Futures Calls Recap for 8/17/15

Super light volume day at 1.3 billion NASDAQ shares. The markets gapped down, did nothing for 30 minutes, and eventually came back up to fill and push higher.

Net ticks: +0 ticks.

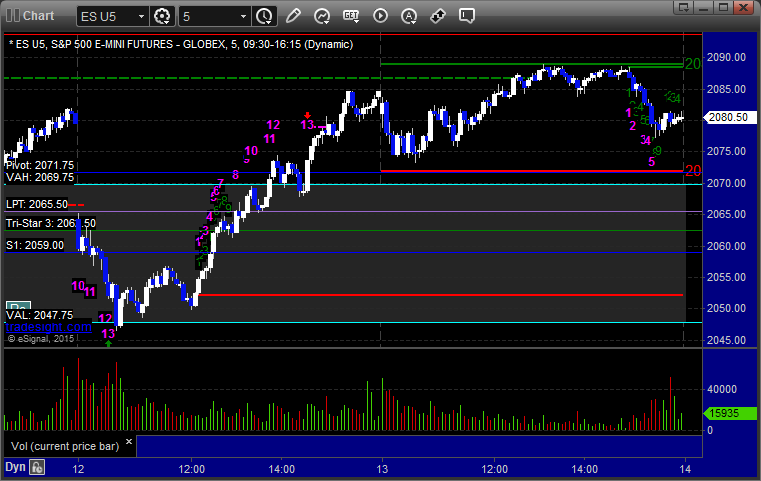

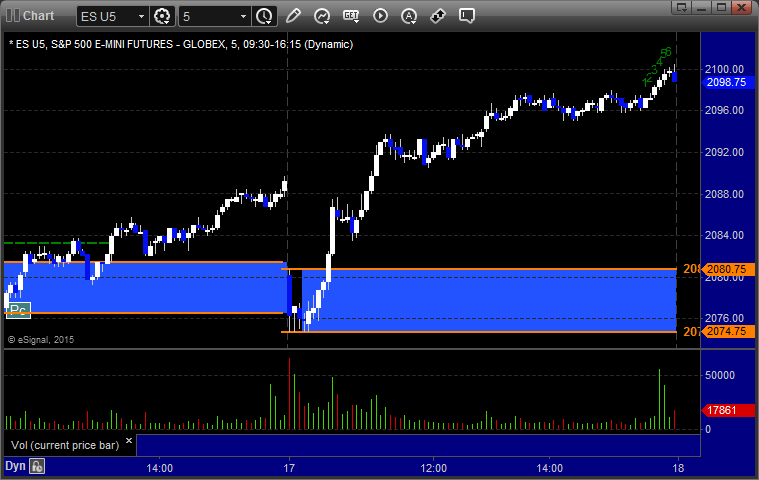

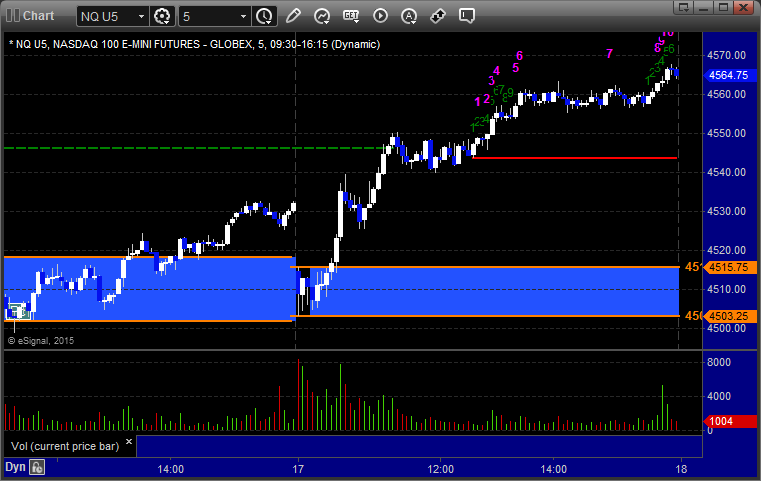

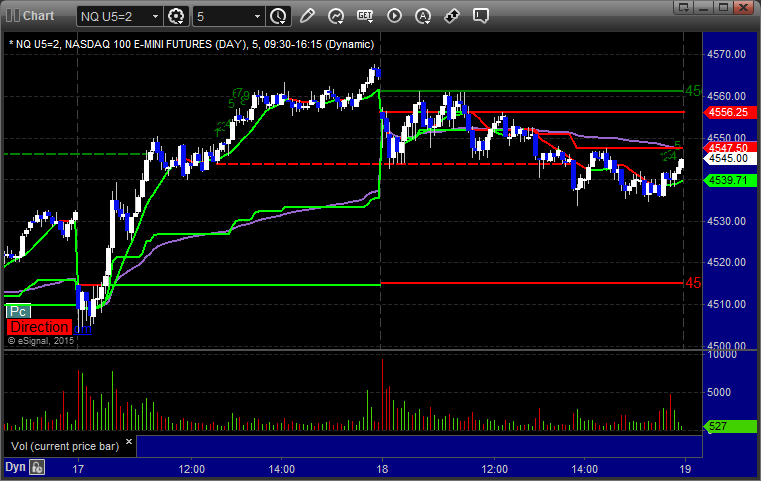

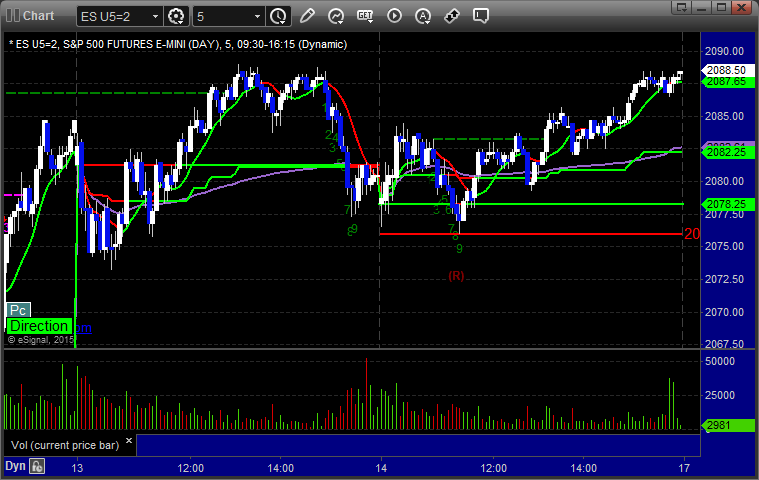

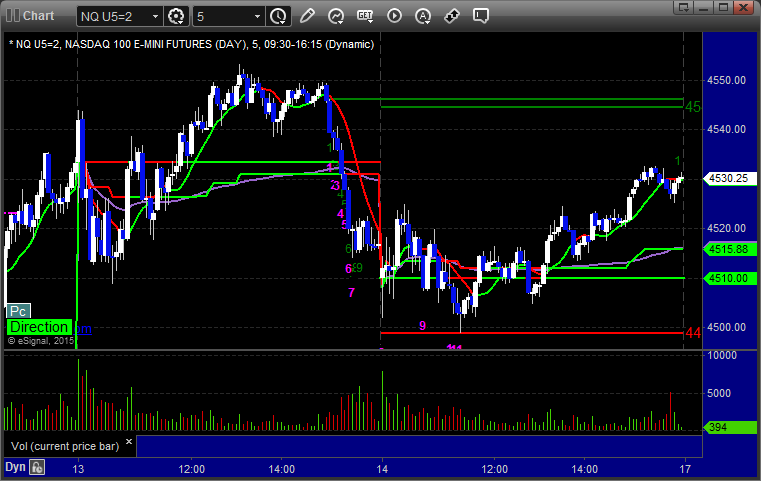

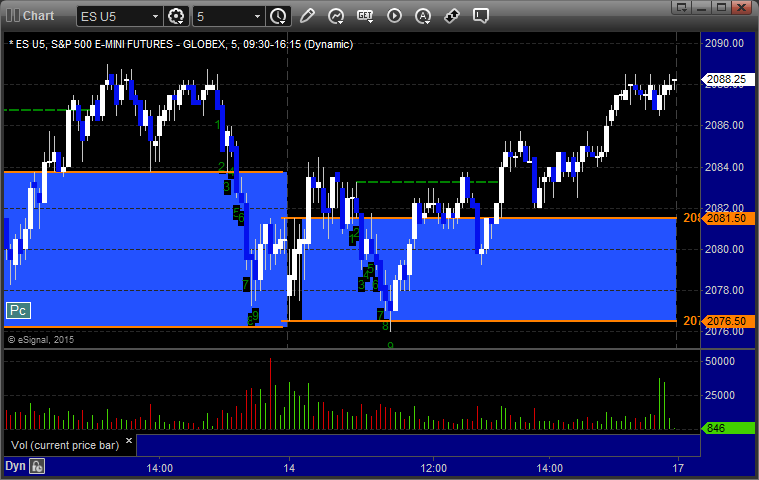

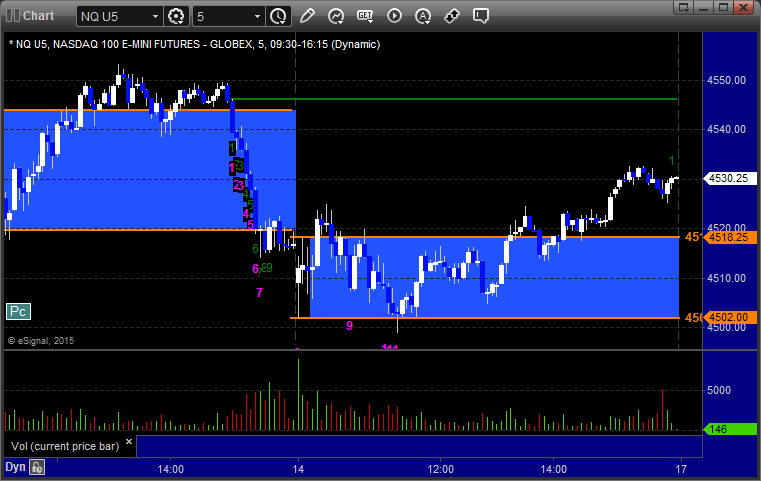

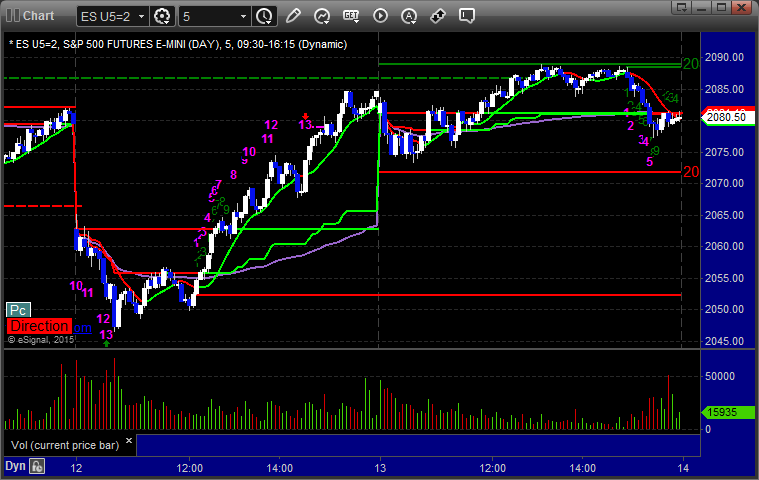

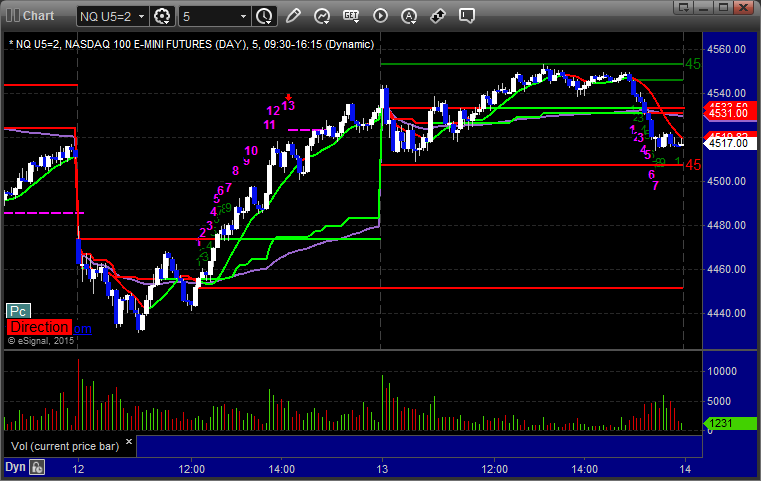

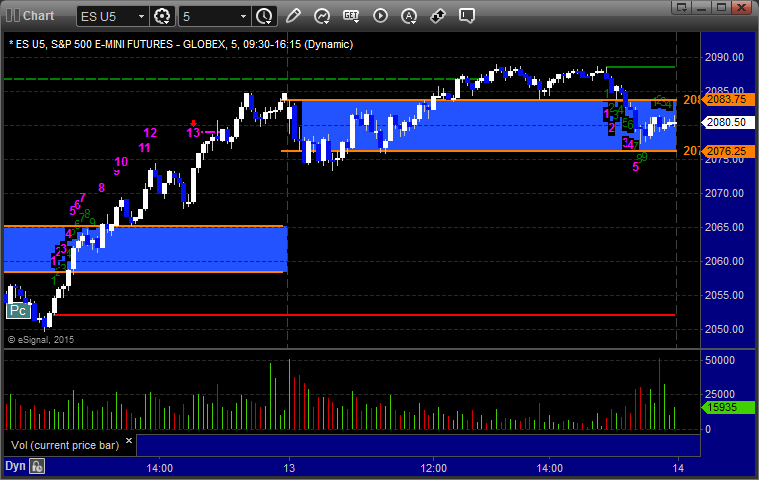

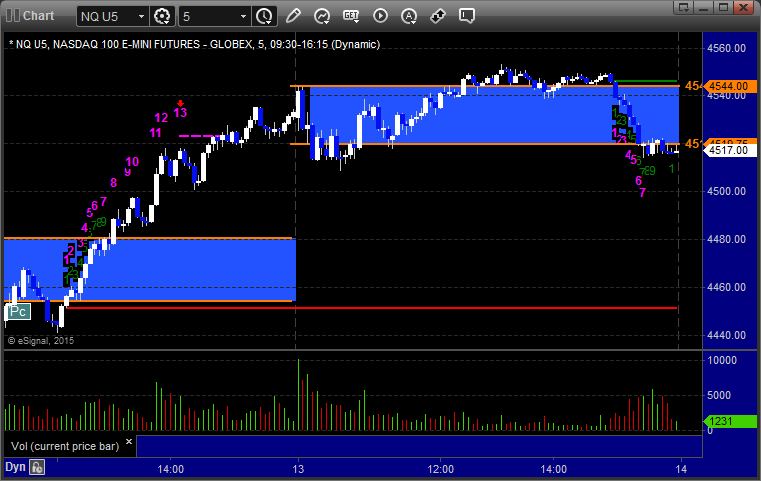

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

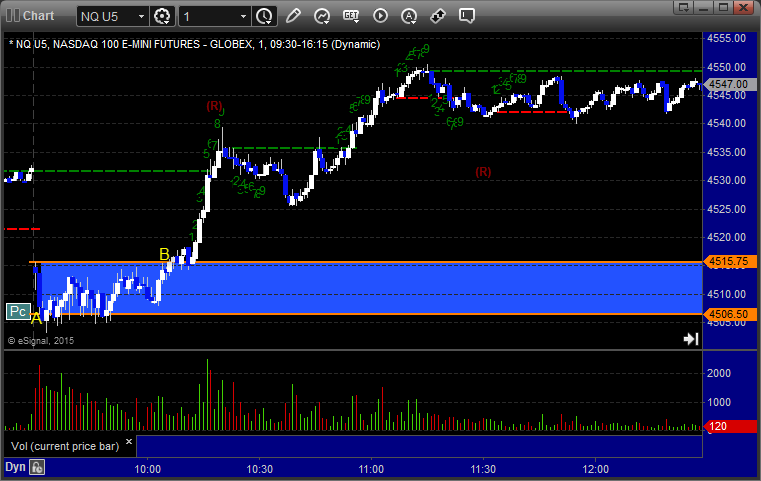

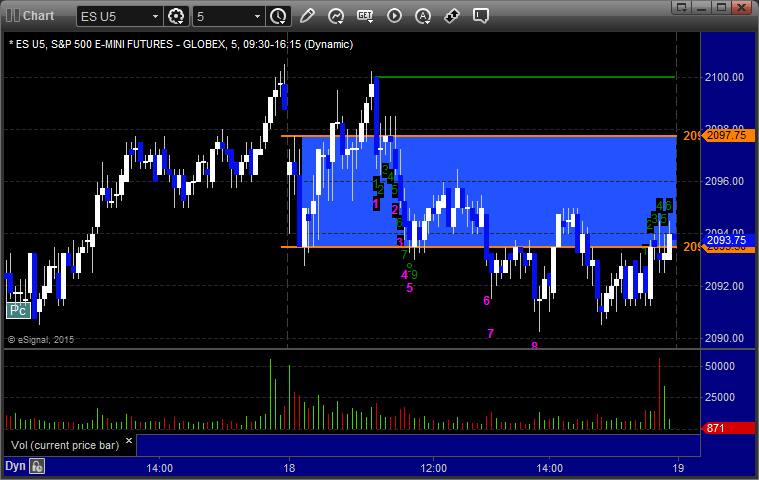

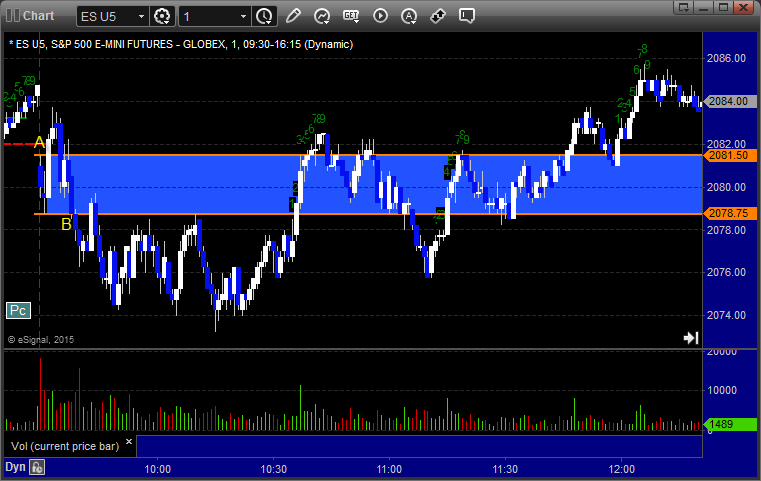

ES Opening Range Play triggered short at A and did nothing for a long time, eventually stopped, then triggered long at B and worked great:

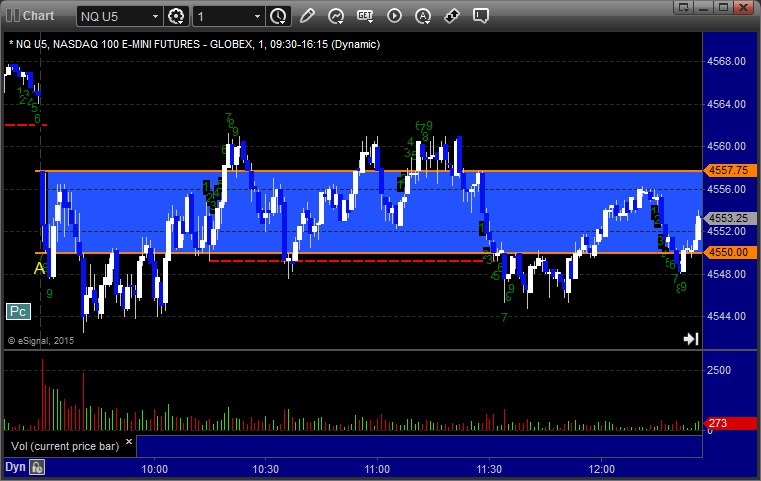

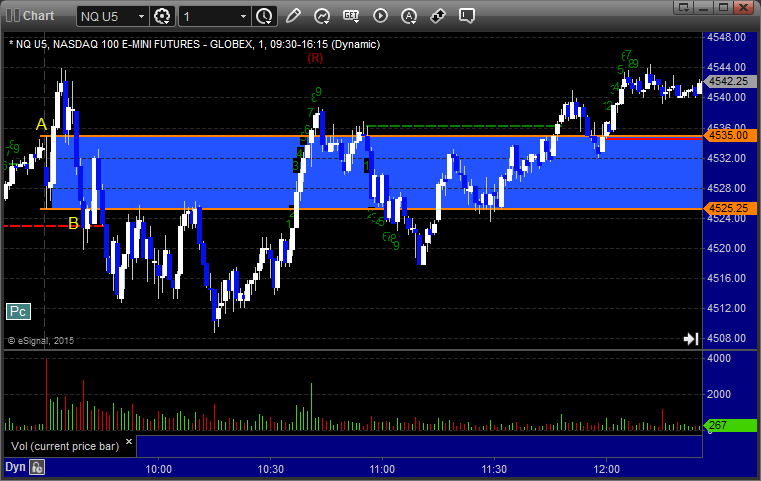

NQ Opening Range Play triggered short at A and did nothing for a long time, eventually stopped, then triggered long at B and worked great:

ES Tradesight Institutional Range Play:

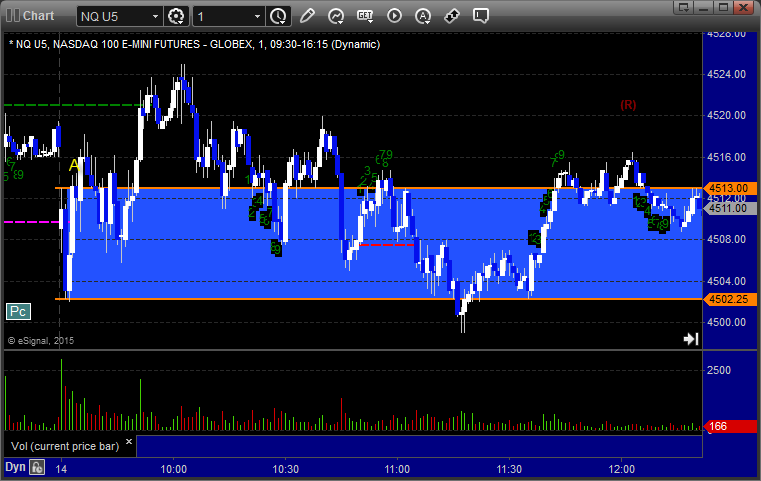

NQ Tradesight Institutional Range Play:

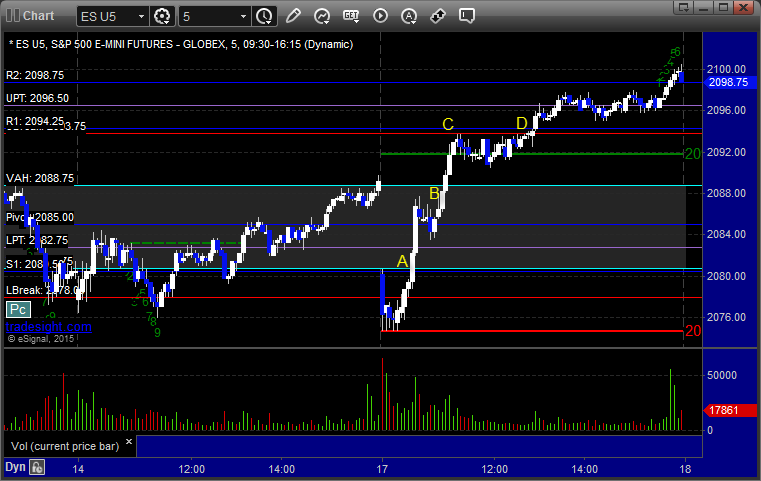

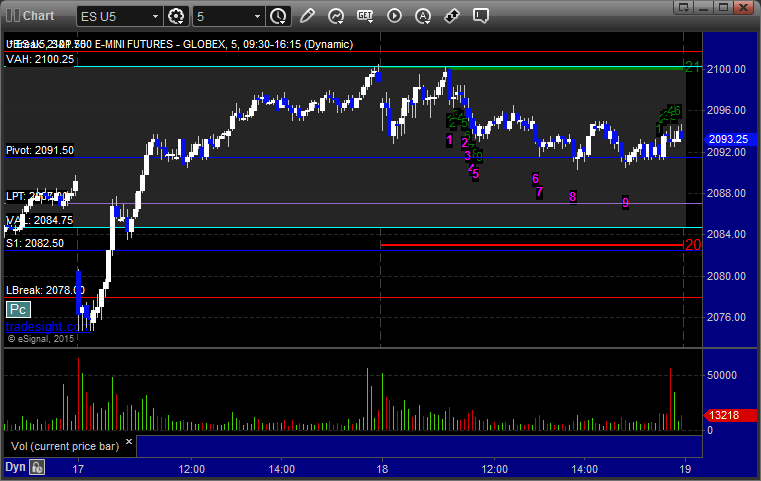

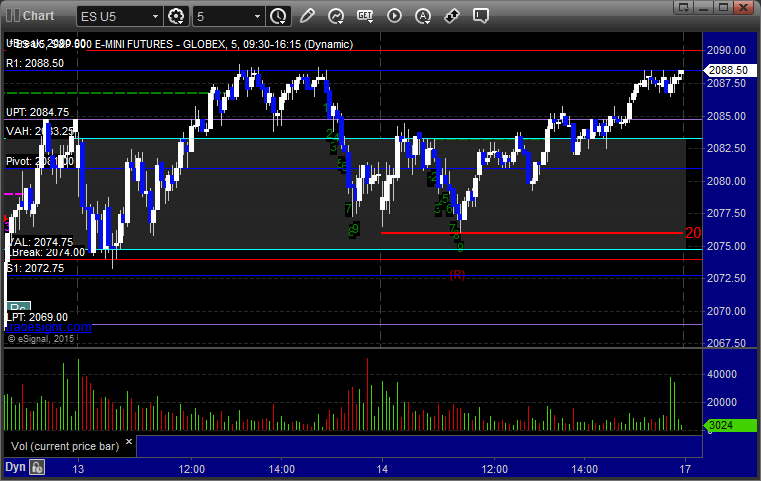

ES:

The main call didn't trigger, but note the great Value Area play that triggered at A and crossed the Value Area to B, and then another perfect setup against UBreak at C that triggered at D, right out of the course:

Forex Calls Recap for 8/17/15

August doldrums continue as the pairs stayed contained for the session. See EURUSD and GBPUSD sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

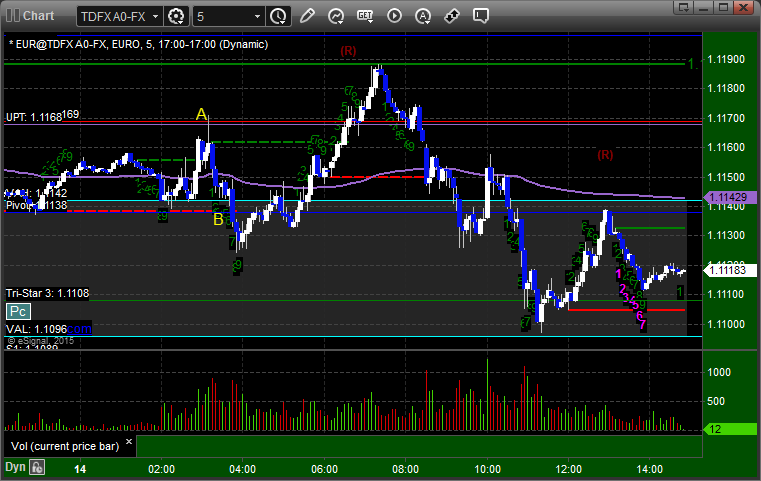

EURUSD:

Triggered short at A and stopped:

GBPUSD:

Triggered long at A and stopped:

Stock Picks Recap for 8/18/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EXPD triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TJX triggered long (with market support) and didn't work:

His FB triggered long (with market support) and worked:

Mark's LNKD triggered short (with market support) and worked enough for a partial:

WYNN triggered short (with market support) and worked enough for a partial:

Rich's NTAP triggered short (with market support) and didn't work:

Mark's SNDK triggered short (without market support) and didn't work:

Rich's ROST triggered long (without market support) and didn't work:

His ANFI triggered short (with market support) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

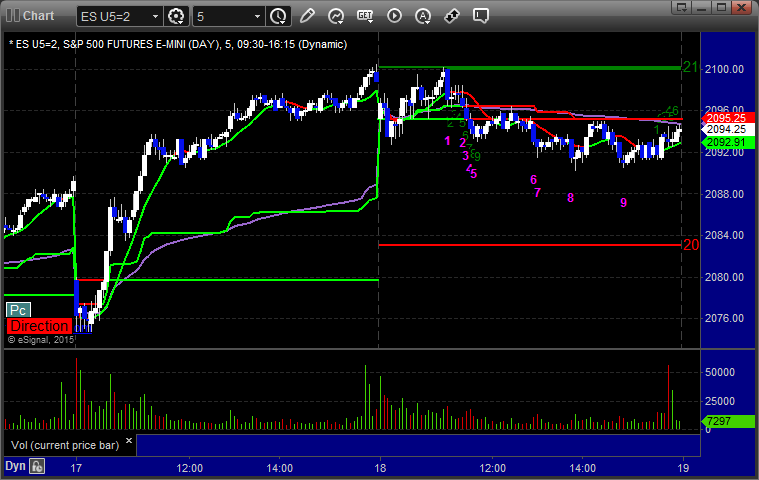

Futures Calls Recap for 8/18/15

A good day to not post any calls. The markets gapped down a little and took an hour or more to fill. Volume was super light and will likely continue to be until the end of next week. Even nice technical setups like the ES against the Pivot today have a lesser chance of working without volume. We drifted lower and closed near lows on 1.25 billion NASDAQ shares. Mixed bag for once on the Opening Range Plays. See that section below.

Net ticks: +0 ticks.

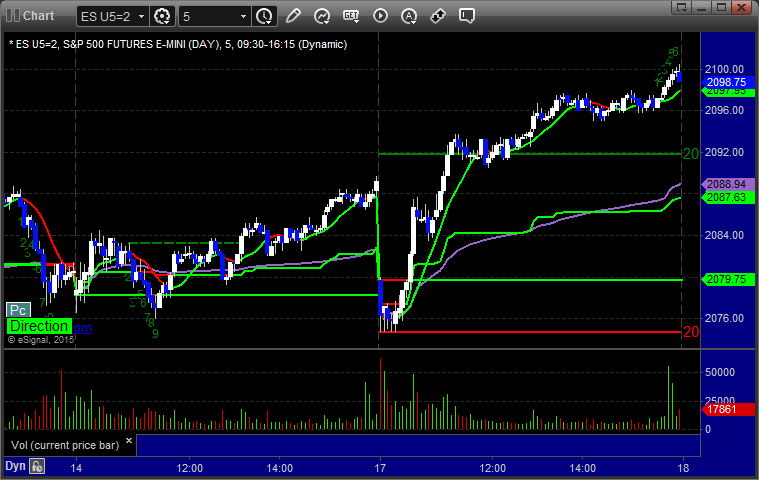

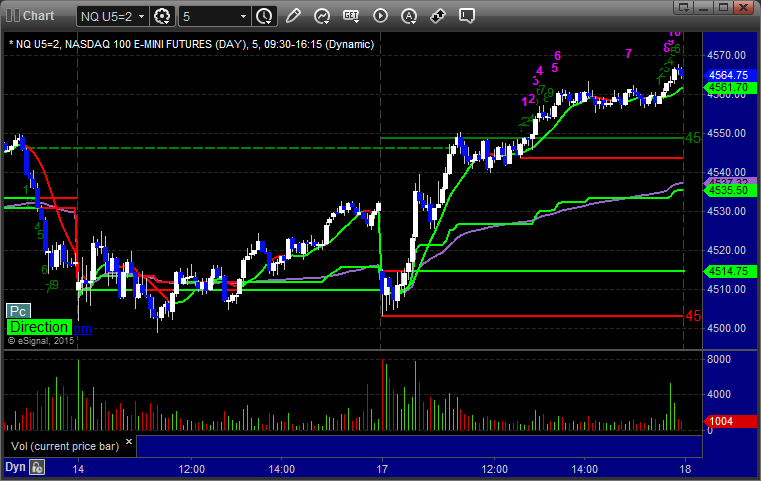

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and short at B and didn't work:

NQ Opening Range Play triggered short at A and worked eventually:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/18/15

A loser and a winner on a news spike. See GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

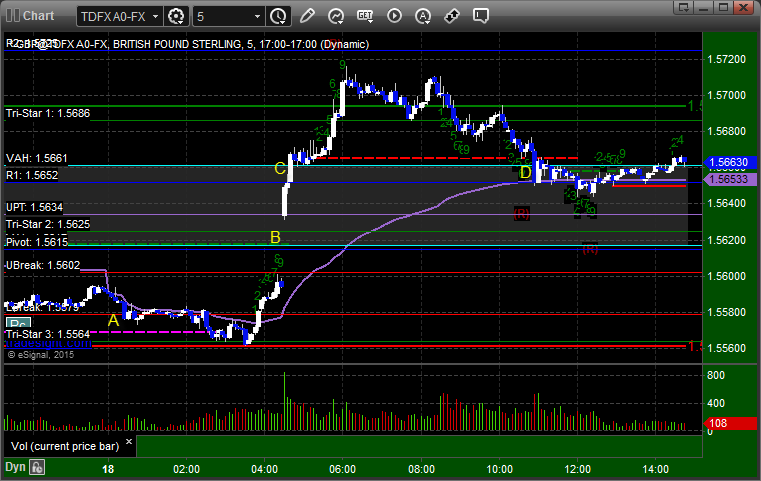

GBPUSD:

Triggered short at A and stopped. Triggered long at B although on a spike so if you got filled, then hit first target at B and raised stop to C:

Stock Picks Recap for 8/14/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SBAC triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, WYNN triggered short (without market support) and worked:

Mark's ASML triggered short (without market support) and worked:

In total, that's 1 trade triggering with market support, and it worked.

Futures Calls Recap for 8/14/15

A boring summer session as expected. Opening range plays worked, see that section below. The markets stayed mostly in the Value Area and NASDAQ volume was only 1.4 billion shares.

Net ticks: +0 ticks. Opening range plays both worked.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked if you were willing to take it that far above the OR high:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/14/15

After a couple of days of winners, back to August summer doldrums with a sweep both ways. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered long at A and didn't work, triggered short at B and didn't work:

Stock Picks Recap for 8/13/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TTEK triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's NTES triggered short (with market support) and worked:

Rich's TSLA triggered short (without market support) and didn't work:

GOOG triggered short (with market support) and didn't work:

AAPL triggered short (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Futures Calls Recap for 8/13/15

The markets gapped down a little and went lower, but finally came back up over lunch to fill the gap and that was about it for the session on 1.5 billion NASDAQ shares. We closed right where we opened. It's a measuring day after the gaps and swings of the last three. Opening range plays worked net and that's about it. No levels touched on the ES for a main call.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work. Triggered short at B and did:

NQ Opening Range Play triggered long at A and worked enough for a partial. Triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES: