Forex Calls Recap for 12/3/15

We closed out a big winner in the GBPUSD from the prior session and then unfortunately stopped out of two new trades. See that section below.

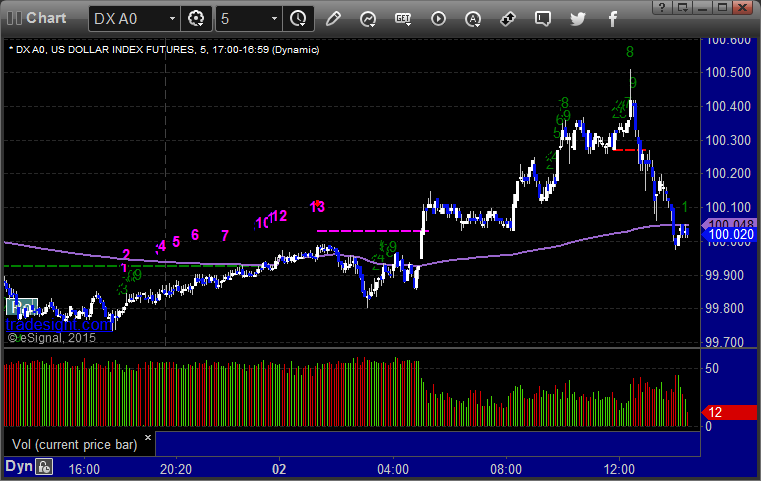

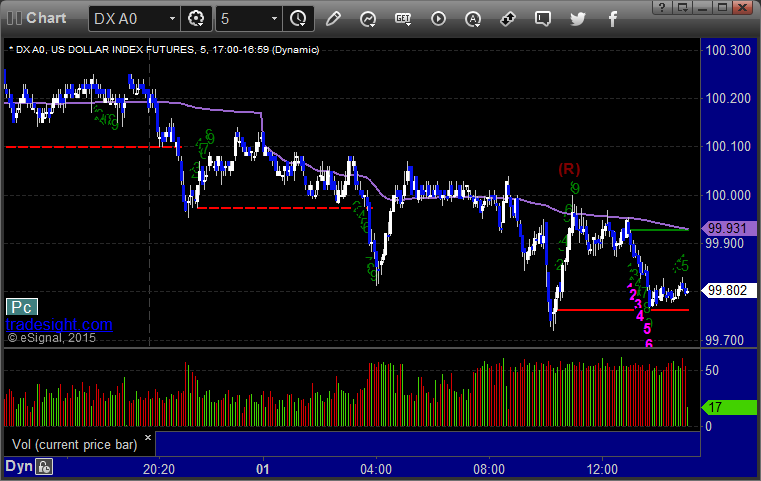

Here's a look at the US Dollar Index intraday with our market directional lines:

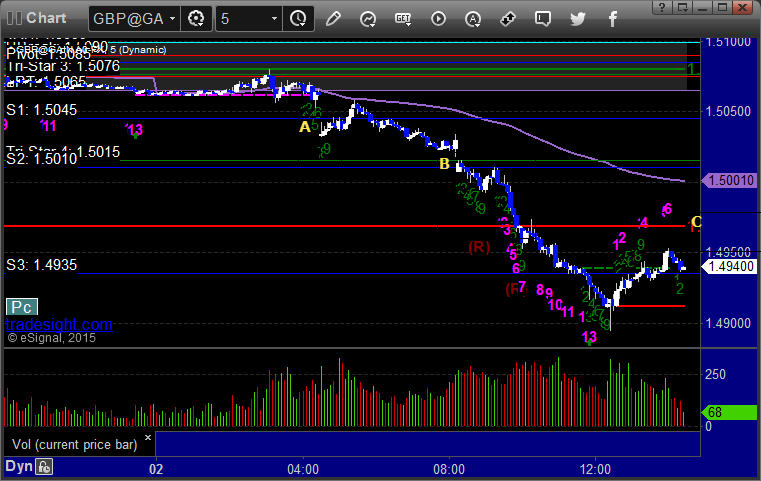

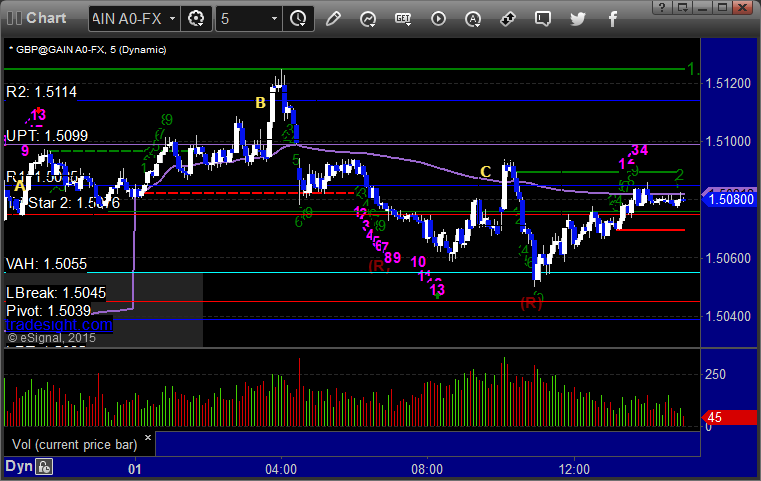

GBPUSD:

Triggered short at A and stopped. Triggered long at B and unfortunately stopped on the pullback to C before working great:

Rich Derrick's List of 17 Trading Rules

This is a list of tips for traders from our own Rich Derrick:

1 - Never ever add to a losing position.

2 - Trade like a mercenary soldier.

3 - Mental capital trumps real capital.

4 - We are not in the business of buying low and selling high.

5 - In bull markets, one must only be long or neutral.

6 - Markets can remain illogical far longer than you or I can remain solvent.

7 - Buy that which shows the greatest strength and short that which shows the greatest weakness.

8 - Think like a fundamentalist but trade like a technician.

9 - Trading results cycle and it's mostly mental.

10 - KISS: Keep It Simple ______.

11 - Understanding mass psychology is always more important than understanding economics.

12 - There is never just one cockroach.

13 - Be patient with winning trades. Be very impatient with losing trades.

14 - Do more of that which is working and less of that which is not.

15 - Fix ALL errors immediately.

16 - Our job is setting alerts and taking losses. The rest will take care of itself.

17 - Amateurs open markets. Professionals close them.

Stock Picks Recap for 12/2/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NFLX triggered long (with market support) and worked:

AVGO triggered long (without market support) and didn't work:

HAIN triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GILD triggered short (with market support) and didn't work:

Mark's QCOM triggered long (with market support) and worked:

AMZN triggered long (with market support) and worked:

WYNN triggered long (with market support) and worked:

Rich's VRX triggered long (with market support) and worked enough for a partial:

His MNK triggered long (with market support) and worked enough for a partial:

COST triggered short (with market support) and didn't work:

His ZFGN triggered long (without market support) and worked enough for a partial:

His NFLX triggered long (without market support) and worked enough for a partial:

Rich's BABA triggered long (without market support) and worked:

His GOOG triggered short (with market support) and worked:

WYNN triggered short (with market support) and worked:

AMGN triggered short (with market support) and didn't work:

In total, that's 12 trades triggering with market support, 9 of them worked, 3 did not.

Futures Calls Recap for 12/2/15

The markets opened flat, and we had another nice set of winners in the Opening Range plays. See that section below. The ES side was a bit weaker over lunch, but in the afternoon, both sides headed down on 1.9 billion NASDAQ shares.

Net ticks: +0 ticks.

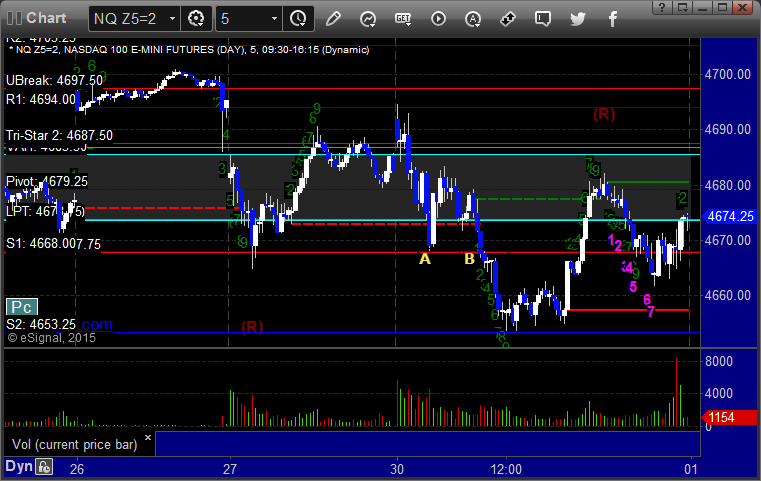

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 12/2/15

A nice winner that is currently over 100 pips in the money and still going as I write this in the GBPUSD. See that section below.

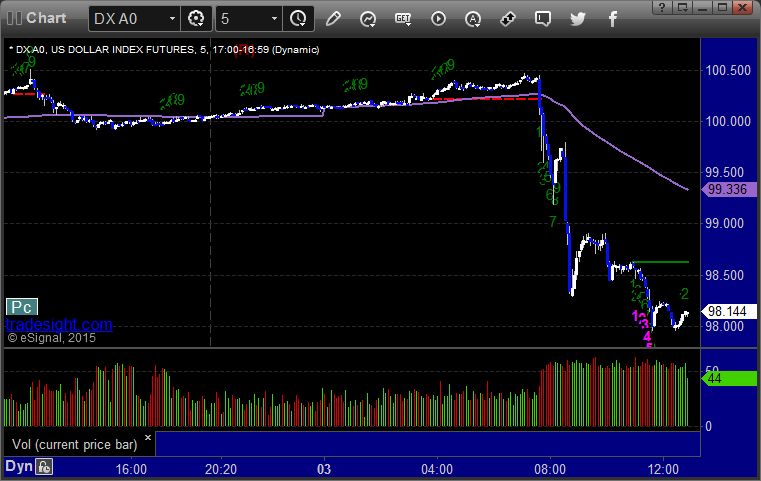

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, and still holding second half with a stop at C:

Stock Picks Recap for 12/1/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EBAY gapped over, no play.

CREE triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMBA triggered long (with market support) and worked enough for a partial:

His AGN triggered long (with market support) and worked great:

VRSN triggered long (with market support) and worked enough for a partial:

Mark's ADBE triggered long (with market support) and didn't work:

KLAC triggered long (with market support) and worked:

Mark's BRCM triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 12/1/15

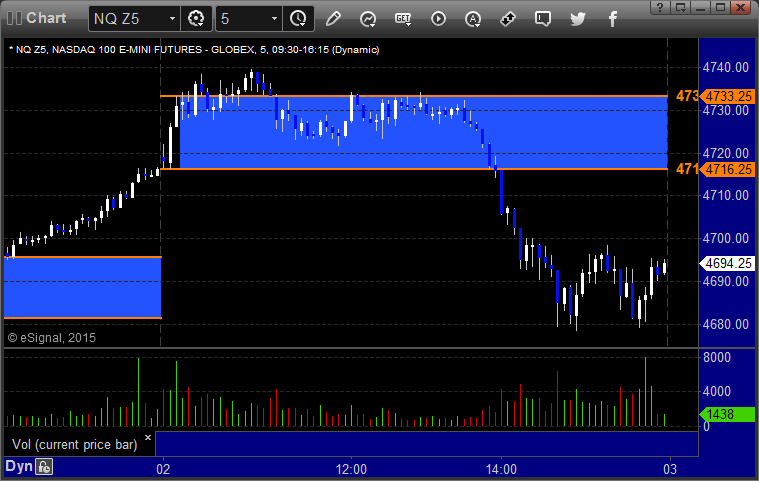

A huge day for futures trading as the opening range plays worked great (after the NQ stopped out once first). The markets gapped up, pulled back briefly, and then ran hard for 30 minutes until rumors hit of a bomb threat in the UK that tanked things briefly. That killed the good volume and momentum for the session and the range for the day was set. The gaps did not fill. We had a great inverted cup and handle short idea on the NQ into the Value Area and for the gap fill, but it didn't trigger.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked huge:

NQ Opening Range Play triggered short at A and stopped, triggered long at B and worked huge:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 12/1/15

The second half of the prior day's trade stopped in the money, and then we had a trade trigger twice, working once and stopping out the second time. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, stopped second half. Triggered again in the morning at C and stopped:

Stock Picks Recap for 11/30/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls due to weak scans from Friday's half day.

From the Messenger/Tradesight_st Twitter Feed, Mark's CREE triggered long (without market support) and worked:

His LPLA triggered long (without market support) and worked:

CELG triggered short (with market support) and worked:

Rich's VRX triggered long (without market support) and worked:

His FIT triggered short (with market support) and didn't work:

His AMZN triggered short (with market support) and worked but just in the last 10 minutes:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

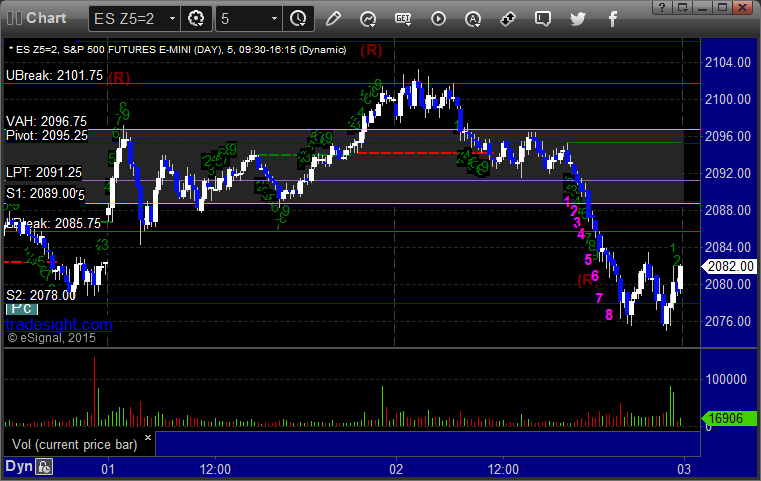

Futures Calls Recap for 11/30/15

The markets gapped up, filled, and most of the morning was flat after that. We dipped lower over lunch but recovered, and then dipped again in the afternoon, although the NASDAQ side stayed stronger. NASDAQ volume closed at 2 billion shares, which was partially about the end of the month. Our opening range plays worked well, and there was a nice setup on the NQ also. See those sections below.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Classic setup from our course, set the LBreak at A and then triggered short at B and worked straight to S2: