Futures Calls Recap for 1/21/16

The markets opened much flatter and were choppier than the last few days. We pushed lower early, then reversed to highs, topped out on a ES Comber 13 on the 5 minute chart, and then got stuck in neutral on the VWAP for the last three hours on 2.2 billion NASDAQ shares. Opening range plays worked, see that section below, and the main trade call didn't trigger.

Net ticks: +15.5 ticks.

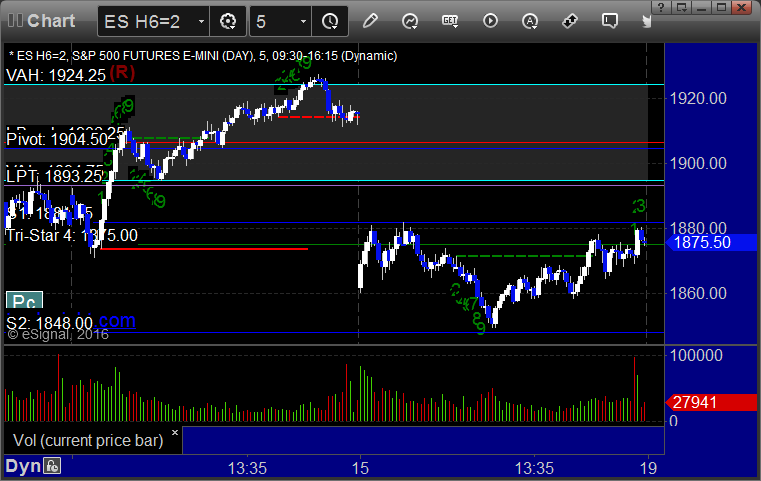

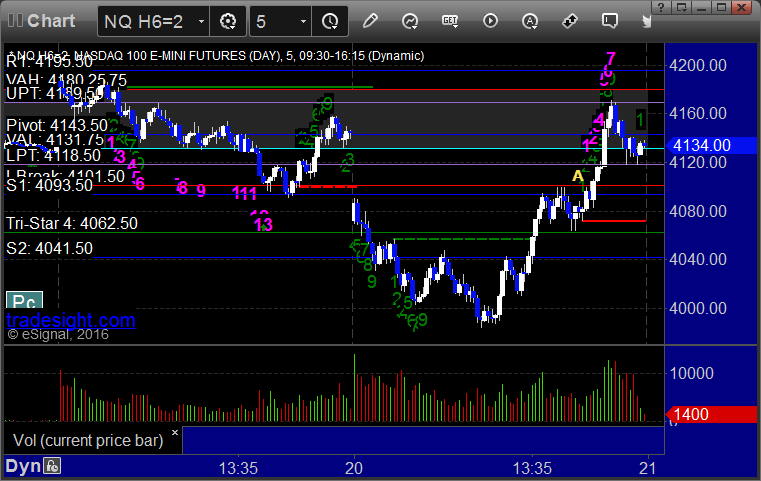

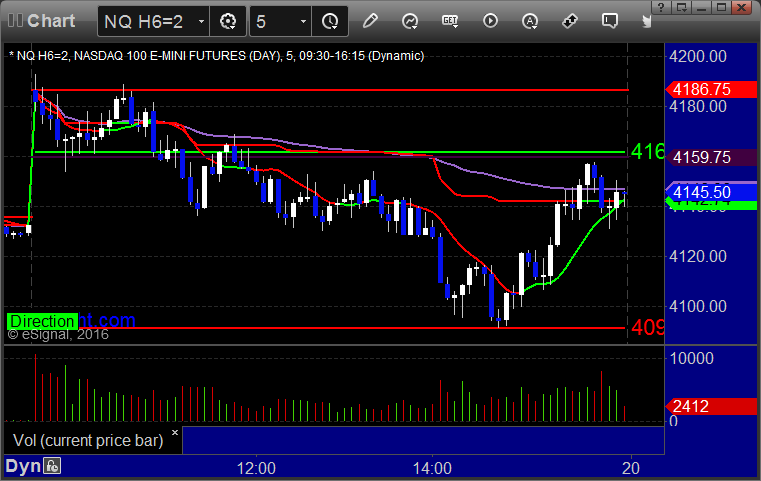

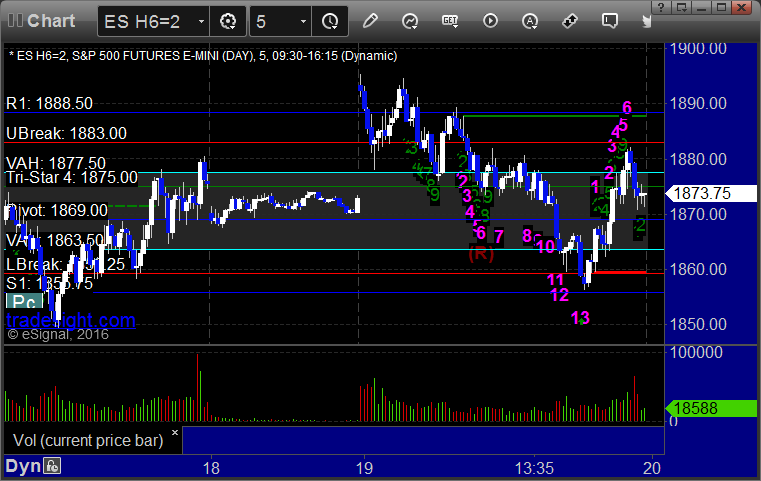

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

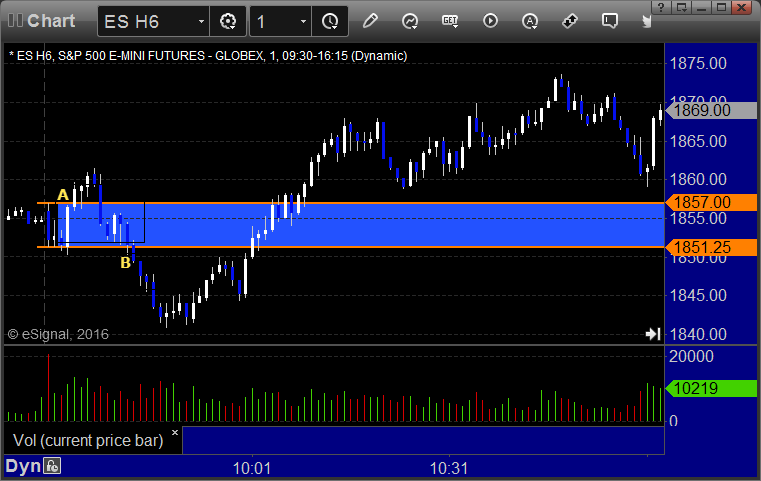

ES and NQ Opening and Institutional Range:

ES Opening Range Play triggered long at A and worked enough for a partial. Triggered short at B and worked enough for a partial:

NQ Opening Range Play triggered short at A but was too far beyond the lower boundary to take under our rules. It did trigger long later, but much later, and I didn't take it (would have worked):

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 1/21/16

Interesting to have the long, then the short, then the long trigger and 2 out of the 3 worked, with one still going. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

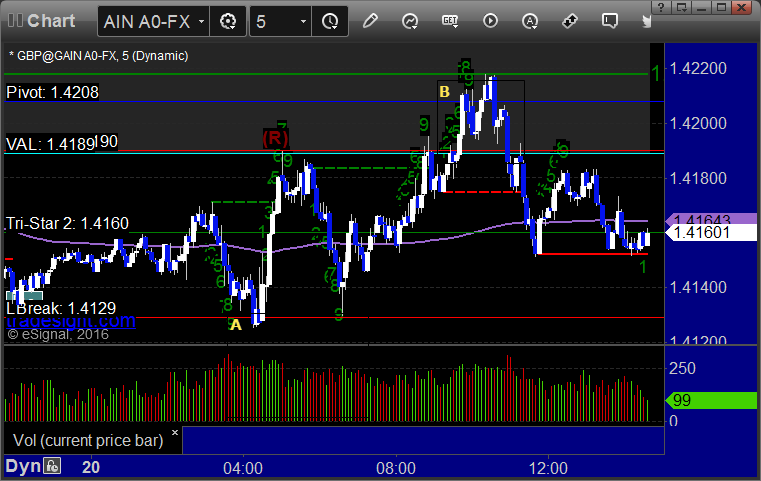

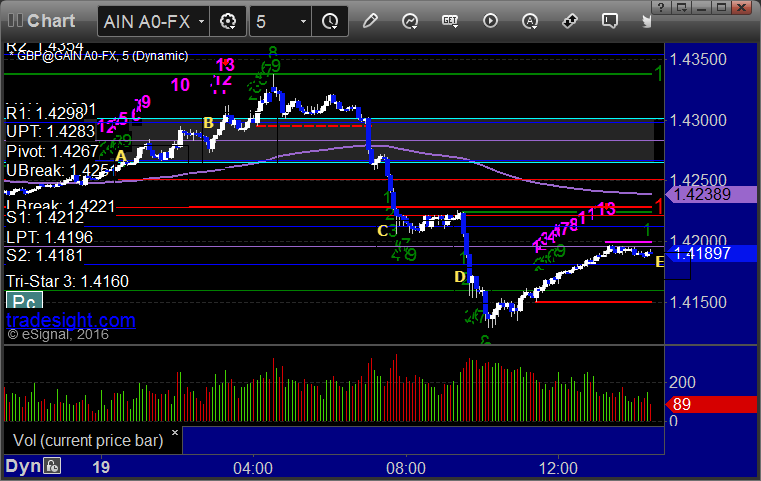

GBPUSD:

Triggered long at A and stopped. Triggered short at B, hit first target (exactly) at C, lowered stop in the morning and stopped at D. Triggered long at E, hit first target at F, and still holding second half with a stop under entry:

Stock Picks Recap for 1/20/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ROVI triggered long (with market support) and worked a little:

VDSI, CERN, and GOGO gapped below their short triggers, no plays.

From the Messenger/Tradesight_st Twitter Feed, Rich's VRX triggered long (without market support) and didn't work:

His IBM triggered long (without market support) and worked enough for a partial:

His TSLA triggered short (with market support) and worked:

His WMB triggered long (with market support) and worked:

TEVA triggered short (with market support) and worked:

NFLX triggered short (with market support) and worked:

COST triggered short (with market support) and worked:

Rich's FB triggered long (without market support) and didn't work:

His VXX triggered long (ETF, so no market support needed) and worked:

His WTW triggered long (with market support) and worked:

His AAPL triggered long (with market support) and didn't work:

His APC triggered long (with market support) and worked:

In total, that's 10 trades triggering with market support, 9 of them worked, 1 did not.

Futures Calls Recap for 1/20/16

A wild day on Wall Street. The markets gapped down big and volume was heavy all day, very steady too as we pushed lower. Opening range plays were mixed, see that section below, but we identified the reversal and nailed a nice futures calls for 100 ticks on the NQ coming back up to fill the gap. NASDAQ volume closed at 3.2 billion shares.

Net ticks: +20.5 ticks.

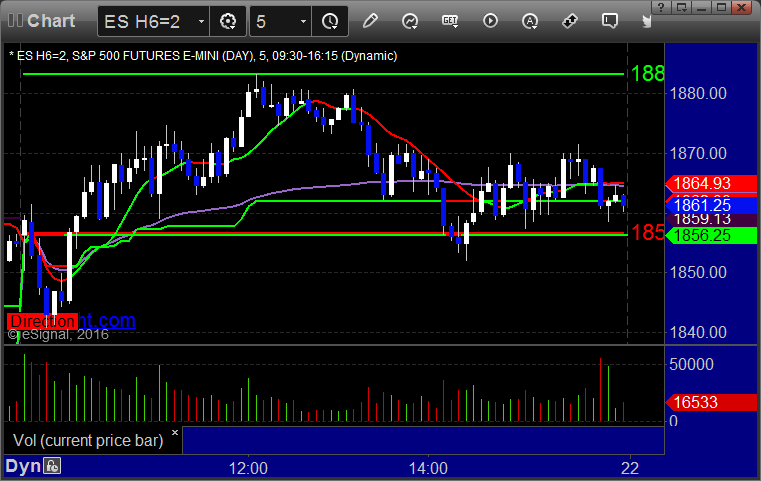

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, triggered short at B and went enough for a partial and nothing more:

NQ Opening Range Play triggered long too far beyond the boundary under our rules to take, and same with the short after:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 4102.00 and stopped out twice before going, classic reversal setup into the gap against the LBreak. Ended up closing the final piece just under 4152.00 for basically 50 points/handles:

Forex Calls Recap for 1/20/16

Another uneventful Forex session while the rest of the markets moved big. See GBPUSD section below.

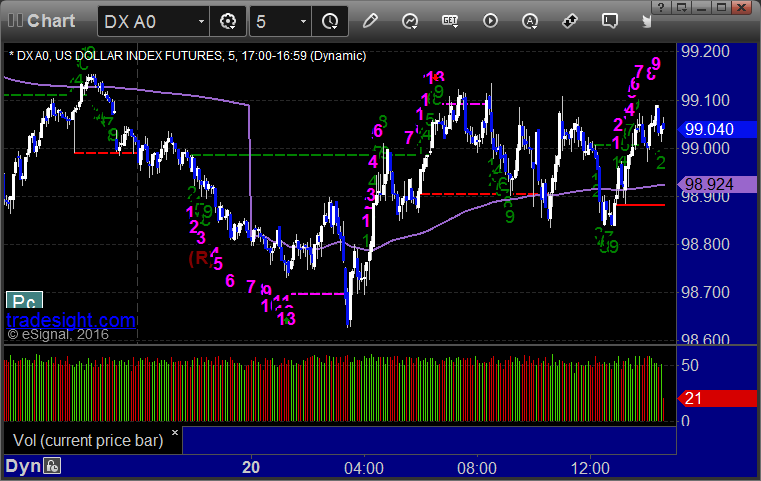

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Following our order staggering rules, only part of the short triggered at A and stopped. The long triggered at B and stopped:

Stock Picks Recap for 1/19/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's APC triggered short (with market support) and didn't work:

His WMB triggered short (with market support) and worked enough for a partial:

Mark's NTES triggered long (with market support) and worked:

Rich's PCLN triggered long (with market support) and worked:

TSLA triggered long (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 1/19/16

The markets gapped up to start the short week, and the Opening Range plays worked great. See that section below. We filled the gap and closed flat on 2.1 billion NASDAQ shares.

Net ticks: +31.5 ticks.

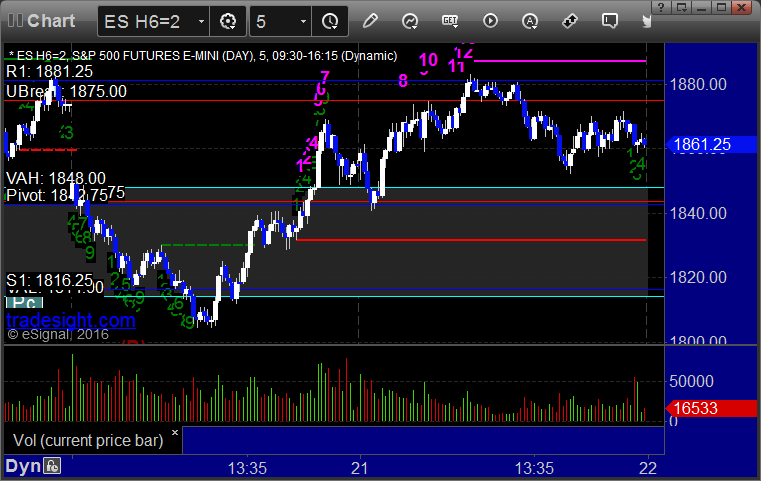

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked great, stopped out of final piece at B:

NQ Opening Range Play triggered short at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 1/19/16

Two winners for the session in the GBPUSD, see that section below. Very unusual to have both trades trigger and work.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, stopped second half. Triggered short at C, hit first target at D, closed second half at E:

Stock Picks Recap 1/15/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VDSI triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's SRPT triggered short (without market support) and worked:

Mark's TWTR triggered short (with market support) and worked enough for a partial:

Rich's TSLA triggered short (with market support) and worked enough for a partial:

His BIDU triggered short (with market support) and worked:

His APC triggered short (with market support) and worked:

His AAPL triggered short (with market support) and didn't work:

His VXX triggered long (ETF, so no market support needed) and worked enough for a partial:

His AMZN triggered short (with market support) and worked:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

Futures Calls Recap for 1/15/16

The markets gapped down big again for options expiration. Our Opening Ranges plays were big again, and with expiration and the gap, we didn't make any additional calls. The market tried the highs and lows and settled on the midpoint (shocker) over lunch and beyond on 2.7 billion NASDAQ shares.

Net ticks: +30 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked very nicely:

NQ Opening Range Play triggered long at A and worked very nicely:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: