Stock Picks Recap for 4/30/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SINA triggered long (without market support due to opening 5 minutes) and worked:

EPZM triggered short (with market support) and worked:

NVDQ triggered short (without market support due to opening 5 minutes) and technically worked enough for a partial, but I doubt anyone tried to get it:

DISH triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIIB triggered short (with market support) and worked great:

We couldn't get any extra calls in due to the tech issues early.

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 4/30/15

Opening range plays worked both ways after the markets gapped down and wiggled around early on. The range was set early until the last two hours and then they strangely broke the market to the downside after lunch (on the last day of the month) on 2 billion NASDAQ shares. We had some website tech issues today so no official calls, but check out the ES section below for the obvious setup from the course.

Net ticks: +0 ticks.

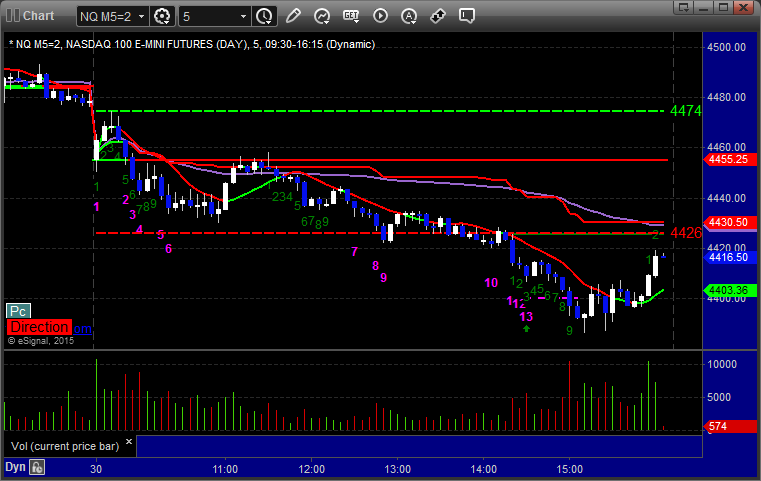

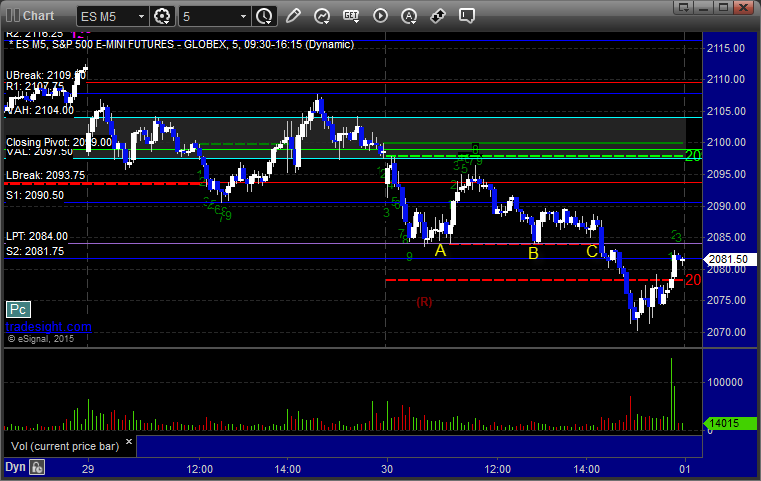

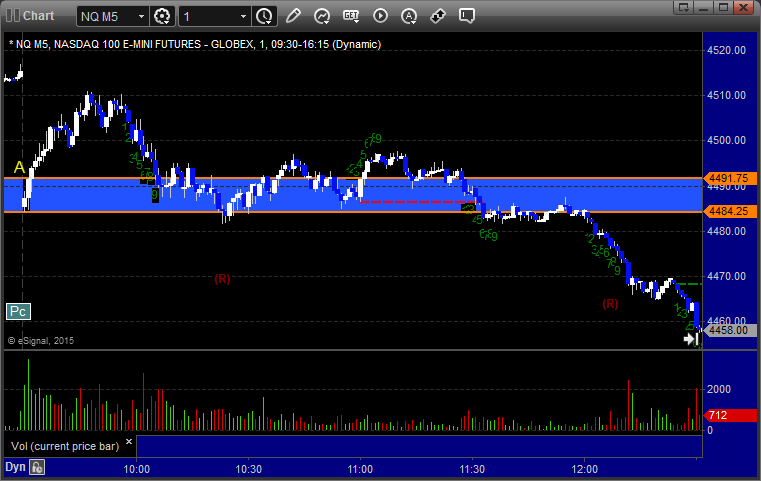

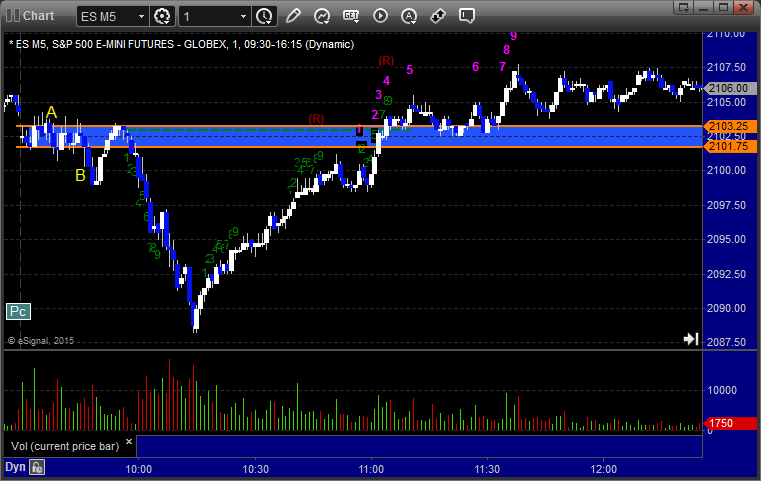

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

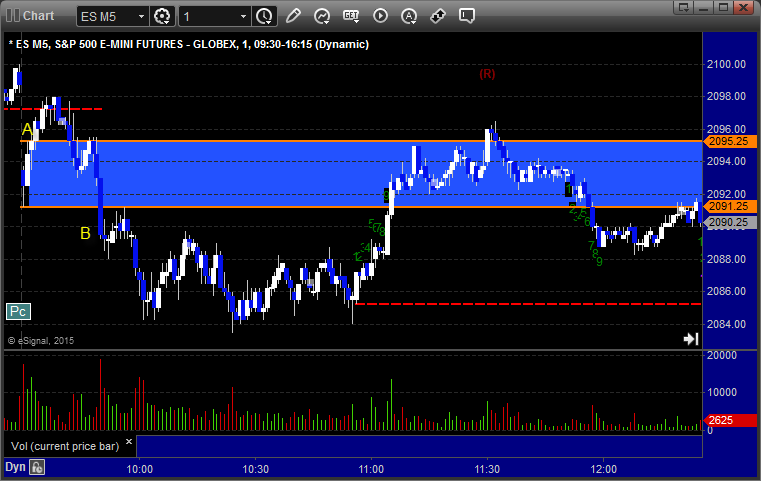

ES Opening Range Play triggered long at A and worked, triggered short at B and worked:

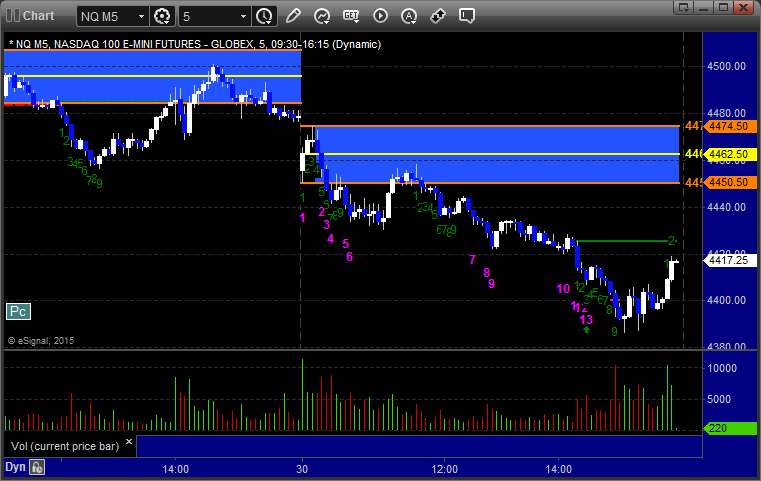

NQ Opening Range Play triggered long at A and worked, triggered short at B and worked:

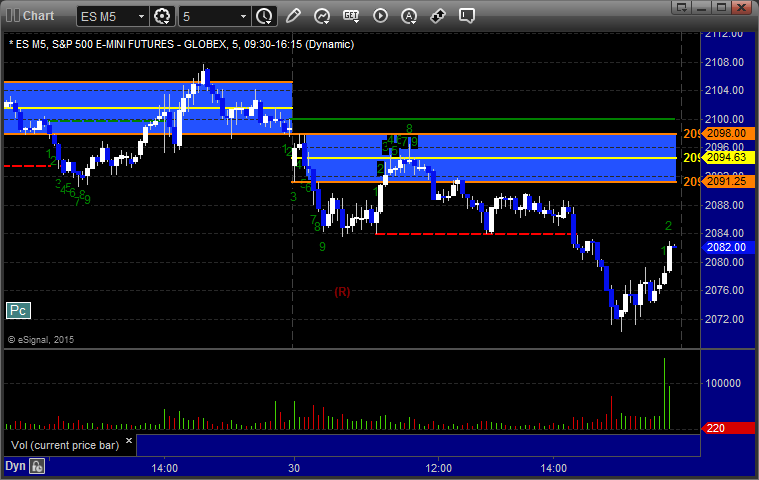

ES Tradesight Institutional Range Play worked:

NQ Tradesight Institutional Range Play worked:

ES:

Note the perfect setup under LPT from the cup and handle at A and B that triggered at C:

Forex Calls Recap for 4/30/15

A winner and a loser for the session. See the EURUSD section below.

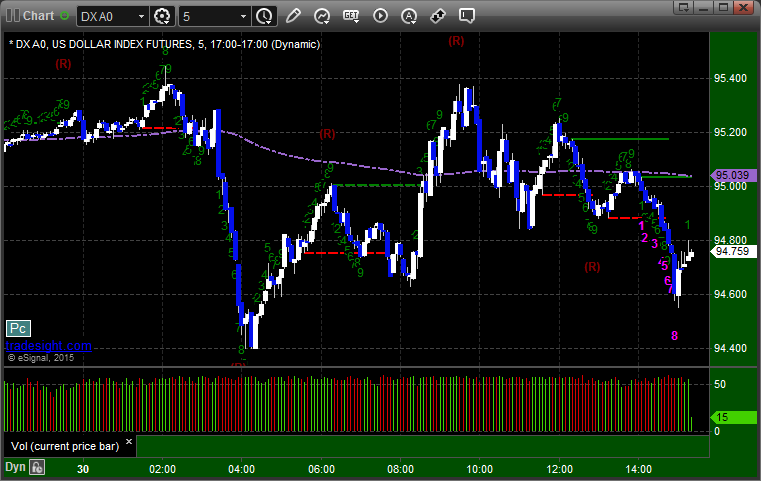

Here's a look at the US Dollar Index intraday with our market directional lines:

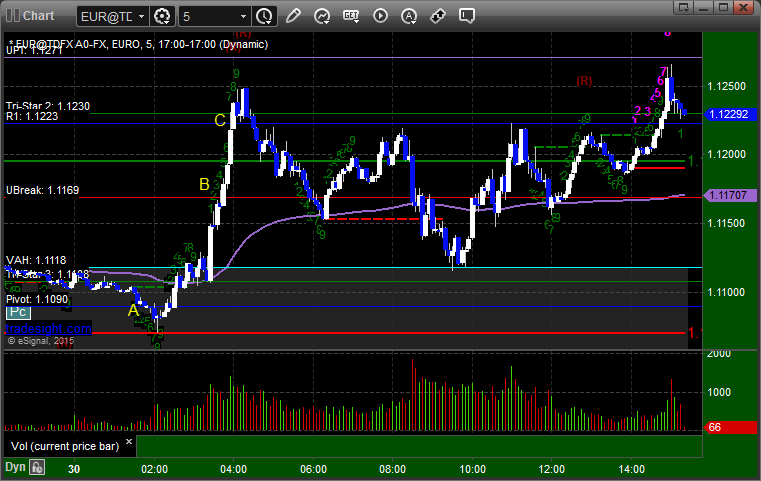

EURUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, stopped second half:

Stock Picks Recap for 4/29/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's SSYS triggered long (with market support) and didn't work:

BIDU triggered short (with market support) and didn't work on a sweep, then worked after:

SINA triggered long (without market support) and worked:

FSLR triggered short (with market support) and worked:

Rich's AAPL triggered short (with market support) and worked:

TSLA triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 2 of them worked, 3 did not.

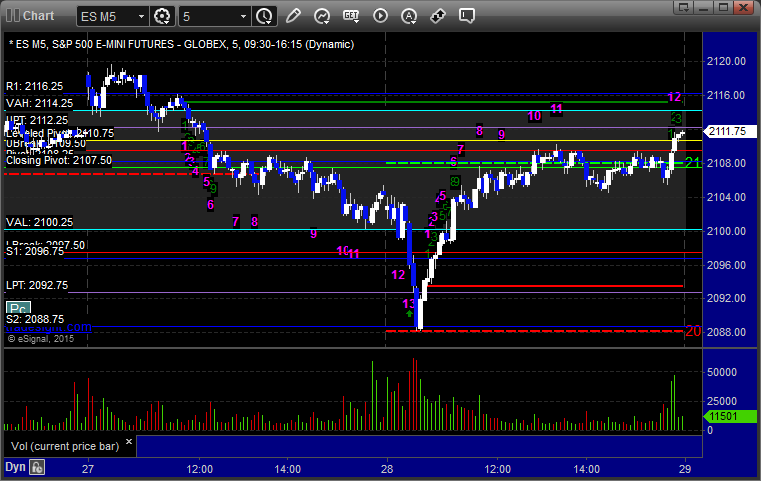

Futures Calls Recap for 4/29/15

A loser that swept and then worked after the Fed announcement on a day that was basically what you would expect on a Fed announcement day...choppy and ended up going nowhere on 1.7 billion NASDAQ shares.

Net ticks: -4.5 ticks.

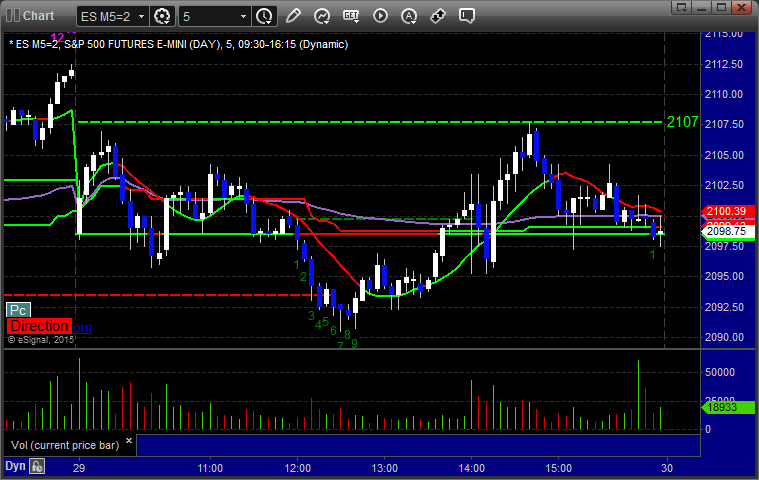

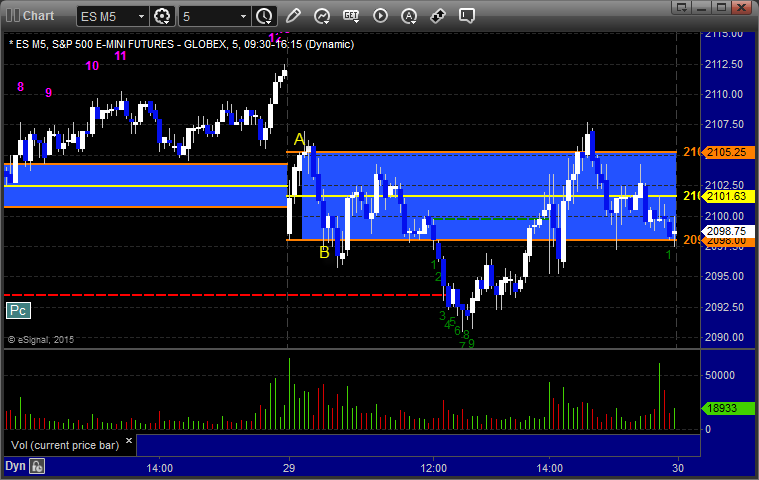

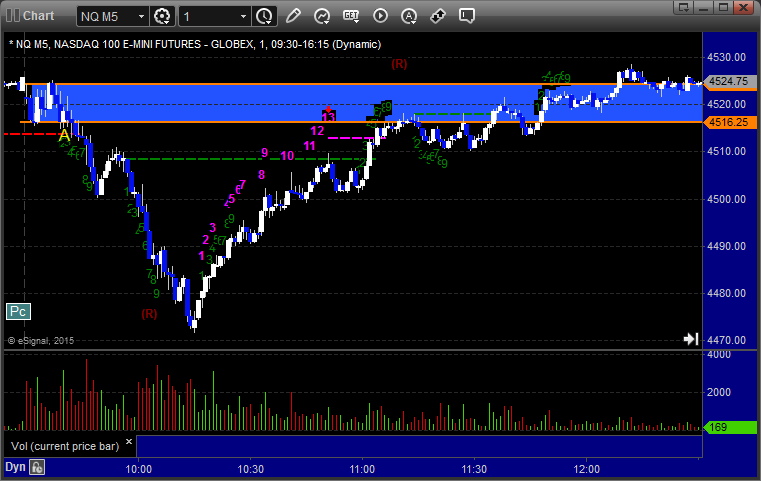

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play triggered long at A and didn't work, triggered short at B and didn't work:

NQ Tradesight Institutional Range Play triggered long at A and didn't work:

ES:

Triggered long at A at 2104.50 and stopped, then took it again, hit first target, second half stopped under the entry:

Forex Calls Recap for 4/29/15

We came into the session long the second half of the GBPUSD trade from the prior day. That continued to work, plus we had a new GBPUSD trade work. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

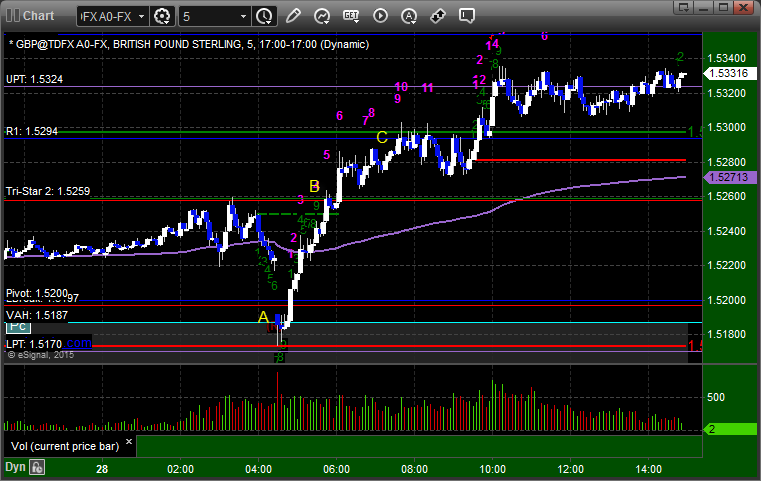

GBPUSD:

We came into the session still long the second half of the prior day's trade and that continued through with the new trigger as well. New trade triggered long at A, hit first target at B, and we closed the second half of both trades at C:

Stock Picks Recap for 4/28/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CROX triggered long (with market support) and worked:

AAPL gapped over, no trigger.

KERX triggered short (with market support) and worked enough for a partial:

EXAS triggered short (with market support) and worked enough for a partial, but was very thin:

OVAS triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and worked:

Mark's YNDX triggered long (with market support) and worked:

Rich's BABA triggered short (with market support) and worked:

His COH triggered short (with market support) and didn't work:

GILD triggered short (with market support) and worked:

Rich's UA triggered short (with market support) and worked:

His WUBA triggered short (without market support) and worked enough for a partial:

In total, that's 10 trades triggering with market support, 9 of them worked, 1 did not.

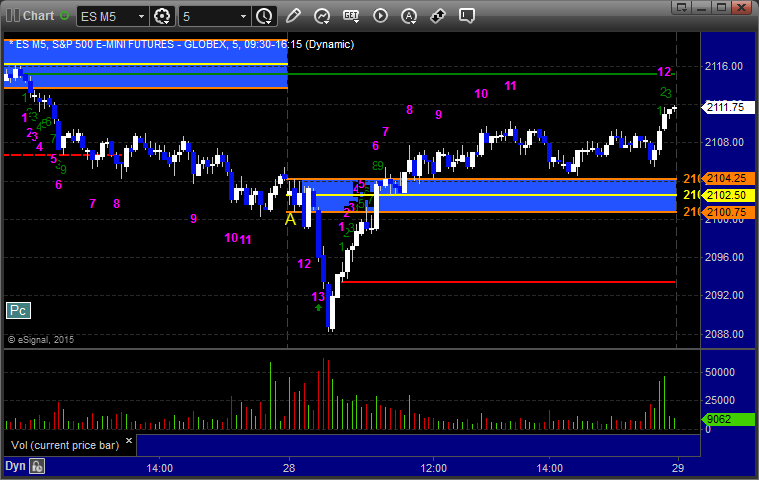

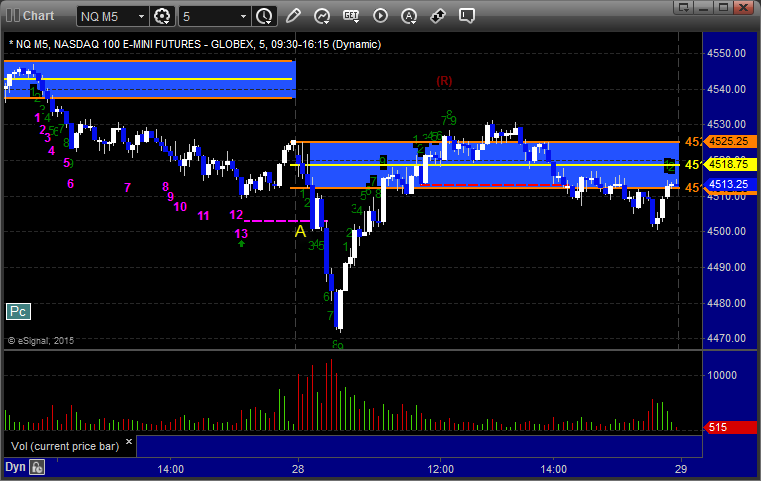

Futures Calls Recap for 4/28/15

No official calls for the session and finally a mixed bag on the Opening Range plays. The markets opened fairly flat and tanked early but reversed just as sharply and then stuck flat around even for the rest of the session on 1.9 billion NASDAQ shares.

Net ticks: +0 ticks.

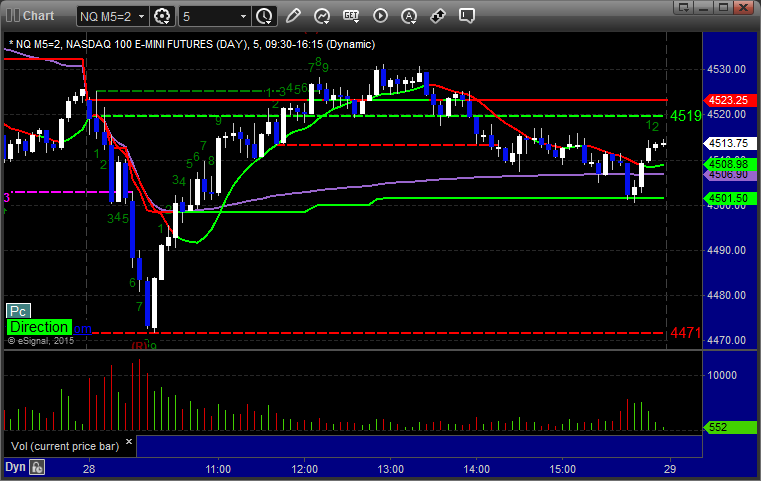

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work (very tight stop due to narrow OR) and short at B and didn't work:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play triggered short at A and worked:

NQ Tradesight Institutional Range Play technically triggered short at A but it was 10 points below the OR Low when it closed the candle, which is too far to take an entry, even though it ended up working):

ES:

Forex Calls Recap for 4/28/15

A loser and a winner that is still going. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, and still holding second half of the long:

Stock Picks Recap for 4/27/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MNST triggered long (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, TWTR triggered long (with market support) and worked:

Rich's AMGN triggered short (with market support) and worked great:

His AAPL triggered short (with market support) and eventually worked, but you would have had to wait hours, never went enough against to stop over price:

His WUBA triggered short (with market support) and worked:

His second WUBA call triggered short (with market support) and worked:

His TSLA triggered short (with market support) and didn't work:

His AMZN triggered short (with market support) and worked:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.