Stock Picks Recap for 10/16/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ADBE triggered long (without market support) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's IBB triggered short (ETF, so no market support needed) and worked:

His SLB triggered short (with market support) and worked:

His WYNN triggered long (with market support) and worked:

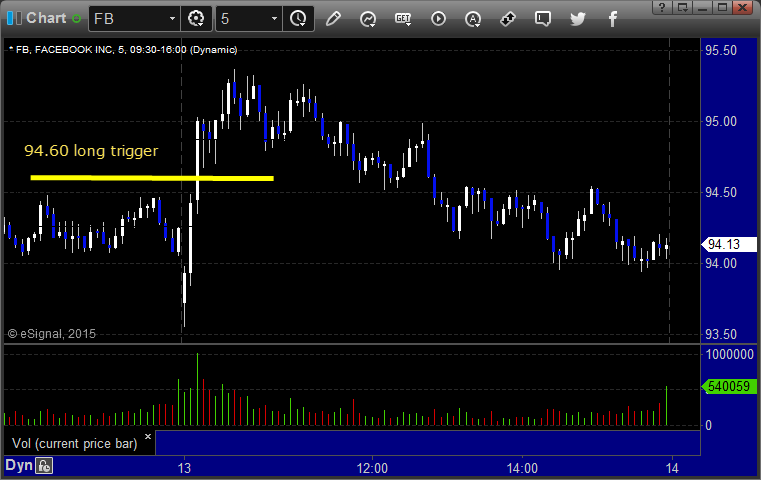

His FB triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked, plus the top report call in ADBE.

Futures Calls Recap for 10/16/15

Pretty much as expected for expiration, although volume ended up being much lighter than I would have thought. We closed at 1.6 billion NASDAQ shares, which is really unusual to see for expiration. The market was flat most of the session.

Net ticks: -7 ticks.

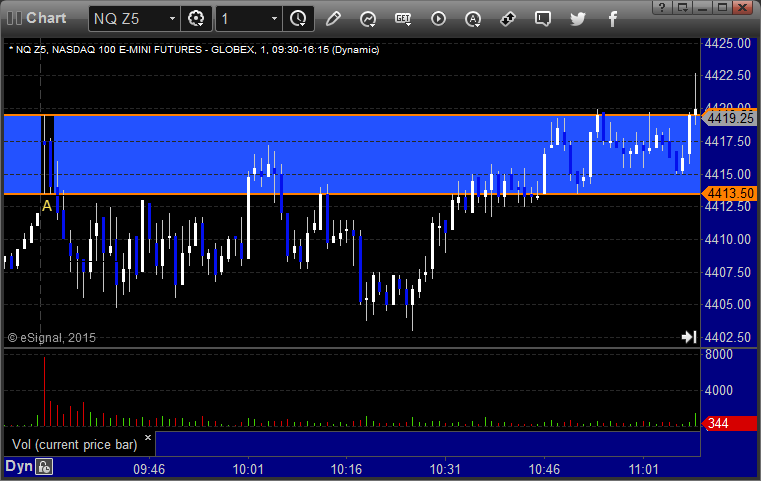

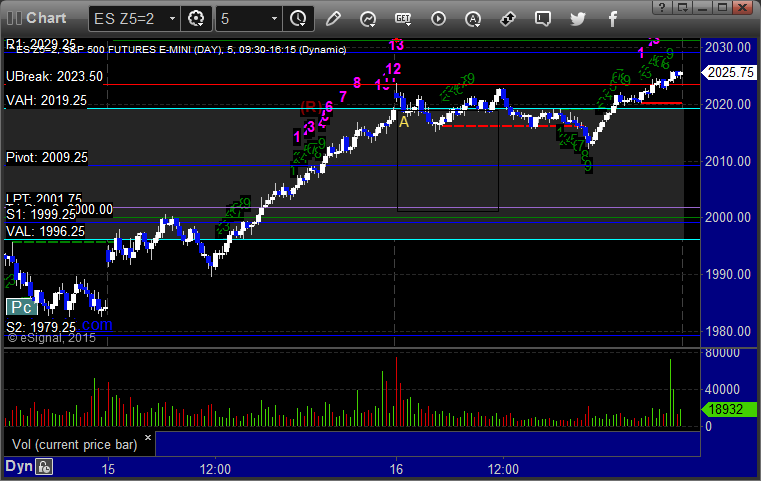

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at 2019.00 at A and stopped. I did not put it back in, but it worked the second time:

Forex Calls Recap for 10/16/15

A small winner to close out the week. See GBPUSD section below.

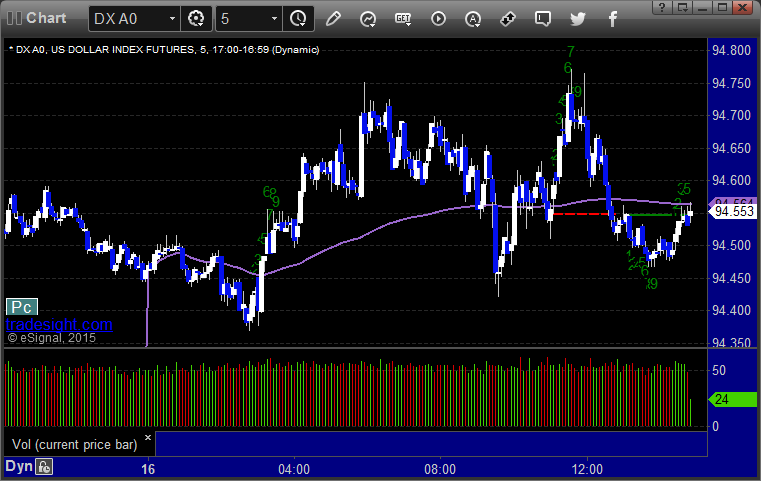

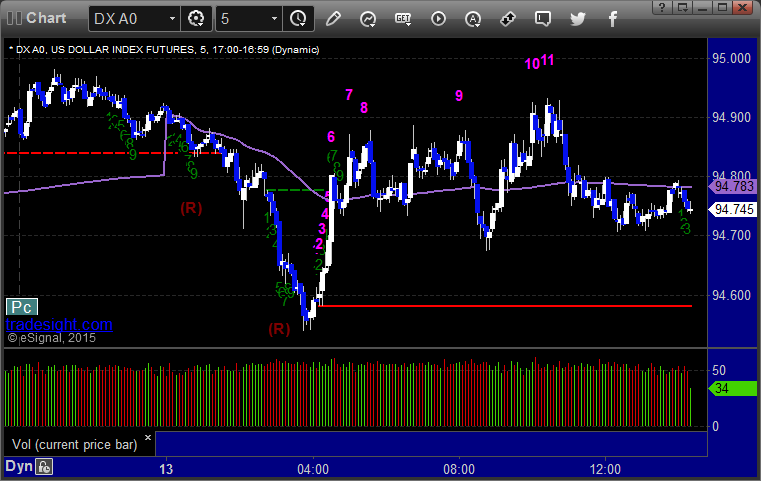

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

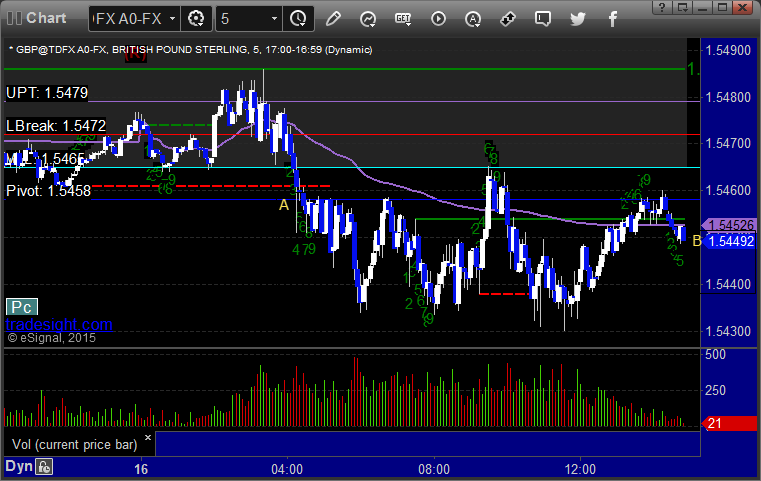

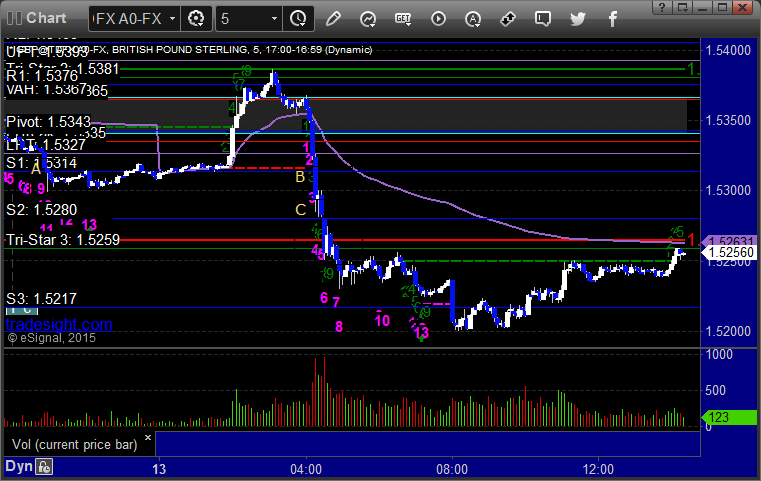

GBPUSD:

Triggered short at A, did not hit stop or first target, closed 15 pips in the money at B for end of week:

Stock Picks Recap for 10/14/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered (common in earnings season).

From the Messenger/Tradesight_st Twitter Feed, Rich's TRIP triggered short (without market support) and worked:

His NEM triggered long (with market support) and didn't:

His NFLX triggered long (with market support) and didn't work:

His BIIB triggered short (without market support) and worked great:

His LVS triggered long (with market support) and worked:

AMZN triggered short (with market support) and worked:

Rich's NTES triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 10/14/15

The markets opened flat and while volume was a little better (NASDAQ volume 1.7 billion at the close), it was still a very limited environment for earnings season. We did get an options unraveling move after the first hour to the downside, and that implied a close near the lows of the day, which we got. Mixed results on the Opening Range Plays, but I warned about the short side triggers in the room. See that and the ES and NQ sections below.

Net ticks: -11.5 ticks.

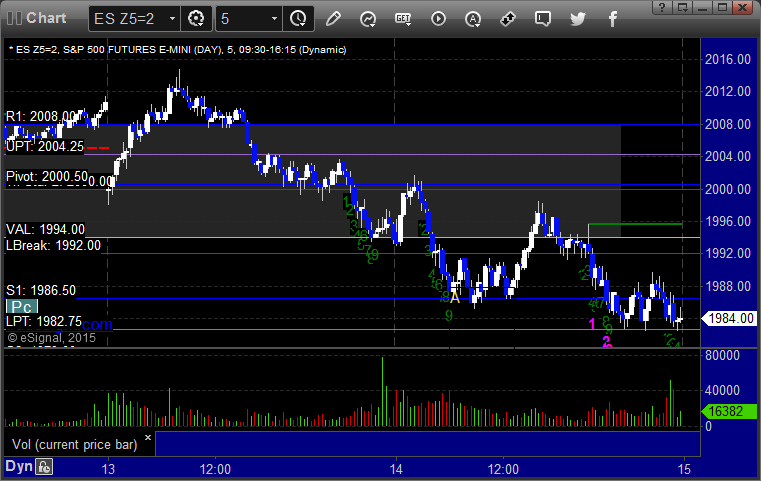

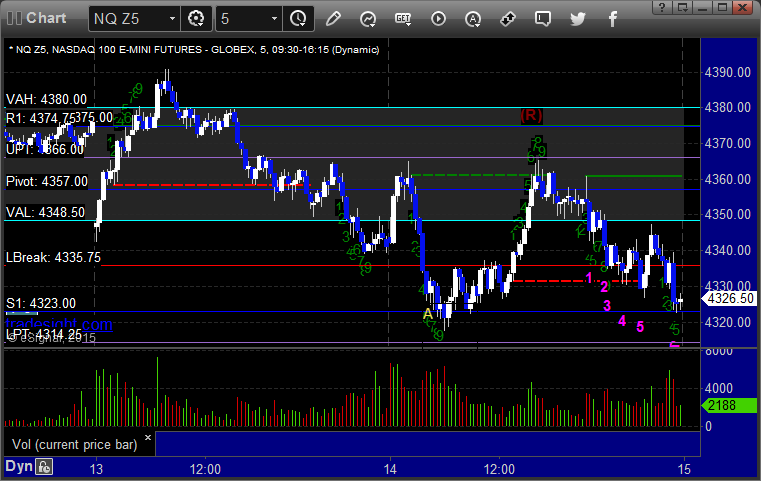

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

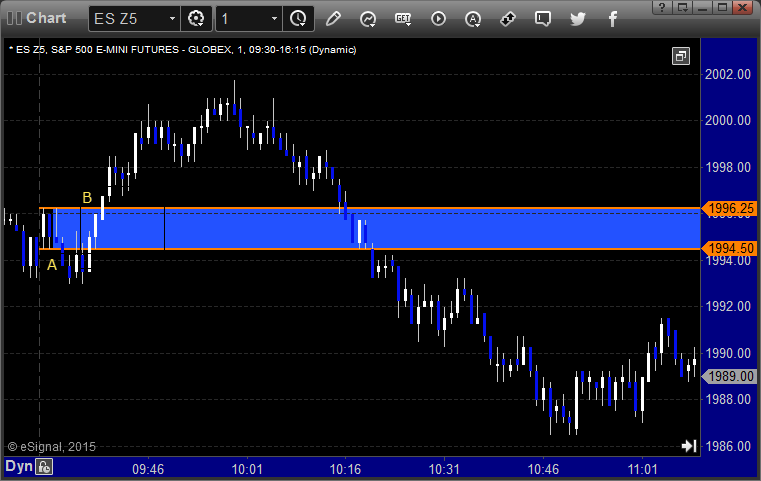

ES Opening Range Play triggered short at A and only filled the gap, which was the concern I stated in the room, but then triggered long at B and worked great:

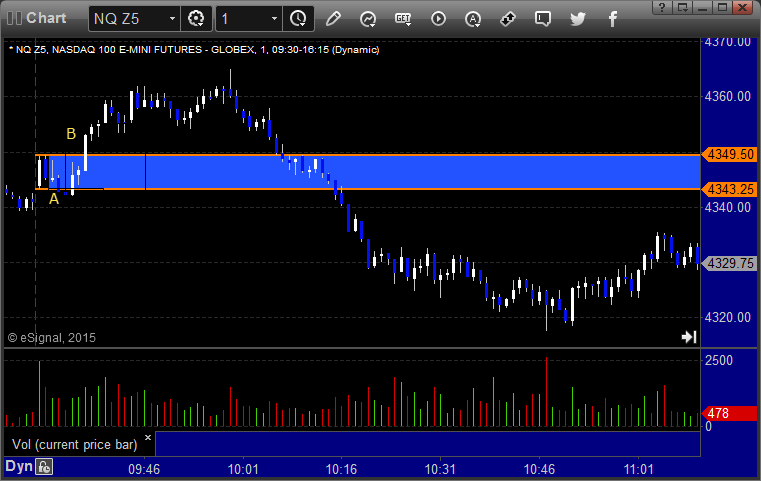

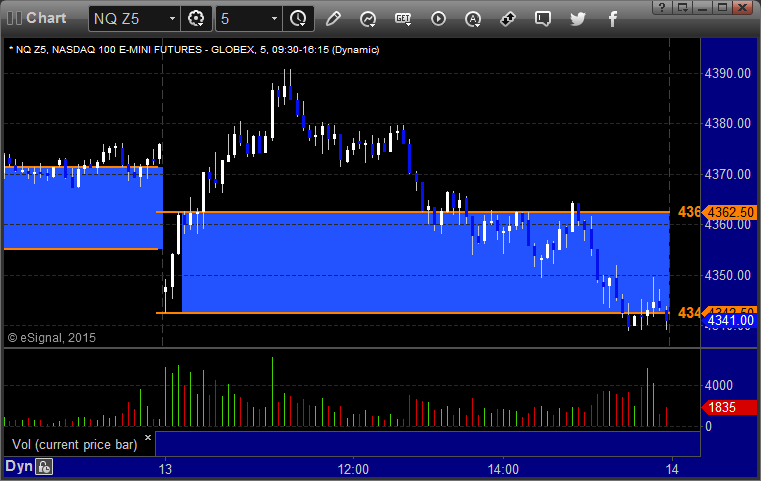

NQ Opening Range Play triggered short at A and only filled the gap, which was the concern I stated in the room, but then triggered long at B and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

This triggered short at A at 1986.25 and stopped. I did not take it again:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at 4322.50 at A and stopped. He put it back in and it triggered, hit first target, stopped second half over entry:

Forex Calls Recap for 10/14/15

A winner for the session, although the identical trade in the GBPUDS would have worked better. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

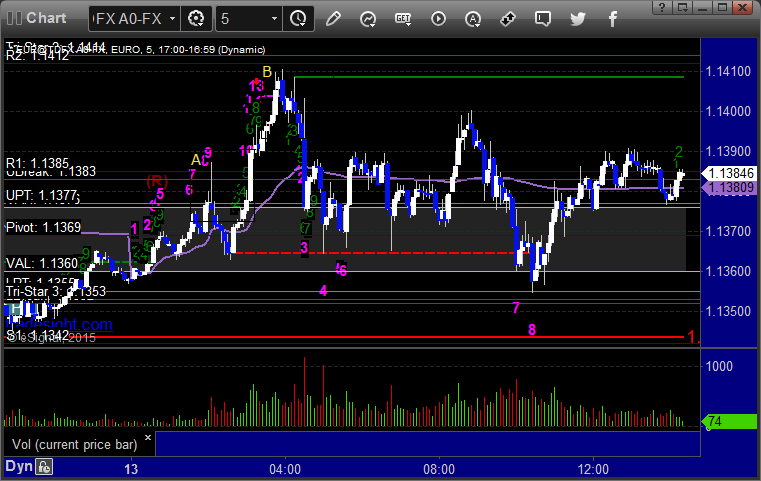

EURUSD:

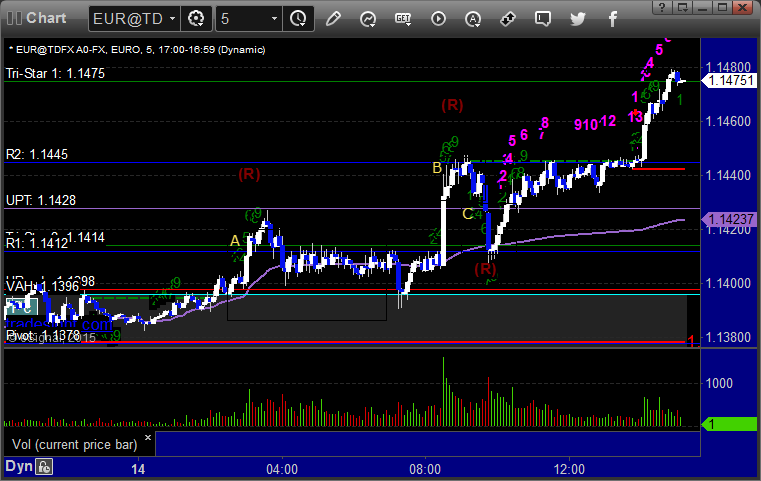

Triggered long at A, hit first target at B, stopped second half at C:

Stock Picks Recap for 10/13/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TTEK triggered long (with market support) and didn't work:

AMZN triggered long (with market support) and worked:

VNDA triggered short (without market support) and worked:

ETSY triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (with market support) and worked:

EBAY triggered long (with market support) and worked:

NTAP triggered long (with market support) and worked:

Rich's AAPL triggered short (without market support) and worked:

Mark's SAP triggered short (with market support) and didn't work:

Rich's R triggered short (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Futures Calls Recap for 10/13/15

The markets gapped down, immediately headed up, eventually crossed the Value Areas and filled the gaps, and then rolled again in the afternoon back to the open on a super-weak 1.3 billion NASDAQ shares as everyone appears to be waiting for earnings.

Net ticks: -1.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked great:

NQ Opening Range Play triggered short at A and stopped, triggered long at B and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Mark's call triggered long on a stop at 2005.00 at A and stopped for 7 ticks. He put it back in and it triggered again 10 minutes later, hit first target, stopped second half 5 ticks in the money:

Forex Calls Recap for 10/13/15

A winner and a loser (although the loser triggered again later and worked. See EURUSD and GBPUSD sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, closed second half under entry in the morning:

GBPUSD:

Triggered short at A and stopped. If you were awake, triggered short at B, hit first target at C, and much more:

Stock Picks Recap for 10/9/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, HA gapped over, no play.

CTAS triggered long (with market support) and worked:

MRKT triggered long (without market support) and worked:

HAWK triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FCX triggered short (without market support due to opening 5 minutes) and worked:

His BIIB triggered short (with market support) and worked:

His ADBE triggered short (with market support) and worked enough for a partial:

In total, that's 3 trades triggering with market support, all 3 of them worked.