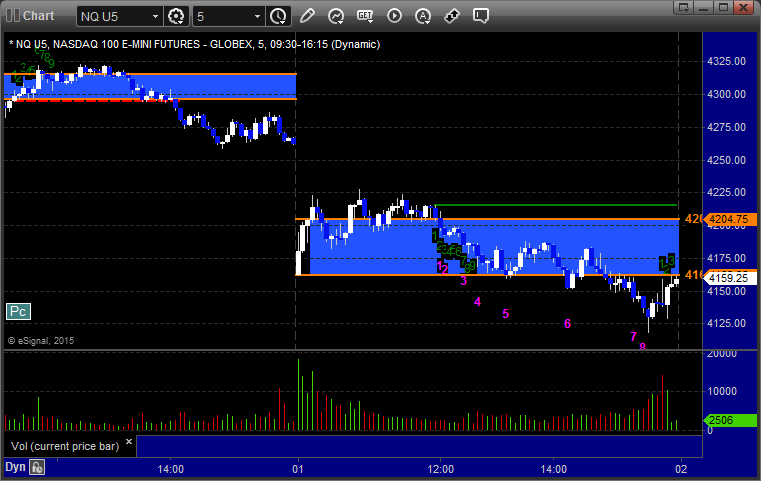

Futures Calls Recap for 9/1/15

Another big gap down in the markets out of the blue. We got a feeble bounce early that failed and then things went lower, although the sell-off once we cracked lows wasn't as much as I was hoping for. NASDAQ volume was 2.0 billion shares. No main calls as we barely touched a Level, but see the Opening Range plays below.

Net ticks: +0 ticks.

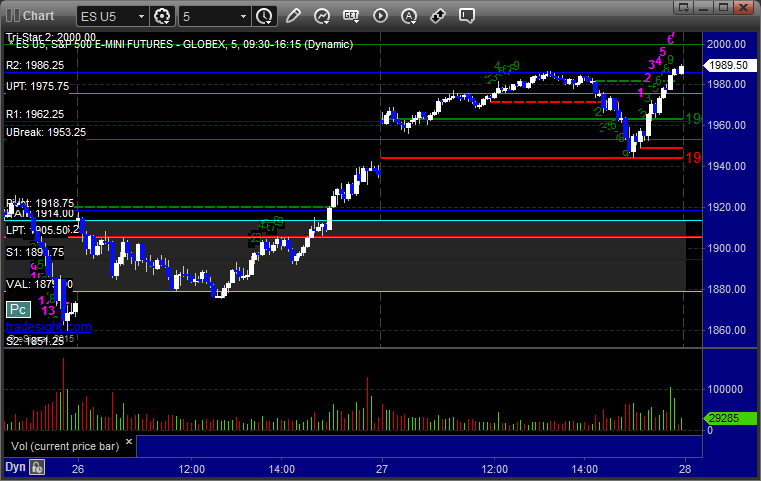

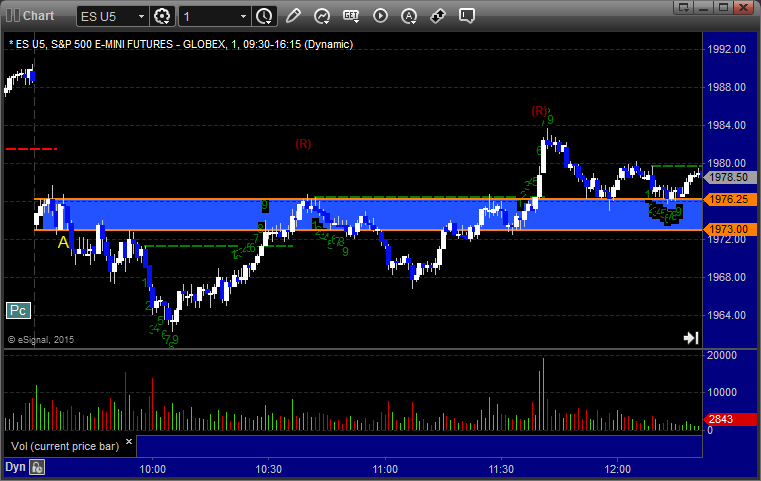

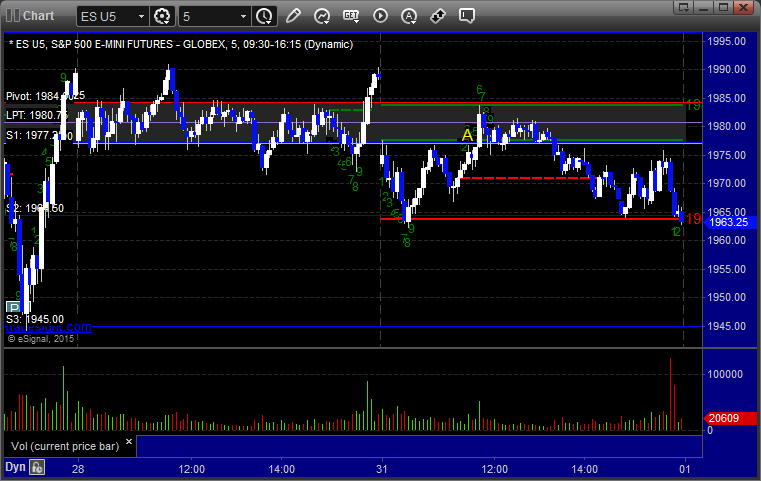

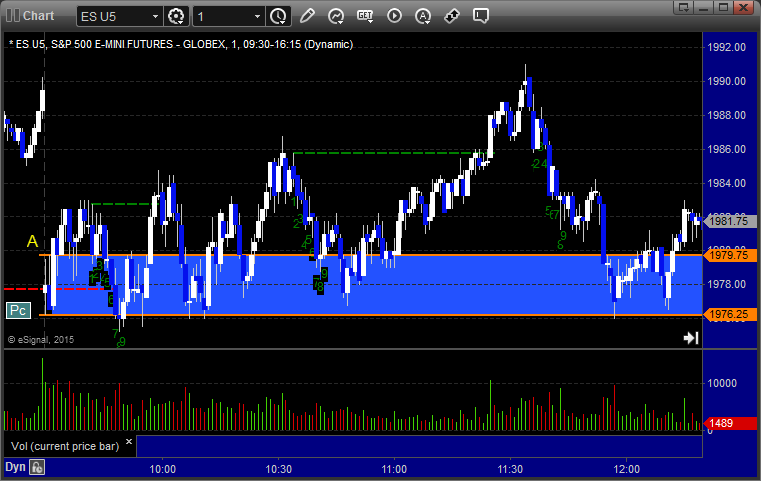

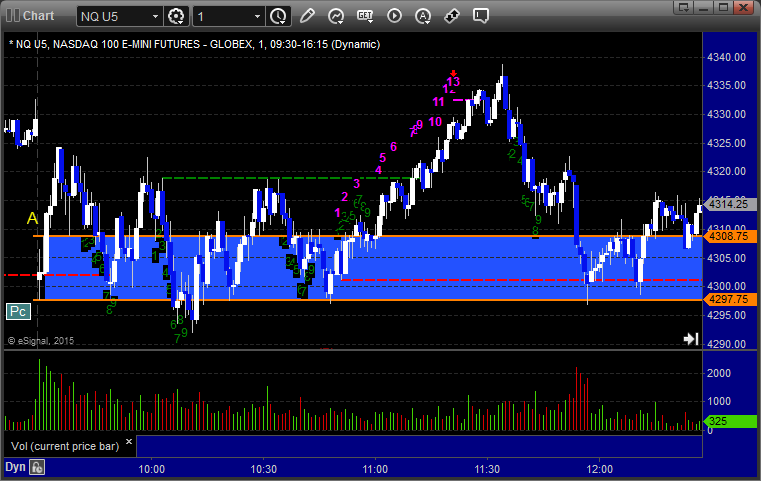

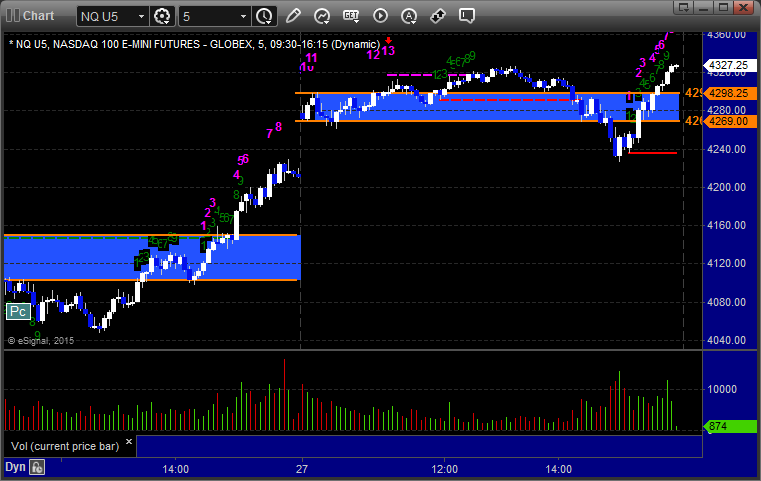

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A but was a bit outside the range and it worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

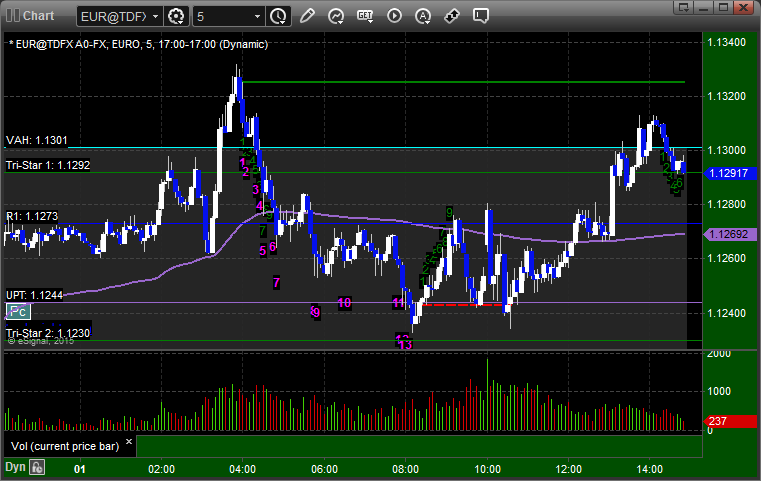

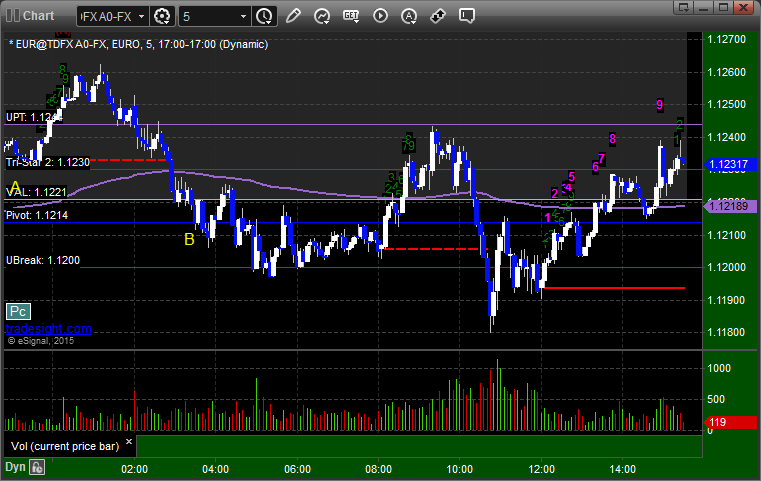

Forex Calls Recap for 9/1/15

The FX Levels were incorrect and Mark is traveling in Turkey and could not be reached to fix, so we went without them. Turns out, it probably saved us as the range on the EURUSD was poor. Only the Break levels are correct in the charts below, but I've included the action anyway.

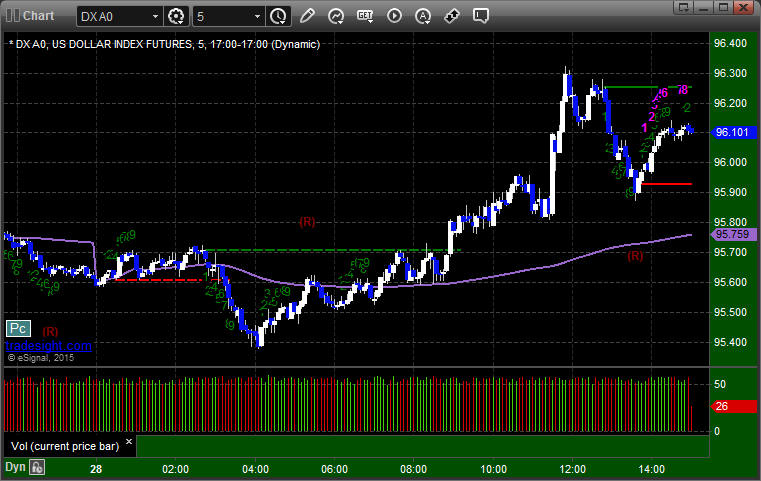

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 8/31/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, COMM triggered long (with market support) and didn't go enough either direction to count:

From the Messenger/Tradesight_st Twitter Feed, AAPL triggered long (with market support) and didn't work immediately, worked later:

Rich's RIG triggered short (with market support) and didn't work:

AMGN triggered short (with market support) and worked great:

Rich's AAPL triggered short (with market support) and worked a little:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

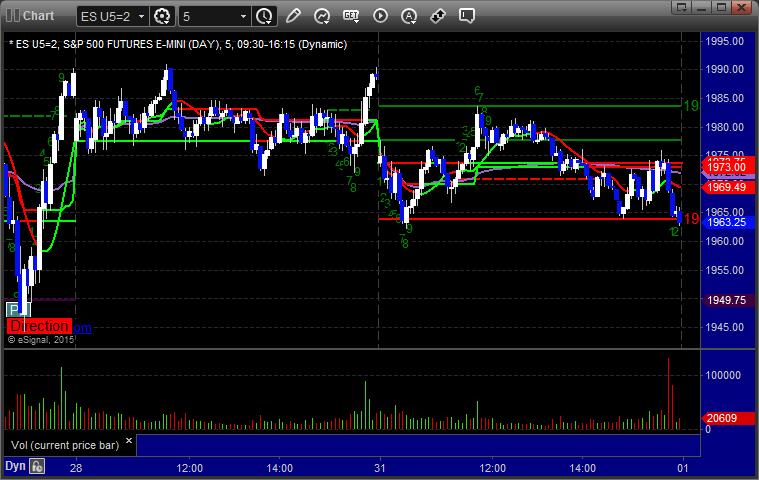

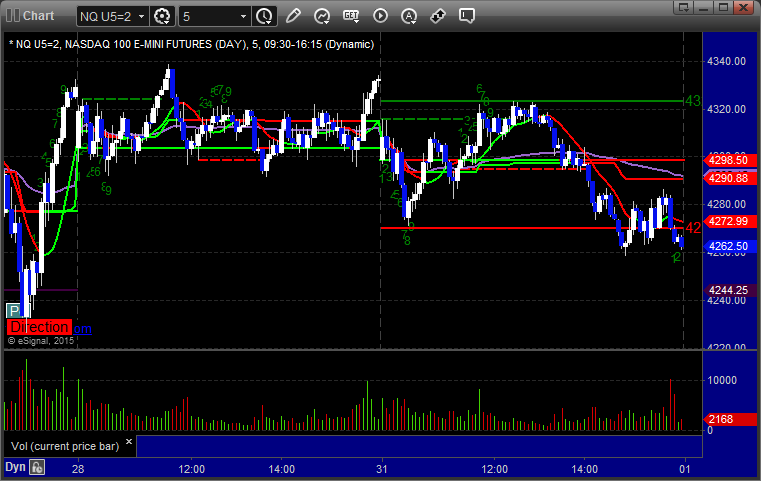

Futures Calls Recap for 8/31/15

Last day of August plus the week before Labor Day plus a Holiday in the UK equals a slow session, but our Opening Range plays worked and we had a call that was basically a Value Area play on the ES that worked. NASDAQ volume was only 1.6 billion shares. See ES section below.

Net ticks: +7 ticks.

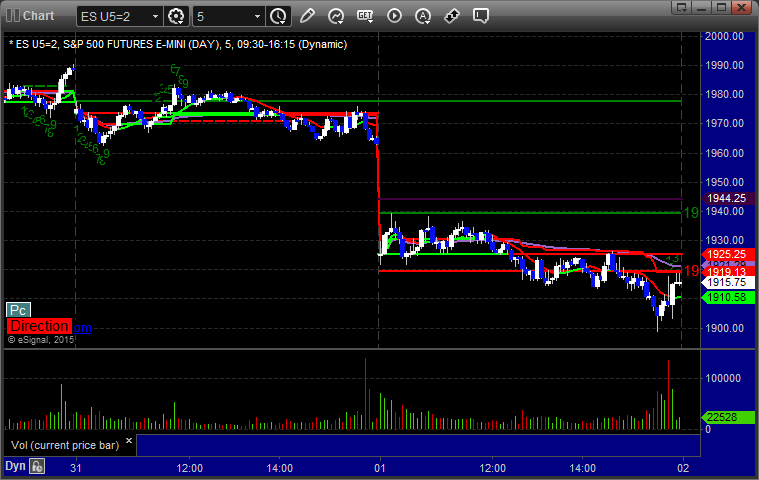

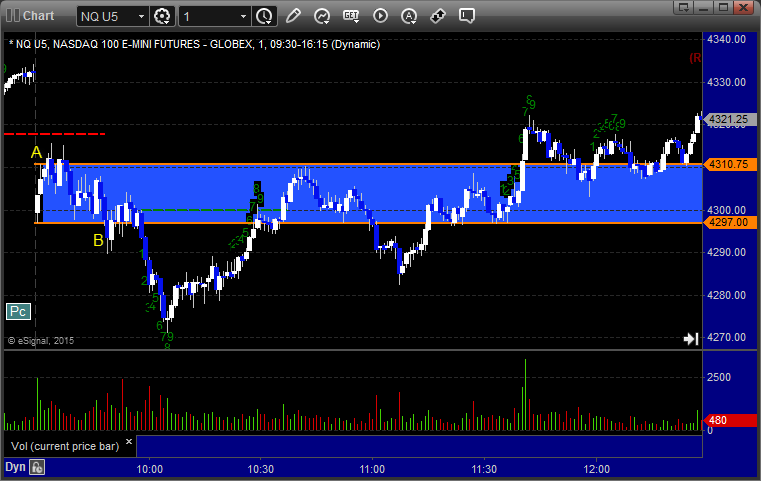

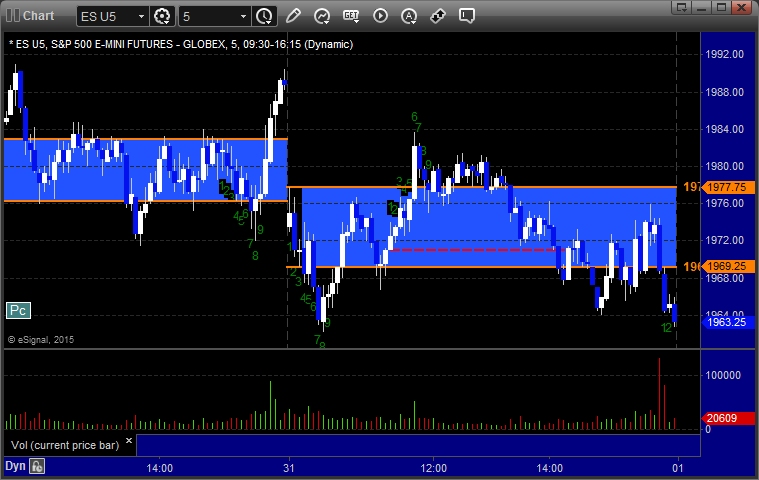

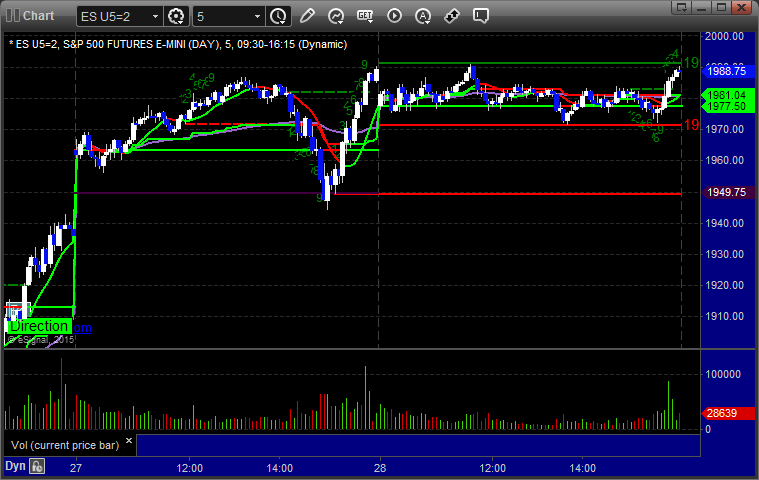

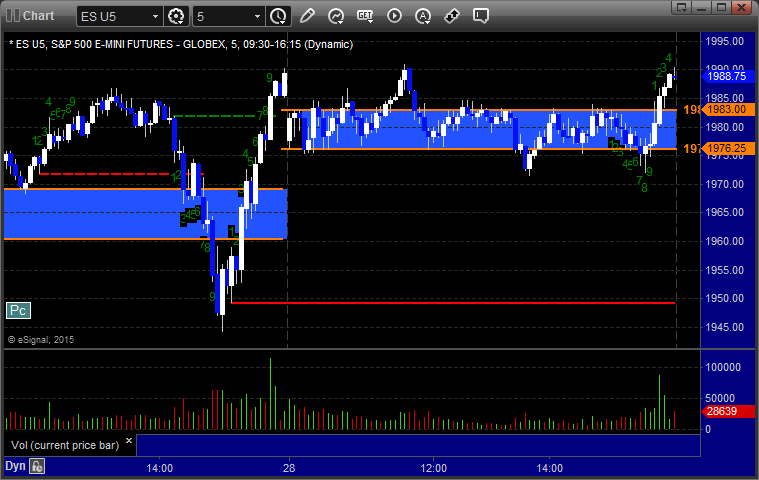

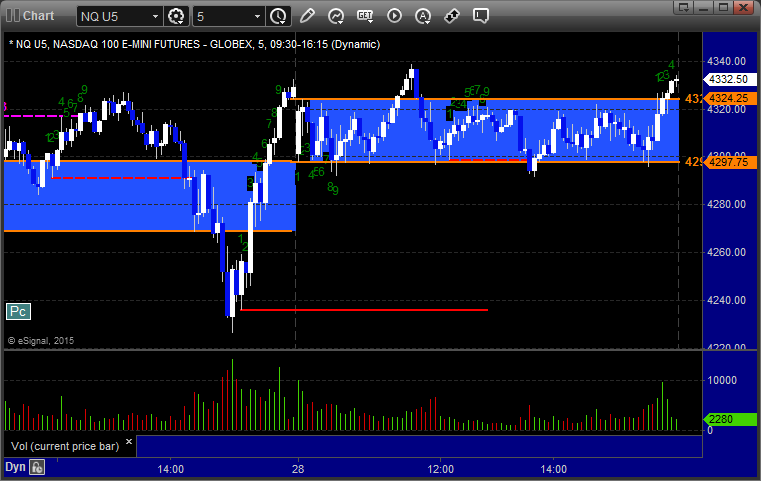

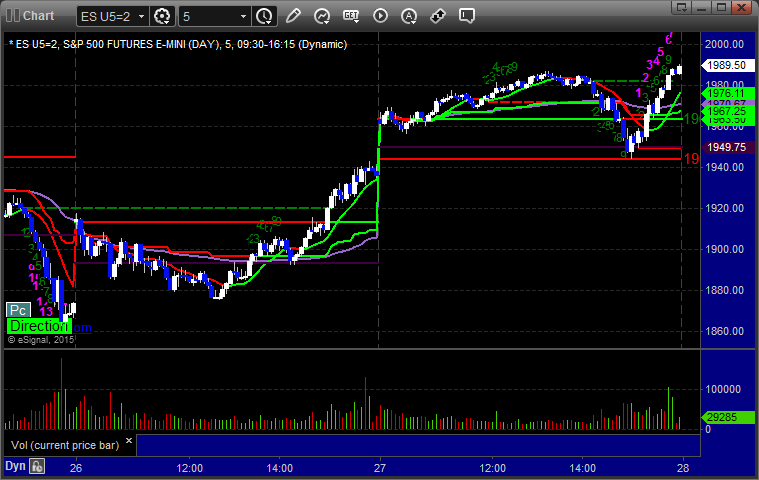

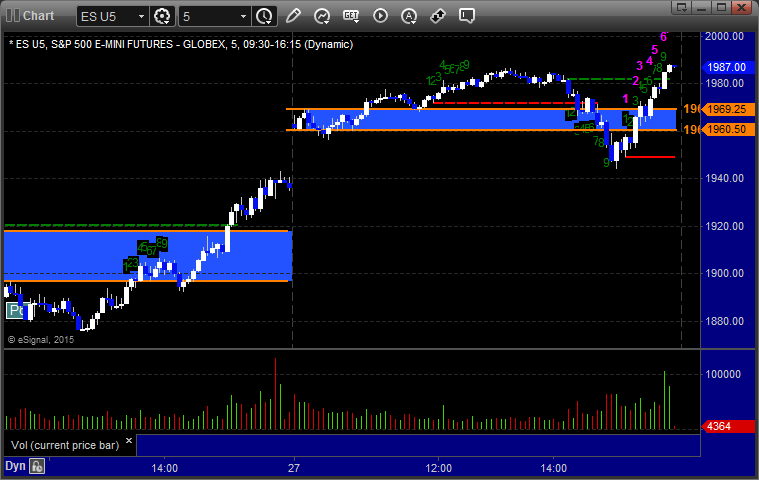

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

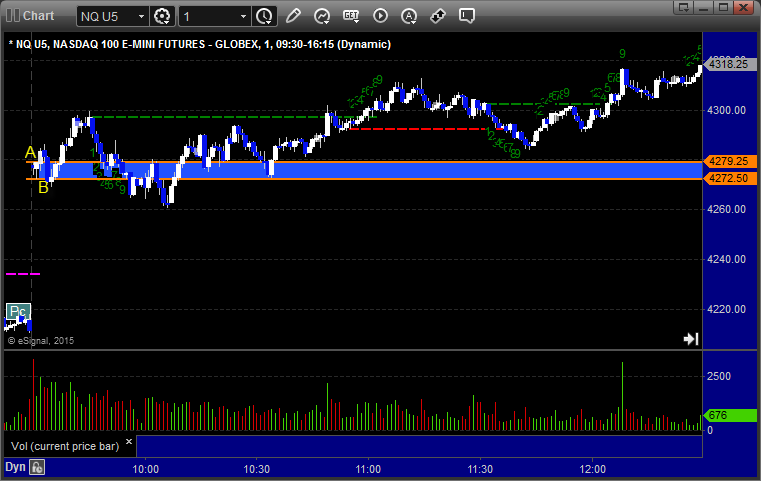

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered long at A and didn't work, triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 1978.00, hit first target for 6 ticks, raised stop and stopped second half 8 ticks in the money:

Forex Calls Recap for 8/31/15

One trade in the EURUSD went a little early and was looking good, but didn't quite get to the first target. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long early before the chart (to the left of A), never got to first target, and stopped at B in the morning:

Stock Picks Recap for 8/28/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no triggers.

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered long (with market support) and didn't work:

Rich's BABA triggered long (with market support) and worked:

His AAPL triggered short (with market support) and didn't work:

His APA triggered long (with market support) and worked:

His WUBA triggered short (with market support) and worked:

His VXX triggered long (with market support) and worked:

His TSLA triggered short (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Futures Calls Recap for 8/28/15

I thought we'd get some excitement in the back end of the day and I waited around for it, but in the end, it was as flat as the market was a few weeks ago on 1.7 billion NASDAQ shares. We gapped down, filled, and stuck in a narrow range for the whole session. Opening range plays worked a little again.

Net ticks: +0 ticks.

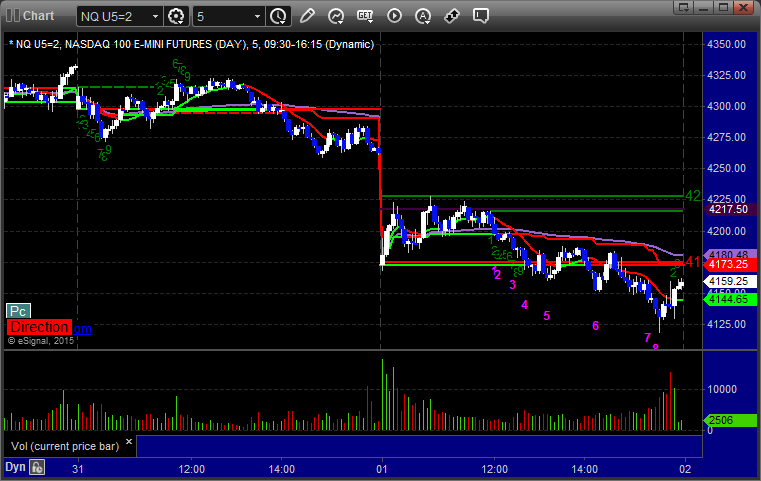

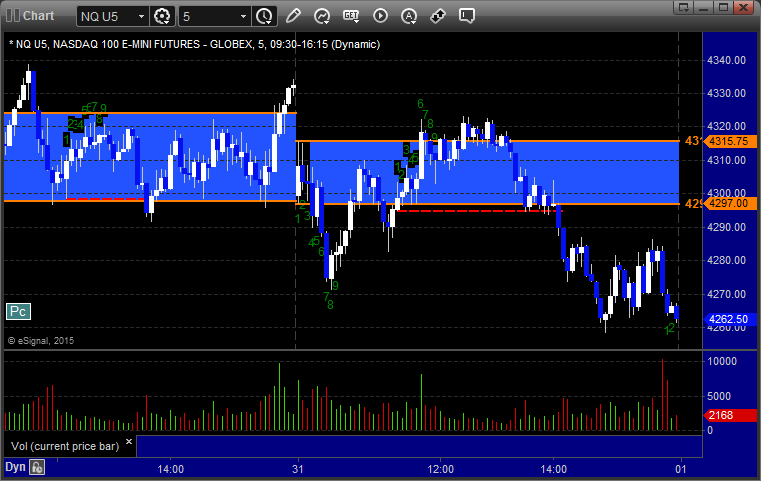

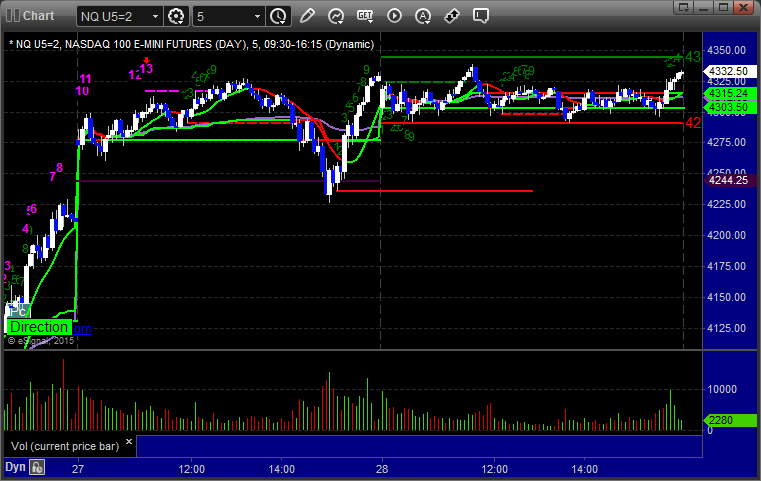

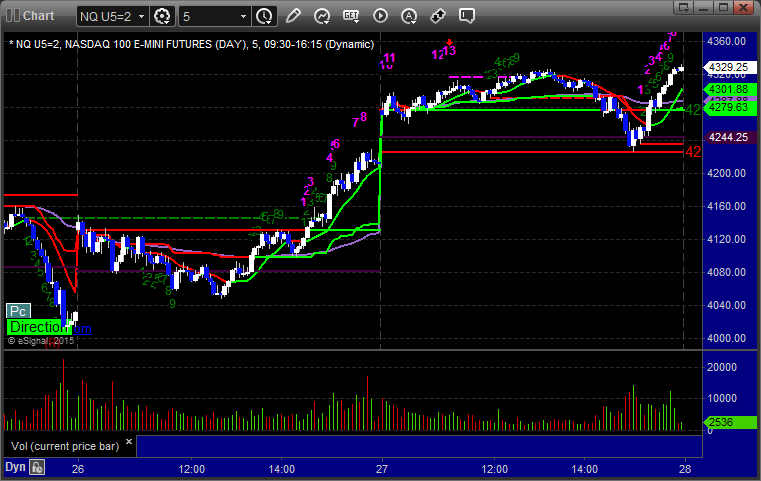

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

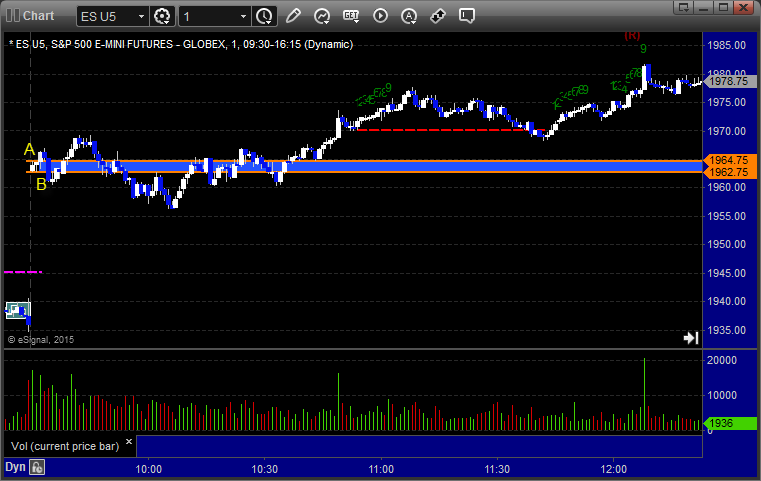

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/28/15

A loser to end the week, but it was a nice week. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered short at A (on a Comber 13 buy signal...lol) and didn't work. Worked later to the first target if you were awake to take it:

Stock Picks Recap for 8/27/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support) and didn't work:

His WSM triggered short (without market support) and didn't work:

His VMW triggered short (with market support) and worked enough for a partial:

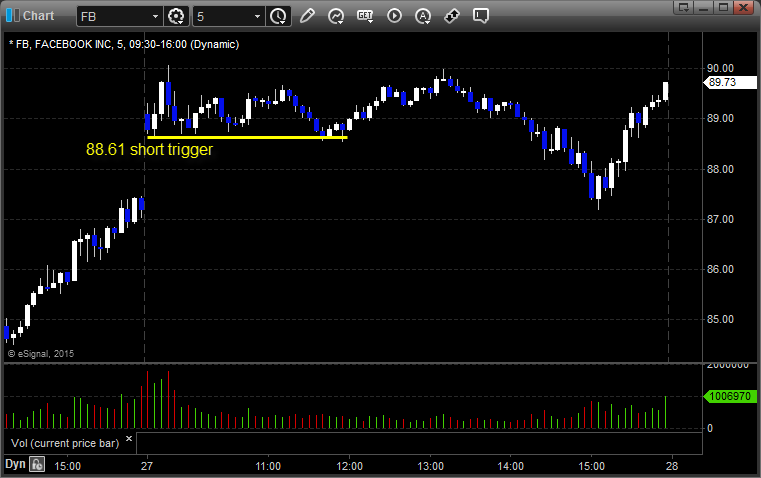

His FB triggered short (without market support) and didn't work:

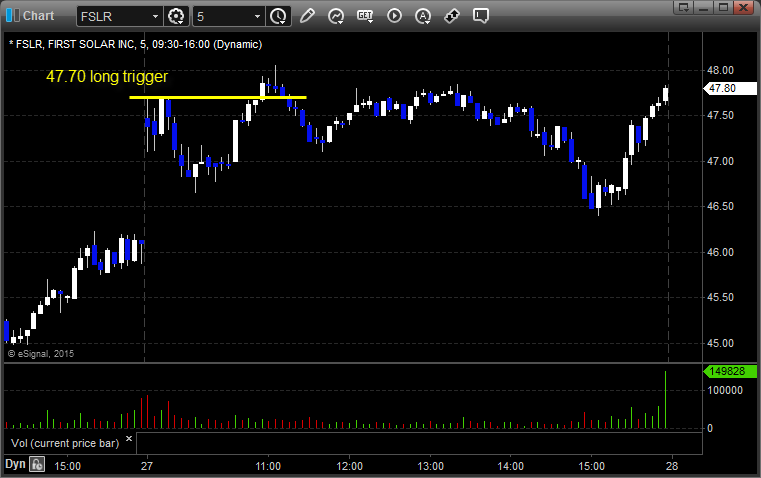

FSLR triggered long (with market support) and worked enough for a partial:

Rich's APA triggered long (with market support) and worked:

His AMZN triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 8/27/15

A much slower day in the markets as we gapped up again but just drifted higher on much more limited volume, then rolled over to lows after lunch but did not fill the gaps, and then bounced a bit into the close on 2.1 billion shares. It was also the first day in a while that the Opening Range plays didn't work.

Net ticks: +0 ticks.

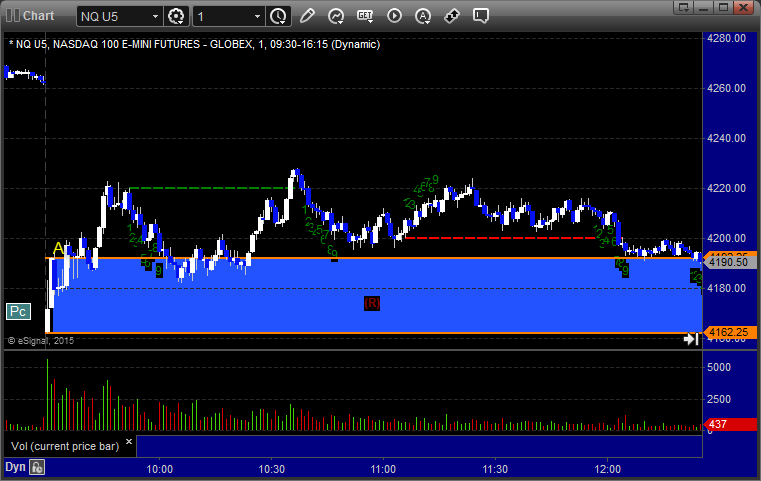

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work, triggered short at B and didn't work:

NQ Opening Range Play triggered long at A and didn't work (although it may have been too far above the OR to take), triggered short at B and didn't work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: