Stock Picks Recap for 12/10/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BRCM triggered long (with market support) and worked enough for a partial:

SONC triggered long (with market support) and didn't work:

FTNT triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's SHLD triggered long (without market support) and didn't work:

Mark's FSLR triggered long (with market support) and worked enough for a partial:

Rich's AGN triggered long (with market support) and didn't work:

His KMI triggered long (with market support) and didn't work:

His FEYE triggered long (with market support) and worked:

His SLB triggered long (with market support) and worked:

His YHOO triggered long (with market support) and didn't work:

BIIB triggered long (with market support) and didn't work:

Rich's MW triggered long (with market support) and worked:

His WYNN triggered long (with market support) and didn't work:

His FB triggered long (with market support) and didn't work:

In total, that's 12 trades triggering with market support, 5 of them worked, 7 did not.

Futures Calls Recap for 12/10/15

The markets gapped up a little as we started the contract roll process, and even the Opening Range plays were mixed for the session. Friday should be worse as it is the first full day on the new contract and the technicals haven't set yet, so no official calls tomorrow either.

Net ticks: +0 ticks.

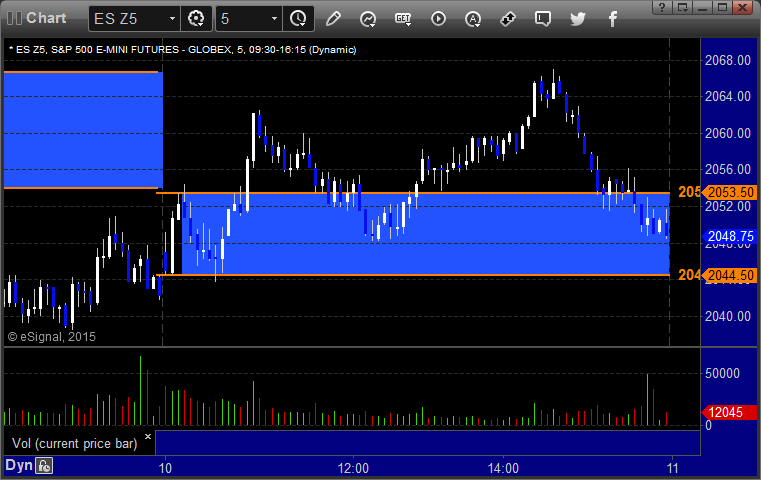

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work, triggered long at B and did:

NQ Opening Range Play triggered short at A and didn't work, triggered long at B and did:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 12/10/15

Closed out the second half of the prior day's GBPUSD well in the money, and we have a new trade working (and still going) on EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

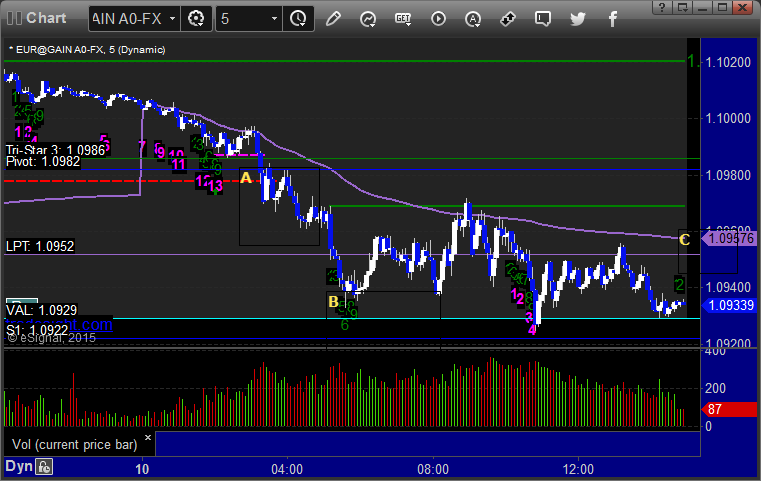

EURUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over C:

Stock Picks Recap for 12/9/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CERS triggered long (without market support due to opening 5 minutes) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Mark's LVS triggered long (with market support) and worked:

Rich's WMB triggered long (with market support) and worked:

His WYNN triggered long (with market support) and worked:

Mark's CREE triggered long (with market support) and worked enough for a partial:

Rich's APC triggered long (with market support) and worked enough for a partial:

His SLB triggered long (with market support) and worked:

His NFLX triggered short (with market support) and didn't work:

His KMI triggered long (without market support) and worked:

His HAL triggered long (without market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Futures Calls Recap for 12/9/15

Big winners in the Opening Range plays after a gap down led to no need to make additional calls. The markets did sell off in the second half of the day after rallying back to fill the gaps early. NASDAQ volume was 1.8 billion shares.

Net ticks: +0 ticks.

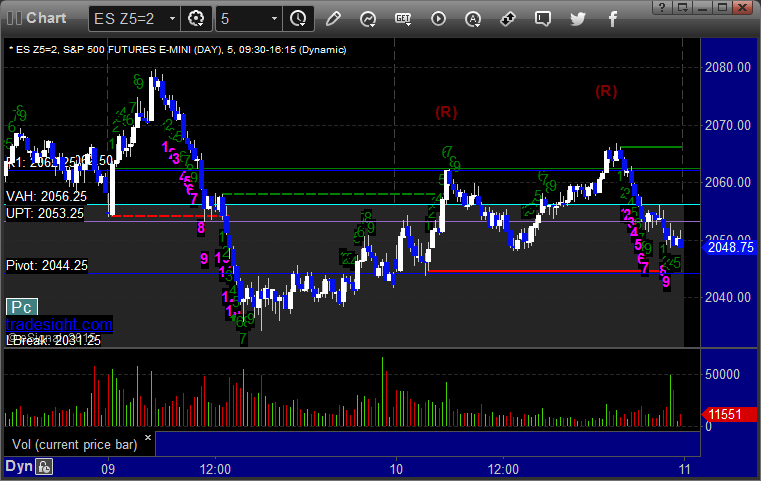

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 12/9/15

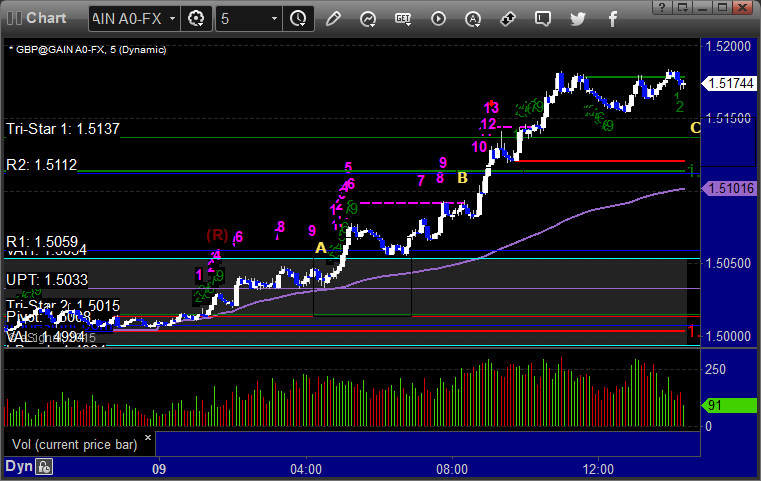

A nice clean trigger and trade in the GBPUSD for the session. We finally got some action. Still holding the second half of the trade, see that section below.

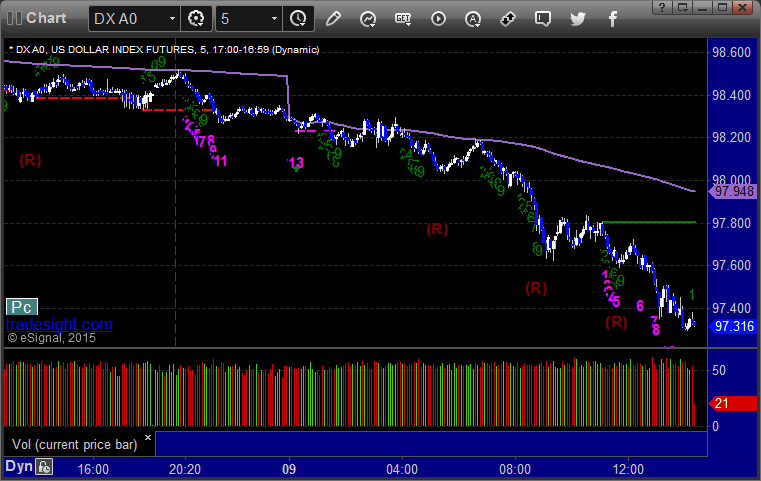

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, still holding second half over 100 pips in the money with a stop at 1.5150 at C:

Stock Picks Recap for 12/8/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TASR triggered short (without market support due to opening 5 minutes) and didn't work, shouldn't have been taken:

From the Messenger/Tradesight_st Twitter Feed, Rich's OUTR triggered short (without market support) and worked enough for a partial:

His AMZN triggered short (without market support) and worked:

His AGN triggered long (with market support) and didn't work:

His KMI triggered long (with market support) and worked enough for a partial:

His IBM triggered long (with market support) and worked enough for a partial:

His APA triggered long (with market support) and worked enough for a partial:

BABA triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 12/8/15

The markets gapped down big and were pretty slow early with a slightly upward bias. It eventually shot up for the NASDAQ side to fill the gap and that was the high. The ES never made it. NASDAQ volume closed at 1.7 billion and we spent the second half of the day doing nothing and closed on the VWAP. Trades in the ES and the NQ, plus the Opening Range plays worked great again.

Net ticks: +9.5 ticks.

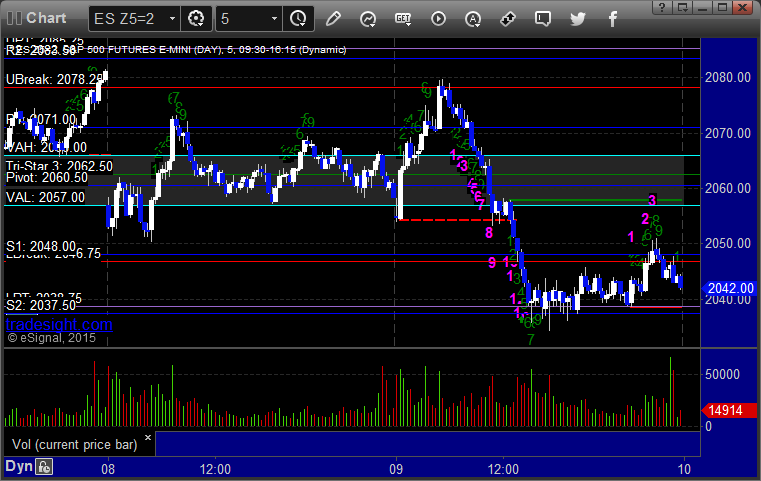

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered long at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Mark's call triggered long at A at 2066.25, hit first target for 6 ticks, and then he raised the stop a couple of times and stopped 17 ticks in the money at 2070.50:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered long at A at 4667.50 and stopped, then we put it back in and triggered again at B, hit first target for 6 ticks and closed second half at 4669.50:

Forex Calls Recap for 12/8/15

Not a very exciting session, but we had a small winner. See GBPUSD section below.

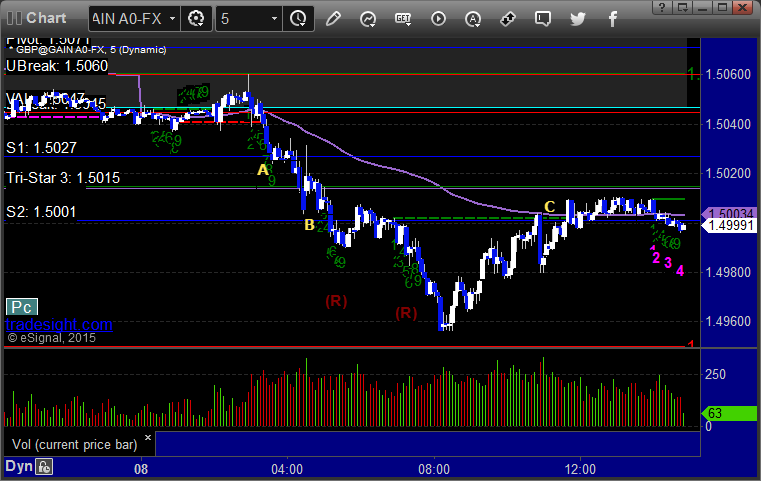

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, lowered stop in the morning and stopped in the money at C:

Stock Picks Recap for 12/7/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's CMG triggered long (without market support) and worked:

His SLB triggered short (with market support) and worked:

His AAPL triggered short (with market support) and didn't work:

NTAP triggered long (without market support) and didn't work:

Rich's TSLA triggered short (with market support) and worked:

His TWTR triggered short (with market support) and didn't work:

His KMI triggered long (without market support) and didn't work, worked later:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.