Futures Calls Recap for 10/9/15

The markets opened fairly flat and it was a much duller session to close out the week. We had a nice trade setup on the ES for the Value Area, but that call didn't trigger. Mixed results out of the Opening Range plays. NASDAQ volume closed at 1.6 billion shares, but even that was boosted by some excessive volume in one stock.

Net ticks: +0 ticks.

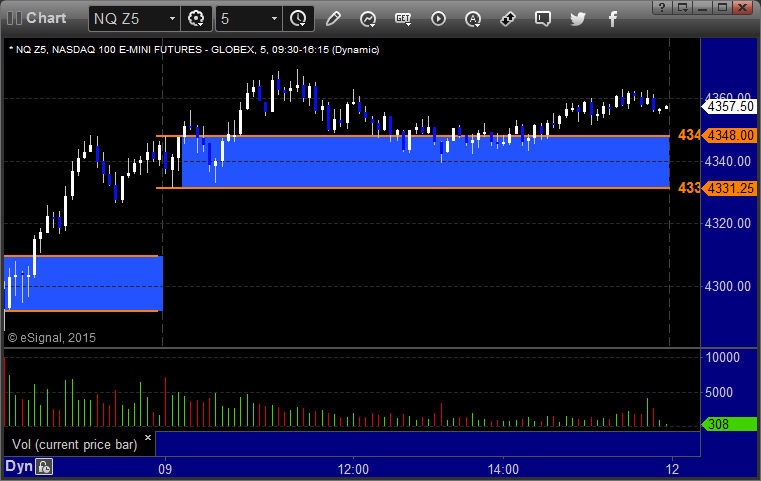

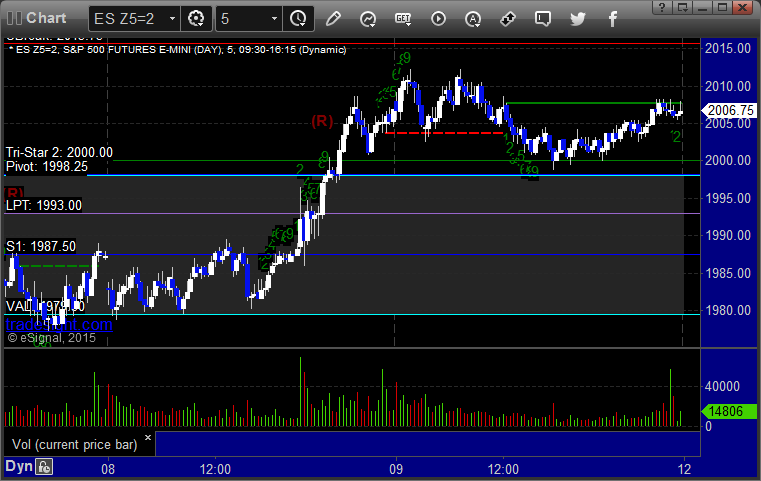

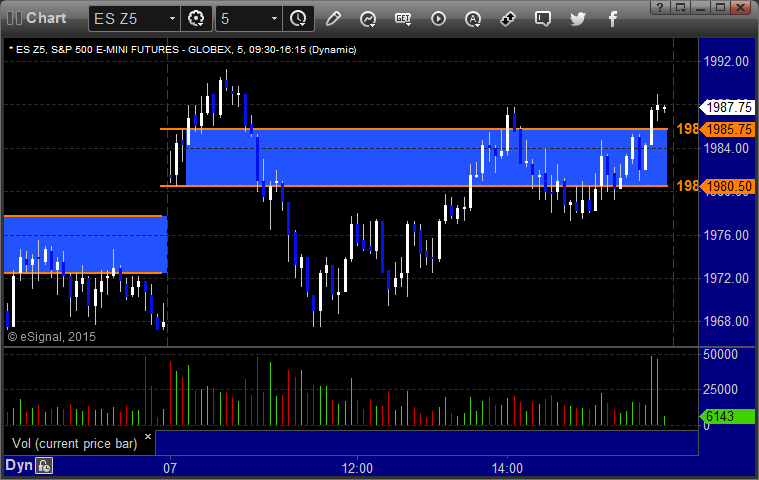

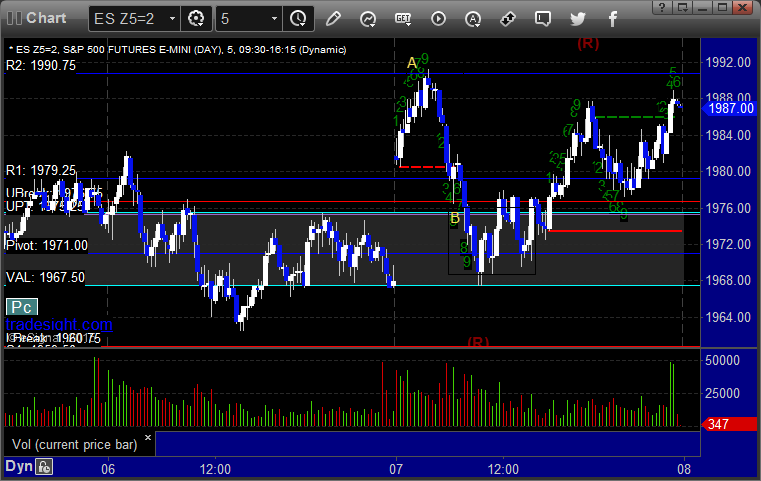

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

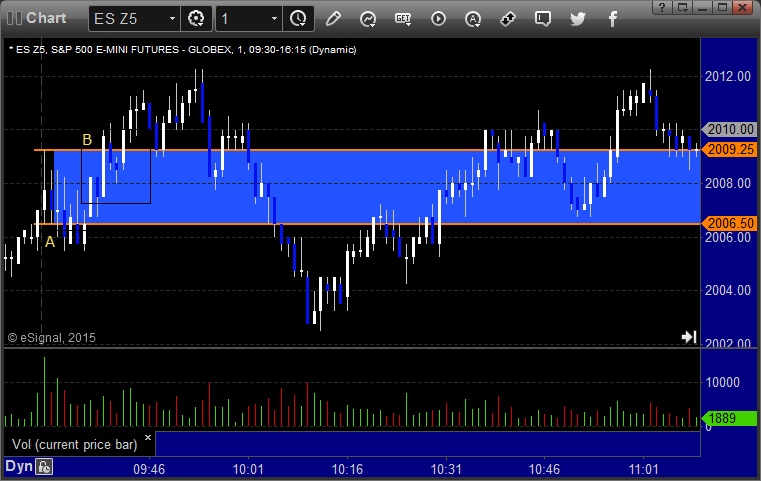

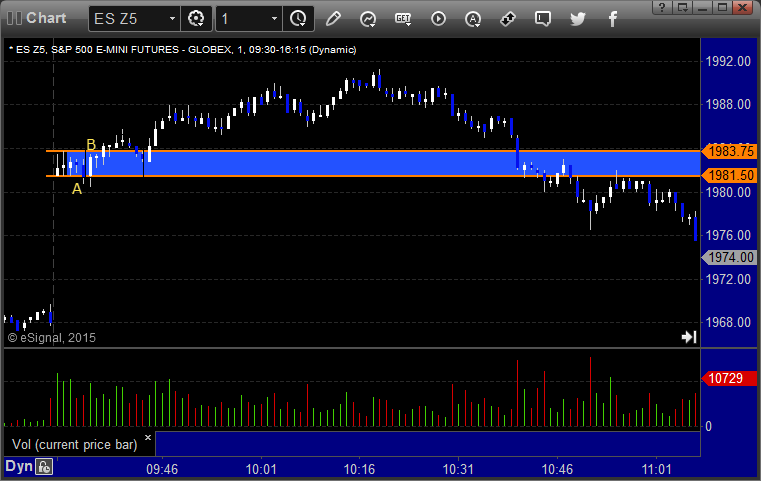

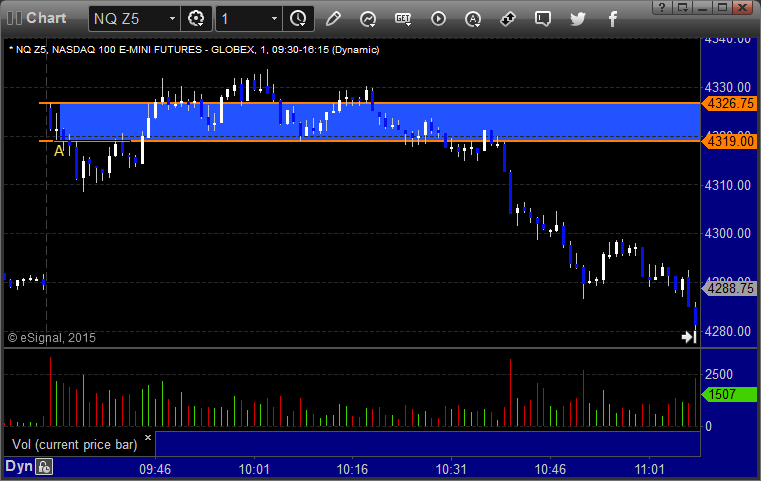

ES Opening Range Play triggered short at A and didn't work, then triggered long at B and did:

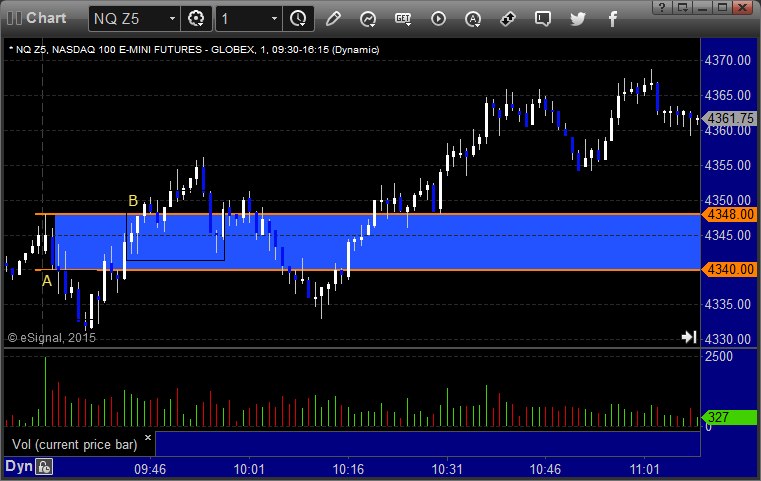

NQ Opening Range Play triggered short at A and worked enough for a partial. Triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Our trade call did not trigger:

Forex Calls Recap for 10/9/15

A winner to close out the week on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

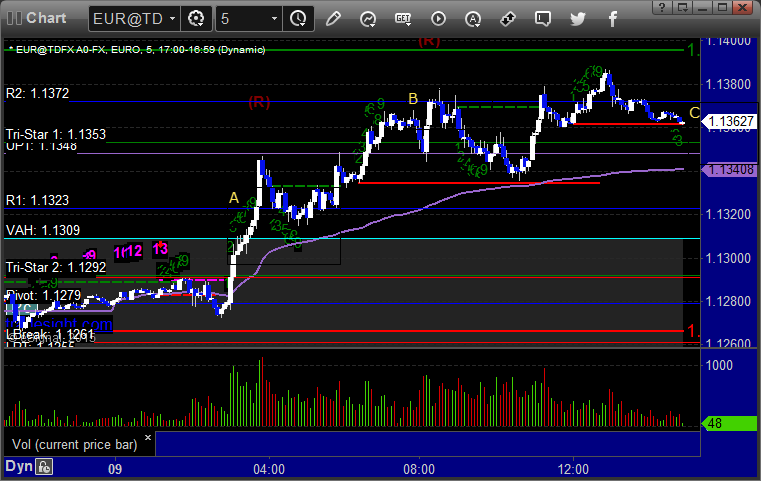

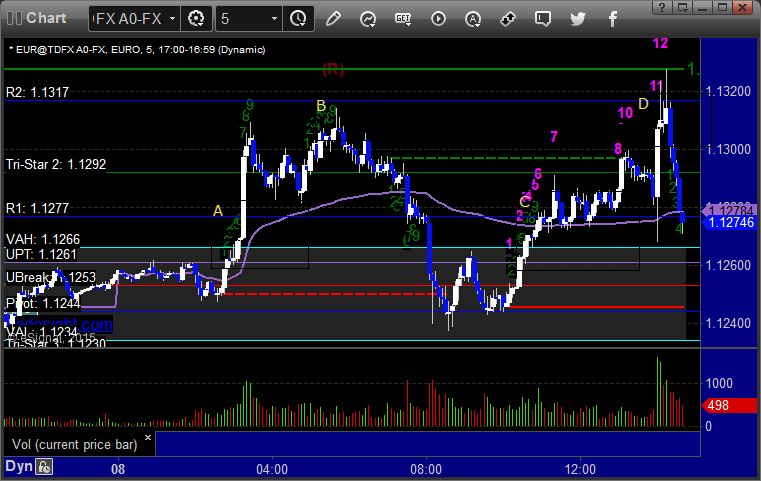

EURUSD:

Triggered long at A, hit first target at B, closed second half at C (same price as first target) for end of week:

Tradesight August 2015 Futures Results

Before we get to August’s numbers, here is a short reminder of the results from July. The full report from July can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for July 2015

Number of trades: 14

Number of losers: 4

Winning percentage: 71.4%

Net ticks: +15.5 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

It is important to note that these results do not include the Tradesight Value Area, Opening Range, or Institutional Range plays, all of which have been working quite well on their own.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for August 2015

Number of trades: 8

Number of losers: 1

Winning percentage: 87.5%

Net ticks: +28 ticks

August is usually a bit slower in the markets, but this August was an exception when the markets tumbled mid-month and gave us some volatility. We kept the number of official calls down, and on certain days earlier in the month, nothing actually triggered because it was so flat.

In addition, our Opening Range Plays worked 17 out of 21 days in the month, continuing the usual streak. Easiest play on the planet.

Overall, the ranges in the markets expanded in August, which is unusual, and we got through the month with solid gains in futures and can now look forward to the rest of the year and what is typically better trading.

Tradesight August 2015 Forex Results

Before we get to August’s numbers, here is a short reminder of the results from July. The full report from July can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for July 2015

Number of trades: 26

Number of losers: 14

Winning percentage: 53.8%

Worst losing streak: 4 in a row

Net pips: +175 pips

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for August 2015

Number of trades: 29

Number of losers: 18

Winning percentage: 37.9%

Worst losing streak: 6 in a row

Net pips: +135 pips

We are usually half size by the time August starts, and this year was no exception. We do this because August is typically the worst month of the year, with much of Europe on vacation. This August started out particularly bad, and the overall win ratio was very poor at only 37.9%, which will probably be the worst month of the year from that perspective. However, things got exciting when the markets got shaky and despite the early losses and the low win ratio, we ended up pulling out a positive month thanks to some huge winners in the back two weeks. In fact, average daily ranges (based on the 6 month trailing) didn't change much for the month, which is very unusual for August. We will take it.

Stock Picks Recap for 10/8/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

As I said above, what a great trading session.

From the report, ACXM triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to opening 5 minutes) and didn't work, worked later:

His EBAY triggered short (with market support) and didn't work:

His BABA triggered long (with market support) and worked:

His BIDU triggered short (with market support) and worked:

Mark's VRTX triggered short (with market support) and worked:

FB triggered short (with market support) and didn't work, worked later:

Rich's TSLA triggered short (without market support) and worked great:

His GPRO triggered short (without market support) and worked:

Rich's RIG triggered short (without market support) and worked:

Mark's BMRN triggered short (with market support) and worked great:

Rich's IBB triggered short (ETF, so no market support needed) and worked:

COST triggered long (with market support) and worked:

Rich's AMZN triggered short (with market support) and worked:

His GPRO triggered long (with market support) and worked a little:

In total, that's 11 trades triggering with market support, 9 of them worked, 2 did not.

Futures Calls Recap for 10/8/15

A mixed bag on the Opening Ranges as the markets gapped down and the ES triggered both long and short, both stopped, but the NQs worked. Meanwhile, we were pretty flat for most of the session and then

Net ticks: +17 ticks.

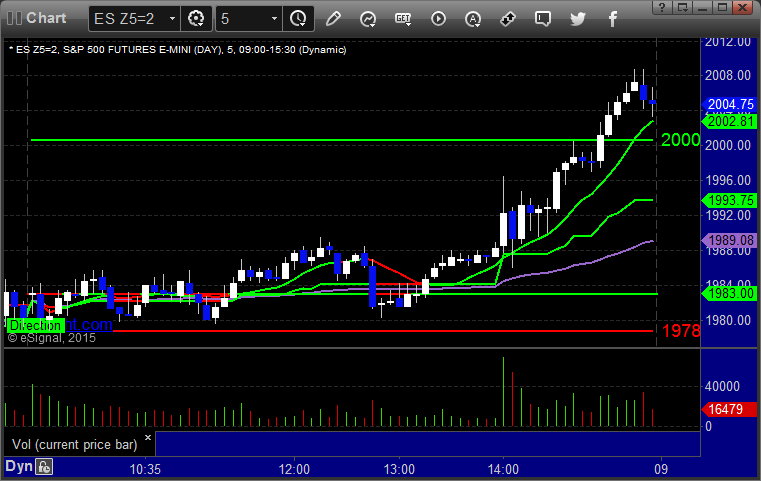

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and stopped, triggered short at B and stopped:

NQ Opening Range Play triggered short at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call was a long over R1 at 1996.75 at A after it set beautifully on the spike on the release of the Fed minutes. This was also the 61.8% Fib retracement on the daily chart that we have been monitoring. Hit first target for 6 ticks, raised the stop several times, and stopped 28 ticks in the money:

Forex Calls Recap for 10/8/15

Two triggers, one in each direction, one worked, and the other did not. See EURUSD and GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and hit first target at B, second half stopped. If you wanted to put it back in (usually I would but I forgot), it triggered at C and hit first target again at D:

GBPUSD:

Triggered short at A and stopped:

Stock Picks Recap for 10/7/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, OVTI gapped over the trigger, no play.

BPOP triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIIB triggered short (without market support) and worked enough for a partial:

Mark's LVS triggered long (with market support) and worked:

Rich's FB triggered short (with market support) and worked:

His AMGN triggered long (with market support) and worked great and very fast:

Mark's TSLA triggered short (without market support) and worked:

Rich's ADBE triggered short (with market support) and worked:

CELG triggered long (with market support) and didn't work:

Rich's APA triggered short (without market support just barely) and worked:

GILD triggered long (with market support) and worked enough for a partial:

Rich's MU triggered short (without market support) and worked:

His DD triggered short (with market support) and worked enough for a partial:

His BIIB triggered long (without market support) and worked:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

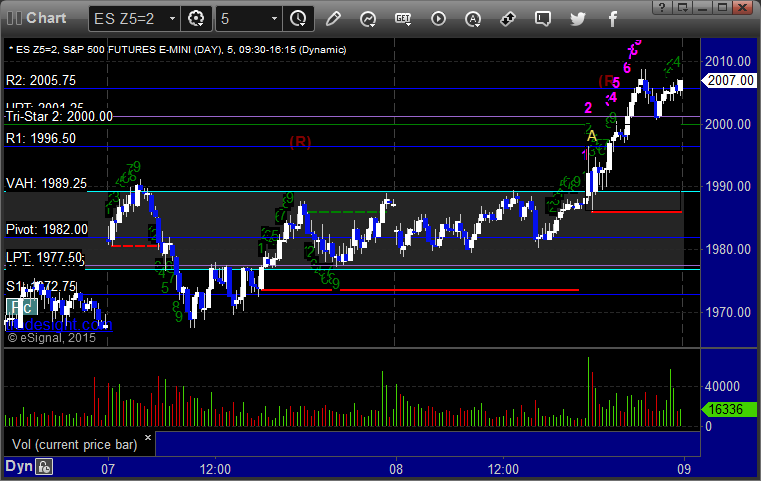

Futures Calls Recap for 10/7/15

The markets gapped up, pushed a little higher, then rolled over and gave us a perfect Value Area/Gap Fill play and that was the range for the session on 1.7 billion NASDAQ shares.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

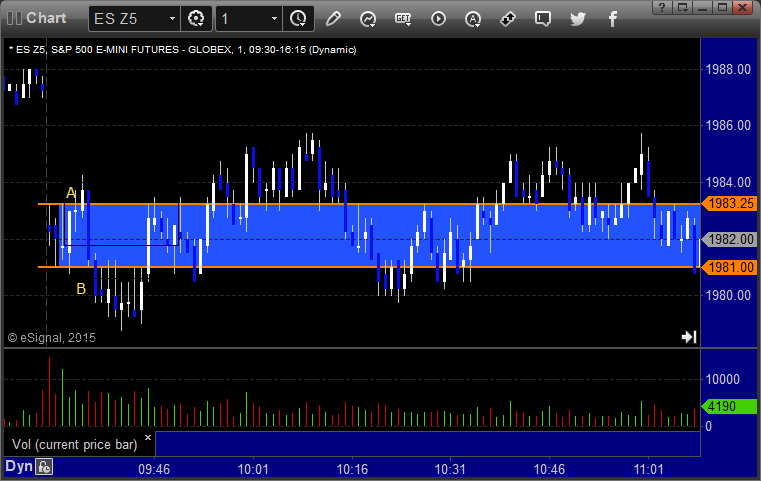

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short by a tick at A and stopped, triggered long at B and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 1991.00 and stopped for 7 ticks. Triggered short at B at 1975.25, hit first target for 6 ticks, and stopped second half 19 ticks in the money after we filled the gap and crossed the Value Area:

Forex Calls Recap for 10/7/15

The second half of the prior session's long stopped in the money and then two new calls triggered and stopped in a fairly flat session. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

The second half of the prior day's trade stopped under LBreak at E in the money. New call triggered short at A, stopped at B, and then triggered short again at C and stopped at D: