Stock Picks Recap for 7/22/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MNST gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered long (with market support) and didn't work initially, worked later:

BIDU triggered long (with market support) and worked:

Rich's IBM triggered short (with market suport) and worked:

His APA triggered short (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

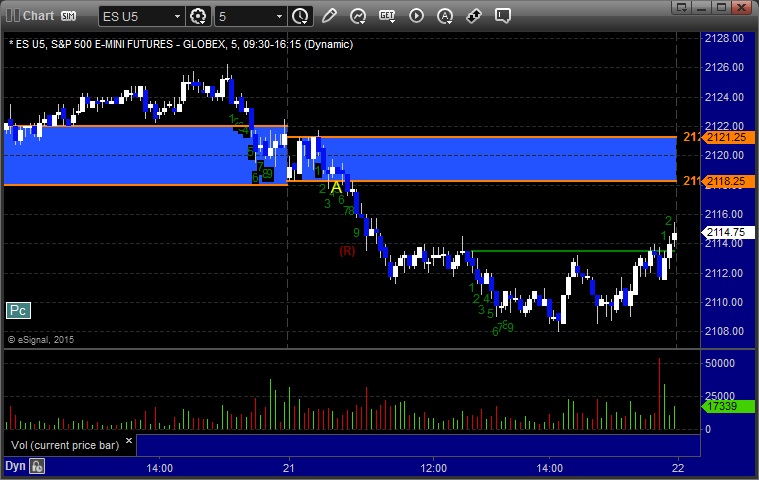

Futures Calls Recap for 7/22/15

A gap down on AAPL (and other earnings) and we did get some action early, but then things flattened out. Opening Range Plays worked (again). The gaps never filled. NASDAQ volume was 1.85 billion shares.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Mark's call triggered long at A at 2109.50 into the Value Area, hit first target for 6 ticks, stopped second half under the entry:

Forex Calls Recap for 7/22/15

Another boring session and I'm glad we are half size for the key part of summer. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

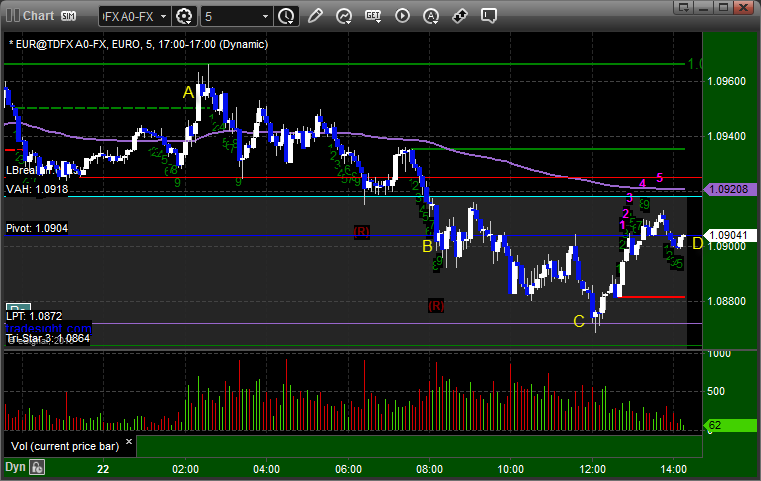

EURUSD:

Triggered long at A and stopped. Triggered short at B, never hit first target, found support at LPT at C, and finally closed at entry at D for end of session:

Stock Picks Recap for 7/21/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GPRO triggered long (without market support due to opening 5 minutes) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's RHT triggered long (with market support) and worked enough for a partial:

Rich's AAPL triggered long (without market support) and didn't work:

TEVA triggered short (with market support) and didn't work:

TSLA triggered short (with market support) and didn't work:

BIDU triggered long (without market support) and didn't work:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

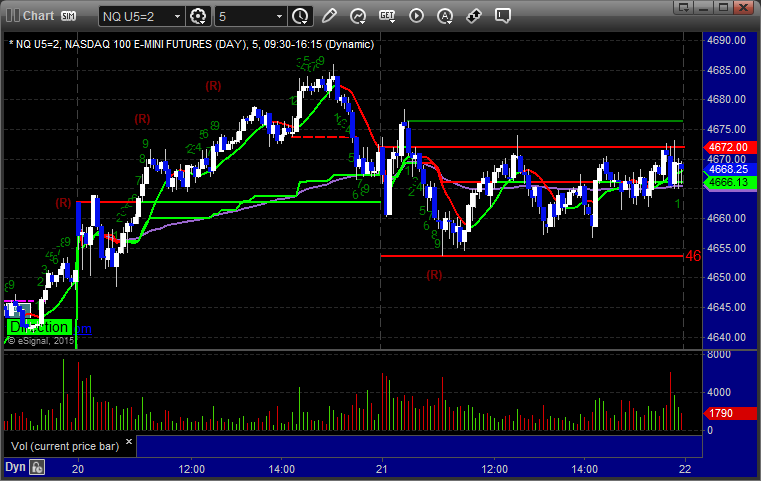

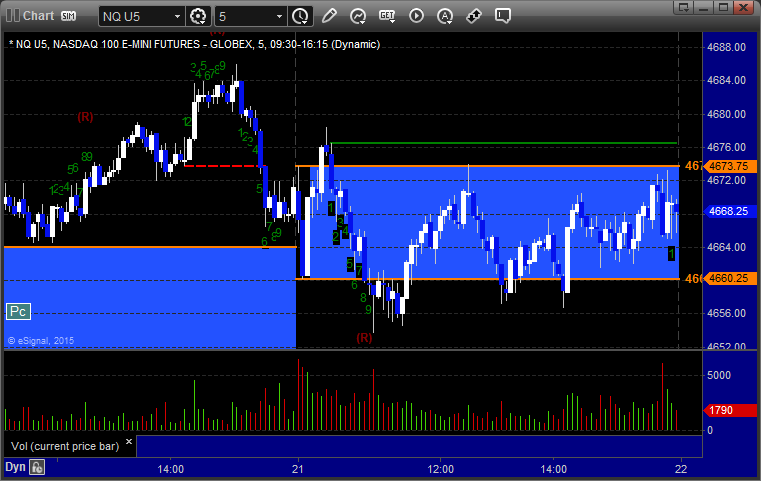

Futures Calls Recap for 7/21/15

The broad market had a small gap down that took the whole first 30 minutes to fill, and that was the high of the day. I mentioned in the Lab that based on the first 30 minute activity, I thought that the Institutional Range plays were going to be the key for the ES, and it was (see that section below). NASDAQ volume closed at 1.6 billion shares.

Net ticks: -7 ticks.

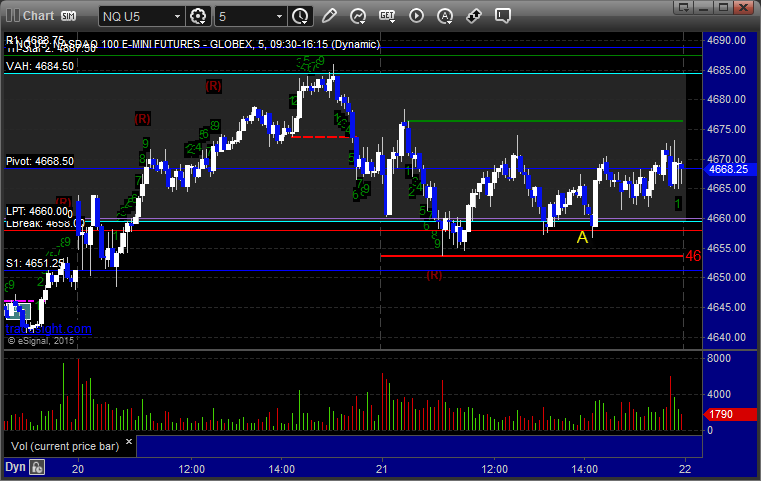

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work, took foever, triggered short at B and eventually worked:

NQ Opening Range Play triggered short at A and worked enough for a partial:

ES Tradesight Institutional Range Play, as I mentioned specifically in the Lab as the key trigger, triggered short at A and worked great:

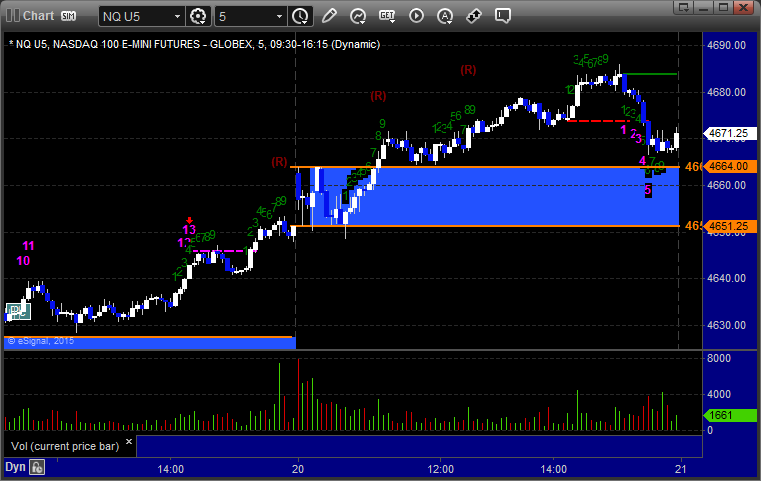

NQ Tradesight Institutional Range Play:

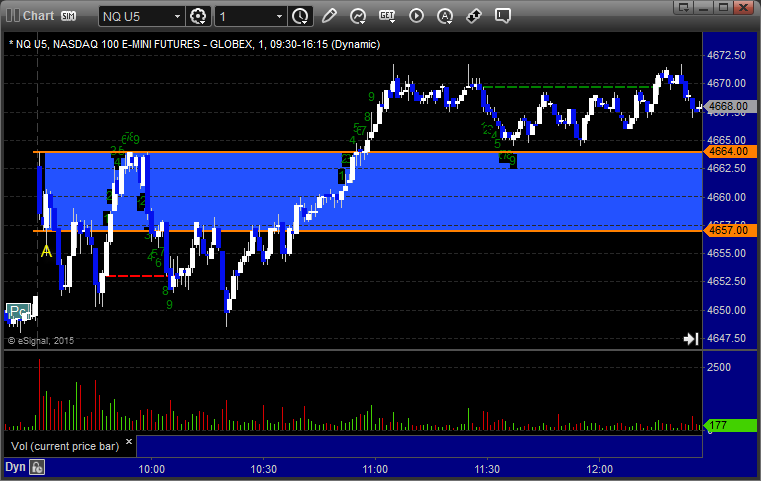

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 4657.00 and stopped for 7 ticks:

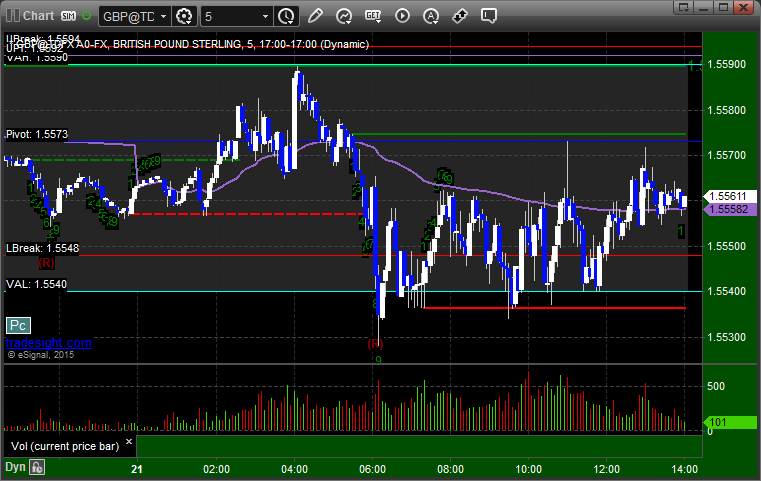

Forex Calls Recap for 7/21/15

GBPUSD never broke S1 or R1, so we had no trade triggers for the session. Unusual, but if it is going to happen, this time of year would be the time. We will have new calls tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 7/20/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MDSO triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (without market support) and didn't work:

His SLB triggered short (without market support) and didn't do enough either way to count:

AMGN triggered long (without market support) and worked:

COST triggered long (with market support) and didn't go enough in either direction to count:

Rich's FB triggered long (with market support) and worked great:

His SYNA triggered short (without market support) and didn't work:

In total, that's 2 trades triggering with market support, both of them worked.

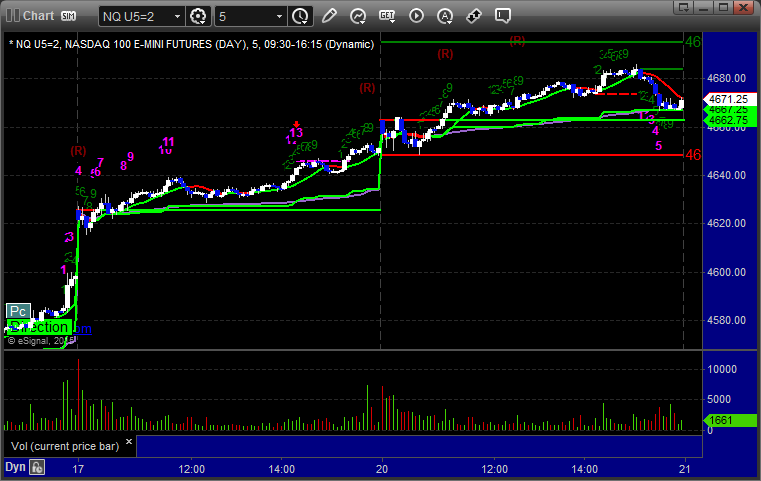

Futures Calls Recap for 7/20/15

Another set of Opening Range play winners (see that section below) as the market opened fairly flat and stuck in about a 3 point range (after the first 5 minutes) for over an hour on the ES. We eventually drifted higher and then pulled back for the close. NASDAQ volume was 1.6 billion share.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered short at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 7/20/15

Two stop outs to start the week, one in the EURUSD and one in the GBPUSD. See those sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped:

GBPUSD:

Triggered short at A and stopped. If you were awake to re-enter, triggered at B, hit first target at C pretty well:

Tradesight May 2015 Futures Results

Before we get to May’s numbers, here is a short reminder of the results from April. The full report from April can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for April 2015

Number of trades: 6

Number of losers: 4

Winning percentage: 33.3%

Net ticks: -13.5 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

It is important to note that these results do not include the Tradesight Value Area, Opening Range, or Institutional Range plays, all of which have been working quite well on their own.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for April 2015

Number of trades: 7

Number of losers: 2

Winning percentage: 71.4%

Net ticks: +20.5 ticks

Due to the overall narrow ranges of the markets, we've scaled back the main trade calls a bit and continue to focus on the Opening Range plays, which tend to trigger in the first 10-15 minutes of the day when there is some action before things settle down. Once again, the Opening Range plays worked well and should have added over 100 ticks of gains to the month. Out of 19 trading days in the month, the Opening Range plays worked 17 of them, which is quite amazing. We will continue to focus on that more until the ranges of the market in general start to expand. Even with that, our main trade calls worked for the month.