Futures Calls Recap for 3/27/15

No official calls for what ended up being exactly as predicted...a dead flat Friday session on light volume (1.45 billion NASDAQ shares traded). Opening range plays worked.

Net ticks: +0 ticks.

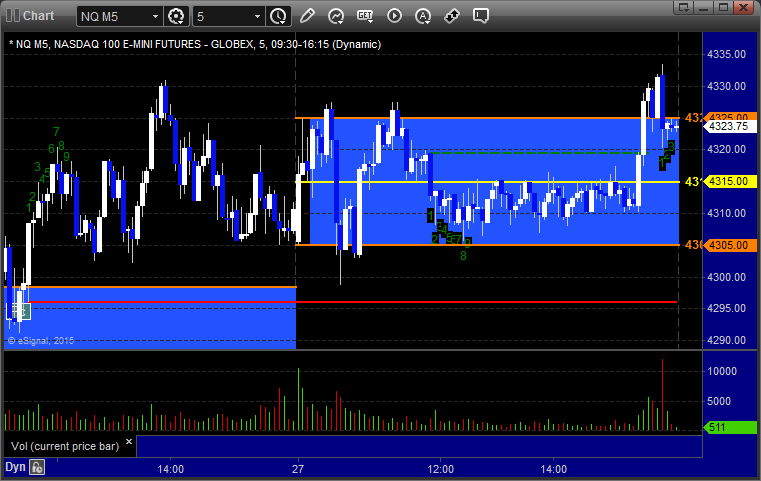

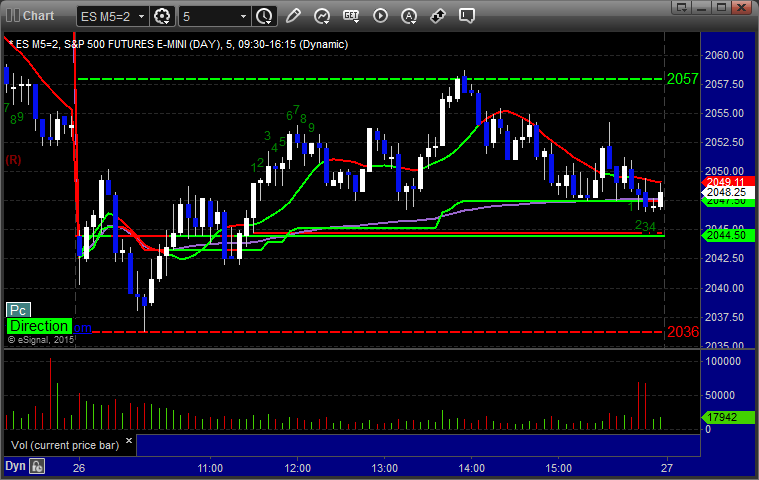

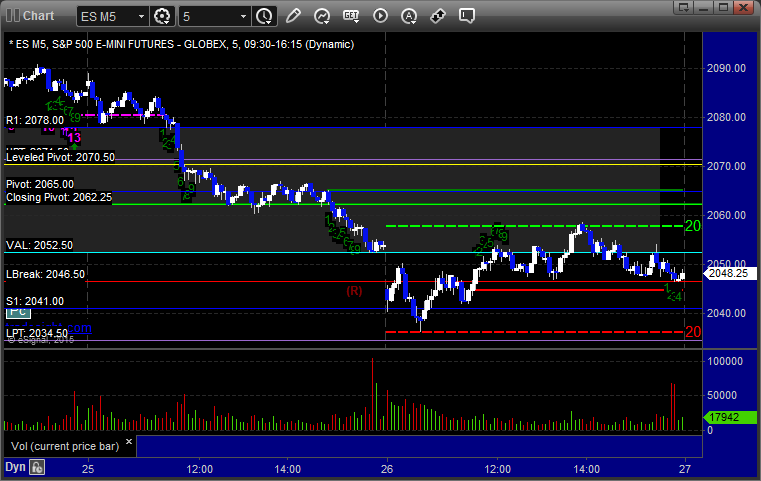

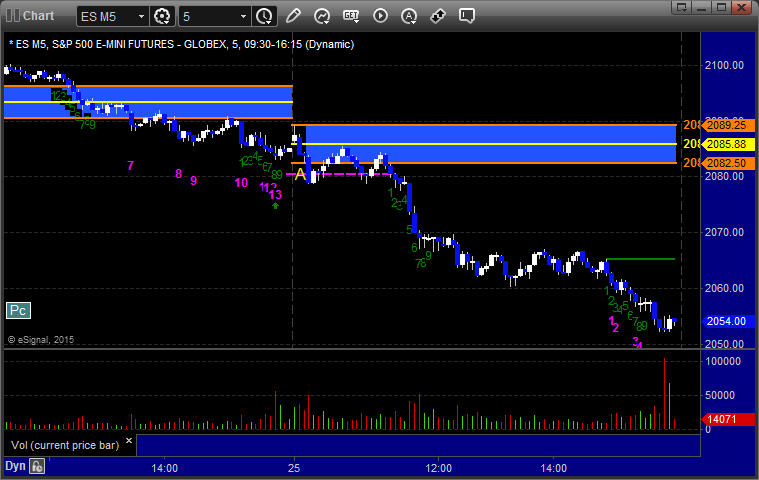

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

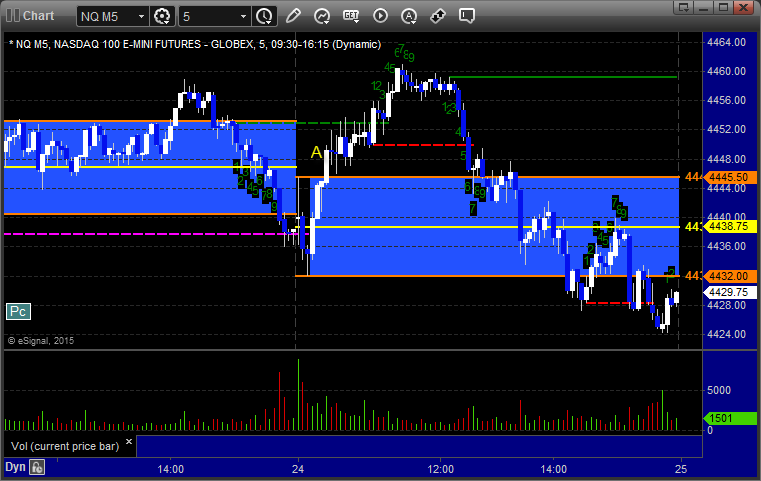

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

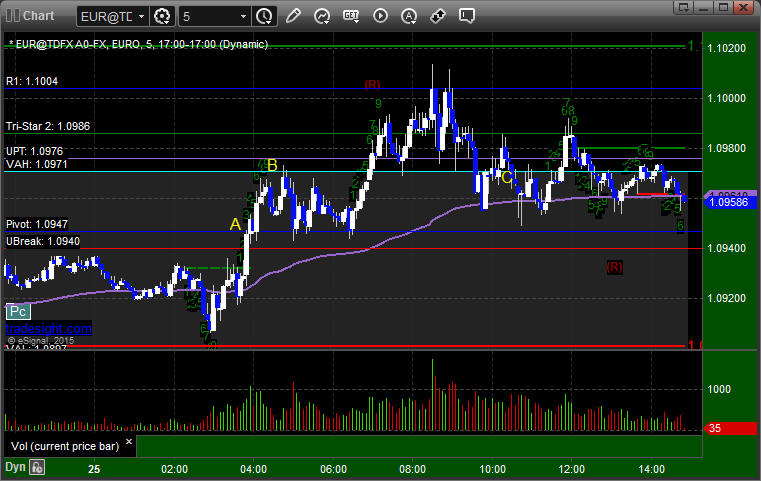

Forex Calls Recap for 3/27/15

A loser and a winner for basically a wash to close out the week as we head into the end of the first quarter. See the GBPUSD section below. The second half of the EURUSD from the prior session stopped out in the money.

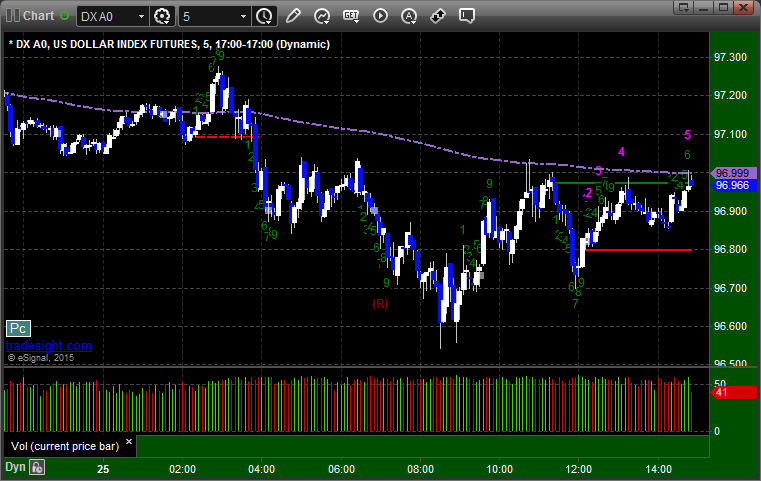

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, closed second half at D in the morning:

Stock Picks Recap for 3/26/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SPWR triggered short (without market support due to opening 5 minutes) and worked enough for a quick partial:

SINA triggered short (without market support due to opening 5 minutes) and didn't work:

SYMC gapped under the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, WYNN triggered short (with market support) and worked enough for a partial:

BABA triggered long (with market support) and worked:

TSLA triggered short (with market support) and didn't work:

Rich's TSLA triggered short (without market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

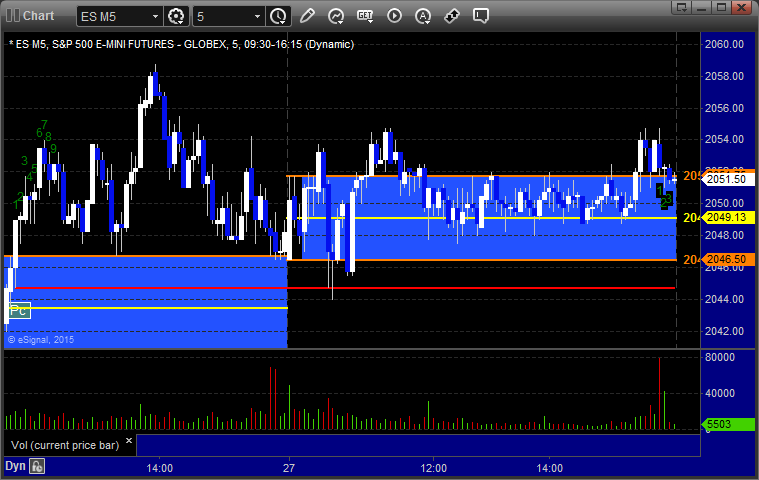

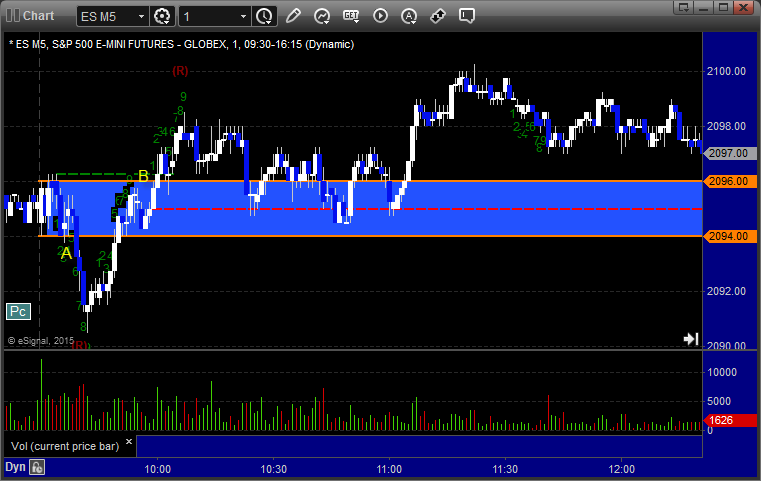

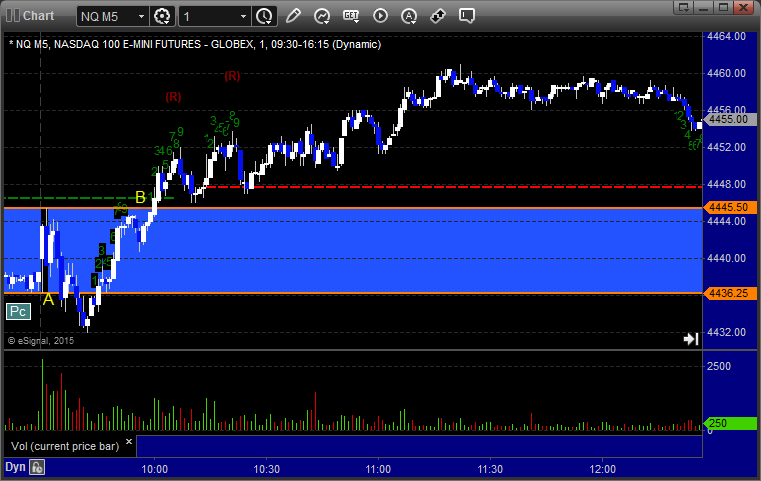

Futures Calls Recap for 3/26/15

The markets gapped down and eventually filled over lunch. We had great volume at 1.8 billion shares, but it was a complete measuring day after the plunge on Wednesday. Not a lot happened. We ended up getting stopped out of the ES twice (before it went on to work) and we had winners and losers in the Opening Range plays.

Net ticks: -14 ticks.

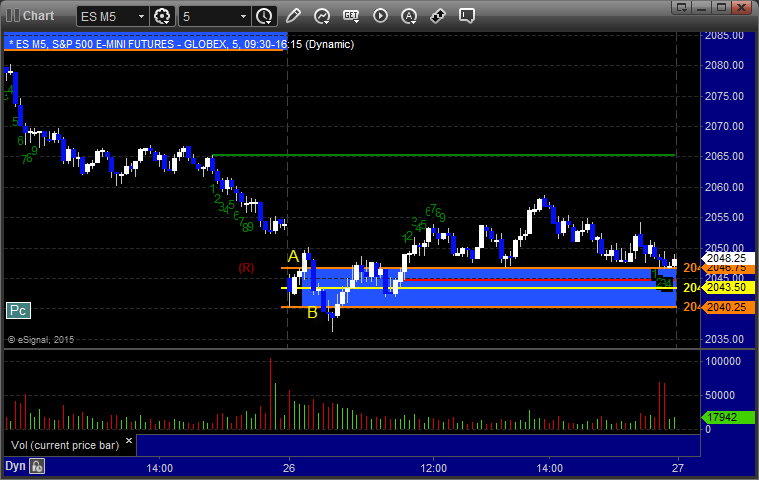

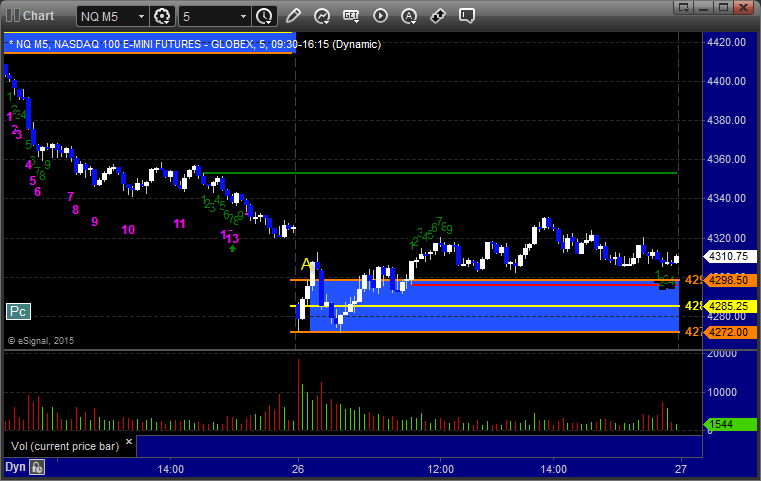

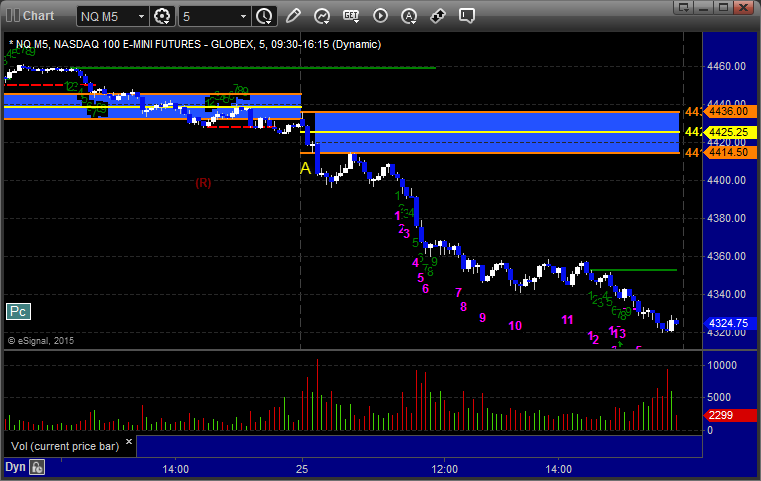

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

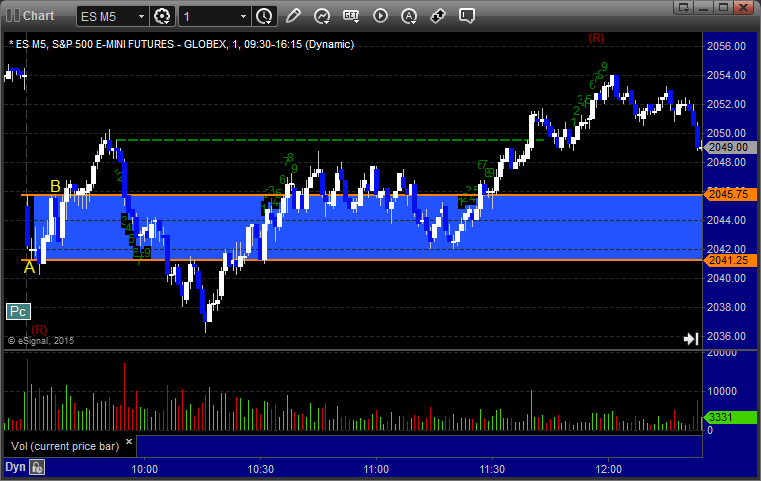

ES Opening Range Play triggered short at A and didn't work, then triggered long at B and worked:

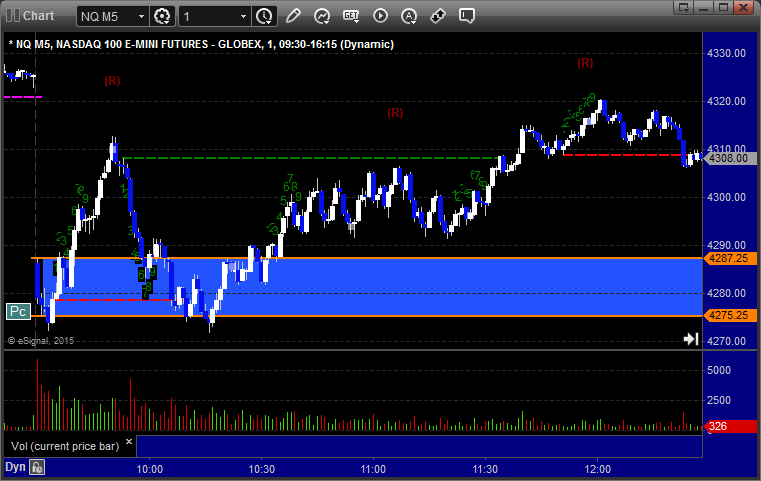

NQ Opening Range Play triggered short at A and didn't work, then triggered long at B and worked great:

ES Tradesight Institutional Range Play triggered long at A and didn't work, triggered short at B and worked:

NQ Tradesight Institutional Range Play triggered at A, but that should have been a little too far outside the range to take:

ES:

Triggered long at A at 2046.75 over the LBreak and stopped. Triggered again and stopped, so we posted not to retrigger, although the third time worked as it often does:

Forex Calls Recap for 3/26/15

Couple of winner for the session in the EURUSD, and we are still holding the second half of the short. See that section below.

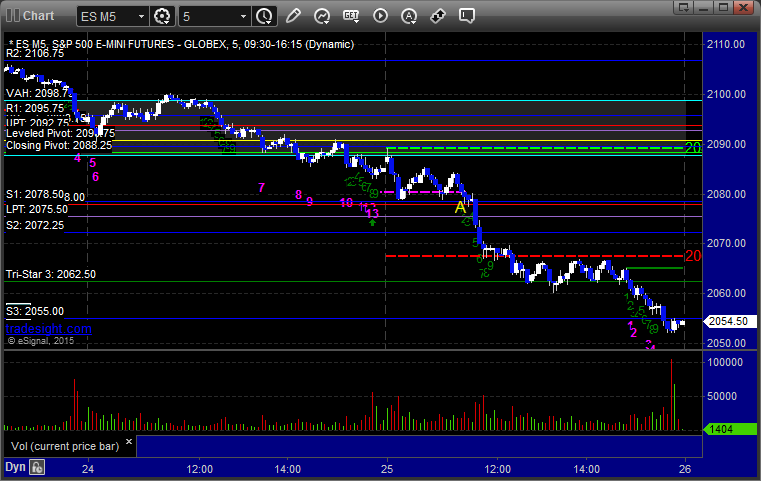

Here's a look at the US Dollar Index intraday with our market directional lines:

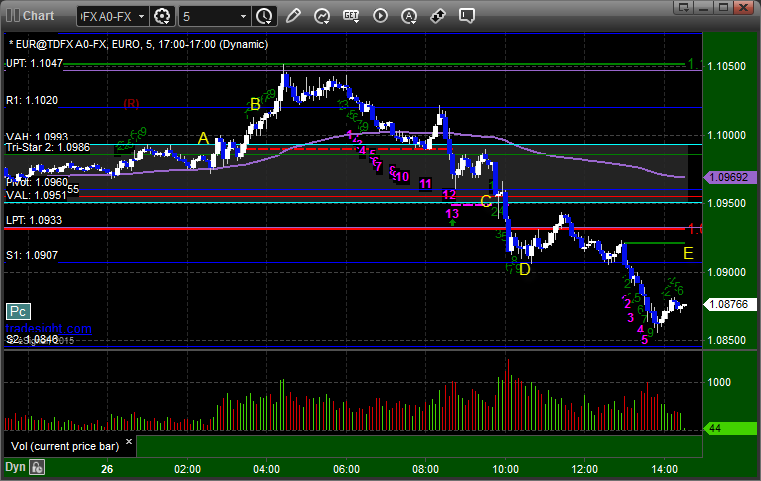

EURUSD:

Triggered long at A, hit first target at B, second half either stopped at original stop or under entry if you were awake to adjust. Short triggered at C, hit first target at D, and still holding second half with a stop over S1 at E:

Stock Picks Recap for 3/25/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NTAP gapped under, so no play.

FEYE triggered short (without market support due to opening 5 minutes) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to opening 5 minutes) and worked great:

Rich's VLO triggered long (without market support) and worked:

His BIIB triggered short (with market support) and worked:

GOOG triggered short (with market support) and worked:

GILD triggered long (without market support) and didn't work:

NFLX triggered short (with market support) and worked:

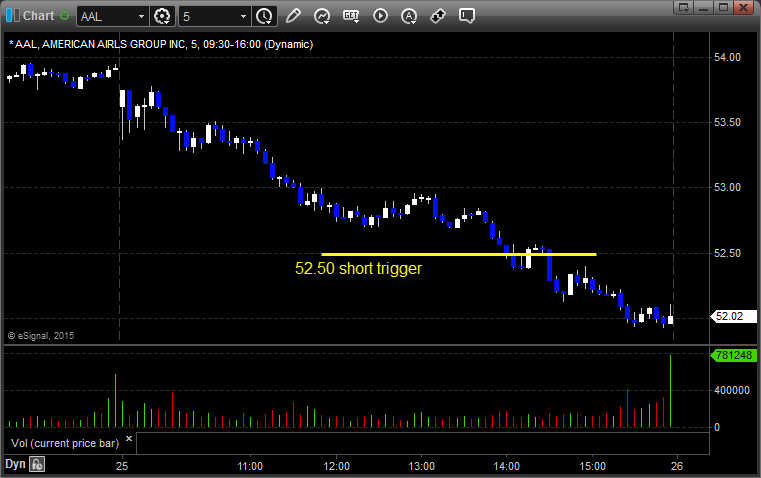

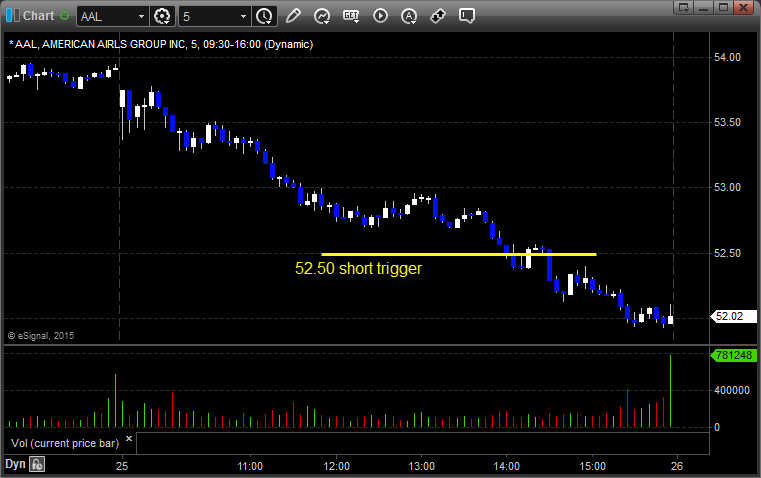

Rich's AAL triggered short (with market support) and worked:

His FB triggered short (with market support) and worked:

His BABA triggered short (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 3/25/15

A sweep/stop and then a winner on the ES, plus some terrific Opening Range plays on both the ES and the NQ. The markets opened flat and pushed lower for most of the session on improved volume of 1.8 billion NASDAQ shares.

Net ticks: +12 ticks.

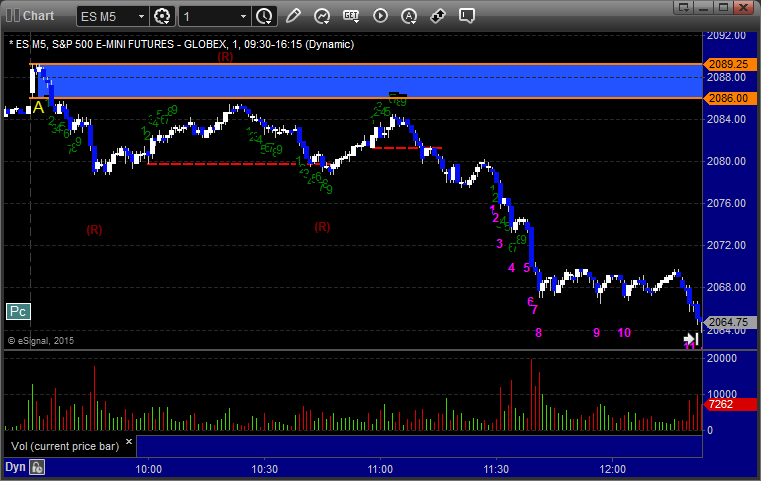

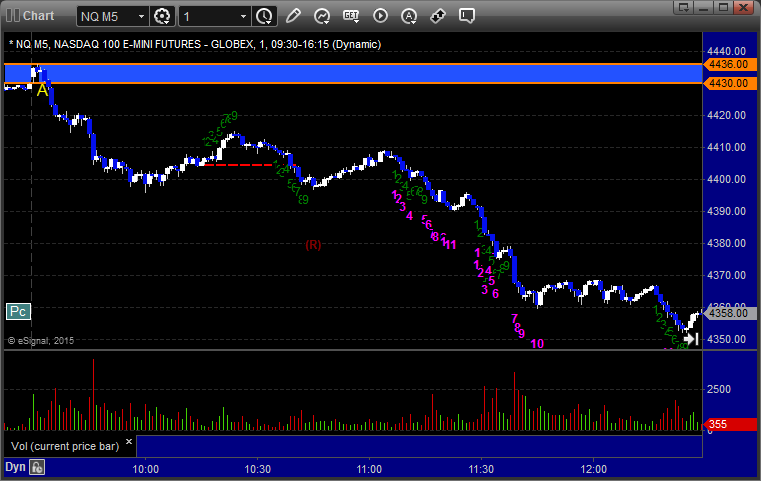

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play triggered short at A and worked but might have been a little too far below the IR for the trigger to justify taking:

NQ Tradesight Institutional Range Play triggered short at A and worked but might have been a little too far below the IR for the trigger to justify taking:

ES:

Triggered short at A at 2077.75 and stopped on a sweep. Put it right back in and it triggered a few minutes later, hit first target for 6 ticks, and lowered the stop several times and stopped the second half 32 ticks in the money at 2070.25:

Forex Calls Recap for 3/25/15

A winner in the EURUSD for the session. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, closed second half in the morning at C:

Stock Picks Recap for 3/24/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ADXS triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, TWTR triggered long (with market support) and worked great:

Rich's VMW triggered long (without market support) and worked:

His SONS triggered long (without market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked, and the other two triggers worked well too.

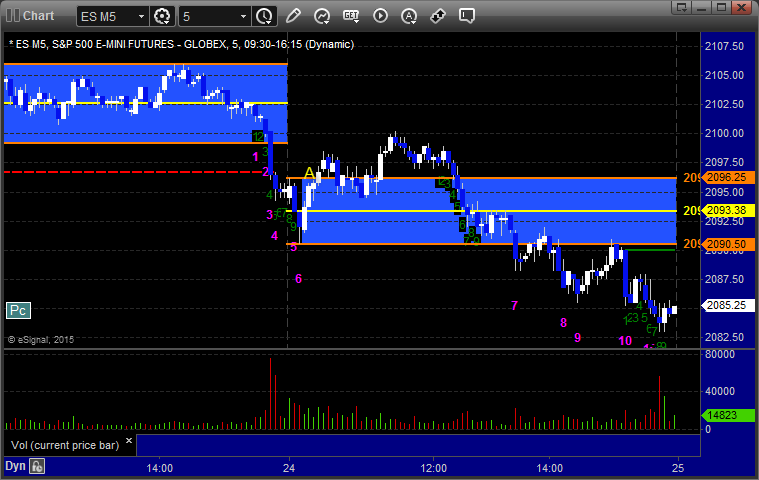

Futures Calls Recap for 3/24/15

Some nice trades all around despite some horrifyingly light volume in the markets. See the Opening and Institutional Range reviews below, plus two winners called on the ES. NASDAQ volume closed at 1.4 billion shares, the lightest of the year.

Net ticks: +8.5 ticks.

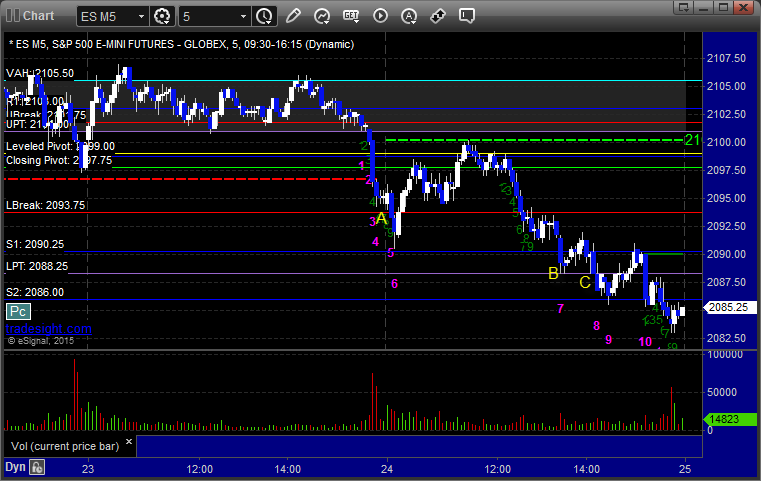

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

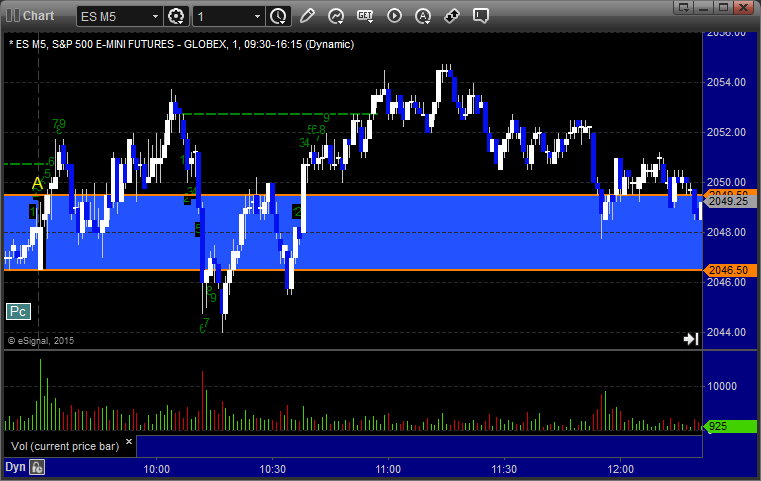

ES Opening Range Play triggered short at A and worked and triggered long at B and worked:

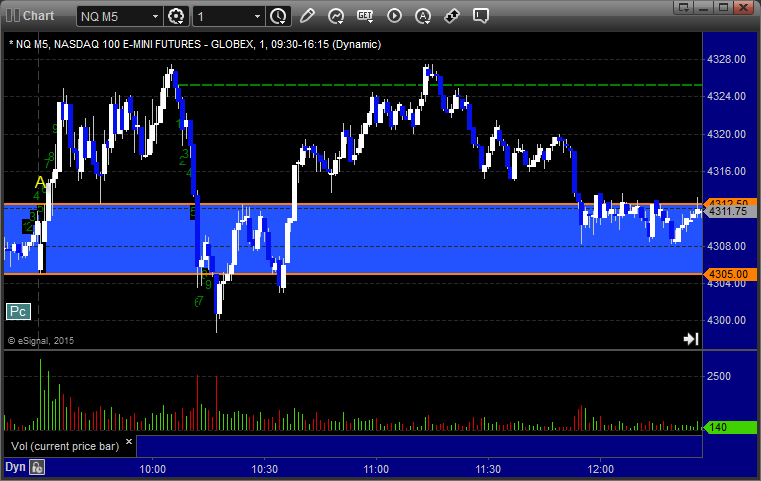

NQ Opening Range Play triggered short at A and worked and triggered long at B and worked, although the Opening Range itself was fairly wide and you probably would have used half of it for the stop (it still worked):

ES Tradesight Institutional Range Play triggered long at A and worked:

NQ Tradesight Institutional Range Play triggered long at A and worked great:

ES:

The first call was a short under LBreak at A at 2093.50 that hit first target for 6 ticks and then stopped the second half 6 ticks in the money. It then later set the LPT at B and we went short at C at 2088.00. That also hit the first target for 6 ticks but stopped the second half at the entry: