Forex Calls Recap for 6/19/15

Another winner to close out the week, this time in the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

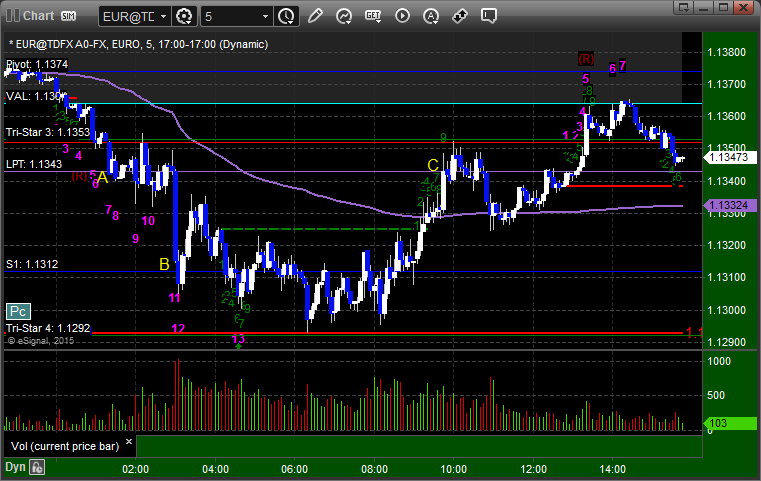

EURUSD:

Triggered short at A, hit first target at B, stopped second half at C:

Stock Picks Recap for 6/18/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BCRX triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's BMRN triggered long (with market support) and worked:

FB triggered long (with market support) and worked enough for a partial:

COST triggered long (with market support) and worked enough for a partial:

Rich's TSLA triggered long (with market support) and didn't work:

His TRIP triggered long (with market support) and worked:

His HOG triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

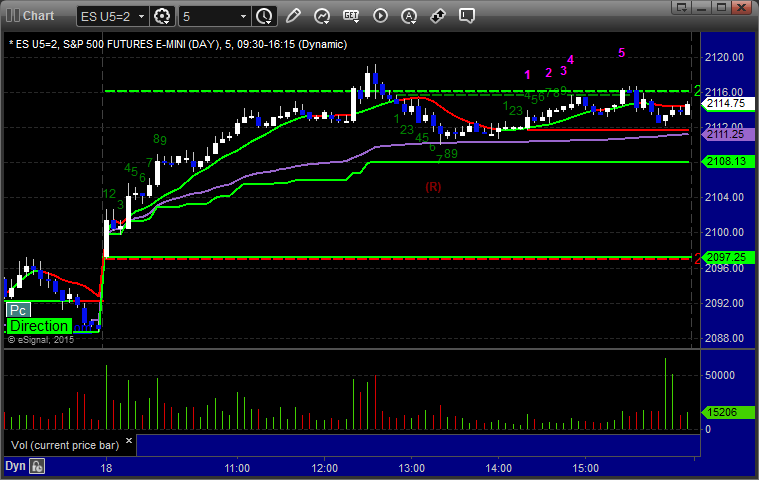

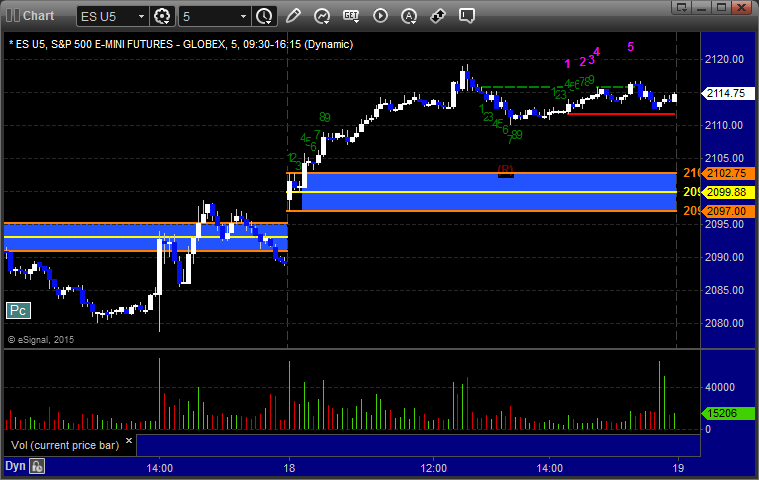

Futures Calls Recap for 6/18/15

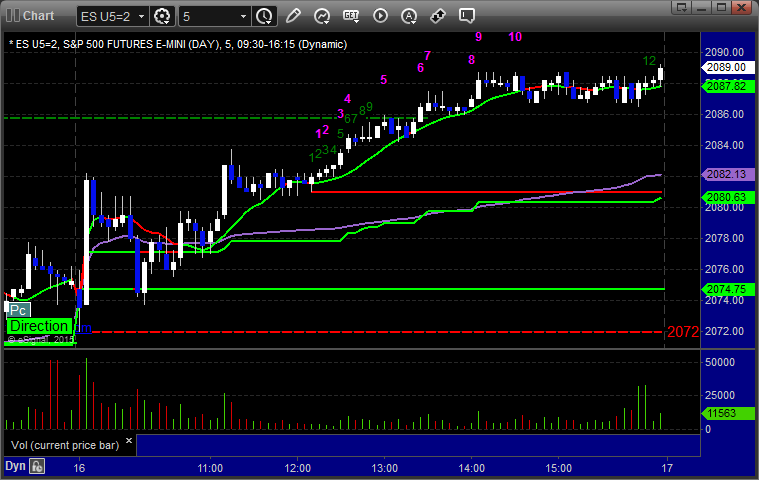

The markets gapped up and kept going on 1.7 billion shares, giving us options unravel and the better trading session of the week. Our main call didn't trigger, but it didn't matter because the ES and NQ Opening Range plays led to huge winners, including 30 handles for me on the final NQ piece.

Net ticks: +0 ticks.

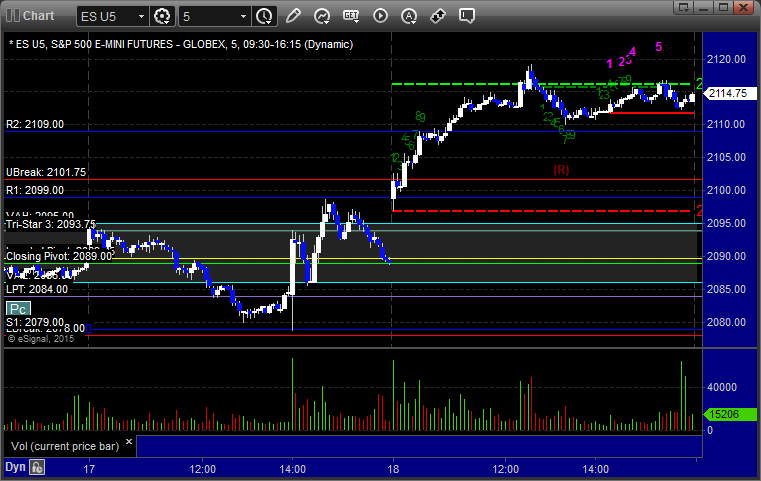

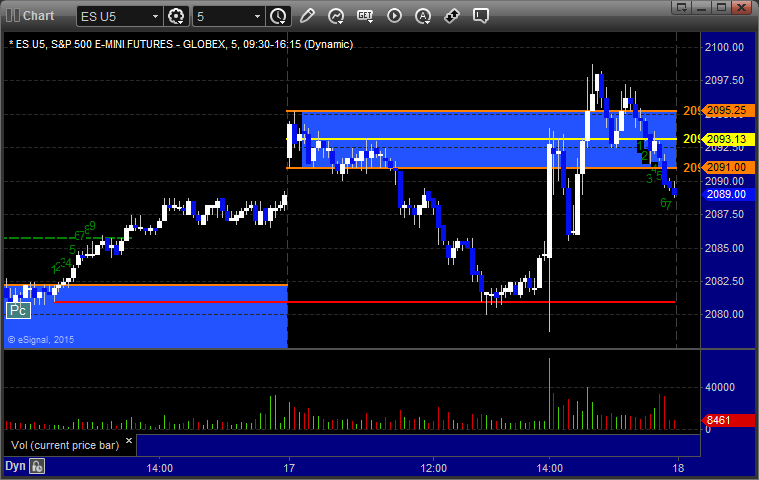

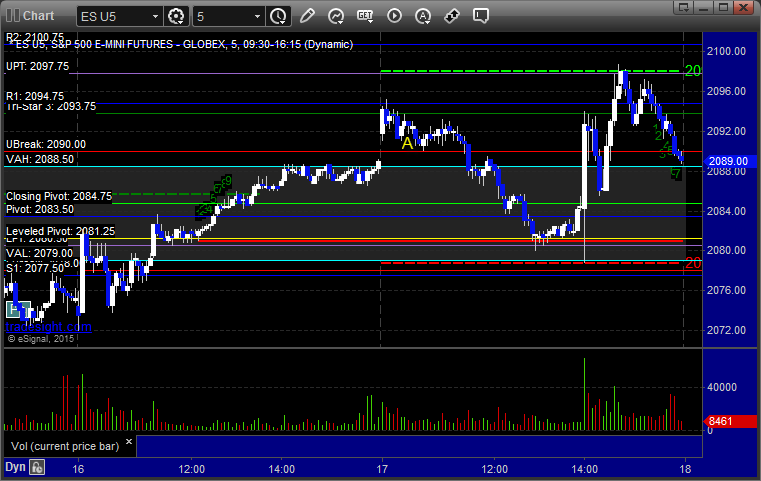

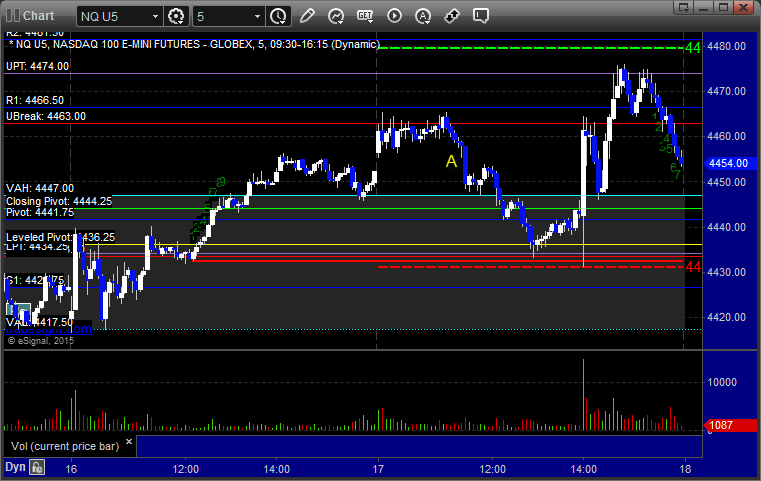

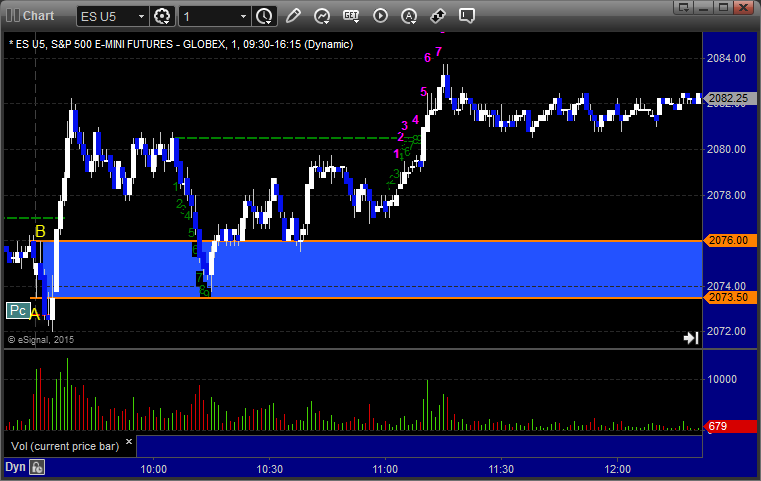

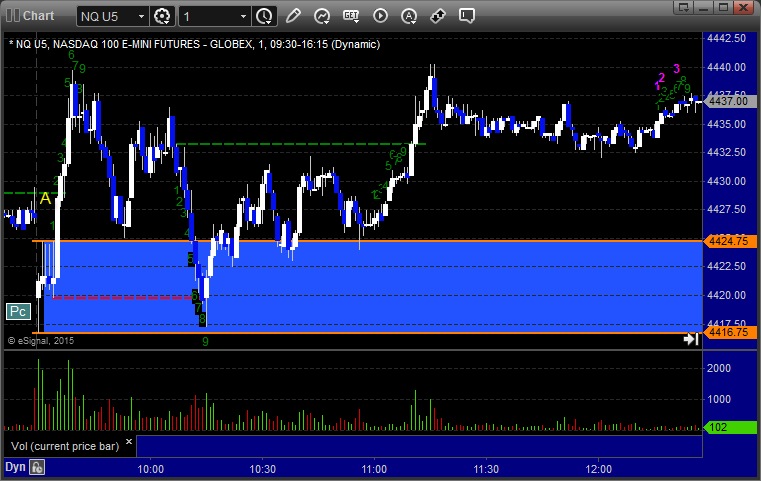

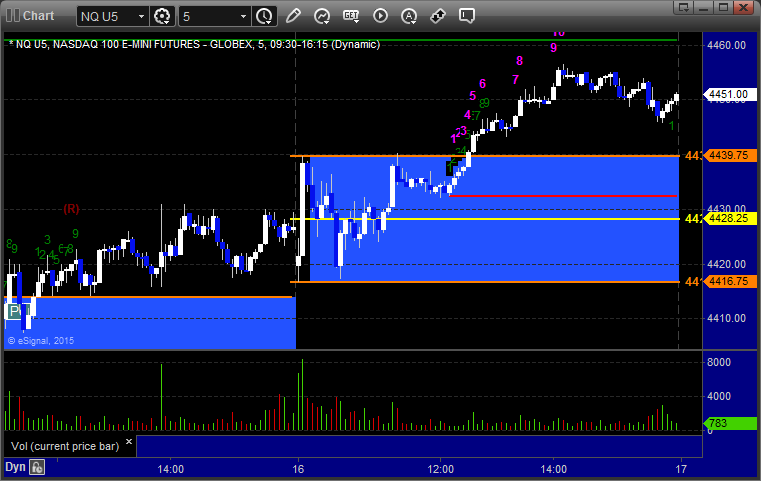

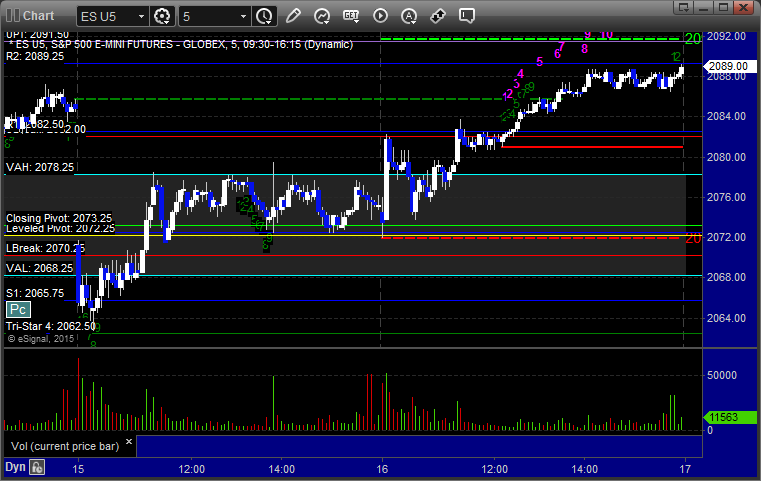

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked great:

NQ Opening Range Play triggered long at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/18/15

Nothing special but another winner for the week. See EURUSD below. We head into triple expiration, so things could be light.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long off the left side of the chart but gave you all the way until A to enter. Hit first target at B, stopped second half at C:

Stock Picks Recap for 6/17/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ALGN triggered long (without market support due to opening 5 minutes) and technically worked enough for a partial but shouldn't have been taken anyway due to the opening minutes and gap up:

EYES triggered long (without market support) and worked enough for a partial:

MDVN triggered short (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIDU triggered long (without market support) and didn't work:

His FB triggered short (with market support) and didn't work:

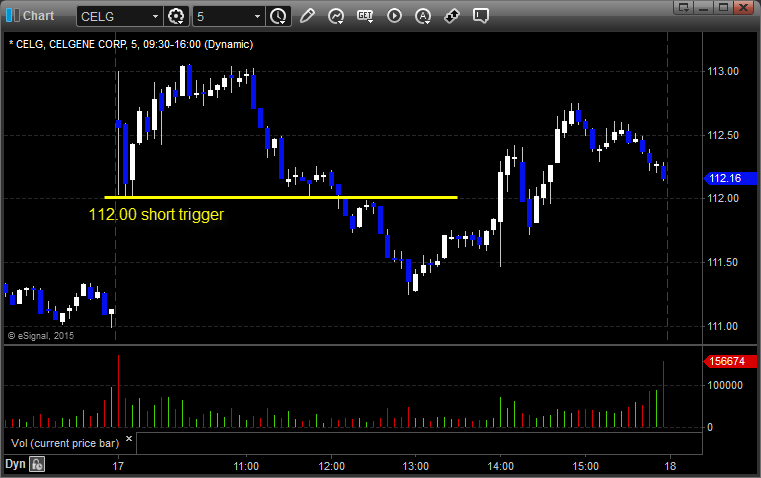

CELG triggered short (with market support) and worked:

Rich's NFLX triggered short (with market support) and worked:

His FAS triggered short (ETF, so no market support needed, but you don't really want to enter a trade on the Fed announcement spike) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 6/17/15

The markets gapped up a little and spent the first two hours inside the opening 15-minute ranges before finally heading down to fill the gaps and going lower over lunch ahead of the Fed. The Fed announcement then spiked the market for wave 1, pulled back for wave 2, and tried to turn up for wave 3 but stalled out...and closed at the VWAP, on 1.55 billion NASDAQ shares.

Net ticks: +1.5 ticks.

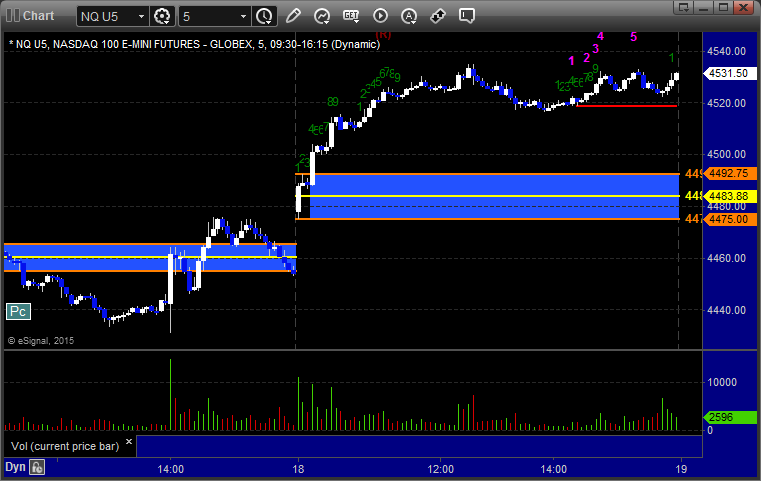

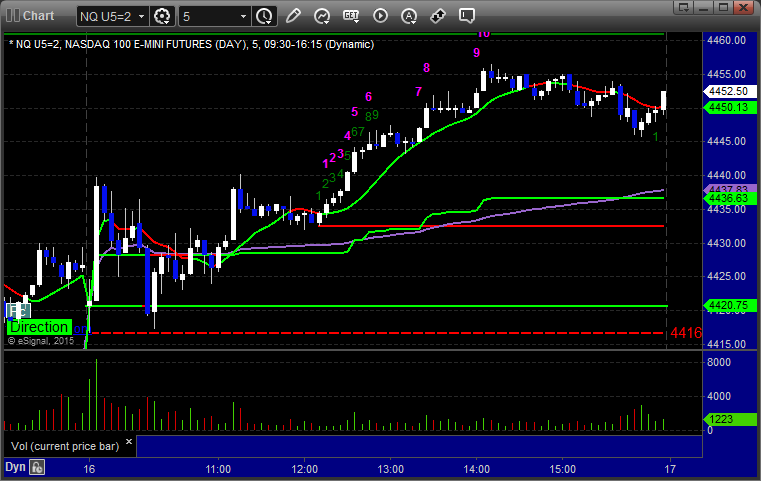

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work:

NQ Opening Range Play triggered long at A and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Mark's call triggered short at A at 2090.50 and stopped for 7 ticks:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

My call triggered short at A at 4455.00, hit first target for six ticks, and I closed the second half at 4449.50 for the gap fill:

Forex Calls Recap for 6/17/15

A decent move for us in the GBPUSD and then the market moved again on the Fed announcement. See GBPUSD section below for our trade review.

Here's a look at the US Dollar Index intraday with our market directional lines:

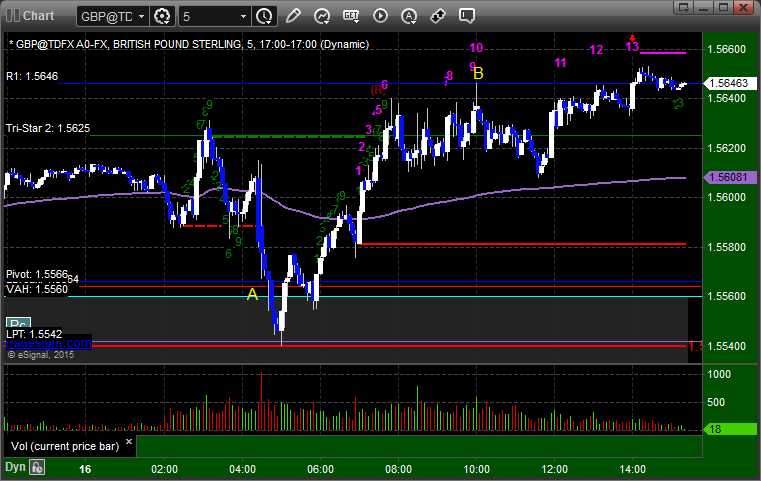

GBPUSD:

Triggered long at A, hit first target at B, raised stop and stopped at C in the morning:

Stock Picks Recap for 6/16/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered short (ETF, so no market support needed) and worked enough for the gap fill:

His FB triggered long (without market support due to opening 5 minutes) and worked enough for a partial technically, but might have been hard to take:

His AAPL triggered long (with market support) and didn't work:

Mark's LRCX triggered long (with market support) and worked:

Rich's AMZN triggered long (with market support) and didn't work:

Lots of other calls but nothing triggered.

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

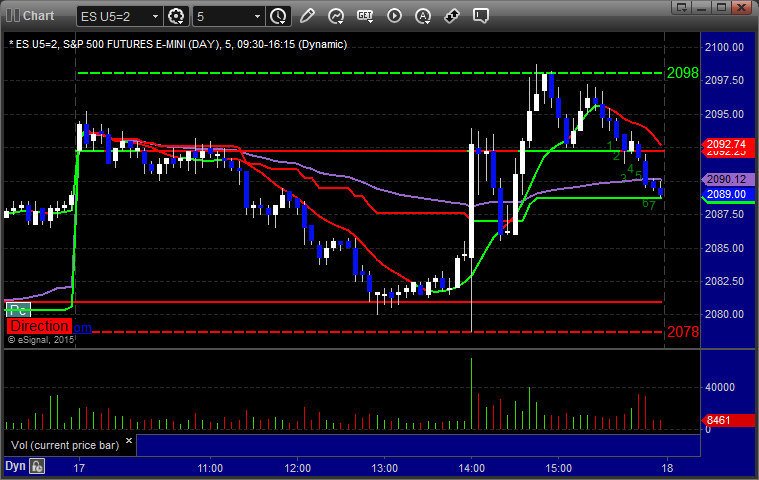

Futures Calls Recap for 6/16/15

A loser and a winner on the Opening Range plays on the ES. Also had a trade trigger over lunch and again later that we will call a wash. See ES section below. The markets opened flat and finally moved up over lunch. NASDAQ volume closed at 1.5 billion shares.

Net ticks: +0 ticks.

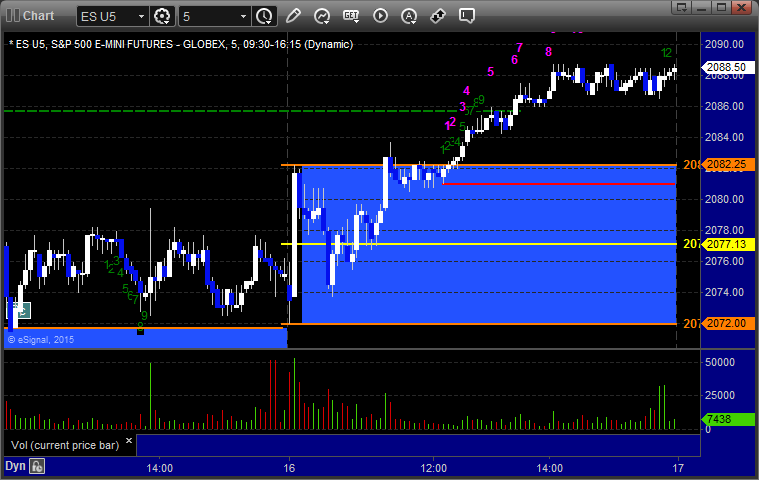

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and didn't work. Triggered long at B and worked:

NQ Opening Range Play triggered long at A but that was too far above the OR to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

I had a call in to go long over R1 at 2082.50, which was set up after the ES hit that level at A. However, it didn't triggered until the start of lunch at B. Per the course, that would have been a small size trade due to time of day. It stopped by two ticks. You would have then put it back in and triggered at B and worked. However, I wasn't around to update:

Forex Calls Recap for 6/16/15

Been a week or so of unexciting sessions and this was no different. See GBPUSD section below. Note how well it used the long trigger.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Note the perfect use of the R1, which was the long trigger, at B, and then it got too late in the session to take: