Stock Picks Recap for 11/20/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls made.

From the Messenger/Tradesight_st Twitter Feed, Rich's NKE triggered short (without market support) and didn't work:

His ANF triggered long (with market support) and worked:

Mark's NTES triggered long (with market support) and didn't work:

Rich's INTU triggered short (without market support) and didn't work:

His MENT triggered short (without market support) and worked:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 11/20/15

This was one of the lightest volume options expiration Fridays that I have ever seen. The markets gapped up and nothing happened. The gaps did not fill and we closed on only 1.6 billion NASDAQ shares, which is nuts for expiration. We did have nice Opening Range Plays.

Net ticks: -7 ticks.

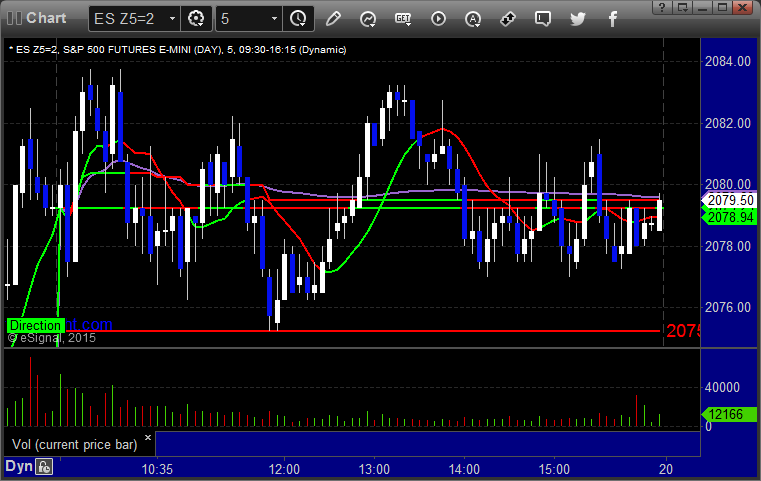

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

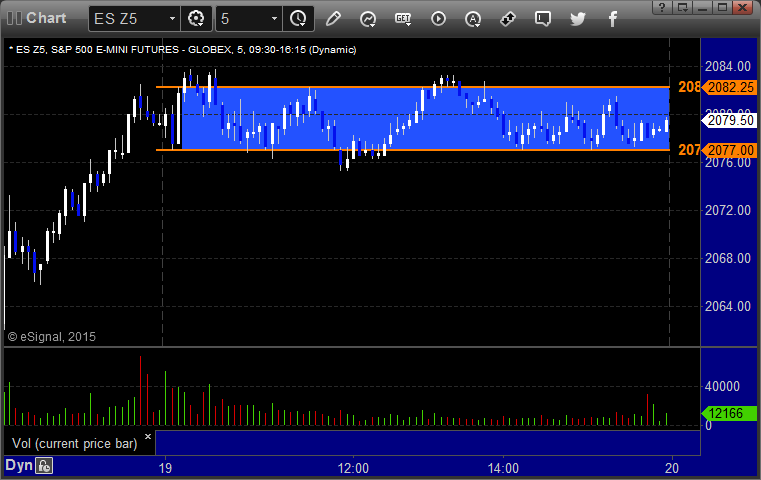

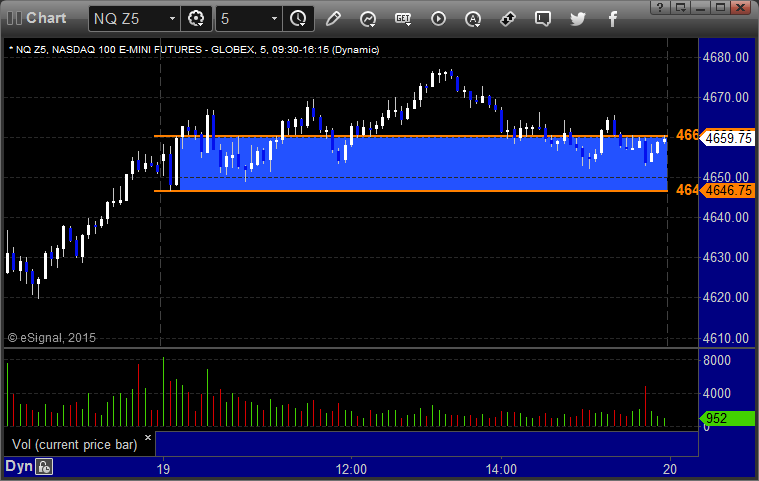

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Probably shouldn't have bothered making a call with the market so dead, but there was a nice inverted cup and handle against the UPT that triggered at A at 2085.75 and stopped. I did not put it back in:

Forex Calls Recap for 11/20/15

Finally a decent winner to wrap up the week. See the EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

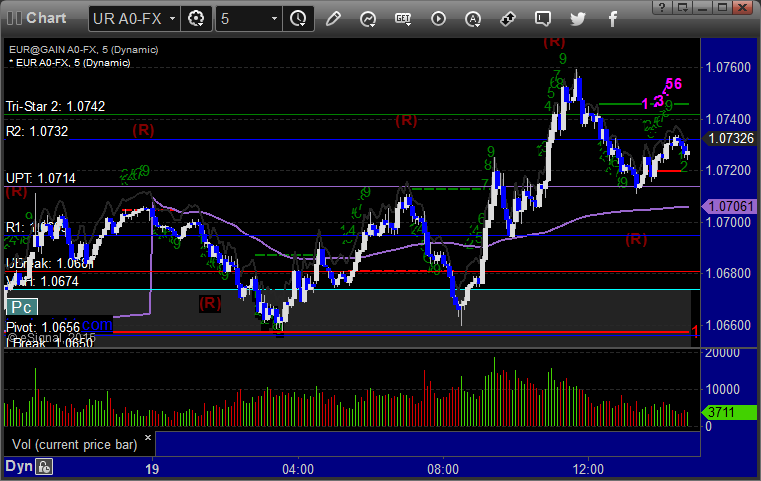

EURUSD:

Triggered short at A, hit first target at B, closed second half at C for 50 pips for end of week:

Stock Picks Recap for 11/19/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ZIXI triggered long (with market support) and worked:

NBIX triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Mark's SINA triggered long (with market support) and didn't work:

MON triggered long (with market support) and didn't work:

Rich's BABA triggered short (without market support) and worked:

His SLB triggered long (with market support) and didn't work:

His GMCR triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 2 of them worked, 4 did not. We knew this probably wasn't going to be worth trading.

Futures Calls Recap for 11/19/15

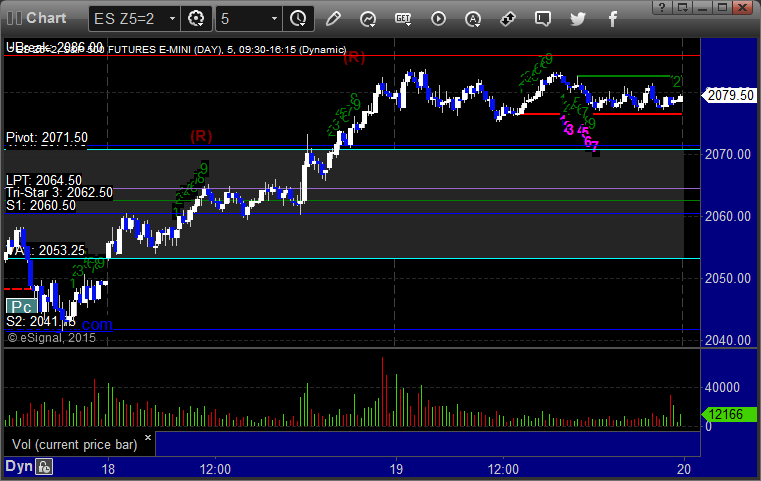

With Wednesday's options unravel behind us, Thursday was dead. I was expecting slow, but this was crazy. The ES literally never touched a level. Look at the ES market directional chart to see how bad it was. The Opening Range plays were mixed. Nothing triggered.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

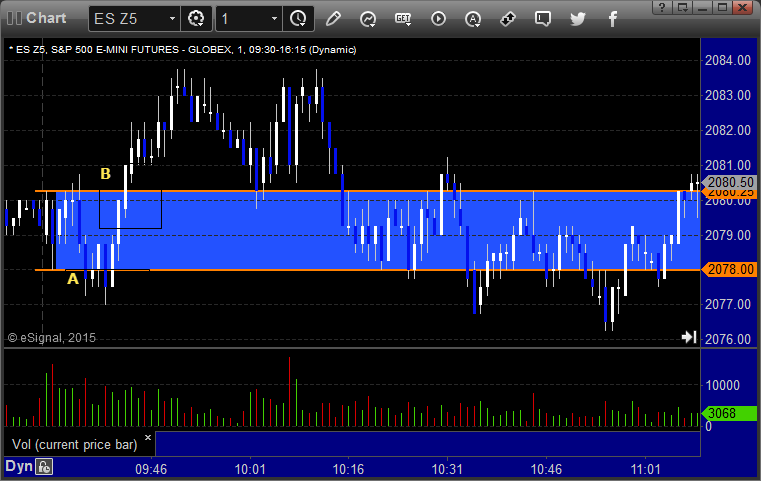

ES Opening Range Play triggered short at A and didn't work, triggered long at B and did:

NQ Opening Range Play triggered short at A and didn't work, triggered long at B and did:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 11/19/15

No calls because the Levels got too narrow based on the last couple of days' trading, and that ended up being a good thing it looks like. Still no good movement. Charts below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 11/18/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IDTI triggered long (with market support) and worked great:

SMCI triggered short (without market support) and didn't work:

IACI triggered short (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered long (with market support) and worked:

Mark's SINA triggered long (with market support) and worked enough for a partial:

Rich's DKS triggered long (with market support) and worked enough for a partial:

His FB triggered long (with market support) and worked:

NTAP triggered short (without market support) and didn't work (shouldn't have been taken once we knew the options unravel direction):

Rich's MON triggered long (with market support) and didn't work:

His AMZN triggered long (with market support) and worked:

His APA triggered short (without market support) and worked:

His TSLA triggered long (with market support) and worked:

His CTXS triggered short (without market support) and worked a little:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not. Big day, end of story.

Futures Calls Recap for 11/18/15

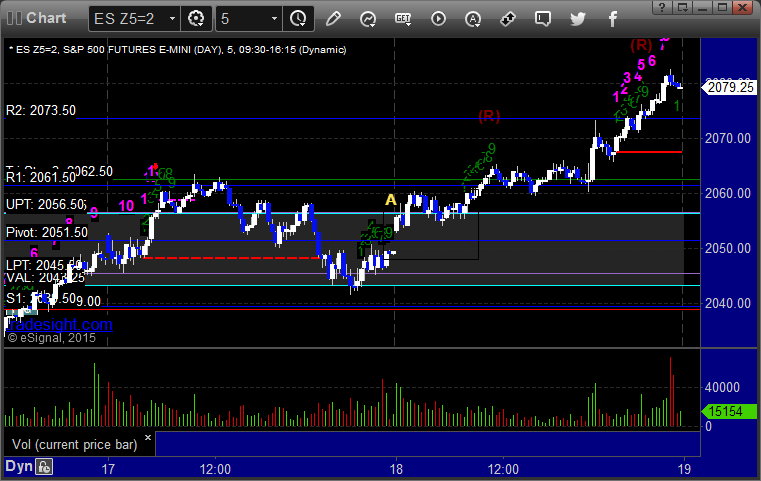

Another slower session, although we did get an options unraveling move after the first hour, which was to the upside, and worked as it should (stay in that direction the rest of the day). NASDAQ volume closed at 1.8 billion shares.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A and didn't work, then triggered long at B and did. I was already long ES before NQ short triggered and I don't usually take conflicting directions:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Mark's call triggered long at 2058.50, hit first target for 6 ticks, stopped second half under entry:

Forex Calls Recap for 11/18/15

Wow, the ranges continue to get worse and nothing triggered overnight. GBPUSD hit the long trigger but couldn't get through. Charts shown below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 11/17/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NXST triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked:

His LOW triggered short (with market support) and worked enough for a partial:

His DKS triggered long (without market support) and didn't work, triggered again later with market support and worked:

KLAC triggered long (without market support) and worked:

LULU triggered short (with market support) and worked:

Rich's VRX triggered short (with market support) and worked enough for a partial late in the day:

His FB triggered short (without market support) and didn't work:

COST triggered long (with market support) and worked enough for a partial:

Rich's PCLN triggered short (without market support) and didn't work:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.