Futures Calls Recap for 7/31/15

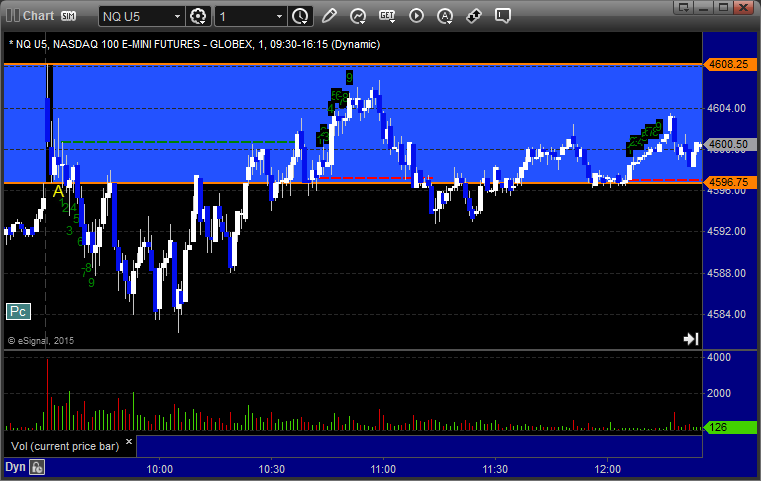

No regular calls for the final session of the month, which we knew would be light due to the end of month and a summer Friday. However, the Opening Range plays still worked once again. NASDAQ volume closed at a weak 1.4 billion shares.

Net ticks: +0 ticks.

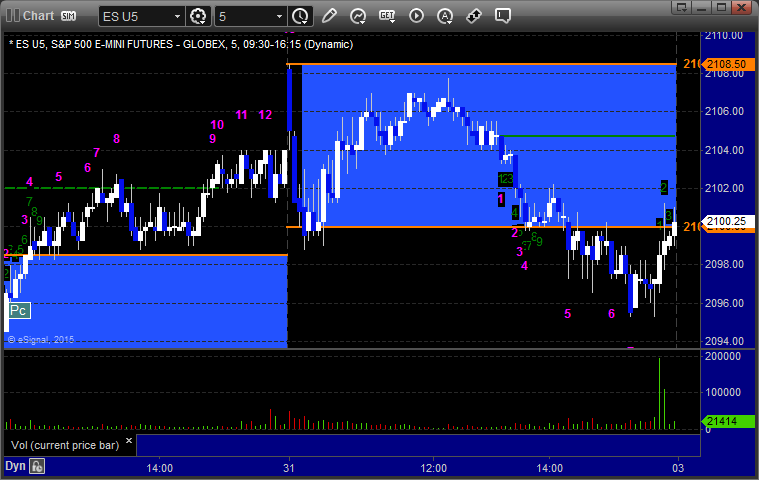

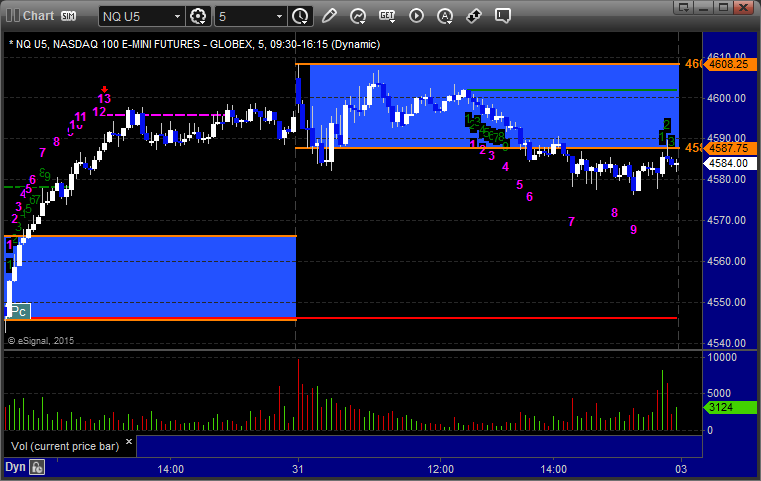

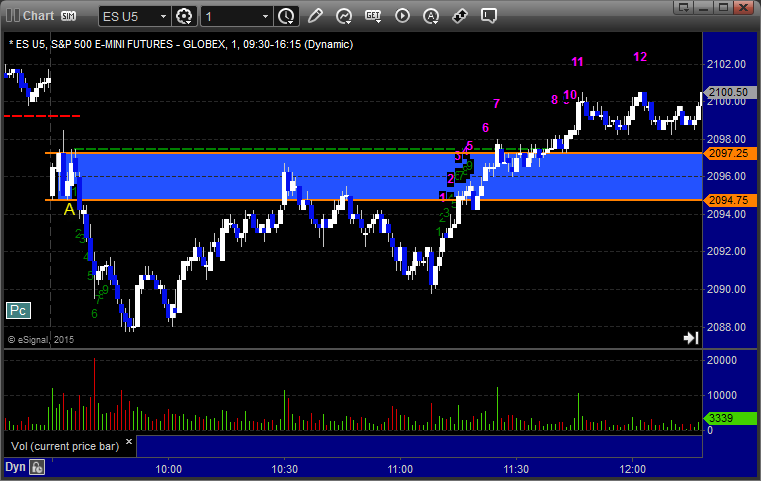

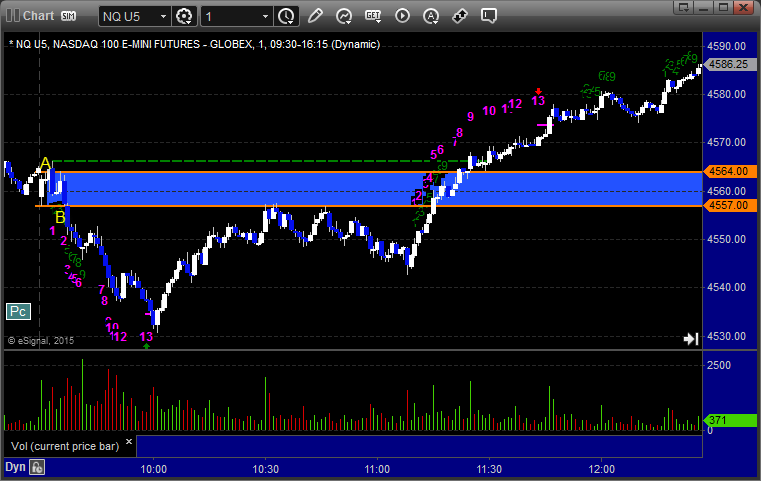

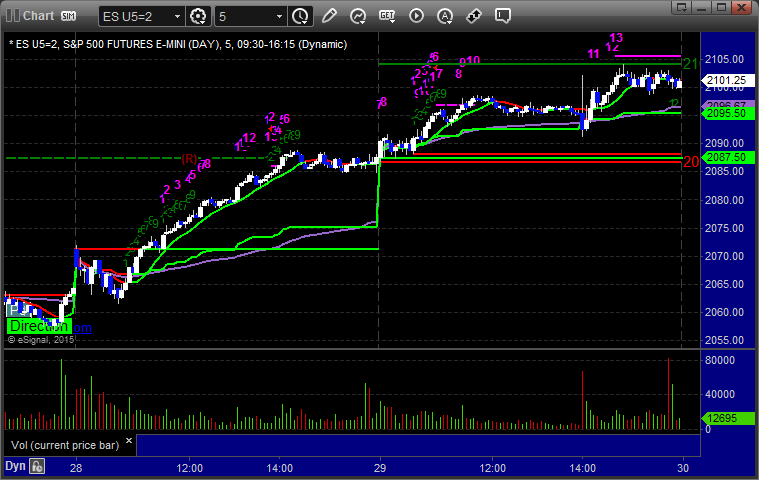

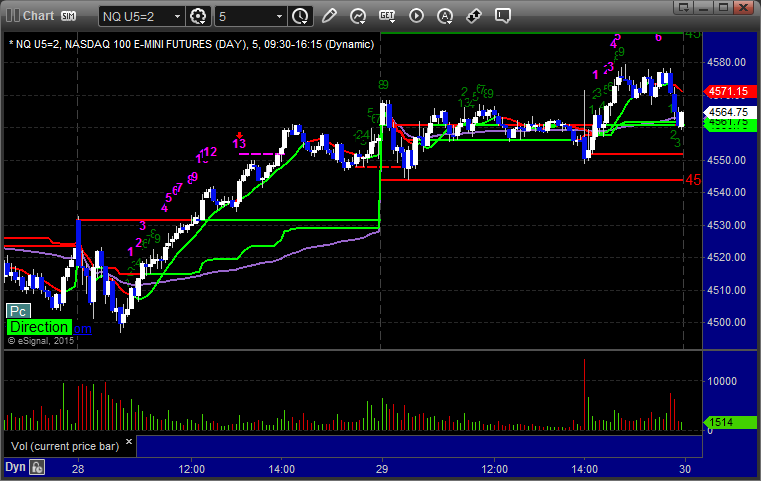

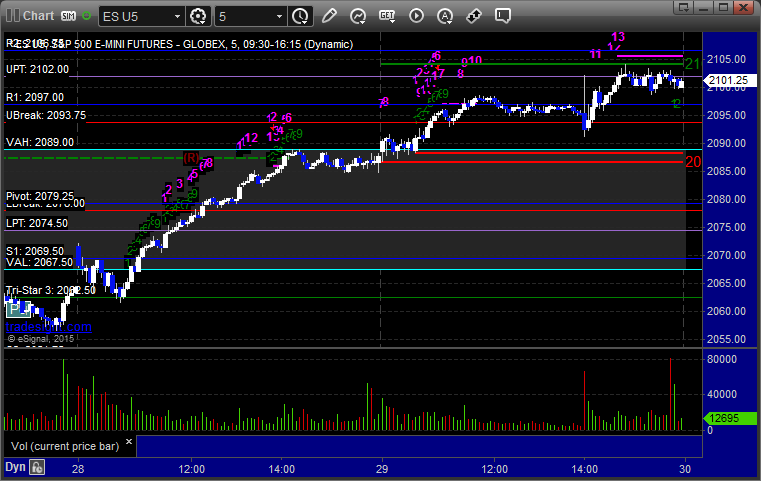

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

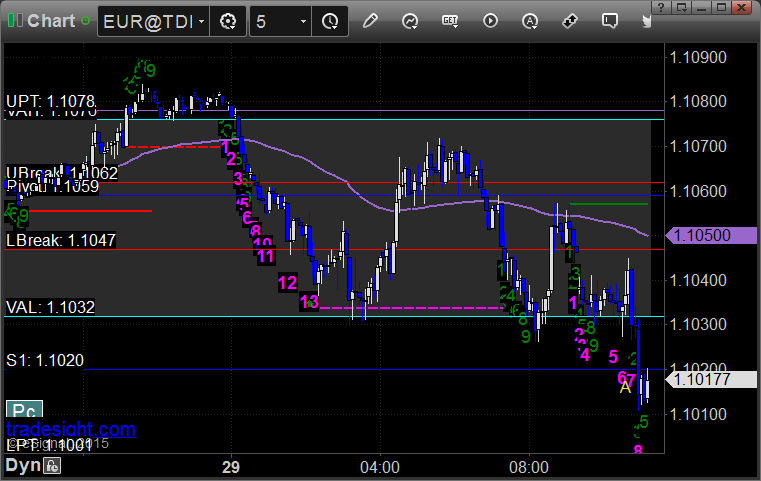

Forex Calls Recap for 7/31/15

A terrific end to the month as we had a EURUSD winner that went 140 pips to the final exit. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered long over UBreak at A (and earlier, gave you plenty of time to enter), never went 20 pips against, and hit first target at B, closed second half at C for 140 pips:

Stock Picks Recap for 7/30/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, XRAY gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Mark's TEVA triggered short (with market support) and worked:

His CREE triggered long on a sweep (with market support) late in the session and didn't work:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 7/30/15

A nice winner and some Opening Range play action as well as we prepare to wrap the month of July. The markets gapped down, went lower, came back over lunch to close the gap, and closed on the VWAP. NASDAQ volume was 1.7 billion shares.

Net ticks: +8.5 ticks.

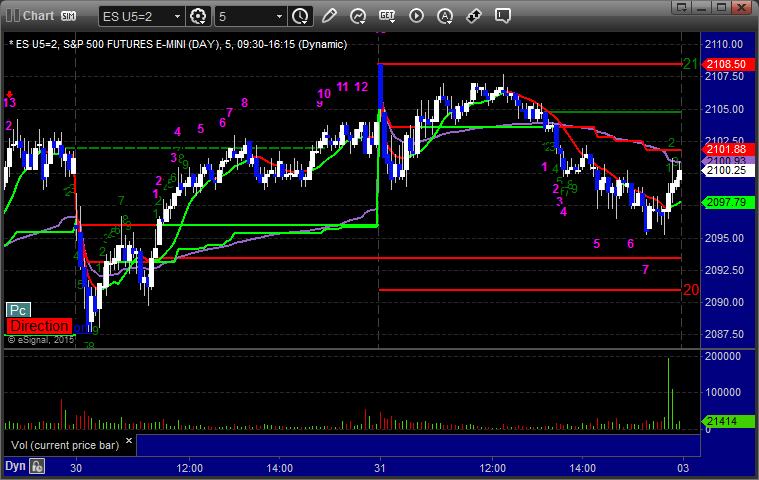

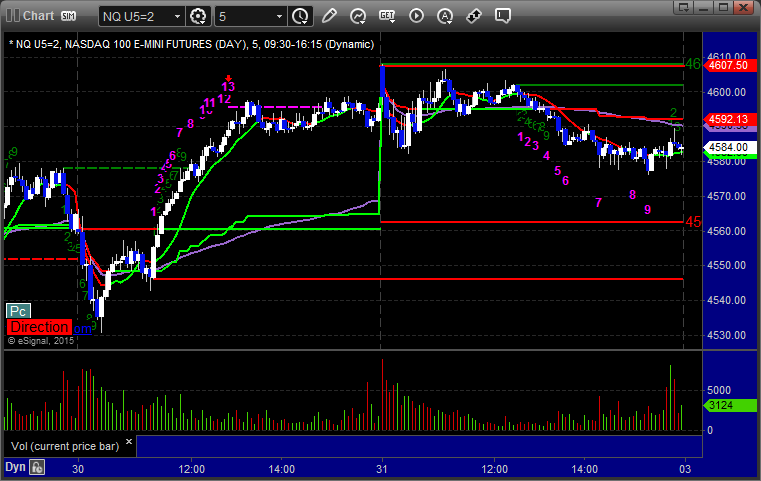

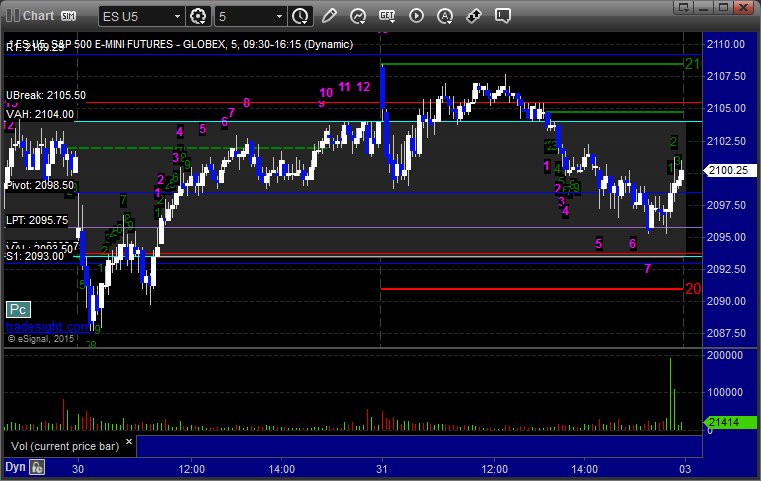

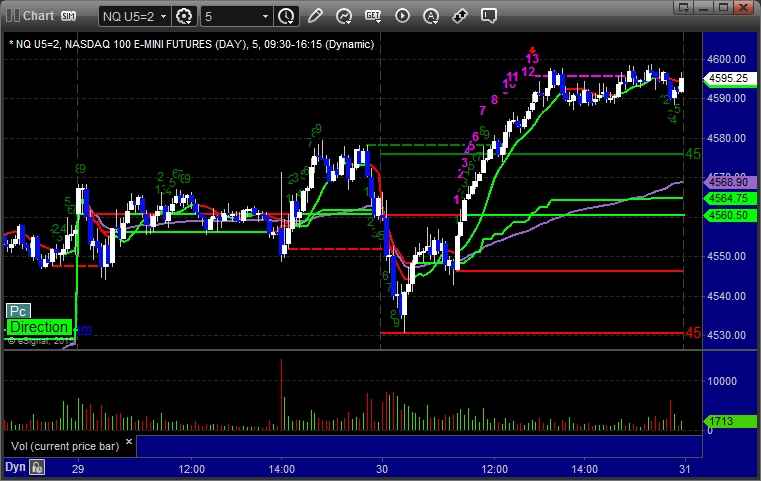

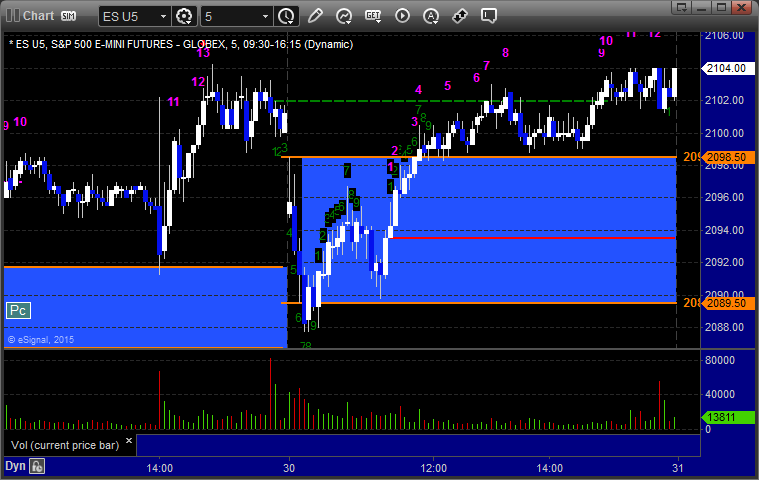

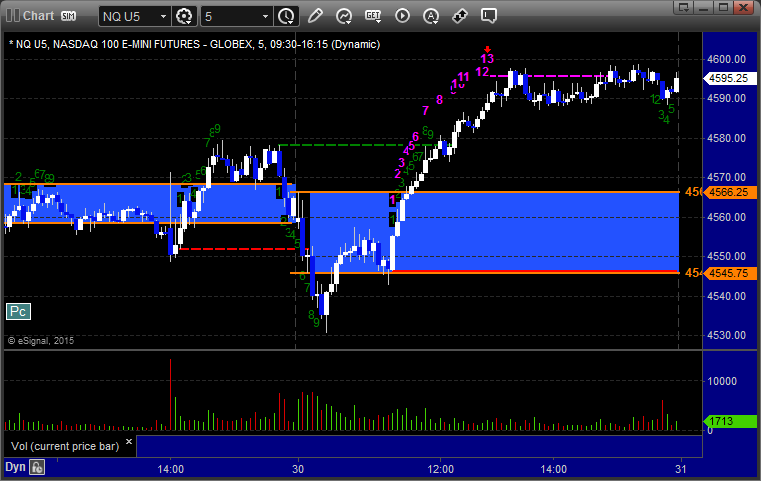

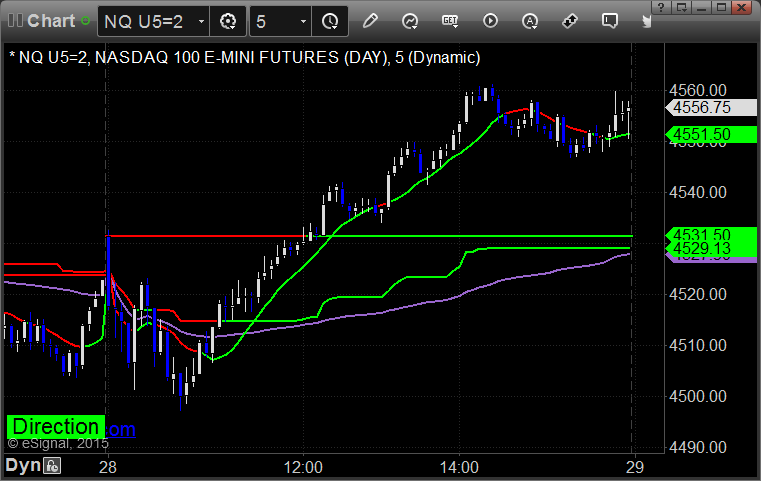

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

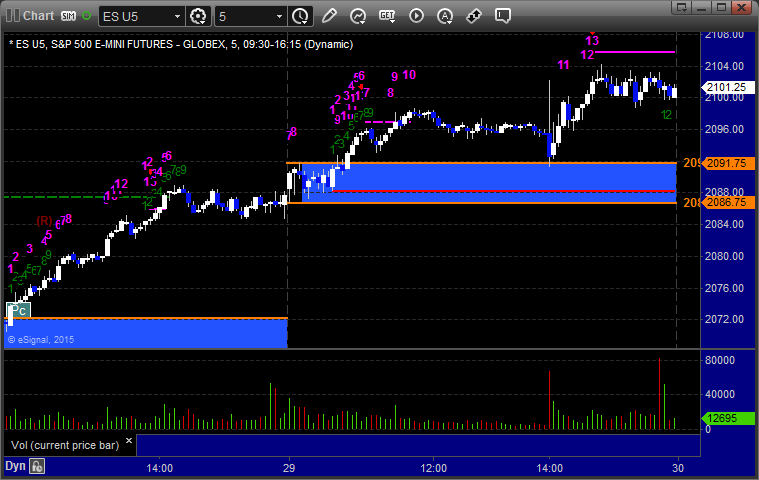

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered long at A and didn't work, triggered short at B and worked, note the 13 Comber at the bottom:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call triggered long at 2098.75 at A, hit first target for 6 ticks, and raised the stop a couple of times and stopped 11 ticks in the money at 2101.50:

Forex Calls Recap for 7/30/15

A dull night ahead of the GDP number and then a 2-way spike on that number, and then a later winner in the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A on the GDP data (something we don't usually want, and we teach that if the trade hasn't triggered, you should cancel ahead of that) and stopped. We were also half size or less ahead of that key data point. It then triggered again at B, hit first target at C, and stopped second half at D:

Stock Picks Recap for 7/29/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AVID triggered short (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, there were several calls, but none triggered.

In total, that's no trades triggering with market support, first time in a long time, but a Fed meeting day in July is a day for that to happen.

Futures Calls Recap for 7/29/15

The markets opened fairly flat. The NASDAQ side had a negative early bias, well the broad market was more positive heading into the Fed announcement. That announcement did little to move the markets in the afternoon, and we closed on 1.7 billion NASDAQ shares. No calls given the poor activity, but check the Opening Range Plays below.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

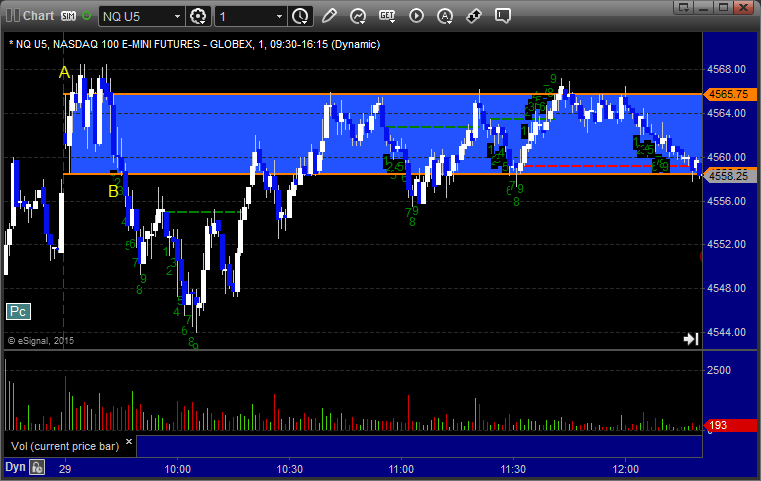

NQ Opening Range Play triggered long at A and didn't work, triggered short at B and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 7/29/15

A very slow overnight session ahead of the Fed. Neither side of our EURUSD calls triggered until the North American session, and I just closed it since the Fed was looming. This report is posted before the Fed announcement because I am on the road. Usually, I would wait and show the reaction from the Fed.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A but I closed it with the Fed only hours away by the time it triggered:

Stock Picks Recap for 7/28/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ACHN triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered short (with market support) and worked:

Mark's GPRO triggered long (with market support) and worked:

BABA triggered short (with market support) and worked enough for a partial:

Mark's SNDK triggered short (with market support) and didn't work:

Mark's AAPL triggered long (with market support) and didn't work, but it held in the money long enough that you should have been fine:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 7/28/15

More winners in the Opening Range plays, but then a loser and a small winner from the ES call. The markets gapped up, filled the gaps, then rallied on light volume over lunch and flattened out once volume came back. NASDAQ volume was 1.8 billion shares.

Net ticks: -4.5 ticks.

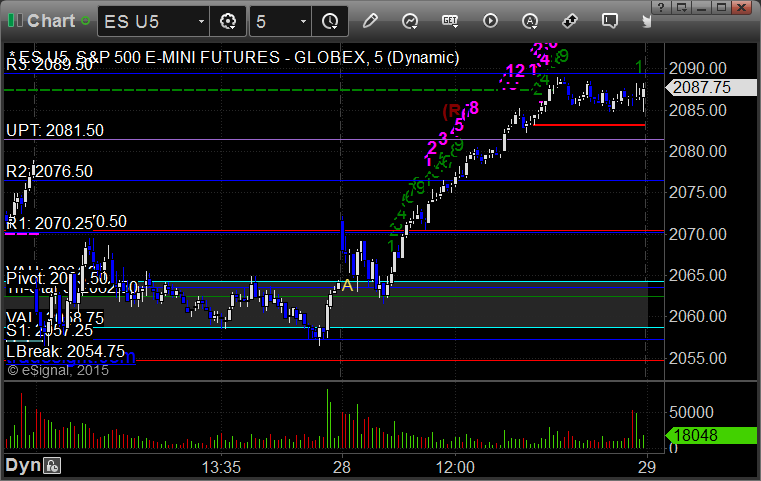

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Main call triggered short at 2065.00 and stopped, then triggered again, hit first target, closed second half over entry: