Stock Picks Recap for 10/6/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, JCOM triggered long (with market support) but basically gapped through the number so wasn't tradeable even though it worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (without market support) and didn't work:

Mark's TSLA triggered short (with market support) and worked:

Rich's WYNN triggered long (with market support) and worked:

Mark's BMRN triggered short (with market support) and didn't work, worked later:

SNDK triggered long (without market support) and worked enough for a partial:

SLB triggered long (with market support) and worked:

BIDU triggered long (with market support) and worked:

Rich's IBB triggered short (ETF, so no market support needed) and worked:

Rich's ILMN triggered long (without market support) and worked:

His FB triggered short (with market support) and didn't work:

His AGN triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not. I didn't count JCOM because it gapped through the trigger.

Futures Calls Recap for 10/6/15

Not a very exciting day. A flat opening for the markets and then we meandered around, closing down a little on 1.9 billion NASDAQ shares. No main calls, but the Opening Range plays had mixed results.

Net ticks: +0 ticks.

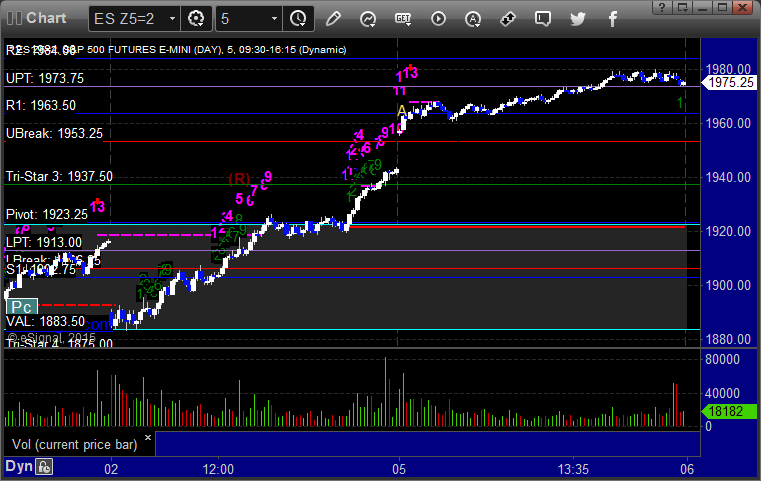

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

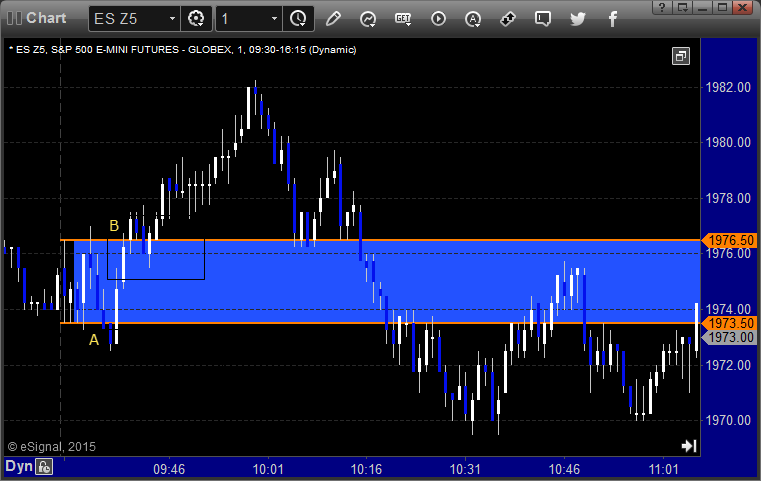

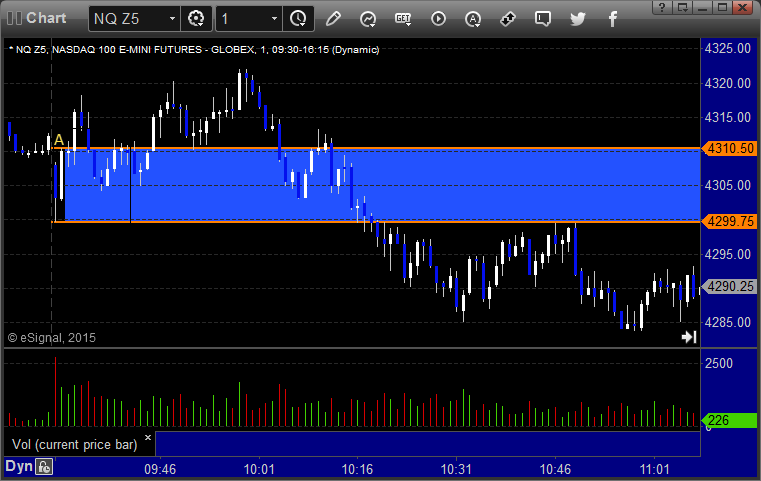

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work, triggered long at B and did:

NQ Opening Range Play:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 10/6/15

A nice winner that is still going on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

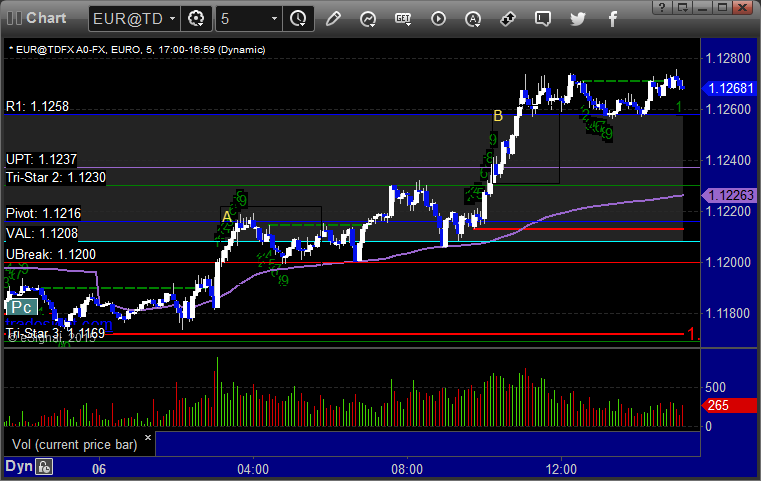

EURUSD:

Triggered long at A, hit first target at B, still holding second half with stop under UPT:

Stock Picks Recap for 10/5/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered long (with market support) and worked:

Rich's AMGN triggered long (with market support) and didn't work:

His WYNN triggered long (with market support) and worked:

His LVS triggered long (with market support) and worked:

His AAPL triggered short (without market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 10/5/15

Mixed bag on the Opening Range plays as the NQ triggered short and stopped and then long and stopped, but the ES only triggered long and worked great to make up for it. We also had a winner on the ES. See that section below. The markets gapped up and kept going to start the week on 1.8 billion NASDAQ shares.

Net ticks: +2.5 ticks.

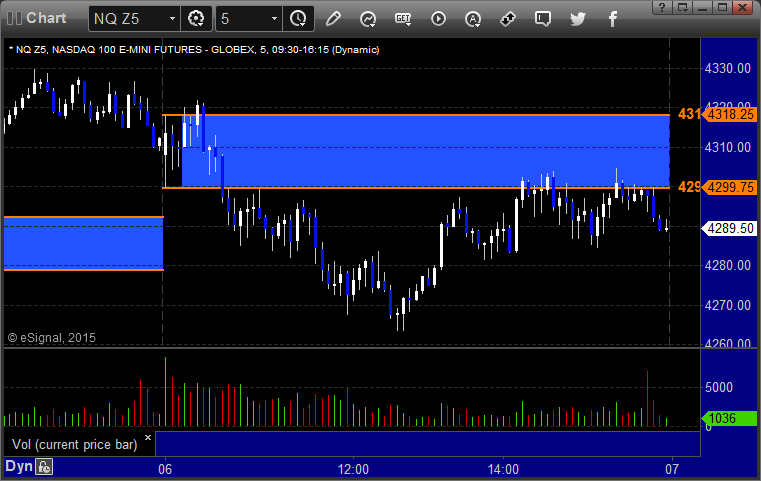

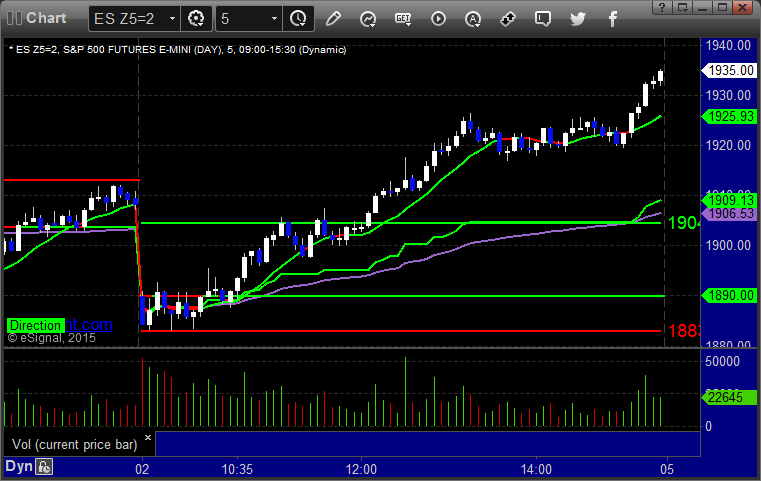

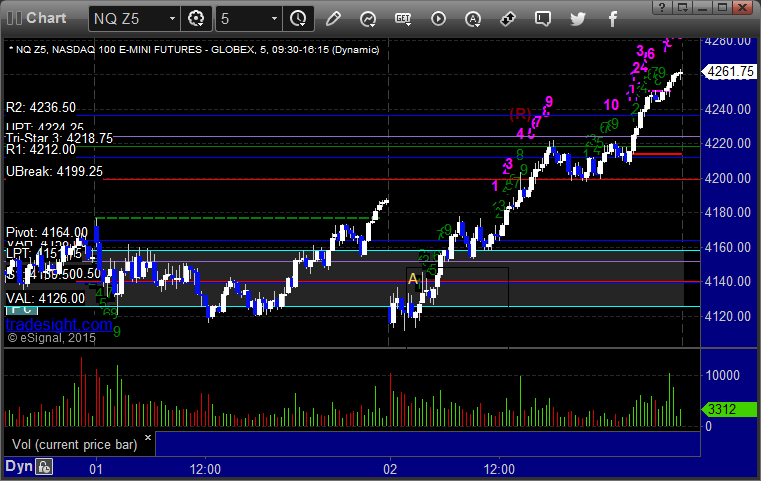

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A and didn't work, triggered long at B and didn't work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered long at A at 1963.75, hit firs target for 6 ticks, and stopped second half under the entry:

Forex Calls Recap for 10/5/15

A winner to start the week. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, closed second half just under the entry at C when I woke up:

Stock Picks Recap for 10/2/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VRSN triggered long (with market support) and worked great:

RDUS triggered long (with market support) and worked:

PTEN gapped under the short trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and didn't work:

His FAS triggered short (ETF, so no market support needed) and worked enough for a partial:

His LVS triggered long (with market support) and worked:

His BIDU triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 10/2/15

The markets gapped down on the Unemployment data, then pushed up most of the day and closed green. NASDAQ volume was 2 billion shares.

Net ticks: +7 ticks.

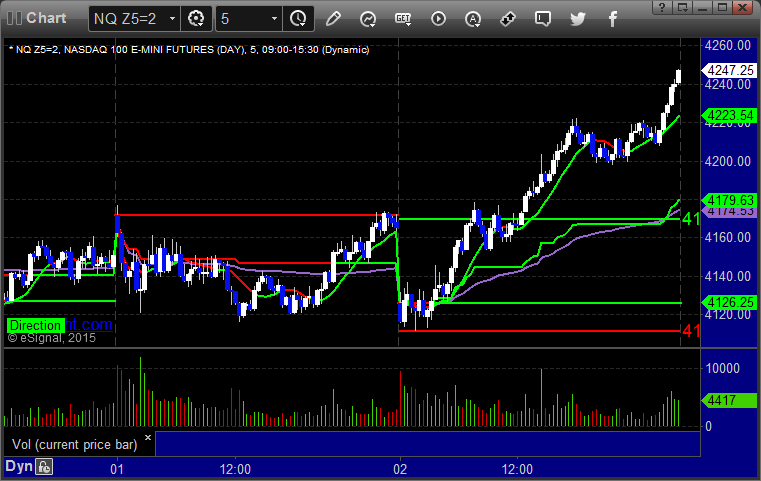

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work:

NQ Opening Range Play triggered short at A and didn't work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

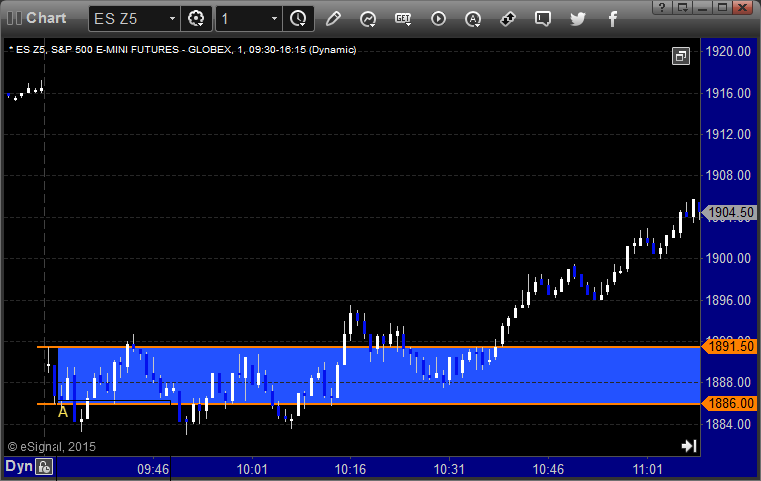

ES:

My call triggered long at A at 1899.00 and stopped the first time. Put it back in, triggered, hit first target for 6 ticks, raised stop twice and stopped in the money at 1903.25:

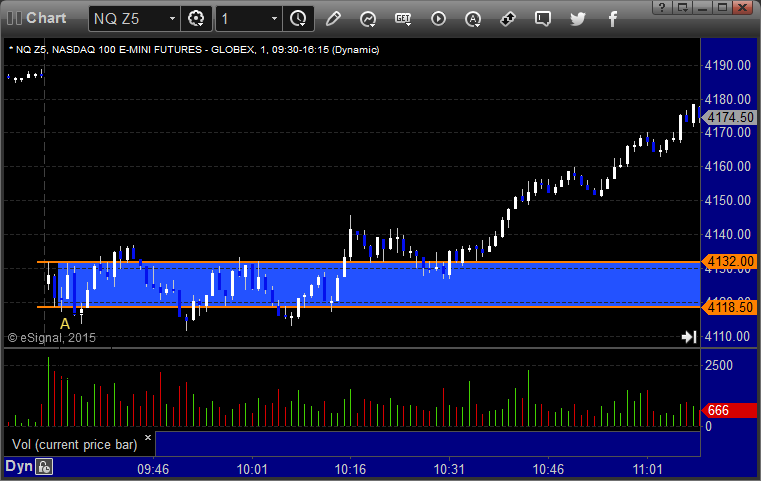

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered long at A at 4141.00, hit first target for 6 ticks, stopped second half under entry:

Forex Calls Recap for 10/2/15

A wild session once the Unemployment Data hit. That's why you go half size ahead of the big news items. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered short at A, hit first target exactly at B, second half stopped. Triggered long at C (if you got filled on the news spike), hit first target at D, second half stopped at E:

Stock Picks Recap for 10/1/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SIMO triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

CPRT gapped under the short trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's DNKN triggered short (with market support) and worked enough for a partial:

His AAPL triggered short (with market support) and worked enough for a partial:

GILD triggered short (with market support) and didn't work:

Rich's TWTR triggered short (with market support) and worked:

Mark's ASML triggered short (with market support) and worked:

His GOOG triggered short (with market support) and didn't work:

Mark's TEVA triggered long (with market support) and worked:

Rich's BIIB triggered short (with market support) and worked enough for a partial:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.