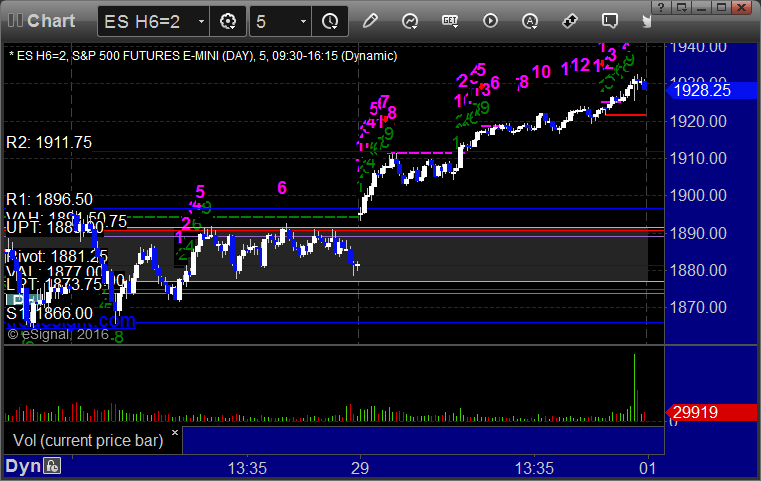

Futures Calls Recap for 1/29/16

The markets gapped up and kept going, closing the month and week on an unusual (for month end) gap and go session on 2.3 billion NASDAQ shares. Opening Range plays worked great, and you could have taken the ES long over R2 as well for a clean play.

Net ticks: +26 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked great:

NQ Opening Range Play triggered long at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

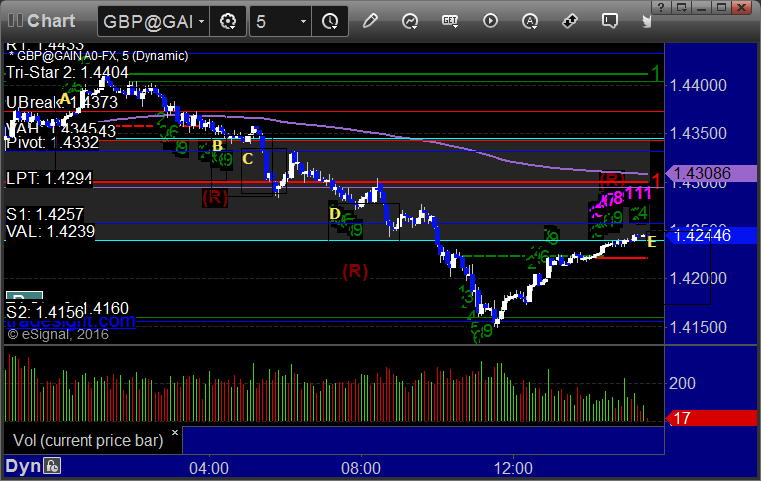

Forex Calls Recap for 1/29/16

The second half of the prior day's trade stopped in the money, and then we had two new trades trigger. One worked and one didn't. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

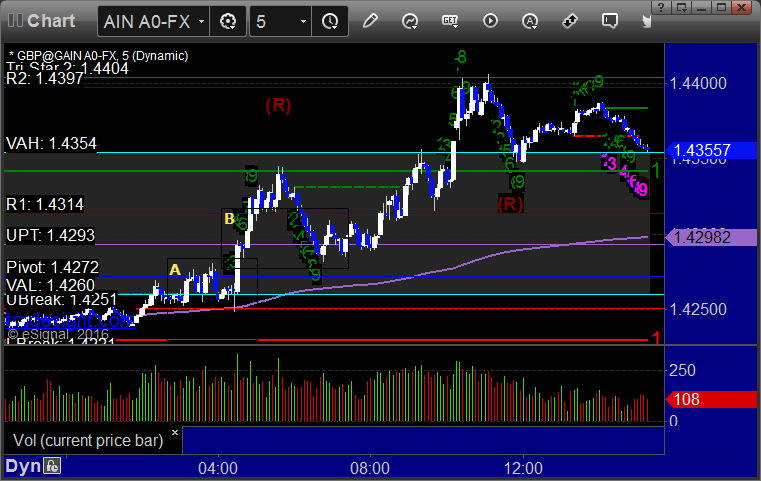

GBPUSD:

We came in long the second half of the prior day's trade with a stop under LBreak. The new long idea triggered at A (when this happens, you should raise stop on the piece from the prior session if you are awake) and stopped out. If you didn't adjust then the second half of the prior trade stopped at B. The new short triggered at C, hit first target at D, actually went all the way to S2, and closed for end of week at E:

Stock Picks Recap for 1/28/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CPHD triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (without market support) and worked enough for a partial:

His CELG triggered short (with market support) and worked:

His NFLX triggered short (with market support) and worked enough for a partial:

His QCOM triggered short (with market support) and didn't work:

GILD triggered short (with market support) and worked great:

Rich's VRTX triggered long (with market support) and worked:

His SWKS triggered long (with market support) and worked enough for a partial:

His SCTY triggered short (without market support) and didn't work:

His NKE triggered long (with market support) and didn't work:

His AAPL triggered long (with market support) and didn't work:

In total, that's 9 trades triggering with market support, 6 of them worked, 3 did not.

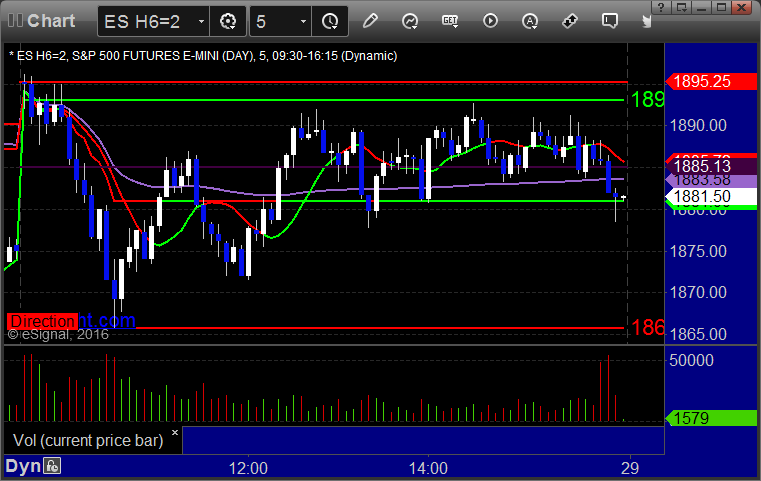

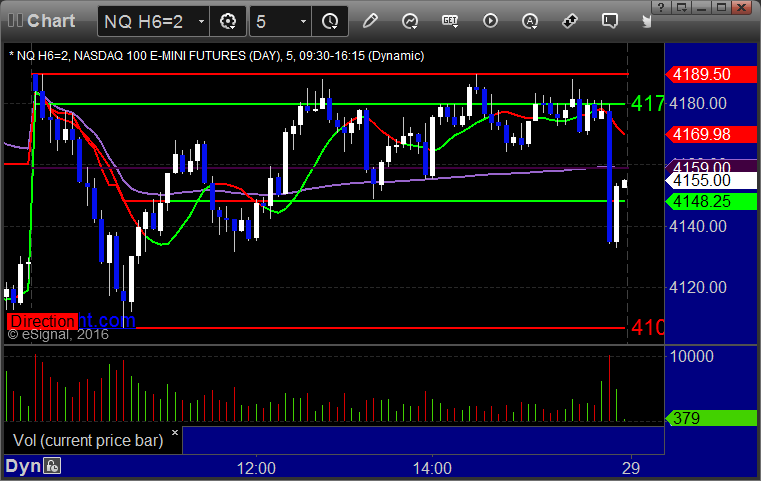

Futures Calls Recap for 1/28/16

The markets gapped up and filled in about an hour and then did not much else for the rest of the day, closing on the VWAP (before dropping right after the stock market close) on 2.1 billion NASDAQ shares. Opening range plays worked, see that section below. I tried to post an ES call but it went too quick.

Net ticks: +30.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked, and I suggested in the Lab holding this one a bit longer for the retest of the lower band:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

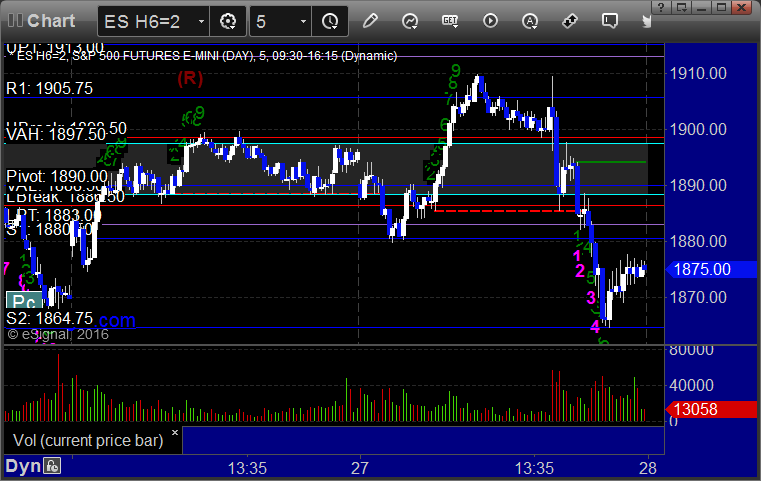

ES:

Forex Calls Recap for 1/28/16

Another winner as we wrap up January. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Second half of the prior day's short stopped out over the new VAL in the money. New trade triggered long at A, hit first target at B, still holding second half with a stop under R1:

Stock Picks Recap for 1/27/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NFLX triggered short (with market support, totally clean trigger after the announcement and should have been taken heavily) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's IBM triggered short (with market support) and didn't work:

NTAP triggered long (with market support) and didn't work:

Rich's TWTR triggered long (with market support) and didn't work:

LULU triggered long (without market support) and didn't work:

Rich's APC triggered long (without market support) and didn't work:

Rich's NFLX triggered short (with market support) and worked:

His TSLA triggered short (with market support) and worked enough for a partial:

His AAPL triggered long (with market support) and worked enough for a partial:

GILD triggered short (with market support) and didn't work:

COST triggered short (with market support) and didn't work:

Rich's PCLN triggered short (with market support) and worked:

His BA triggered long (with market support) and didn't work:

His AAPL triggered short (with market support) and worked:

His WMB triggered short (with market support) and worked enough for a partial:

TEVA triggered short (with market support) and worked enough for a partial:

In total, that's 14 trades triggering with market support, 8 of them worked, 6 did not.

Futures Calls Recap for 1/27/16

The markets gapped down, although the NASDAQ side was much worse due to AAPL. We were split for a bit and then headed lower, then recovered to highs ahead of lunch and sat there until the Fed. The announcement didn't do much initially, but then we picked up some downside speed. NASDAQ volume closed at 1.9 billion shares.

Net ticks: -42 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and stopped:

NQ Opening Range Play triggered long at A and stopped, triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 1/27/16

A slow overnight ahead of the Fed, and then our GBPUSD triggered and worked enough before the announcement. After the announcement...absolutely nothing happened. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

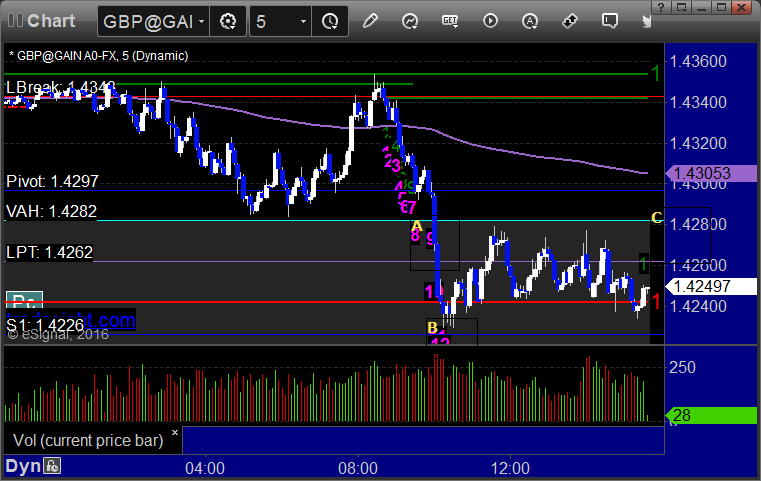

GBPUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over entry at C:

Futures Recap and Results for 2015

Let's start by looking back at the year in the markets just to see how action and ranges look. Here's the ES daily chart from the start of 2015 to December 31:

Hard to remember now how slow the first eight months were. One of the slowest periods in the markets that I can recall except for the lead up to the invasion of Iraq over a decade ago. Then, things got exciting when the markets fell apart a bit in August, recovered, and flattened out for the end of the year and closed almost exactly where we started. 2015 ended with the ES at 2054.00 and 2016 ended at 2035.75, down 16 points.

Here's the NQ side:

This was obviously more positive, stacked by stocks like GOOG and AMZN that wouldn't quit into the end of the year for tax reasons, but still very narrowly contained overall for the markets.

I should also note that the volatility picked up quite a bit after August, as reflected in the 6-month average daily range numbers of the ES and NQ. At the start of the year, the ES traded an average of less than 18 points per day (from high to low) and the NQ less then 44. That's using the average of the 6 months before (basically the last half of 2014). And then ranges got worse during the year. However, by the end of the year, the average ranges for those two symbols was 24 and 65, respectively. That's a 33% boost for the ES!

Our results for futures for the year fit exactly in line with what our system teaches. Of the trades called officially, 63.4% of them were winners. Note that this does not count set plays like the Opening Range plays, Institutional Range plays, Value Areas, and Seeker/Comber setups that we teach in the program. Starting January 1, 2016, we are officially tracking the Opening Range plays as well, which added over 100 ticks in gains to some of the months in 2015.

As it was, with the 63.4% win rate, we locked in +369.5 ticks in futures calls winners in 2015, which was not bad at all. Granted, that's a deceptive number since it doesn't count some of the bigger gains in the mechanical plays.

Here's to a good 2016 in futures!

Forex Recap and Results for 2015

2015 is in the books, and it's time to take a quick look at what the Forex markets accomplished in the year, and also how Tradesight did within that.

Let's start by looking at the US Dollar Index from the start of the year to the end:

That's about a 10 point range, which is average at best. Note the only Seeker signal that we got on the daily timeframe was the 13 sell signal in April, and that was the high of the year.

In terms of the major pairs and their ranges for the year, here's the EURUSD:

That's about 1500 pips of range, although if you just take out January, most of the year was in about a 900 pip range. Compare that to 2014, which saw 2000 pips of range for the year, and you can see that 2015 was a little more limited in terms of action.

Here's the GBPUSD:

That's 1200 pips of range, as opposed to 1800 in 2014, so again, not as much movement.

I'll throw up two more for the record. Here's the GBPJPY:

And AUDUSD:

What's interesting about all of this though is the while the total ranges (high to low) of the year for these pairs was not as big as 2014, the intraday ranges tell a different story.

When 2015 started, the 6-month average daily range on the EURUSD was 84 pips, and on the GBPUSD, it was 96 pips.

By the end of 2015, those had moved to 113 and 109, respectively. That's a statistically significant difference that gives us more to work with on a daily basis. For example, that's a 34 percent expansion of the average daily movement on the EURUSD. And that helped us put together a terrific year once again for Forex. Let's recap the results of the year by summarizing all of the monthly results.

For the year, our main trade calls (which is by no means the extent of what you should be doing with our service if you've taken the program) totaled 312 calls that triggered. Our goal in our system is to target something close to 60% winners. This year, we came up a little short of that at 53.2%. However, our system also keeps losers small and lets winners ride. Our total net pip gains for the year was +2040 pips! This included only 2 months that were barely in the red, January and November. June and August (August is always boring) were similarly just barely in the green. The rest of the months added up nicely, and this doesn't even include our Value Area Plays, Power Hour Plays, or Seeker/Comber trades. This is just pure "set and forget" plays that you can trade overnight while you sleep.

2015 shows that daily ranges matter more than total price movement in a year, and we look forward to another great trading year for Forex in 2016.