Forex Calls Recap for 8/27/15

We stopped out of the second half of the prior day's trade in the money, then had a loser and a winner on the EURUSD. See that section below.

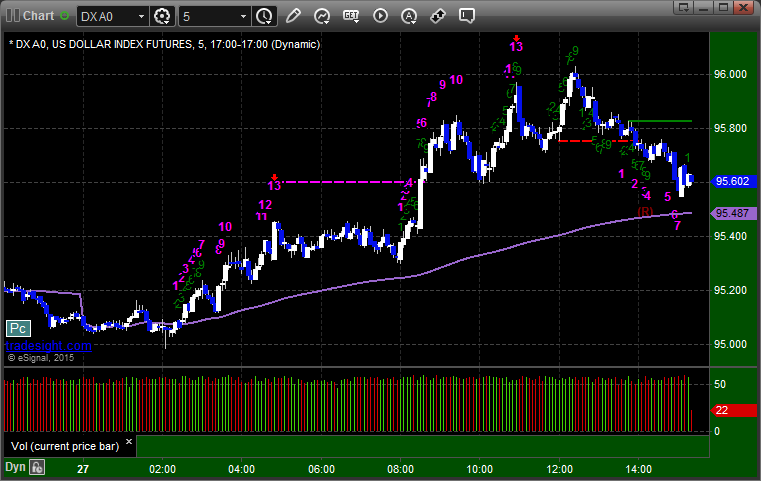

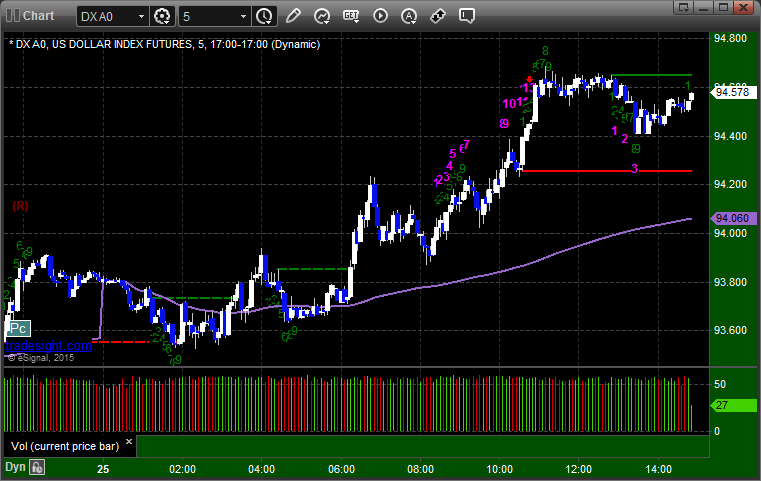

Here's a look at the US Dollar Index intraday with our market directional lines:

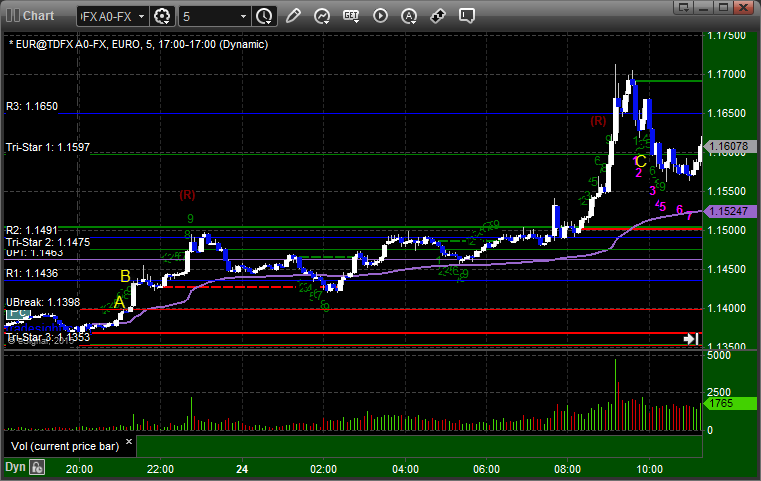

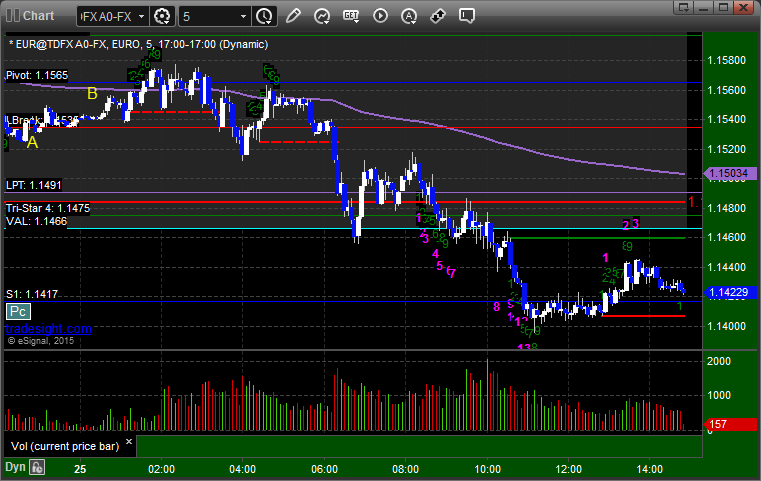

EURUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, stopped second half in the money at D:

Stock Picks Recap for 8/26/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's VMW triggered short (with market support) and didn't work unless you stuck with it:

His GS triggered short (with market support) and worked:

NFLX triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked enough for a partial:

Rich's BABA triggered short (with market support) and worked:

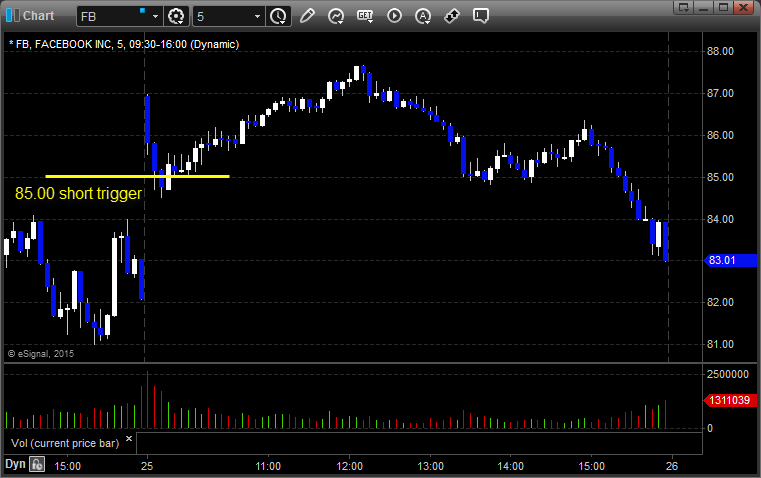

His FB triggered short (with market support) and worked (for the third time in three days, it looks like a blip but it is enough for a partial):

His AAPL triggered short (with market support) and didn't work:

WYNN triggered short (with market support) and worked:

Rich's AAPL triggered short (without market support) and worked enough for a partial:

His TWTR triggered short (without market support) and didn't work:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

Futures Calls Recap for 8/26/15

We made a regular call, but the volatility is still so crazy that it triggered immediately, we hit the first target, and stopped out of the second half in 5 minutes or less. See ES section below. The markets gapped up, drifted lower, bottomed out over lunch, but then rallied to highs on 2.4 billion NASDAQ shares in the afternoon. The gap is NOT filled.

Net ticks: +2.5 ticks.

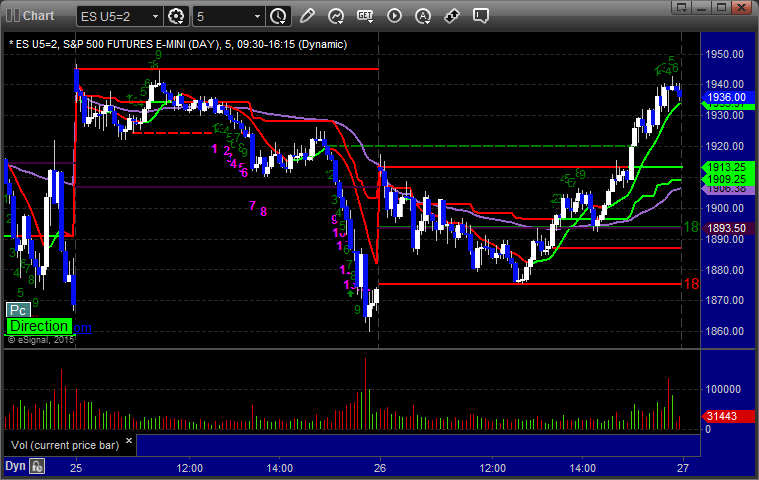

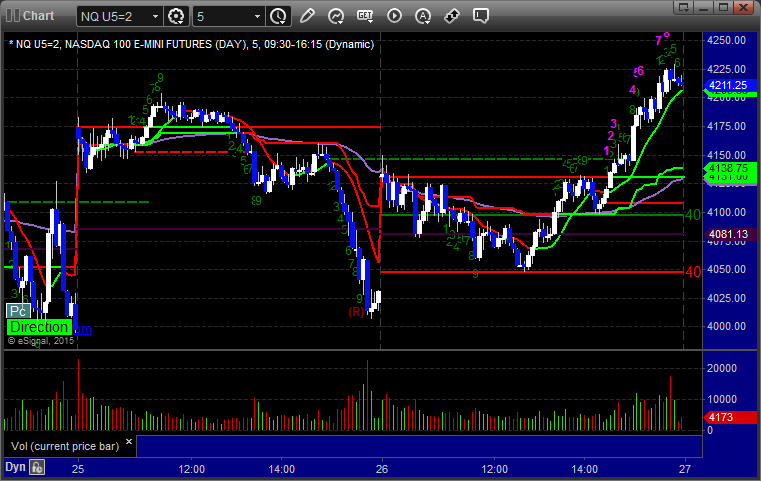

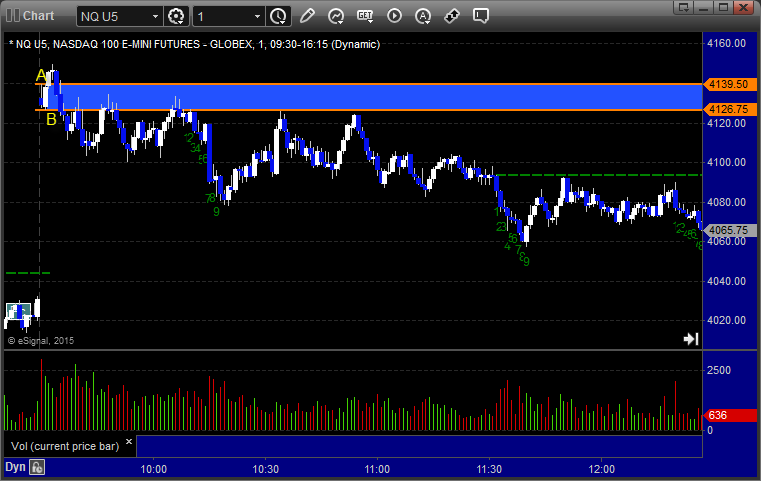

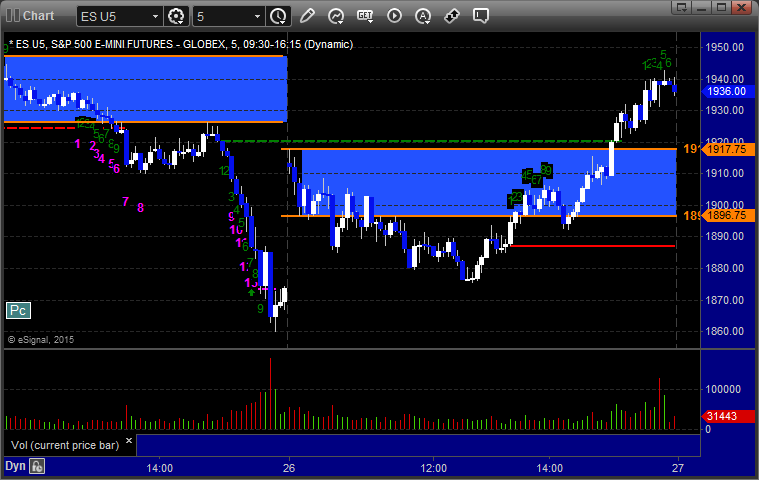

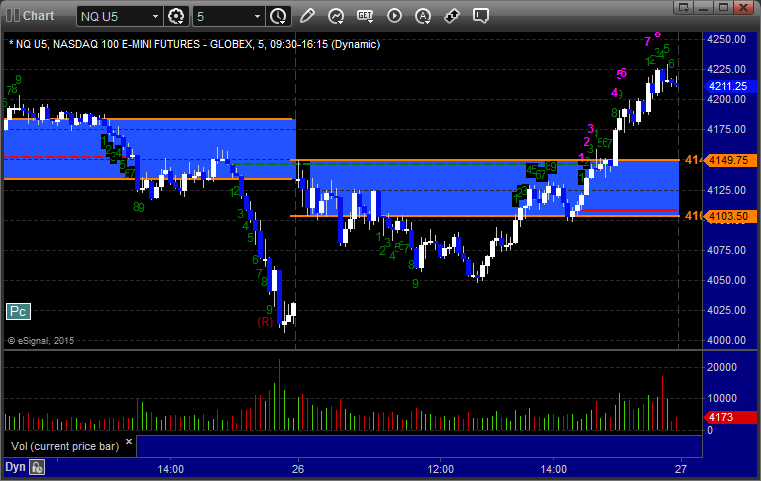

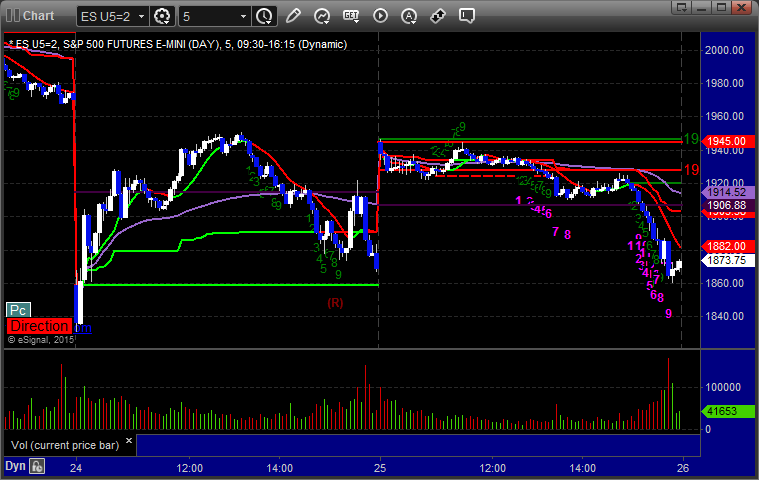

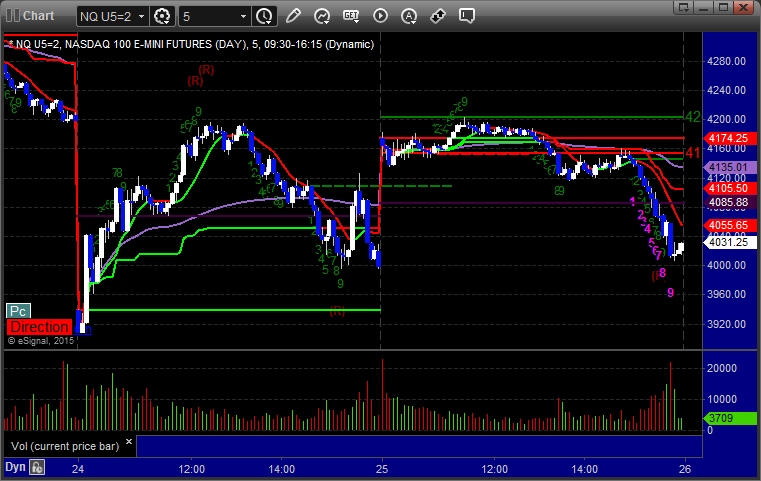

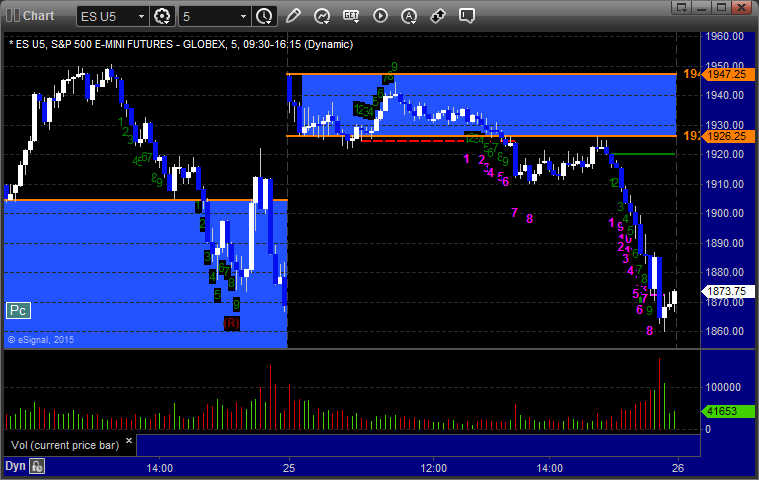

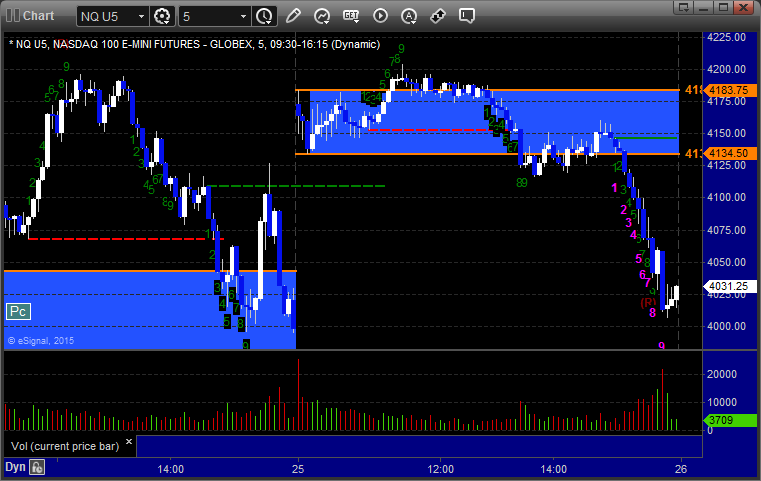

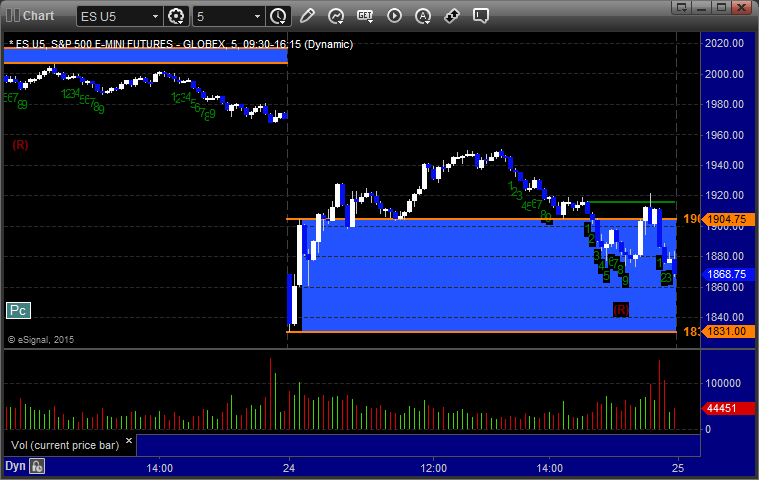

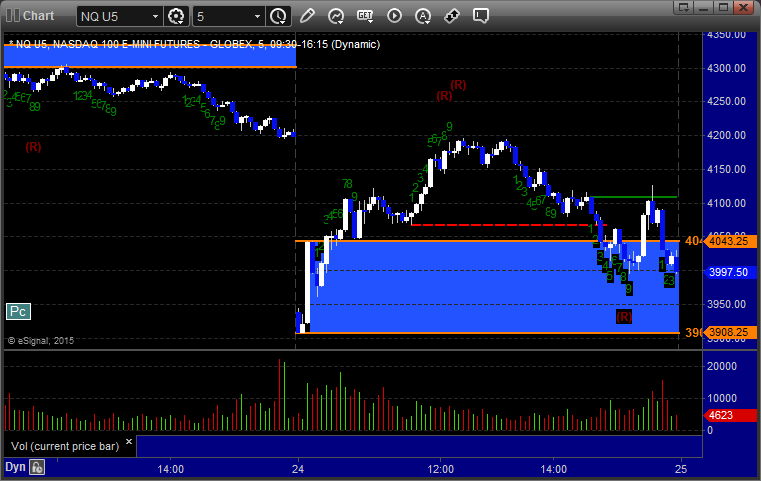

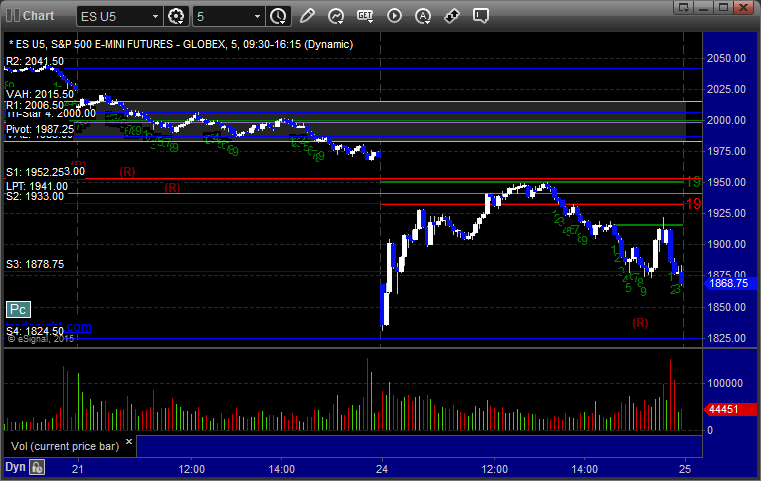

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work, triggered short at B and did:

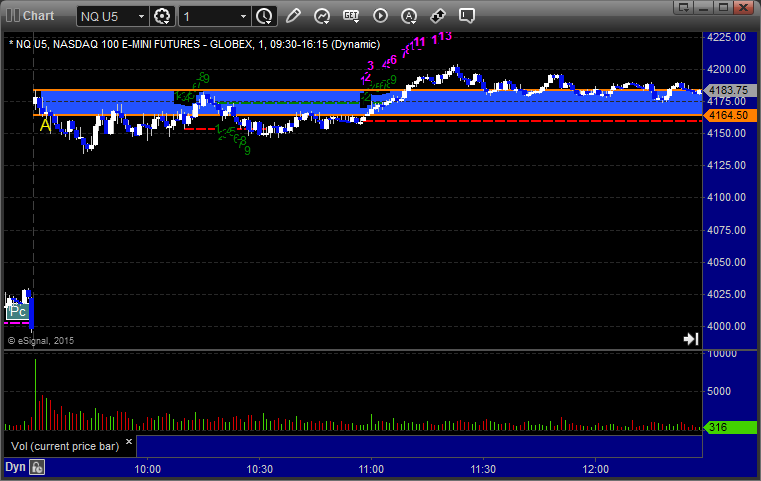

NQ Opening Range Play triggered long at A, which I said was too far outside of the range to take, but then triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 1906.00, hit first target for 6 ticks, stopped second half over entry:

Forex Calls Recap for 8/26/15

Another nice clean winner that is currently 200 pips in the money. See GBPUSD section below.

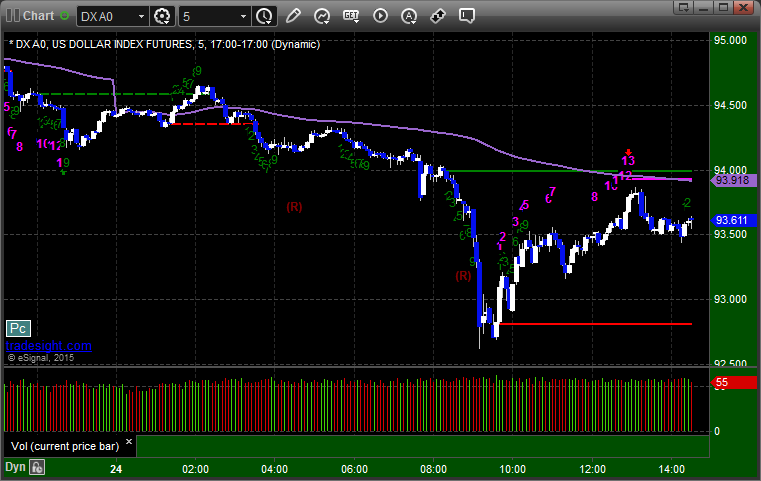

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, still holding second half with a stop at C, which will be 170 pips if it stops, or we will see if we can get more:

Stock Picks Recap for 8/25/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked enough for a partial:

His VLO triggered short (with market support) and worked enough for a partial:

His FB triggered short (with market support) and worked enough for a partial, once again it looks like a blip but it was $0.50:

His BIIB triggered long (without market support) and worked enough for a partial:

His AAPL triggered short (with market support) and worked great:

TSLA triggered short (with market support) and didn't work (swept), then worked later on the crack of the same level (we only count the first time officially):

Rich's BABA triggered long (without market support) and worked enough for a partial:

GS triggered short (with market support) and worked great:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

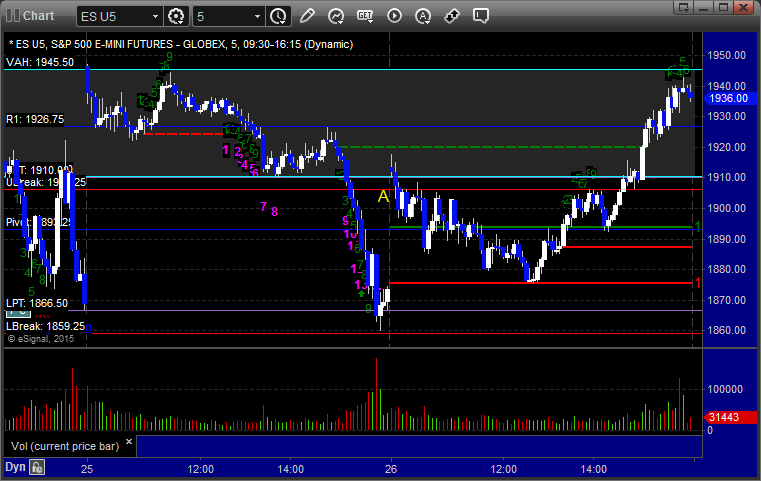

Futures Calls Recap for 8/25/15

The markets gapped up after the plunge on Monday and held up until after lunch in fairly tight range and then sold off sharply for the last hour to close in the red on 2.4 billion NASDAQ shares. The Opening Range plays worked great, so there was no need for main calls in the flat action. See that section below as we continue to take the easy trades in this volatility.

Net ticks: +0 ticks.

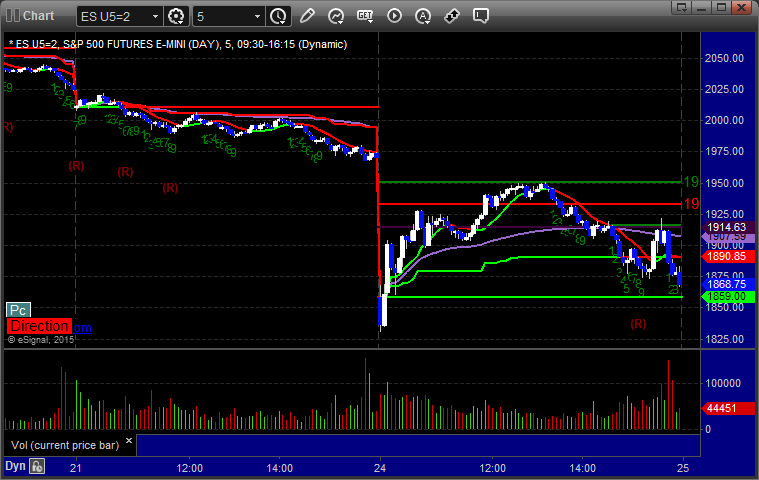

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/25/15

A slower night after the big one the prior day, and we stopped out of one trade, which is fine. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped at B:

Stock Picks Recap for 8/24/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered short (without market support) and worked enough for a partial, although it's just a blip now, but it did move over $0.50:

GILD triggered long (without market support because I stated that futures should take out the highs first) and worked:

AMGN triggered long (with market support) and worked:

Rich's PANW triggered long (with market support) and worked:

His LNKD triggered long (with market support) and worked:

His LRCX triggered long (with market support) and didn't work:

TSLA triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 8/24/15

With the gap and expected volatility, I passed on the Opening Range plays (although the ES Institutional Range play would have worked great). The markets recovered about 75% of the drop and then stalled out over lunch and picked up speed to the downside later in the session on 3.2 billion NASDAQ shares.

Net ticks: +0 ticks.

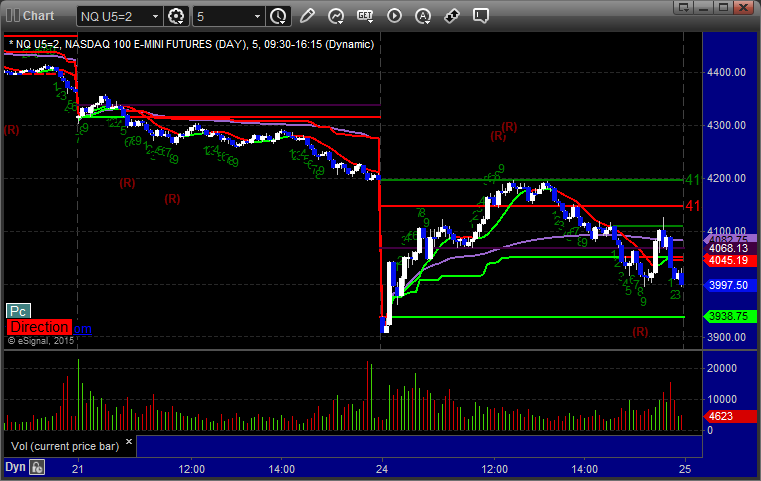

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked if you were interested:

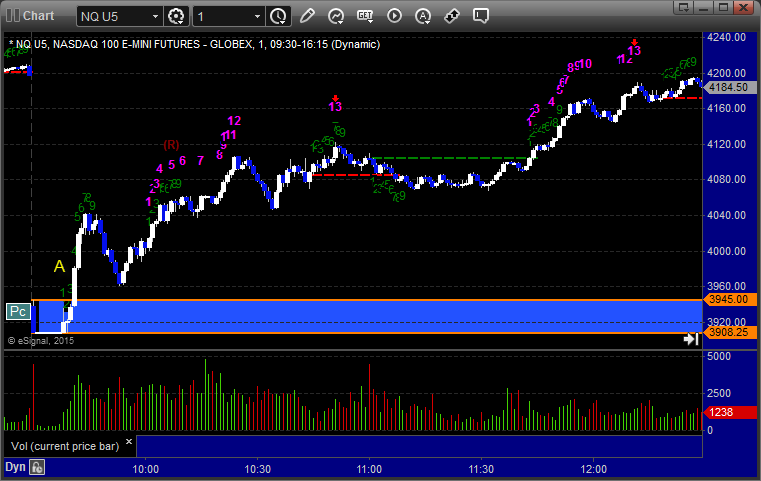

NQ Opening Range Play triggered long at A but was way too far outside the range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/24/15

Interesting times. We had a big winning session as the US Dollar tanked with everything going on in the world. See EURUSD section below. Strange time of year for winners this big.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, which looks like a blip now, and moved stop in the morning and stopped out at C for 200 pips: