Forex Calls Recap for 2/13/15

And we wrap a strange week with no triggers at all because the EURUSD sat in a 50 pip range.

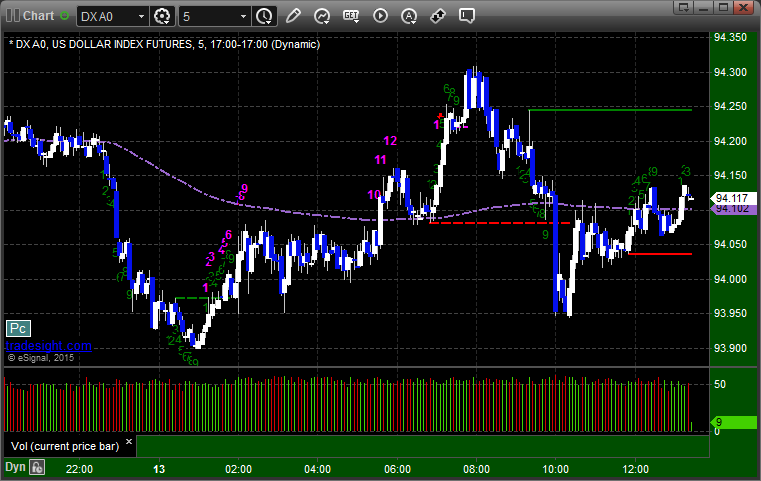

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

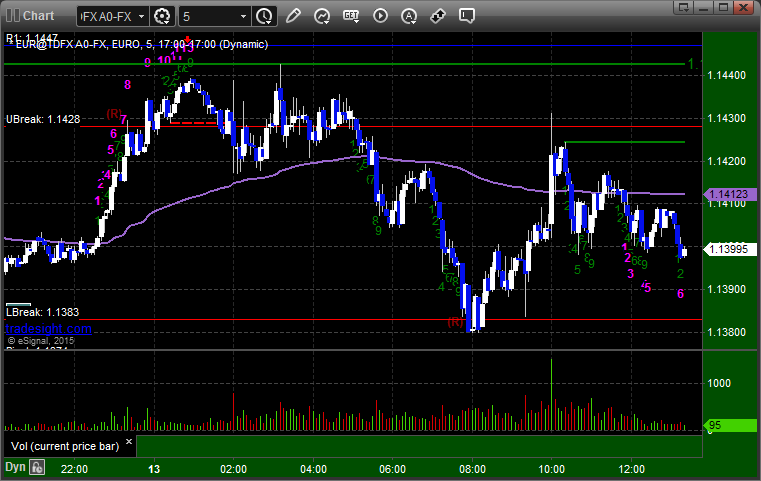

EURUSD:

Stock Picks Recap for 2/12/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FEYE, NVDA, and FNSR all gapped over, no plays.

NDAQ triggered long (with market support) and worked:

AKAM triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TWTR triggered short (with market support) and worked:

GOOG triggered long (with market support) and worked:

Rich's AAPL triggered short (without market support) and worked:

Rich's VXX triggered short (ETF, so no market support needed) and worked:

In total, that's 5 trades triggering with market support, all 5 of them worked.

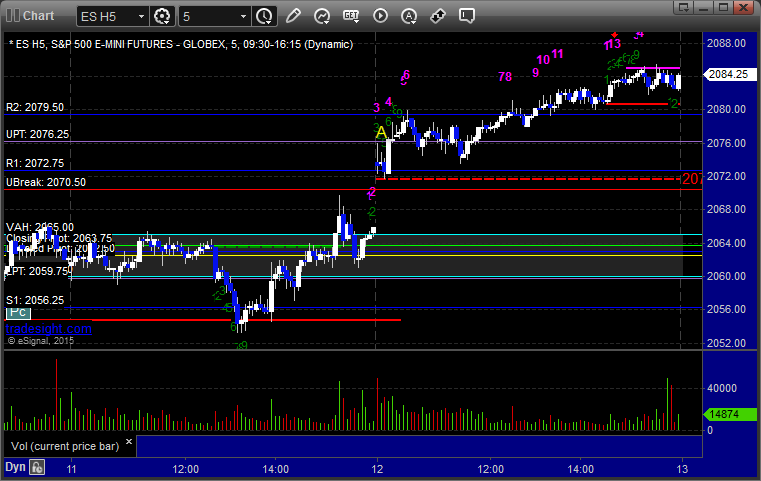

Futures Calls Recap for 2/12/15

A small winner to the first target and nothing else on a gap and go session. See ES below. Mixed results today on the Opening Range plays.

Net ticks: +2.5 ticks.

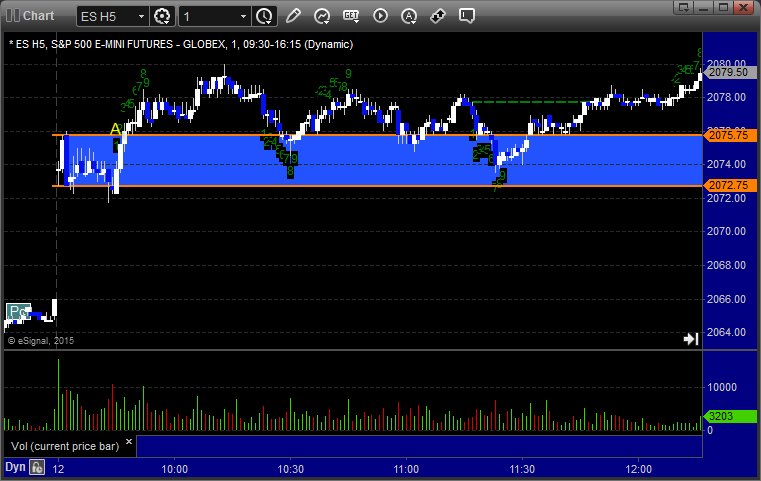

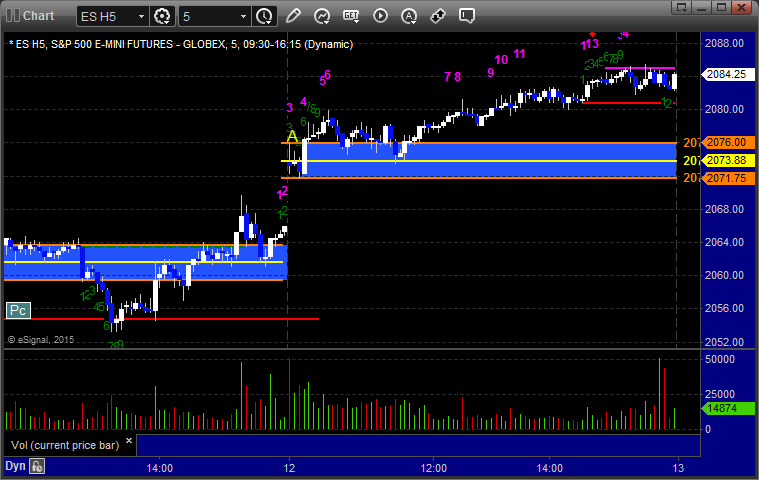

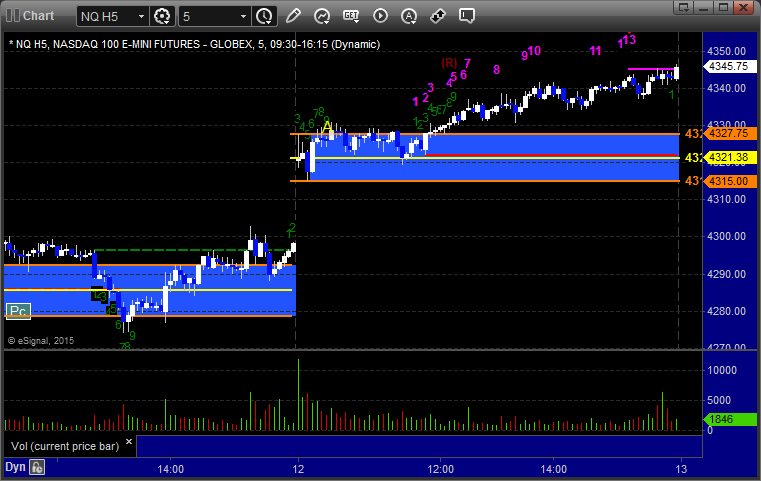

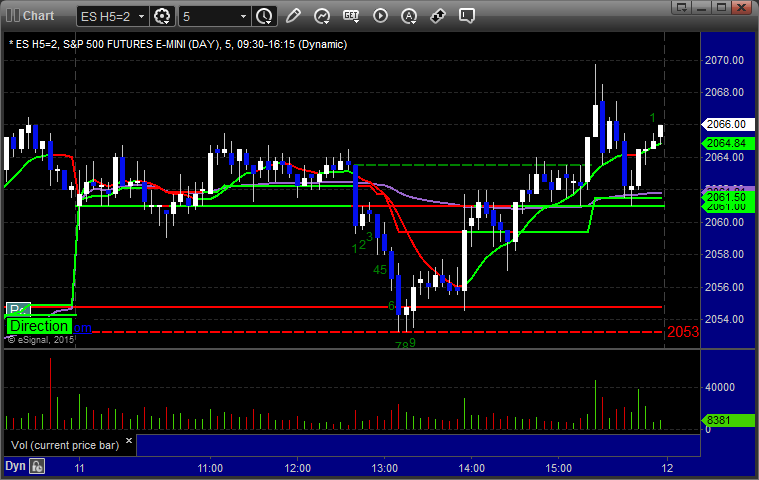

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

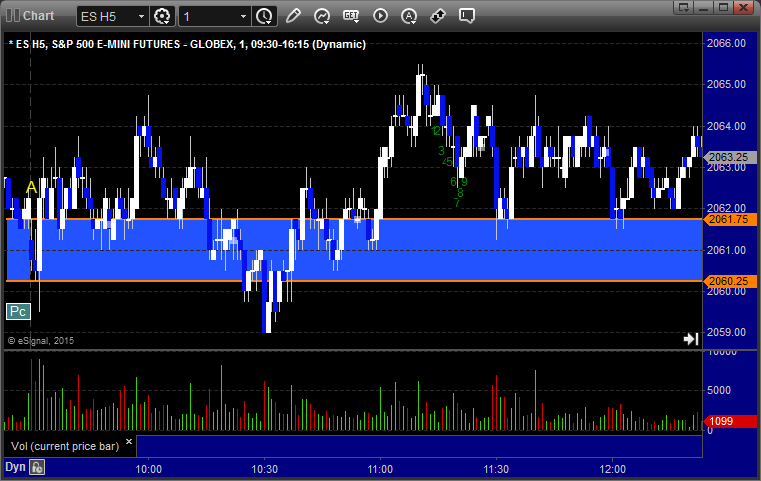

ES Opening Range Play triggered long at A and worked:

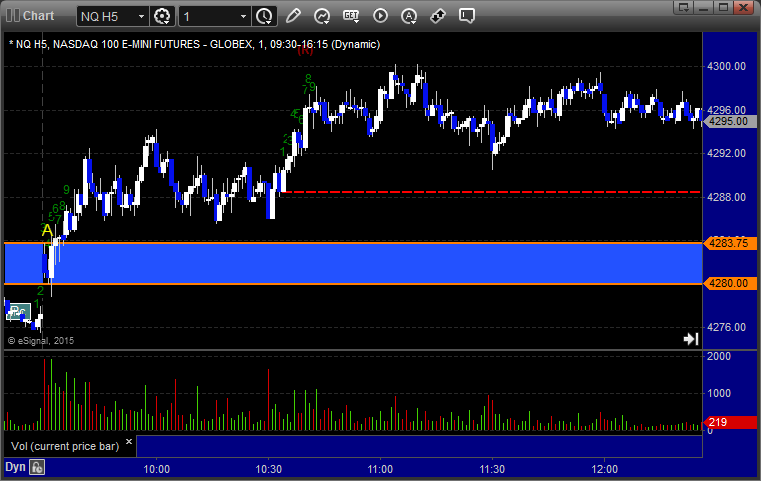

NQ Opening Range Play triggered short at A and didn't work, triggered long at B and eventually worked if you wanted to wait around that long...can't remember the last time one of these took so long to do anything:

ES Tradesight Institutional Range Play triggered long at A and worked:

NQ Tradesight Institutional Range Play triggered long at A and just barely stopped at B:

ES:

Triggered long at A at 2076.50, hit first target for 6 ticks, stopped second half under the entry:

Forex Calls Recap for 2/12/15

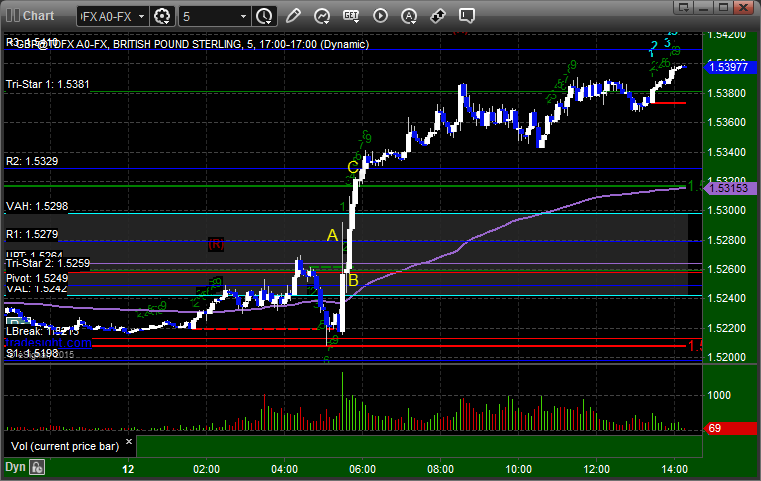

A good example of why we try to avoid news as the trade triggered on news (that usually wouldn't be news) that spiked the market both ways and stopped us on the way to working fine. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A on the news and unfortunately, that news shook and stopped it immediately at B before proceeding to the first target at C and beyond:

Stock Picks Recap for 2/11/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LLTC triggered long (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered long (with market support) and worked:

His EOG triggered short (without market support) and worked:

Mark's BIDU triggered short (with market support and swept by a penny) and didn't work, worked later:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 2/11/15

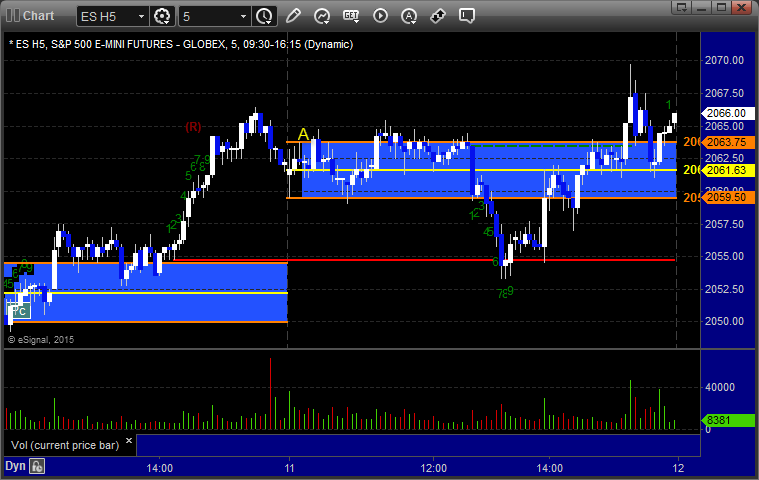

No calls for the session as I was out of town and Mark didn't see anything he liked beyond the Opening Range plays (see those below. The markets opened flat and were as flat as can be for several hours before dipping over lunch and then coming back late on 1.6 billion NASDAQ shares.

Net ticks: +0 ticks.

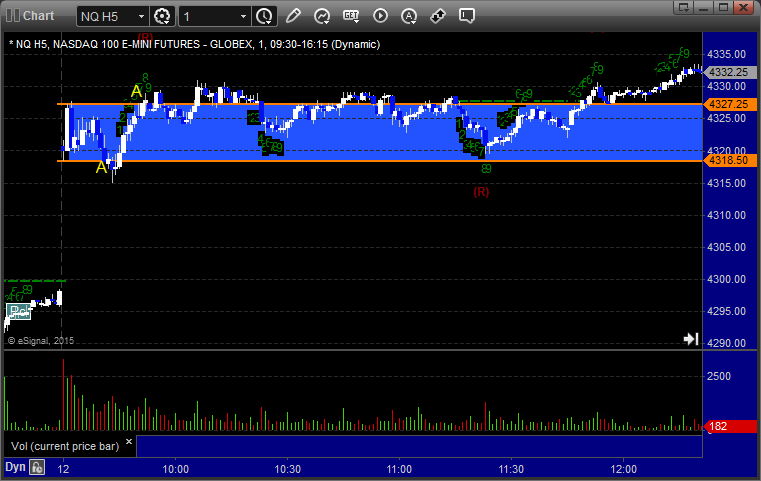

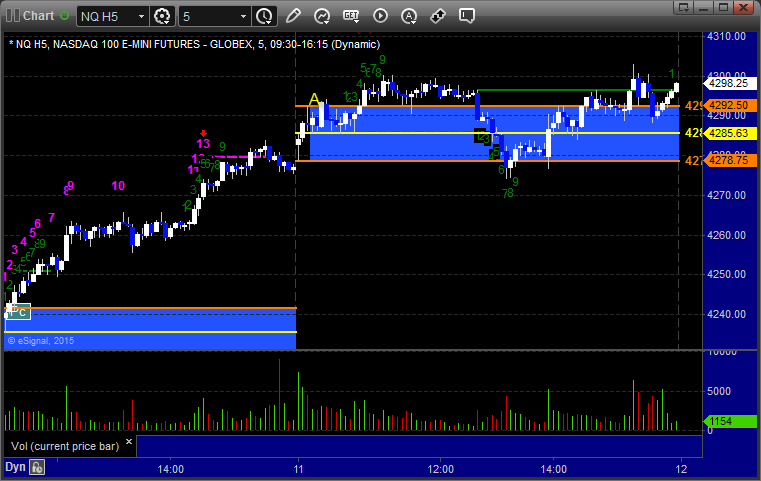

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked enough for a partial:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play triggered long at A and didn't work:

NQ Tradesight Institutional Range Play triggered long at A and worked:

ES:

Forex Calls Recap for 2/11/15

The markets (stocks, futures, forex) have all slowed down considerably this week out of the blue. We'd rather have nothing trigger than get stopped out, and nothing triggered for the session as the range on the EURUSD couldn't even break R1 or S1 either way.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 2/10/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's TBT triggered long (ETF, so no market support needed) and didn't work:

His QCOM triggered short (with market support) and didn't work:

His VXX triggered short (ETF, so no market support needed) and worked:

LNKD triggered long (with market support) and worked:

Mark's LRCX triggered long (without market support) and worked:

BIIB triggered short (without market support) and eventually worked, no reason to wait around for it though:

Rich's APA triggered short (with market support) and didn't work:

BIDU triggered long (with market support) and worked:

Rich's NFLX triggered long (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 3 of them worked, 4 did not.

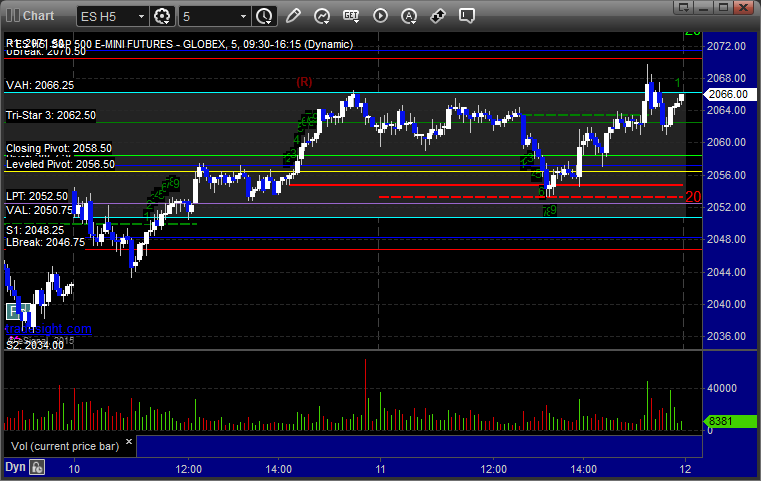

Futures Calls Recap for 2/10/15

Another Opening Range play winner or two, but the rest of the calls were a waste of time in a market that again posted a very light volume day (1.5 billion NASDAQ shares). The markets gapped up, neither the ES nor the NQ quite filled, and then broke out after lunch, which was the better part of the day. Both of the ES calls would have worked on their retriggers, but I didn't take them again due to light volume.

Net ticks: -21 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked. It also would have triggered long at B and worked, but that's 90 minutes in on a session with a bad volume warning, plus the Comber 13 sell signal at that moment:

NQ Opening Range Play triggered short at A and didn't work, triggered long at B and did:

I'm not really a fan of taking the IR plays hours later on light volume days. Having said that, the ES Tradesight Institutional Range Play triggered short at A and worked and long at B and worked:

NQ Tradesight Institutional Range Play triggered long at A and didn't work (tried again later at B and did):

ES:

My first call triggered short at A under R1 after setting it nicely as the low of the opening bar on the gap up but stopped. That would have worked on a retrigger, which we usually would take. Another setup under the UBreak triggered at B and also stopped. This also would have worked the second time but I didn't retake:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 4329.00 and stopped:

Forex Calls Recap for 2/10/15

The TDFX data feed had some issues and was down for a bit, but our trade had already triggered and played out anyway, so I'll just use those charts. The EURUSD trade worked a little, see that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, if you are awake then you move the stop over the entry on the second half, otherwise, it stops at the original stop: