Tradesight Recap Report for 2/11/22

Overview

The markets opened flat, tried to push up a little, and stayed flat until lunch and then sold off in the afternoon on concerns about a Russian invasion of Ukraine. NASDAQ volume was 5.2 billion shares.

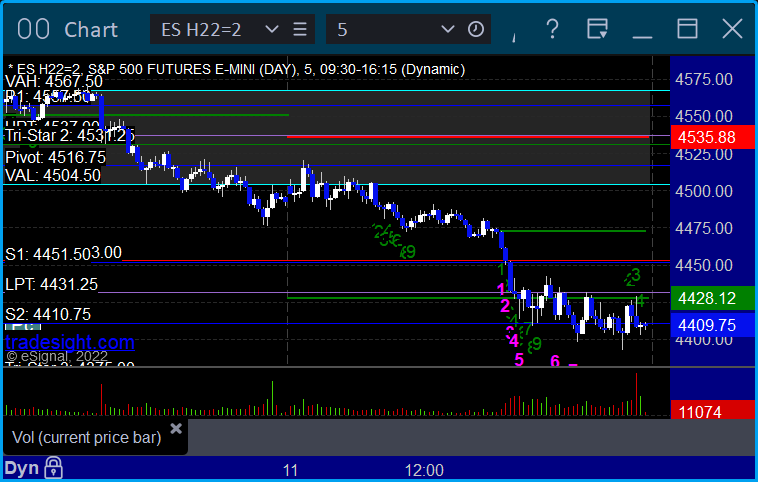

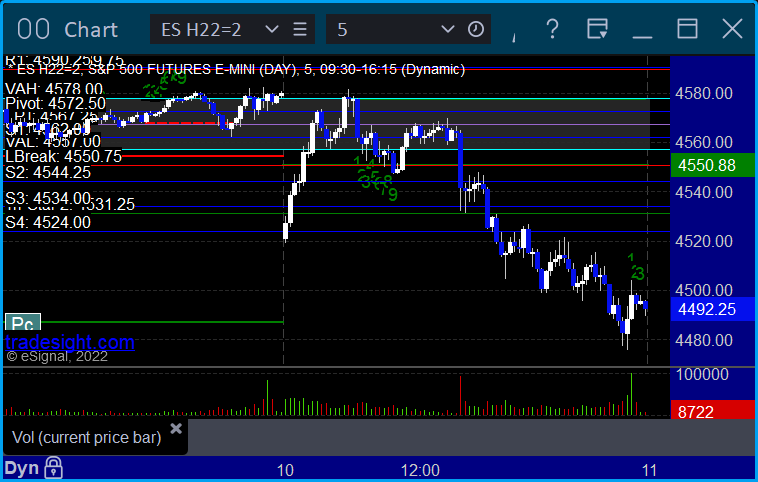

ES with Levels:

ES with Market Directional:

Futures:

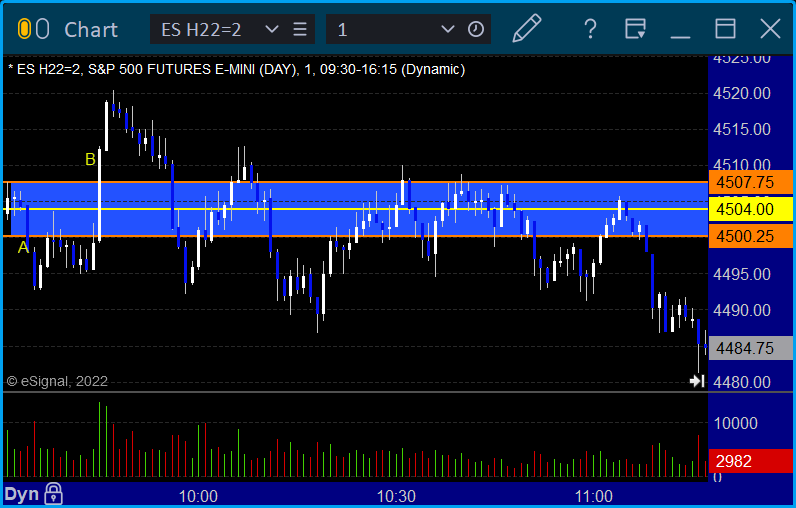

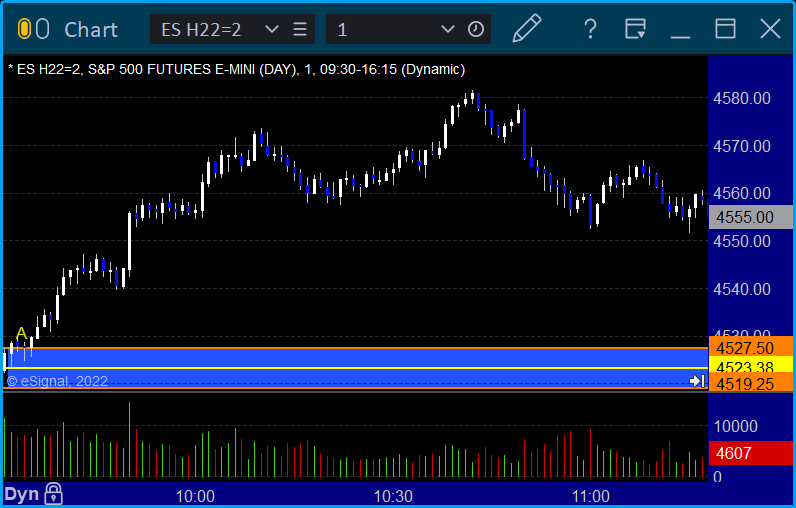

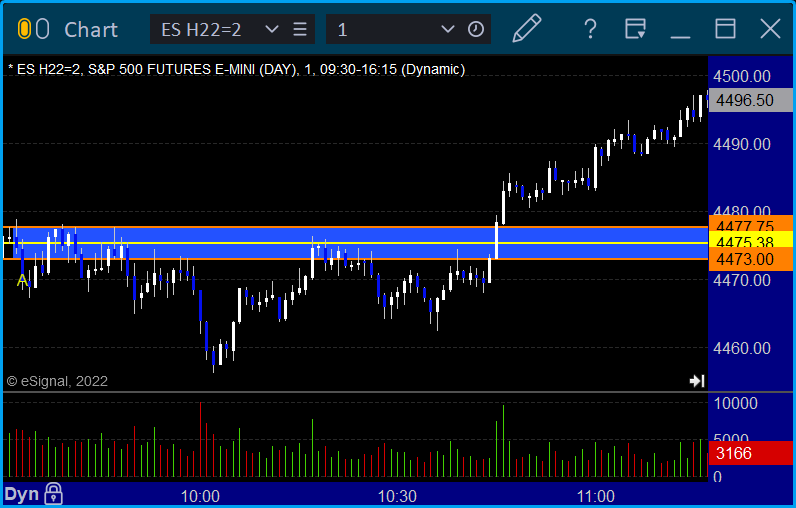

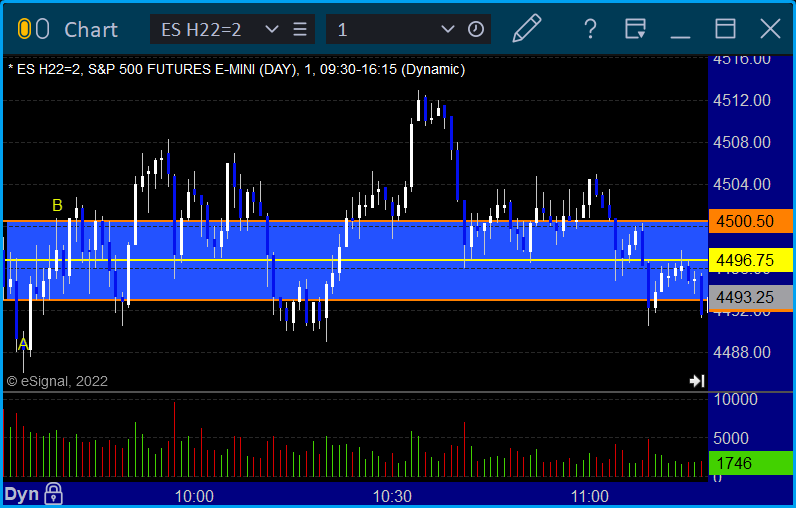

ES Opening Range Play triggered short at A and long at B, both too far out of range to take:

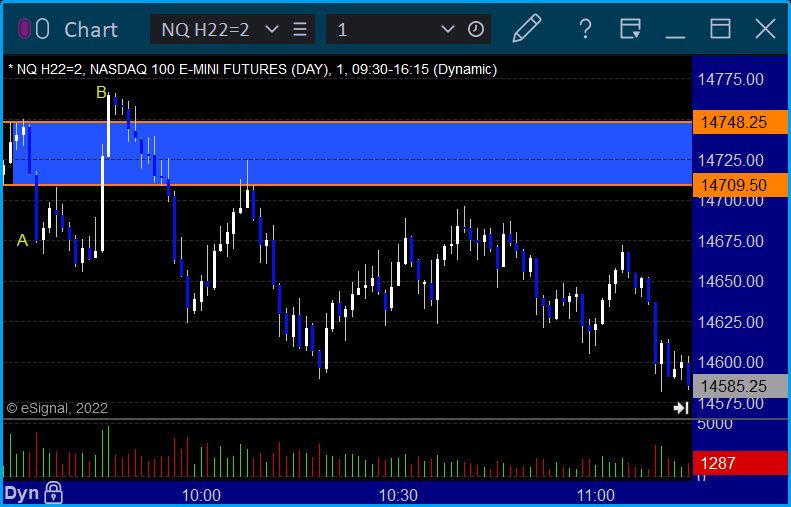

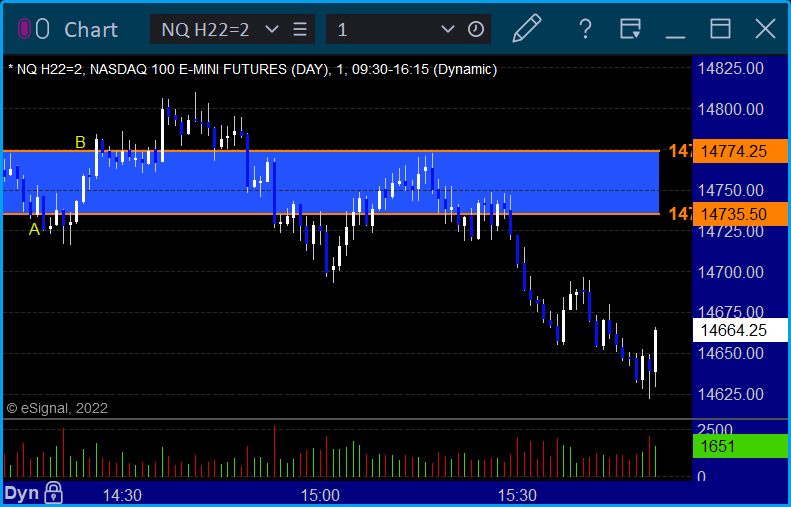

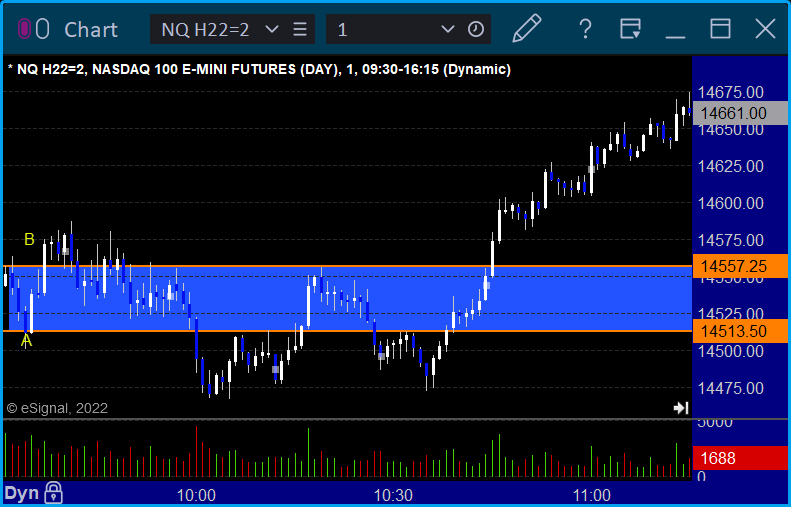

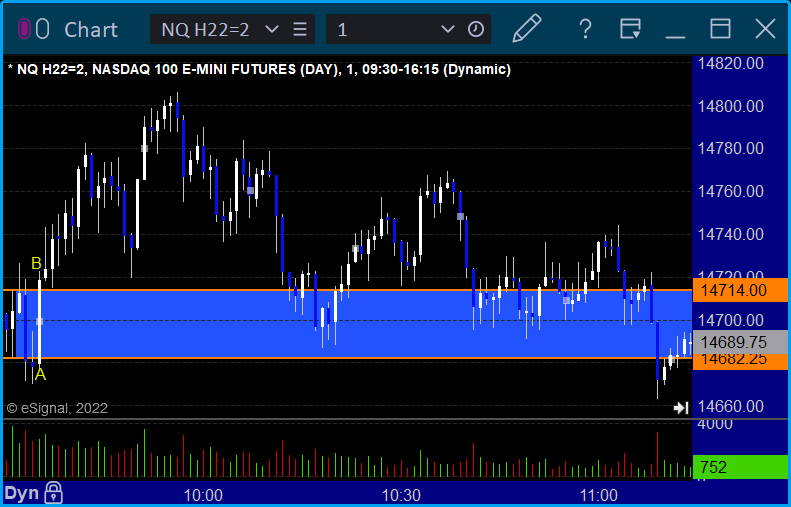

NQ Opening Range Play triggered short at A and long at B, both too far out of range to take:

Results: +0 ticks

Forex:

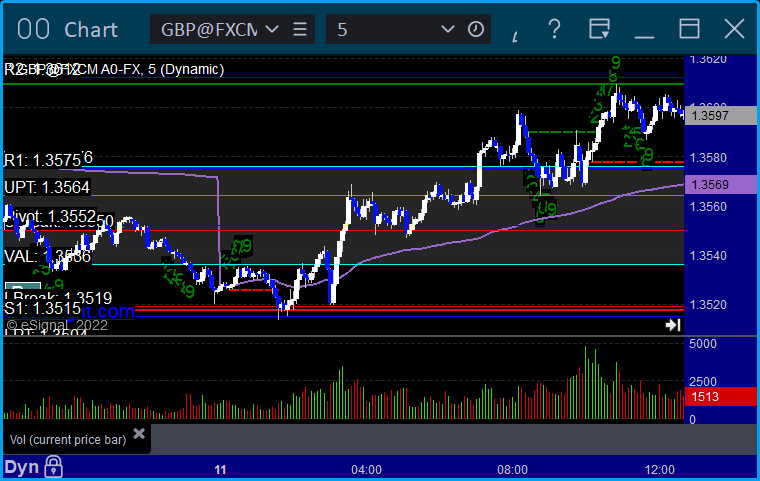

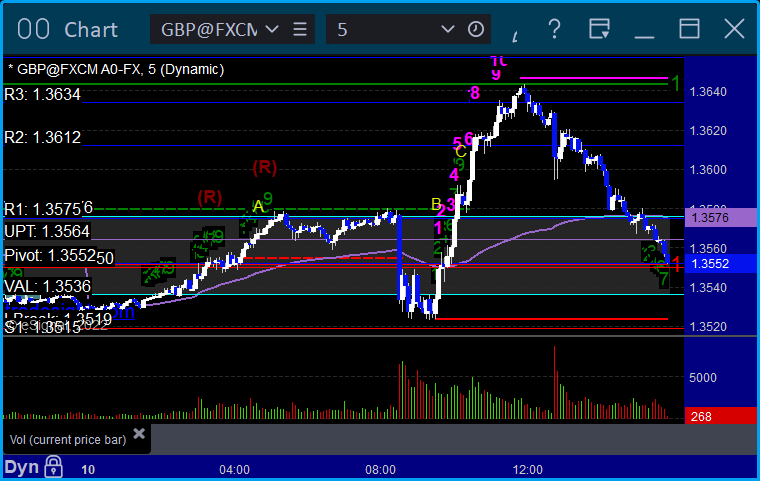

GBPUSD:

Results: +0 pips

Stocks:

Another weird day that was flat with a very slight drift lower until after lunch, then sold off on the Ukraine news. Didn't look tradeable until late.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's VMW triggered short (with market support) and worked huge:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 2/10/22

Overview

A wild day in the markets as they gapped down hard after the CPI number came out an hour before the open, but then rallied back to even and then sold off on the session to close at lows on 5 billion NASDAQ shares.

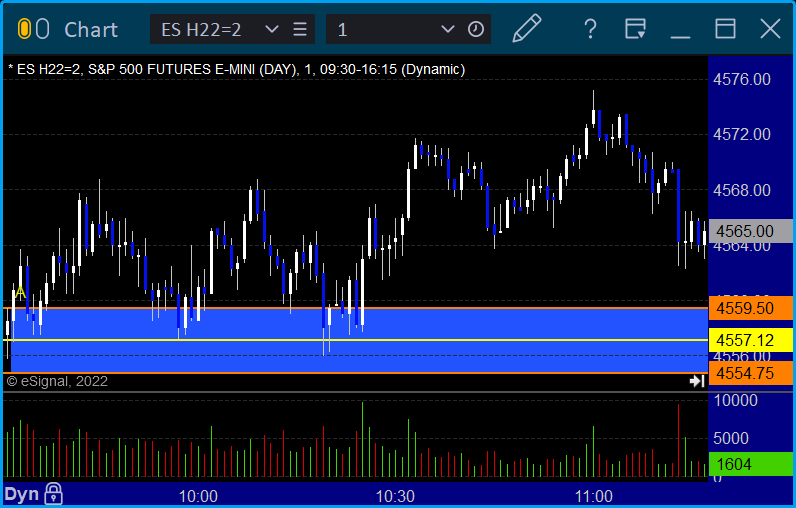

ES with Levels:

ES with Market Directional:

Futures:

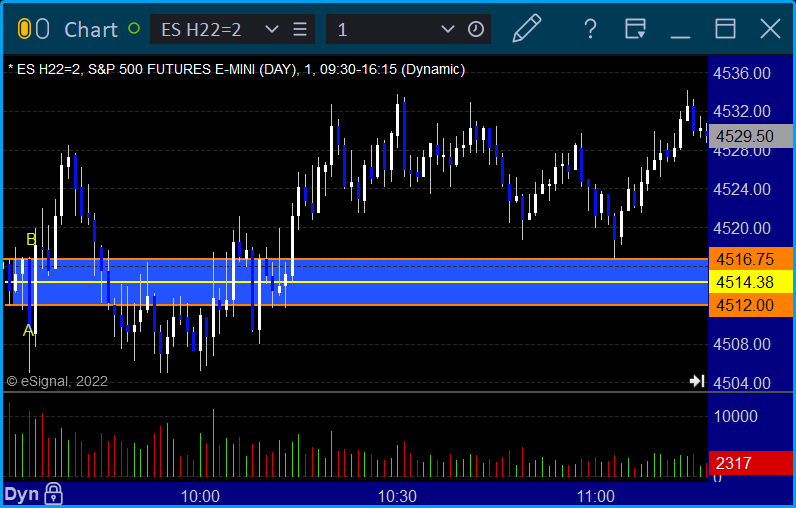

ES Opening Range Play triggered long at A and worked great:

NQ Opening Range Play triggered short at A and long at B but both too far out of range to take:

Results: +31.5 ticks

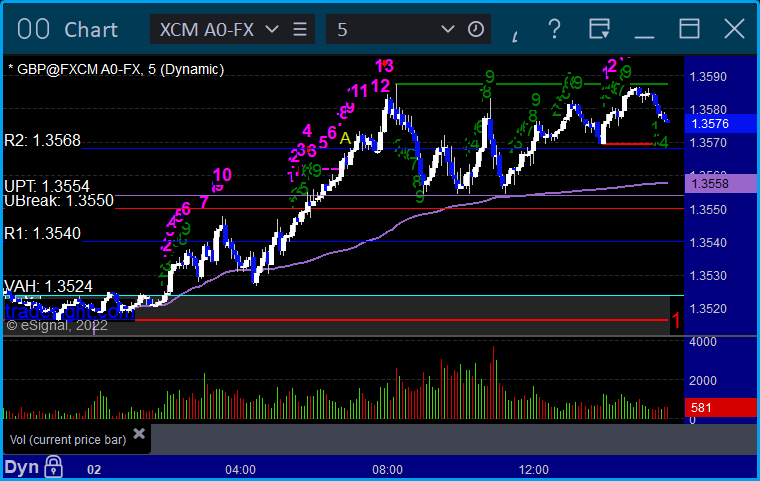

Forex:

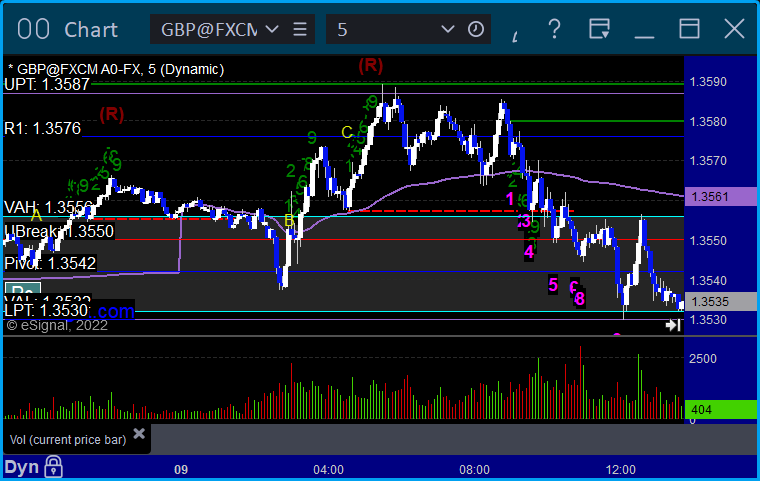

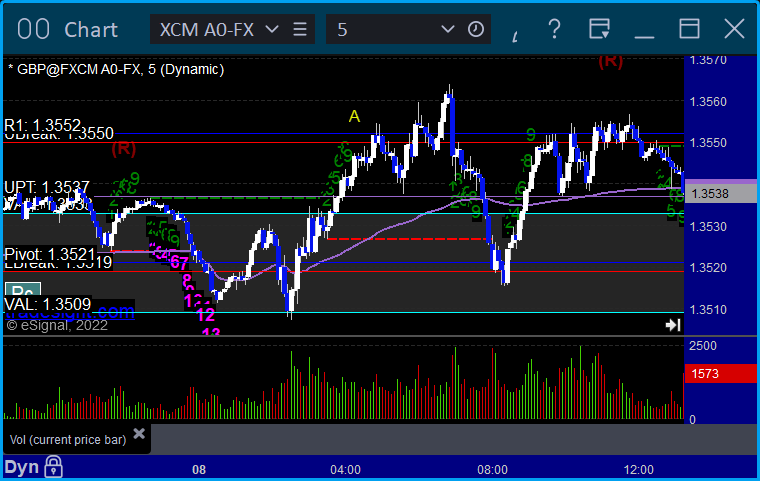

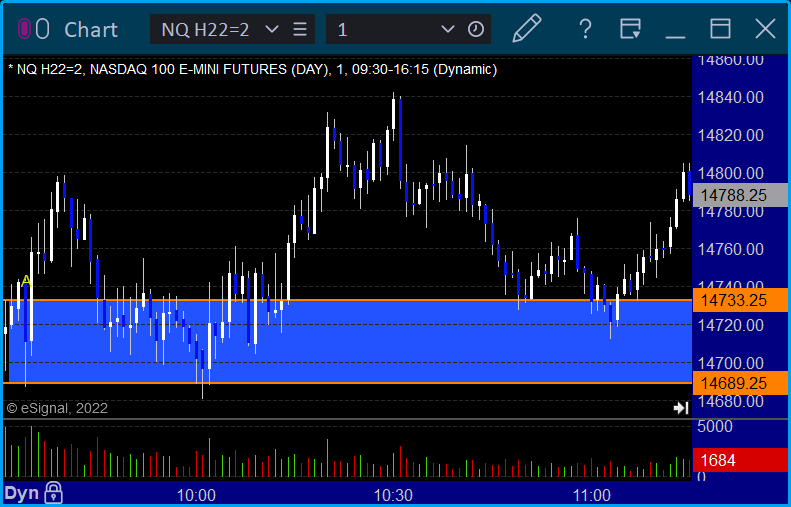

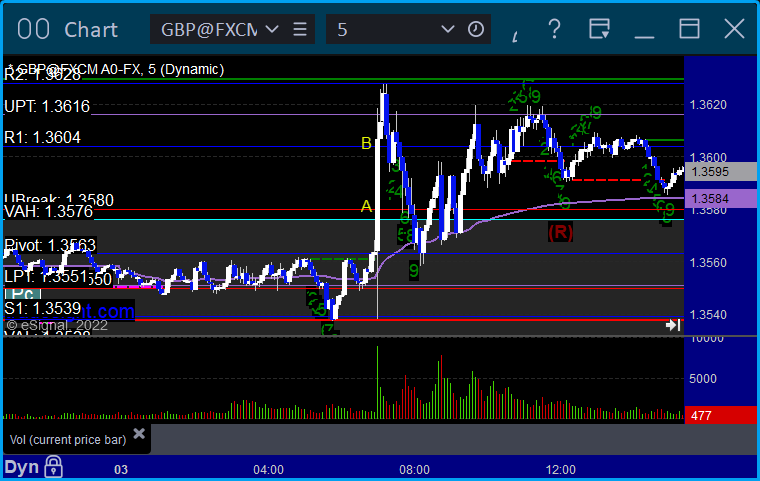

GBPUSD triggered long at A and stopped, triggered long at B, hit first target at C, and stopped second half:

Results: +10 pips

Stocks:

Another weird (and very weird day) in the markets.

From the Tradesight Plus Report, CPRX triggered long (with market support) and worked:

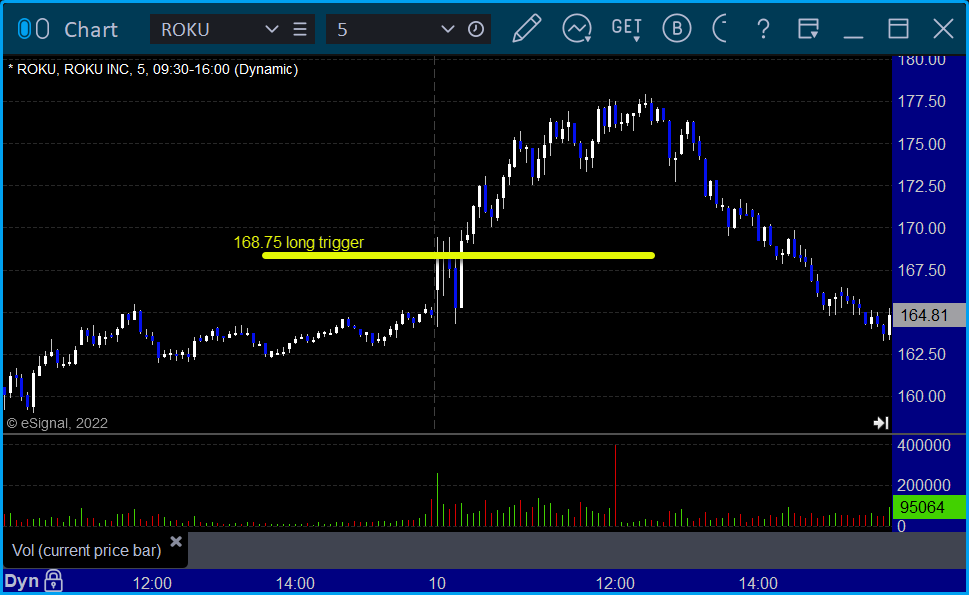

From the Tradesight Plus Twitter feed, ROKU triggered long (with market support) and didn't work initially, worked later:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 2/9/22

Overview

The markets gapped up and went completely flat for the day on a weak 3.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play:

Results: +4 ticks

Forex:

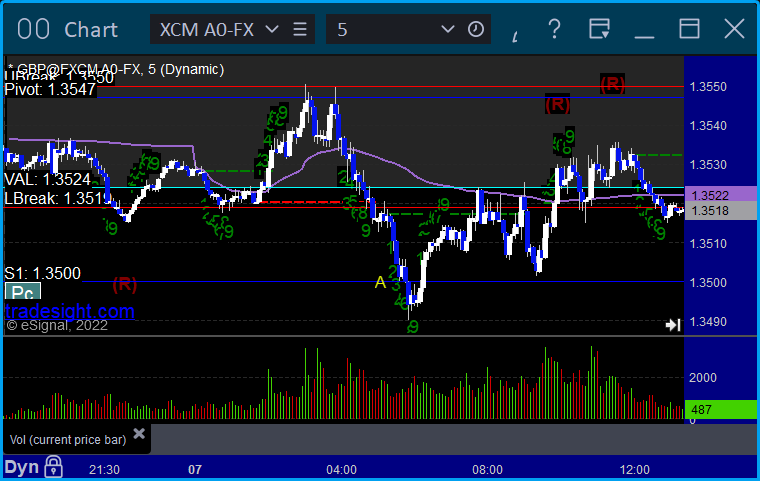

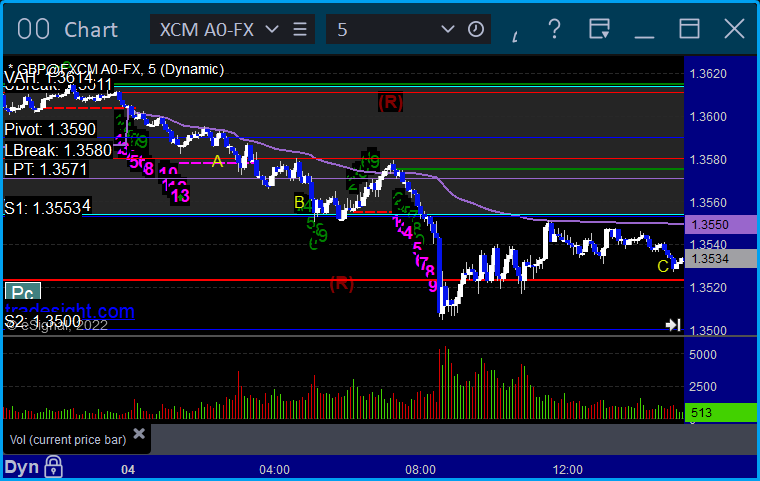

GBPUSD triggered long at A and stopped, triggered long at B, hit first target at C, and stopped under the entry:

Results: -15 pips

Stocks:

A dead flat day in the markets after a gap up.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, a lot of calls, but not much triggered.

Rich's FB triggered long (with market support) and worked:

That’s x triggers with market support, x of them worked and x didn’t.

Tradesight Plus Report for 2-8-22

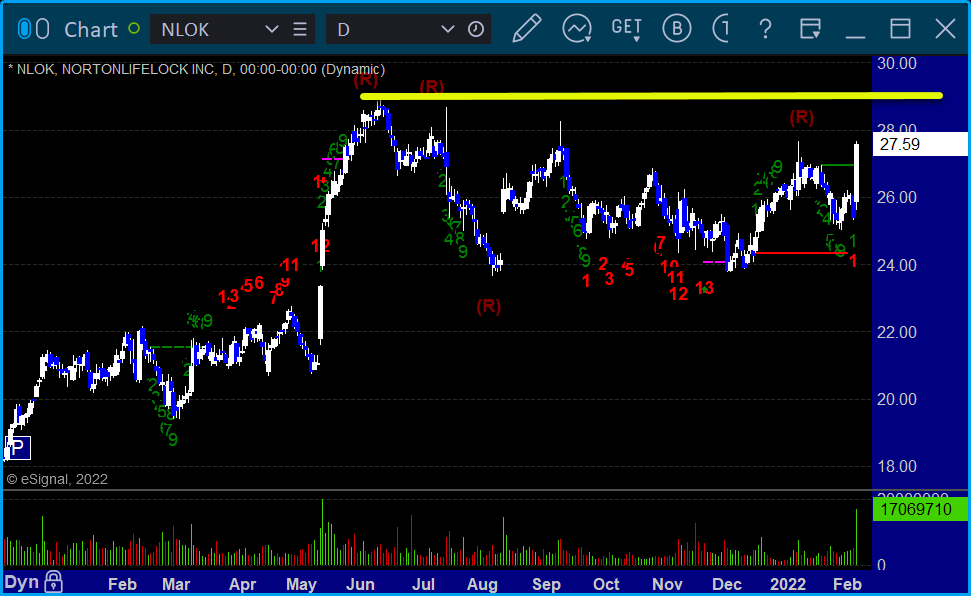

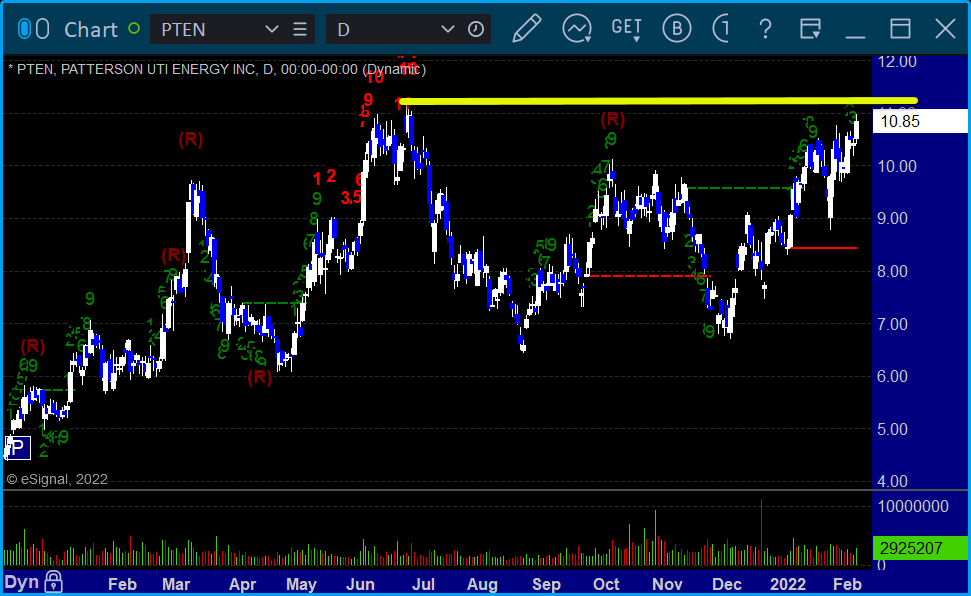

Opening comments posted to YouTube. Only a few daily chart plays found. I don't love that they are both long ideas, but they are great patterns.

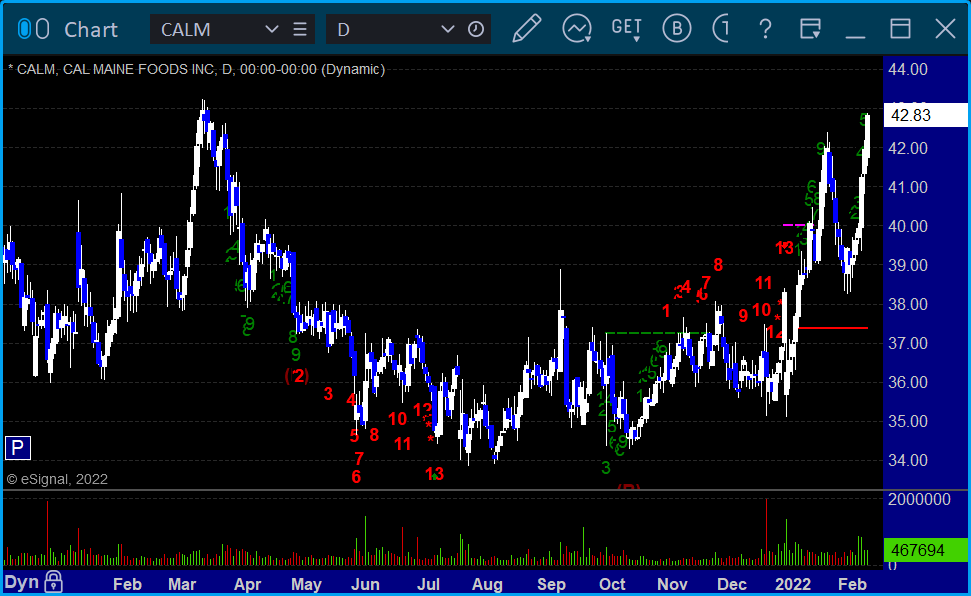

Longs first, in order of best chart construction, starting with CALM > 43.23:

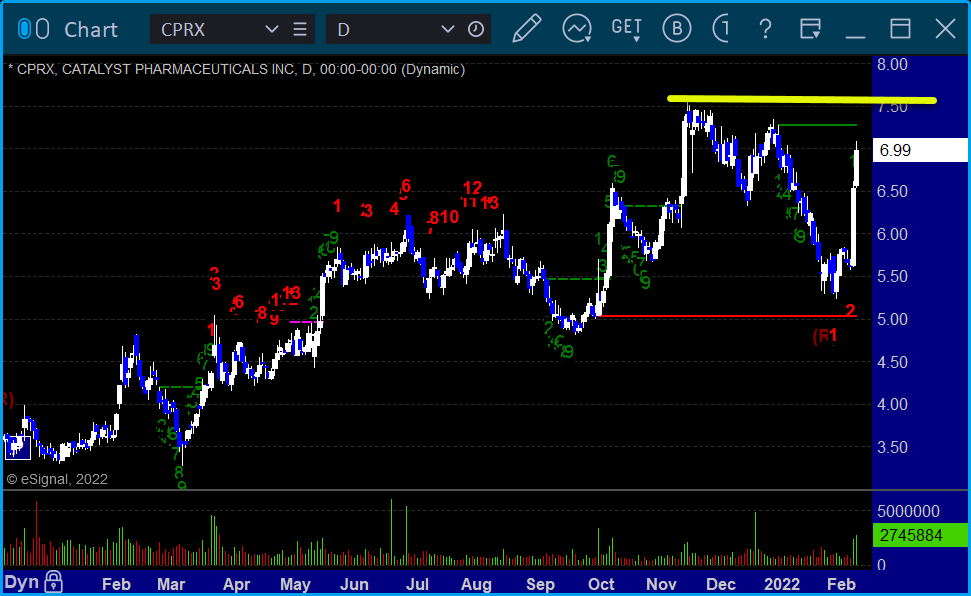

CPRX > 7.58:

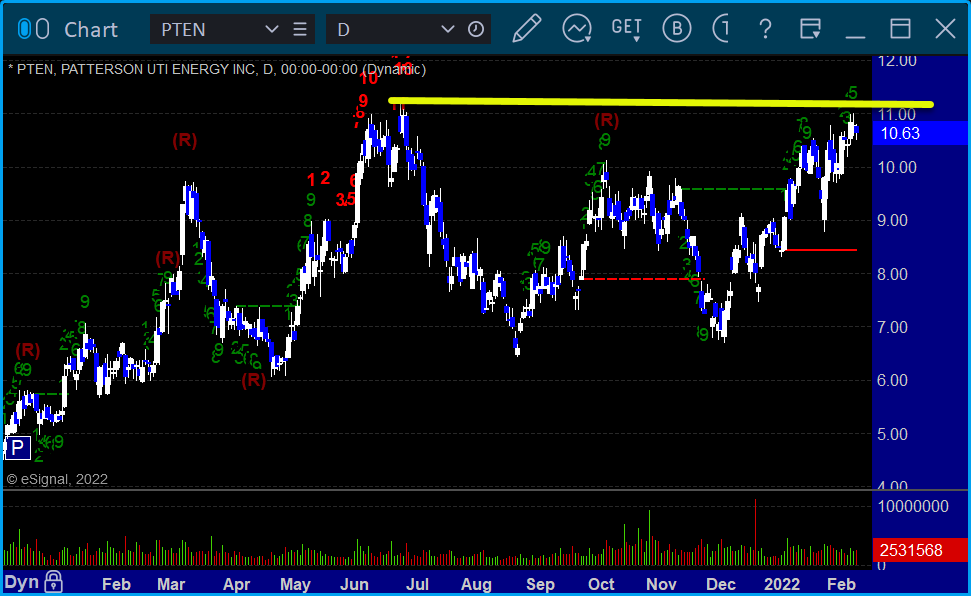

PTEN > 11.27:

No shorts found.

That's it.

Tradesight Recap Report for 2/8/22

Overview

The markets gapped down, filled, went lower, went higher over lunch, pulled back to even after lunch and then rallied a bit late on 4.2 billion NASDAQ shares, which is light again.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

NQ Opening Range Play triggers were too far out of range to take:

Results: +0 ticks

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

Not a very interesting day again.

From the Tradesight Plus Report, NLOK triggered long (with market support) and worked:

From the Tradesight Plus Twitter feed, nothing triggered.

That’s 1 trigger with market support, and it worked great.

Tradesight Recap Report for 2/7/22

Overview

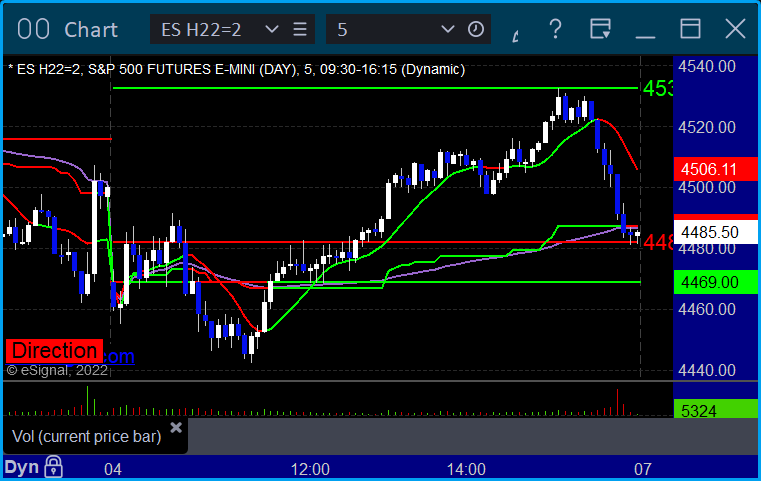

The markets gapped up a little and took until lunch to fill, then drifted back to highs, and then sold off very late to lows on a weak 4.1 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

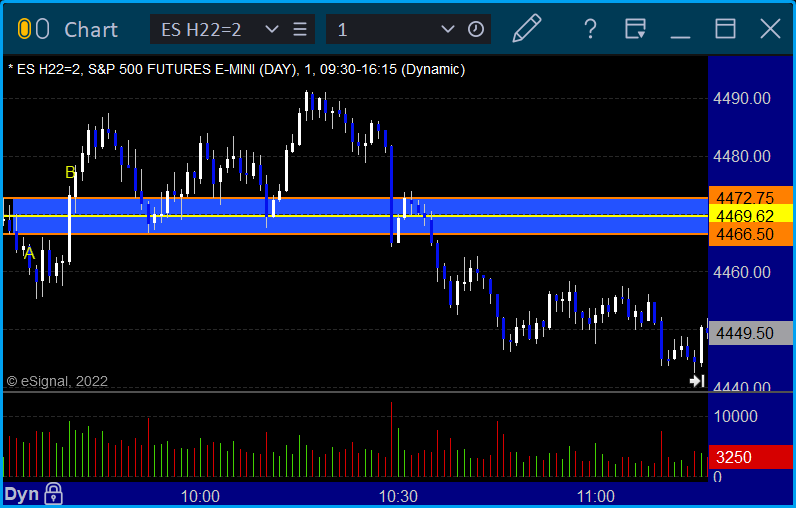

Futures:

ES Opening Range Play, triggered short at A but too far out of range to take, triggered long at B and stopped under the midpoint

NQ Opening Range Play:

Results: -16 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

An extremely dull day on light volume, so there wasn't much to call.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's NFLX triggered short (with market support) and worked enough for a partial:

That’s 1 trigger with market support, and it worked.

Tradesight Plus Report for 2-7-22

Opening comments posted to YouTube. Only a couple of daily chart plays found. I don't love that they are both long ideas, but they are great patterns.

Longs first, in order of best chart construction, starting with NLOK > 28.92:

PTEN > 11.27:

No shorts found.

That's it.

Tradesight Recap Report for 2/4/22

Overview

The markets gapped down, wiggled back and forth, hit lows ahead of lunch, then rallied until the last hour and then sold off to come back a bit on a super-weak 3.7 billion NASDAQ shares. No one was around for this.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take, triggered long at B and worked:

NQ Opening Range Play, both triggers were too far out of range to take:

Results: +19.5 ticks

Forex:

GBPUSD triggered short at A, hit first target at B, closed at C for end of week:

Results: +35 pips

Stocks:

Not much but a winner.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's HOOD triggered long (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 2/3/22

Overview

The markets gapped down huge on FB earnings, really stayed fairly contained again most of the day, and then pushed lower in the last hour on a weak 4.3 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

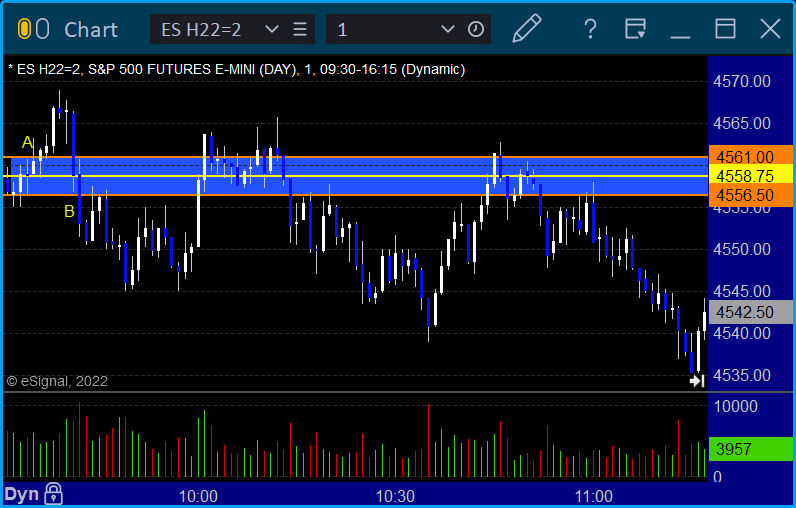

ES Opening Range Play triggered short at A but too far out of range to take, triggered long at B and also technically too far out of range to take and count, but it was fairly close and wouldn't blame you if you took it for a small gain:

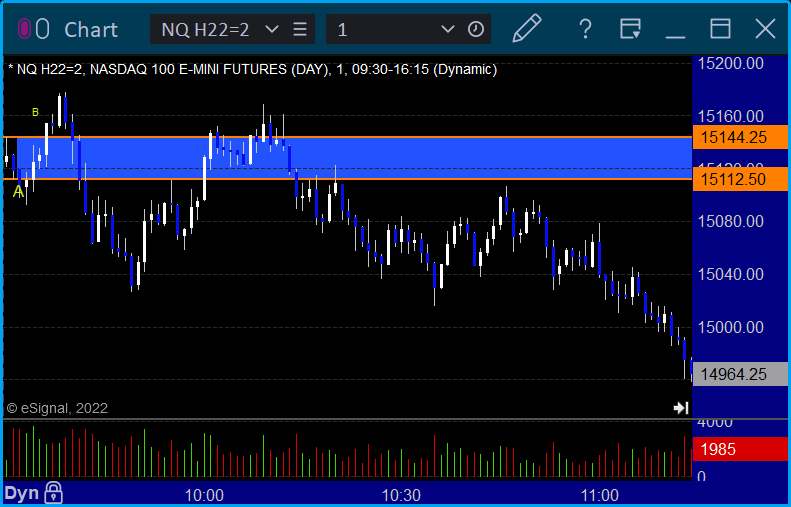

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +0 ticks

Forex:

GBPUSD triggered long at A, hit first target at B, stopped second half under entry:

Results: +10 pips

Stocks:

A little more excitement, but not much.

From the Tradesight Plus Report, no calls.

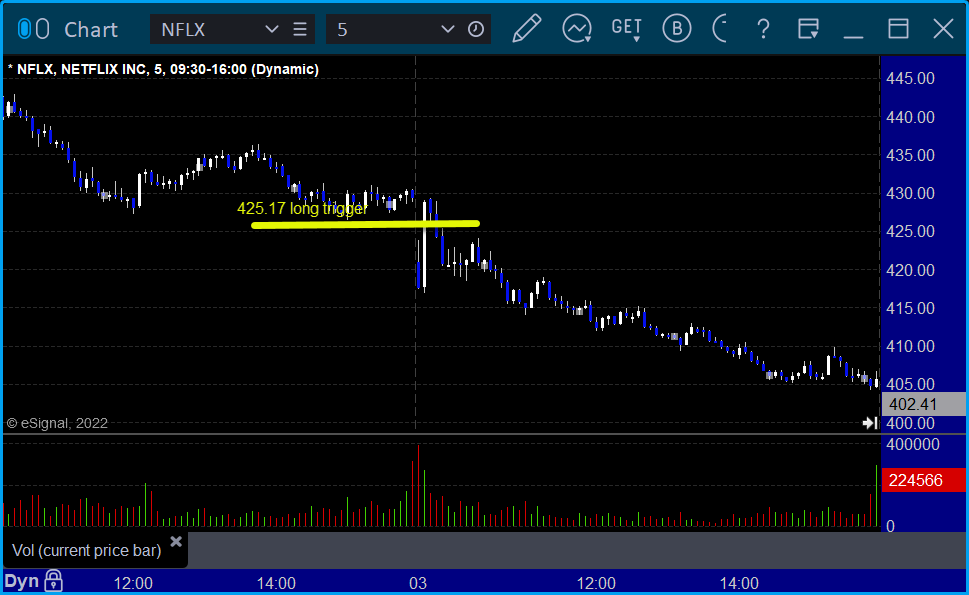

From the Tradesight Plus Twitter feed, Rich's NFLX triggered long (with market support) and worked enough for a partial:

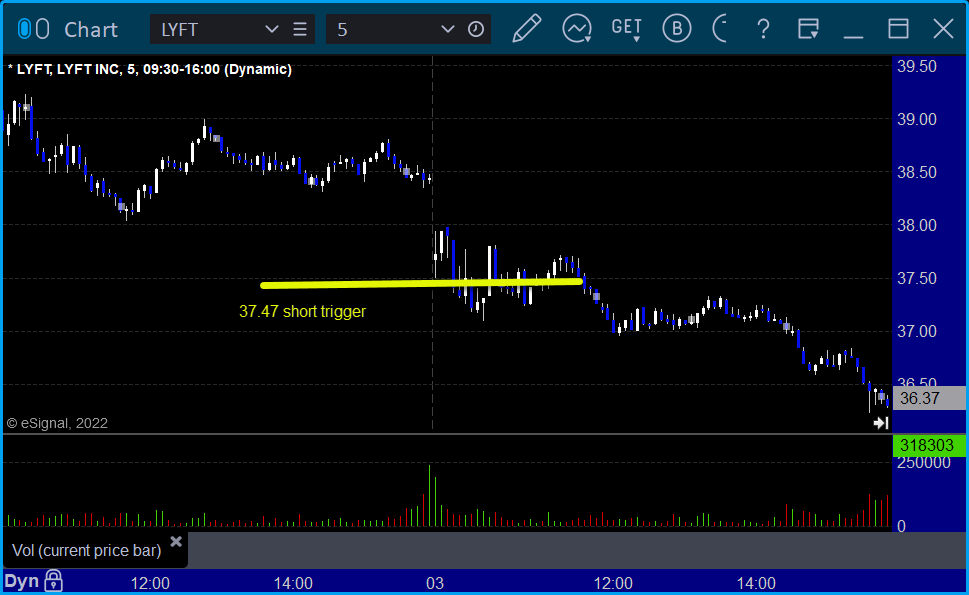

LYFT triggered short (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 2/2/22

Overview

The markets gapped up, took all morning to just fill, then drifted back up to the open over lunch, got a 13 exhaustion signal after lunch, and the risk line was the top on 4.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked, triggered short at B and worked enough for a partial:

NQ Opening Range Play triggered at A and B but both too far out of range to take:

Results: +9 ticks

Forex:

GBPUSD triggered long at A and closed at the end of the chart slightly in the money:

Results: +10 pips

Stocks:

Not a very exciting day at all.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's SWKS triggered long (with market support) and didn't work:

GS triggered short (with market support) and didn't work:

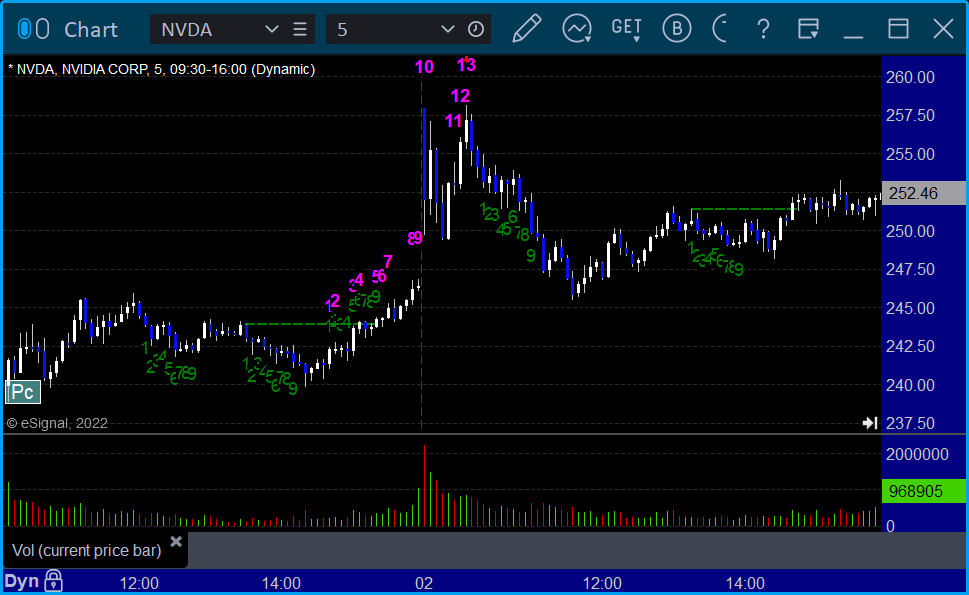

I called NVDA triggered short on a Comber 13 sell signal and it worked for up to ten points, we don't count these officially:

That’s 2 triggers with market support, neither of them worked.