Stock Picks Recap for 2/3/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, UTEK triggered long (without market support due to opening 5 minutes and didn't work):

PVTB triggered short (with market support) and worked:

AMZN triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered short (without market support due to opening 5 minutes) and worked great:

His NFLX triggered short (with market support) and worked:

Rich's GILD triggered long (with market support) and worked:

CELG triggered short (with market support) and worked:

BMRN triggered short (with market support) and worked:

Rich's NTES triggered short (with market support) and didn't work:

His BABA triggered long (without market support) and worked:

His RIG triggered long (without market support) and worked:

His IBM triggered long (with market support) and worked:

His JWN triggered long (with market support) and worked:

His FB triggered short (with market support) and worked:

His APC triggered long (with market support) and worked:

GS triggered long (with market support) and worked enough for a partial:

In total, that's 11 trades triggering with market support, 10 of them worked, 1 did not.

Futures Calls Recap for 2/3/16

The markets gapped up and gave us an Opening Range play that led into the gap and into the Value Area...dream plays that worked big on both the ES and NQ. See that section below. We sold off sharply, bounced to the VWAP going into lunch, and then hung near the lows for the close on 2.0 billion NASDAQ shares.

Net ticks: +43 ticks.

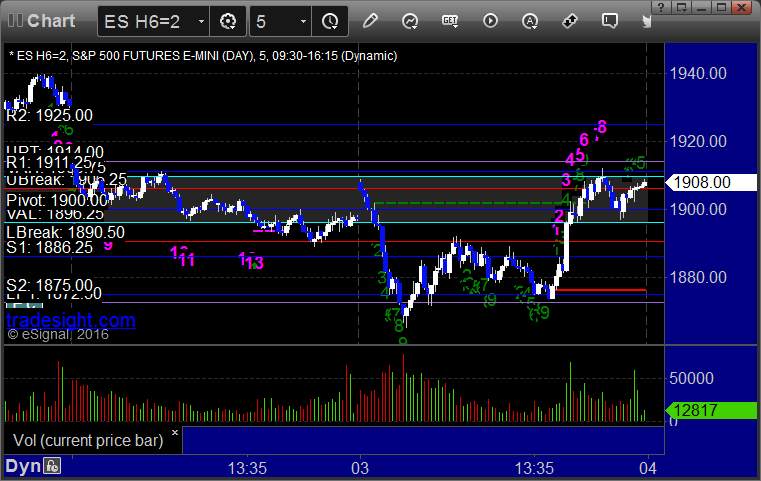

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES and NQ Opening and Institutional Range Plays ES and NQ Opening and Institutional Range PlaysES Opening Range Play triggered short at A and worked great:

NQ Opening Range Play triggered short at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

|

Forex Calls Recap for 2/3/16

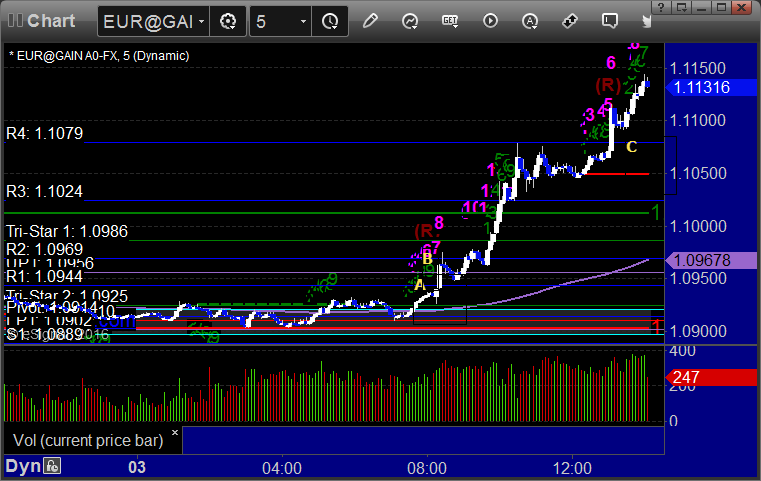

It's very rare that the R4/S4 levels come into play on Forex pairs, but the EURUSD got there today and we were (and still are) long for it. Holding the second half almost 200 pips in the money. See that section below.

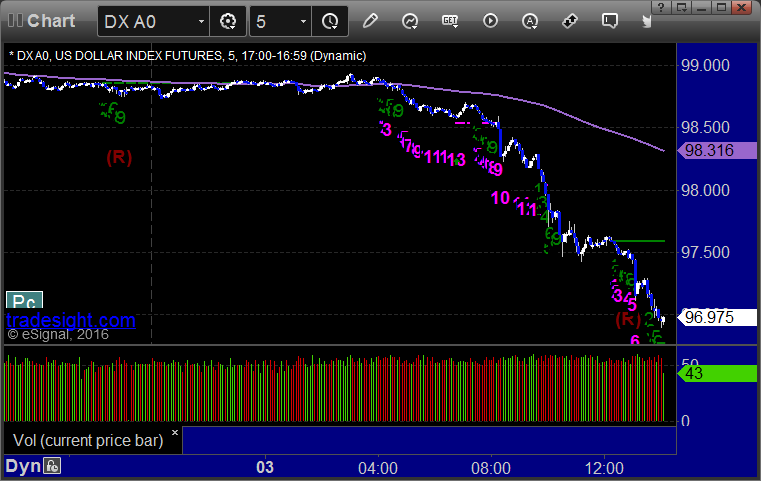

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under R4 at C, note how precisely we hit it and stopped on the way up:

Stock Picks Recap for 2/2/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TAST triggered long (without market support) and worked:

IONS triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FAS triggered short (ETF, so no market support needed) and worked:

His FB triggered short (with market support) and didn't work:

Mark's TLT triggered long (ETF, so no market support needed) and didn't go enough in either direction for hours to count either way (eventually worked but that's not a likely hold):

CELG triggered long (without market support) and worked enough for a partial:

FSLR triggered short (with market support) and worked great:

Rich's LNKD triggered long (without market support) and didn't work:

His AAPL triggered short (with market support) and worked:

His XON triggered short (with market support) and didn't work:

His GOOG triggered short (with market support) and worked enough for a partial:

His second FB call triggered short (with market support) and worked:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

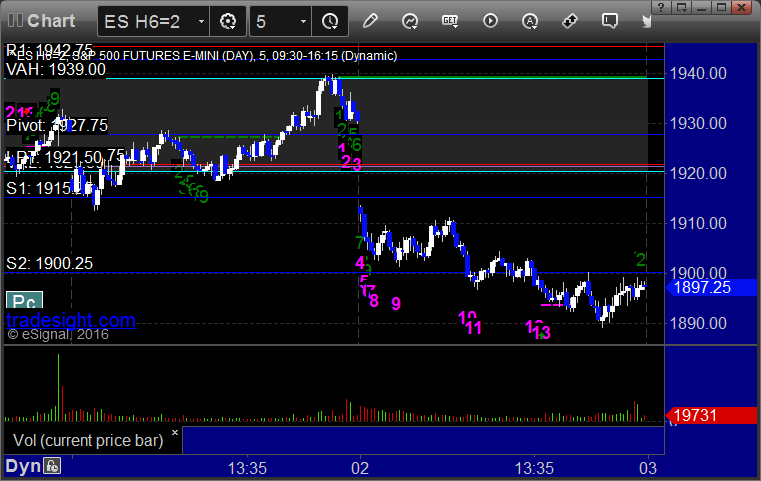

Futures Calls Recap for 2/2/16

The markets gapped down and kept going. We had huge winners in the Opening Range Plays that worked before the ES had even touched a level. NASDAQ volume closed at 1.9 billion shares.

Net ticks: +39 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked big, posted final exits in Twitter feed:

NQ Opening Range Play triggered short at A and worked big, posted final exits in Twitter feed:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 2/2/16

A winner for the session in the GBPUSD. See that section below.

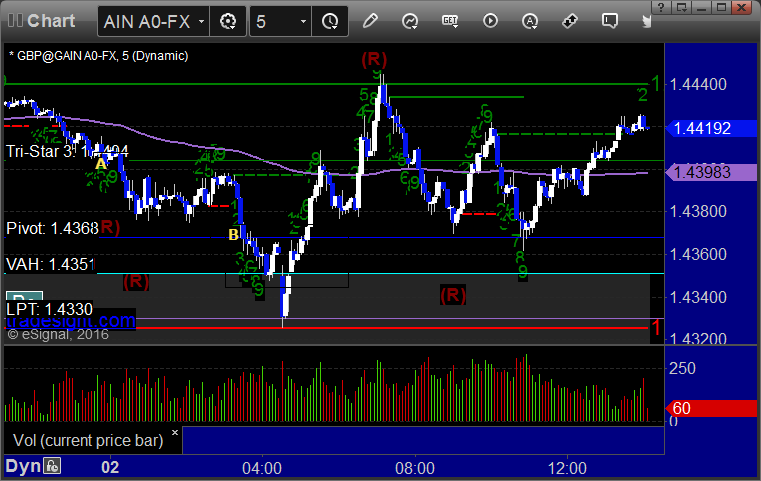

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, second half stopped:

Stock Picks Recap for 2/1/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AGN triggered short (without market support) and didn't work:

His IBM triggered long (with market support) and didn't work:

His FB triggered short (without market support) and didn't work:

His LNKD triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 2/1/16

A very dead session to start the month of February. Mondays don't have to be exciting but this was a little ridiculous. The S&P 500 literally closed down less than a point and spent the first several hours in a tiny range after gapping down. With that, of course, the futures were choppy, so we're off to a slow start for the month. See the ES section for Mark's call and the Opening Range plays.

Net ticks: -41 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work. Triggered long at B and didn't work:

NQ Opening Range Play triggered short at A and worked enough for a partial. The long entry trigger was too far outside of the range to take under our rules:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

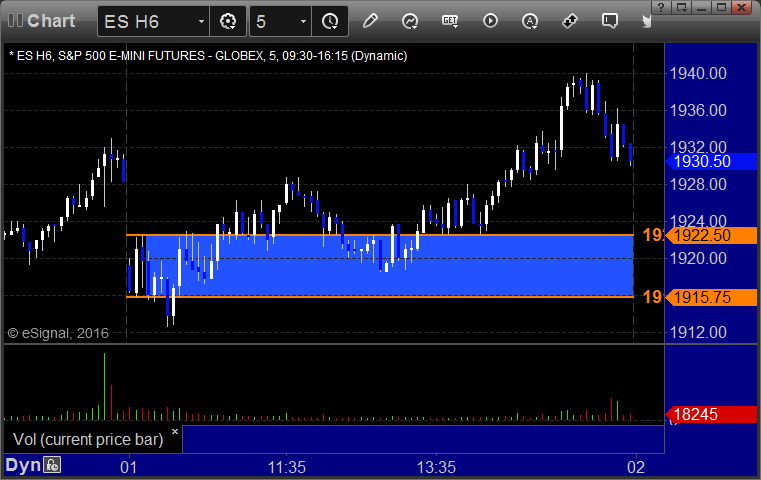

Mark's call triggered long at A at 1922.75 and stopped. He did not re-enter:

Forex Calls Recap for 2/1/16

A loser to start the week, which was unfortunate because it ended up working great after stopping us out. See GBPUSD section below.

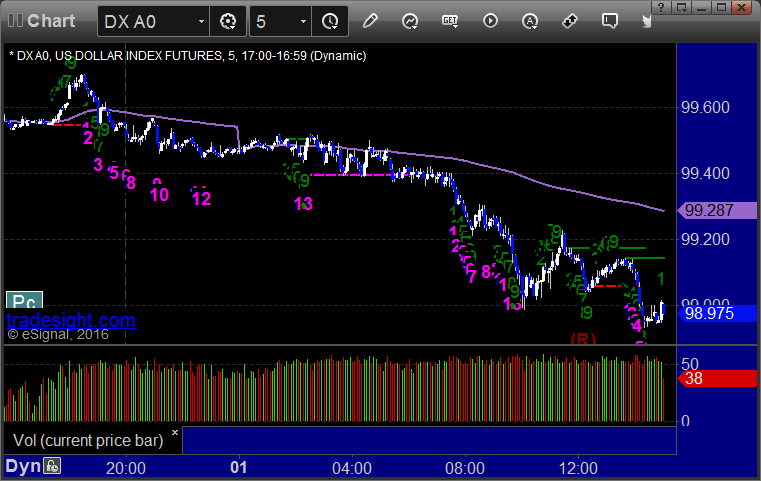

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. If you were awake to put it back in, worked, but that wasn't available on my sleep schedule:

Stock Picks Recap for 1/29/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NDAQ triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and worked:

His GILD triggered long (with market support) and didn't work:

His AMGN triggered long (with market support) and worked enough for a partial (but was quick):

Mark's SNDK triggered long (with market support) and worked:

Rich's EA triggered short (without market support) and worked:

His GOOGL triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.