Forex Calls Recap for 11/30/15

A winner (still going) to start the week. See the EURUSD section below.

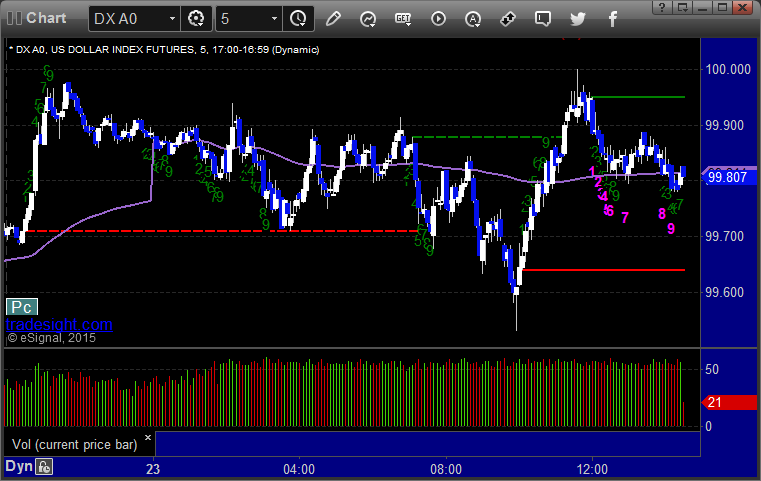

Here's a look at the US Dollar Index intraday with our market directional lines:

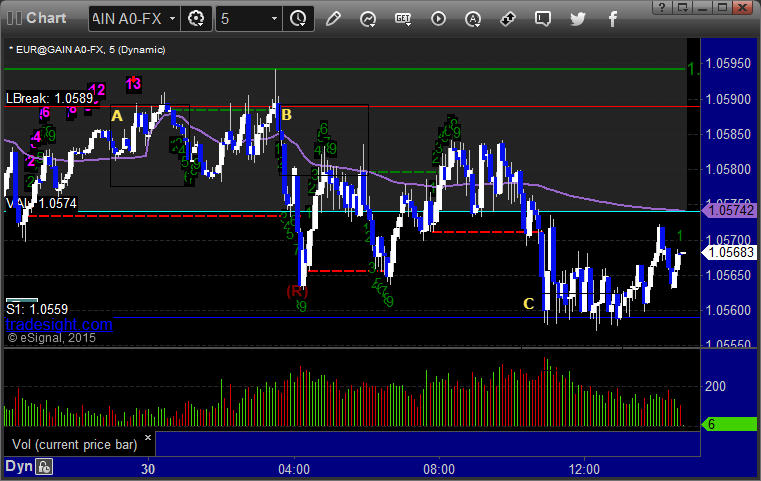

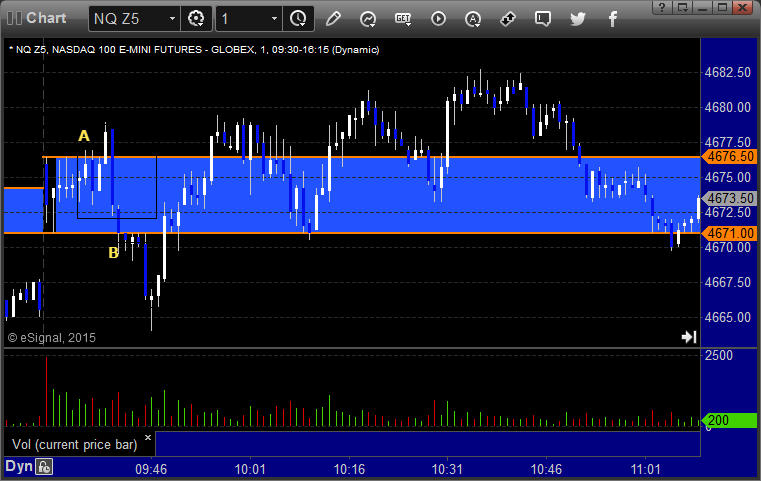

EURUSD:

The call triggered short Sunday late afternoon before the start of the chart below, but it gave you a bunch of time from A (on a 13 Seeker sell signal even) to B to get short under LBreak. Hit first target finally at C and still holding the second half with a stop over LBreak:

Stock Picks Recap for 11/25/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's VRX triggered long (with market support) and worked:

His BBY triggered long (with market support) and worked:

AGN triggered long (without market support) and worked:

His FB triggered long (with market support) and didn't work:

His VXX triggered short (ETF, so no market support needed) and didn't do enough either way to count, closed at the trigger:

Mark's GILD triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 11/25/15

Pretty much as expected. The markets opened with a small gap up, both sides filled, and that was it for the day. NASDAQ volume was only 1.4 billion as everyone left early. Opening Range plays worked. See that section below.

Net ticks: +0 ticks.

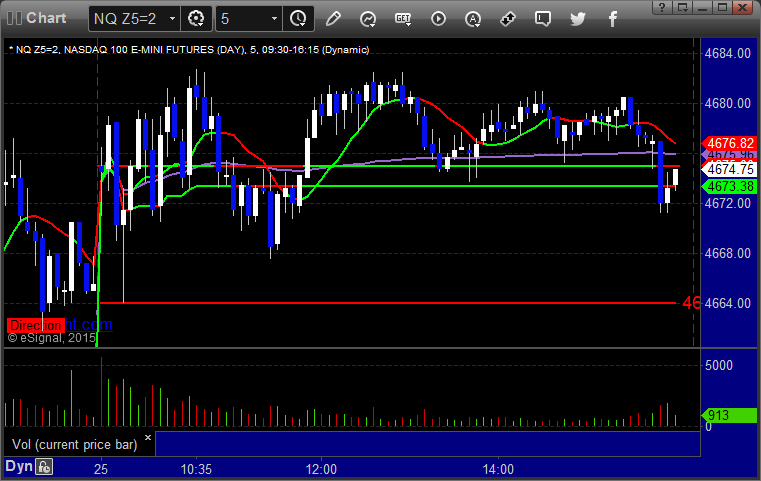

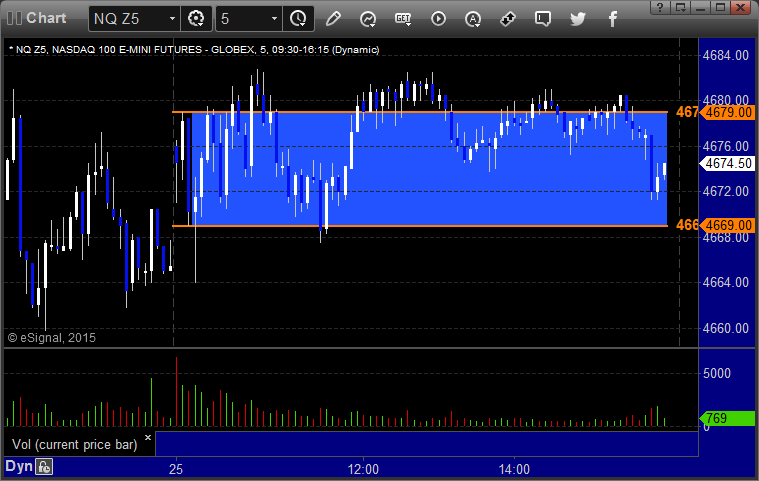

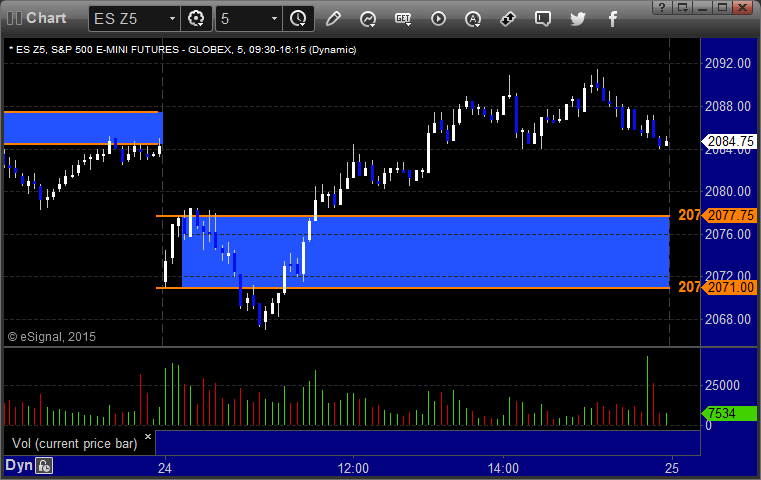

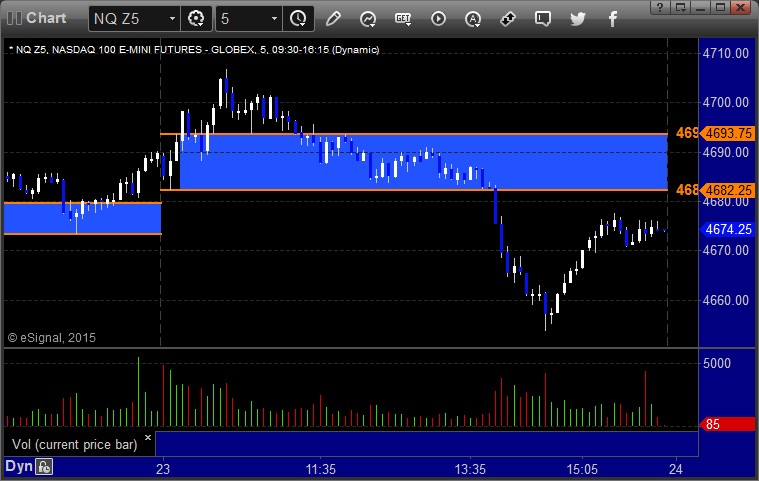

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play technically triggered long at A, but as I said in the Lab, if I'm already short the ES, I don't take the NQ the other direction in the rare cases that that happens, especially when the gap fill was below. NQ then triggered short at B and worked too:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 11/25/15

We stopped out of the second half of the prior day's trade in the money and then had a new trade in GBPUSD. See that section below.

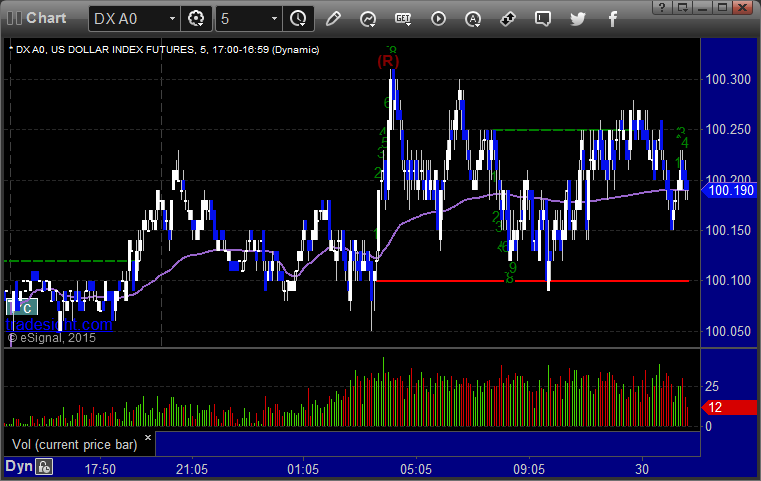

Here's a look at the US Dollar Index intraday with our market directional lines:

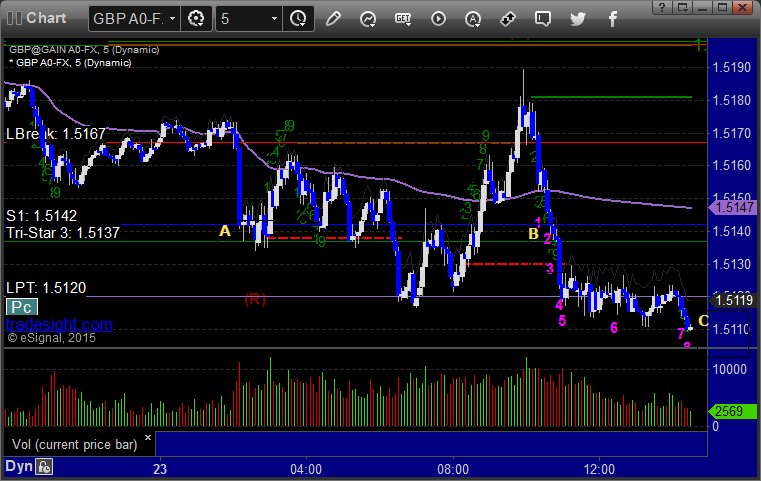

GBPUSD:

Triggered long at A and stopped:

Stock Picks Recap for 11/24/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BRCM triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's MNK triggered long (with market support) and worked enough for a partial:

His AMZN triggered long (with market support) and didn't work:

His TRIP triggered short (without market support) and worked great:

FSLR triggered long (with market support) and worked:

Mark's SWKS triggered long (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 11/24/15

A nice day for futures. Solid winners in the ES and NQ Opening range plays and then a loser and a winner that netted small gains on the ES. The markets gapped down after the news that Turkey had shot down a Russian jet. We gave a weak bounce, then made new lows, then came back up and filled the gaps over lunch and closed at highs on 1.7 billion shares.

Net ticks: +1.5 ticks.

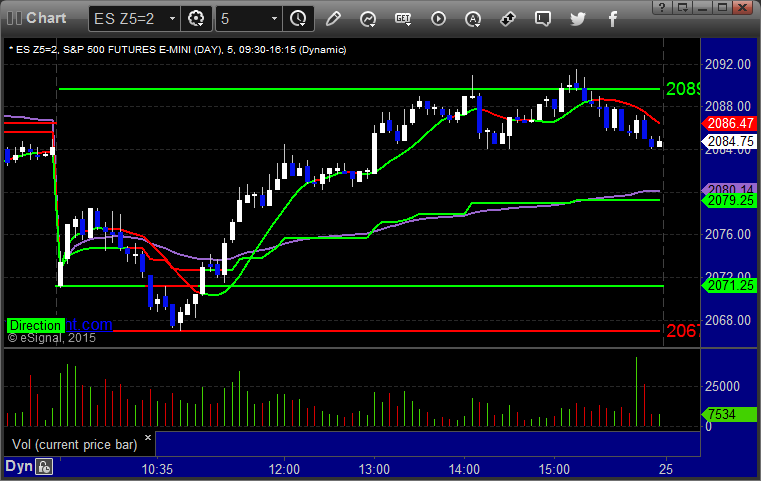

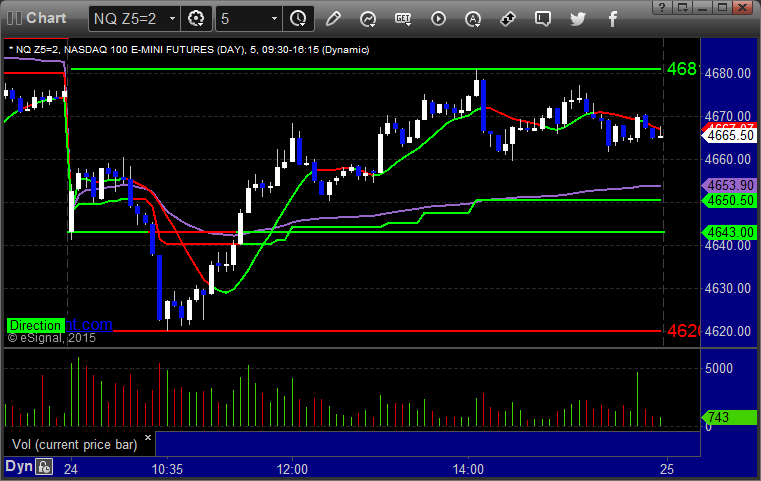

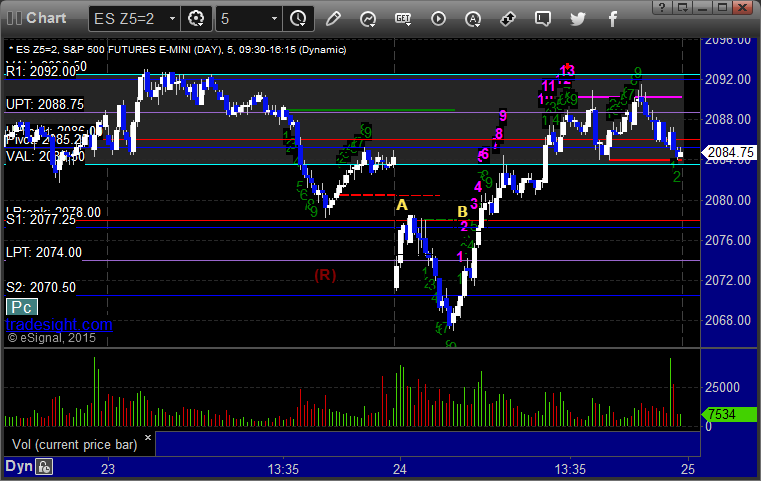

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked great:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 2078.50 and stopped for 7 ticks. Triggered again at B, hit first target for 6 ticks, raised stop and stopped 11 ticks in the money:

Forex Calls Recap for 11/24/15

Another slow night, but this time a loser and a winner that we are still holding. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

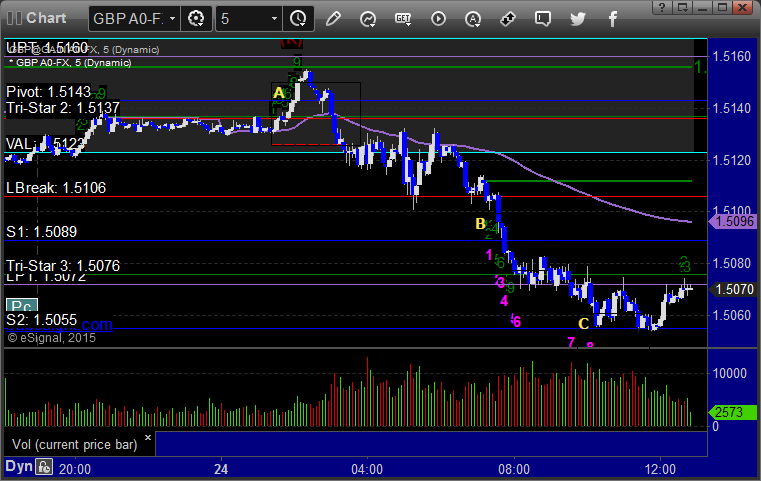

GBPUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, still holding second half with a stop over S1:

Stock Picks Recap for 11/23/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FIVN triggered long (with market support) and worked:

CLDX triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, although this was originally called for a trade at the open, Rich's ASML triggered short hours later (with market support) and didn't work:

Mark's TEVA triggered long (with market support) and worked enough for a partial:

NTAP triggered long (with market support) and worked enough for a partial:

Rich's VRX triggered short (with market support) and worked enough for a partial:

His SRPT triggered long (without market support) and worked:

His TWTR triggered long (without market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 11/23/15

The markets opened a couple of points down and took a while to fill. The NASDAQ side was stronger early and things held up over lunch, then rolled to new lows coming out of lunch before bouncing a bit into the close on a weak 1.5 billion NASDAQ shares. Opening range plays worked. See that section below. Don't expect too many regular calls this week with the light volume Holiday environment.

Net ticks: +0 ticks.

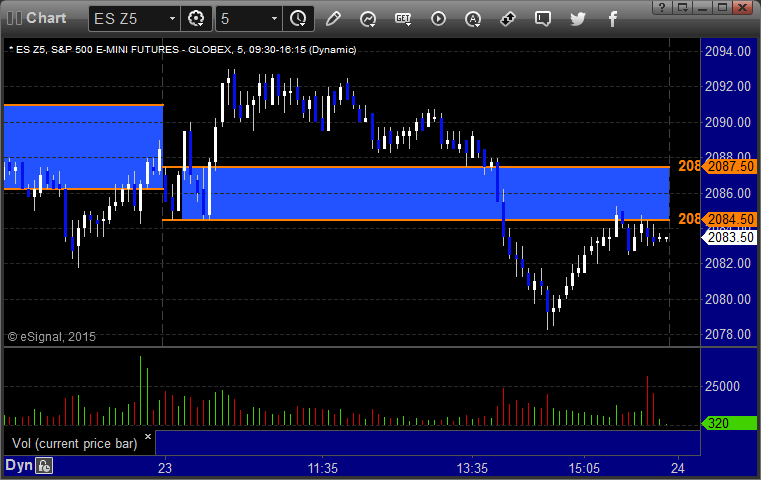

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work, triggered long at B and worked enough for a partial:

NQ Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 11/23/15

The slowness continues. Basically 50 pips of range in EURUSD and GBPUSD. Two triggers in GBPUSD, see that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Put it back in in the morning, triggered at B, never did much, closed at C for 15 pips: