Futures Calls Recap for 10/1/15

Big winners again on the Opening Range plays as the market gapped up and then headed lower. The volume looked good and closed at 1.9 billion NASDAQ shares, but the range of the session was defined in the first hour on the NASDASQ and the Lower Pressure Threshold was the low on the both the ES and NQ.

Net ticks: +0 ticks.

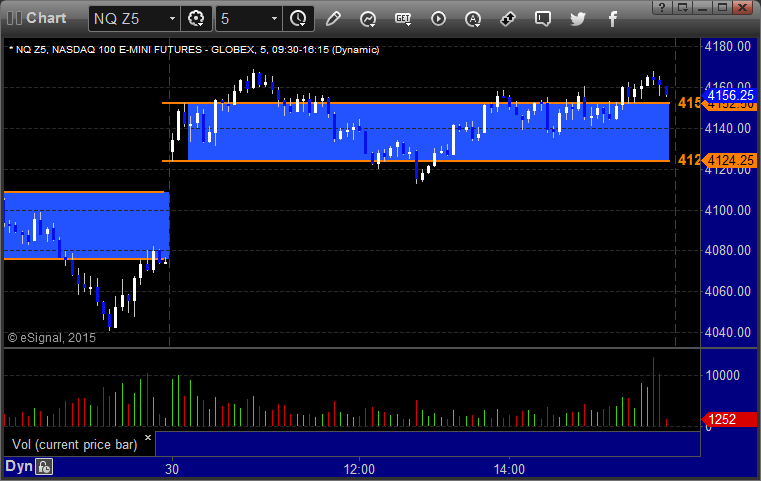

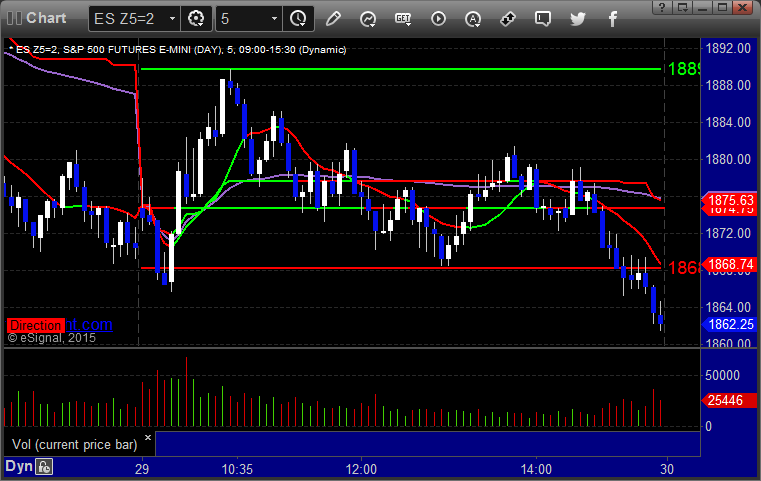

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

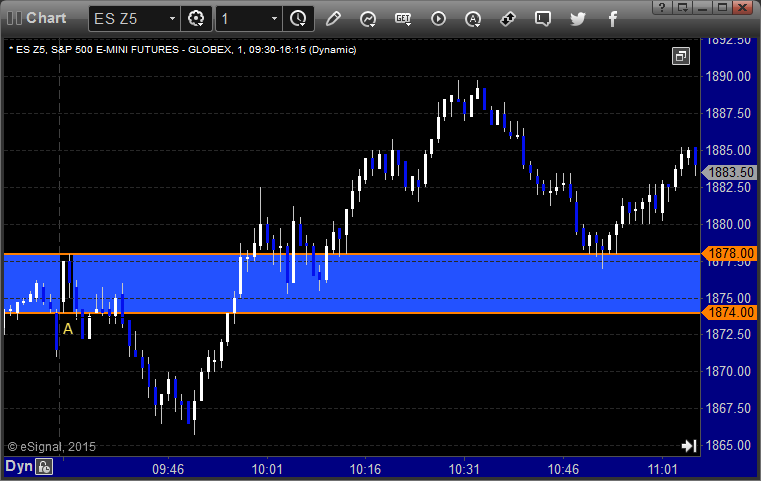

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked great:

NQ Opening Range Play triggered short at A and worked great, but I did not take this one as the trigger candle closed 8 points (not ticks, points) below the OR Low:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 10/1/15

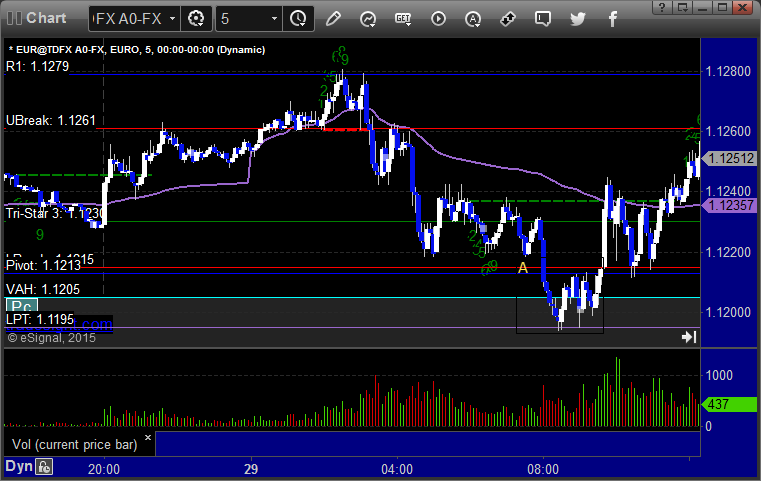

Very technical action on the EURUSD, see that section below. Ranges still not huge.

Here's a look at the US Dollar Index intraday with our market directional lines:

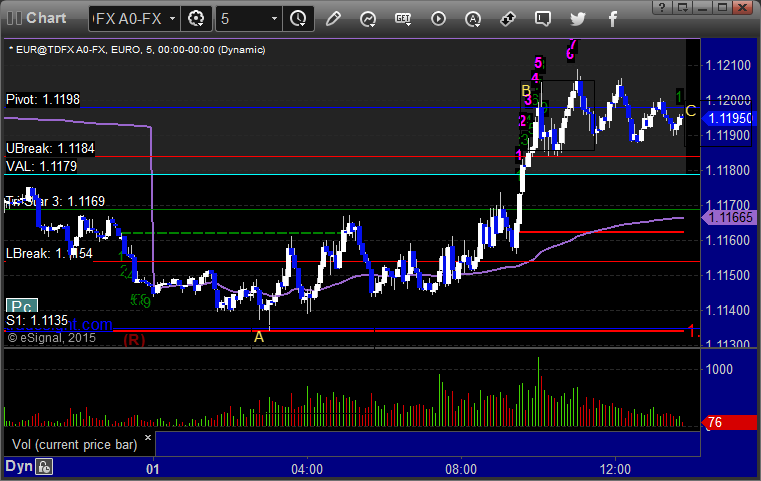

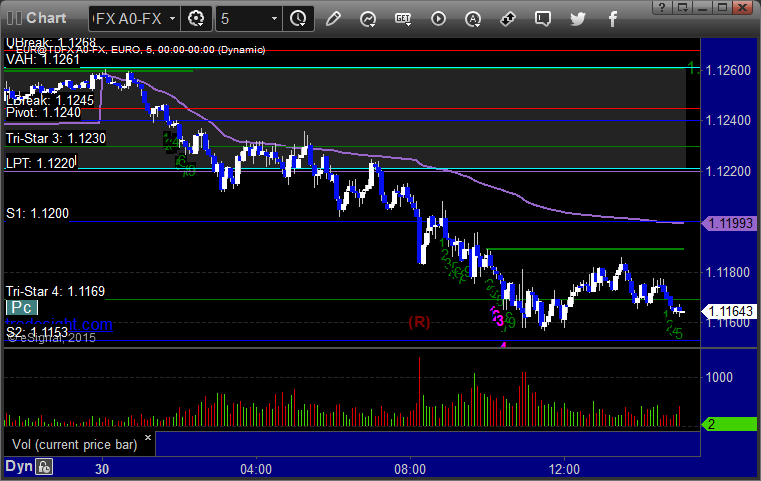

EURUSD:

Exactly touched the short trigger under S1 at A but didn't trigger. Triggered long at B, never went far, closed around entry at C for end of session:

Stock Picks Recap for 9/30/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's CELG triggered long (with market support) and worked:

Rich's AMGN triggered long (with market support) and didn't work:

His FB triggered long (with market support) and didn't work initially, worked later:

His AGN triggered long (with market support) and worked:

GS triggered short (just barely without market support) and worked enough for a partial:

Mark's SNDK triggered long (with market support) and worked:

Rich's first AAPL call triggered short (without market support) and worked:

His next AAPL call triggered short (with market support) and worked:

His SLB triggered short (without market support) and didn't work:

His final AAPL call triggered short (without market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 9/30/15

A loser, and then a sweep that retriggered and worked. The markets gapped up and meandered around for the last day of the quarter, which isn't anything new. NASDAQ volume closed at 2 billion shares. Once again, the Opening Range Plays worked great.

Net ticks: -7 ticks.

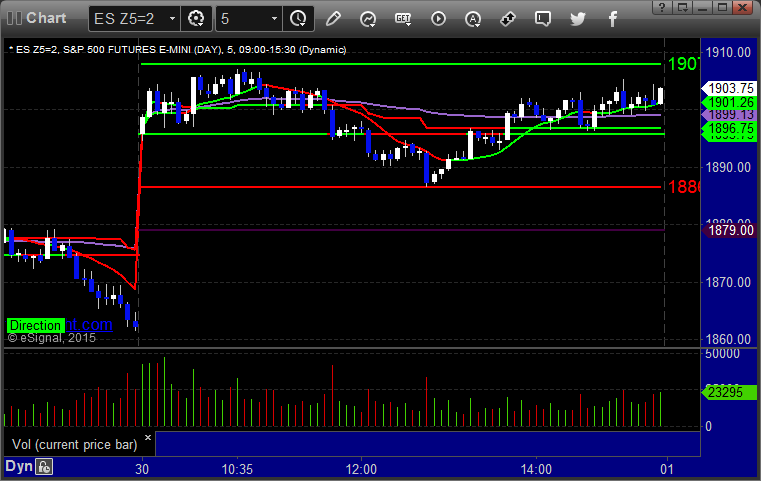

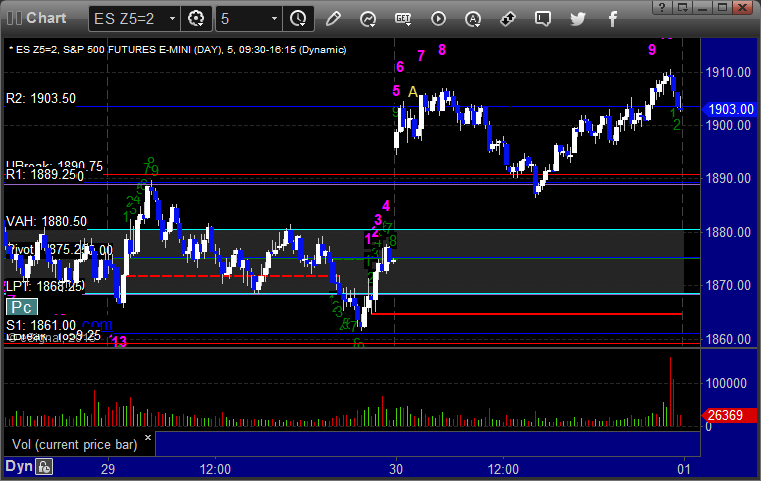

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 1904.75 and didn't work, I did not re-enter:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A and stopped on a sweep, then triggered again, hit first target, lowered stop twice and stopped in the money:

Forex Calls Recap for 9/30/15

I didn't make a call for the session because I didn't like the Levels spacing on the EURUSD and GBPUSD based on the prior day's action. It's an unusual thing to do, but the calls I was considering wouldn't have worked, so it was the correct thing. Back to it tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 9/29/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's IBB triggered long (ETF, so no market support needed) and worked:

His AGN triggered long (with market support) and worked:

His BIIB triggered long (with market support) and worked:

His FCX triggered long (with market support) and didn't go enough in either direction to count:

Rich's LRCX triggered long (with market support) and worked:

FB triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, all 5 of them worked.

Futures Calls Recap for 9/29/15

The markets opened fairly flat and closed even after dipping lower on 2.1 billion NASDAQ shares. It was a decent volume day and that's it. We had Mark's trade trigger in the NQ and he didn't put it back in and it worked later. Meanwhile the Opening Range Plays worked.

Net ticks: -7 ticks.

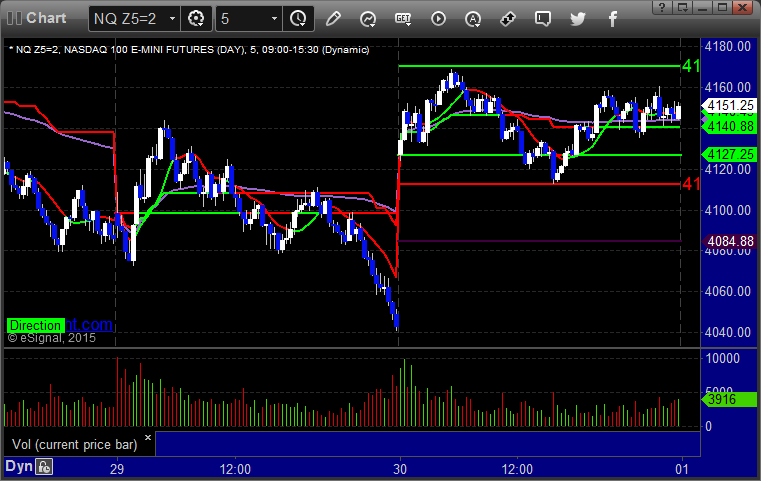

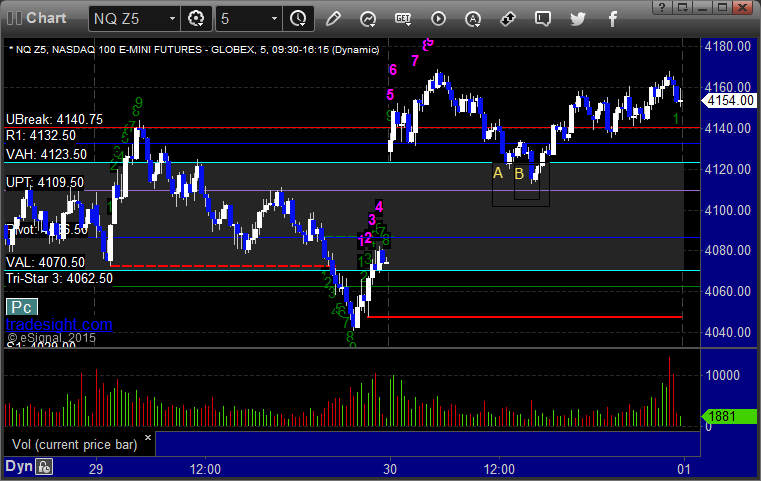

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 4074.50 and stopped. Mark did not put it back in although he should have:

Forex Calls Recap for 9/29/15

Not a very big session. Sad that we went half size.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped:

Stock Picks Recap for 9/28/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ELGX triggered short (with market support) and didn't work:

CLDX triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's ASML triggered short (with market support) and worked:

Rich's FB triggered short (with market support) and worked:

His WYNN triggered short (with market support) and worked:

Rich's AAPL triggered short (with market support) and worked:

His TWTR triggered short (with market support) and didn't work:

His TLT triggered long (ETF, so no market support needed) and worked:

His CELG triggered long (without market support) and worked:

His AMZN triggered short (with market support) and worked:

His SCTY triggered short (with market support) and worked enough for a partial:

His PCLN triggered short (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and worked enough for a partial:

In total, that's 11 trades triggering with market support, 9 of them worked, 2 did not.

Futures Calls Recap for 9/28/15

The markets gapped down and kept going. Once again the Opening Range plays worked on 1.9 billion NASDAQ shares.

Net ticks: +0 ticks.

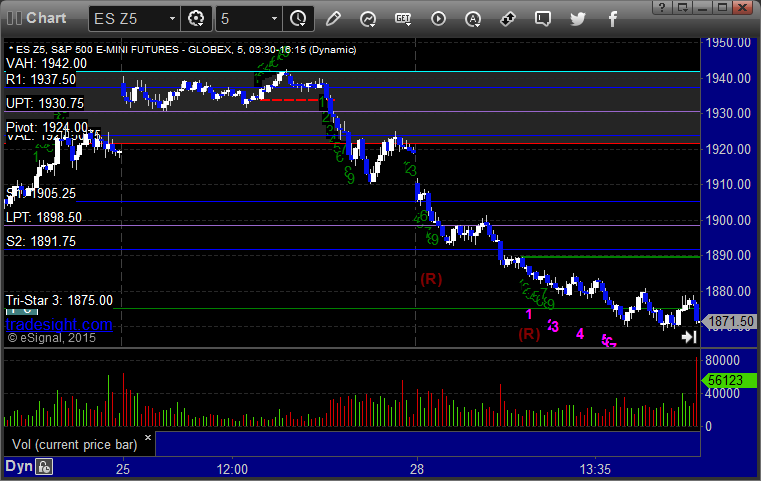

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: