Tradesight May 2015 Forex Results

Before we get to May’s numbers, here is a short reminder of the results from April. The full report from April can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for April 2015

Number of trades: 33

Number of losers: 12

Winning percentage: 63.6%

Worst losing streak: 2 in a row

Net pips: +360 pips

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for May 2015

Number of trades: 29

Number of losers: 13

Winning percentage: 44.8%

Worst losing streak: 3 in a row

Net pips: +320 pips

We continue to pile on the gains in Forex in May. This was an interesting month because we actually had slightly more losing trades than winners, but the market continues to move well, so we had several big, multi-day winners that led to several hundred pip final exits. Six month average daily ranges are back to 130 pips on the EURUSD and GBPUSD, which is historically where we like them. The Levels spacing is better because of this, and we had several days where the distance to the first targets were 50 pips.

Stock Picks Recap for 7/17/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, only WYNN triggered short (without market support) and didn't work:

In total, that's 0 trades triggering with market support, welcome to options expiration in July.

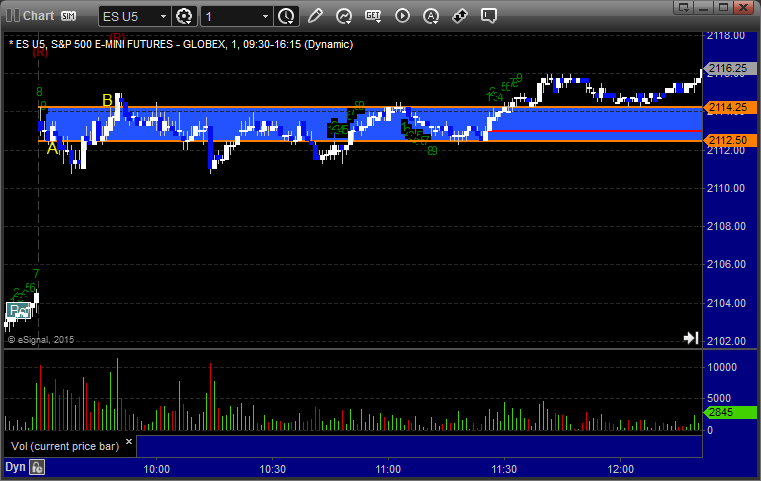

Futures Calls Recap for 7/17/15

Exactly what we expected from options expiration Friday. The broad market opened flat (NASDAQ gapped up because of GOOG) and we stuck in basically a 5 point range for the session. NASDAQ volume was only 1.68 billion shares, which isn't much considering GOOG traded 80 million more than usual and we had all of the options expiration volume. No calls, but the Opening Range Plays worked.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough:

NQ Opening Range Play triggered short at A and worked enough:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 7/17/15

Not a very exciting session, and we close the week with a winner and a loser on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

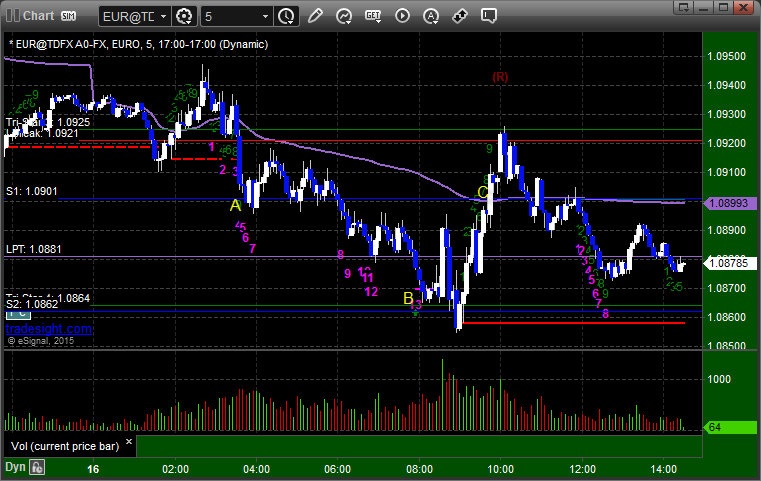

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

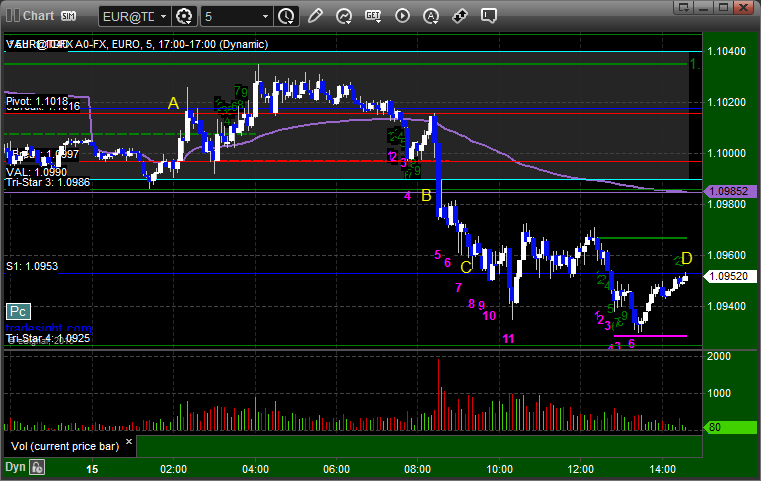

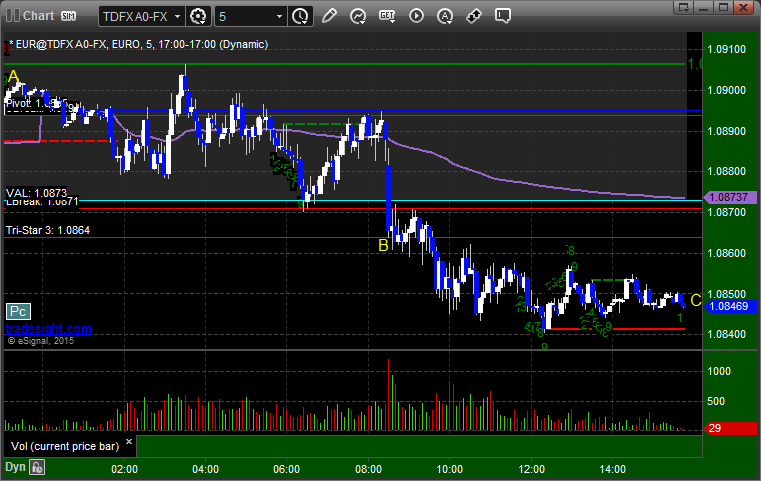

EURUSD:

Triggered long at A just at the beginning of the chart and stopped. Triggered short at B, closed in the money at C for end of week but never hit first target:

Stock Picks Recap for 7/16/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ALGN gapped over, no play.

AMAT gapped under the short trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's EBAY triggered long (without market support due to opening 5 minutes) and worked:

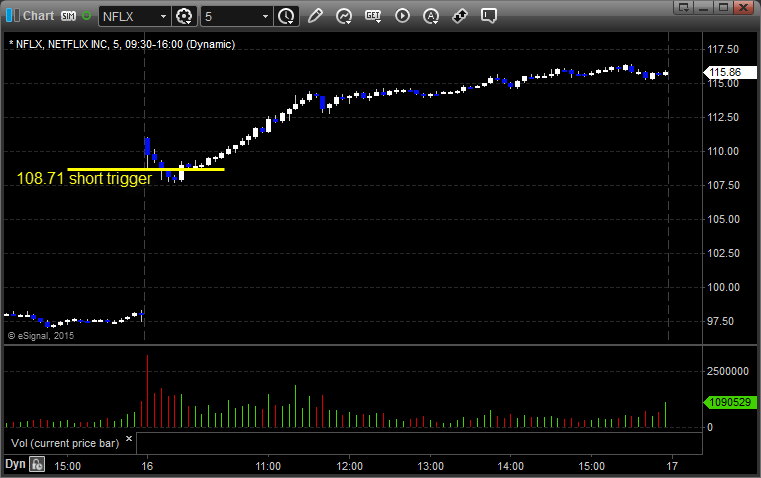

His NFLX triggered short (with market support) and worked enough for a partial:

AMZN triggered short (with market support) and didn't work:

TEVA triggered long (with market support) and worked enough for a partial:

Rich's AAPL triggered long (with market support) and worked:

His FB triggered long (with market support) and worked:

His GOOG triggered short (without market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

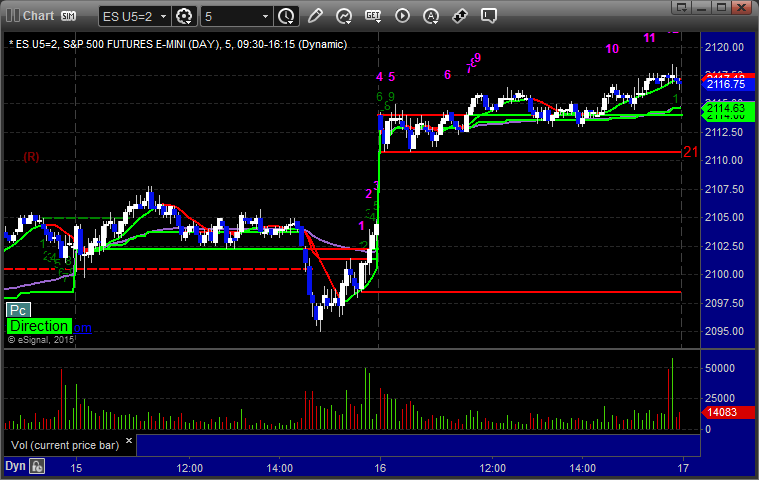

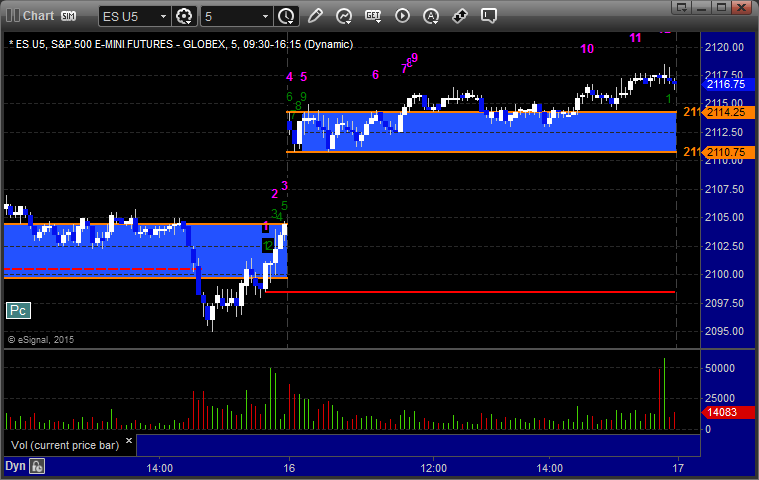

Futures Calls Recap for 7/16/15

The markets gapped up on NFLX earnings and others and then literally flatlined the whole day on 1.6 billion NASDAQ shares. We had a tiny winner in the calls and the Opening Range plays didn't do anything for once. The Institutional Range Plays did work. See ES section below.

Net ticks: +2 ticks.

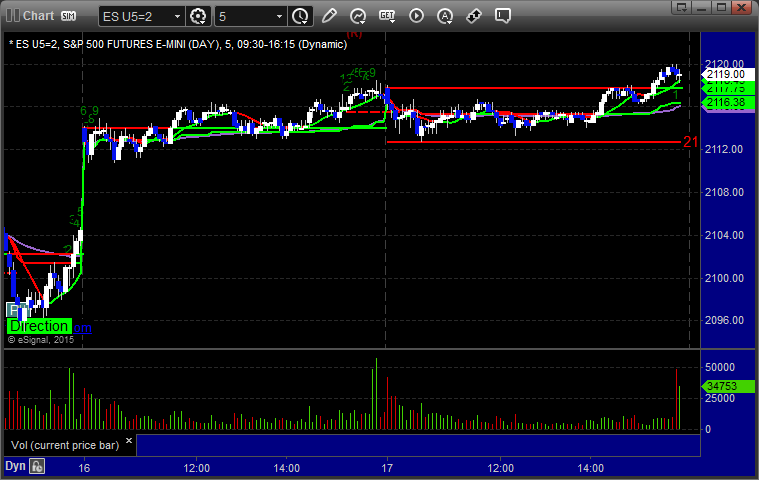

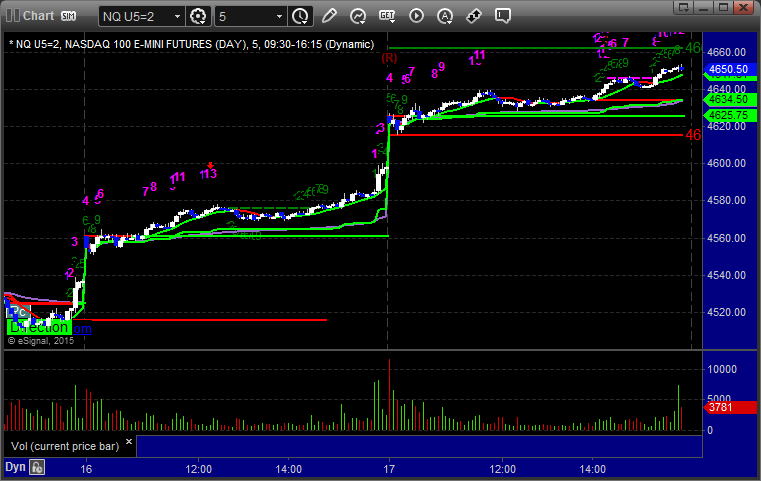

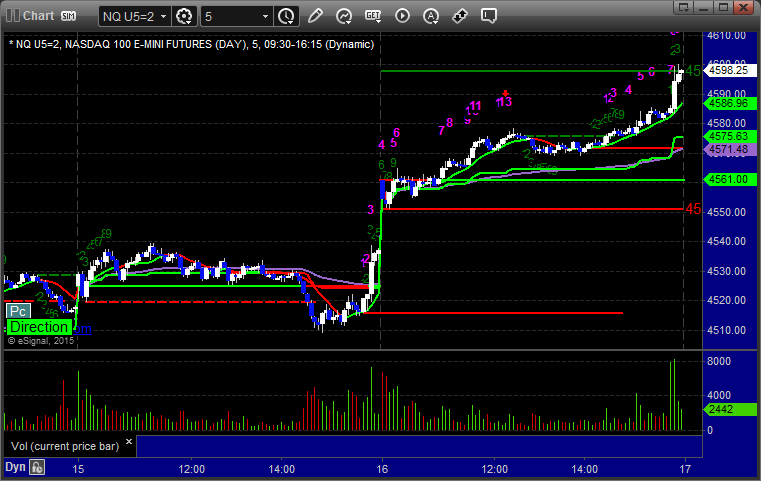

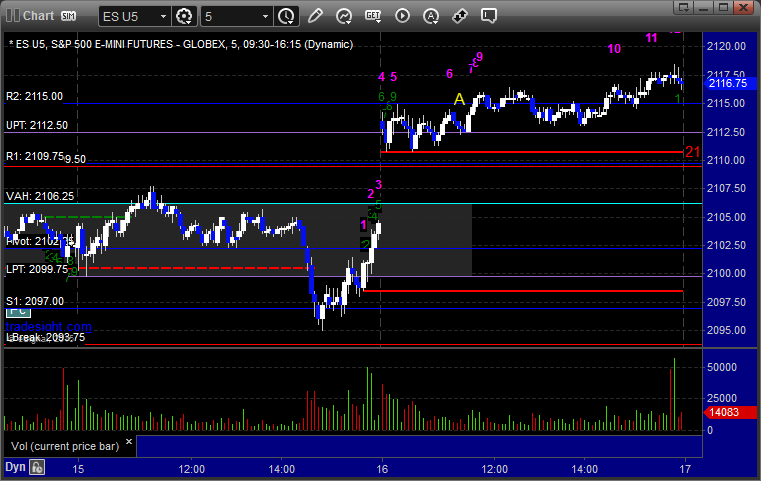

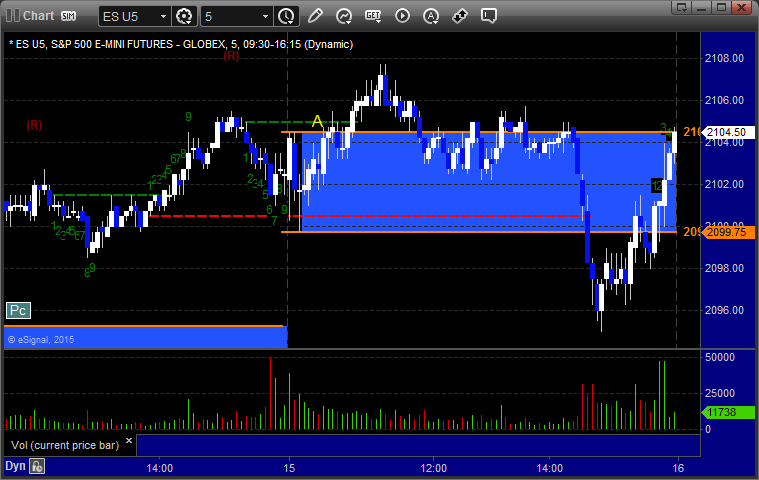

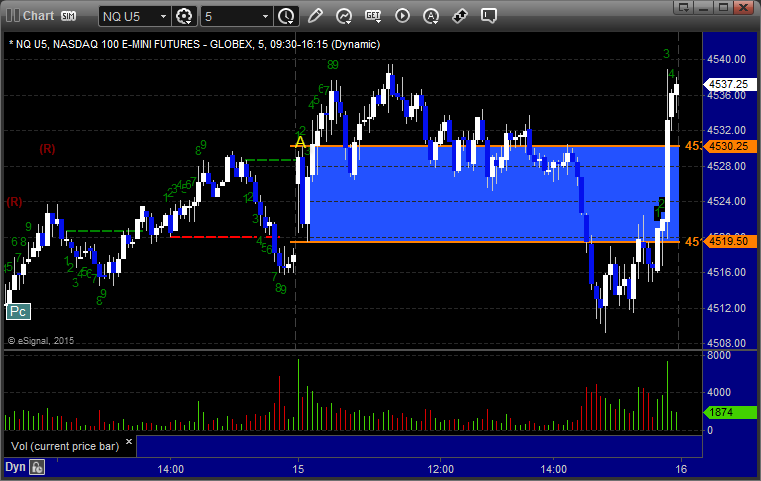

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered both ways and didn't work:

NQ Opening Range Play triggered both ways and didn't work:

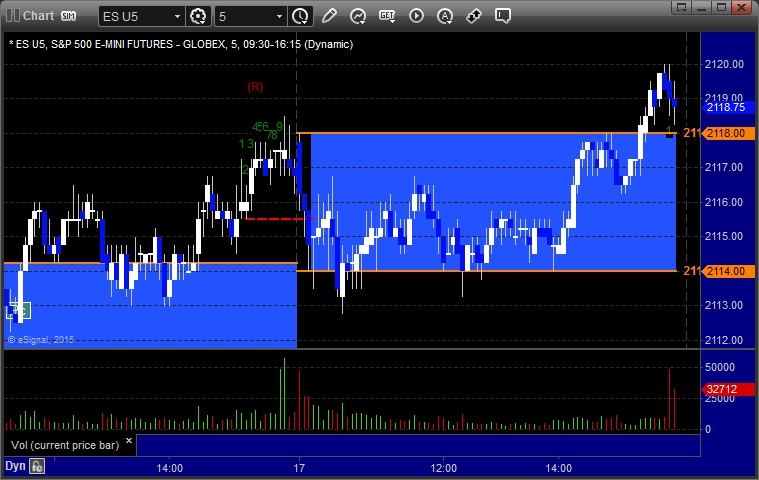

ES Tradesight Institutional Range Play triggered long and worked:

NQ Tradesight Institutional Range Play triggered long and worked:

ES:

My call triggered long at 2115.25 at A and after more than an hour of not hitting the first target or the stop, I closed it for 2 ticks:

Forex Calls Recap for 7/16/15

Another day of mild winners as we closed out the second half of the prior day's winner and then had a new winner. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

We stopped out of the second half of the prior day's trade in the money before the new session really got started, and then the new trade triggered short at A, hit first target at B, stopped second half over the entry at C:

Stock Picks Recap for 7/15/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BCRX gapped over, no play.

BNCL triggered long (with market support) and never did anything:

ALGN triggered long (with market support) and didn't work:

ICON triggered short (with market support) in the last 10 minutes of the day:

![]()

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered short (with market support) and worked enough for a partial:

His NFLX triggered short (without market support) and didn't work:

His CELG triggered short (with market support) and worked enough for a partial:

His AAPL triggered short (with market support) and didn't work, although in the Lab he told everyone not to take this one:

TSLA triggered short (with market support) and worked enough for a partial:

TWTR triggered short (with market support) but I closed it even:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

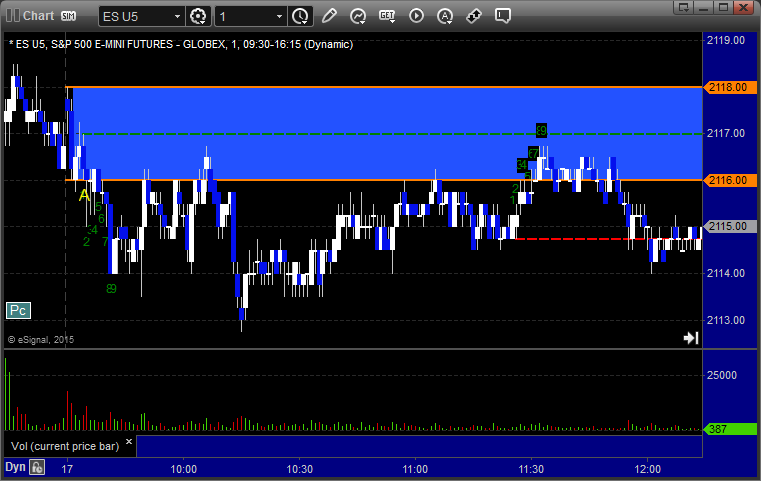

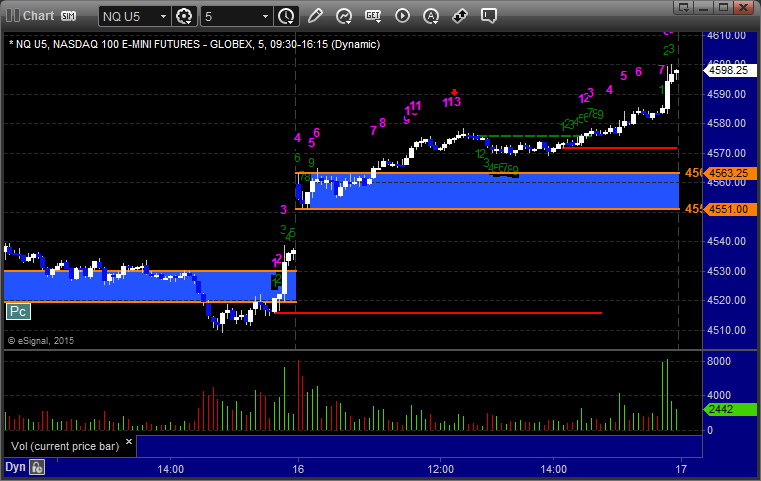

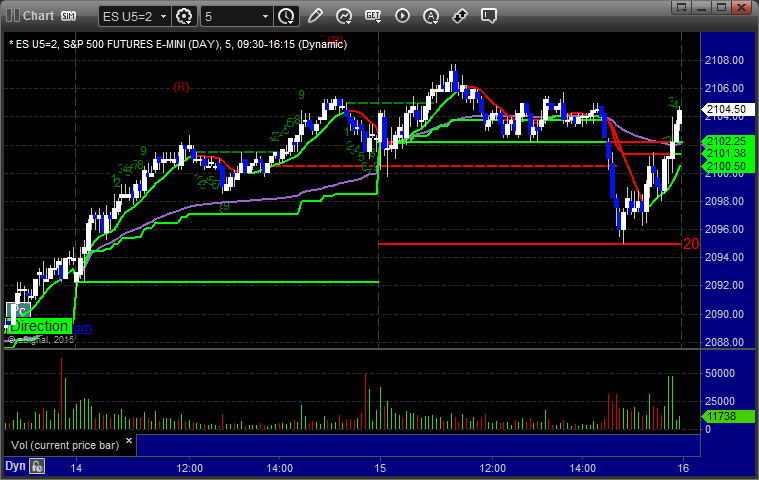

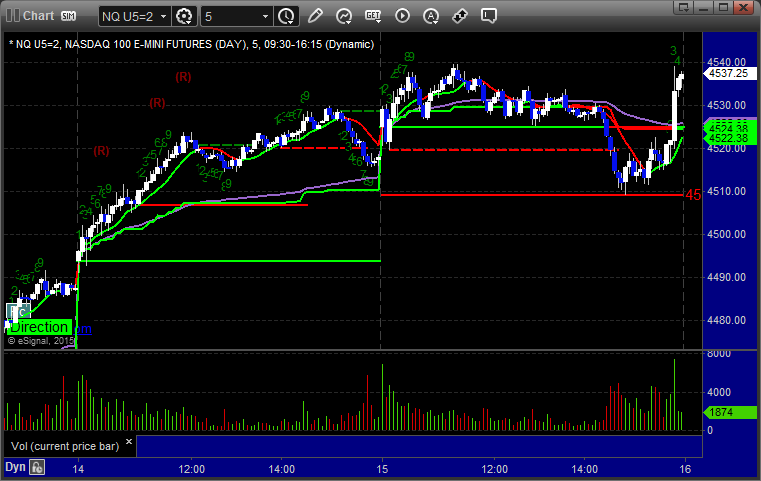

Futures Calls Recap for 7/15/15

A couple of winning calls after a super-slow start with no gap. The markets showed some action in the afternoon for the first time in a while but that didn't lead to much and we closed around the VWAP on 1.5 billion NASDAQ shares.

Net ticks: +10.5 ticks.

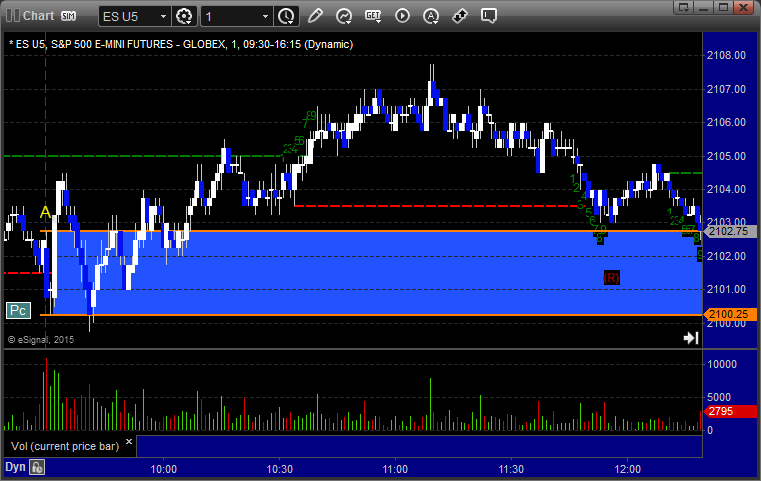

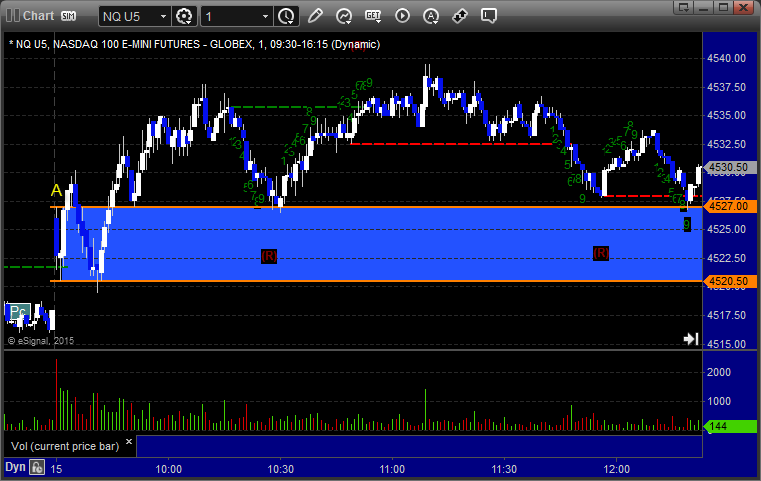

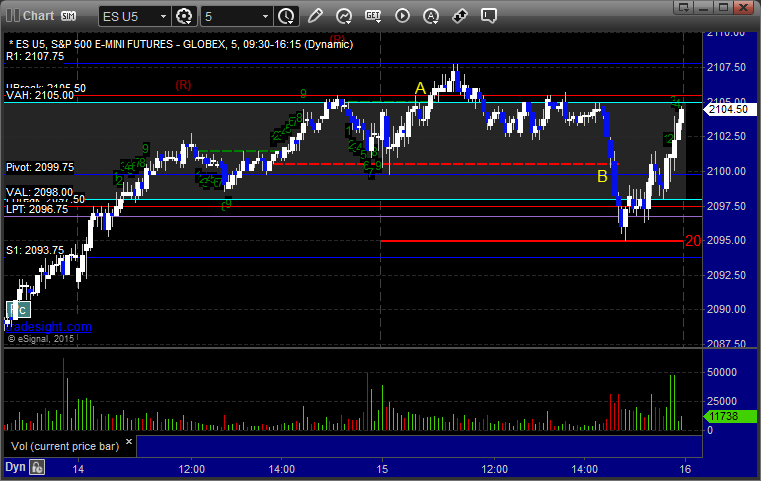

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work:

NQ Opening Range Play triggered long at A and didn't work:

ES Tradesight Institutional Range Play triggered long at A and worked:

NQ Tradesight Institutional Range Play triggered long at A and worked:

ES:

My long call triggered at A at 2105.75 but I ended up closing it for a 3 tick gain after it didn't get anywhere for 20 minutes, which was fine. The short triggered in the after at B at 2099.50, hit first target for 6 ticks, and closed final half after adjusting the stop three times for 9 ticks:

Forex Calls Recap for 7/15/15

Again, a loser and a winner (and this time the winner is still going). See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, and still holding second half with a stop over S1 at D: