Tradesight Recap Report for 2/1/22

Overview

The markets opened flat, started to head lower, and then rebounded to the opening level and sat there all day until the last hour or so on 4.6 billion NASDAQ shares.

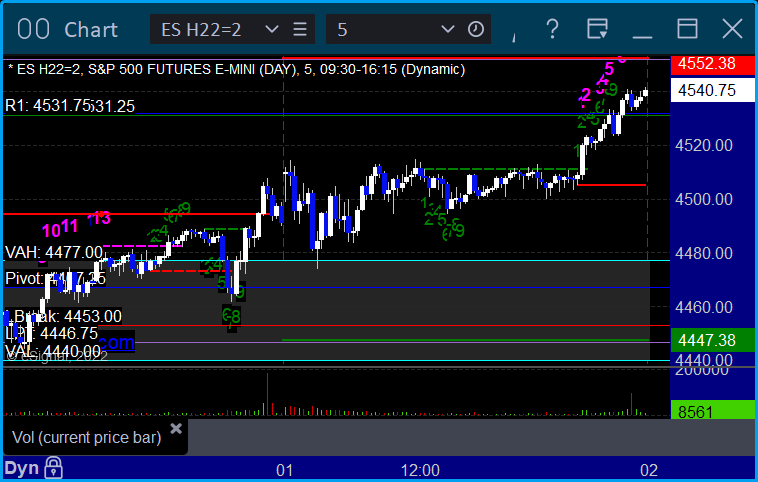

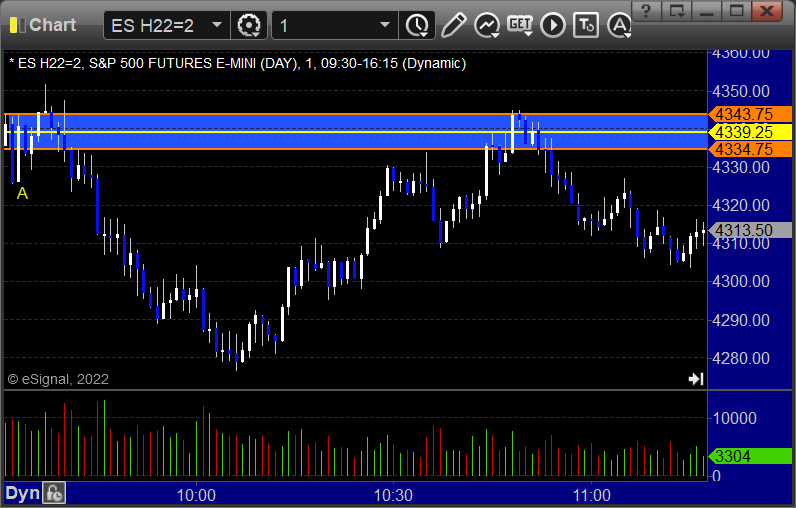

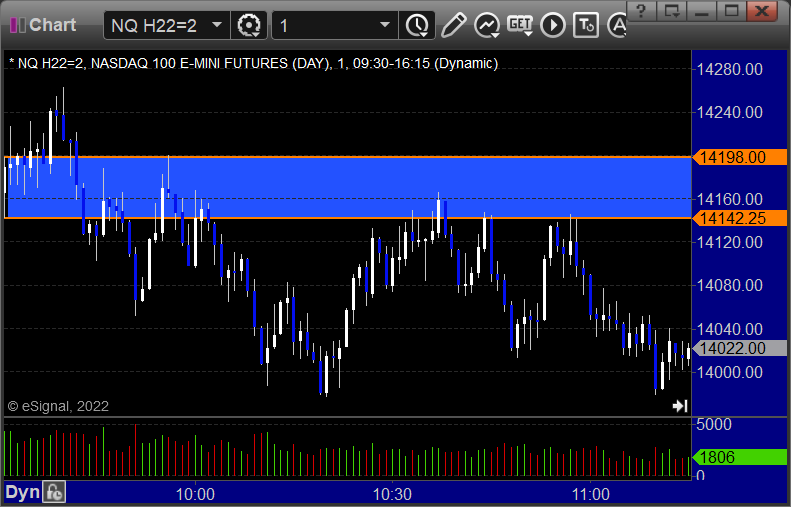

ES with Levels:

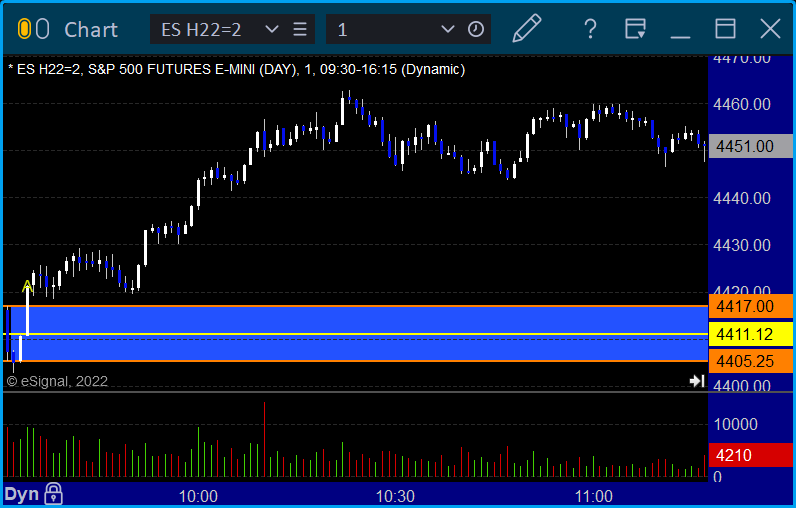

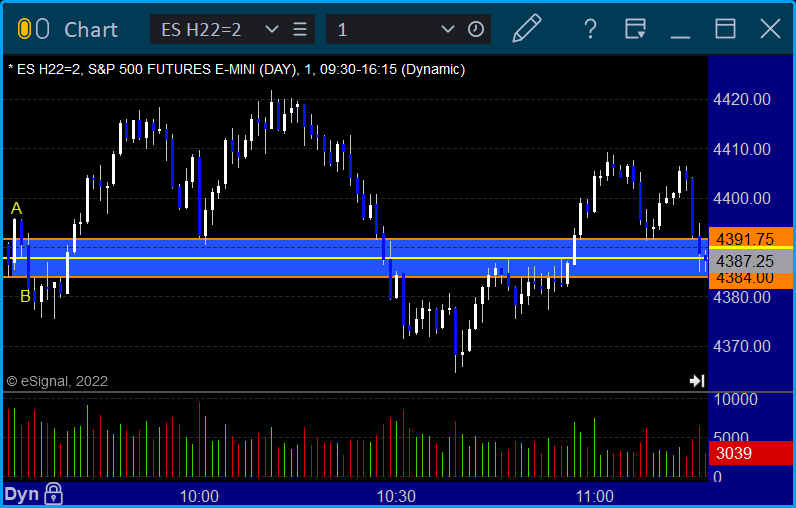

ES with Market Directional:

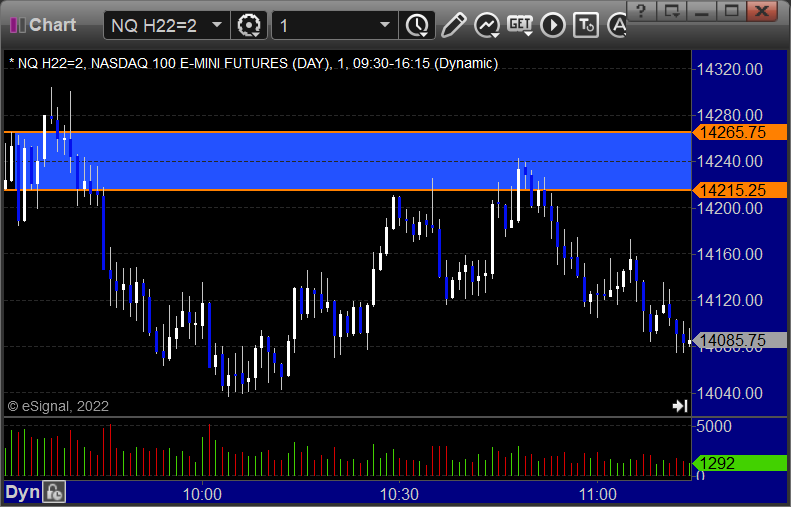

Futures:

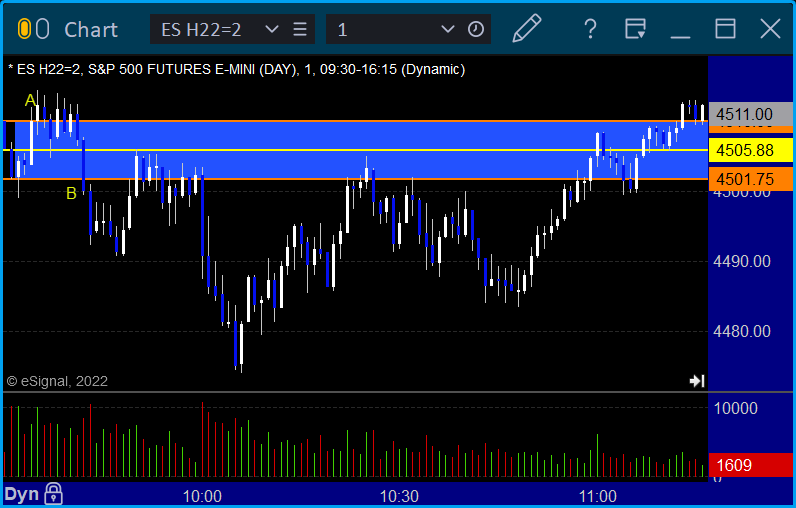

ES Opening Range Play triggered long at A (too far out of range to take) and short at B (technically too far out of range to take by a couple of ticks, so we won't count it, but if you took it, it worked):

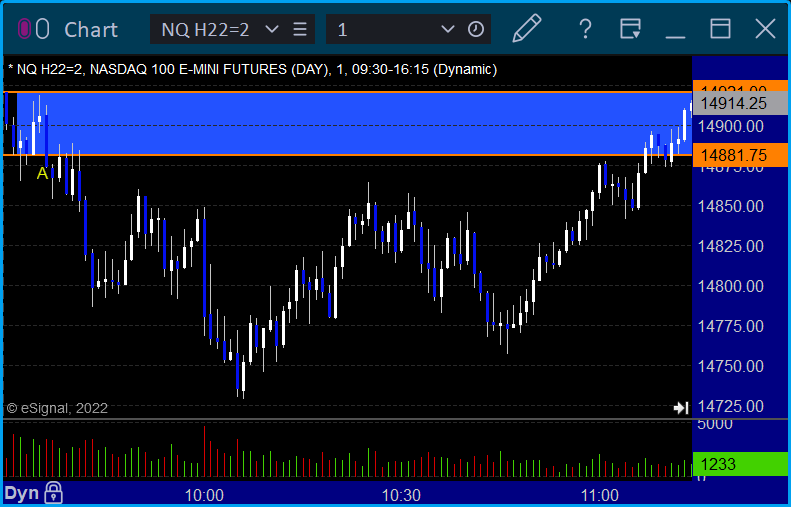

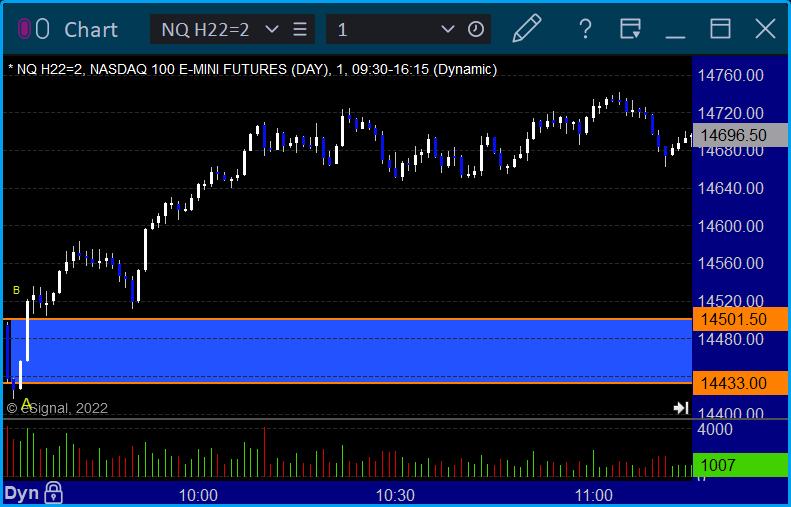

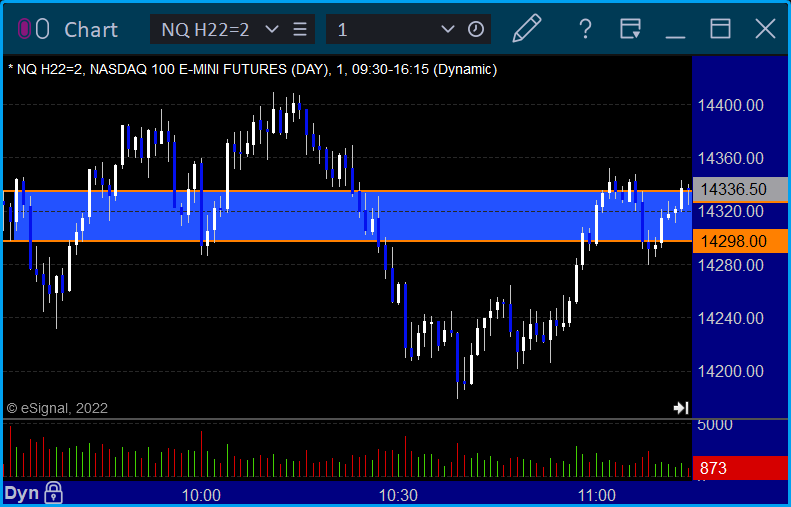

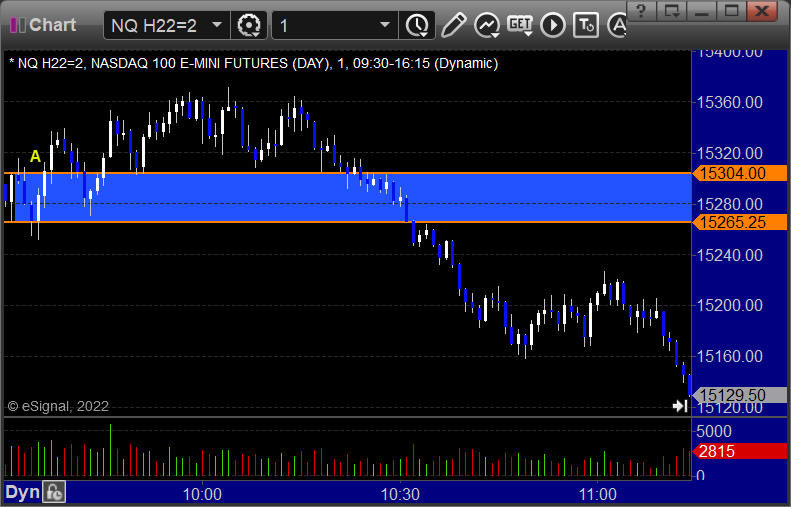

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +0 ticks

Forex:

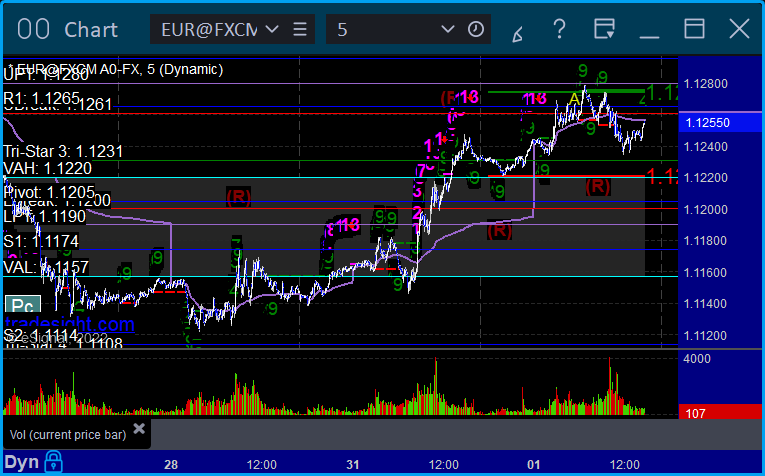

EURUSD:

Results: -25 pips

Stocks:

A less interesting day than Monday even.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, RIch's GS triggered long (with market support) and worked:

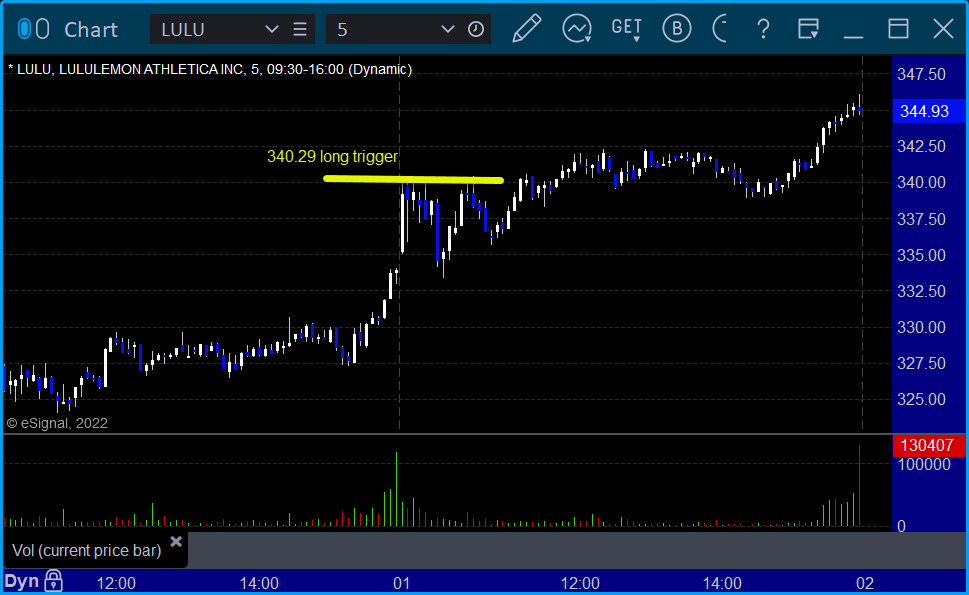

LULU triggered long (with market support) and barely stopped out, then would have worked:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 1/31/22

Overview

The markets opened flat to higher and pushed up for a couple of minutes, once in the morning and once in the afternoon. Five hours were spent on the same price. NASDAQ volume was 4.9 billion NASDAQ shares.

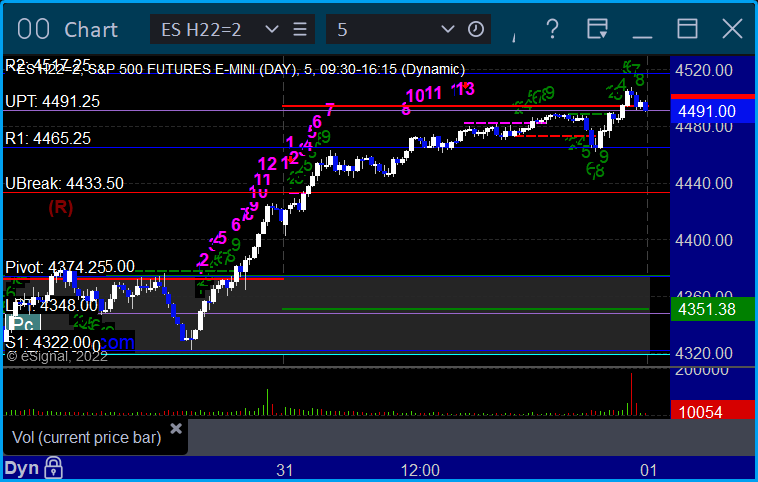

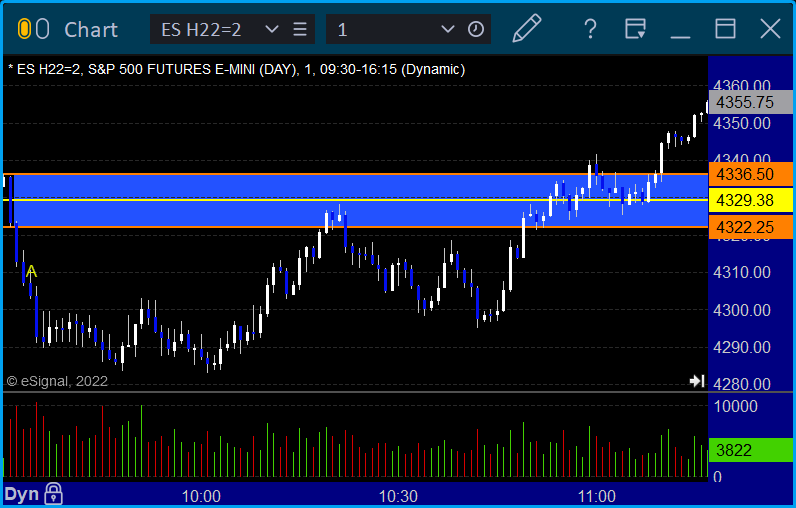

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A but too far out of range to take again:

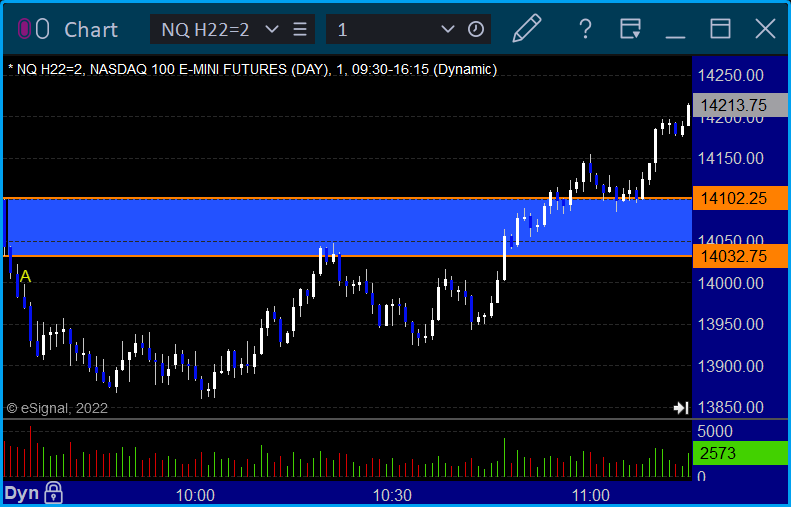

NQ Opening Range Play, both triggers were too far out of range to take:

Results: +0 ticks

Forex:

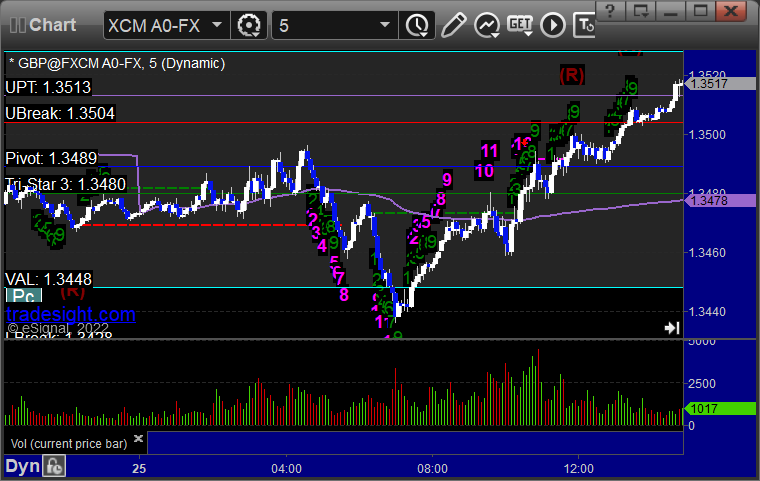

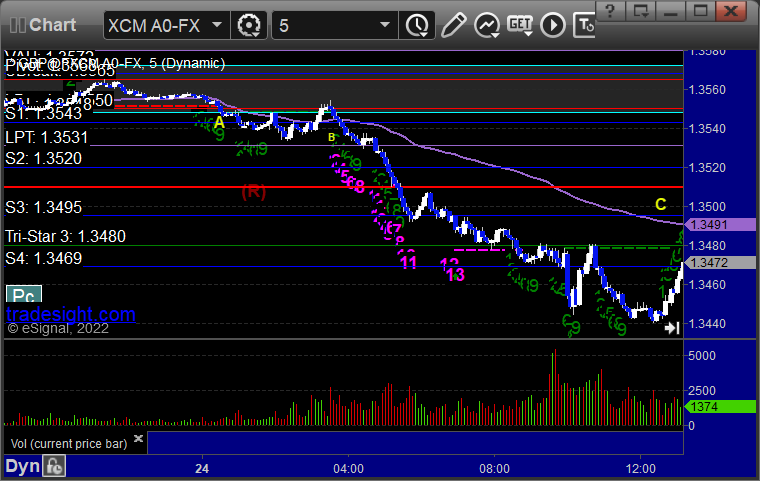

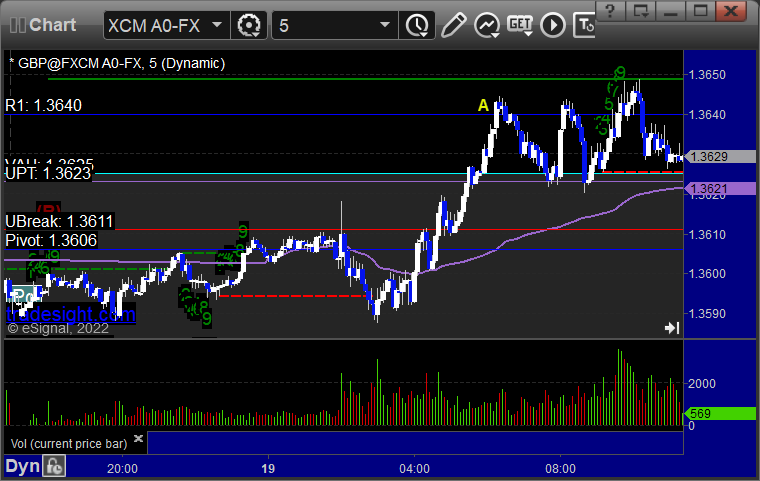

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

Not a very interesting day for month-end window dressing.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, PTON triggered long (with market support) and worked enough for a partial:

Rich's AVGO triggered long (with market support) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 1/28/22

Overview

The markets gapped down, filled, went higher ahead of lunch, pulled back to even coming out of lunch, and then rallied late on 4.9 billion NASDAQ shares, the lightest of the week.

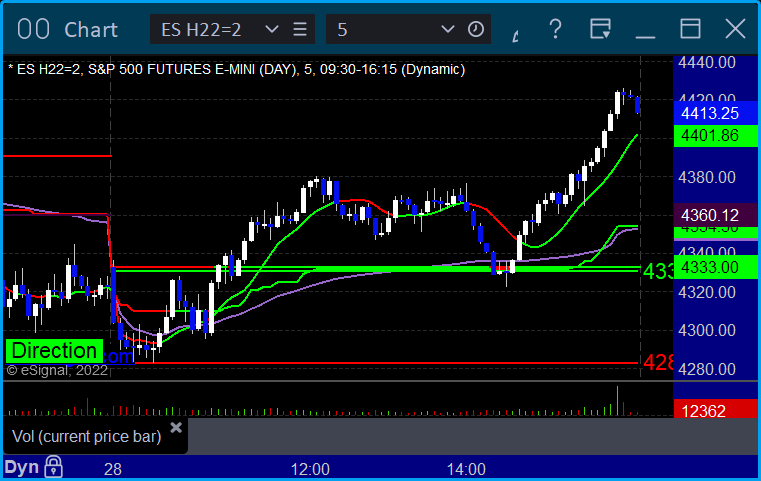

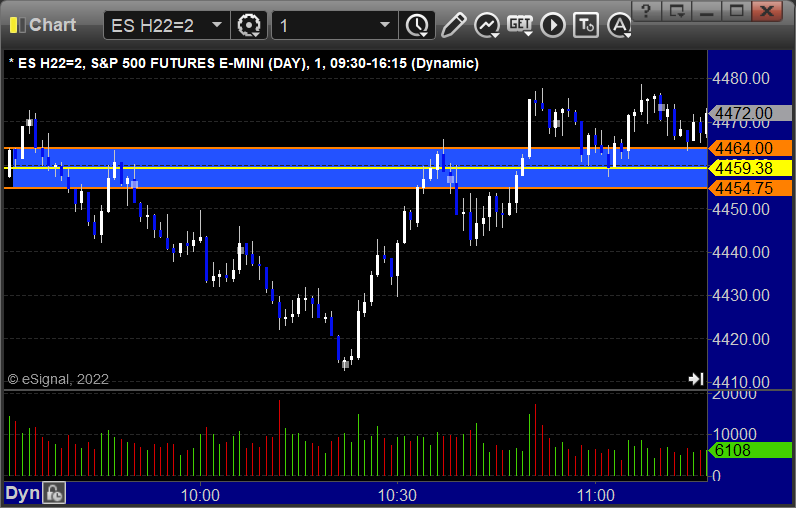

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

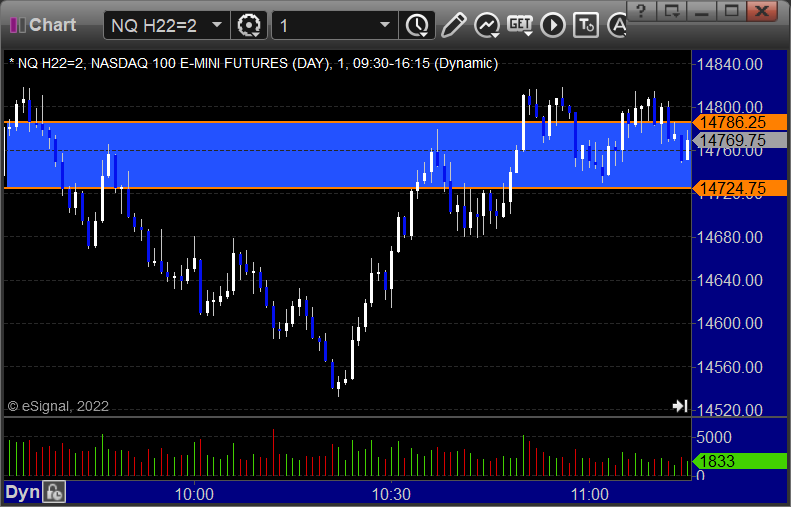

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD, closed out the prior day's trade and that was it:

Results: +30 pips

Stocks:

No much of a Friday.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, BABA triggered short (with market support) and didn't work:

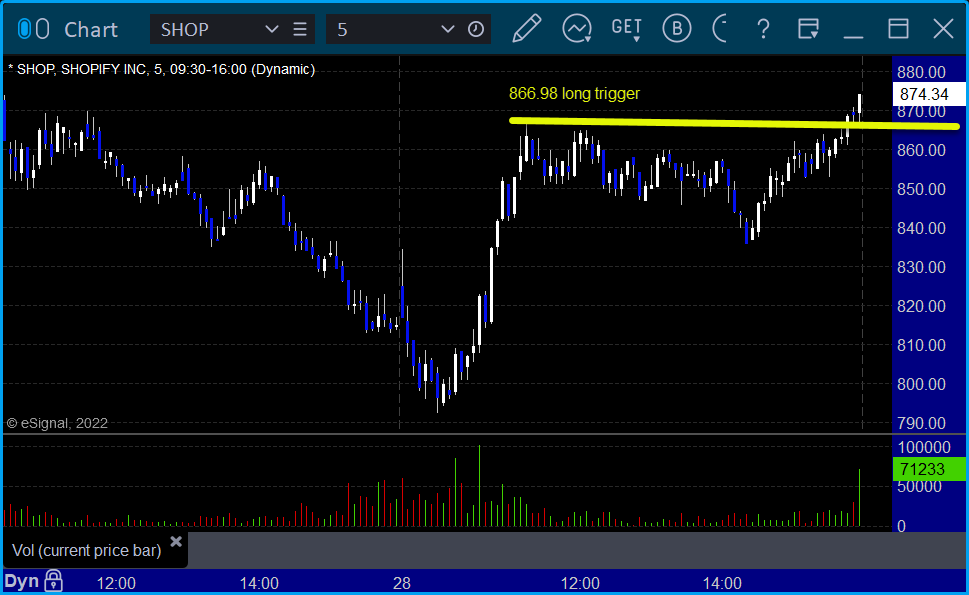

Rich's SHOP triggered long (with market support) and worked a little late in the day:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 1/27/22

Overview

The markets gapped up, stayed flat for hours, and then pulled back to fill the gap and a little more over lunch and then went flat. We are still stuck in a range. NASDAQ volume was 5.1 billion shares.

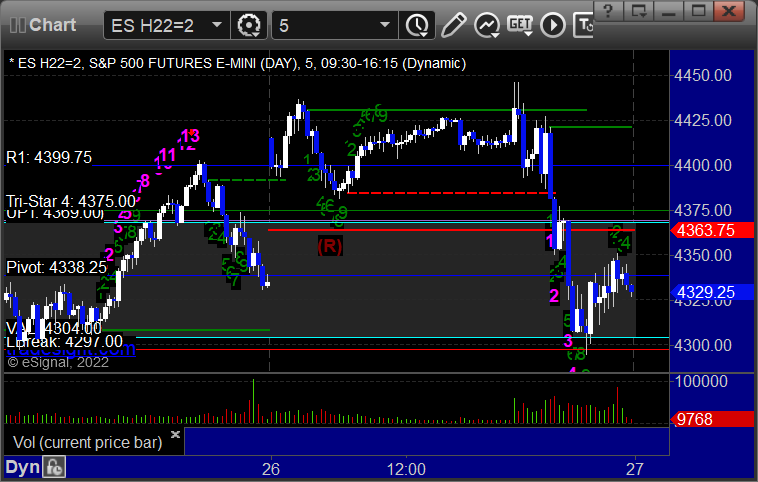

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and short at B but both too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

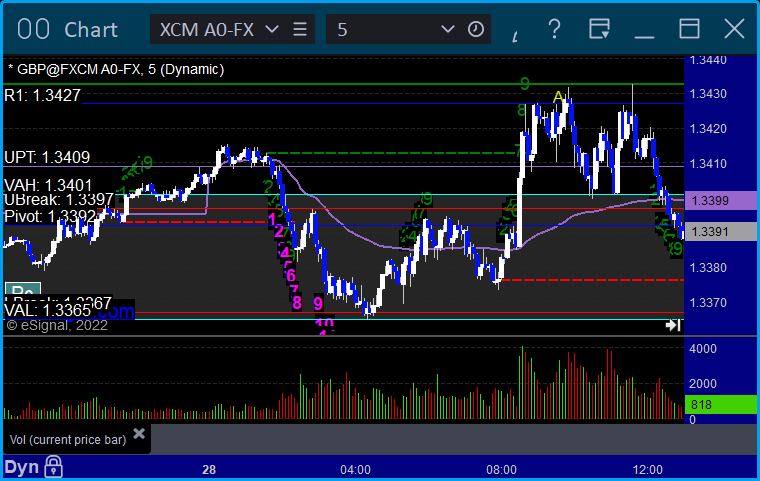

GBPUSD triggered short at A, hit first target at B, stopped second half over 1.3400:

Results: +30 pips

Stocks:

Not a big day for triggers.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, SHOP triggered long (with market support) late in the day and barely had time to work but closed green:

That’s 1 trigger with market support, and it worked a little.

Tradesight Recap Report for 1/26/22

Overview

The markets gapped up and held flat ahead of the Fed, popped higher on the announcement and then reversed back, and then plunged on the comments on 5.7 billion NASDAQ shares, which is heavy.

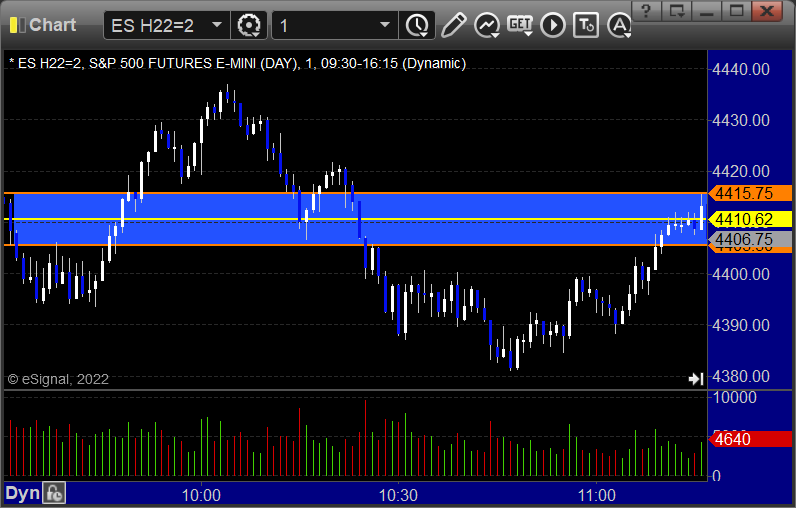

ES with Levels:

ES with Market Directional:

Futures:

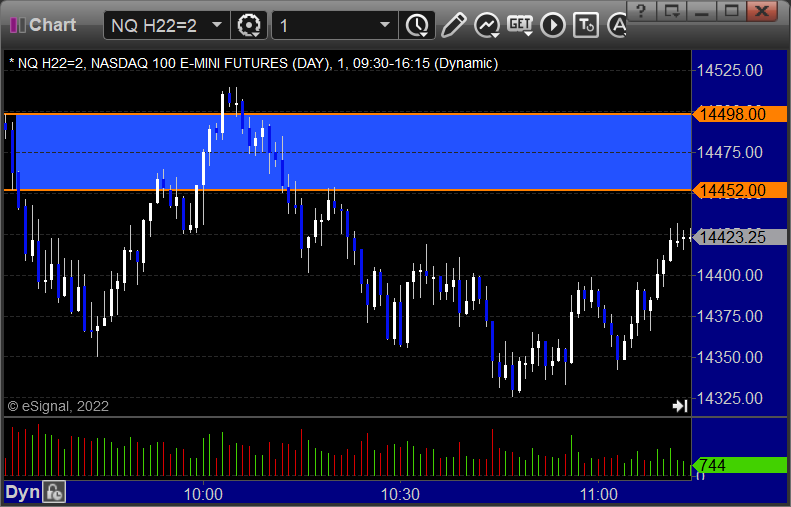

ES Opening Range Play triggered short and long but both too far out of range to take:

NQ Opening Range Play triggered short and long but both too far out of range to take:

Results: +0 ticks

Forex:

GBPUSD, no calls:

Results: +0 pips

Stocks:

A slow day ahead of the Fed and then a late move down.

From the Tradesight Plus Report, no calls.

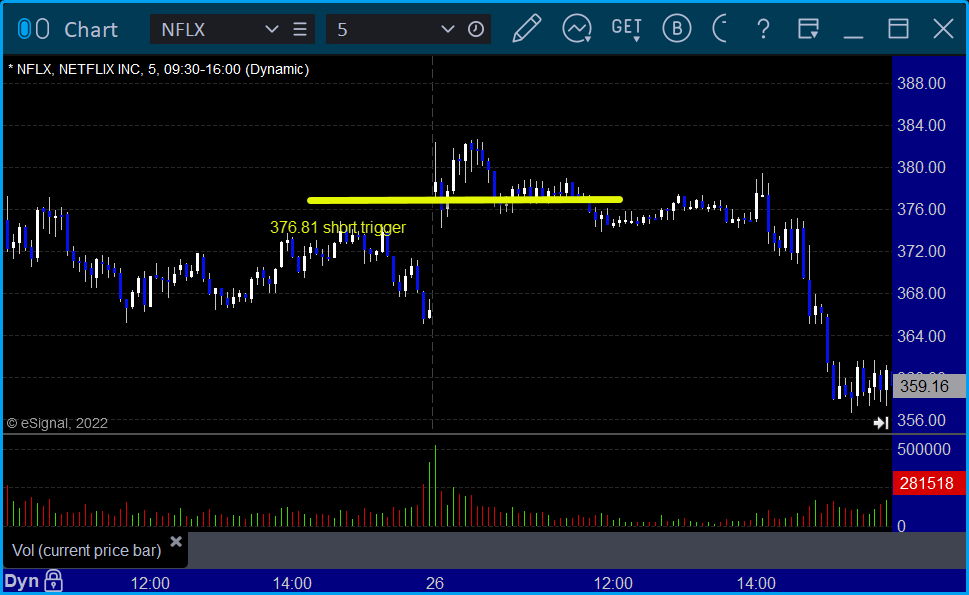

From the Tradesight Plus Twitter feed, Rich's NFLX triggered short (with market support) and didn't work, worked later:

His SMH triggered long (ETF, so no market support needed) and worked enough for a partial:

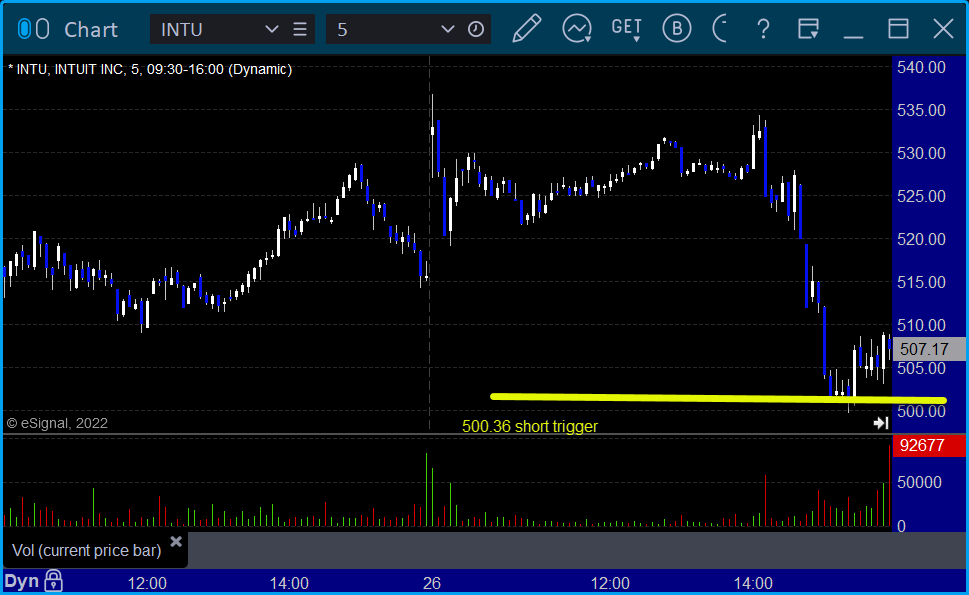

His INTU triggered short (with market support) but too late in the day to count:

That’s 2 triggers with market support, 1 of them worked and 1 didn’t.

Tradesight Recap Report for 1/25/22

Overview

The markets gapped down, went lower and then flat, popped to fill the gap, and closed negative on 4.5 billion shares.

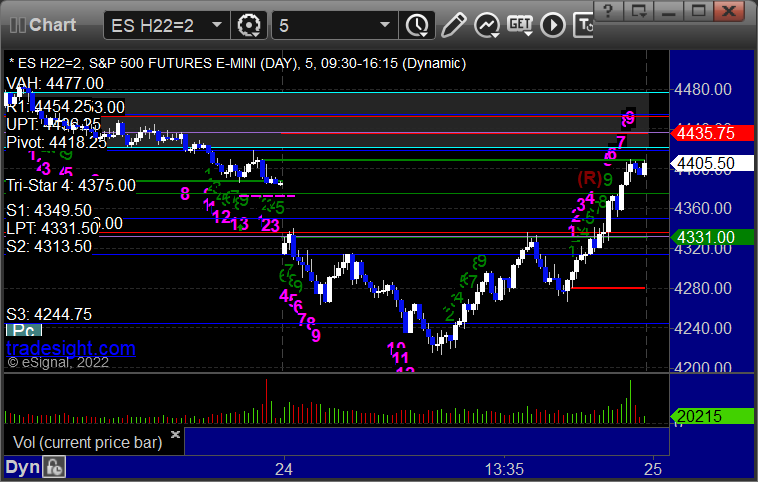

ES with Levels:

ES with Market Directional:

Futures:

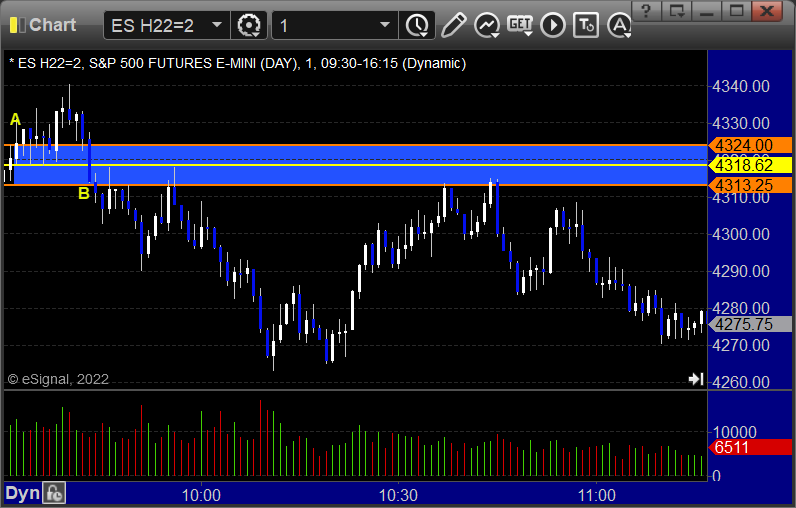

ES Opening Range Play triggered short at A but too far out of range to take:

NQ Opening Range Play:

Results: +0 ticks

Forex:

GBPUSD, no triggers:

Results: +0 pips

Stocks:

Not a super exciting day with a choppy market.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's VLO triggered long (with market support) and worked:

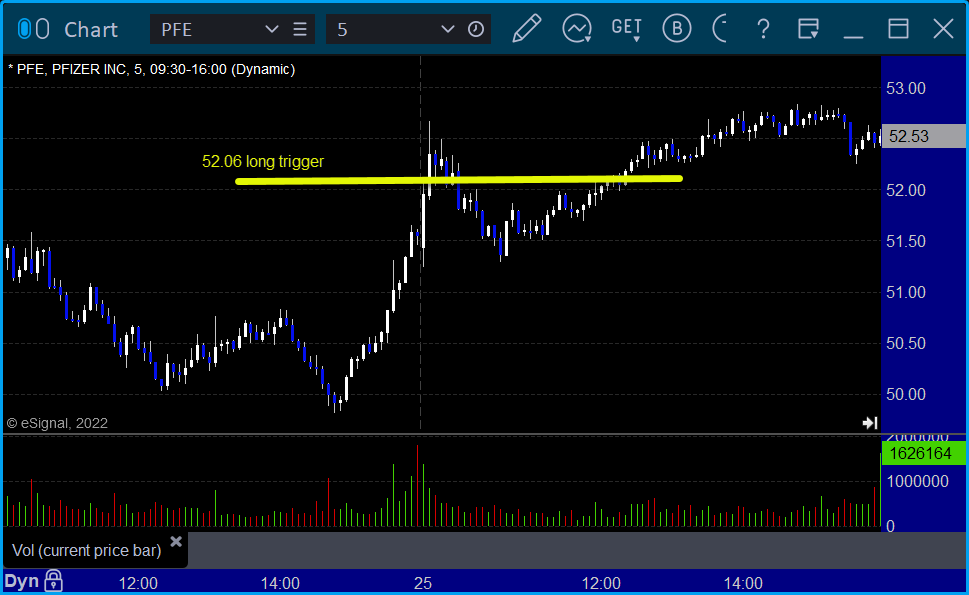

His PFE triggered long (with market support) and worked:

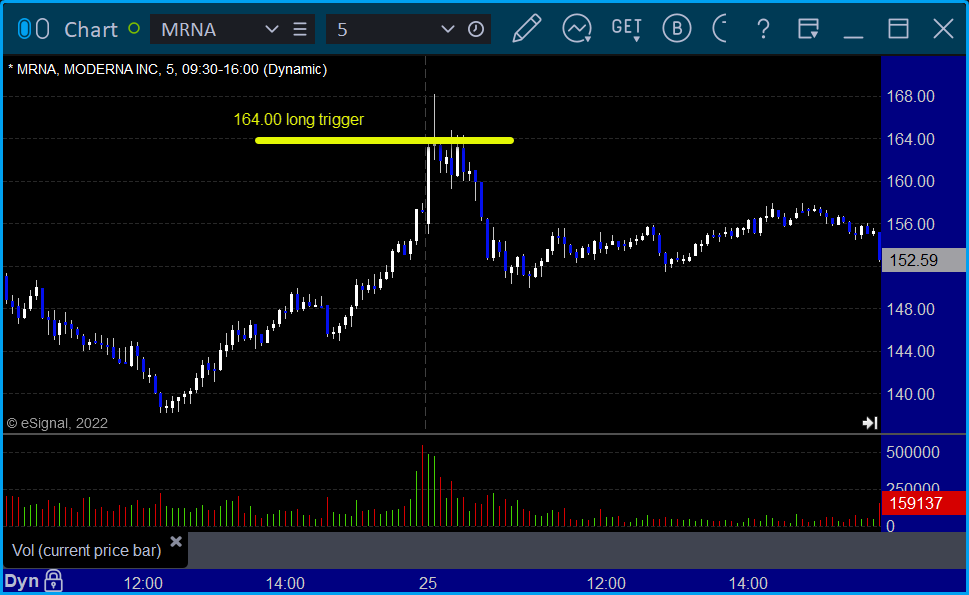

His MRNA triggered long (with market support) and didn't work:

His AVGO triggered short (with market support) and didn't work:

FSLR triggered short (with market support) and worked enough for a partial:

Rich's APA triggered long (with market support) and worked:

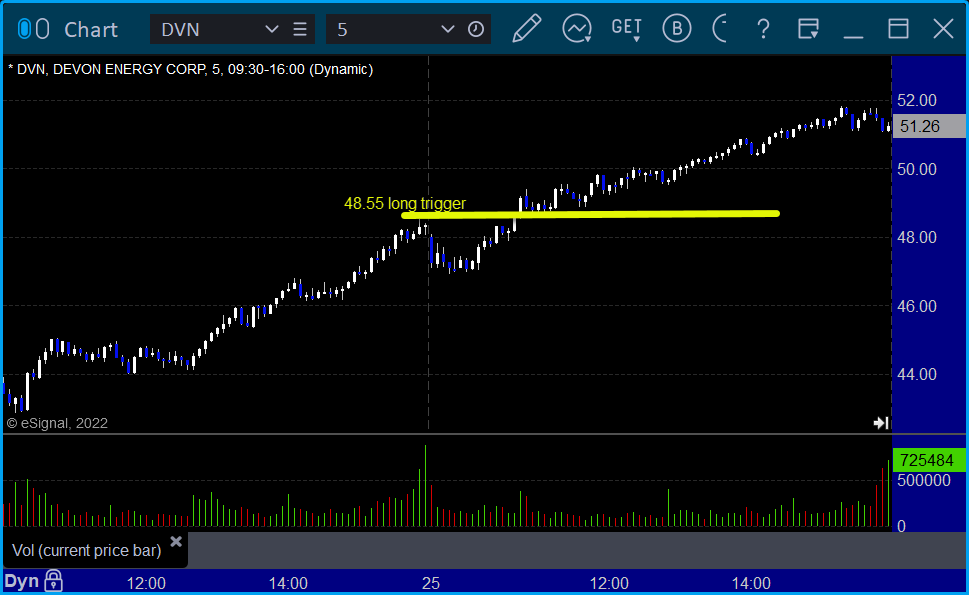

His DVN triggered long (with market support) and worked:

His GOOGL triggered long (with market support) and didn't work:

His SHOP triggered long (with market support) and worked enough for a partial:

That’s 9 triggers with market support, 6 of them worked and 3 didn’t.

Tradesight Recap Report for 1/24/22

Overview

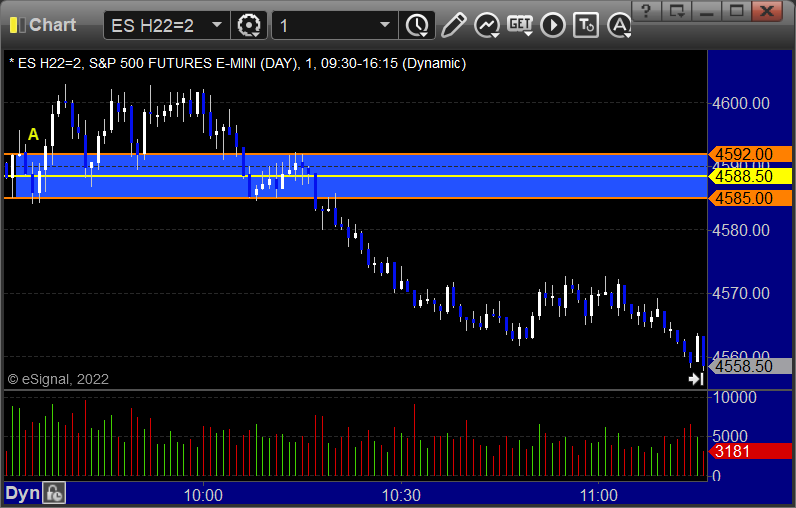

The markets gapped down, went lower, bottomed ahead of lunch, then came back to slightly positive on 7 billion shares ahead of the 2-day Fed meeting that starts tomorrow.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and short at B, both too far out of range to take:

NQ Opening Range Play triggered long at A and short at B, both too far out of range to take:

Results: +0 ticks

Forex:

A winner (still going) for the session.

GBPUSD triggered short at A, hit first target at B, still holding second half with a stop over S3 at C:

Results: No results yet as the trade is still going

Stocks:

A mixed day.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's PTON triggered long (without market support) and worked enough for a partial:

His LRCX triggered long (without market support) and didn't work:

That’s 0 trigger with market support.

Tradesight Recap Report for 1/21/22

Overview

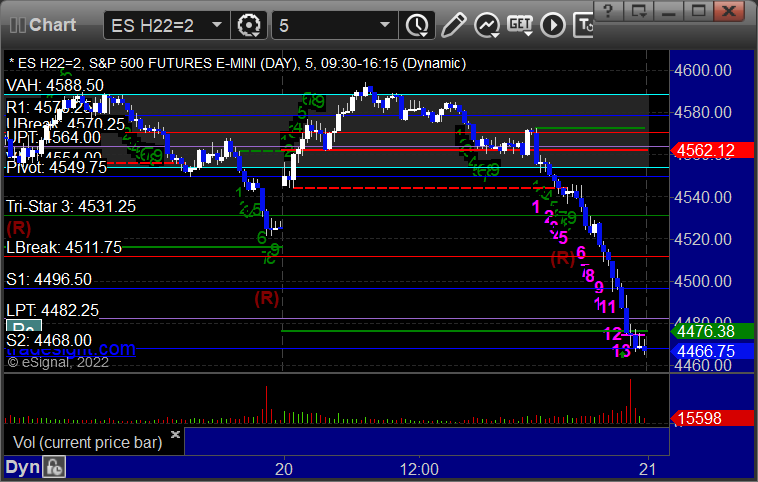

The markets opened flat, headed lower, bounced hard, and then sold off to lows on 4.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play both triggers were too far out of range to take:

NQ Opening Range Play both triggers were too far out of range to take:

Results: +0 ticks

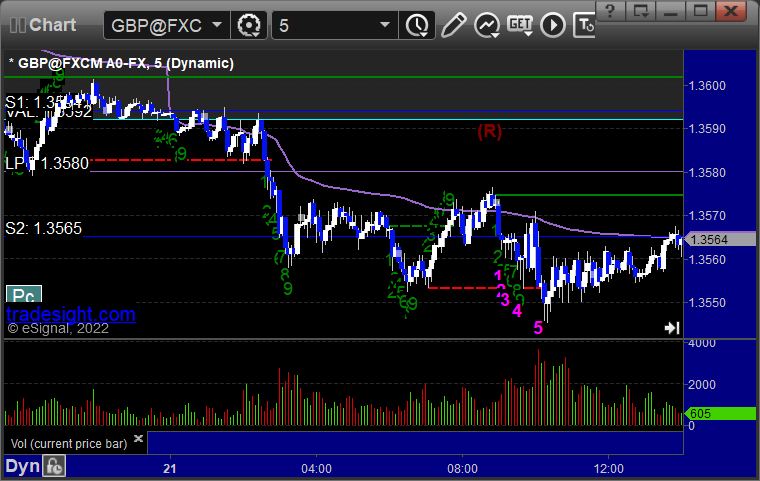

Forex:

GBPUSD triggered short under S2 and closed for 10 pip winner for end of week:

Results: +10 pips

Stocks:

A little more interesting session.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's TSLA triggered short (with market support) and worked:

AVGO triggered short (with market support) and didn't work:

NVDA triggered short (with market support) and didn't work:

LYFT triggered short (with market support) and worked enough for a partial:

Rich's AAPL triggered long (with market support) and didn't work:

Rich's NFLX triggered long (with market support) and didn't work:

His AMZN triggered short (with market support) and worked:

That’s 7 triggers with market support, 3 of them worked and 4 didn’t.

Tradesight Recap Report for 1/20/22

Overview

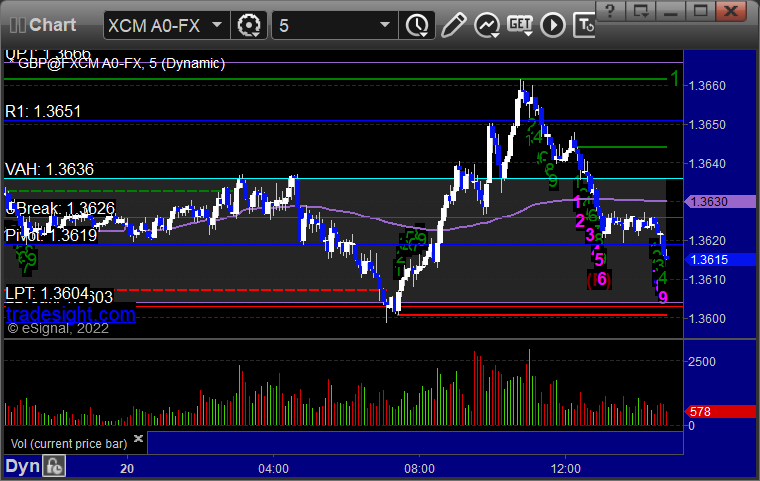

The markets gapped up, went higher, took most of the day to fill the gap, and then finally sold off in the last hour on 4.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play, trigger was out of range:

NQ Opening Range Play, trigger was out of range:

Results: +0 ticks

Forex:

GBPUSD, no calls:

Results: +0 pips

Stocks:

It was a pretty dull day that took until after lunch to fill a lazy gap, and then we sold off. No calls.

That’s 0 triggers with market support.

Tradesight Recap Report for 1/19/22

Overview

The markets gapped up, filled, came back up a bit, and then sold off late on 4.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +15.5 ticks

Forex:

GBPUSD:

Results: -25 pips

Stocks:

A mixxed session.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's ROKU triggered long (with market support) and didn't work:

His DOCU triggered long (with market support) and didn't work:

GS triggered short (with market support) and closed where the trigger was so we won't count it:

NVDA triggered short (with market support) and worked:

That’s 3 triggers with market support, 1 of them worked and 2 didn’t.