Forex Calls Recap for 8/13/15

Stopped out of the second half of the prior day's trade and had a new minor winner in the EURUSD. See that section below. Still pretty unexciting summer action.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, stopped second half at C:

Stock Picks Recap for 8/12/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

An interesting day where a lot of trades worked, even the ones that triggered without market support.

From the report, CONE triggered long (without market support) and worked great:

SINA triggered short (without market support due to opening 5 minutes) and worked:

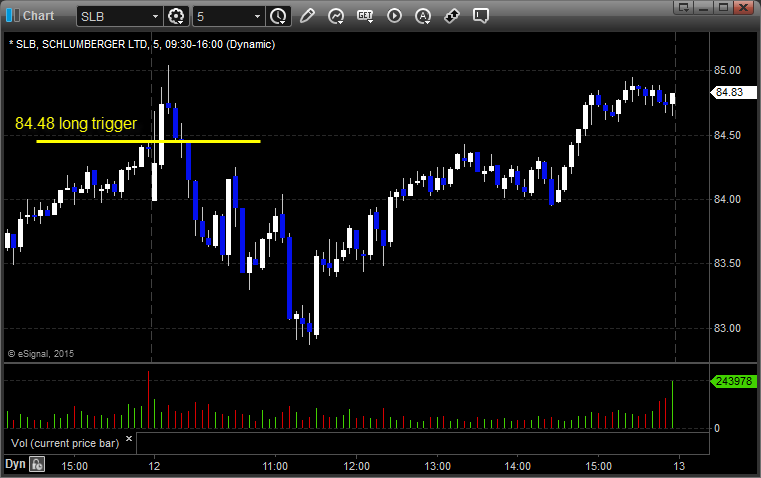

From the Messenger/Tradesight_st Twitter Feed, Rich's SLB triggered long (without market support due to opening 5 minutes) and worked:

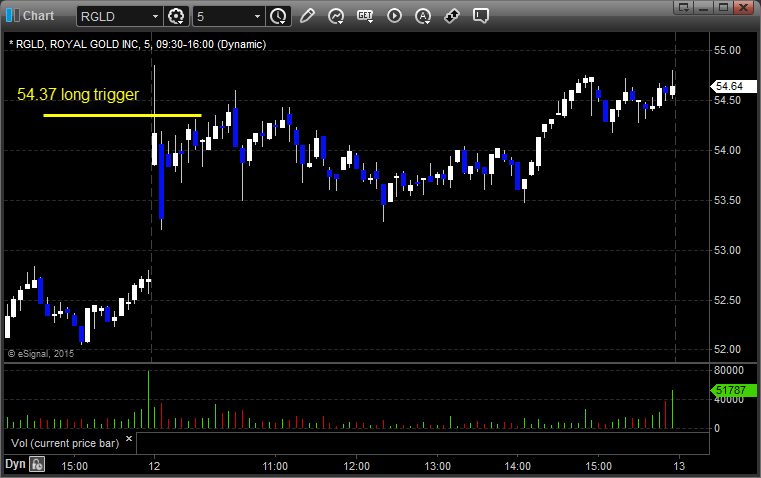

His RGLD triggered long (without market support due to opening 5 minutes) and didn't work:

AMGN triggered short (with market support) and worked:

GOOG triggered short (with market support) and worked enough for a partial:

Rich's CVX triggered long (without market support) and didn't work, worked later:

His BABA triggered long (without market support) and worked enough for a partial:

Rich's AAPL triggered long (without market support) and worked great:

NFLX triggered short (with market support) and worked:

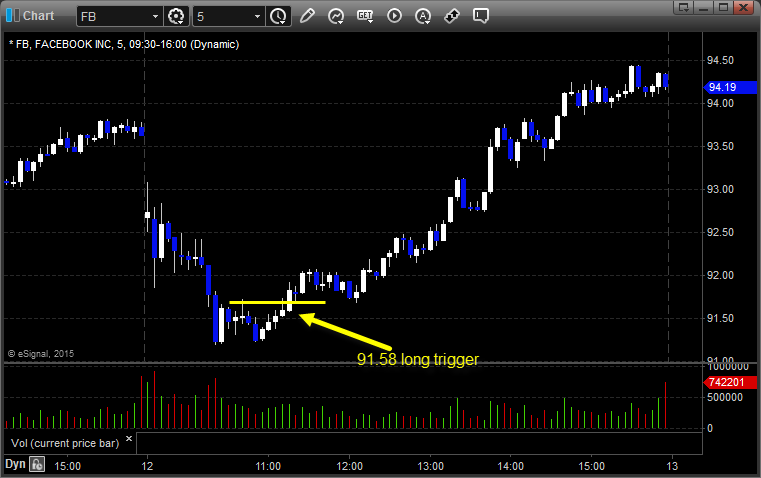

Rich's FB triggered long (without market support) and worked:

His TWTR triggered long (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not. Another 5 trades worked great, including the top long off of the report, just without market support.

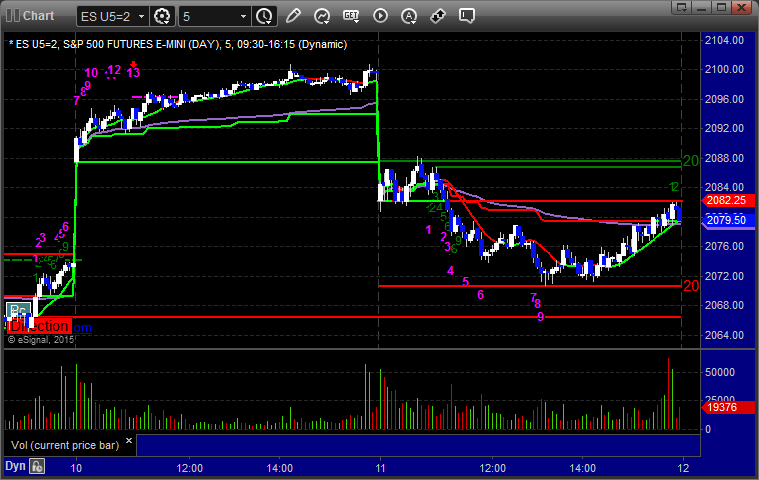

Futures Calls Recap for 8/12/15

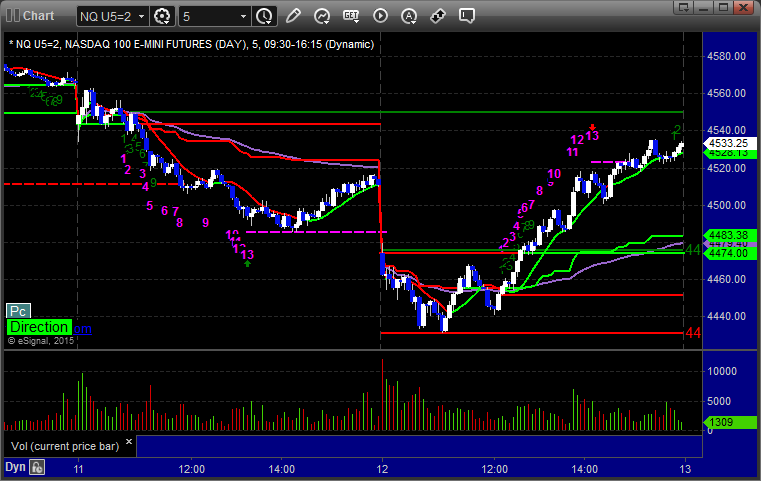

Some nice opening range plays again and nothing else official. The market gapped down and pushed lower initially, but then recovered to close slightly positive on 1.9 billion NASDAQ shares.

Net ticks: +0 ticks. Both Opening Range Plays worked.

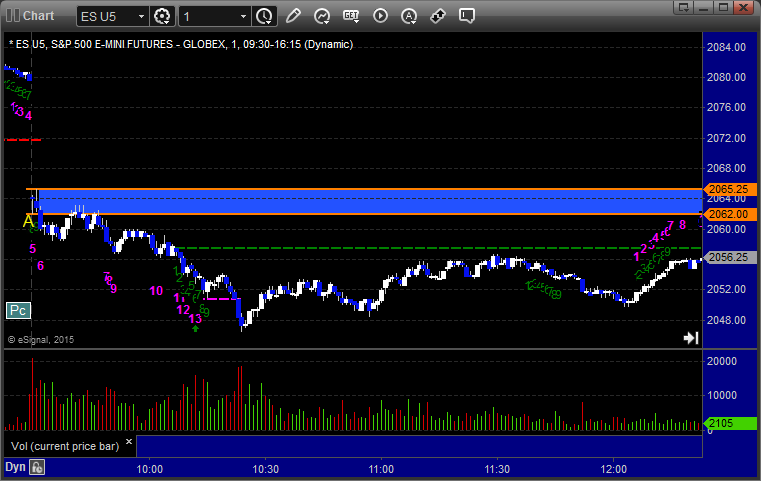

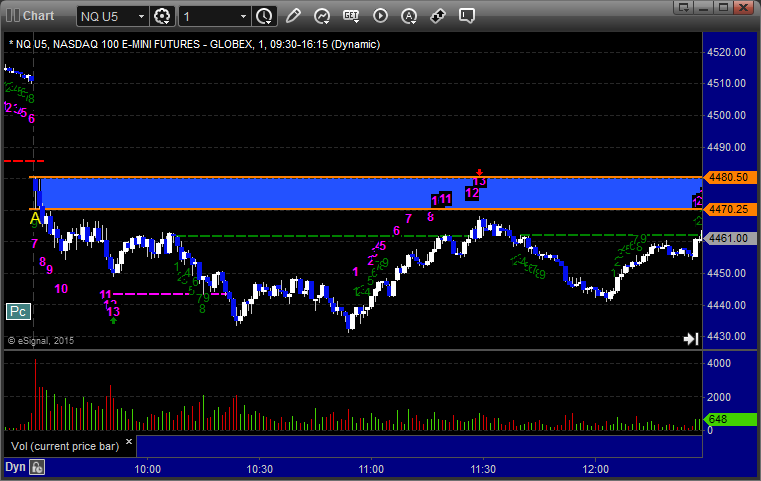

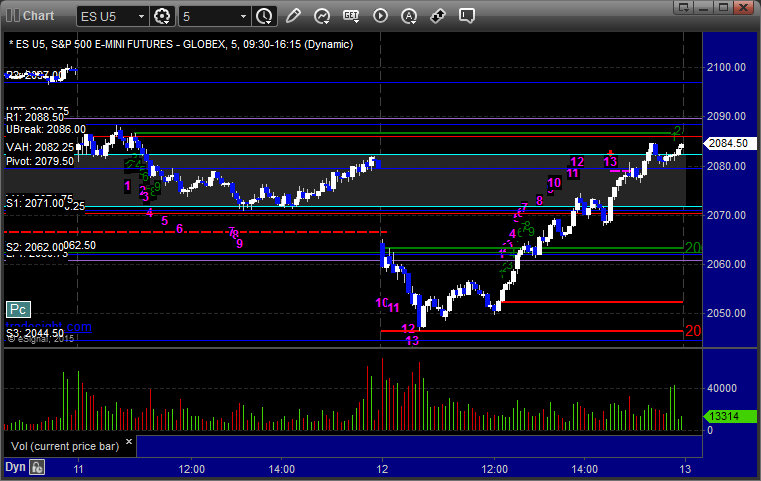

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/12/15

Finally a nice session. We have a solid winner on the EURUSD, which is still going. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under R2 at C:

Stock Picks Recap for 8/11/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AFFX triggered short (with market support) and held in the money all day but didn't go far:

From the Messenger/Tradesight_st Twitter Feed, GS triggered short (with market support) and worked:

Rich's TSLA triggered short (with market support) and didn't work:

His GPRO triggered short (with market support) and worked:

GOOG triggered short (with market support) and worked:

Rich's AAPL triggered long (without market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

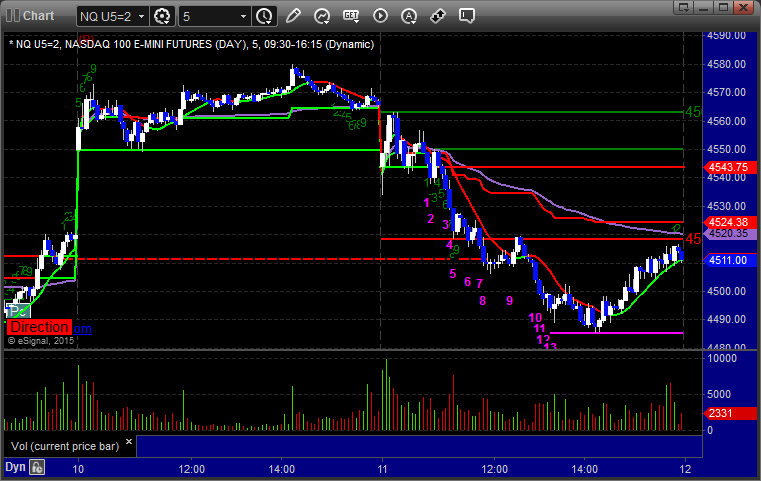

Futures Calls Recap for 8/11/15

A loser and a winner for the session, which started out dull stuck between two key levels for a long time. We did have light volume and eventually moved lower, potentially leaving a floating island above from the gap down. NASDAQ volume was 1.6 billion shares.

Net ticks: -1.5 ticks.

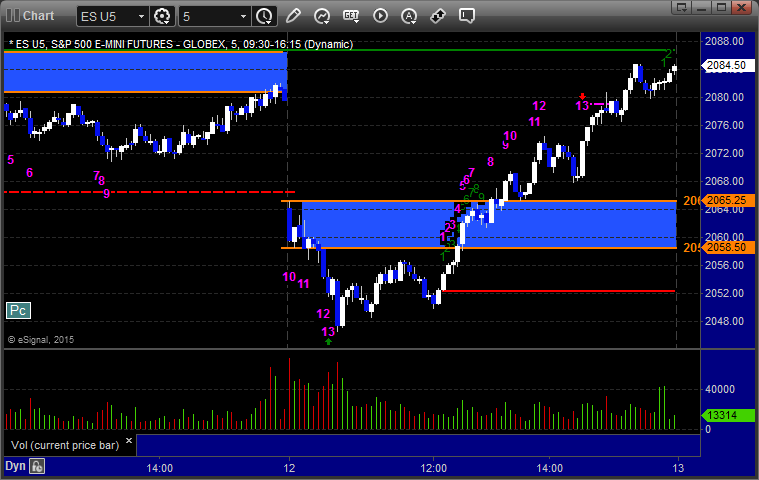

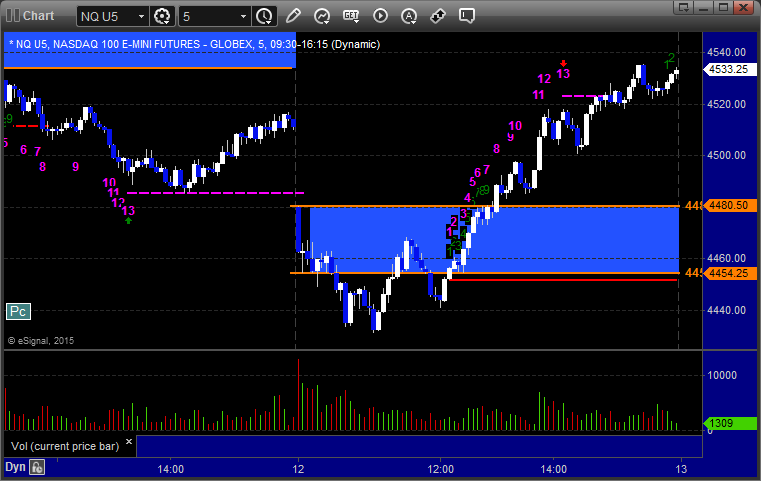

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial eventually:

NQ Opening Range Play triggered short at A and worked enough for a partial. Triggered long at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

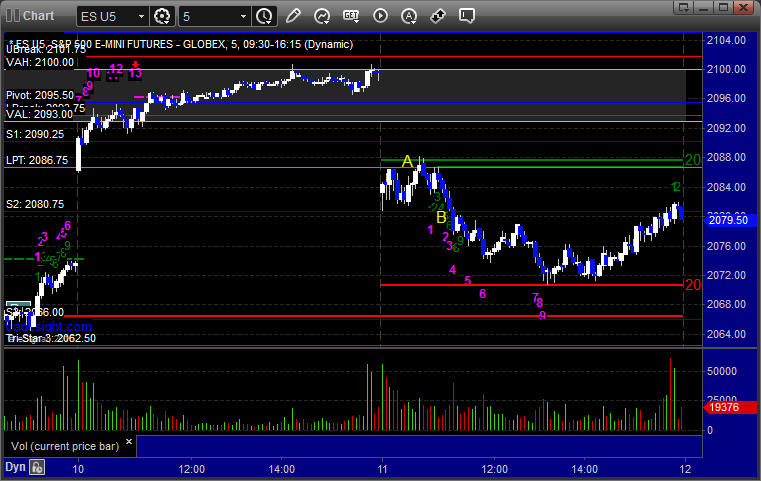

ES:

My long call triggered at A at 2087.00 and stopped for 7 ticks. My short triggered at B at 2080.50 and hit a partial for 6 ticks, stopped second half 5 ticks in the money:

Forex Calls Recap for 8/11/15

Yikes, only 50 pips of range on the GBPUSD for the session. We stopped out of the second half of the prior day's call in the money, but the new call stopped due to the narrow range. See that section below.

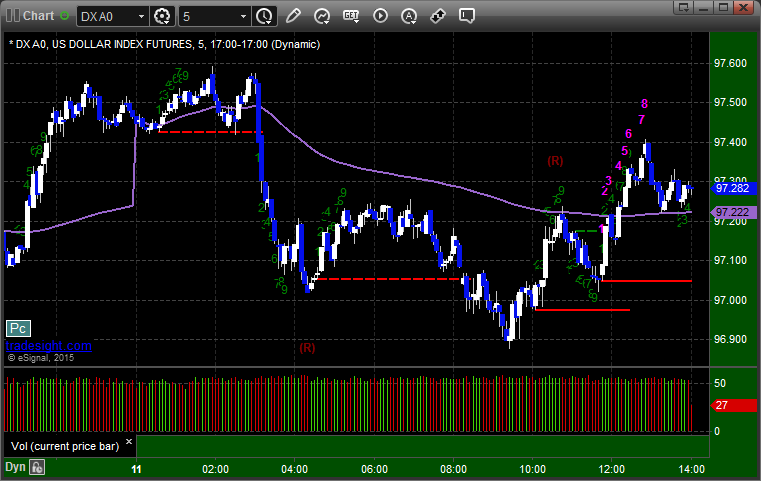

Here's a look at the US Dollar Index intraday with our market directional lines:

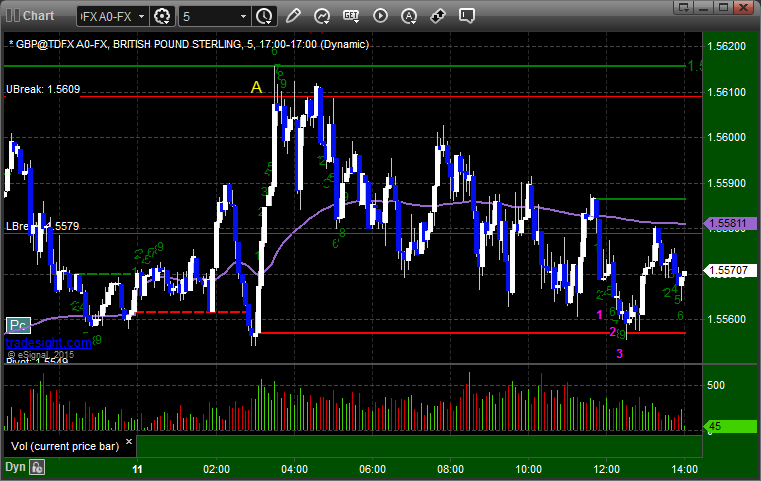

GBPUSD:

The second half of the prior day's long stopped in the money. New call triggered at A and stopped:

Stock Picks Recap for 8/10/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CTAS triggered long (without market support due to opening 5 minutes) and worked:

NVDA triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, TSLA triggered short (without market support) and didn't work:

FSLR triggered long (with market support) and didn't work:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

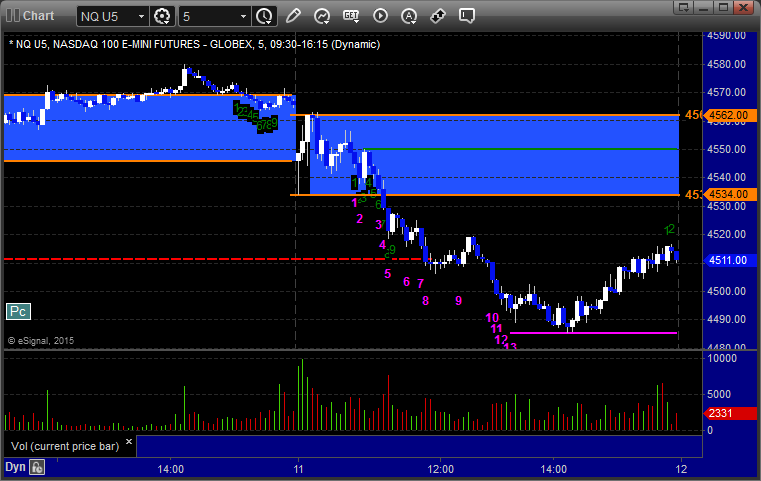

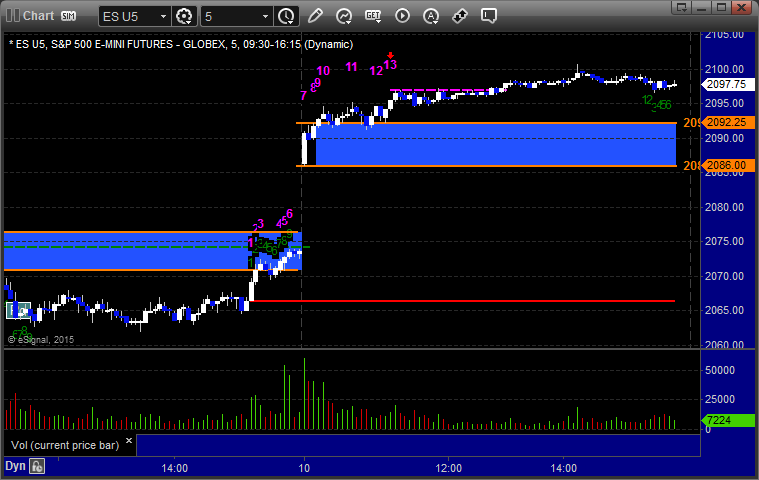

Futures Calls Recap for 8/10/15

The markets gapped up on a Monday to start the week and never looked back. Frankly, they just drifted higher without much volatility and only covered about 2/3rds of average daily range. The ES barely touched one level for the session. The Opening Range plays did work though.

Net ticks: +0 ticks. Opening Range plays worked again.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 8/10/15

Another boring August session, especially during the European hours (feels like Europe is more on vacation than the US as usual). See GBPUSD section below for 2 stopouts and a winner still going.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. Triggered short at B and stopped. Triggered long at C, hit first target at D, still holding second half with a stop under E: