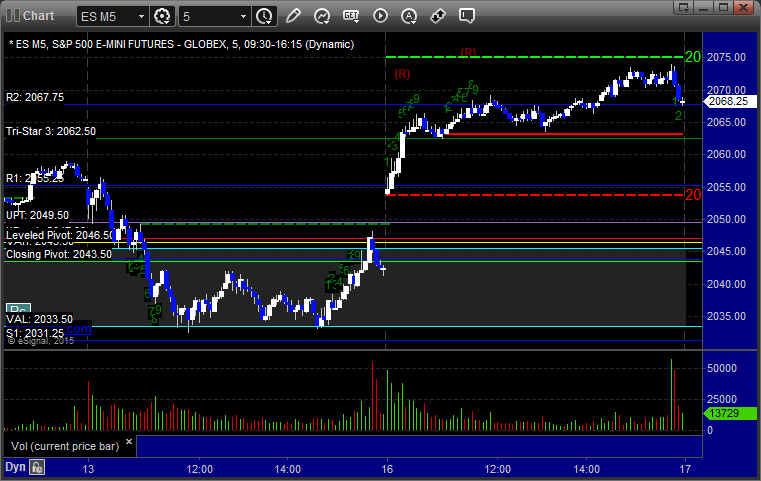

Futures Calls Recap for 3/19/15

The markets gapped down and held for a bit, then made a slight effort to break into the gap but failed. We then rolled to the downside and started what could have been a minor options unraveling move, but that ran out of steam over lunch and the markets just drifted up and stuck to the VWAP. Volume was 1.5 billion NASDAQ shares. Looks like the week is over and options have everything in place for expiration.

Net ticks: +6 ticks.

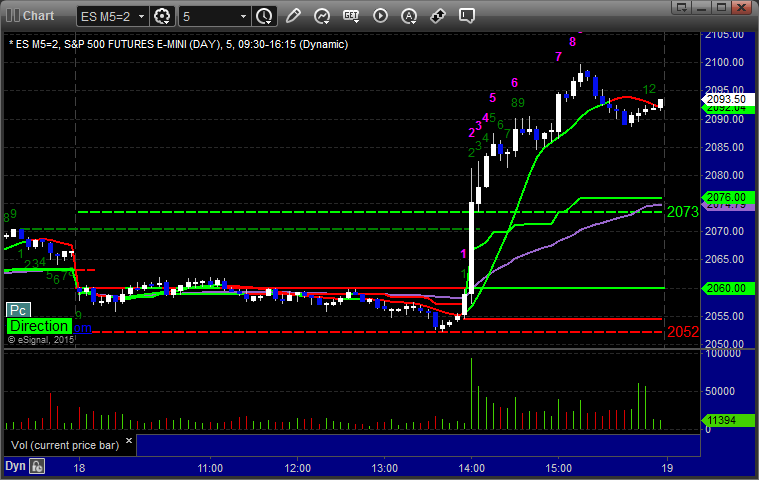

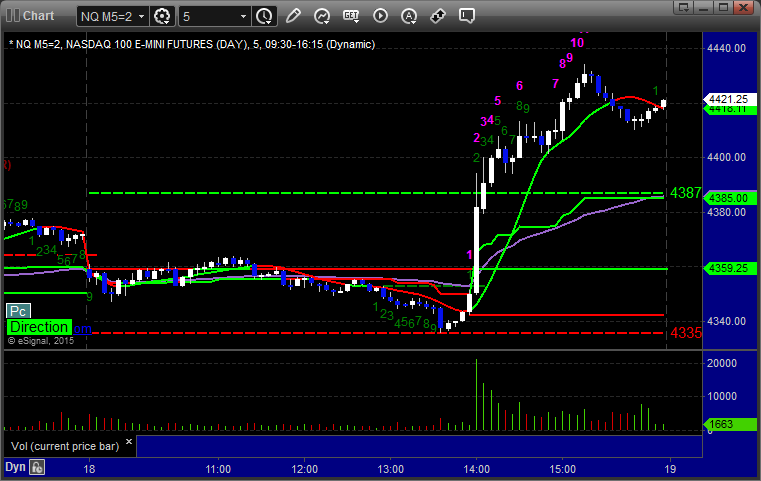

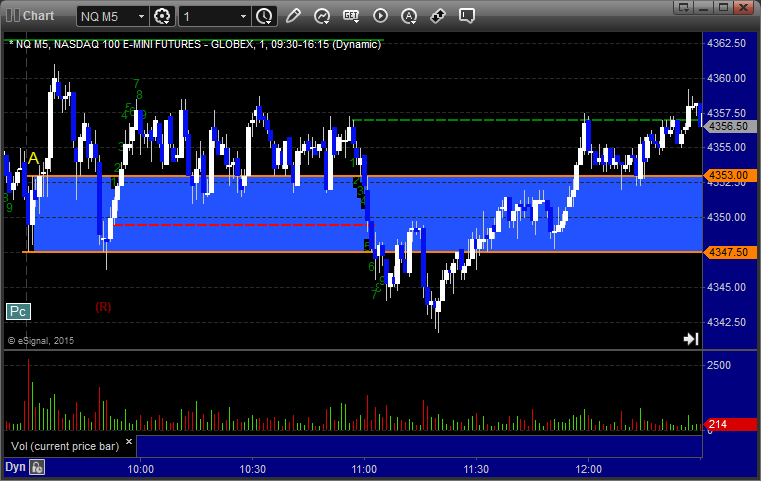

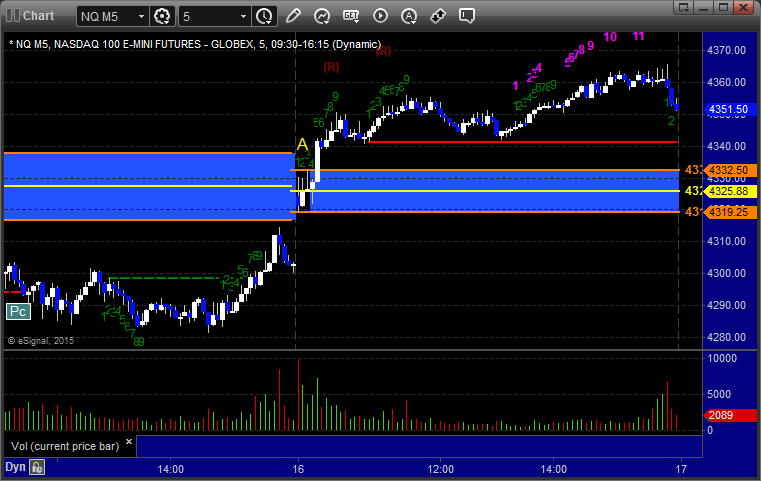

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

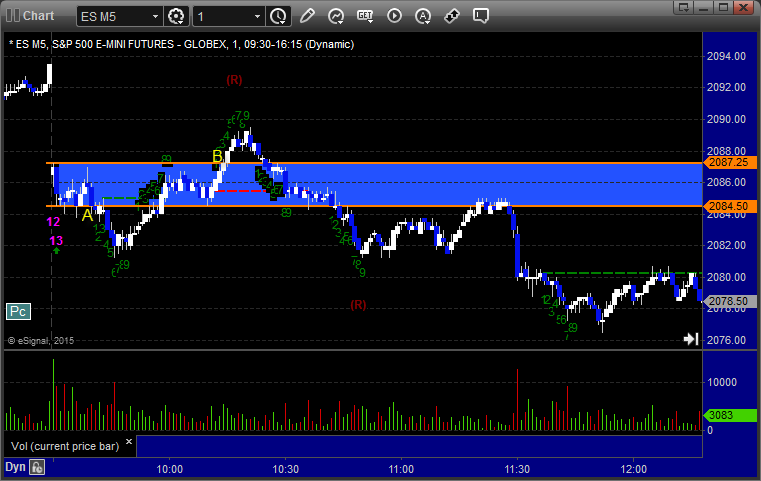

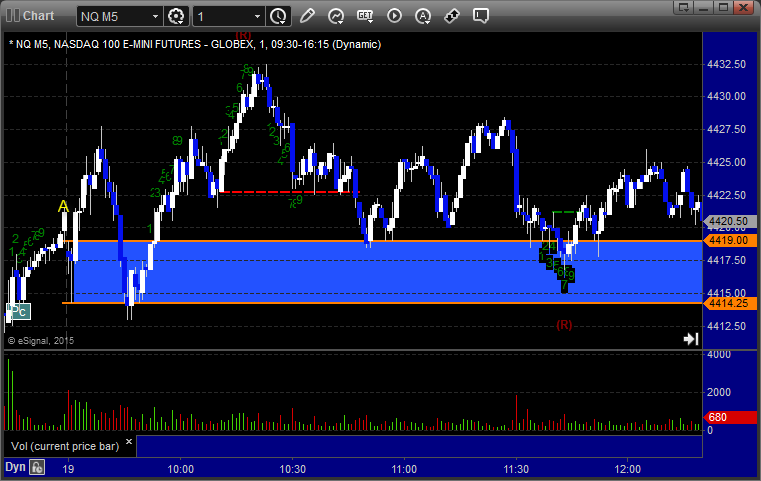

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked, triggered long at B and didn't work:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play did not work either way, but we already had the volume warning by the time it triggered:

NQ Tradesight Institutional Range Play did not work either way, but we already had the volume warning by the time it triggered:

ES:

ES triggered short at 2080.50, hit first target for 6 ticks, and lowered the stop twice and stopped the second half 6 ticks in the money:

Forex Calls Recap for 3/19/15

We closed out the second half of the EURUSD from the prior session for 140 pips or so and have a nice new winner going on the GBPUSD. See that section below.

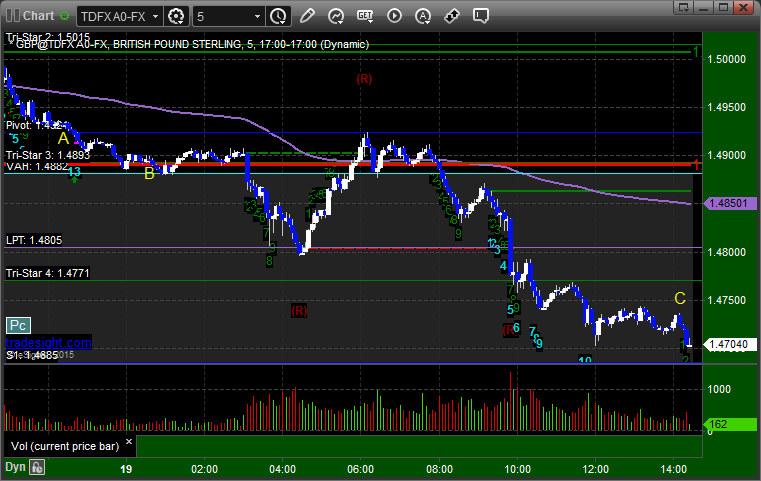

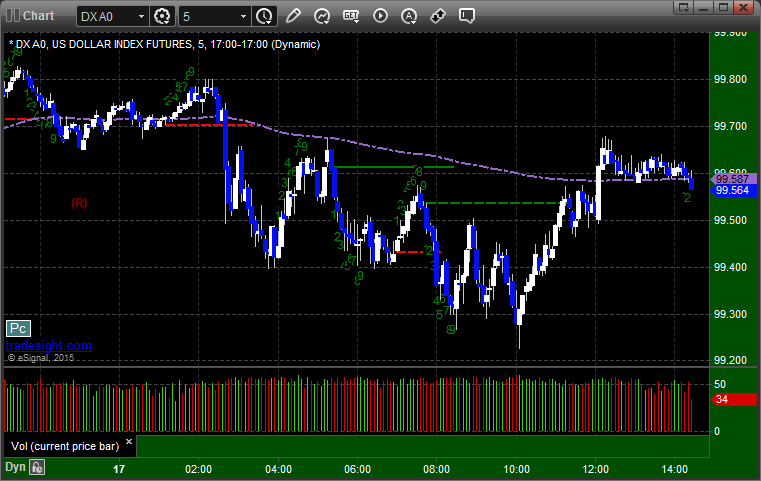

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short under the Pivot at A, hit first target at B, lowered the stop three times and still holding with a stop over C 220 pips in the money:

Stock Picks Recap for 3/18/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, DNMD triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's BABA triggered long (with market support) and worked:

His AAL triggered long (without market support) and didn't work:

His HLF triggered long (without market support) and worked great:

FEYE triggered long (without market support) and didn't work:

Rich's ADBE triggered long (with market support) and worked:

His BABA then triggered short (without market support) and didn't work:

His AAPL triggered short (with market support but right ahead of the Fed) and didn't work:

His BIDU triggered long (with market support) and worked:

His AAPL triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

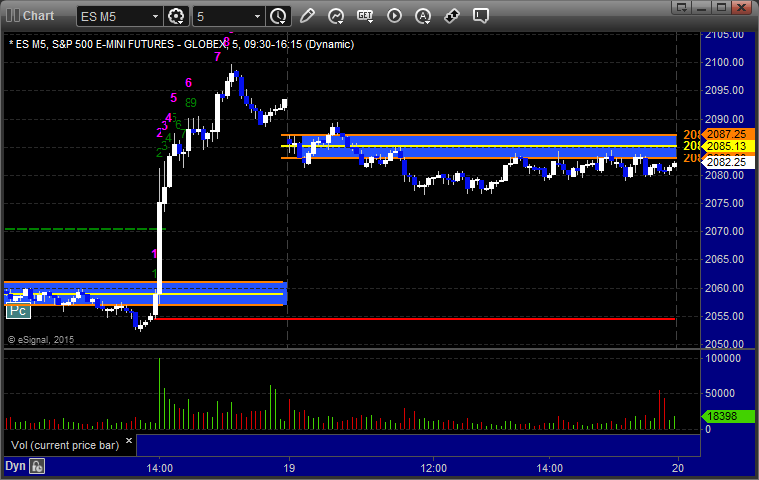

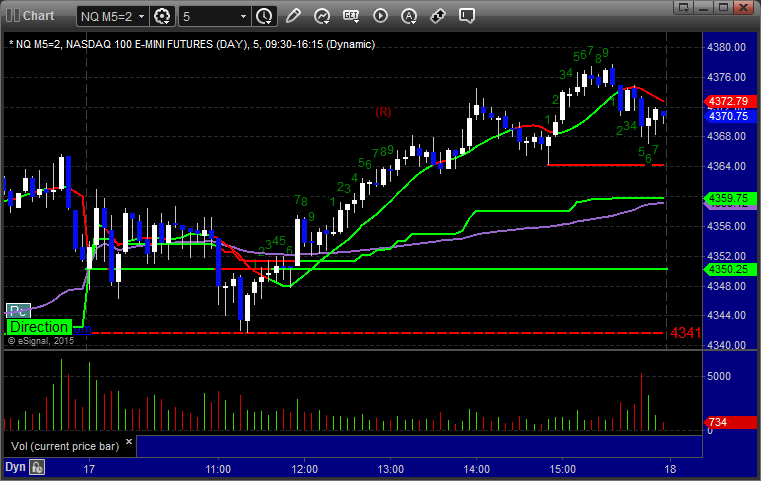

Futures Calls Recap for 3/18/15

The markets gapped down a little ahead of the Fed and gave us the least volume after the first hour of the year at only 321 million shares, which basically meant everyone was waiting for the Fed and there wasn't much point in trading. The Fed news caused a big spike and things just kept going. We did not get the usual 3-wave phenomenon to trade.

Net ticks: +0 ticks.

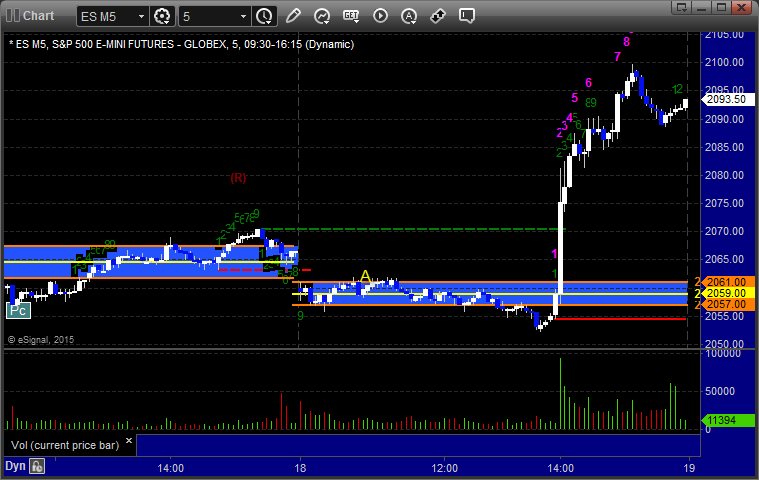

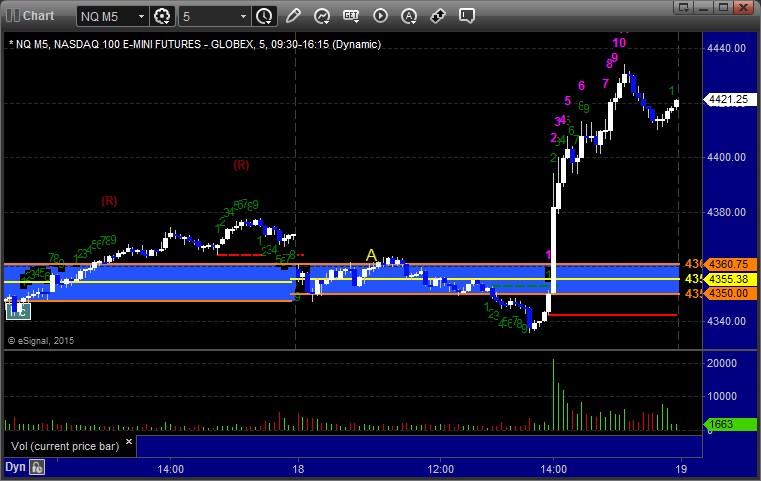

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

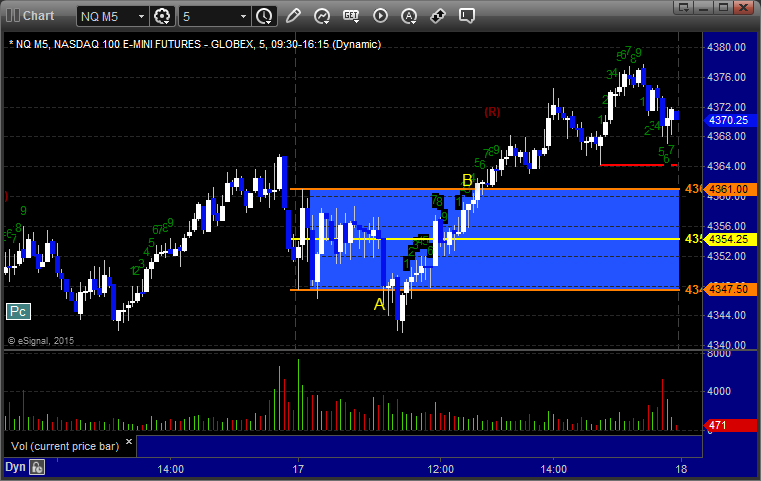

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked enough for a partial, the long didn't trigger until an hour in:

NQ Opening Range Play triggered short at A and worked enough for a partial, the long didn't trigger until 90 minutes in:

ES Tradesight Institutional Range Play triggered long at A and didn't work, triggered short over lunch at B and did:

NQ Tradesight Institutional Range Play triggered long at A and didn't work, triggered short over lunch at B and did:

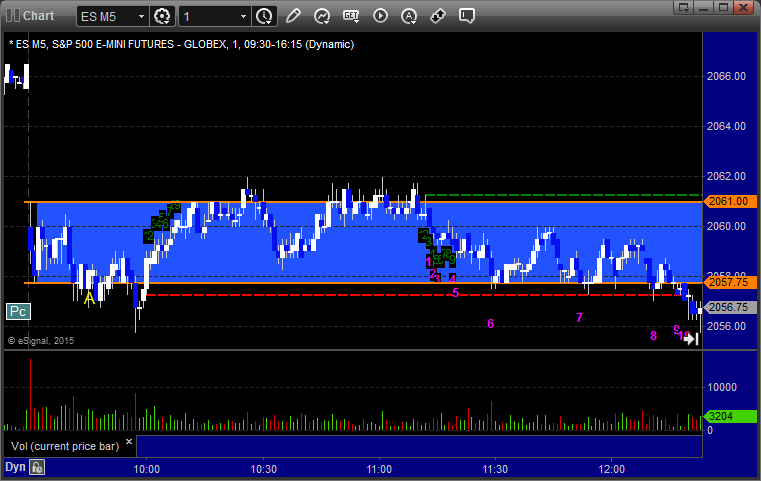

ES:

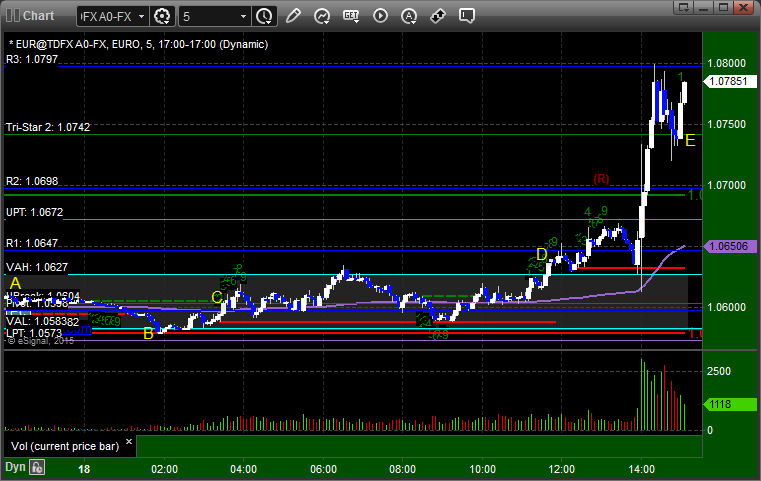

Forex Calls Recap for 3/18/15

Some nice results for lesser size (due to the Fed) in the EURUSD. See that section below. We are still long at the moment.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

There was a very early trigger prior to A on the chart, so as the call said, that should have been 1/4 size and that stopped. Then, 1 leg out of 3 of the short triggered at B and stopped. Finally, the normal half size trade (we go half size overnight ahead of the Fed) triggered at C, hit first target at D, and still holding the rest with a stop under E well in the money:

Stock Picks Recap for 3/17/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's MBLY triggered long (with market support) and worked:

Mark's BMRN triggered long (without market support) and worked enough for a partial:

NFLX triggered short (with market support) and worked enough for a partial:

Rich's AAPL triggered long (with market support) and didn't go enough in either direction to count, which is amazing for AAPL over so many hours:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 3/17/15

Nice session where our Opening Range plays worked early and also our main call. See ES section below. Markets gapped down, eventually filled the gap, basically closed flat, and all of it on 1.5 billion NASDAQ shares as we wait for the Fed on Wednesday.

Net ticks: +2.5 ticks.

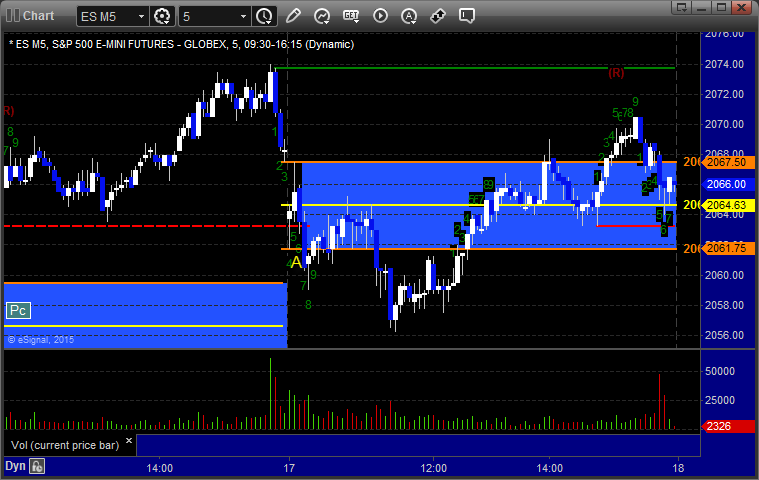

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play triggered short at A and worked:

NQ Tradesight Institutional Range Play eventually triggered short at A but that was over lunch, didn't work, the long worked later but also over lunch:

ES:

Triggered long at A at 2065.50 over the Pivot, hit first target for 6 ticks but didn't reach up and fill the gap, stopped second half under the entry:

Forex Calls Recap for 3/17/15

We closed out the second half of the prior day's long on the GBPUSD in the money and had another winner in the GBPUSD, this time on the short side. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Closed out the second half of the prior day's long at A, triggered short at B, hit first target at C, stopped second half in the money at D:

Stock Picks Recap for 3/16/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INTU triggered long (with market support) and worked:

WERN triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's JAZZ triggered long (with market support) and worked:

Mark's MCHP triggered long (with market support) and worked:

TEVA triggered long (with market support) and didn't work:

Rich's AAPL triggered long (with market support) and worked:

His EBAY triggered long (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Futures Calls Recap for 3/16/15

Mixed results from the Opening Range plays and no official calls after the market gapped up and we got a volume warning. The markets drifted higher, leaving the gap, on 1.5 billion NASDAQ shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered short at A and didn't work, triggered long at B and didn't work:

ES Tradesight Institutional Range Play triggered long at A and worked:

NQ Tradesight Institutional Range Play triggered long at A and worked:

ES: