Futures Calls Recap for 6/25/15

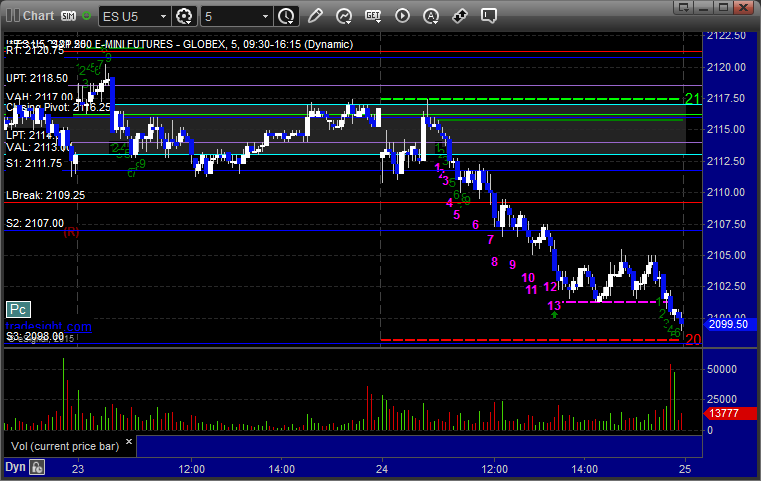

The markets gapped down a little and the ES took about an hour before it spiked up to fill. We finally got a downward move over lunch and the afternoon held near the lows on 1.45 billion NASDAQ shares.

Net ticks: +0 ticks.

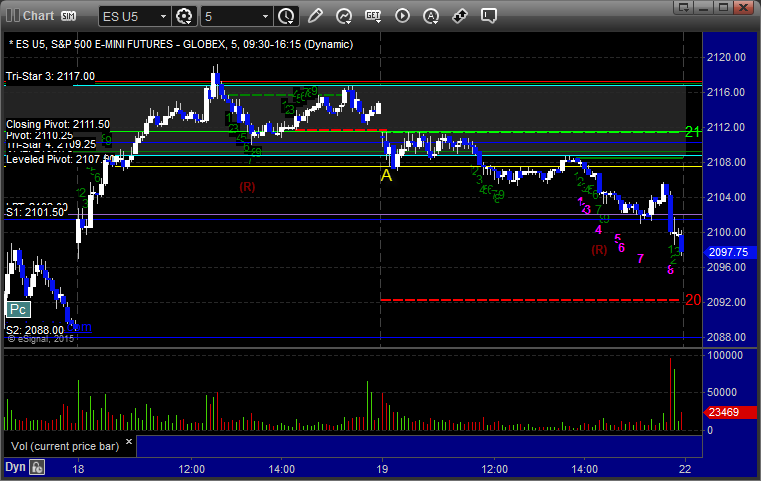

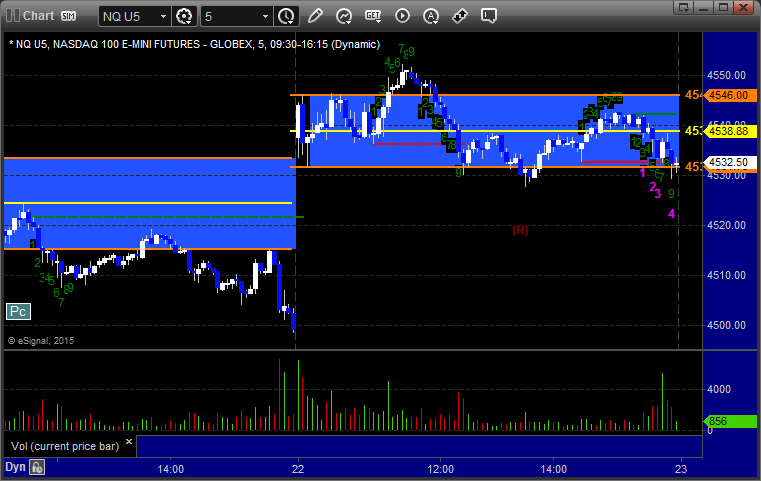

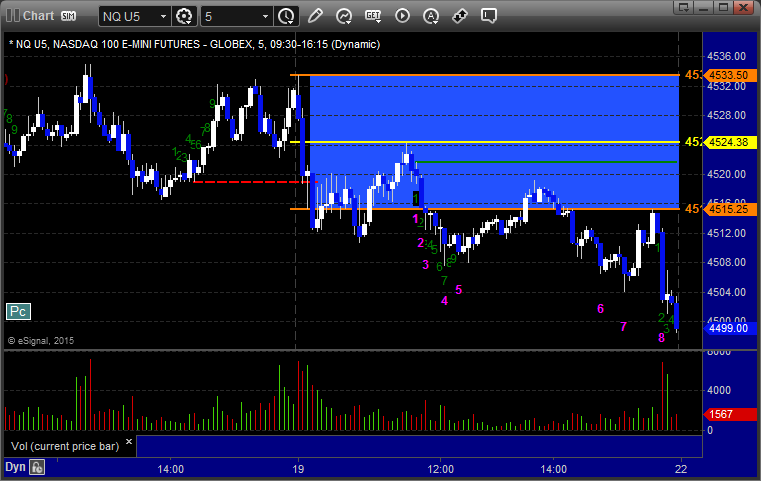

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/25/15

A winner in the GBPUSD to the first target (which was a full almost 50 pips) and that was it for the session, but we will take it. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

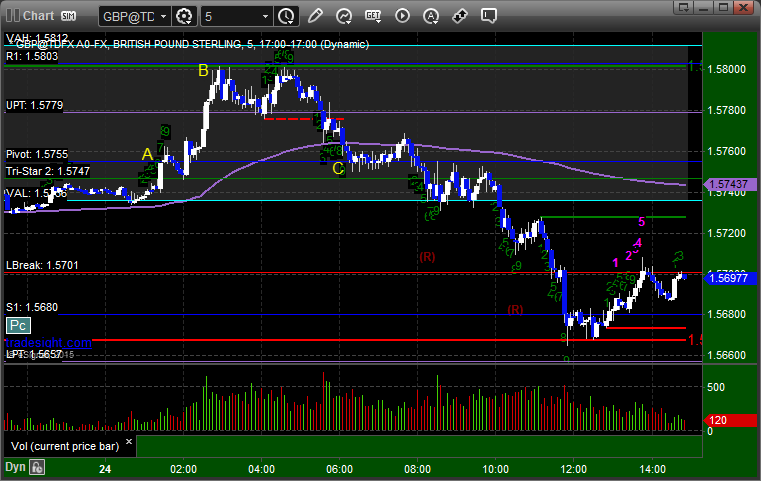

GBPUSD:

Triggered long at A, hit first target at B, moved stop under entry for second half and stopped at C:

Stock Picks Recap for 6/23/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PACW triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support just barely) and didn't work:

BIDU triggered short (without market support) and didn't work:

TWTR triggered short (with market support) and worked:

Rich's WYNN triggered short (without market support) and didn't work:

Mark's NTES triggered long (without market support) and worked:

Rich's SLB triggered long (without market support) and worked:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not. Lot of triggers without market support, which is unusual.

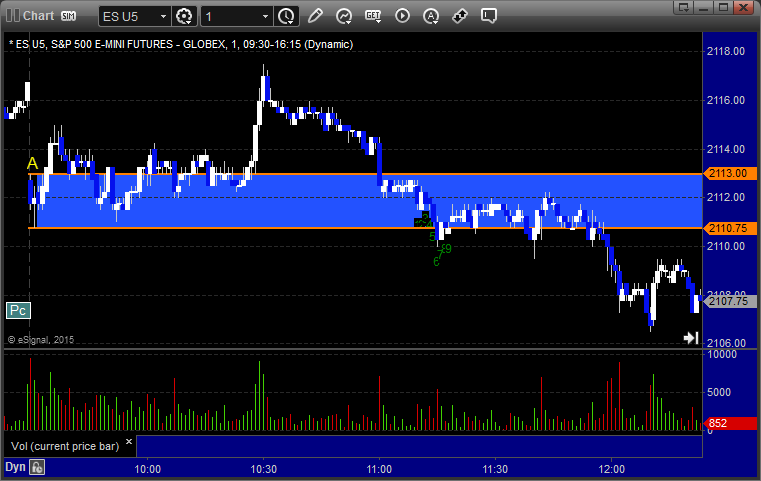

Futures Calls Recap for 6/23/15

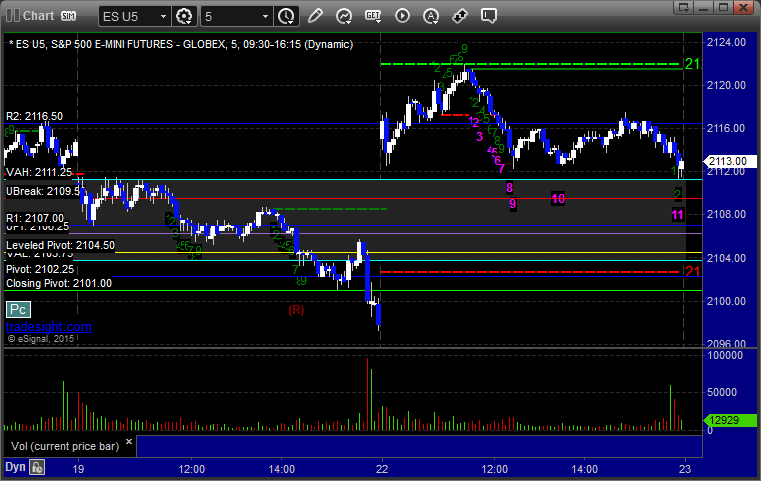

The markets gapped up and took forever to fill. We closed the day on the VWAP in a 7 point or so ES range. The Opening Range plays worked, although it took 30 minutes for the ES to trigger. NASDAQ volume closed at 1.45 billion shares.

Net ticks: +0 ticks.

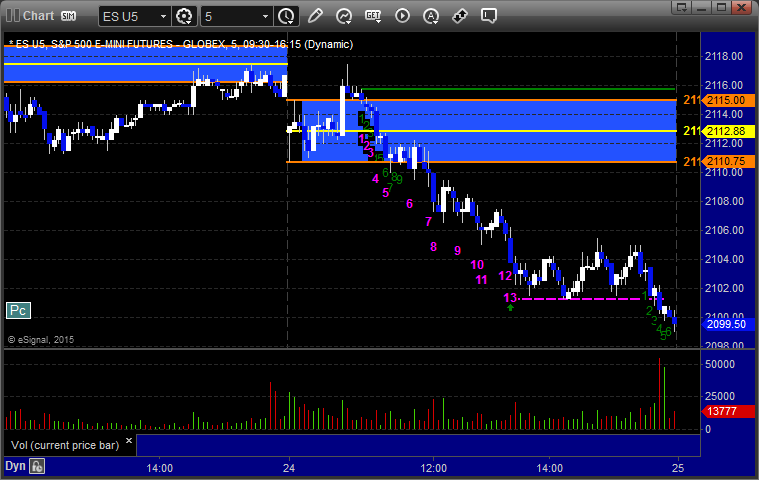

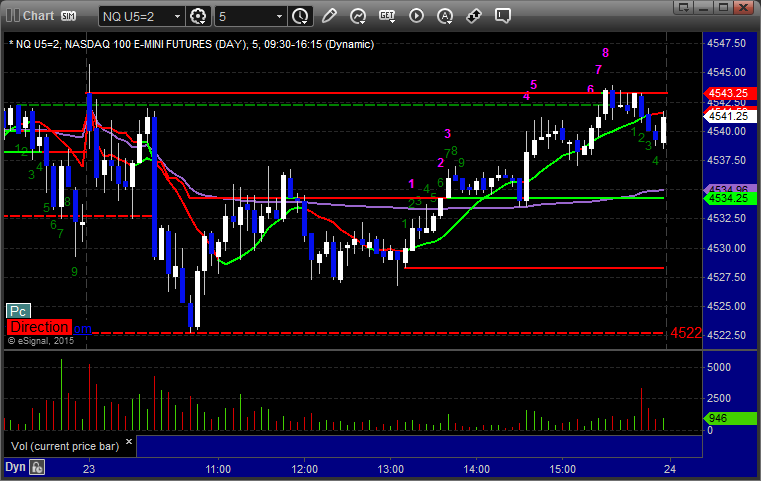

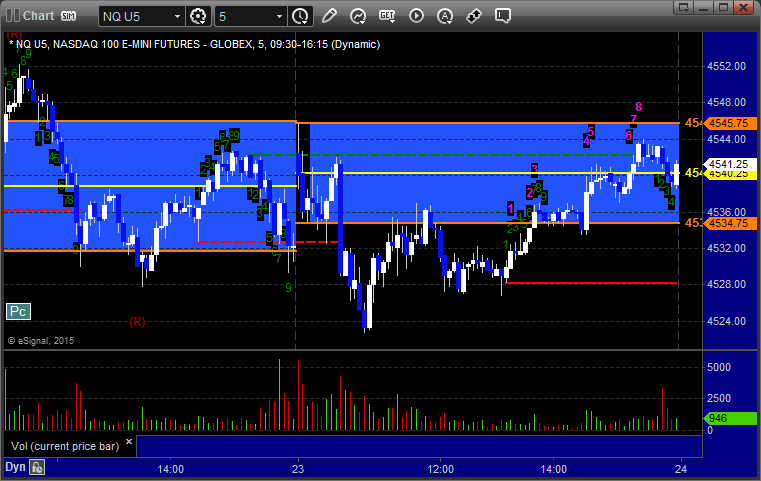

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/23/15

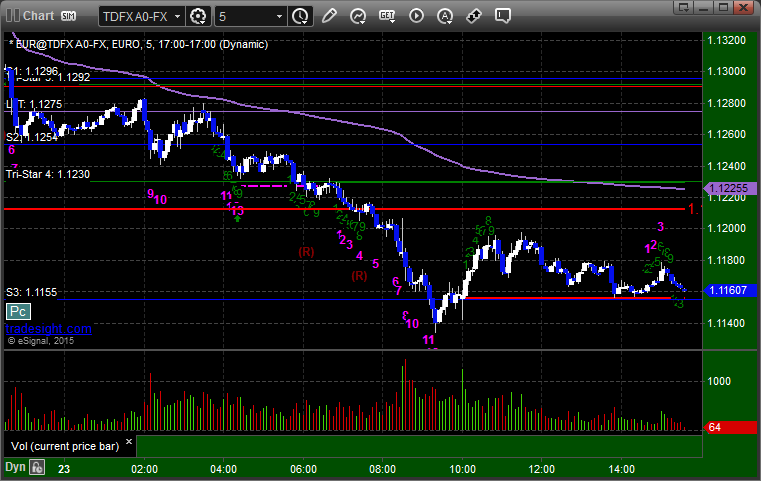

No calls for the session for once due to a personal situation, but I think that the call that I would have made would have stopped. Meanwhile, there was a great 13 signal on the EURUSD that called the bottom after a good move. See that section below.

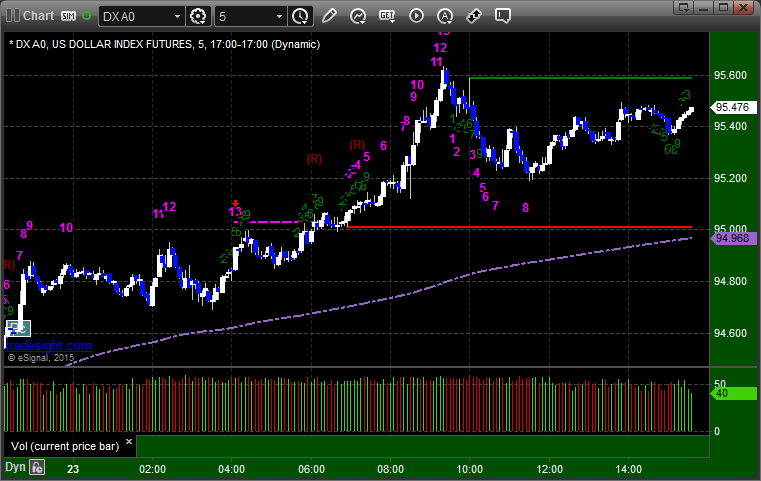

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Note the 13 signal at the low:

Stock Picks Recap for 6/22/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EXAS triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (with market support) and worked:

His AMBA triggered short (with market support) and worked great:

His AAL triggered long (without market support) and didn't work:

NTAP triggered long (with market support) and worked:

Rich's NFLX triggered long (without market support) and worked:

In total, that's 3 trades triggering with market support, all three of them worked.

Futures Calls Recap for 6/22/15

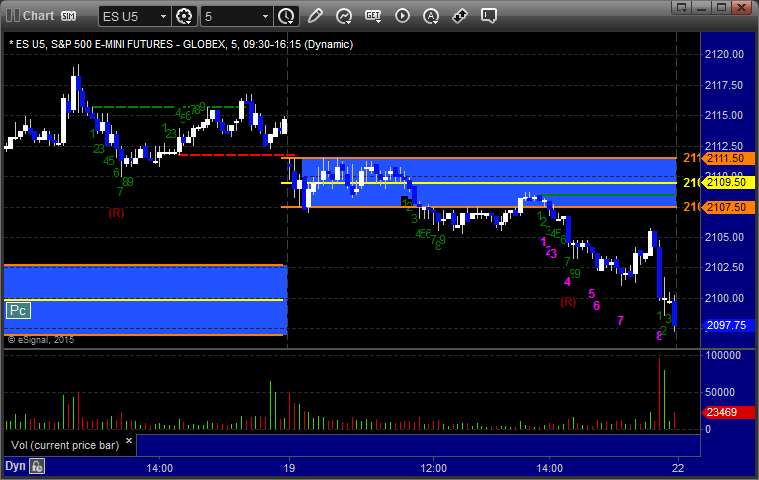

Our main trade call was set up nice but didn't trigger. See ES below. NASDASQ volume was only 1.45 billion shares as the markets gapped up big to start the week and held mostly flat.

Net ticks: +0 ticks.

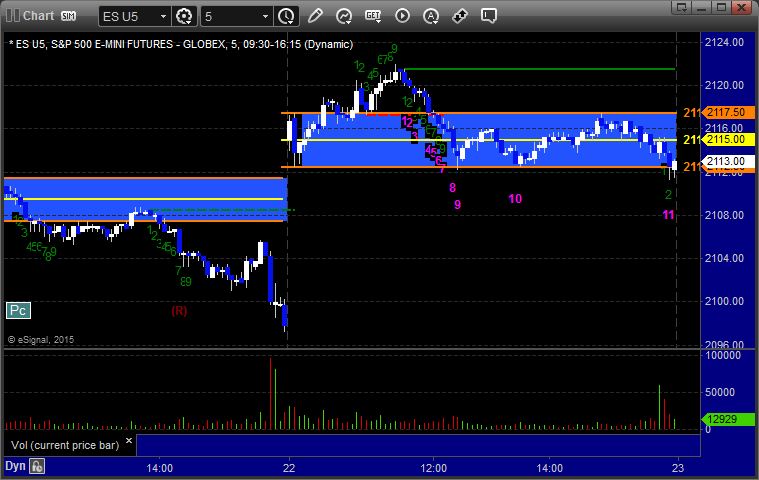

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered both ways and neither worked for once:

NQ Opening Range Play triggered long and didn't work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

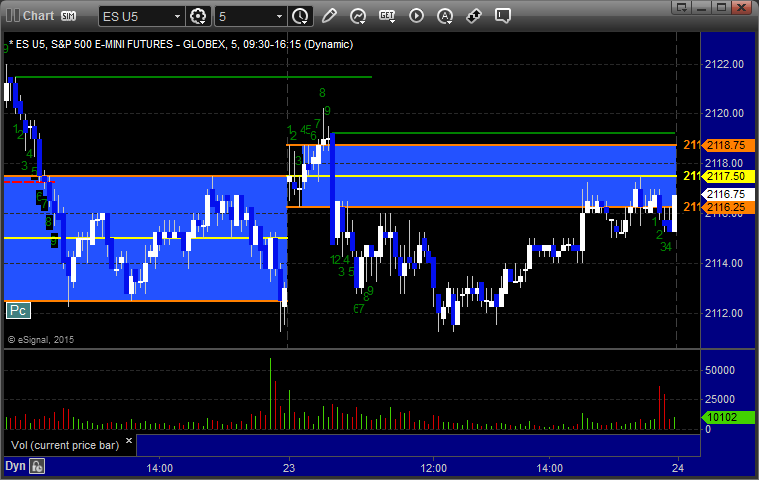

ES:

We had a beautiful inverted cup and handle setup that was called for the Value Area play, but it never triggered (hit the VAH right at the close):

Forex Calls Recap for 6/22/15

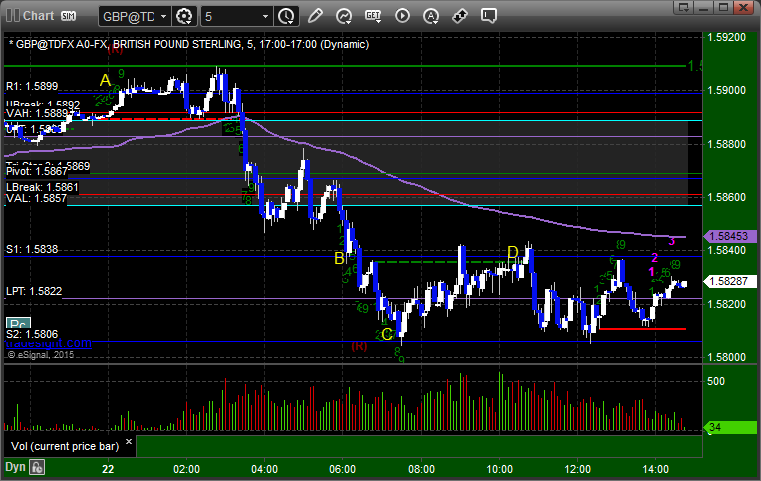

A small winner and a loser for the session. See GBPUSD below for both.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, stopped second half over entry at D in the morning:

Stock Picks Recap for 6/19/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SPPI triggered long (without market support due to opening 5 minutes) and didn't go enough either way to count:

From the Messenger/Tradesight_st Twitter Feed, we had additional calls, but nothing triggered.

In total, that's 0 trades triggering with market support, first time in a while but not unexpected for triple expiration.

Futures Calls Recap for 6/19/15

Not much for options expiration, although the Opening Range plays worked yet again (1 stop out and 2 winners) and the extra trade call was set up nice but didn't work on the ES. The ES left a small gap above and traded in a narrow range. Triple expiration was only 2.2 billion shares, which is obviously up (and not real) but not as big as a usual triple expiration.

Net ticks: -7 ticks.

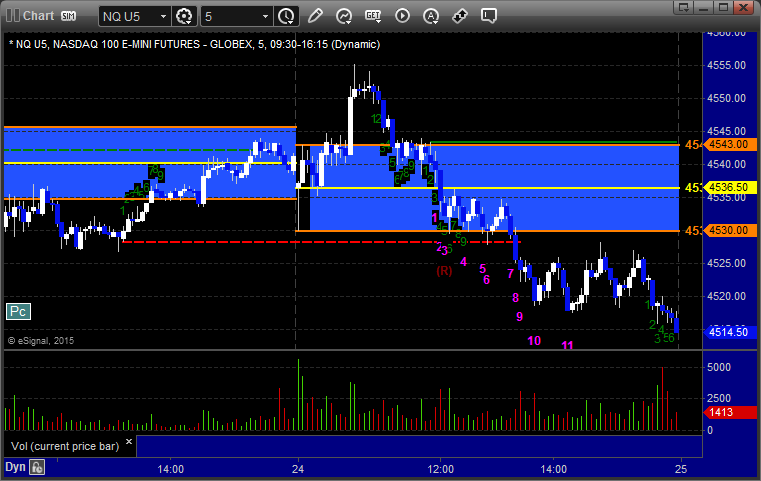

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial:

NQ Opening Range Play triggered long at A and stopped, triggered short at B and worked big:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 2107.25 and stopped for 7 ticks. Did not re-enter on triple expiration Friday: