Futures Calls Recap for 12/21/15

Well, if Monday was a preview of the rest of the year, it looks pretty boring. There's a slight chance that Tuesday will be better since Monday was the first day of a new options cycle, but that's about it. We gapped up, didn't do anything for two hours, tried to reach down over lunch to fill the gap and couldn't, and closed in the lower half of the day's range on 1.4 billion NASDAQ shares. No calls made as the Levels weren't being used technically, and a net loss for the first time in a while on the Opening Range Plays.

Net ticks: +0 ticks.

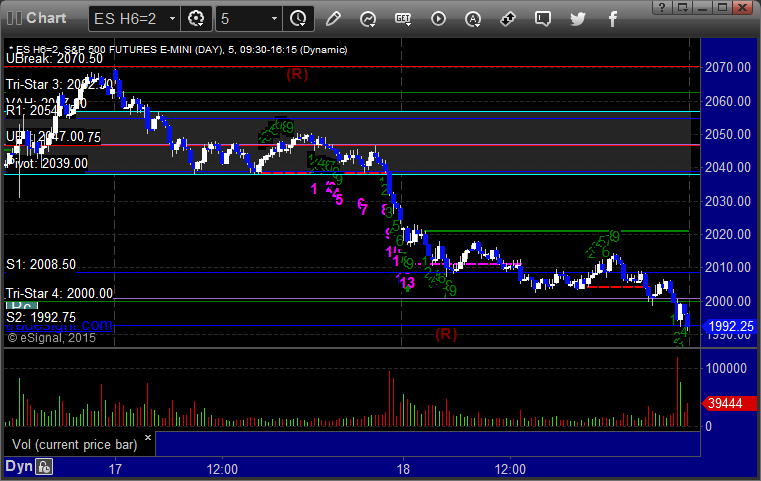

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

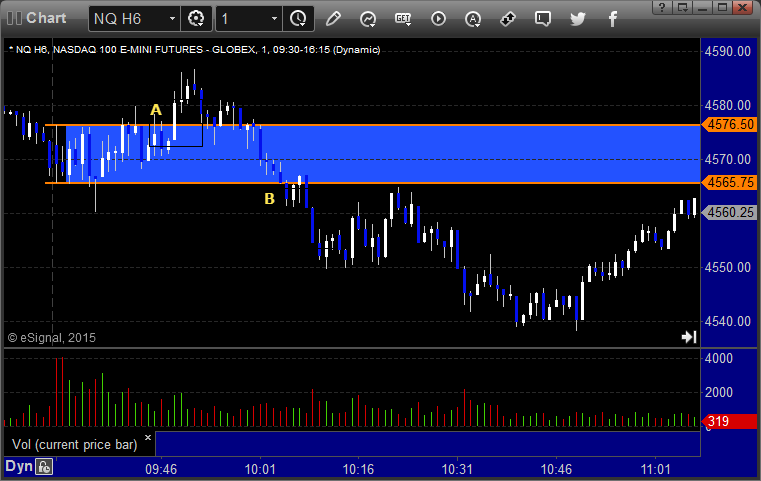

ES Opening Range Play triggered long at A and didn't work, triggered short at B and worked enough for a partial:

NQ Opening Range Play triggered long at A and didn't work, triggered short at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 12/21/15

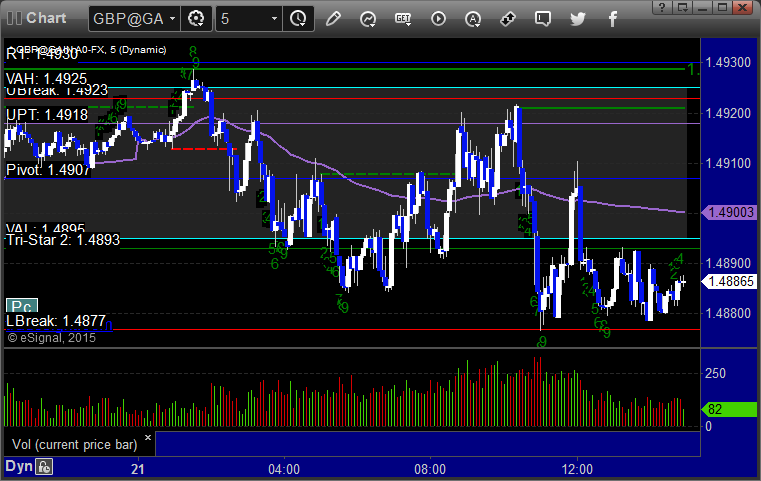

A dead session. 45 pips of range on the GBPUSD, so neither of our calls triggered. Charts below. I may lower to half size as this feels like we're done for the year.

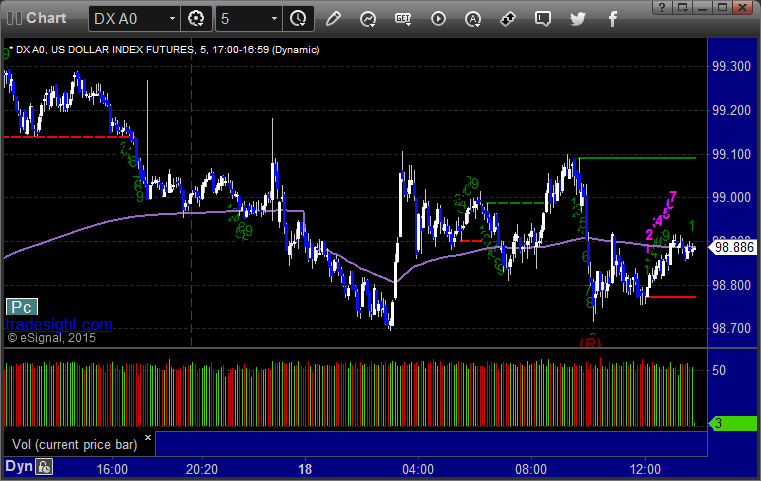

Here's a look at the US Dollar Index intraday with our market directional lines:

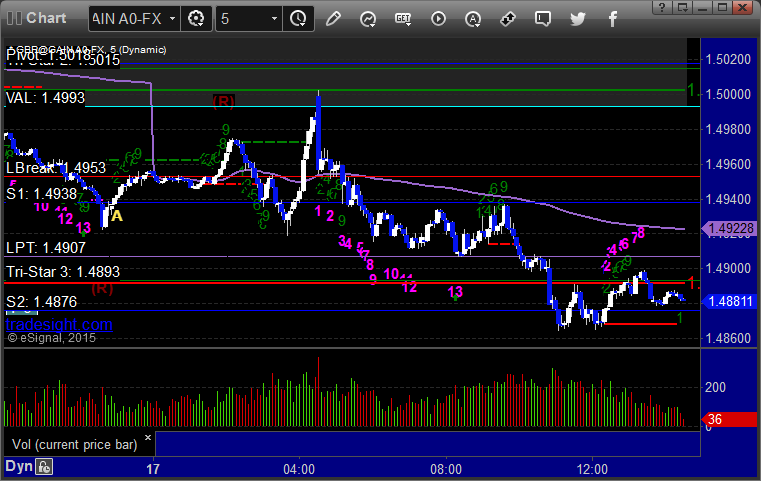

GBPUSD:

Stock Picks Recap for 12/18/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PACB triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's TLT triggered long (ETF, so no market support needed) and didn't work:

Rich's KMX triggered short (with market support) and worked:

His APC triggered long (without market support) and didn't work:

His MNK triggered long (without market support) and worked:

BABA triggered short (with market support) and worked:

Rich's AAPL triggered short (with market support) and worked:

His WYNN triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 12/18/15

The markets opened with a small gap down and were pretty dead for the first couple of hours and over lunch, but then actually moved lower in the last hour on 3 billion NASDAQ shares (which is just volume from triple expiration, most of which isn't real). Opening Range plays worked, no calls for triple expiration.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered long at A and didn't work, triggered short at B and did:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 12/18/15

A fairly uneventful session to end the week, which is not a surprise with triple expiration. See GBPUSD section below.

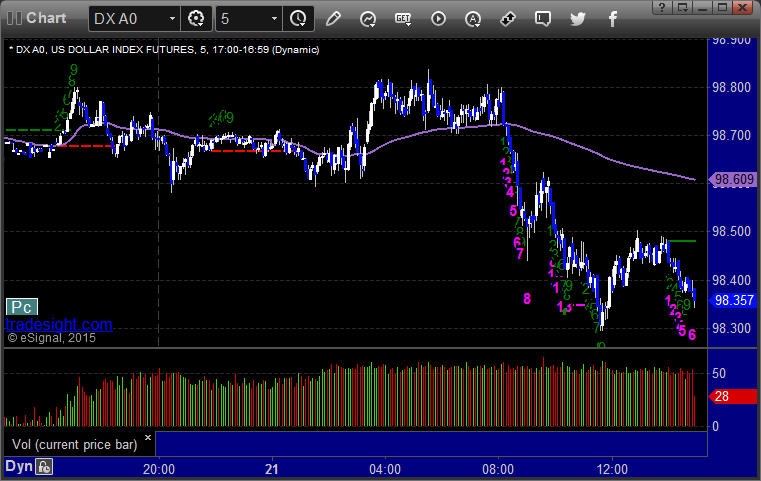

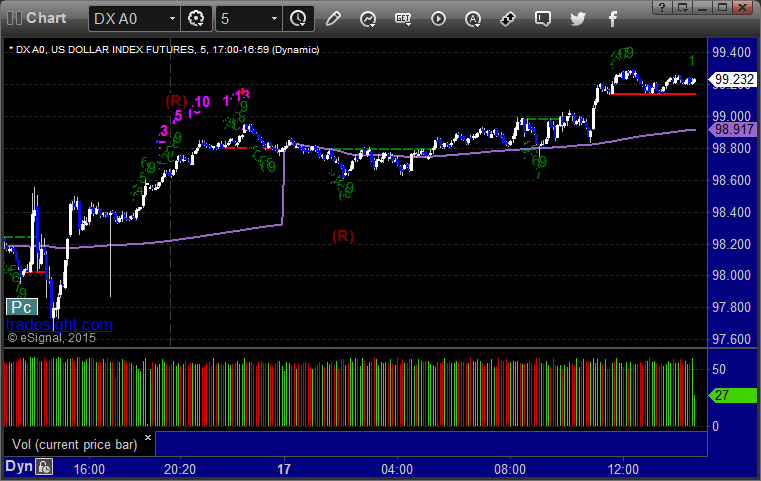

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

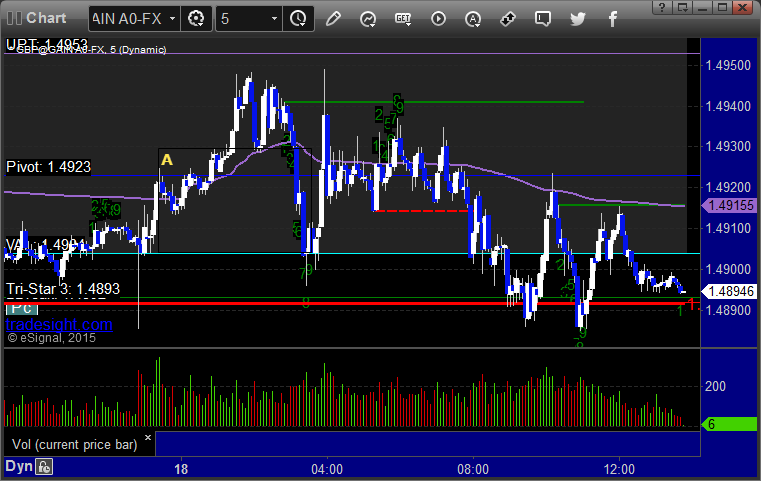

GBPUSD:

Triggered long at A and stopped:

Stock Picks Recap for 12/17/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BBRY triggered long (without market support) and worked:

LGND triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FDX triggered short (with market support) and worked:

Mark's EYES triggered long (without market support) and worked:

Rich's VRX triggered short (with market support) and worked:

His PXD triggered short (with market support) and worked:

His SLB triggered short (with market support) and worked:

His MBLY triggered short (with market support) and worked enough for a partial:

AMGN triggered short (with market support) and worked:

Rich's LL triggered short (with market support) and worked:

His AAPL triggered short (with market support) and worked:

His TSO triggered long (without market support) and didn't work:

His additional AAPL call triggered short (with market support) and worked:

His IBB triggered short (ETF, so no market support needed) and didn't work:

In total, that's 10 trades triggering with market support, 9 of them worked, 1 did not.

Futures Calls Recap for 12/17/15

Big winners again on the Opening Range plays as the markets gapped up and headed down into the gap immediately. We then got an options unraveling move to the downside that took us to the lows for the close on 1.6 billion NASDAQ shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked great:

NQ Opening Range Play triggered short at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

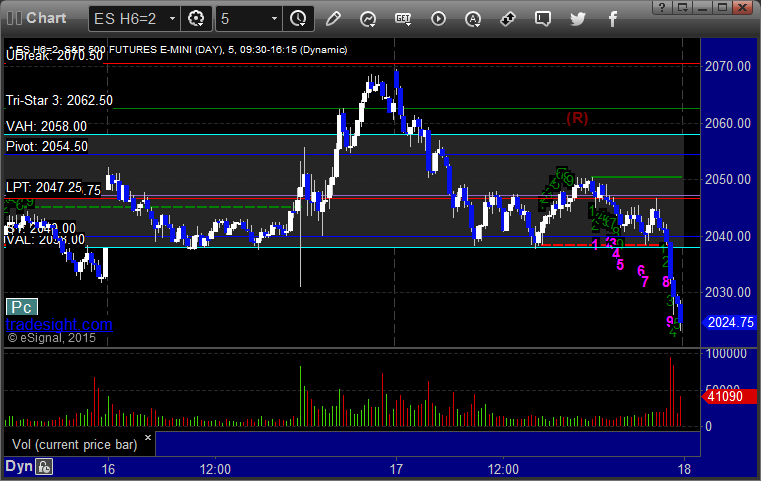

ES:

Forex Calls Recap for 12/17/15

A fairly dull session post-Fed rate hike. We had a trade trigger and stop. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped:

Stock Picks Recap for 12/16/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's BABA triggered long (without market support due to opening 5 minutes) and didn't work:

TSLA triggered long (without market support) and worked:

Rich's MBLY triggered short (with market support) and worked:

His GOOG triggered long (without market support) and worked enough for a partial:

His AMZN triggered long (without market support, and he typo'd the trigger by $100) and didn't work:

His AAPL triggered long (without market support) and worked:

His IBB triggered long (ETF, so no market support needed, but triggered on the Fed) and worked:

His VXX triggered short (ETF, so no market support needed) and didn't work:

GILD triggered long (with market support) and worked some, ran out of time:

AMZN triggered long (with market support) and worked great:

His BABA triggered long, but in the last 15 minutes of the session.

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 12/16/15

The markets gapped up and filled ahead of the Fed, and then spiked down and back up, and about 45 minutes later pushed out to highs and kept going. We had nice opening range plays and a nice call that worked after the Fed announcement. NASDAQ volume was only 1.8 billion shares. See ES section below.

Net ticks: +17 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 2060.25, hit first target for 6 ticks, and raised stop several times and stopped final at 2067.25 for 28 ticks: