Forex Calls Recap for 1/15/16

A nice winner to wrap-up a week that was uneventful compared to everything going on in stocks and futures. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

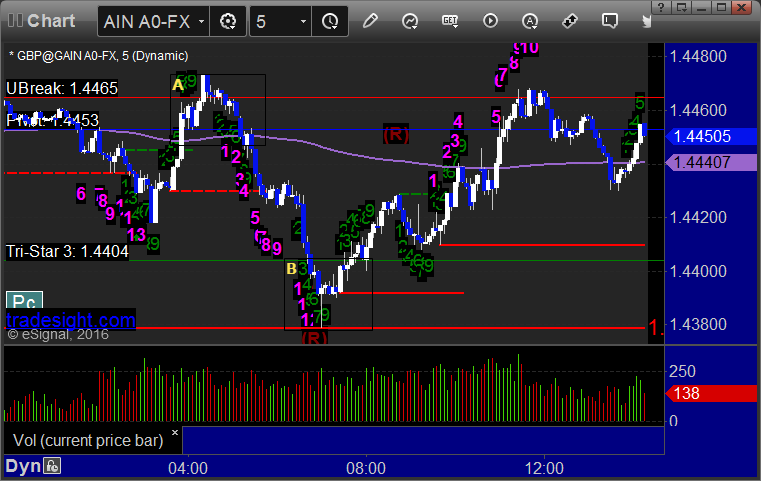

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

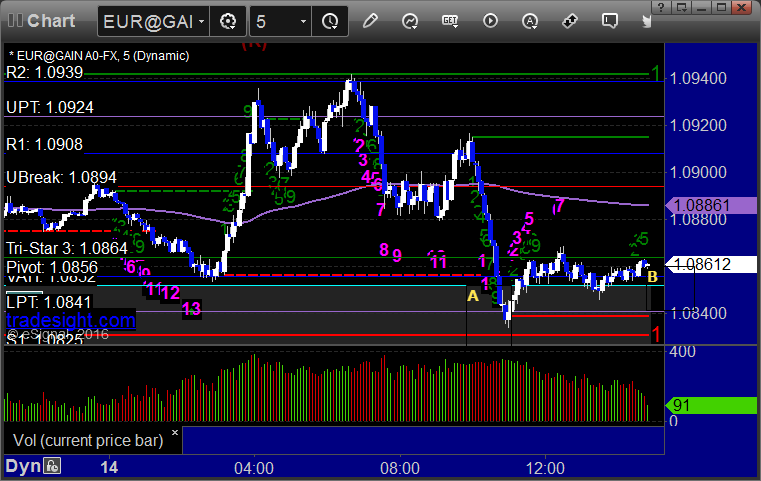

EURUSD:

Triggered long at A over Pivot, hit first target at B, closed last half at C for 70 pips for end of week:

Stock Picks Recap for 1/14/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SAGE triggered short (with market support) and worked enough for a partial:

WYNN triggered short (with market support) and worked:

HAWK triggered short (with market support) and worked enough for a partial:

LGIH triggered short (with market support) and worked enough for a partial:

ESRX triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered long (with market support) and worked:

His AAPL triggered short (with market support) and worked enough for a partial:

GS triggered short (with market support) and worked:

Mark's CELG triggered short (with market support) and worked enough for a partial:

Rich's SLB triggered long (with market support) and worked:

His AAPL triggered long (with market support) and worked:

His FB triggered short (with market support) and worked:

LNKD triggered short (with market support) and worked:

BABA triggered short (with market support) and worked enough for a partial:

Rich's WMB triggered long (with market support) and worked:

His RIG triggered long (with market support) and worked:

His TBT triggered long (ETF, so no market support needed) and worked:

His FB triggered long (with market support) and worked enough for a partial:

His KMI triggered long (with market support) and worked enough for a partial:

In total, that's 18 trades triggering with market support, all 18 of them worked, many for huge gains. Quite a day.

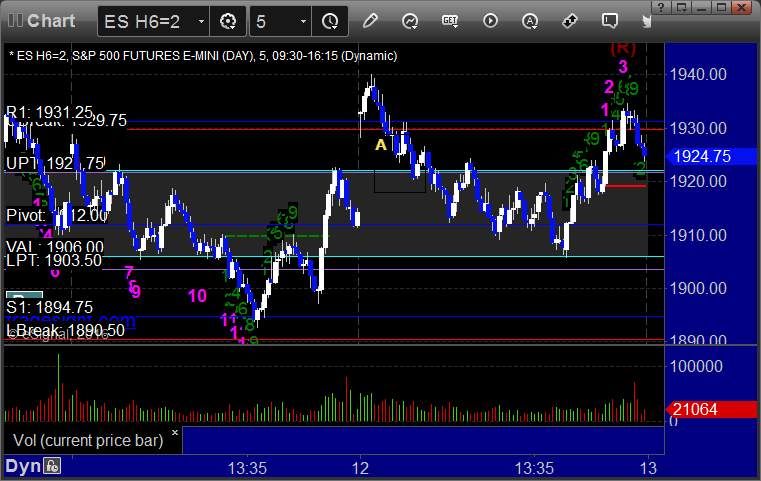

Futures Calls Recap for 1/14/16

The markets gapped up a little and headed lower, filling the gap and then accelerating for 30 minutes, then reversed hard quickly to recover part of the options unraveling sell off from Wednesday. We were mostly flat over lunch and then started to drift higher, then dropped a little bit at the close. NASDAQ volume was 2.3 billion shares. On to expiration Friday.

Net ticks: +21 ticks.

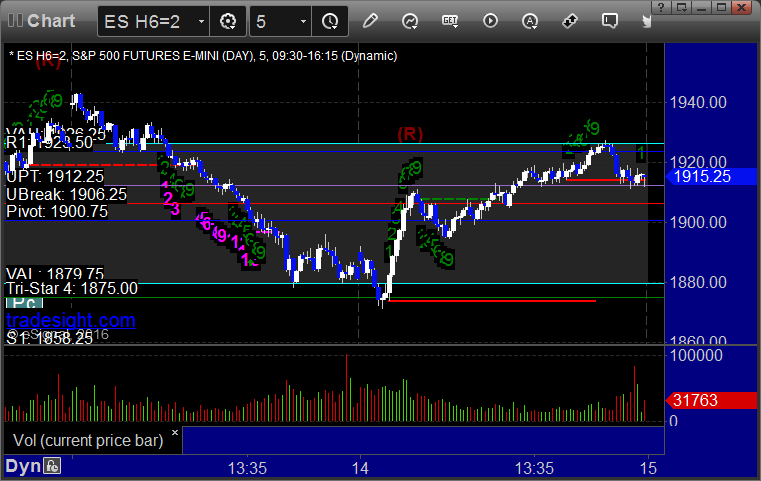

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

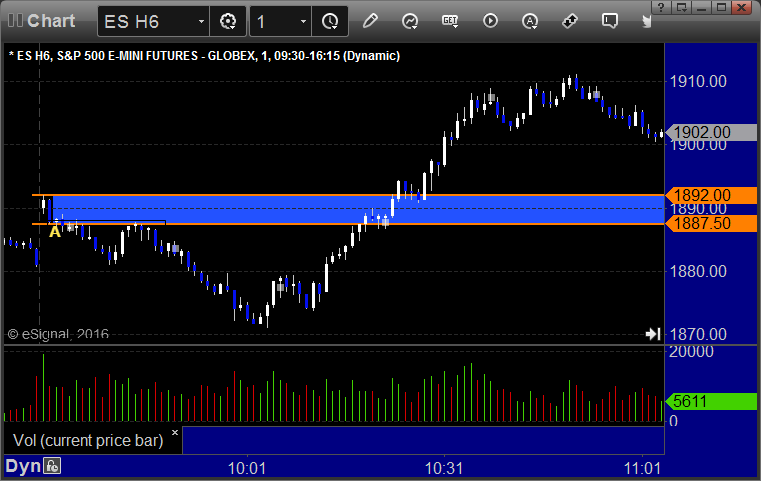

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 1/14/16

Another boring session for Forex while the action is in stocks and futures. We had a trade trigger each way. See EURUSD and GBPUSD sections below.

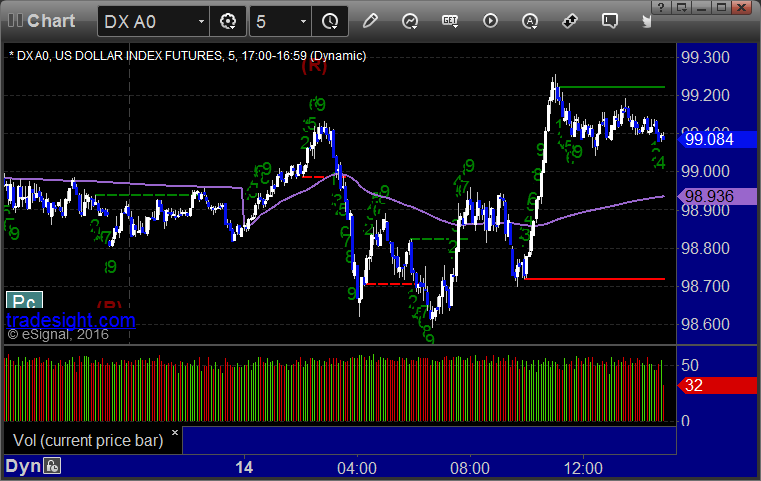

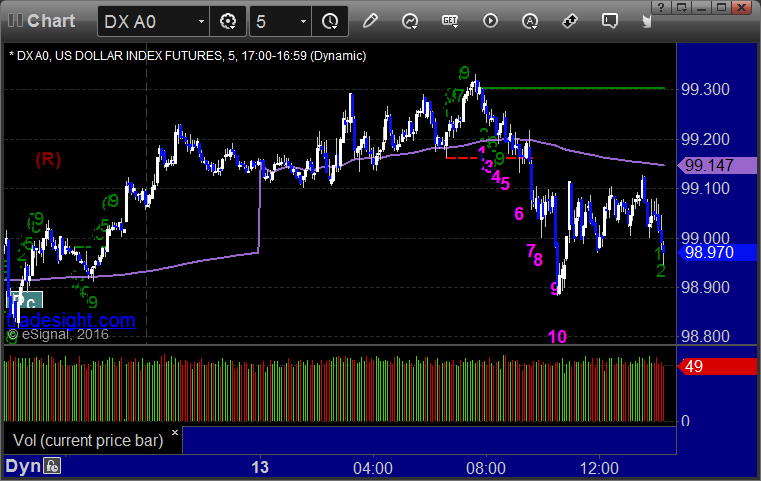

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and closed just above entry at B for end of session:

GBPUSD:

Triggered long at A and stopped:

Stock Picks Recap for 1/13/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's APA triggered long (with market support) and worked:

Rich's WMB triggered short (with market support) and didn't work, swept by a penny, and then worked later:

GS triggered short (with market support) and worked huge:

Rich's FB triggered short (with market support) and didn't work:

WYNN triggered short (with market support) and worked enough for a partial:

Rich's NFLX triggered short (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 1/13/16

The markets gapped up a little and then finally rolled and filled the gaps. Unfortunately, the Opening Range plays swept one way and then worked the other or we would have had a nice session. The markets really sold off badly and gave us what appears to be an options unraveling move in the process, strangely to the downside. We also had an ES call that worked on its own. NASDAQ volume was 2.3 billion shares.

Net ticks: -7.5 ticks.

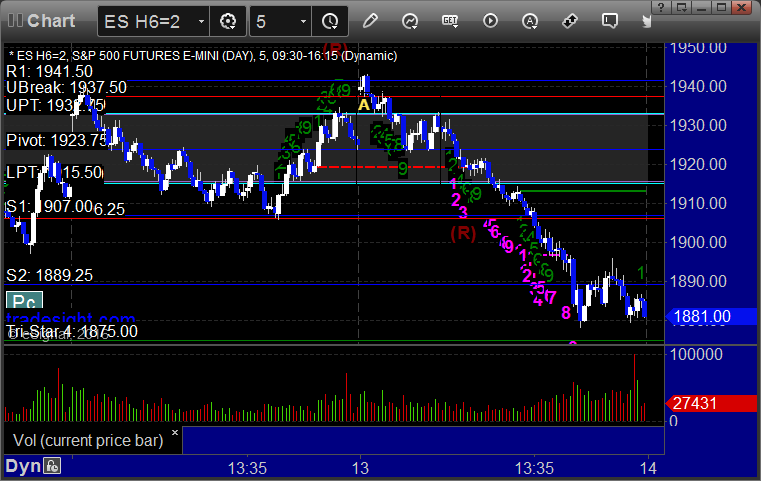

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

NQ Opening Range Play triggered long at A and stopped, triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 1937.25, hit first target for 6 ticks, and stopped second half 4 ticks in the money:

Forex Calls Recap for 1/13/16

The action right now is in oil and stocks. Forex is not going anywhere. Both calls stopped out on the GBPUSD, see that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. Triggered short at B and stopped:

Stock Picks Recap for 1/12/16

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GPRE triggered short (with market support) and worked:

PTCT triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's APC triggered short (with market support) and worked:

His BIDU triggered long (with market support) and didn't work:

NTAP triggered short (without market support, just barely) and worked:

TSLA triggered short (with market support) and didn't work:

Rich's FB triggered short (with market support) and worked enough for a partial:

His APC long triggered long (without market support) and didn't work:

His ERX triggered long (without market support) and worked:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 1/12/16

The markets gapped up and initially went higher for about 20 minutes, then rolled and filled the gaps, crossed the Value Area on the ES and then came back up late in the day to the open on 1.9 billion NASDAQ shares. Opening range plays worked, although the ES triggered short first and stopped, but both long worked. We also had a separate ES call that worked.

Net ticks: +10.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work, triggered long at B and did:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 1928.00, hit first target for 6 ticks, and stopped second half over the entry:

Forex Calls Recap for 1/12/16

A fairly slow session that moved early and triggered our EURUSD call before the European session even started. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Our call triggered short under LBreak off the left of this chart before the European session even started, which makes it half size: