Tradesight Recap Report for 1/18/22

Overview

The markets gapped down and basically just drifted lower without much action on 5 billion NASDAQ shares.

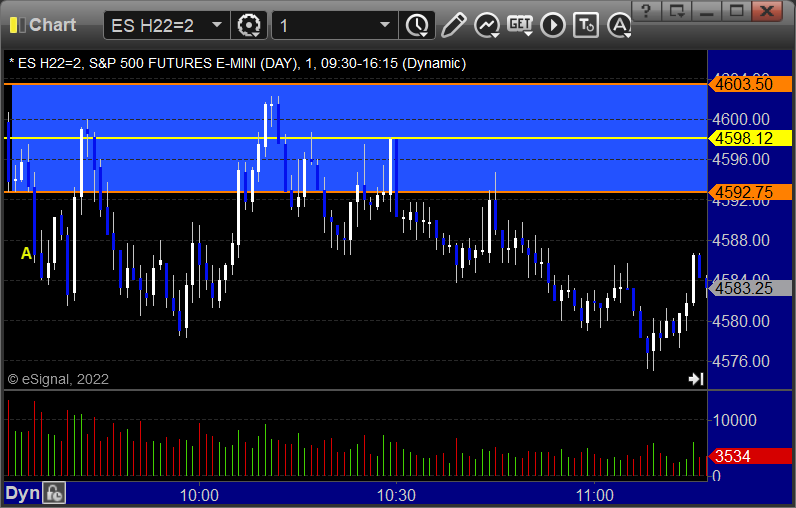

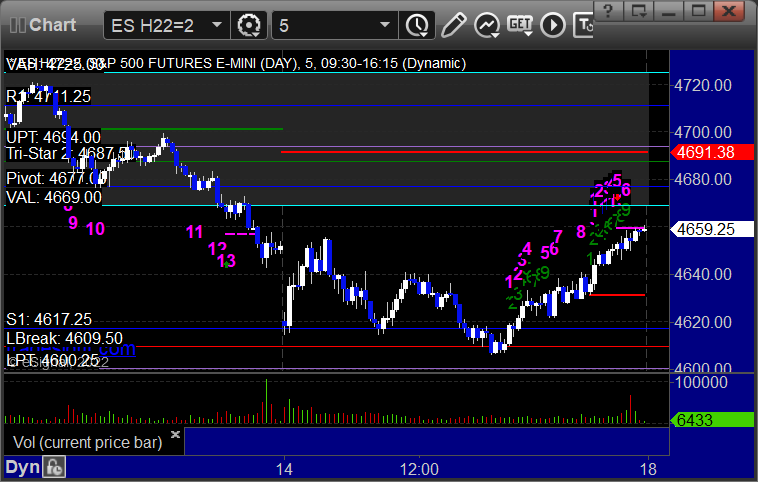

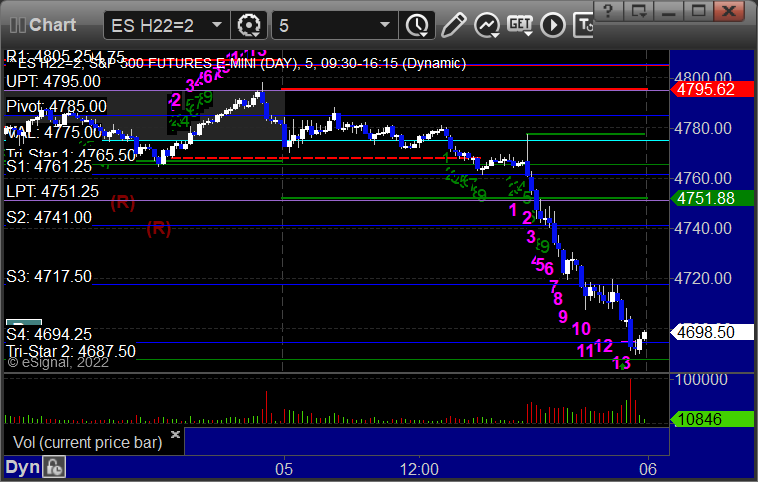

ES with Levels:

ES with Market Directional:

Futures:

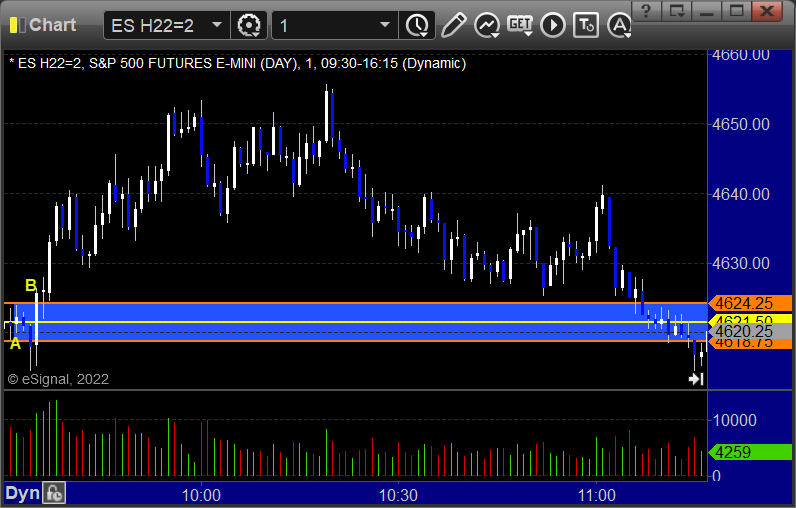

ES Opening Range Play triggered short at A but too far out of range to take:

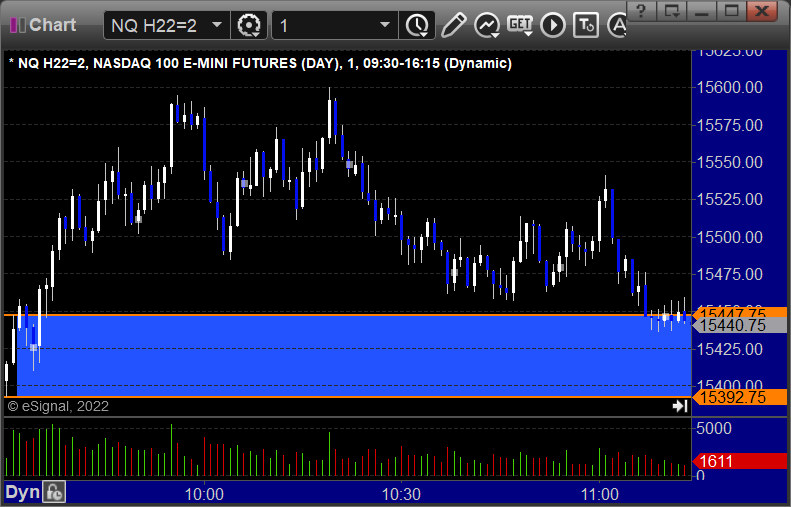

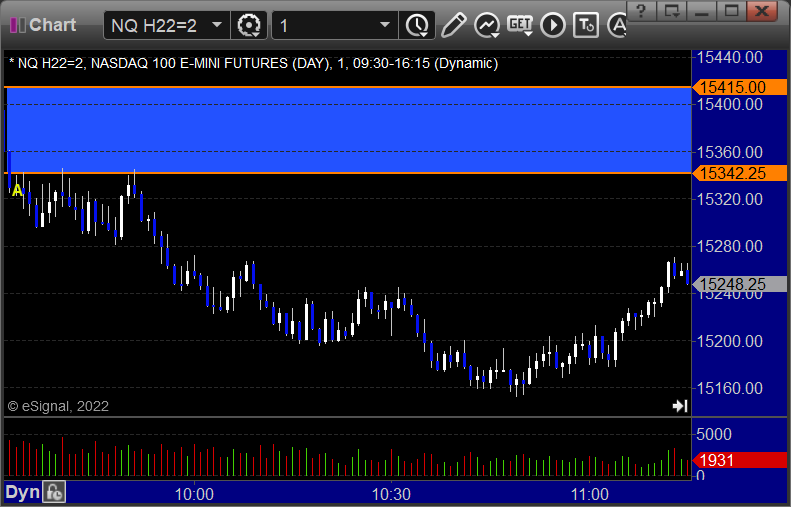

NQ Opening Range Play, triggered short at A but too far out of range to take:

Results: +0 ticks

Forex:

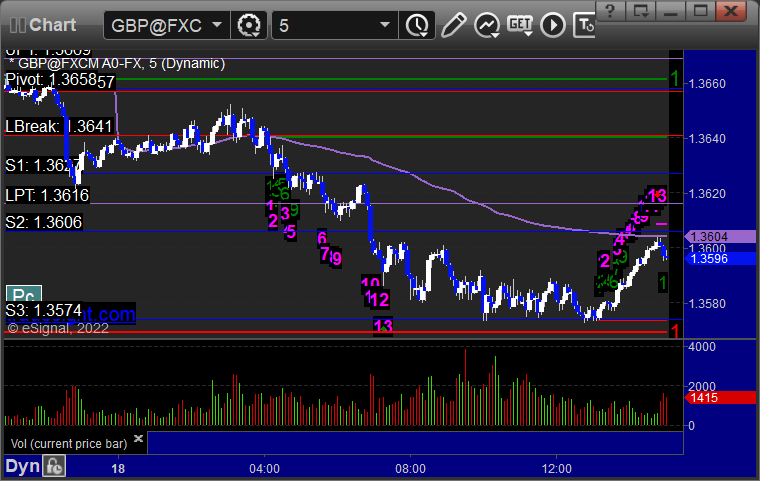

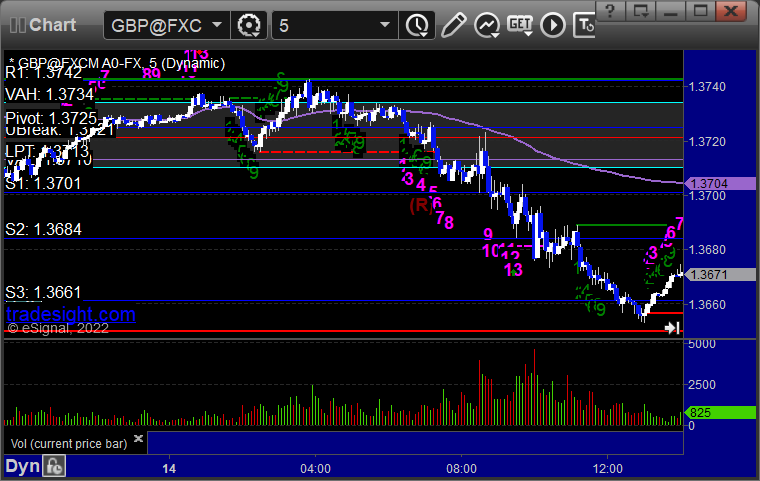

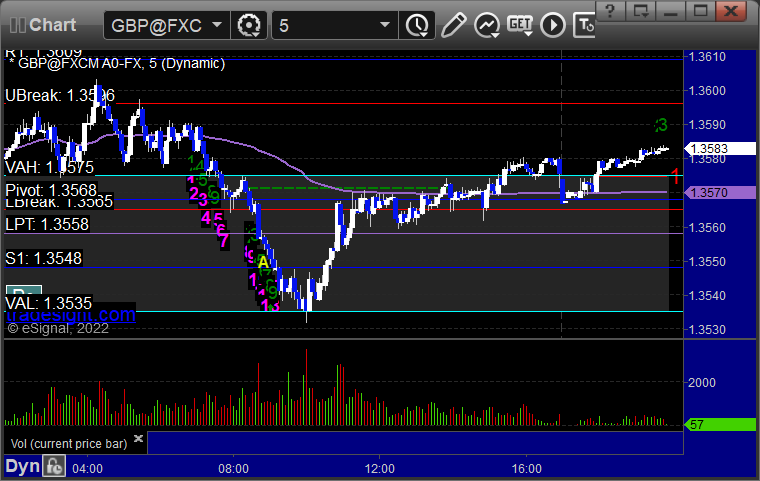

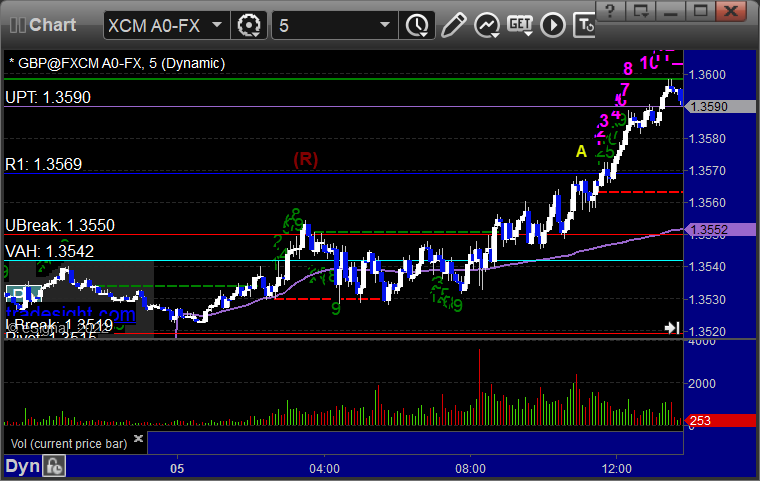

GBPUSD, no calls for the session:

Results: +0 pips

Stocks:

A green day if you stuck with market direction.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's DE triggered long (without market support) and didn't work:

PYPL triggered short (with market support) and worked:

Rich's TEAM triggered long (without market support) and didn't work:

That’s 1 trigger with market support, and it worked.

Tradesight Plus Report for 1-18-22

Opening comments posted to YouTube. Only a couple of daily chart plays found.

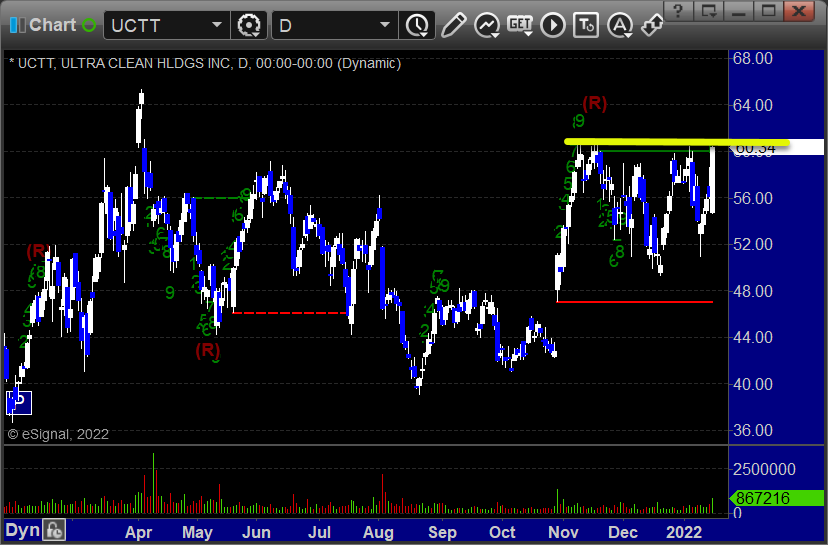

Longs first, in order of best chart construction, starting with UCTT > 60.69:

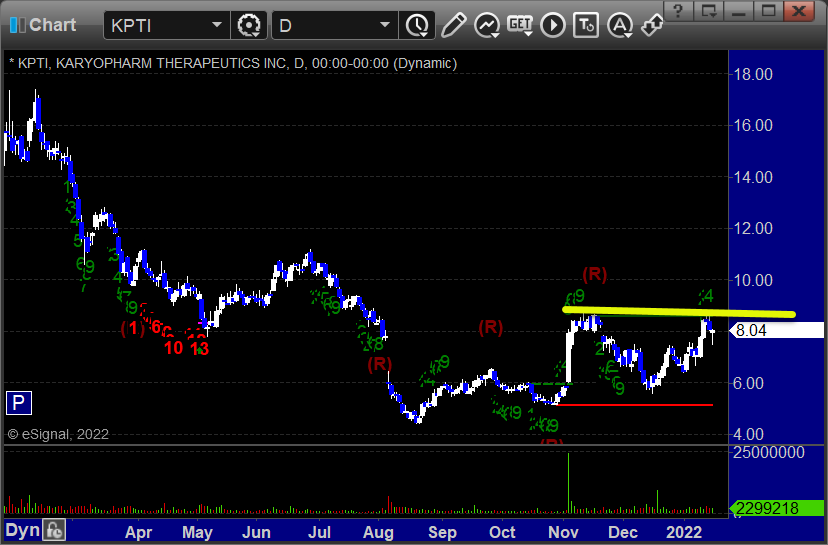

KPTI > 8.70:

No shorts found.

That's it.

Tradesight Recap Report for 1/14/22

Overview

The markets gapped down, filled, and then headed back to the open and sat all day until a last minute rally on 4.3 billion NASDAQ shares.

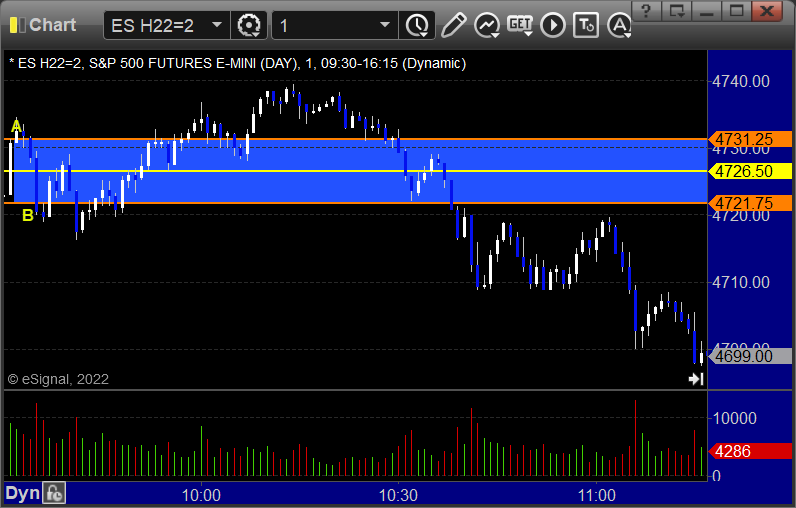

ES with Levels:

ES with Market Directional:

Futures:

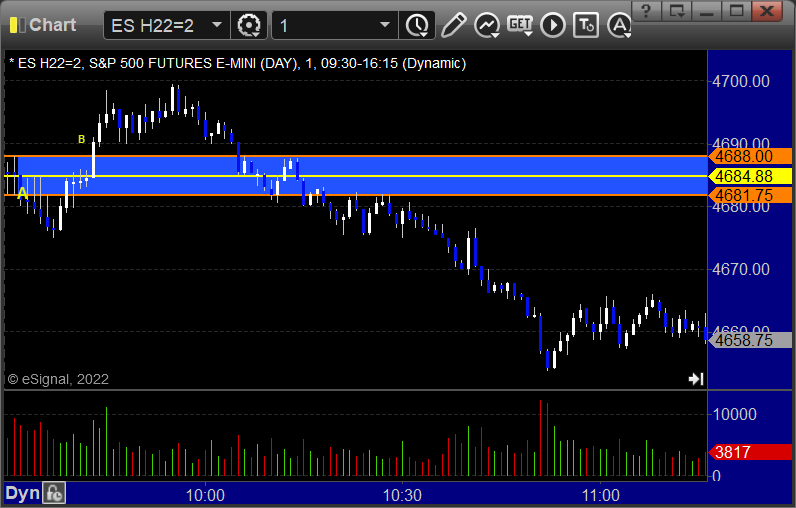

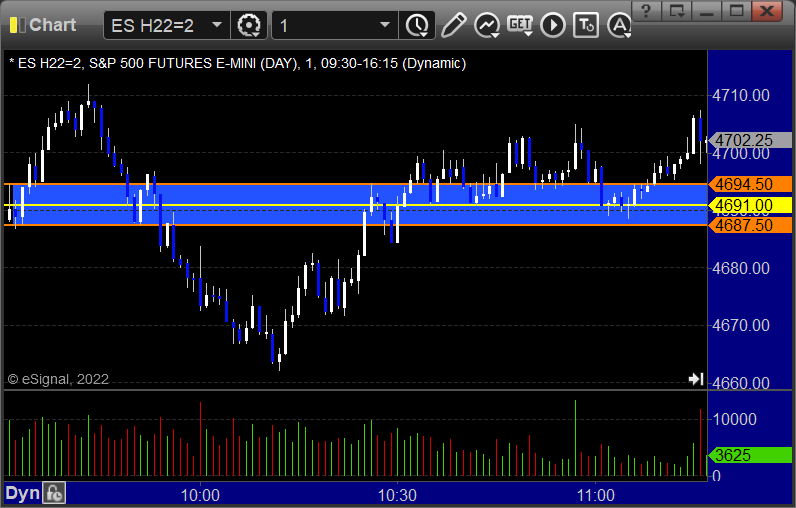

ES Opening Range Play triggered short at A and stopped, triggered long at B and worked:

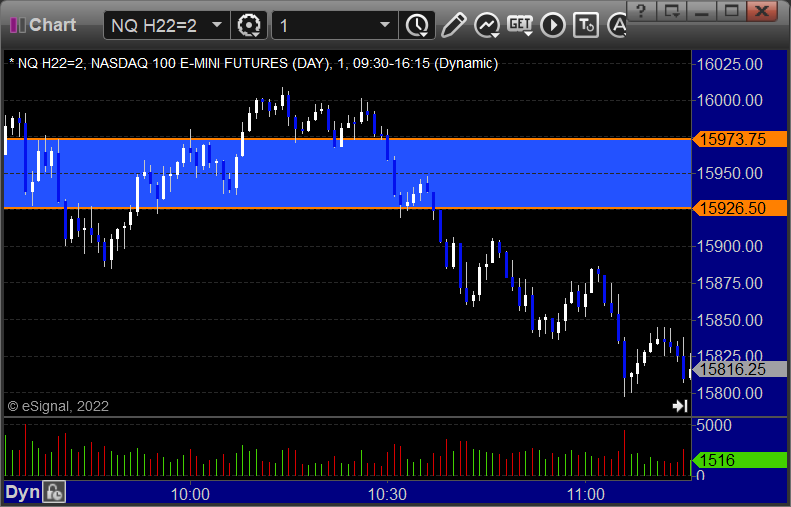

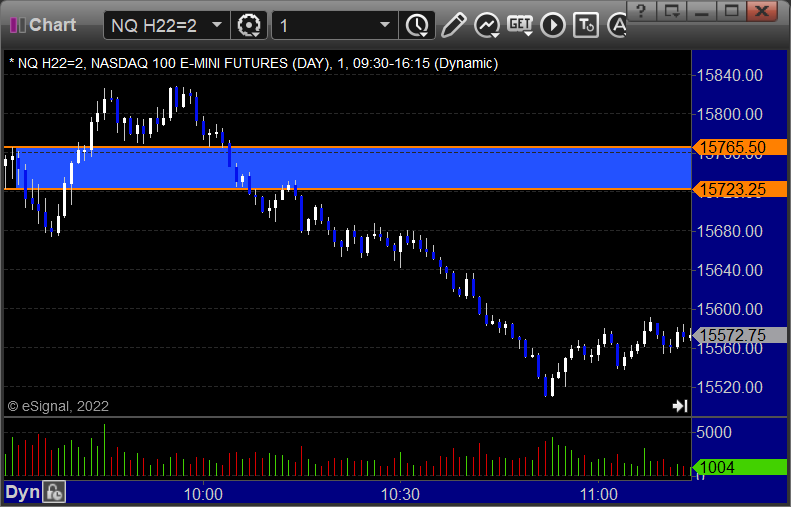

NQ Opening Range Play:

Results: +6 ticks

Forex:

GBPUSD, no calls:

Results: +0 pips

Stocks:

A green Friday heading into a long weekend.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, COST triggered short (with market support) and worked:

That’s 1 trigger with market support, and it worked.

Tradesight Recap Report for 1/13/22

Overview

The markets gapped up a little and were flat for the first hour, then filled and headed into lunch dead even for the session, but we dropped a bit after that and again in the afternoon to close at lows on a WEAK 3.9 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

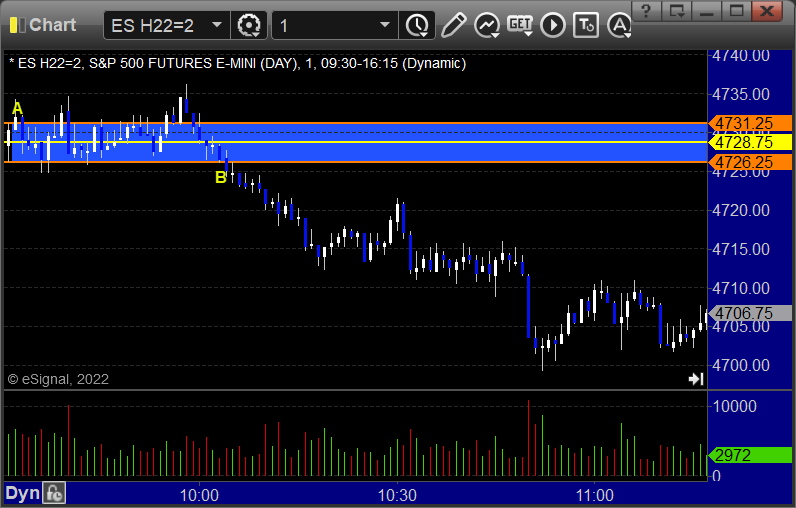

ES Opening Range Play triggered long at A and stopped, triggered short at B and worked:

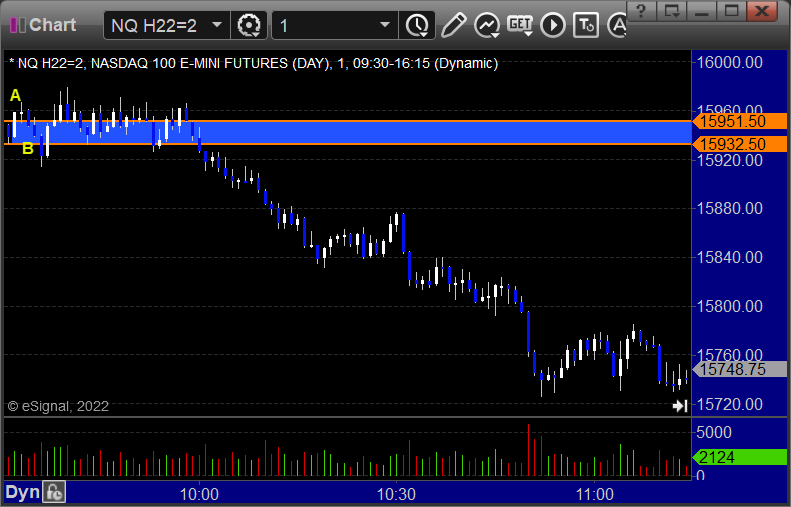

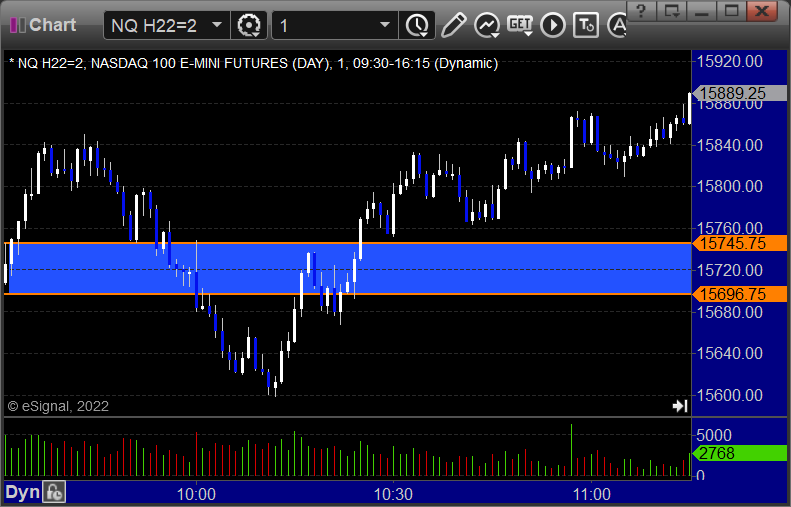

NQ Opening Range Play both triggers were too far out of range to take:

Results: +8.5 ticks

Forex:

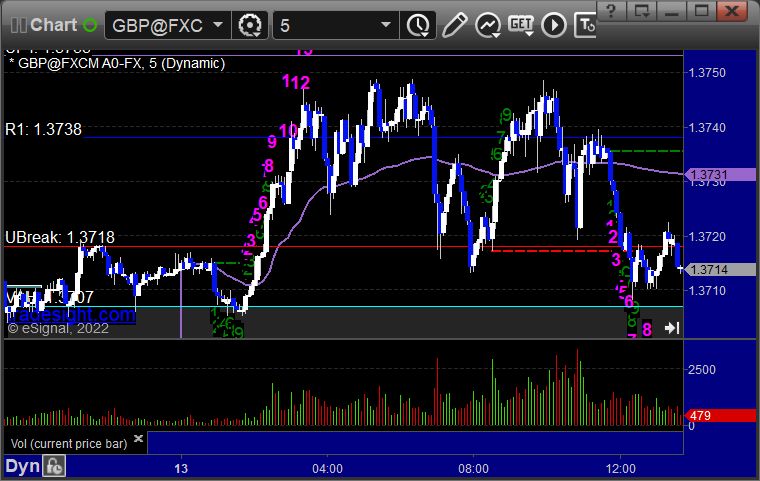

GBPUSD triggered long over R1 and stopped:

Results: -25 pips

Stocks:

A few triggers for the session.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's GOOGL triggered long (with market support) and didn't work:

His ROKU triggered short (with market support) and worked:

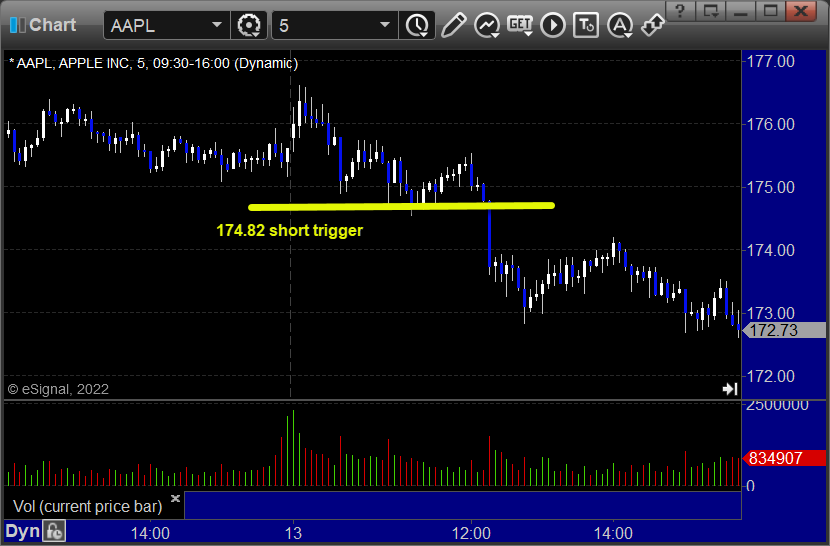

His AAPL triggered short (with market support) and worked:

That’s 3 triggers with market support, 2 of them worked and 1 didn’t.

Tradesight Recap Report for 1/12/22

Overview

The markets gapped up, came back to fill the gap ahead of lunch, and then went dead flat for the session on 4 billion NASDAQ shares.

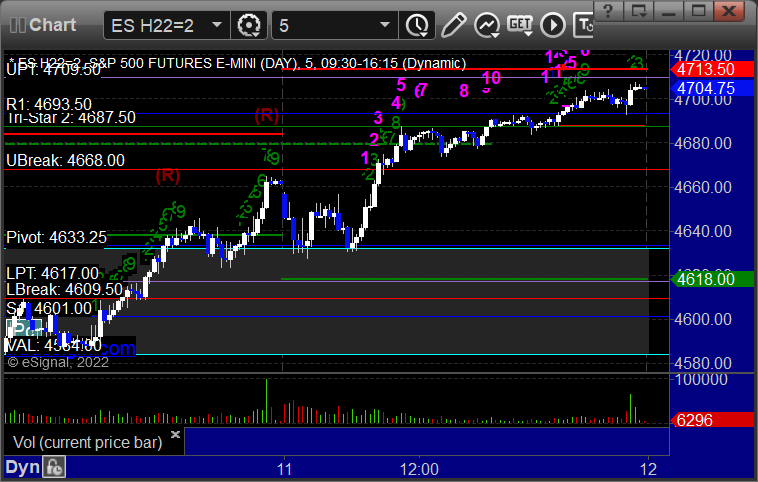

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play both triggers at A and B were too far out of range to take under the rules:

NQ Opening Range Play both triggers at A and B were too far out of range to take under the rules:

Results: +0 ticks

Forex:

A winner for the session.

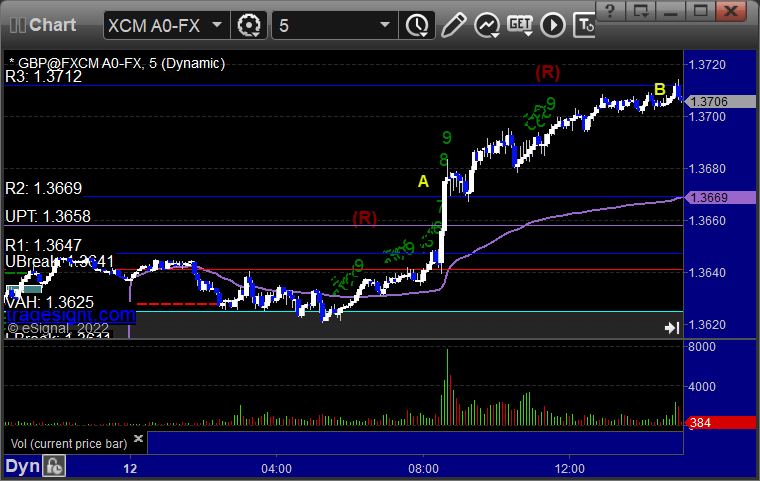

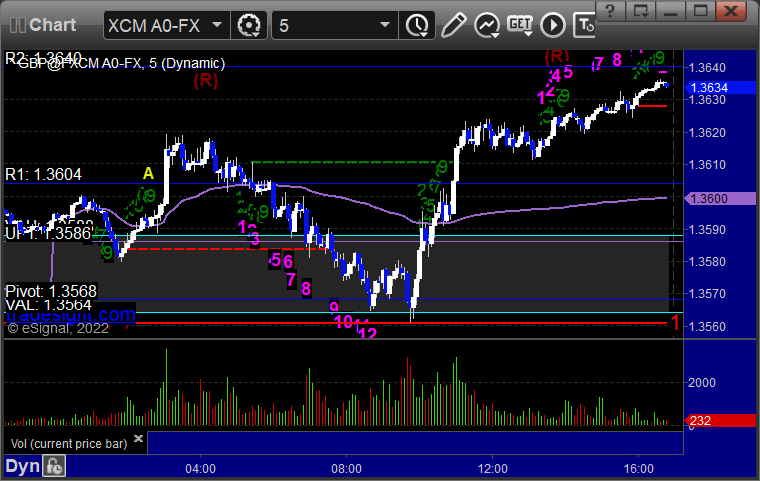

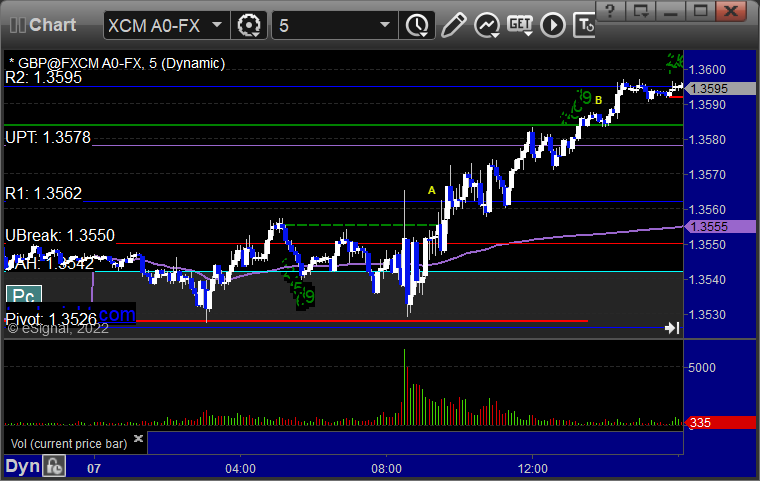

GBPUSD, triggered long at A, hit first target at B, still holding second half with a stop under R2:

Results: No results, trade is still going

Stocks:

Wow, nothing triggered. Probably a good thing on a dead day.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, nothing triggered.

That’s 0 triggers with market support.

Tradesight Recap Report for 1/11/21

Overview

The markets gapped down, went a little lower, but basically did nothing through lunch and then drifted up the rest of the session on 4.3 billion NASDAQ shares.

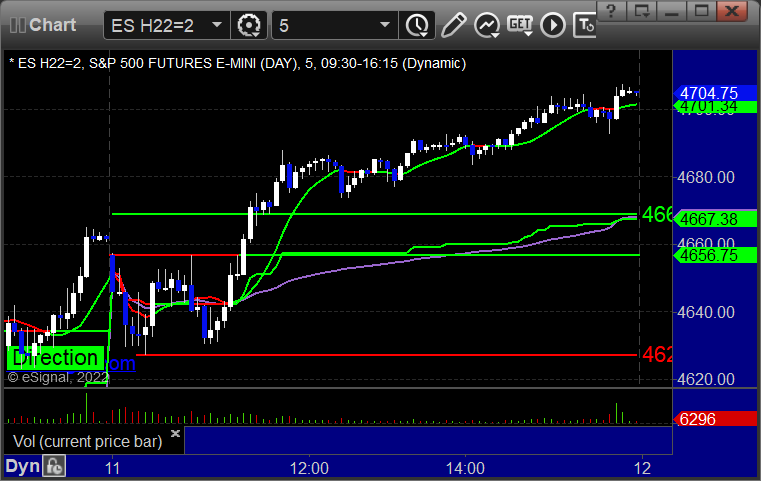

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked enough for a partial:

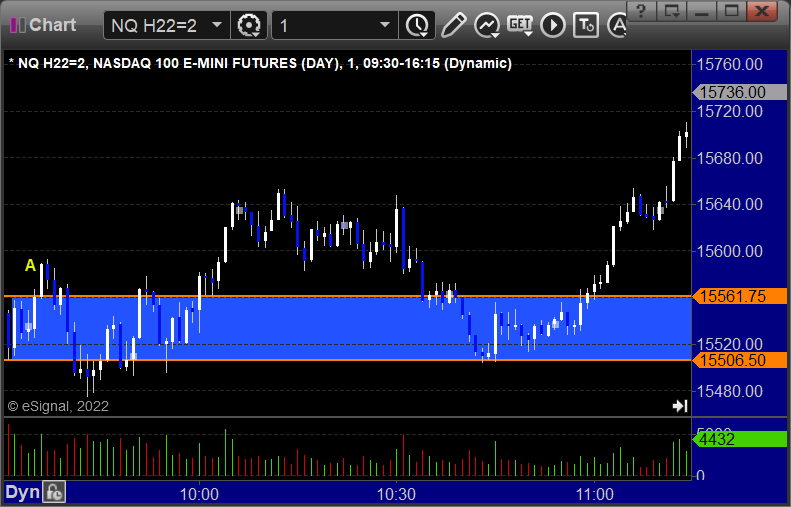

NQ Opening Range Play triggered long at A and short at B, both too far out of range to take:

Results: +4 ticks

Forex:

GBPUSD triggered long at A and stopped:

Results: -25 pips

Stocks:

A couple of trades.

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, Rich's NVDA triggered long (with market support) and worked:

His SMH triggered long (ETF, so no market support needed) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 1/10/21

Overview

The markets gapped down, pushed sharply lower, and then made a big comeback to even after lunch on 5.2 billion NASDAQ shares.

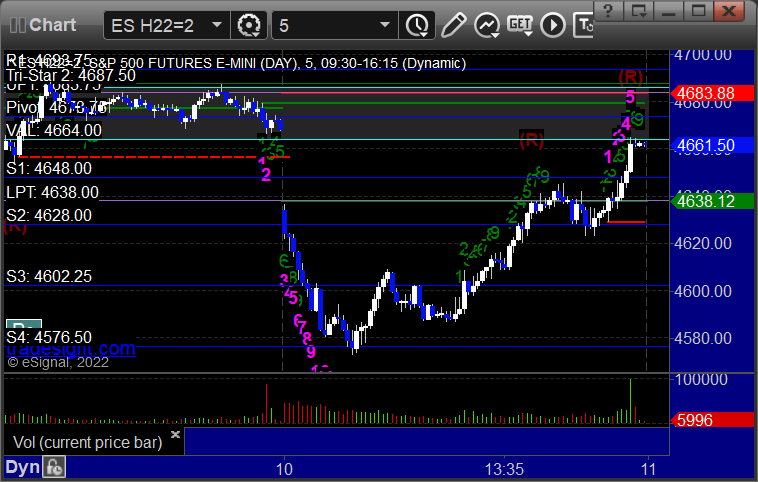

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

NQ Opening Range Play triggered short at A but too far out of range to take:

Results: +0 ticks

Forex:

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

A fun day for stock trading.

From the Tradesight Plus Report, no calls, especially with the gap.

From the Tradesight Plus Twitter feed, Rich's SNOW triggered short (with market support) and worked:

Rich's SMH triggered long (ETF, so no market support needed) and worked:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 1/7/22

Overview

The markets gapped down small, filled and went up small, then dropped and came into lunch flat and the rest of the day was a waste of time on 4.2 billion NASDAQ shares, which is horrible.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

NQ Opening Range Play:

Results: ticks

Forex:

GBPUSD:

Results: pips

Stocks:

From the Tradesight Plus Report:

From the Tradesight Plus Twitter feed:

That’s x triggers with market support, x of them worked and x didn’t.

Tradesight Recap Report for 1/6/22

Overview

A dead day in the markets. They opened where they closed on 4.7 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play:

NQ Opening Range Play:

Results: ticks

Forex:

GBPUSD:

Results: pips

Stocks:

From the Tradesight Plus Report:

From the Tradesight Plus Twitter feed:

That’s x triggers with market support, x of them worked and x didn’t.

Tradesight Recap Report for 1/5/22

Overview

The markets opened flat to lower, did nothing at all until after lunch, and then sold off on 5 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A but too far out of range to take:

NQ Opening Range Play triggered short at A and long at B, both too far out of range to take:

Results: +0 ticks

Forex:

Came into the session long the second half of the prior day's trade, and that continued. Plus we had a new winner.

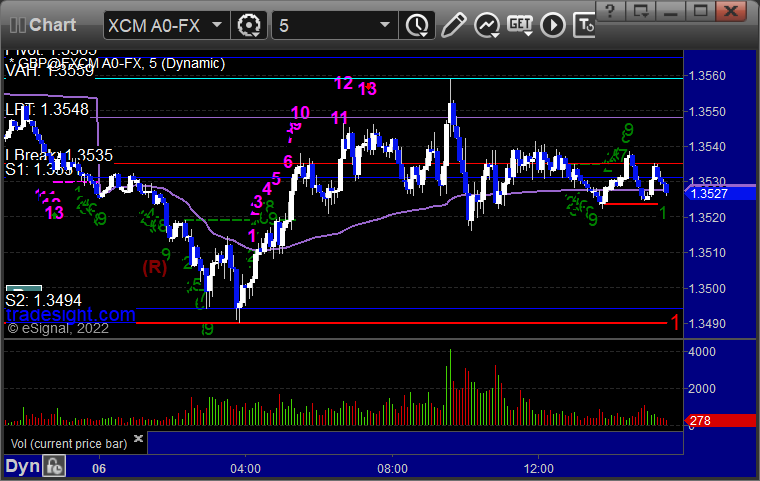

GBPUSD triggered long at A, didn't quite hit first target, still holding second half of the prior day's trade plus this trade with a stop under R1:

Results: Both trades still pending

Stocks:

A boring day until late and then some excitement.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, Rich's ZM triggered long (with market support) and didn't work:

His LRCX triggered short (with market support) and worked:

His REGN triggered short (with market support) and worked:

His SNOW triggered short (with market support) and worked:

That’s 4 triggers with market support, 3 of them worked and 1 didn’t.