Forex Calls Recap for 4/8/15

Good example of why you should use the tools to trade all of the pairs and not just the sample calls. Not much happened in the EURUSD, but we ended up with a perfect Value Area play on the GBPUSD. See both below.

Here's a look at the US Dollar Index intraday with our market directional lines:

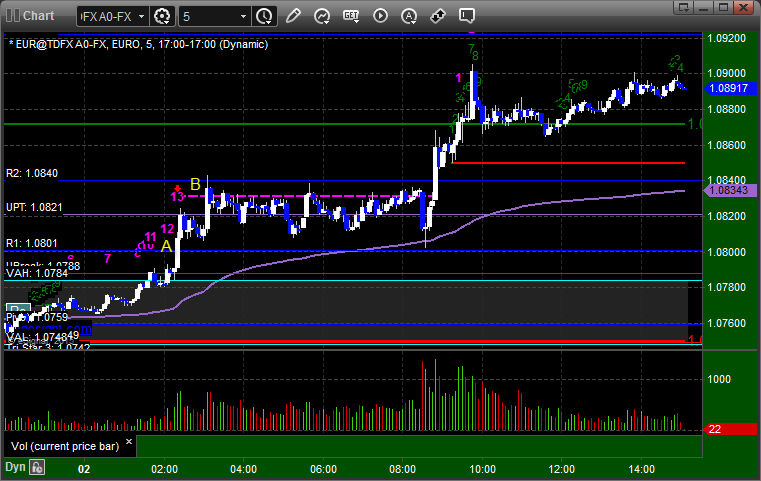

EURUSD:

Triggered long at A, didn't do anything for hours, finally stopped. Triggered short at B, eventually came near the S1 first target, and closed at C slightly in the money for end of session:

Stock Picks Recap for 4/7/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IRDM triggered long (with market support) and didn't do anything either way, we will count as a loser:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIIB triggered long (with market support) and worked:

His BIDU triggered short (without market support) and worked:

SINA triggered long (with market support) and worked:

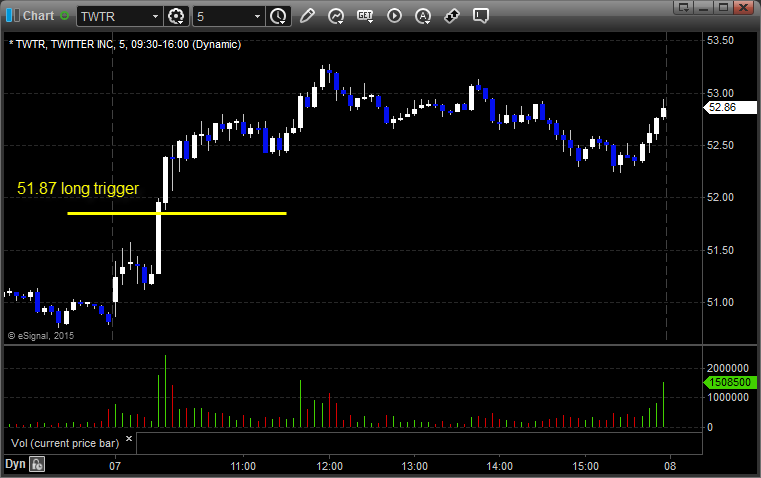

TWTR triggered long (without market support) and worked:

Rich's TSO triggered short (without market support) and worked enough for a partial:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not, but the IRDM was a minor loss and TWTR without market support was great.

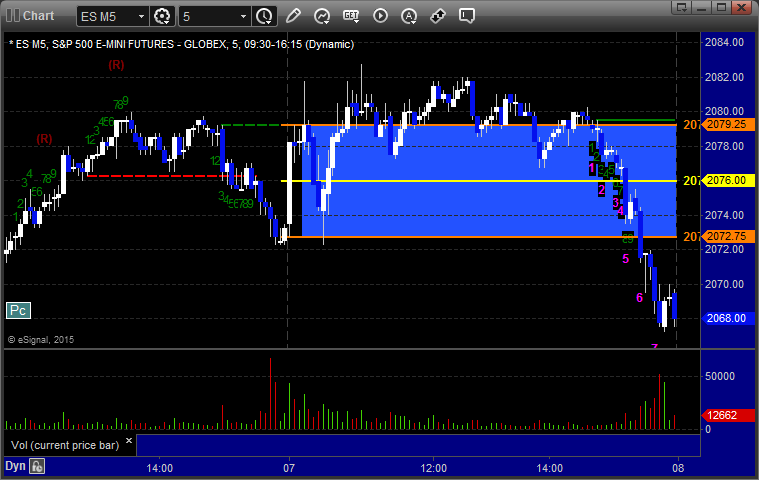

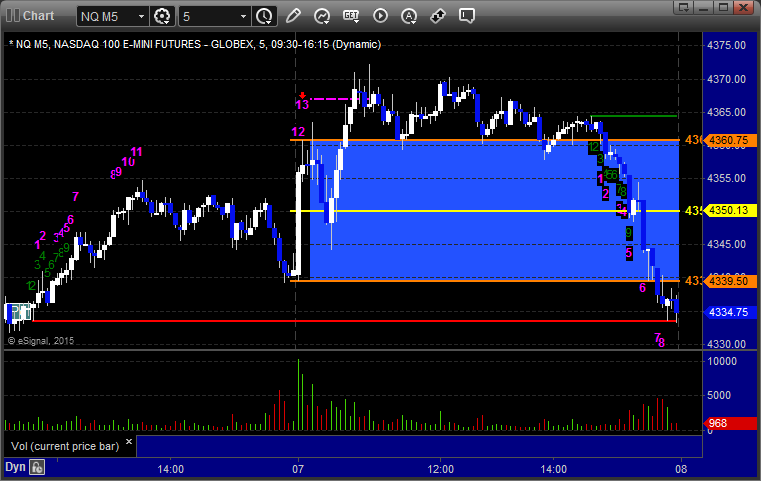

Futures Calls Recap for 4/7/15

We were looking for volume to pick up with the Holiday behind us and we didn't get it. In fact, after a bad volume number early (but slightly better than Monday after the first hour), NASDAQ volume closed at 1.45 billion shares, worse than Monday's total. Once again, we had nice winners with the Opening Range plays in the ES and NQ, but the light action prevented us from making additional calls.

Net ticks: +0 ticks.

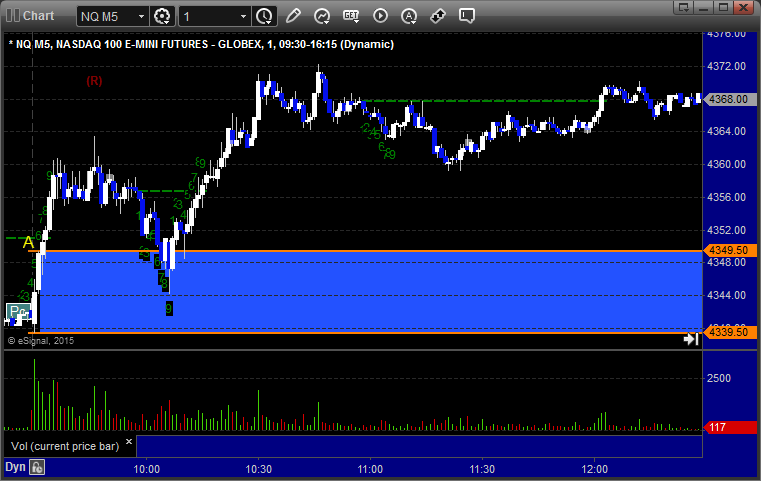

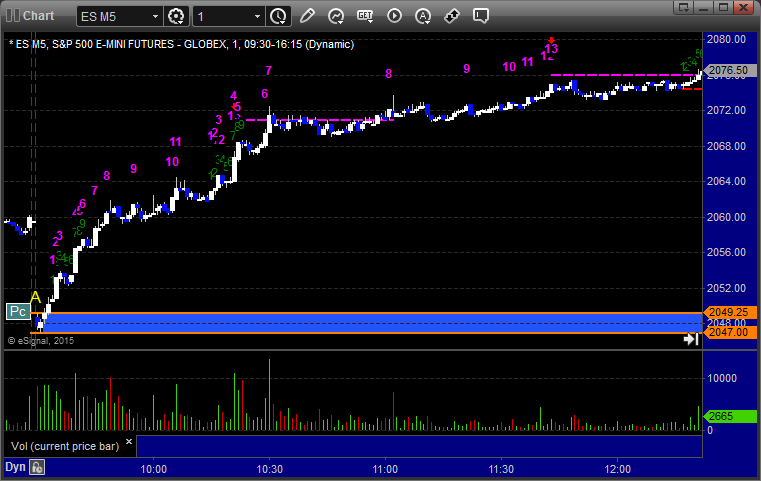

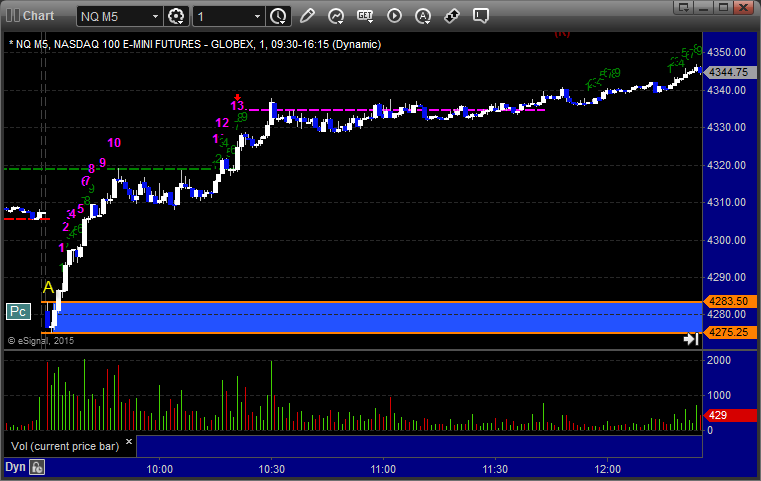

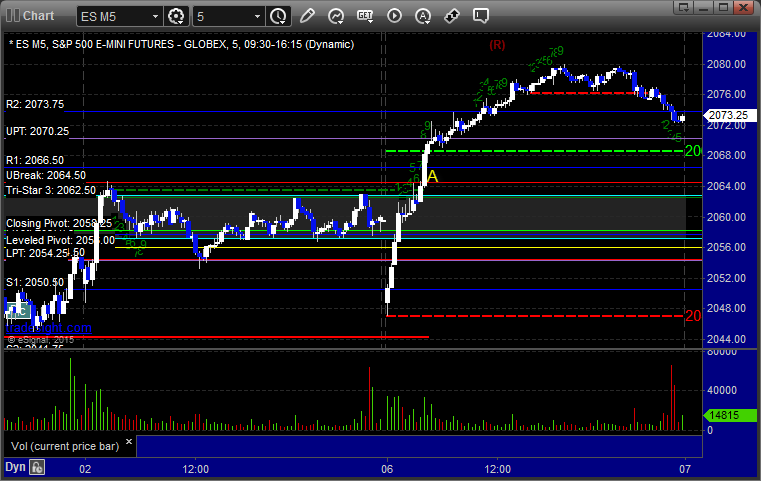

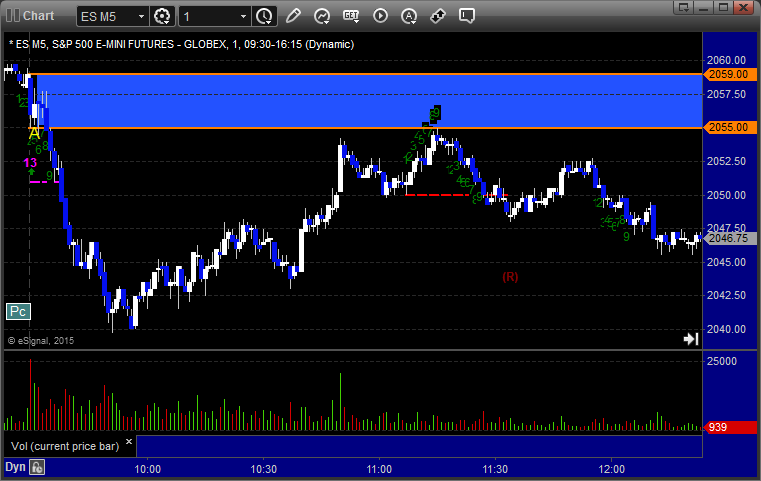

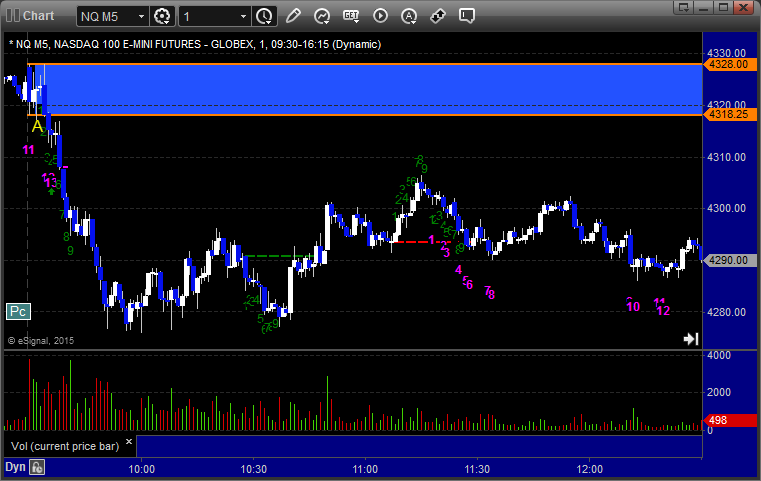

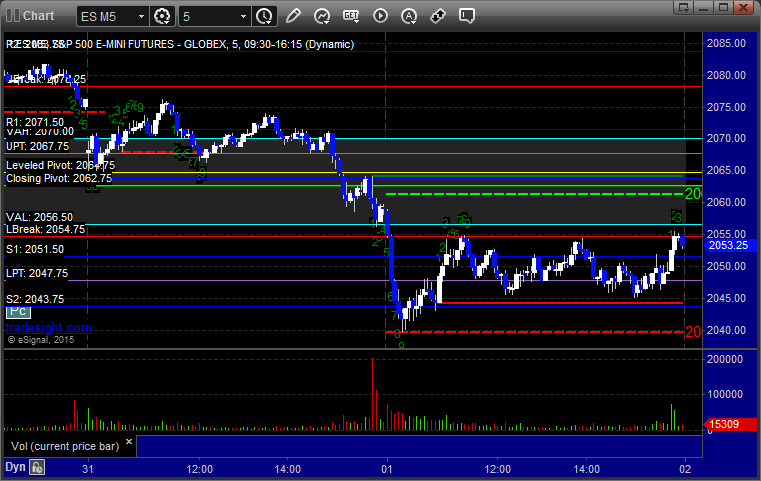

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

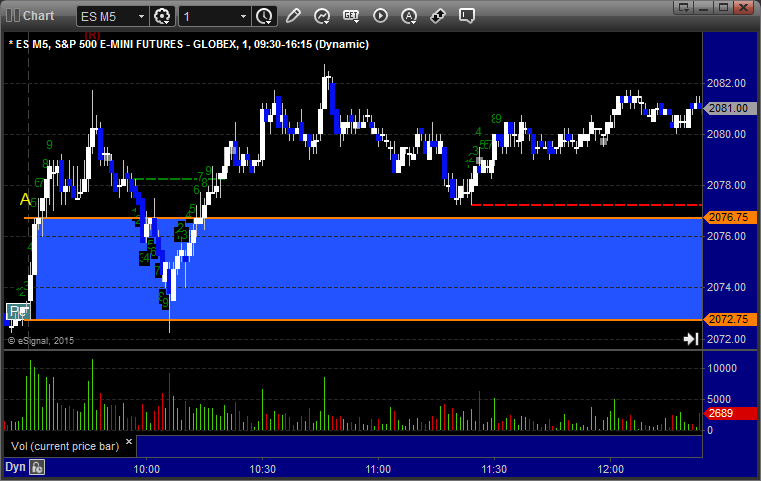

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

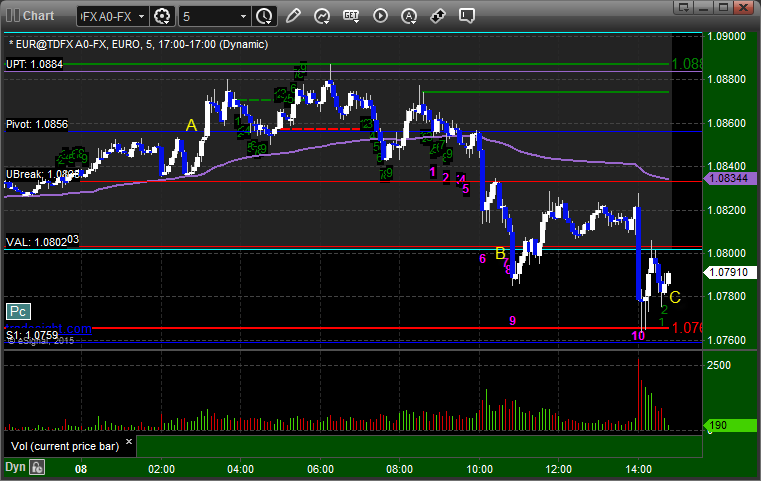

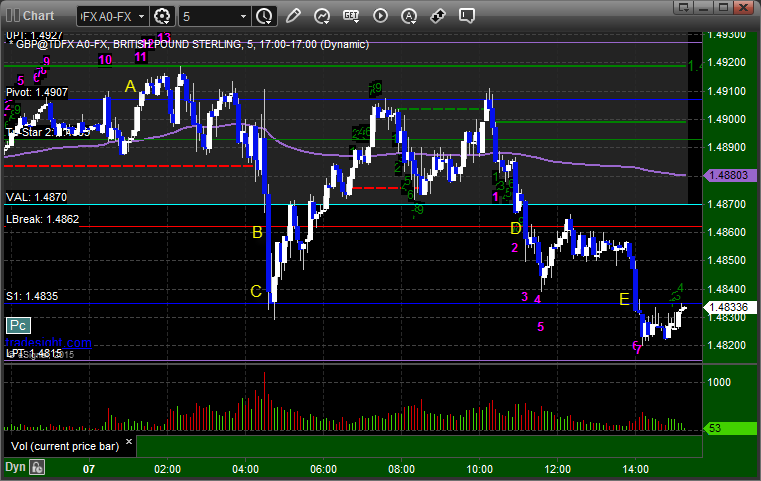

Forex Calls Recap for 4/7/15

Two winners, one still going, and a loser overnight. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, second half stopped. Triggered short at D, hit first target at E, and still holding second half with a stop over 1.4845:

Stock Picks Recap for 4/6/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LSTR triggered short (without market support due to opening 5 minutes and a gap down, should not have been taken):

VDSI triggered short (without market support due to opening 5 minutes and a gap down, should not have been taken):

From the Messenger/Tradesight_st Twitter Feed, Rich's VLO triggered short (without market support) and worked:

TEVA triggered long (with market support) and worked:

Rich's FB triggered long (with market support) and worked enough for a partial:

In total, that's 2 trades triggering with market support, both of them worked.

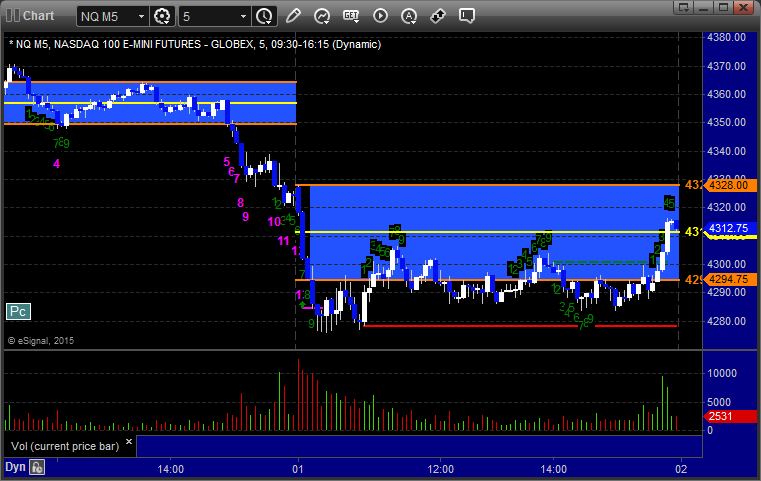

Futures Calls Recap for 4/6/15

Despite the fact that this was basically a Holiday session with most of the world taking the day after Easter off, we ended up with a nice move. The Opening Range plays worked great yet again, plus we had an additional winner on the ES. See those sections below. NASDAQ volume closed at 1.3 billion shares and the markets gapped down and then rallied all day.

Net ticks: +10 ticks.

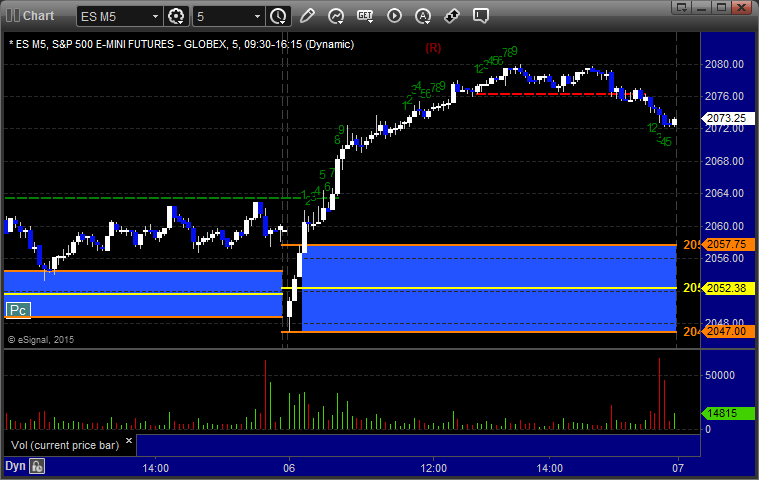

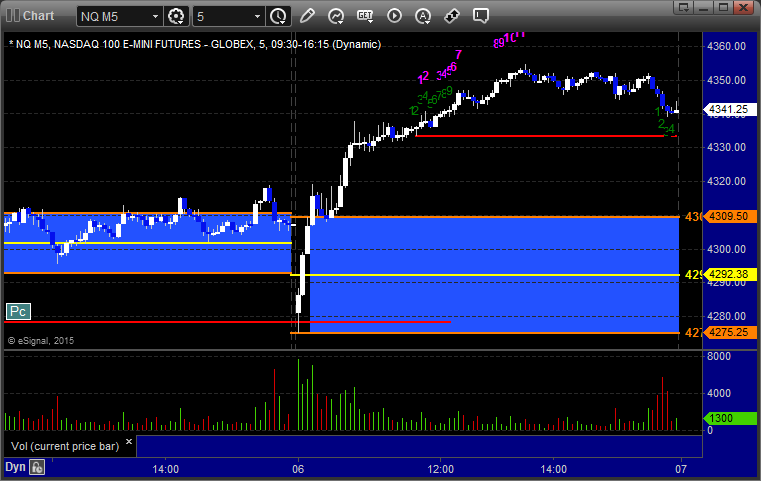

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked great:

NQ Opening Range Play triggered long at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

My call set the UBreak and then triggered at A at 2064.75, hit first target for 6 ticks and closed second half for 14 ticks:

Forex Calls Recap for 4/6/15

No calls for the near-global Bank Holiday (US open, very strange) and not much happened. Charts below, back to normal tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 4/2/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Mark's TSLA triggered long (with market support) and didn't work:

Rich's BABA triggered short (without market support) and worked:

His AAPL triggered long (with market support) and didn't work:

Several other calls, none of them triggered, on a day that we knew not to try hard heading into the long weekend, especially after the early volume warning.

In total, that's 2 trades triggering with market support, neither of them worked.

Futures Calls Recap for 4/2/15

Don't have to make additional calls when the Opening Range plays work so well. I got 40 ticks to my final exit on both the ES and the NQ. See that section below. Meanwhile, to start the quarter, the markets opened flat and dropped out of the gate, then stabilized about 90 minutes in and went flat. Volume was 1.7 billion NASDAQ shares, which isn't spectacular.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked great:

NQ Opening Range Play triggered short at A and worked great:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 4/2/15

Another winner (still holding the second half) for the week. See the EURUSD section below. Not sure if I will make calls. The banks are open tomorrow, but a lot of the world is closed (US stock market closed). If I do make calls based on the setups, it will be a half size session.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under 1.0860: