Forex Calls Recap for 9/11/15

A slower session with a trade that stopped out overnight but then triggered again in the morning after we put it back in and worked. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

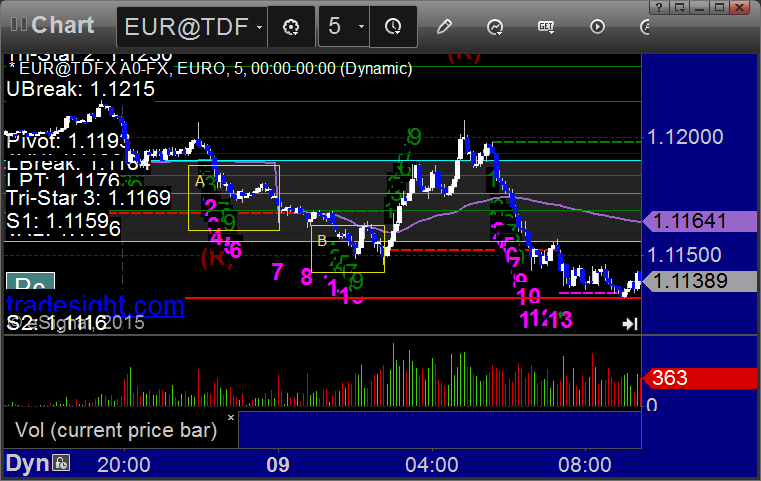

EURUSD:

Triggered long at A and stopped. Put it back in, triggered long at B, hit first target at C, closed second half at D 40 pips in the money for end of week:

c

c

Stock Picks Recap for 9/10/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, THRX gapped under the short trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered short (without market support) and worked enough for a partial:

Rich's APA triggered short (without market support) and worked great:

GS triggered short (with market support) and worked enough for a partial:

Rich's VXX triggered long (ETF, no market support needed) and didn't work:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not. Both of the other triggers worked.

Futures Calls Recap for 9/10/15

A little bit more of a stable session even though volume was light. Opening Range plays both worked again, and we had a nice clean winner in the ES after it lined up against the Pivot and made a cup and handle. Markets gapped down a little, filled early and then went flat before pushing up a bit in the second half of the day on 1.5 billion NASDAQ shares.

Net ticks: +9 ticks.

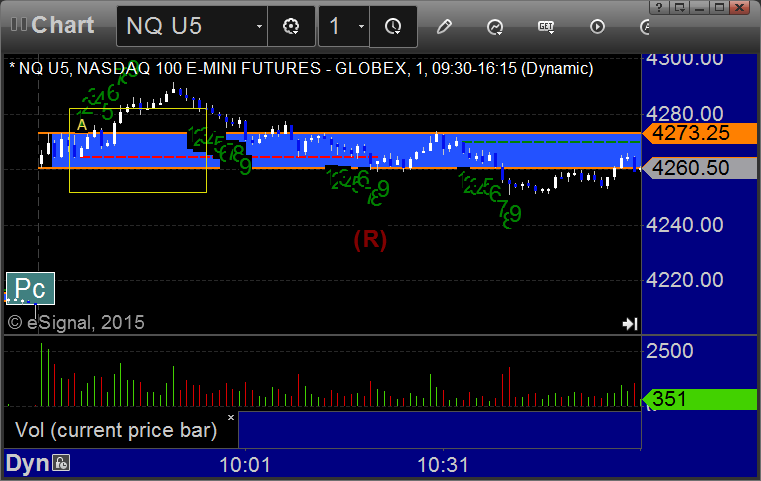

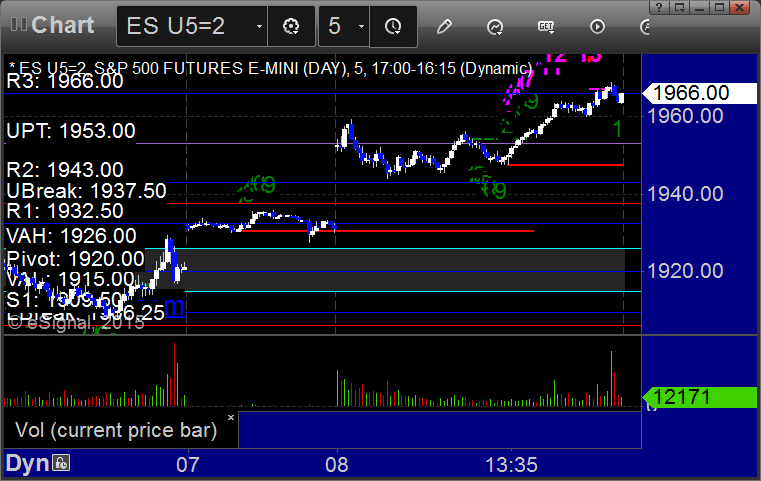

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered long at 1966.00 at A, hit first target for 6 ticks, raised the stop twice and stopped 12 ticks in the money:

Forex Calls Recap for 9/10/15

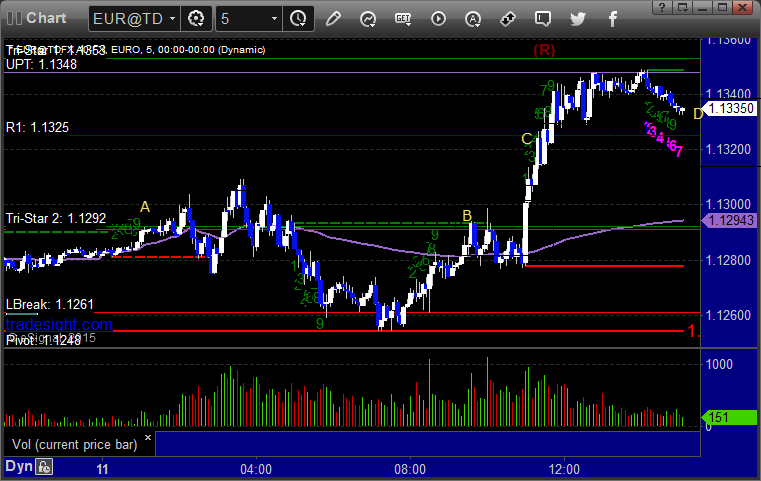

A mixed session with an early stop-out, a regular stop-out, and a winner that is working nice and still going in the EURUSD. See that section below.

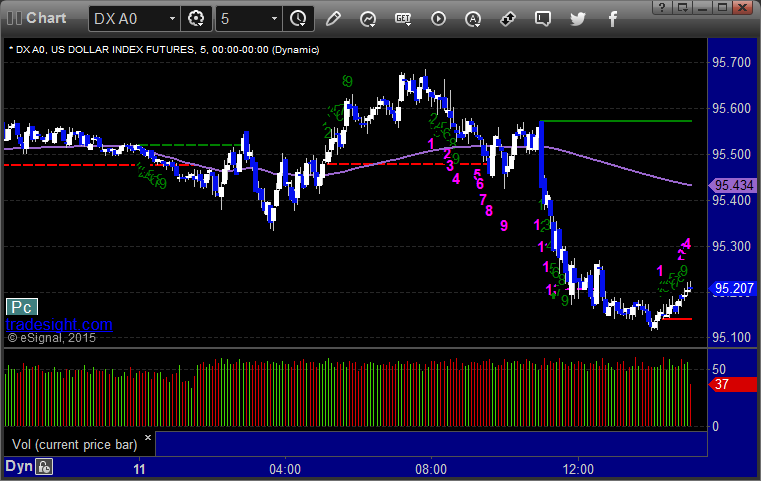

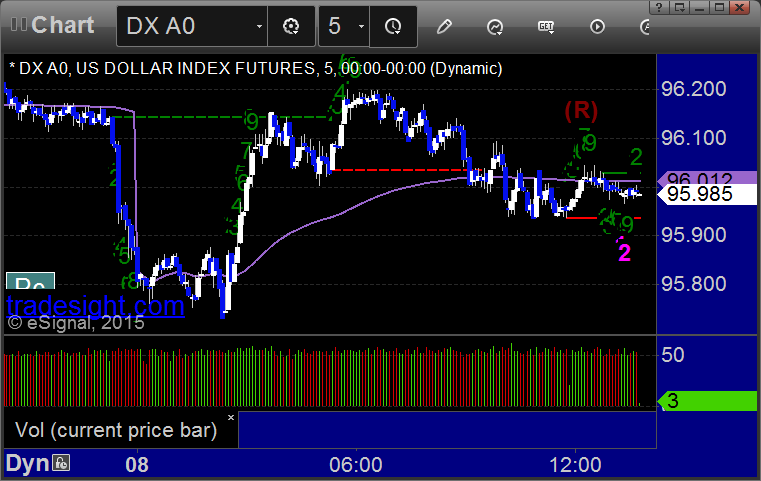

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long early in the Asian session off the left side of the chart, which would be less size for a pre-European trigger, and stopped. Triggered short at A and stopped. Put them back in in the morning, triggered long at B, hit first target at C, and still holding second half with a stop under R2:

Stock Picks Recap for 9/9/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CALD triggered long (without market support due to opening 5 minutes) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and worked:

GILD triggered short (with market support) and worked:

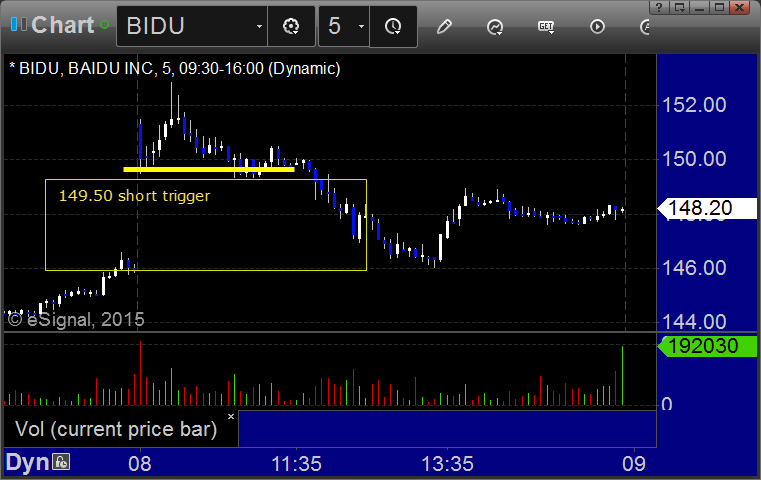

BIDU triggered short (with market support) and worked enough for a partial:

NTES triggered short (with market support) and worked enough to close it in the money before the close:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 9/9/15

The markets gapped up again but this time sold off into negative territory on improved volume of almost 1.8 billion NASDAQ shares. We had a small winner in the NQ plus the Opening Range Plays worked again. See both sections below.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

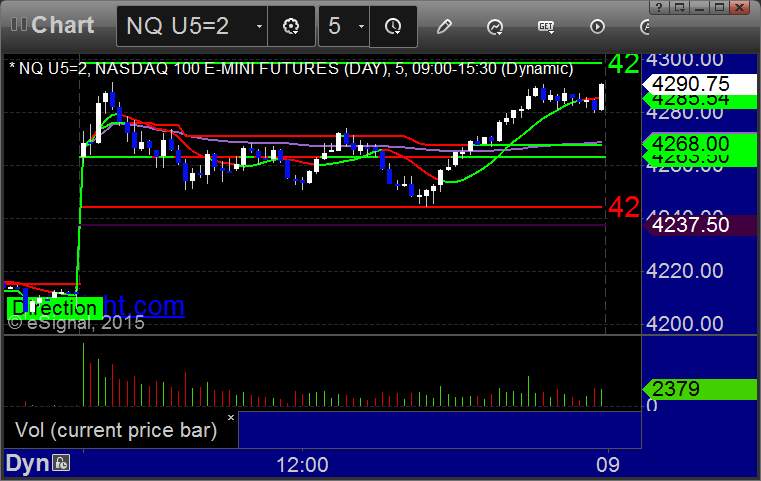

NQ:

ust a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 4316.00 under UBreak after setting the level, hit first target for 6 ticks, stopped second half over entry:

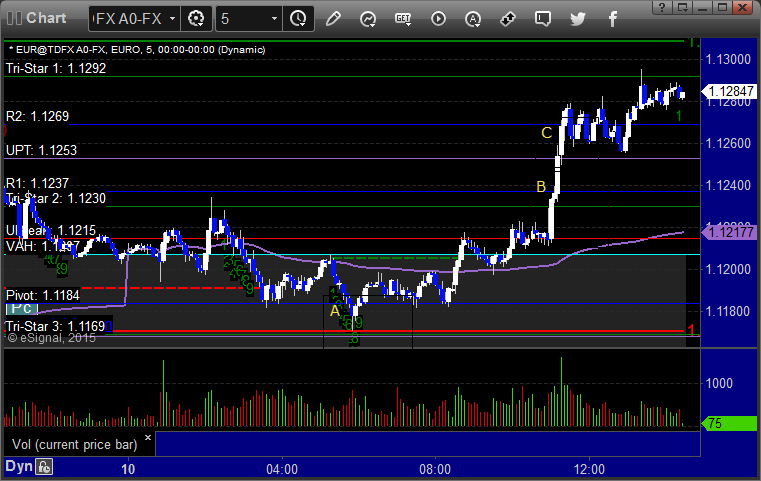

Forex Calls Recap for 9/9/15

Another winner, not as big this time, for the session. See EURUSD section below.

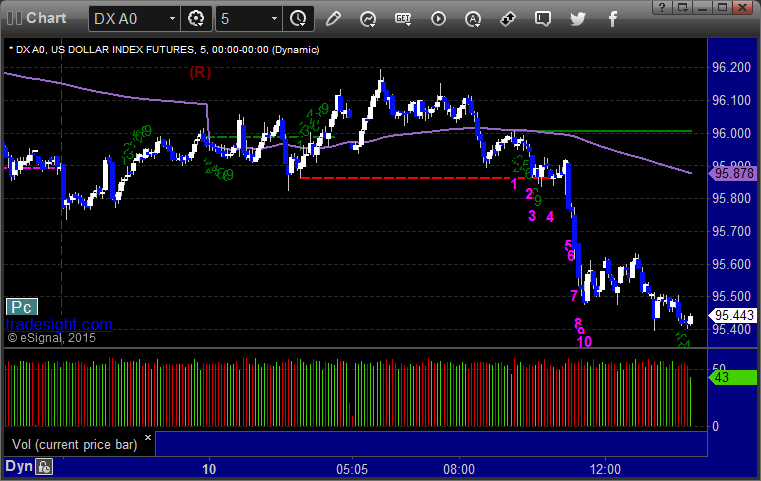

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, stopped second half:

Stock Picks Recap for 9/8/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered short (with market support) and worked:

GS triggered short (with market support) and didn't work:

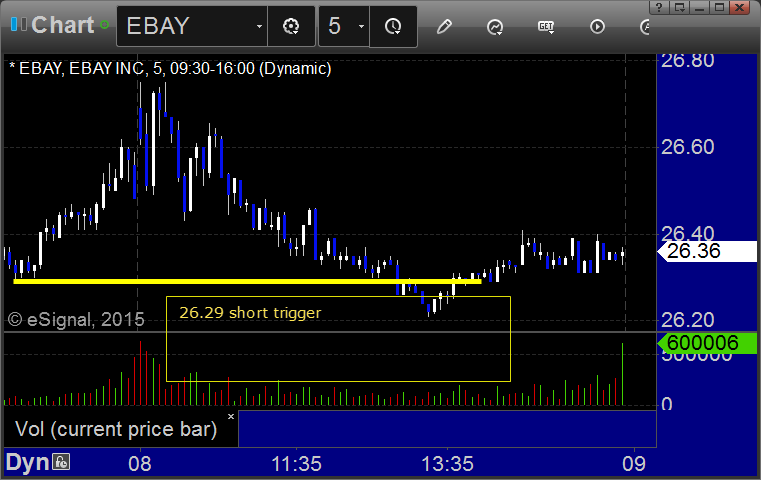

EBAY triggered short (without market support) and didn't go enough in either direction to count:

Rich's BABA triggered short (without market support) and worked enough for a partial:

His REGN triggered long (with market support) and worked great:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 9/8/15

Volume looked strong early after the markets gapped up coming back from the long weekend, then slowed down after 30 minutes and only closed at 1.6 billion NASDAQ shares, which is a small move back up from Friday. The gaps did not fill and the markets closed at highs without trading average daily range. The Opening Range plays worked (see that section below) but we didn't make any additional calls as the big gap took us away from key levels and volume was so light.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 9/8/15

A nice session to start the post-Labor Day week. We had a winner in the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, raised stop in the morning and stopped at C, about 90 pips in the money: