZN triggered short (without market support) and didn't work:

His FAS triggered short (ETF, so no market support needed) and didn't work:

His IBB triggered short (ETF, so no market support needed) and worked enough for a partial:

His LNKD triggered short (with market support) and didn't work:

His WYNN triggered long (with market support) and worked:

His GOOGL triggered long (with market support) and didn't work:

GS triggered long (with market support) and didn't work:

Rich's VRX triggered short (with market support) and worked:

His AAPL triggered short (with market support) and worked:

BIIB triggered short (with market support) and didn't work:

Rich's MYL triggered short (with market support) and worked enough for a partial:

His FB triggered long (with market support) and worked:

His FSLR triggered short (with market support) and worked:

His IBM triggered short (with market support) and worked:

His VXX triggered short (ETF, so no market support needed) and worked:

His AMZN triggered long (with market support) and worked:

In total, that's 15 trades triggering with market support, 10 of them worked, 5 did not.

Futures Calls Recap for 2/11/16

The markets gapped down again as global markets got crushed. The initial push was up, although not as strong as the last gap down despite the fact that there was a LOT of volume. We topped out about an hour in and by lunch we were testing the lows with a horrible setup. After lunch, it looked like things were going to crack, but OPEC came out and said that they would work on reducing supply, and everything popped, filling the NQ gap and closing at highs (ES did not fill) on 2.5 billion shares. The Opening Ranges were wide, so we use the midpoints as the stops. We had an NQ trade that only worked to the first target. See those sections below.

Net ticks: -21.5 ticks.

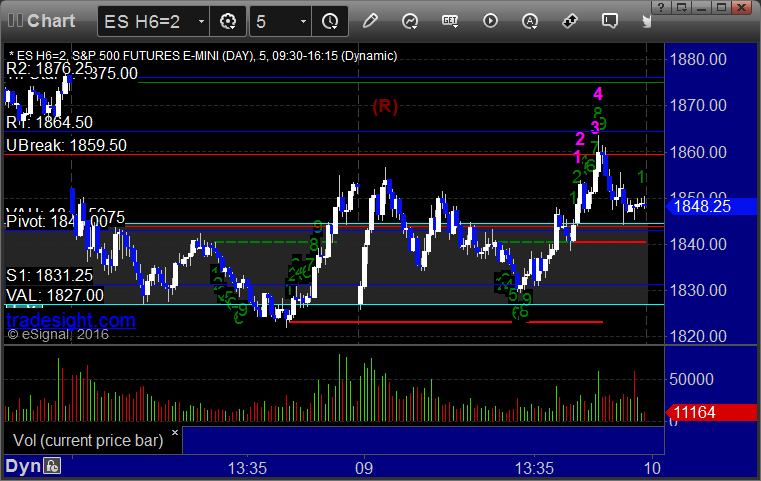

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A, hit first target for 8 ticks, stopped second half:

NQ Opening Range Play triggered long at A and didn't work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

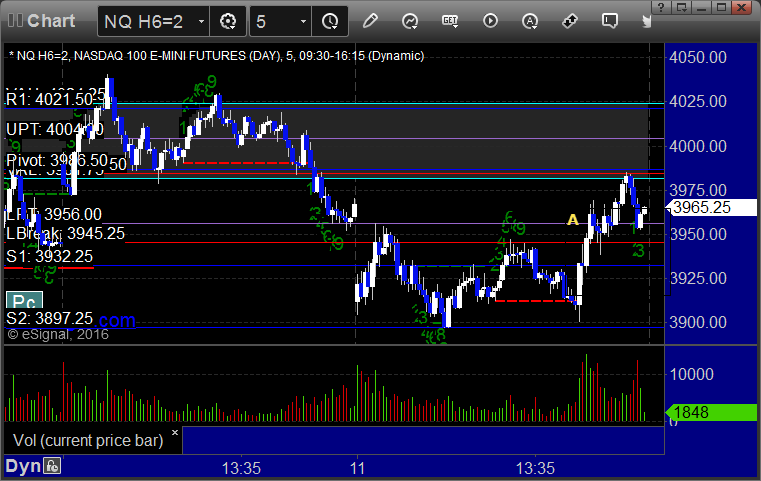

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 3956.50, hit first target for 6 ticks, stopped second half under the entry:

Forex Calls Recap for 2/11/16

Another winner for the week after a partial stop out. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

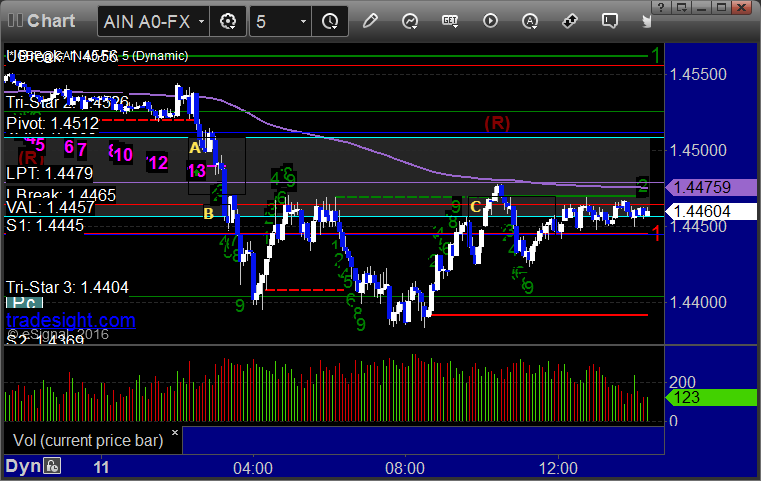

GBPUSD:

Order staggering has helped us a couple of times in the last week. We had a partial trigger on the long trade to the left side of this chart before the session began. Then, the short triggered at A, hit first target at B, and stopped second half at C:

Stock Picks Recap for 2/10/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOGL triggered long (with market support) and worked enough for a partial:

Rich's AGN triggered long (with market support) and worked:

Mark's NTES triggered long (with market support) and didn't work:

Rich's MON triggered short (with market support) and worked great:

COST triggered long (with market support) and worked enough for a partial:

Rich's IBB triggered long (ETF, so no market support needed) and worked:

His GS triggered long (with market support) and worked:

His DIS triggered long (with market support) and worked:

His GLD triggered short (ETF, so no market support needed) and didn't work:

His WDAY triggered long (with market support) and worked enough for a partial:

His TWTR triggered short (with market support) and worked enough for a partial:

In total, that's 11 trades triggering with market support, 9 of them worked, 2 did not.

Futures Calls Recap for 2/10/16

The markets gapped up this time and we got mixed action on the Opening Range plays. See that section below. There was a nice Value Area setup that we called although it only played out as a small winner. The markets were really slow all afternoon, and NASDAQ volume closed at 2.2 billion shares.

Net ticks: -20.5 ticks.

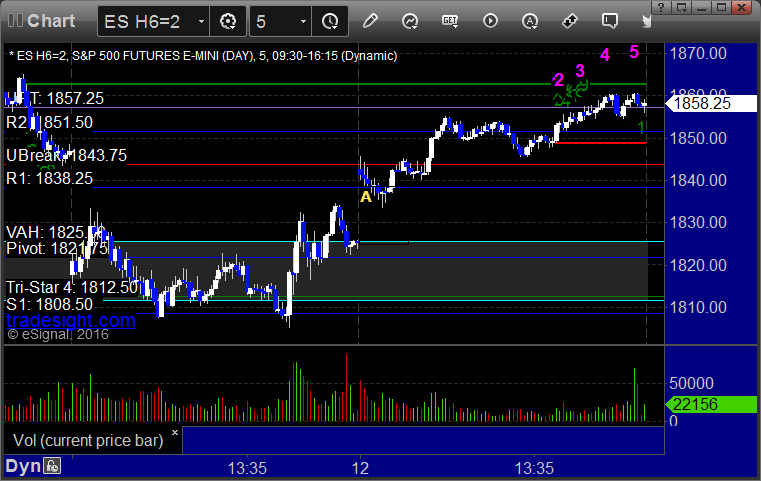

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped. Triggered short at B and stopped:

NQ Opening Range Play triggered short at A and worked enough for a partial. Triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

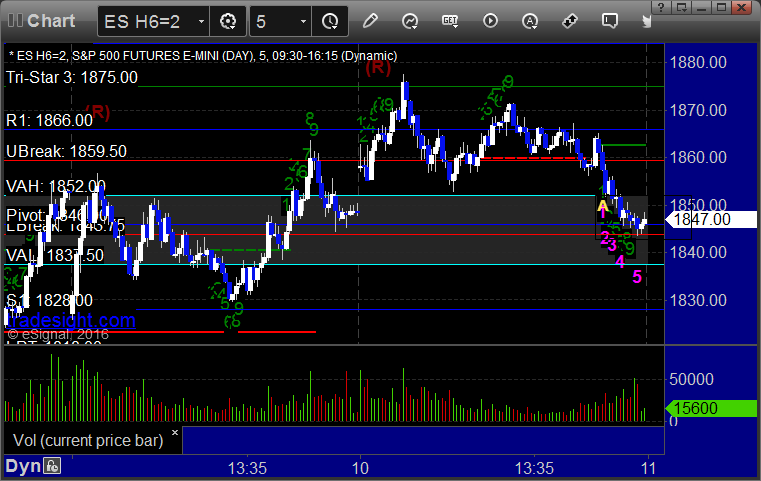

ES:

Perfect Value Area setup triggered short at A at 1851.75, hit first target for 6 ticks, and stopped second half above the entry:

Forex Calls Recap for 2/10/16

A loser and a bigger winner in the EURUSD for the session. See that section below.

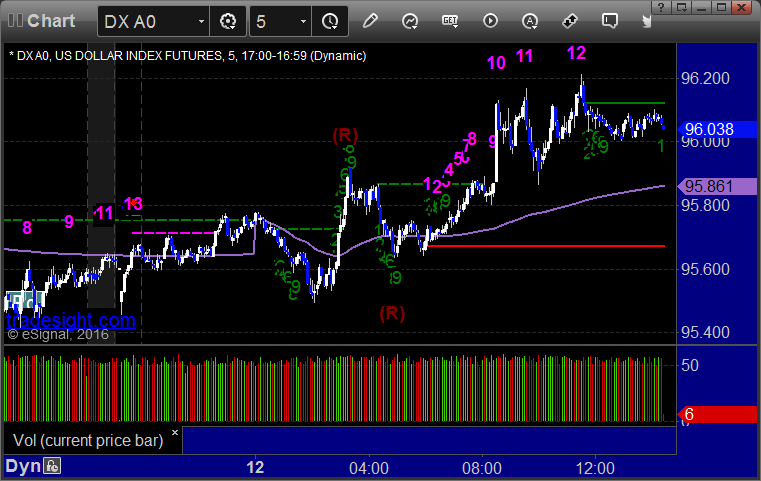

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long early (and just barely) and A and stopped. Triggered short at B, hit first target at C, moved stop and stopped at D:

Stock Picks Recap for 2/9/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ADSK triggered short (without market support due to opening 5 minutes) and worked enough for a quick partial:

CSAL triggered short (without market support) and worked enough for a partial:

PNFP gapped under the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOGL triggered long (with market support) and worked:

GS triggered long (with market support) and worked:

Rich's AMZN triggered long (with market support) and worked:

His VXX triggered short (ETF, so no market support needed) and didn't work:

His IBB triggered long (ETF, so no market support needed) and worked:

His FB triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 2/9/16

The markets gapped down pretty big again but this time started heading up into the gap immediately and just ran. The Opening Range plays worked so well and for so long that it wasn't really worth calling more trades. We filled the gap, tried to go higher over lunch, and then came back and settled on the VWAP on 2.25 billion NASDAQ shares.

Net ticks: +99.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked great, 1847.50 was final exit:

NQ Opening Range Play triggered long at A and worked great, 3967.00 was final exit:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: