Stock Picks Recap for 4/16/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ALNY triggered long (with market support) and worked, but it was quick:

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered long (with market support) and worked enough for a partial:

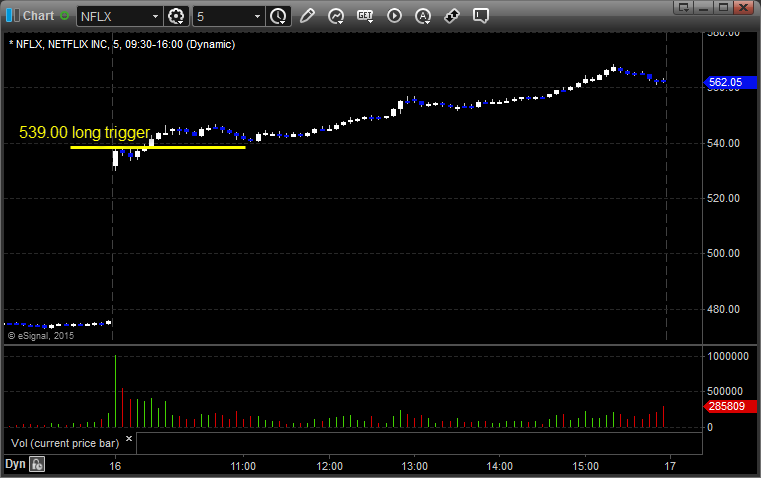

Rich's NFLX triggered long (with market support) and worked:

His C triggered short (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 4/16/15

Don't remember the last time that the ES spent the first hour and 15 minutes inside of the opening 5-minute bar's range. Unreal. NASDAQ volume closed at 1.55 billion shares on what can only be described as an uneventful session.

Net ticks: -7 ticks.

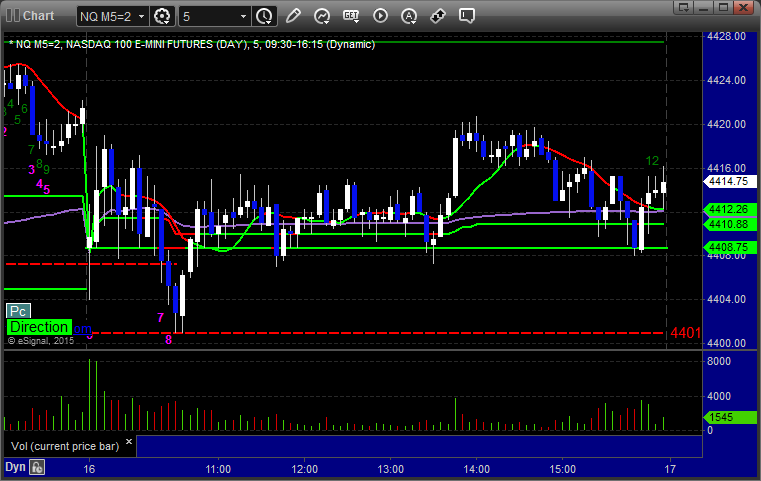

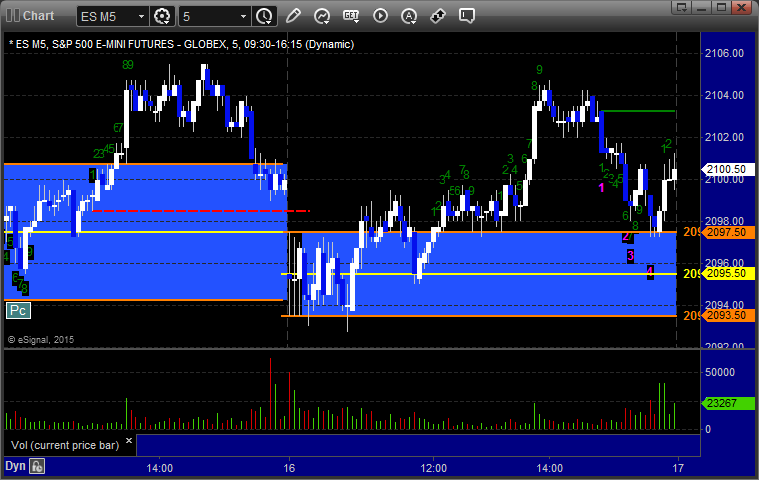

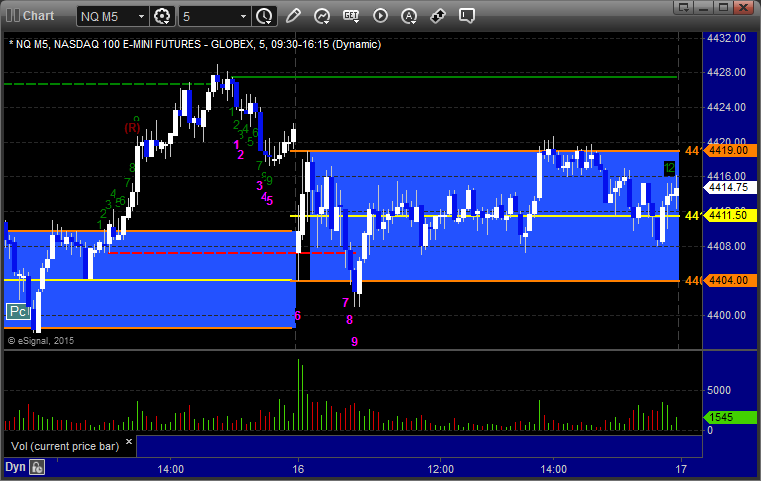

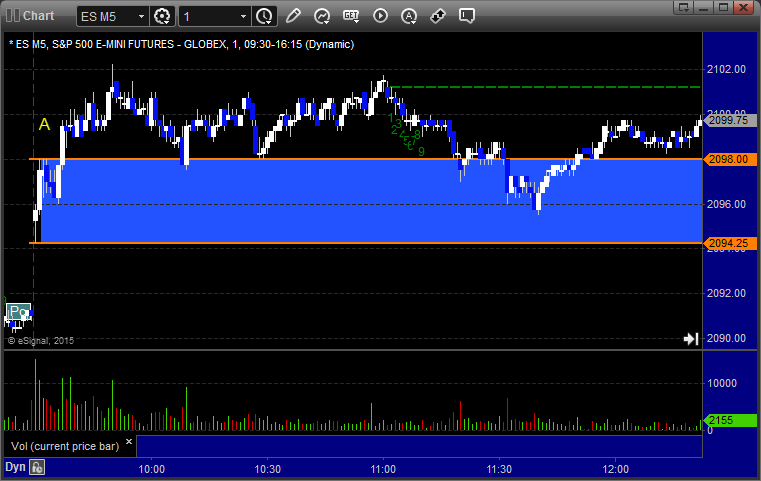

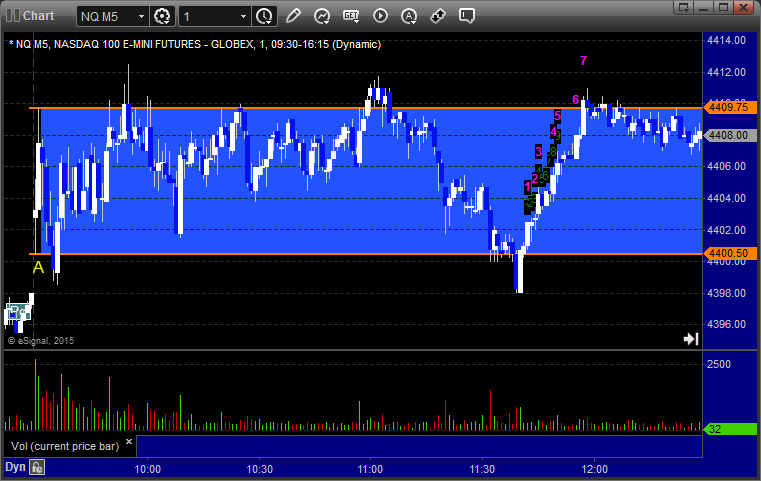

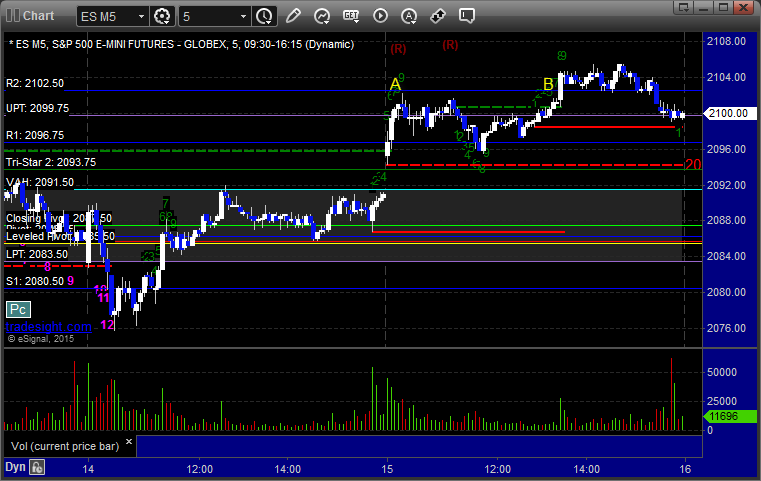

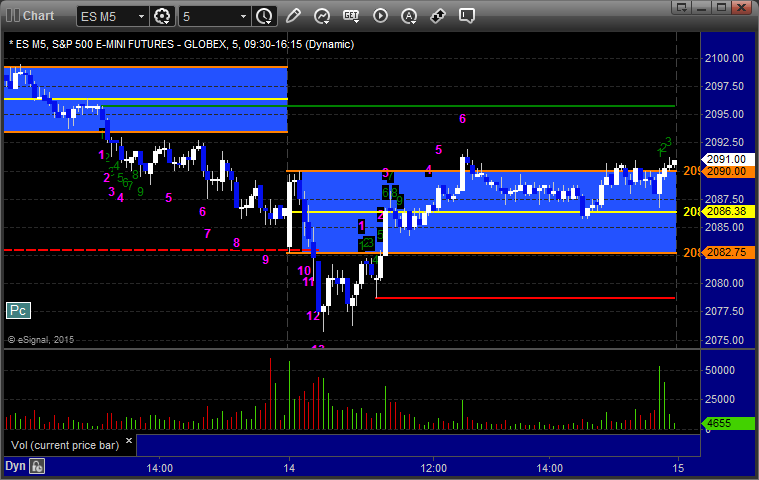

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

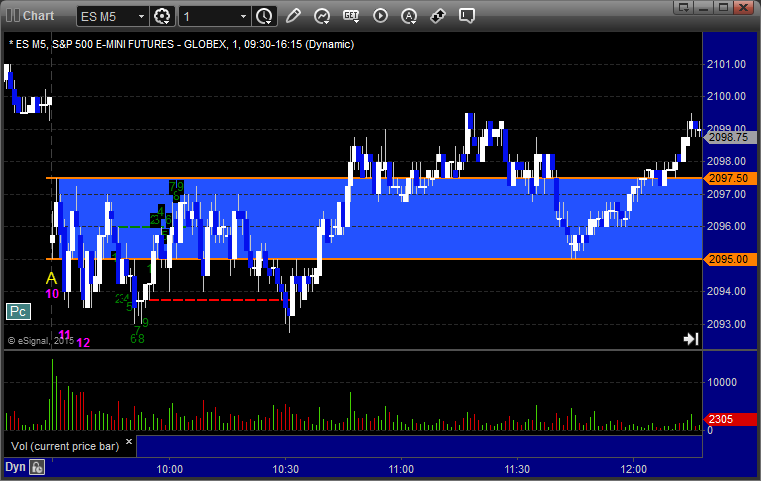

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and never worked:

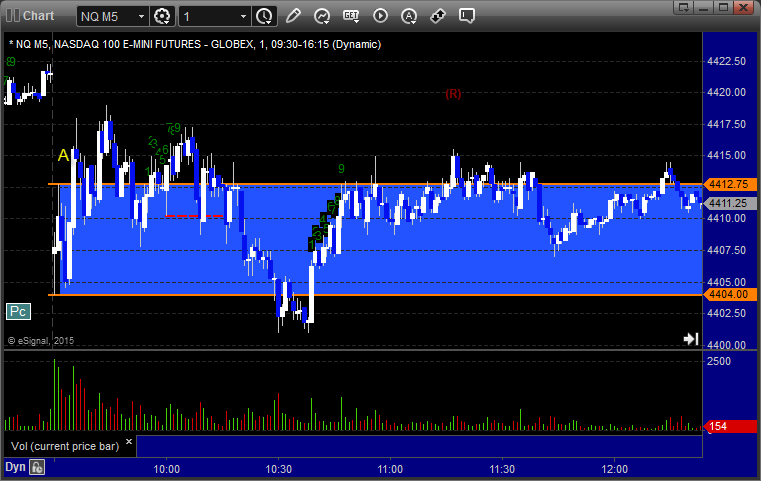

NQ Opening Range Play triggered long at A and never worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

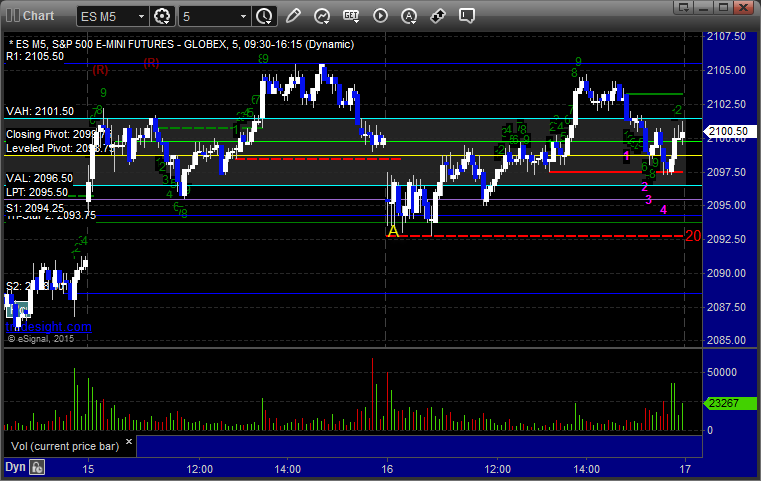

ES:

Triggered short at A at 2093.25 and stopped:

Forex Calls Recap for 4/16/15

A half size loser and a winner for the session. See the GBPUSD section below.

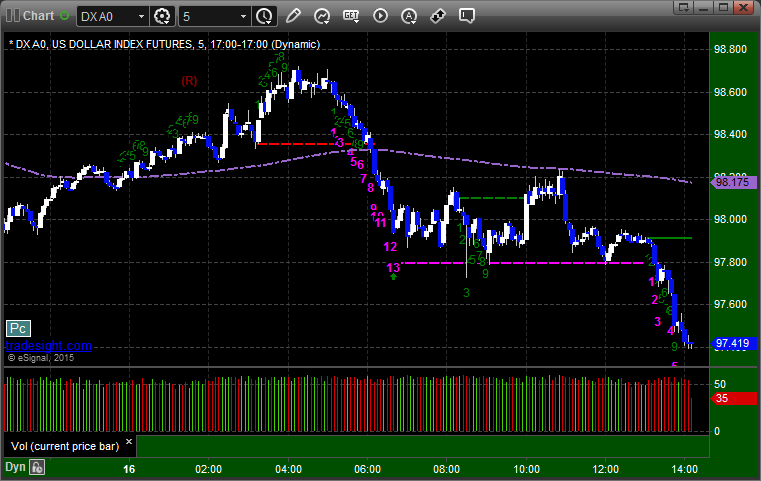

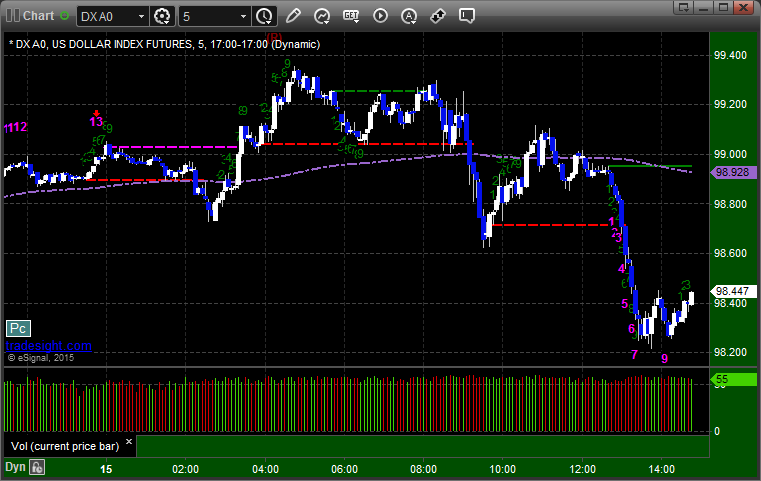

Here's a look at the US Dollar Index intraday with our market directional lines:

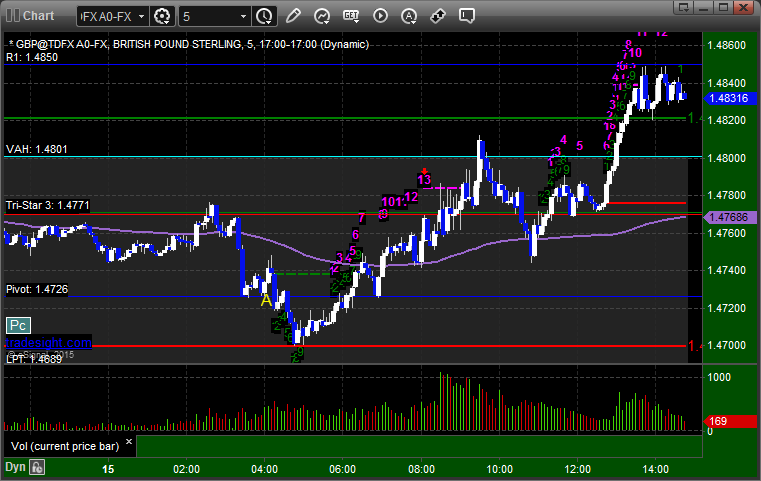

GBPUSD:

Triggered long way early (before the chart begins, so half size) and stopped ahead of European session. Then triggered at A, hit first target at B, closed second half at C:

Stock Picks Recap for 4/15/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's KLAC triggered long (with market support) and worked:

His FAS triggered long (ETF, so no market support needed) and worked:

His BABA triggered short (without market support) and didn't work, worked later when it triggered with market support:

BIDU triggered short (without market support) and worked:

Rich's MBLY triggered long (with market support) and worked:

Mark's TSLA triggered long (with market support) and worked:

Rich's Z triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, all 5 of them worked.

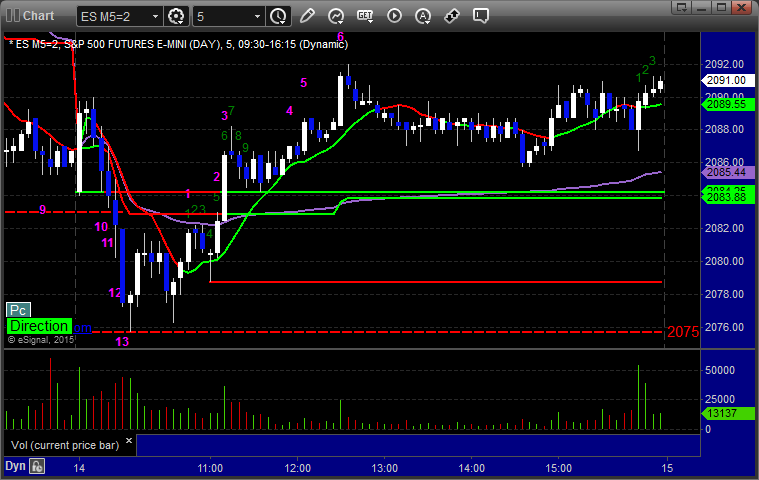

Futures Calls Recap for 4/15/15

The market gapped up and barely touched any levels today. See the Opening Range plays and ES below for some obvious setups. NASDAQ volume closed at 1.6 billion shares, a small uptick from what we have been seeing.

Net ticks: +0 ticks.

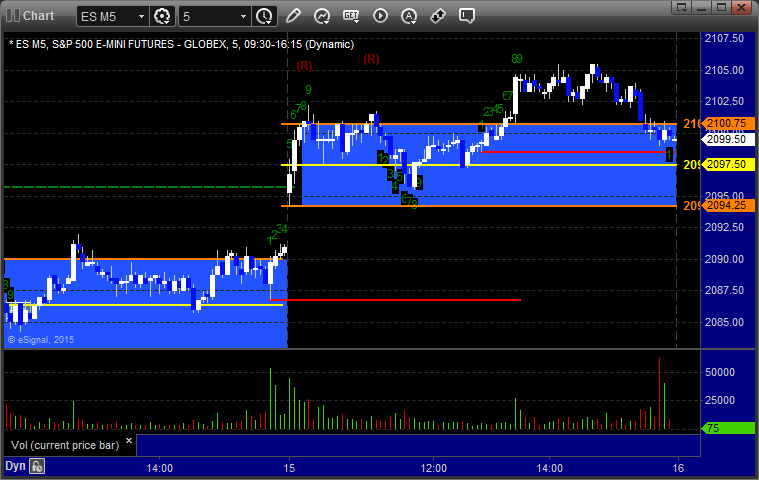

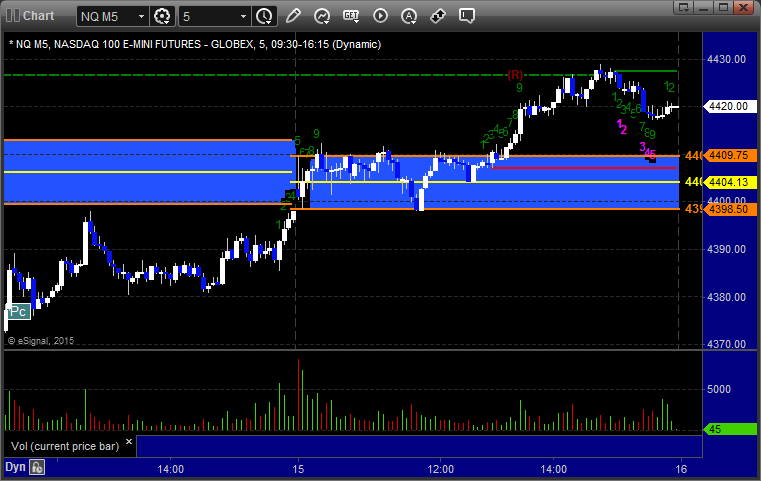

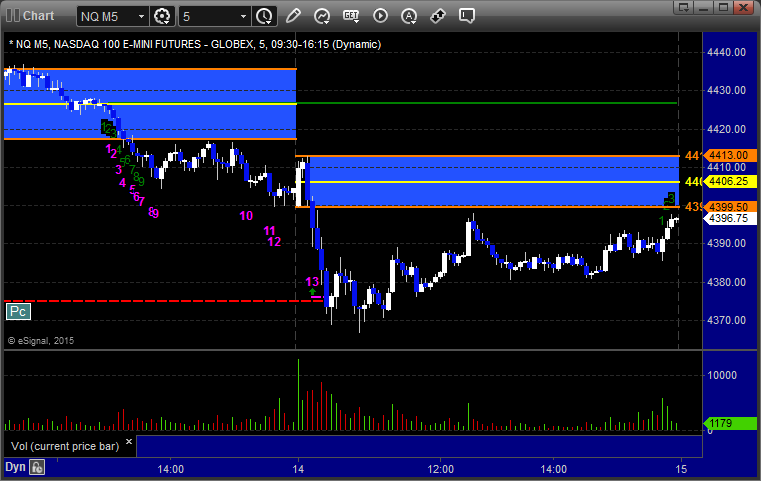

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play triggered short at A and stopped:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Nice setup over lunch, set the R2 level at A and triggered at B:

Forex Calls Recap for 4/15/15

We closed out the second half of the prior day's GBPUSD in the money and then had 2 stop outs in the EURUSD and GBPUSD. See those sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped. Triggered again but awful late in the session, didn't go anywhere:

GBPUSD:

Triggered short at A and stopped:

Stock Picks Recap for 4/14/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, TWTR triggered short (without market support) and worked:

LNKD triggered short (with market support) and worked great:

GOOG triggered short (with market support) and didn't work:

Rich's APA triggered long (with market support) and worked:

Mark's ISIS triggered short (without market support) and worked enough for a partial:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not. The other two trades worked too.

Futures Calls Recap for 4/14/15

Market volume continues to struggle so badly that I'm hesitant to make any official calls, as things tend to not work great without volume. The Opening Range plays did work, though, see that section below. The markets closed around flat on 1.45 billion NASDAQ shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and didn't work, then triggered short at B and did:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

Forex Calls Recap for 4/14/15

A little more volatility and a couple of winning trades in the GBPUSD (including one that is still going). See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

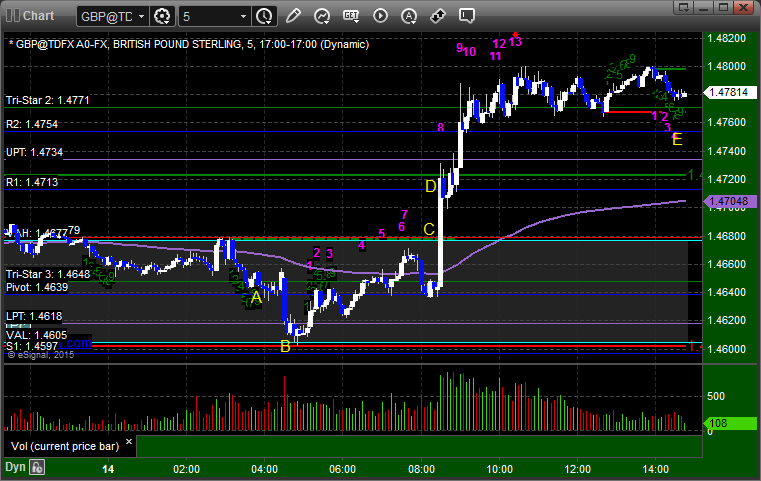

GBPUSD:

There was a long trigger very early yesterday (before Asian session) that would have been half size and stopped. Then, triggered short at A, hit first target at B, stopped second half. Triggered long at C, hit first target at D, still holding second half with a stop under R2 at E:

Stock Picks Recap for 4/13/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

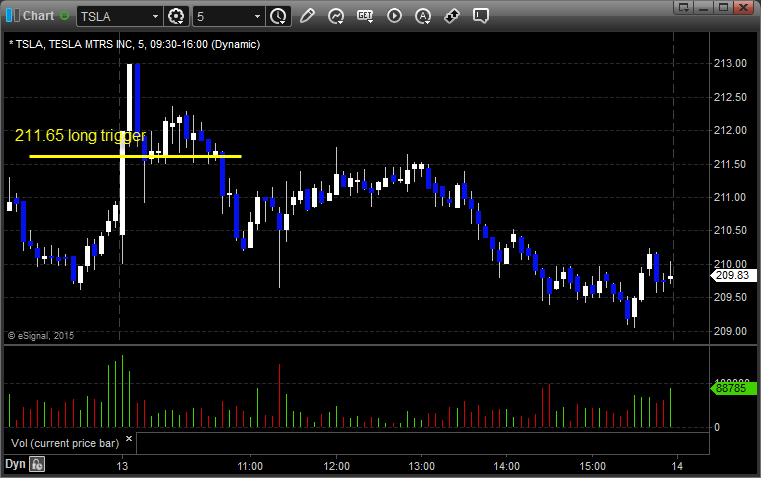

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered long (without market support due to opening 5 minutes) and worked:

Mark's SNDK triggered long (with market support) and worked enough for a partial:

GILD triggered long (with market support) and worked:

Rich's NFLX triggered short (without market support) and didn't work:

GS triggered long (with market support) and worked:

Mark's LRCX triggered long (with market support) and Mark closed it around even when the market stalled:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 was closed flat.