Futures Calls Recap for 2/19/15

Another painfully dull session as the markets once again closed flat. Volume was only 1.45 billion NASDAQ shares. The Opening Range plays worked great, and we stopped out of one other play.

Net ticks: -7 ticks.

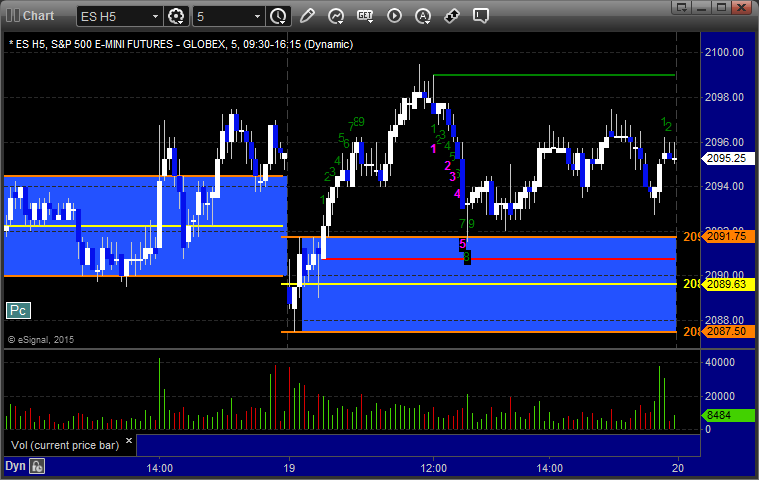

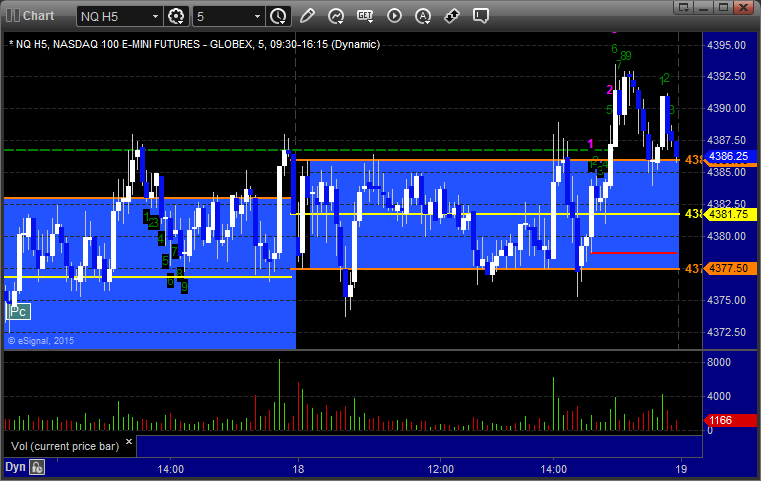

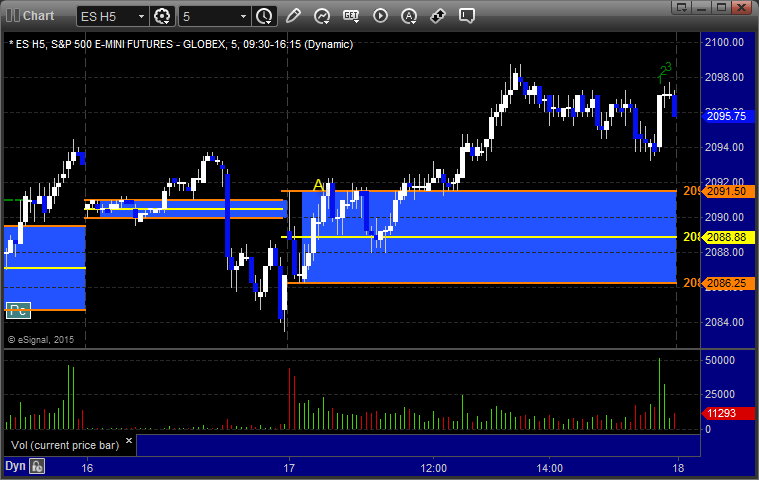

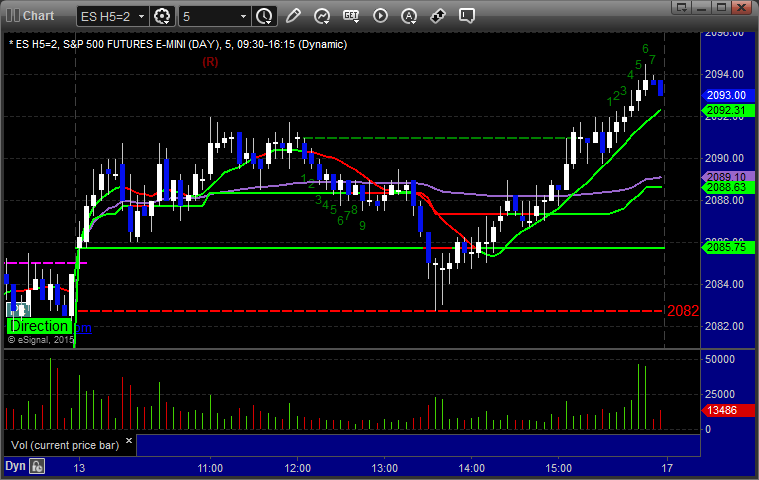

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

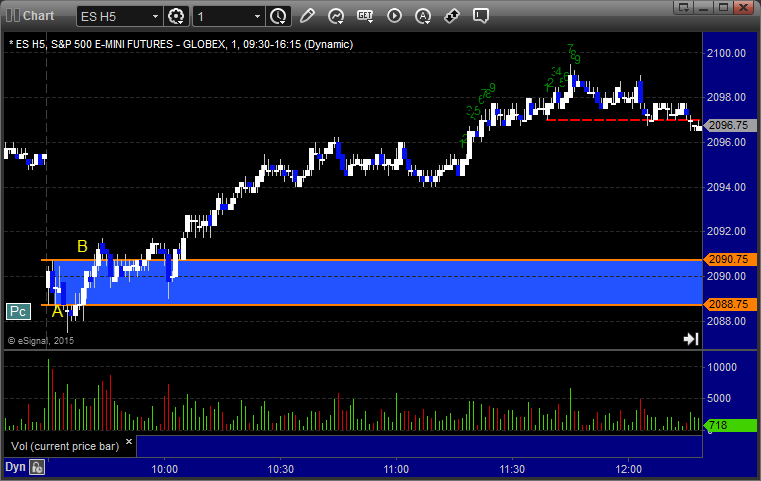

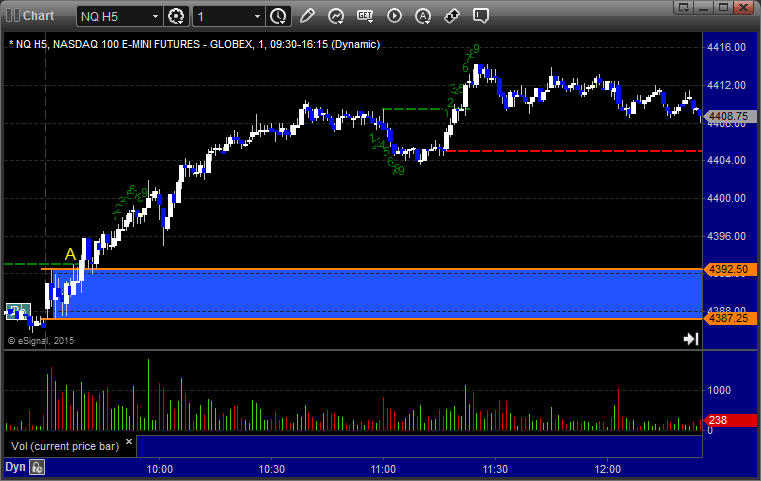

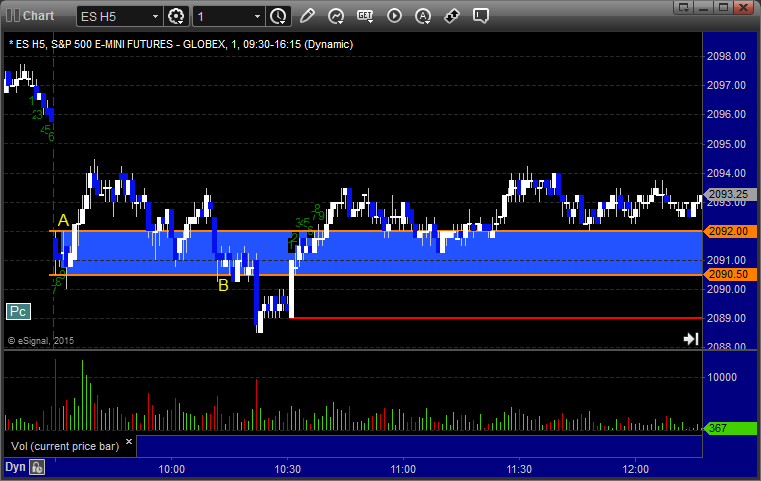

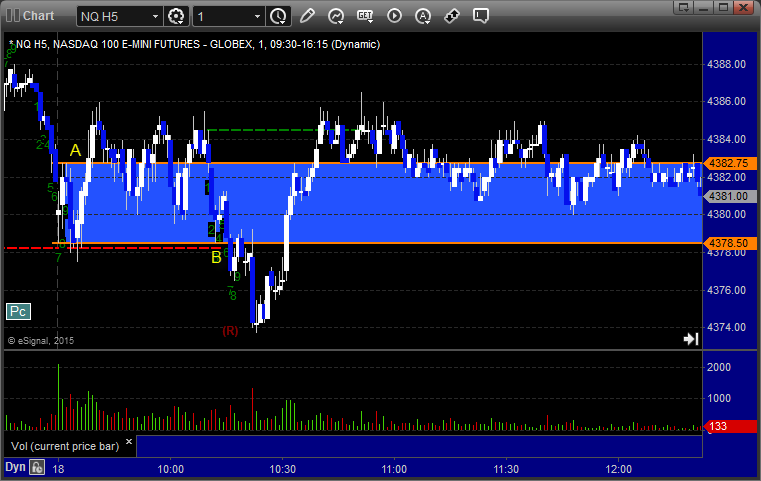

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and stopped, triggered long at B and worked:

NQ Opening Range Play triggered long at A and worked great:

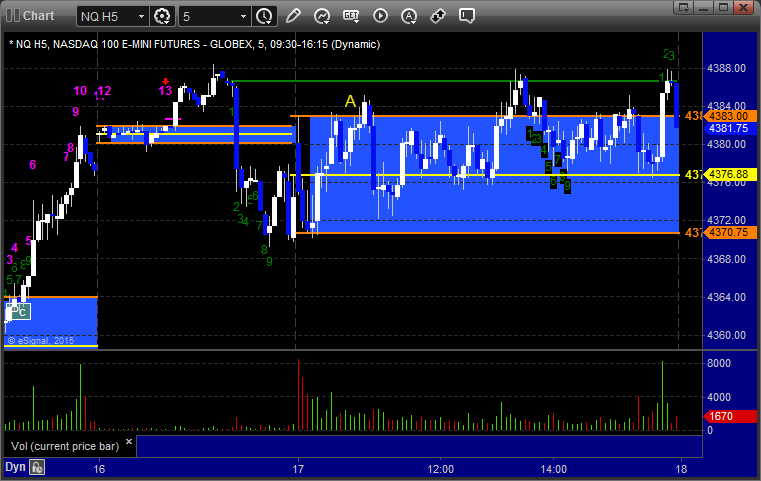

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

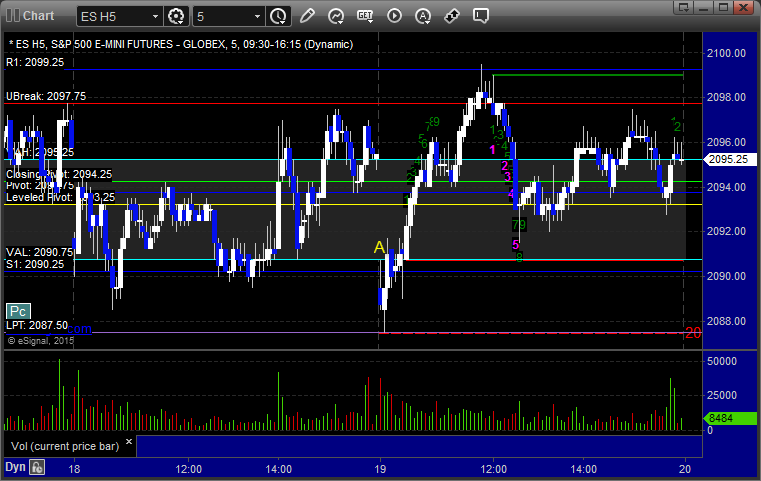

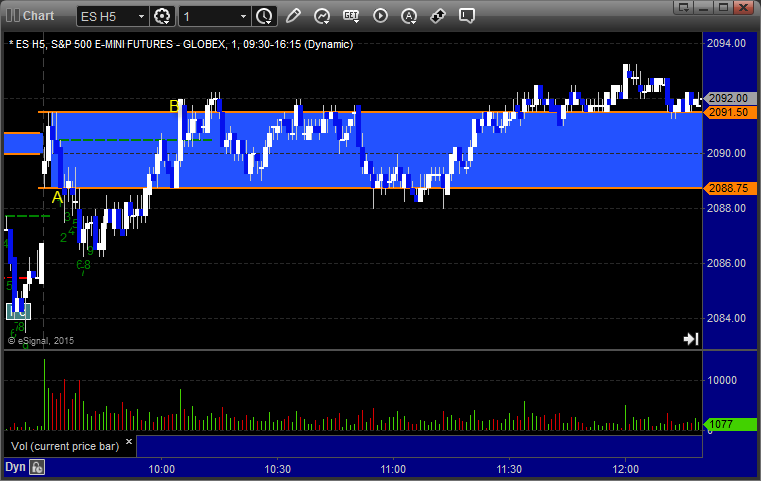

ES:

Triggered long at A at 2091.00 heading into the Value Area and stopped on the news spike 30 minutes into the market before making the move all the way across:

Forex Calls Recap for 2/19/15

Bad ranges continue in the Forex market (and all markets) this week. See EURUSD and GBPUSD below for trade results.

Here's a look at the US Dollar Index intraday with our market directional lines:

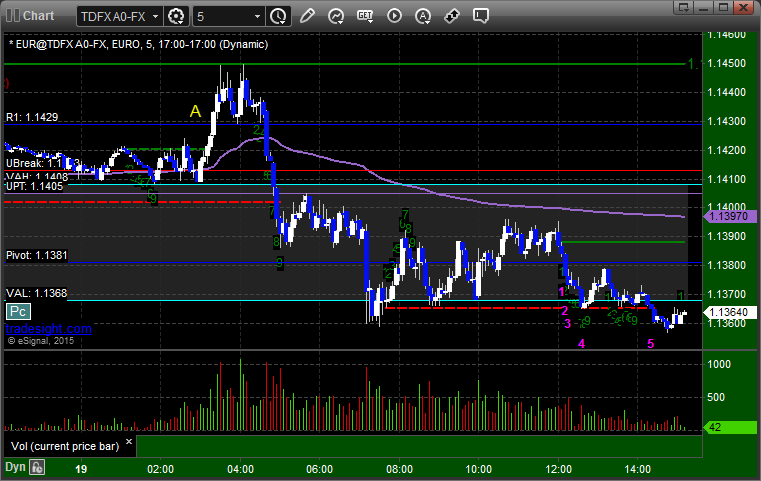

EURUSD:

Triggered long at A and stopped:

Stock Picks Recap for 2/18/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FNSR triggered long (without market support) and didn't work:

SNPS triggered long (without market support) and didn't work:

ADBE triggered long (with market support) and didn't work initially, worked later:

From the Messenger/Tradesight_st Twitter Feed, PCLN triggered short (without market support due to opening 5 minutes) and didn't work:

EBAY triggered long (with market support) and worked:

Mark's CTSH triggered long (without market support) and worked:

FSLR triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 2/18/15

What a completely dull session. The Opening Range plays worked and we did pull off a trade on the release of the Fed minutes but volume was only 1.5 billion shares and activity was very, very contained and dull most of the session. See the ES section below.

Net ticks: +2.5 ticks.

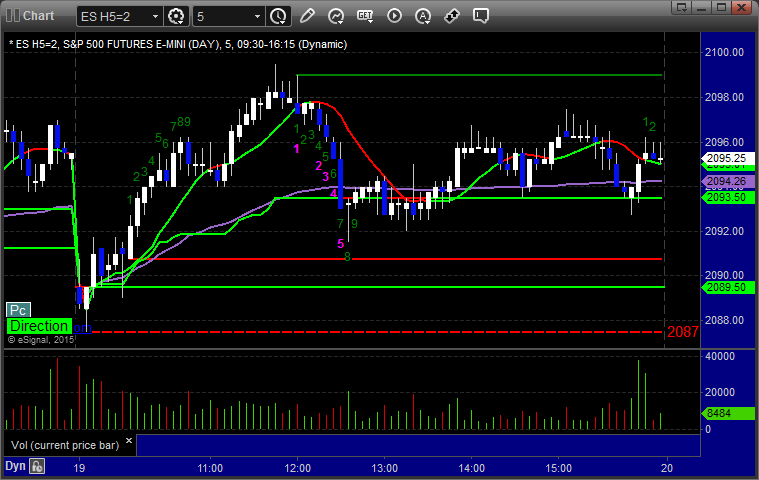

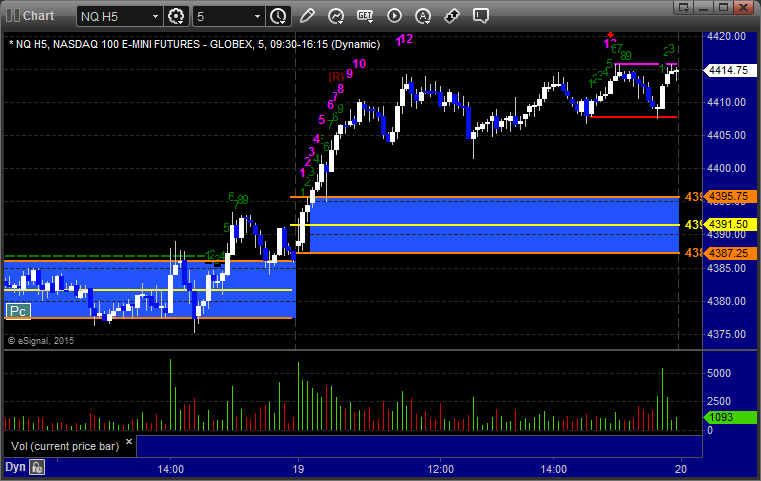

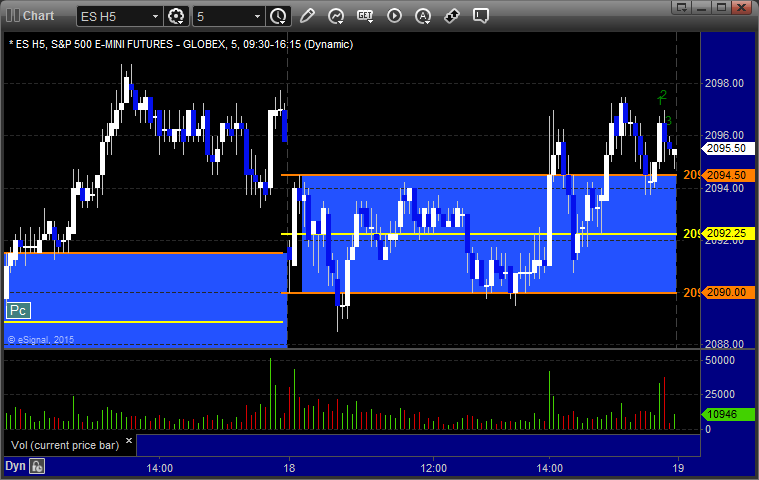

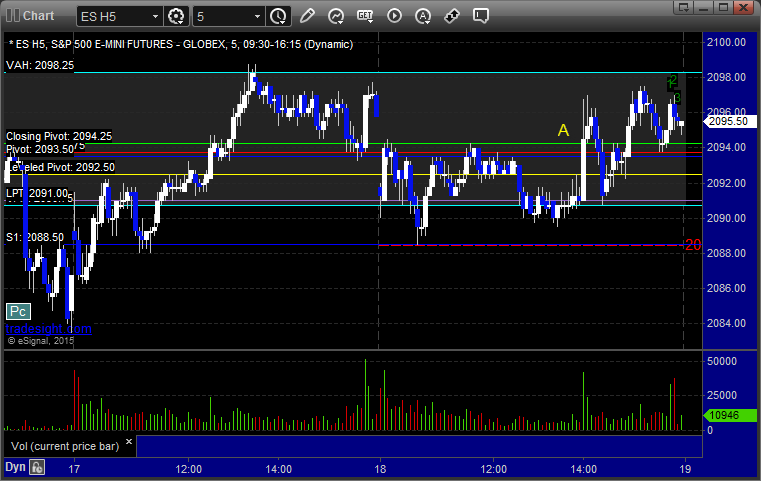

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial. Also triggered short at B and worked enough for a partial:

NQ Opening Range Play triggered long at A and worked enough for a partial. Also triggered short at B and worked enough for a partial:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 2094.75 and hit first target for 6 ticks, stopped second half under entry:

Forex Calls Recap for 2/18/15

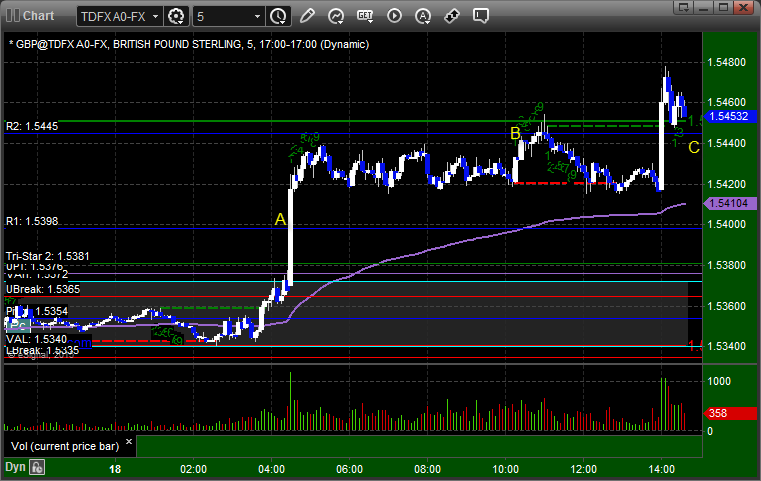

A winner for the session that triggered on news after an otherwise uneventful overnight session. See the GBPUSD section below.

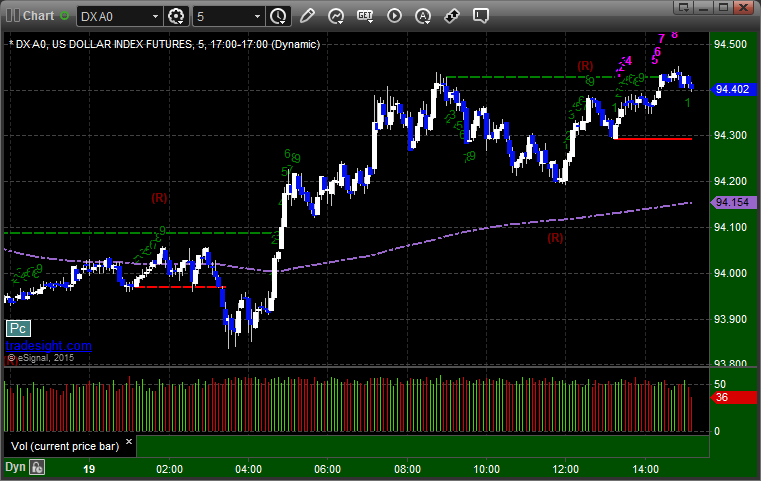

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under R2 at C:

Stock Picks Recap for 2/17/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CYTK triggered long (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Mark's ISIS triggered long (with market support) and worked enough for a partial:

In total, that's 1 trade triggering with market support, and it worked.

Futures Calls Recap for 2/17/15

What a dull session to start the week. The NASDAQ side in particular never did a thing, but even the ES drifted through Levels like they weren't even there. The Opening Range Plays worked once but not the other way. NASDAQ volume closed at 1.6 billion shares with the S&P up 1 and the NDX 100 up 3 for the session.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

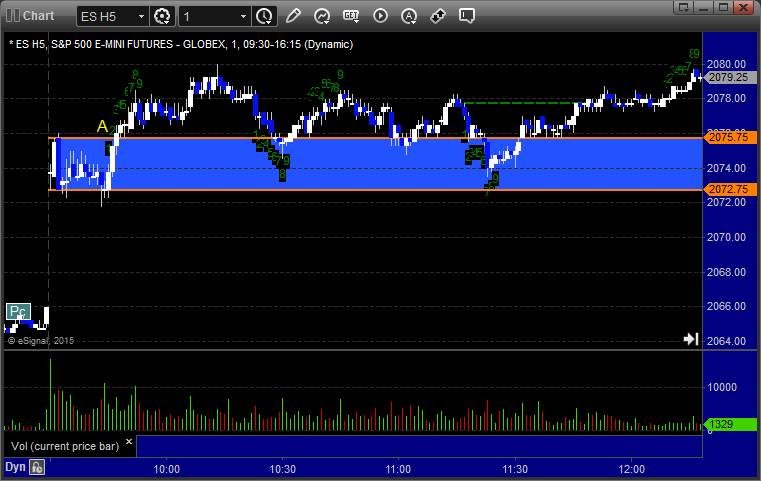

ES Opening Range Play triggered short at A and worked enough for a partial. The long didn't work:

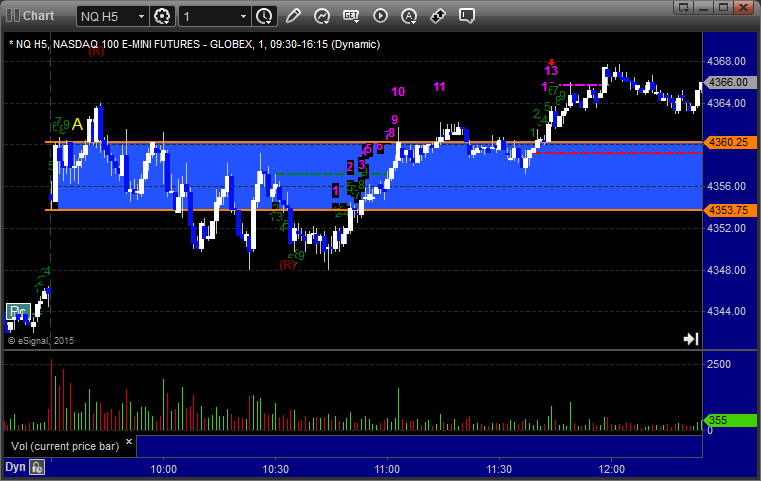

NQ Opening Range Play triggered short at A and worked enough for a partial. The long didn't work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 2/17/15

A winner to start the week. See the EURUSD section below.

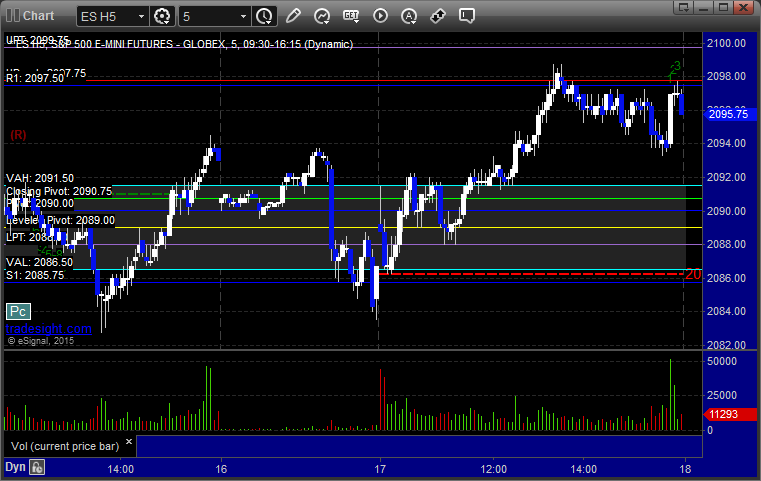

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

It's possible that one leg of your trade triggered at A and stopped because it literally went one pip above the Pivot. Either way, it triggered long at B, hit first target at C, and stopped the second half at D:

Stock Picks Recap for 2/13/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's CYBR triggered short (without market support) and worked enough for a partial:

TWTR triggered long (with market support) and worked enough for a partial:

Rich's BABA triggered long (without market support due to opening 5 minutes) and didn't work:

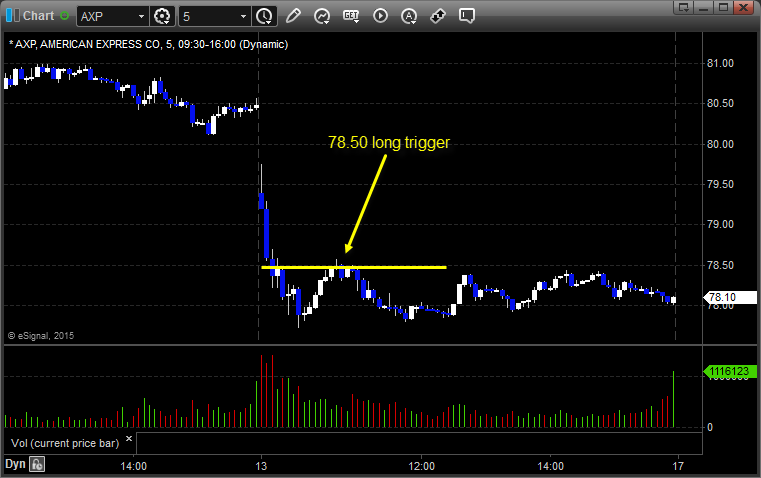

His AXP triggered long (with market support) and didn't work:

His WYNN triggered long (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

Futures Calls Recap for 2/13/15

Pretty much as expected on a Friday heading into the long weekend. We couldn't even fill the small gaps. NASDAQ volume looked OK early but closed at 1.6 billion shares.

Net ticks: +2.5 ticks.

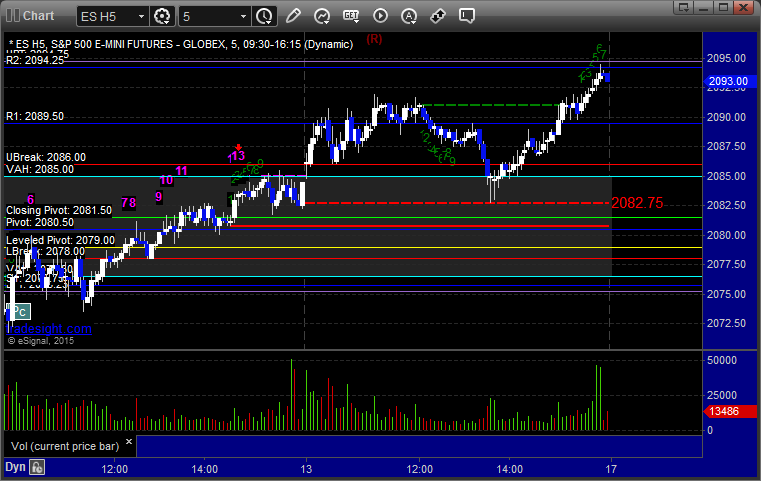

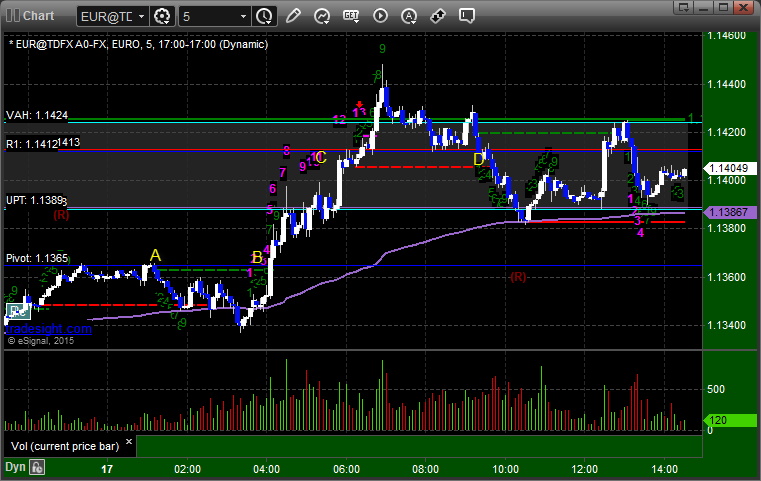

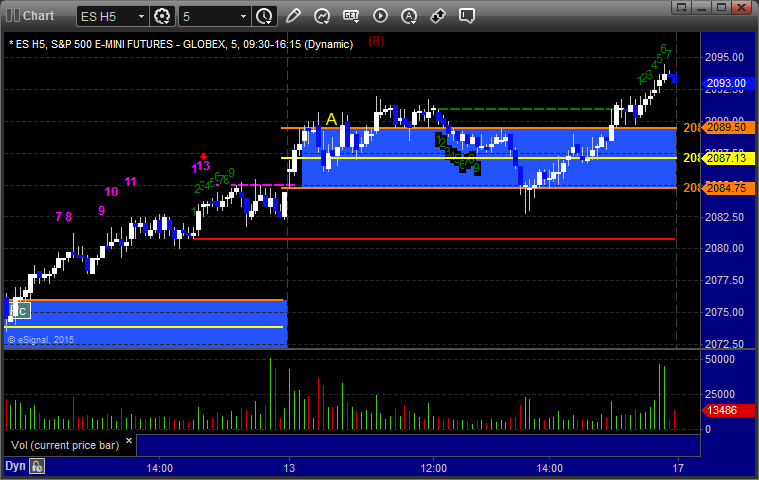

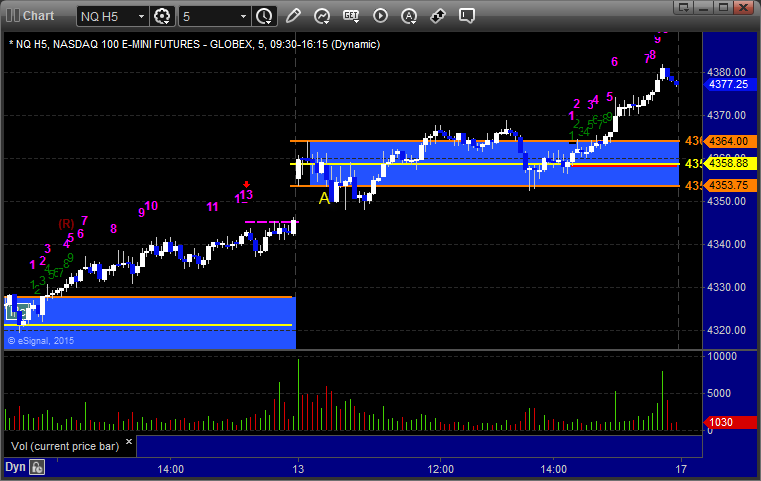

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and didn't work:

ES Tradesight Institutional Range Play triggered long at A and worked enough for a partial:

NQ Tradesight Institutional Range Play triggered short at A and didn't work:

ES:

Triggered short at A at 2084.50, hit first target for 6 ticks, closed second half over the entry: