Futures Calls Recap for 6/10/15

The markets basically opened and closed flat after whipping around in both directions in narrow range on 1.7 billion NASDAQ shares.

Net ticks: +0 ticks.

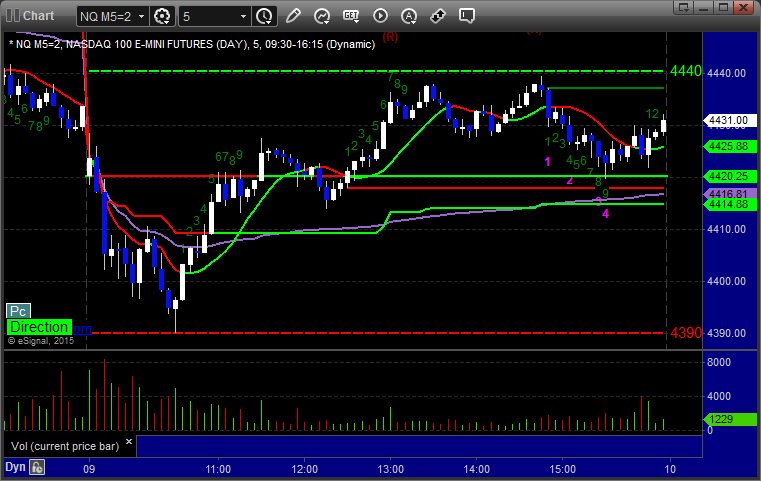

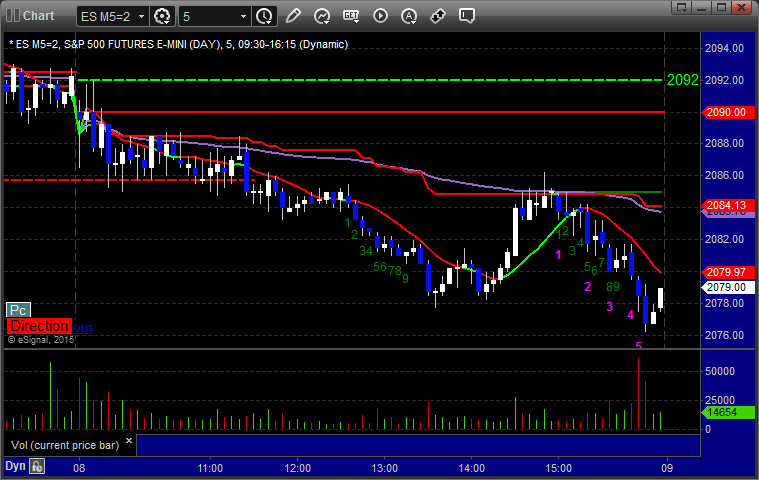

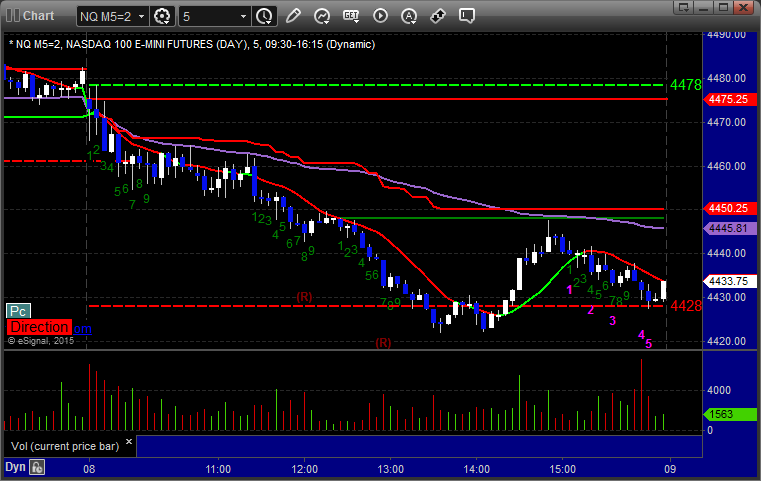

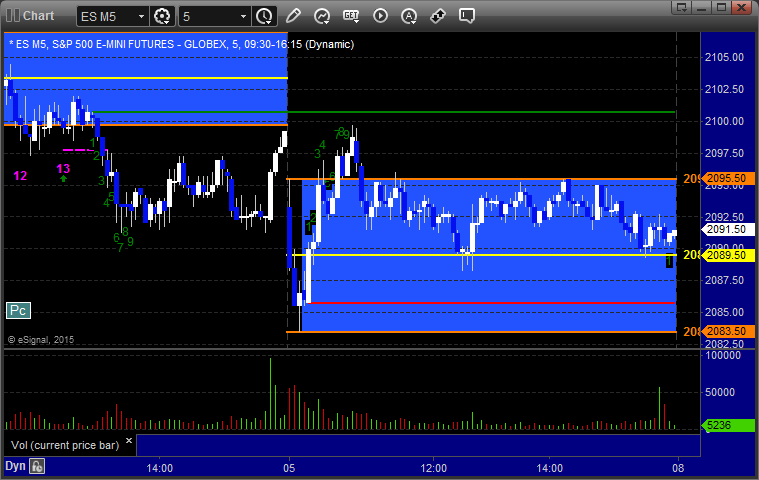

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

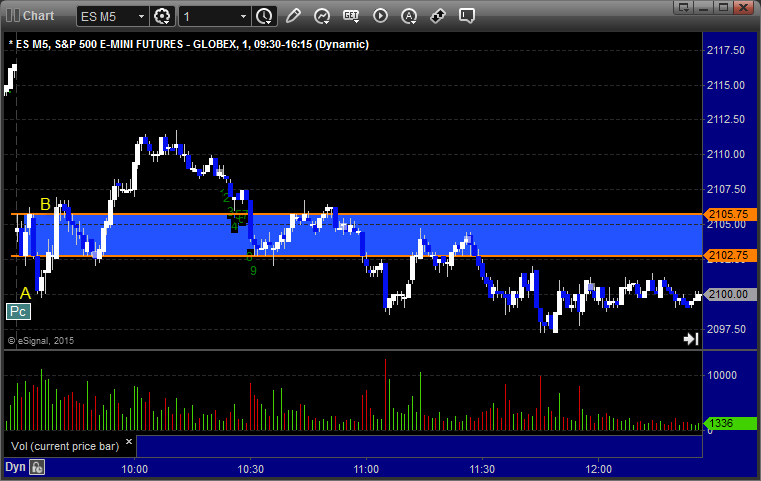

ES Opening Range Play triggered long at A but the close of the candle was too far above the OR to take as discussed in the Lab. Triggered short at B and worked:

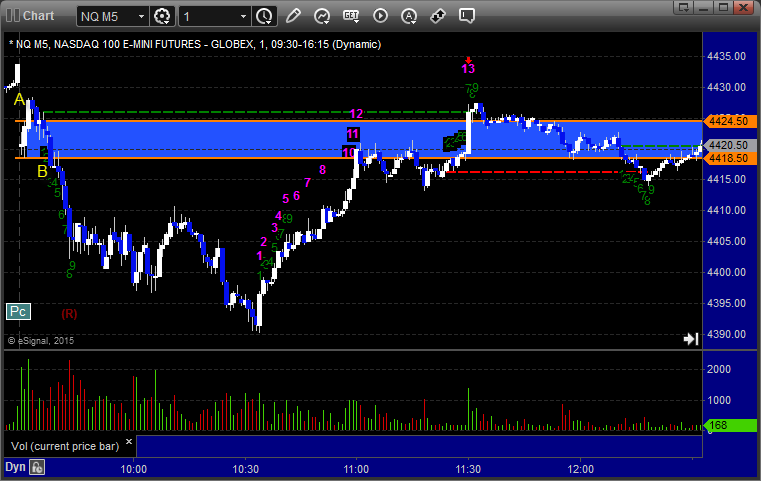

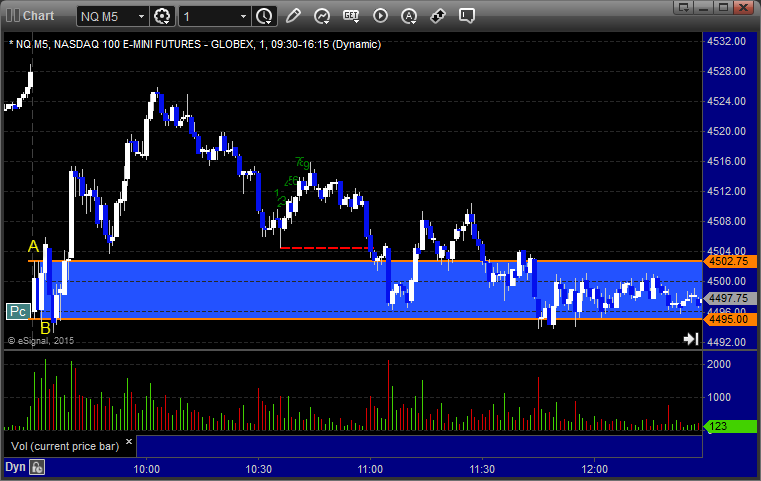

NQ Opening Range Play triggered long at A but the close of the candle was too far above the OR to take as discussed in the Lab. Triggered short at B and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

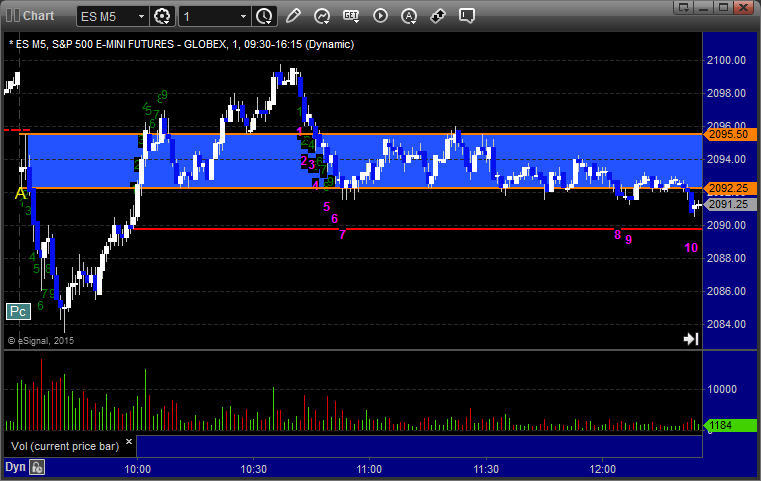

ES:

Forex Calls Recap for 6/10/15

I think that's the first time in 2015 that we had 2 days in a row where we stopped out of both calls. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

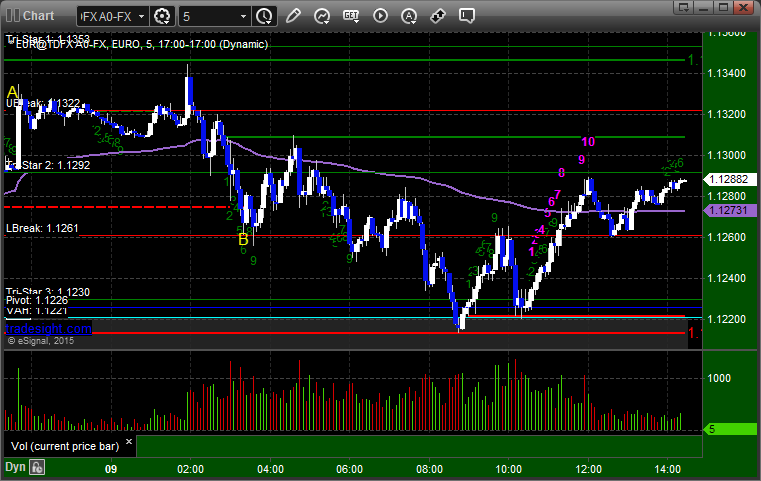

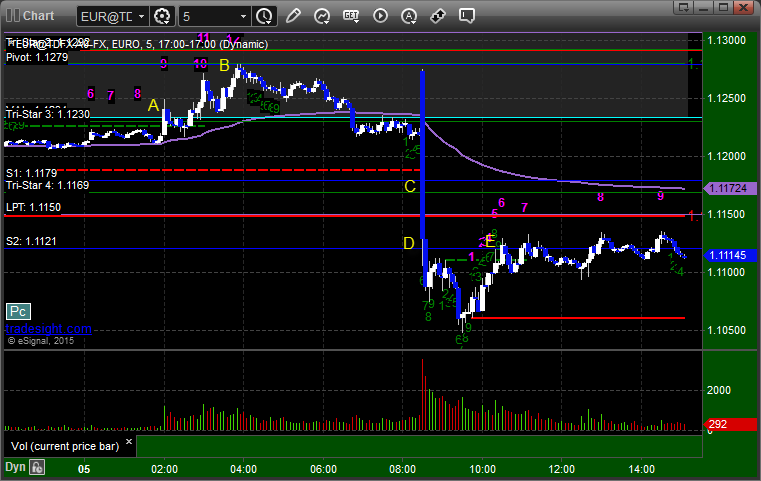

EURUSD:

Triggered long at A and stopped. Triggered short at B and stopped. Ended up right where we started:

Futures Calls Recap for 6/8/15

The markets gapped down, tried to fill, ES missed by a tick or two, and then stuck in a narrow range for the first two hours, then finally headed lower on light volume over lunch, then came back up to the VWAP late and rolled once more to close at the lows on only 1.5 billion NASDAQ shares. Mixed results on the Opening Range plays, see that section below, and no need for additional calls with the first two hours so flat.

Net ticks: +0 ticks.

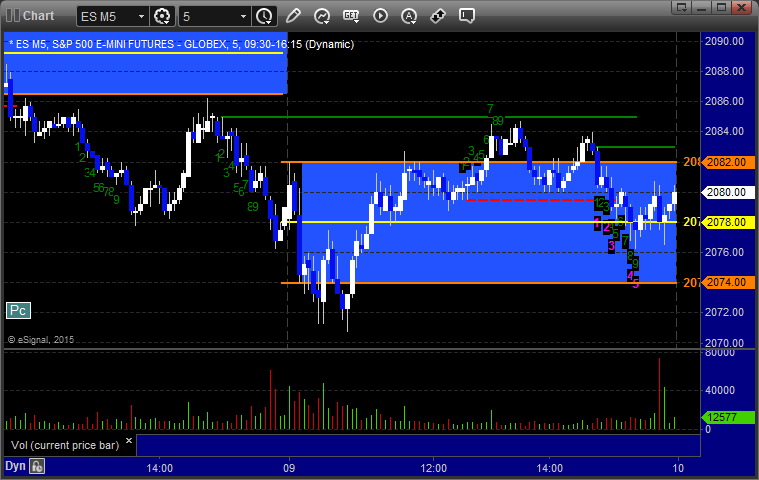

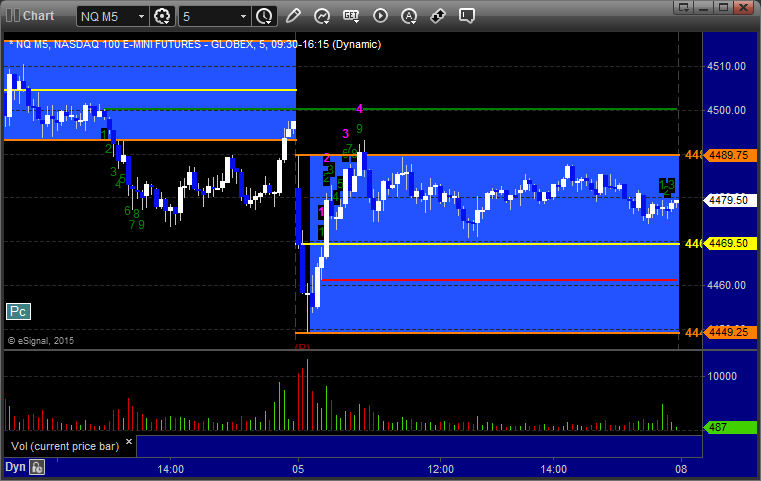

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

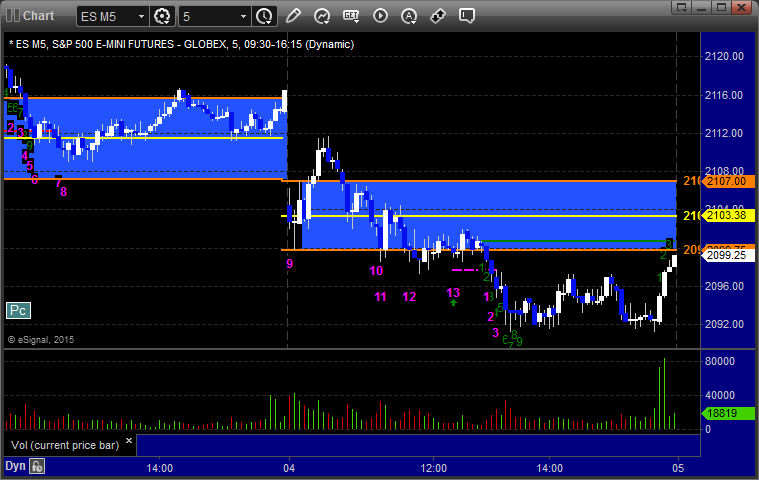

ES Opening Range Play triggered long at A and didn't work. Technically triggered short later and eventually worked if you waited a long time:

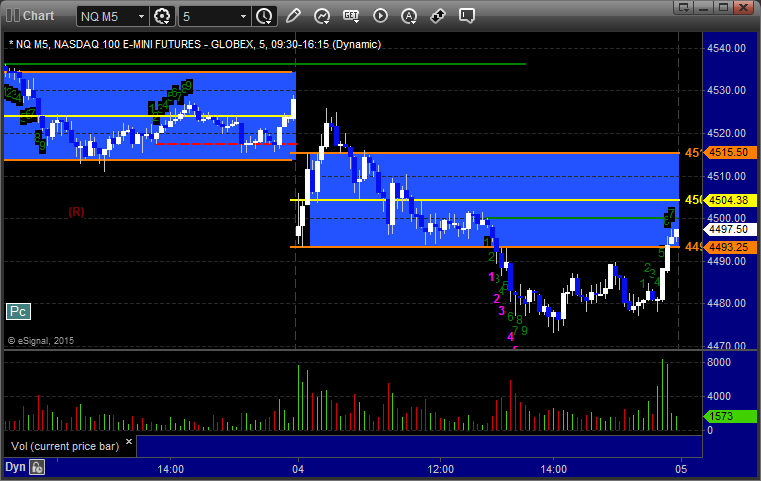

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/8/15

Two triggers on the EURUSD, both of which stopped. The long then triggered again and worked, but I wasn't quite awake in time to take it.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short to the left of the edge of the chart at A and stopped. Triggered long at B, barely stopped at C, which was unfortunate. If you were awake or on the East Coast, could have put it back in at D and hit first target at E and beyond:

Stock Picks Recap for 6/5/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked enough for a partial:

CELG triggered short (with market support) and didn't work:

NFLX triggered long (with market support) and worked:

His FB triggered long (with market support) and didn't work:

Mark's TSLA triggered long (with market support) and worked:

EBAY triggered long (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

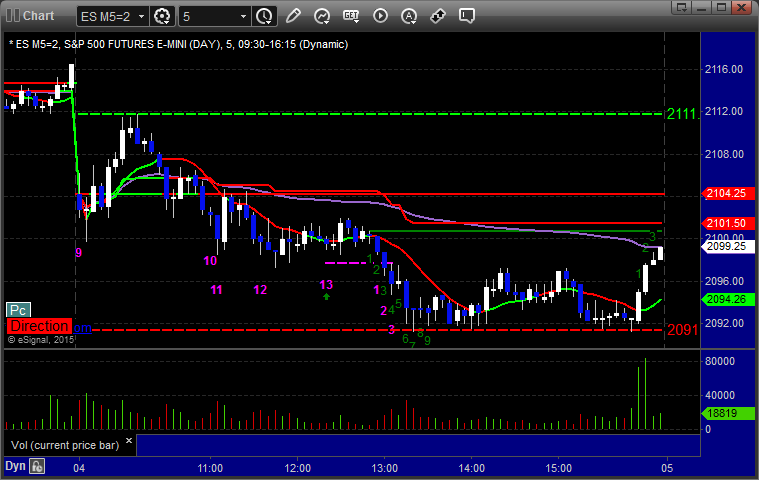

Futures Calls Recap for 6/5/15

Another day, and back to some really nice Opening Range Plays after a one day pause. See that section below. The markets gapped down and pushed sharply lower for 20 minutes, then came back to even and flatlined for the rest of the session. NASDAQ volume was 1.75 billion shares.

Net ticks: +0 ticks.

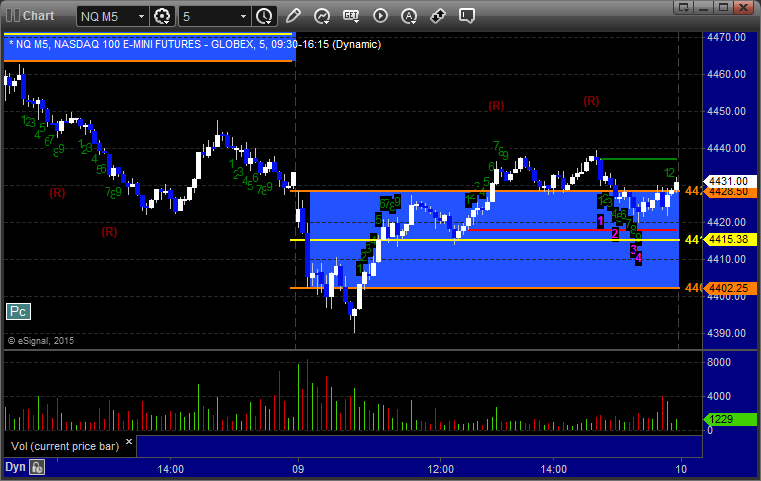

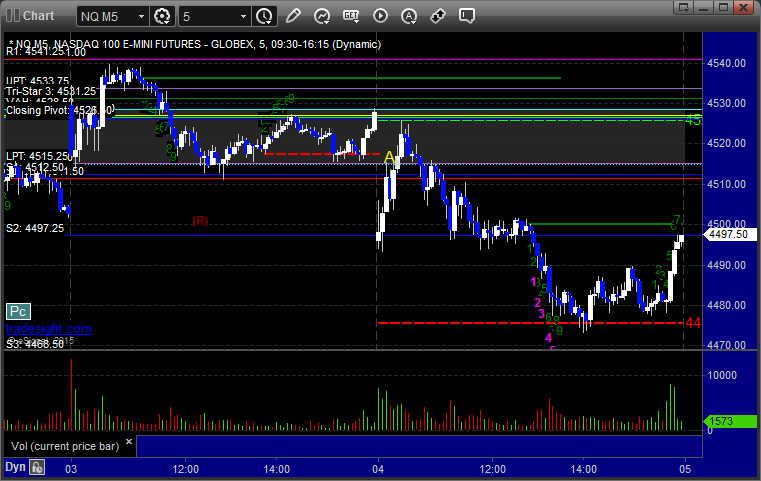

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked great:

NQ Opening Range Play triggered short at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 6/5/15

Mixed results to wrap the week with a big news spike. See the EURUSD section below.

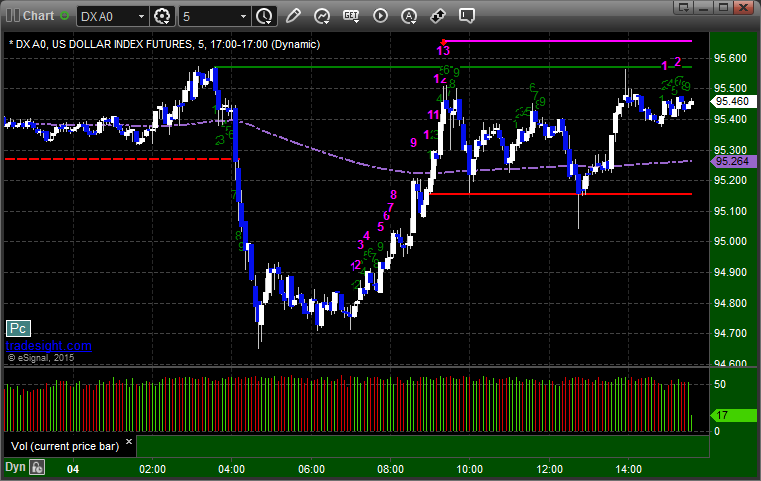

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered long at A, hit first target at B, second half stopped. Triggered short (if you could get any on the news spike) at C, hit first target at D, stopped final at E:

Stock Picks Recap for 6/4/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PRTA triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, SINA triggered short (with market support) and didn't work, worked later:

AMGN triggered long (with market support) and worked enough for a partial:

Rich's RIG triggered short (with market support) and worked:

His FB triggered short (with market support) and worked:

His TSLA triggered short (with market support) and worked great:

His AMZN triggerd short (with market support) and worked:

His WYNN triggered long (without market support) and didn't work:

KLAC triggered short (with market support) late in the day and ran out of time:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 6/4/15

The markets gapped down, wiggled a bit early, reached up to almost fill the gaps, and then retreated to the lows, which they broke over lunch and stayed lower until the last minutes of the day when we rallied to hit the VWAP again on 1.7 billion NASDAQ shares. For the first time in months, we had a couple of stop outs on the Opening Range plays, but the regular call on the NQ worked.

Net ticks: +8.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A but as we said in the room, that was 3 full points under the OR, so we don't take. Triggered long at B and didn't work:

NQ Opening Range Play triggered long at A and didn't work. Triggered short at B and didn't work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 4516.00, hit first target for 6 ticks, raised stop twice and stopped at 4521.50 for 11 ticks:

Forex Calls Recap for 6/4/15

A winner for the session, and the distance to the first target was solid. See the EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target for a big partial on the way to B and stopped the second half. Someone asked if you were awake overnight and it hits UPT at C, do you move stop under R1. Yes: