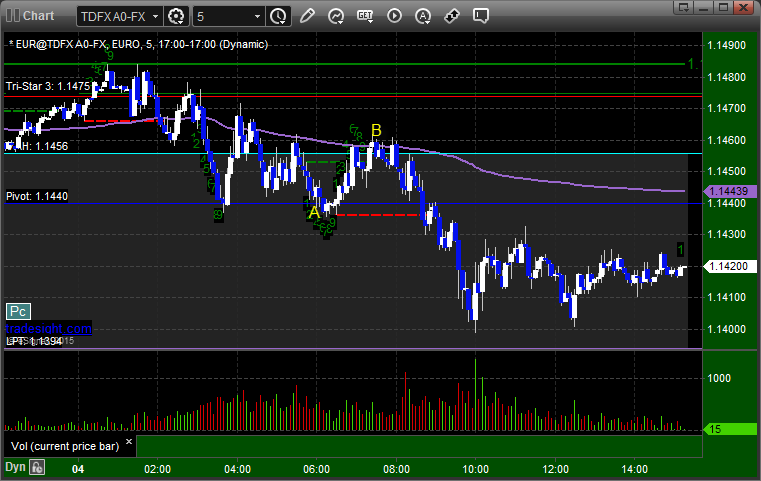

Forex Calls Recap for 2/5/15

A nice winner for the session in the EURUSD that did not stop out first. See that section below. We are still holding the second half of the trade.

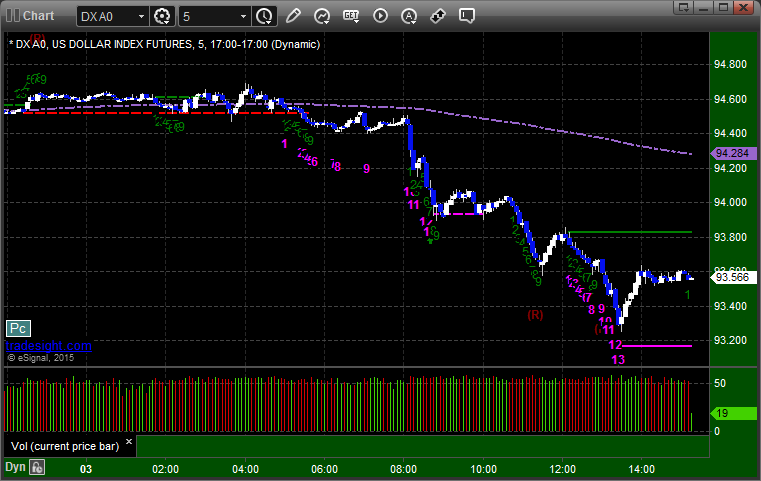

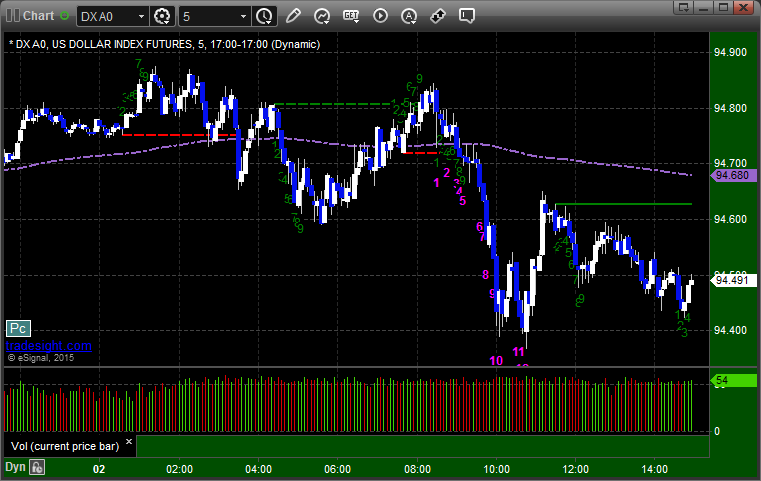

Here's a look at the US Dollar Index intraday with our market directional lines:

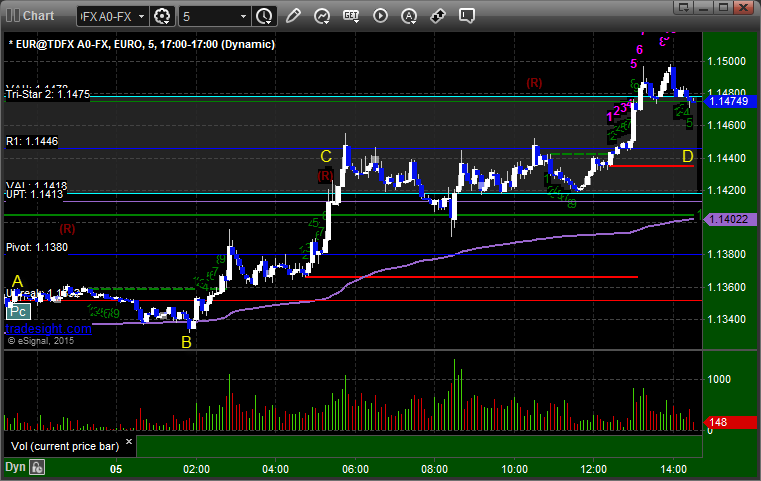

EURUSD:

Triggered long to the left of the chart and the letter A, but gave you hours to enter as it just sat right above UBreak. It did pull back to B, and the low of that is 1.13318. A stop should have been at 1.1330 (20 pips back from the 1.1352 entry level plus the spread of 2). It then went on to hit the first target at C and we are still holding the second half with a stop under R1 at D:

Stock Picks Recap for 2/4/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AAPL triggered long (with market support) but the market was just too dead and we closed it slightly in the money, which ended up being the correct choice:

ETFC triggered long (with market support) and worked (about 4 minutes and 50 seconds into the market:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL intraday call, on the other hand, triggered long (with market support) and worked:

Rich's RIG triggered short (with market support) and didn't work:

His DAL triggered long (without market support) and didn't work:

His UAL triggered long (without market support) and worked great:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not. That counts the AAPL daily long since we closed it in the money.

Futures Calls Recap for 2/4/15

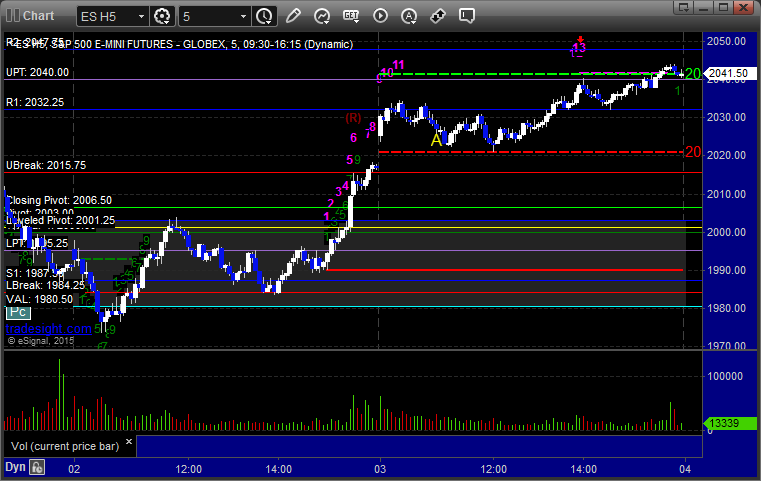

Winners again on the Opening Range plays, but the market went dead flat again early and didn't break out until the late afternoon. The only other call I posted didn't look like it would trigger, but the markets suddenly dropped sharply in the last 30 minutes and got us a trigger and first target. See ES section below.

Net ticks: +2.5 ticks.

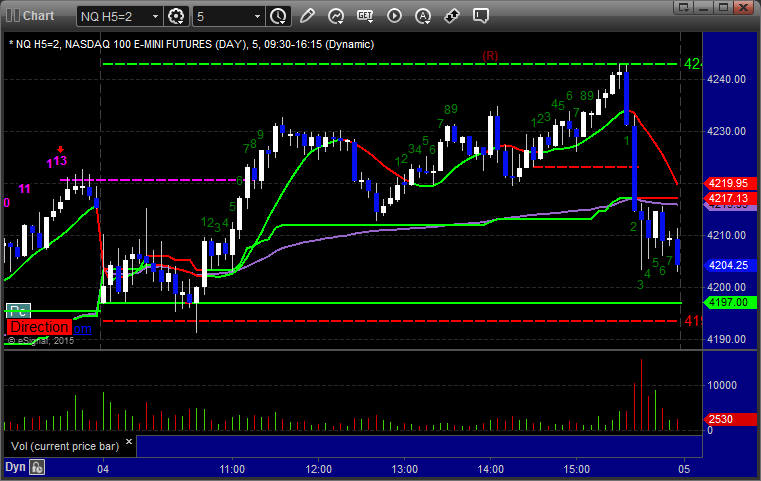

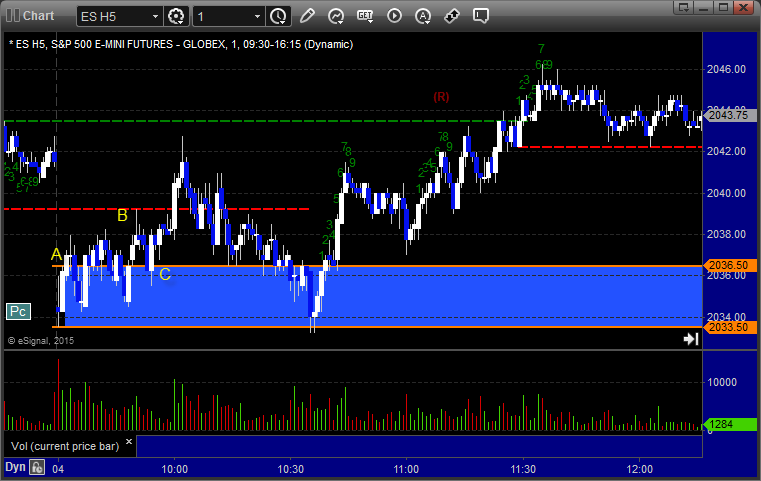

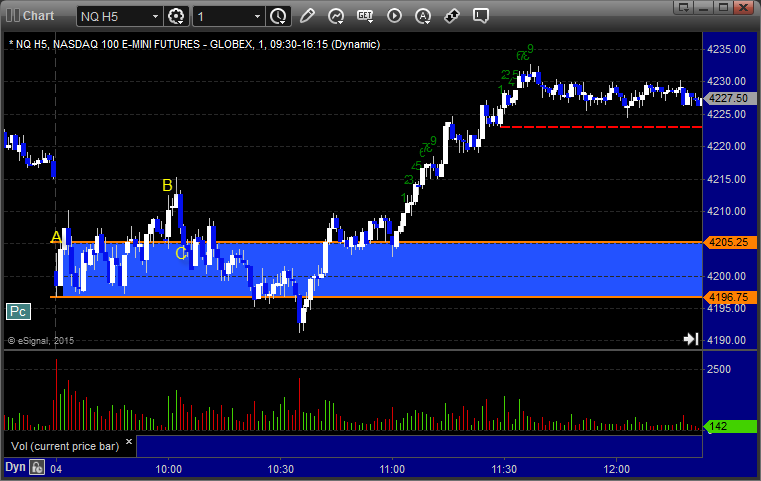

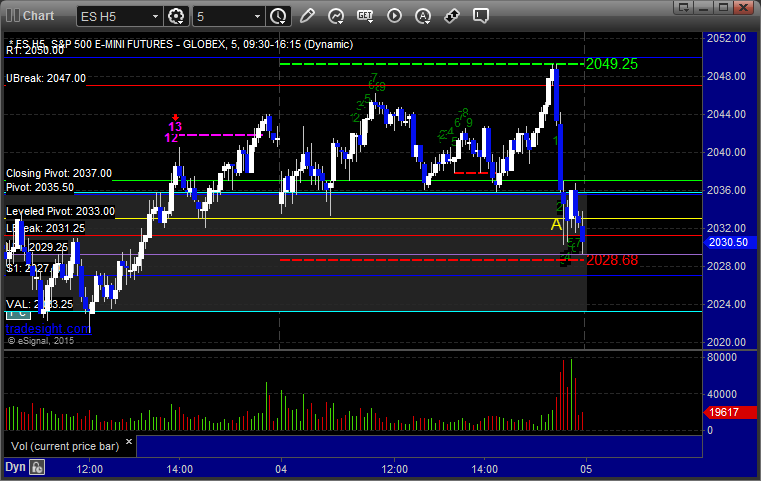

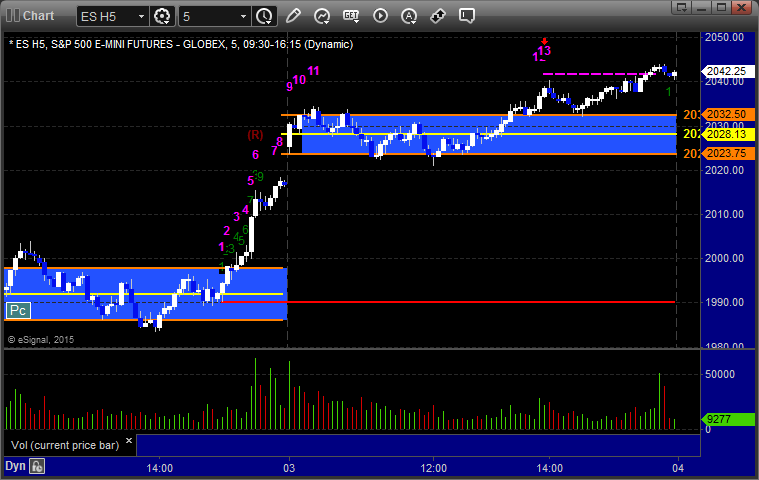

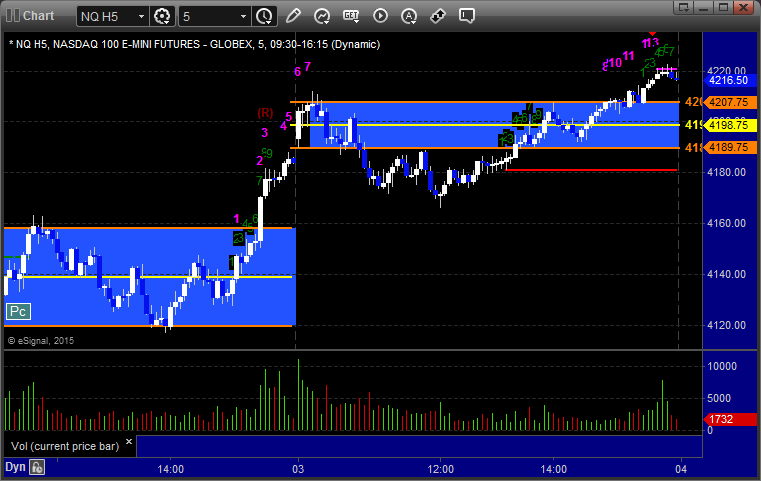

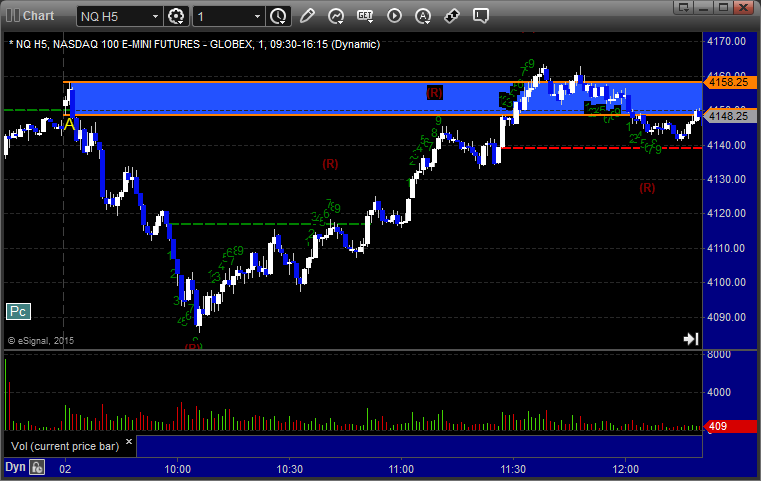

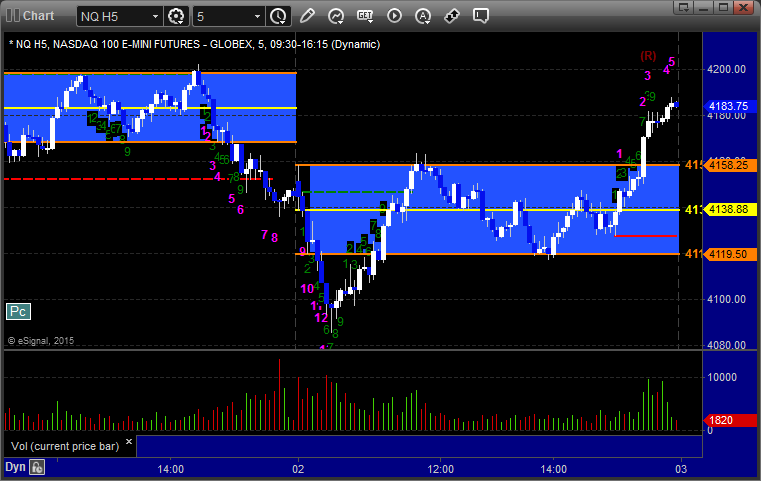

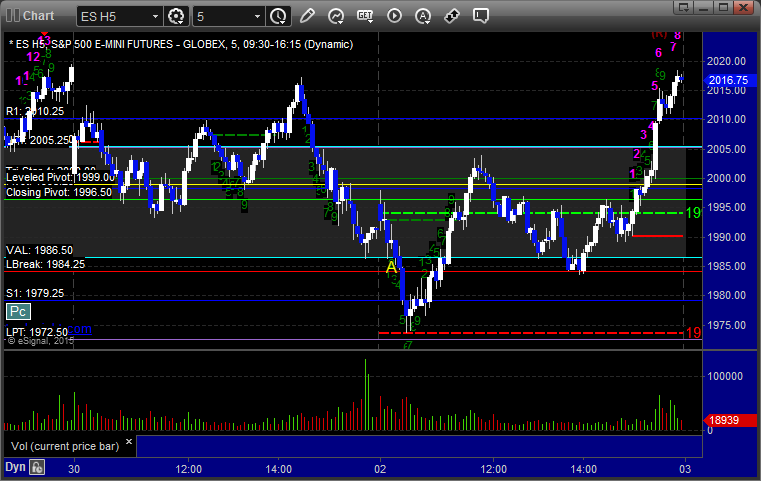

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and went enough for a partial at B before stopping the second half under either the entry or the Opening Range High:

NQ Opening Range Play triggered long at A and went enough for a partial at B before stopping the second half under either the entry or the Opening Range High:

ES Tradesight Institutional Range Play triggered long at A and worked on a spike enough for a partial:

NQ Tradesight Institutional Range Play was even more fascinating, triggered long at A just over the boundary line and working great, but note that there were several candles earlier that tried to bust the range and couldn't close outside of it:

ES:

Triggered short at A at 2032.75, hit first target for 6 ticks, and stopped second half over entry:

Forex Calls Recap for 2/4/15

Another fairly uninteresting session in the middle of a dull two week period here. One stop out in the EURUSD. If you took the trade on the GBPUSD that was indicated in opening comments, it worked.

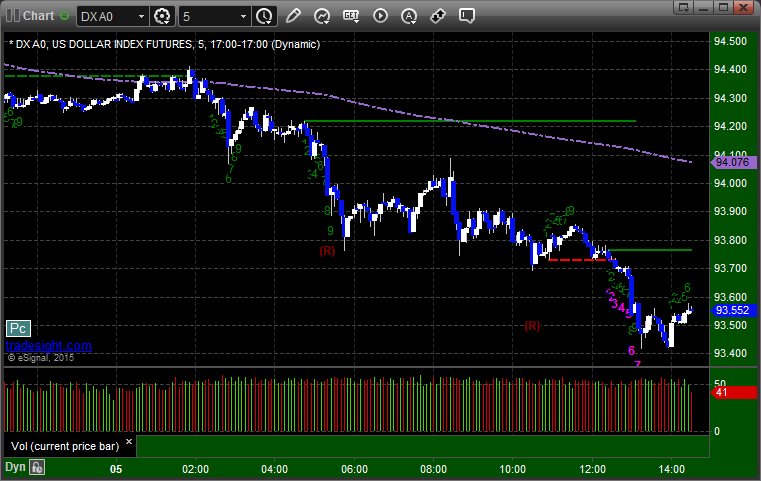

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped:

Stock Picks Recap for 2/3/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, COST triggered long (with market support) and worked great,I ended up with $5.50 gain to the final exit:

FSLR gapped over the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and worked:

His FDX triggered short (with market support) and worked:

PCLN triggered long (with market support) and worked:

FEYE triggered long (with market support) and worked:

Rich's BLUE triggered short (with market support) and worked:

His DDD triggered short (with market support) and worked:

His SCTY triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, all 8 of them worked, many extremely well.

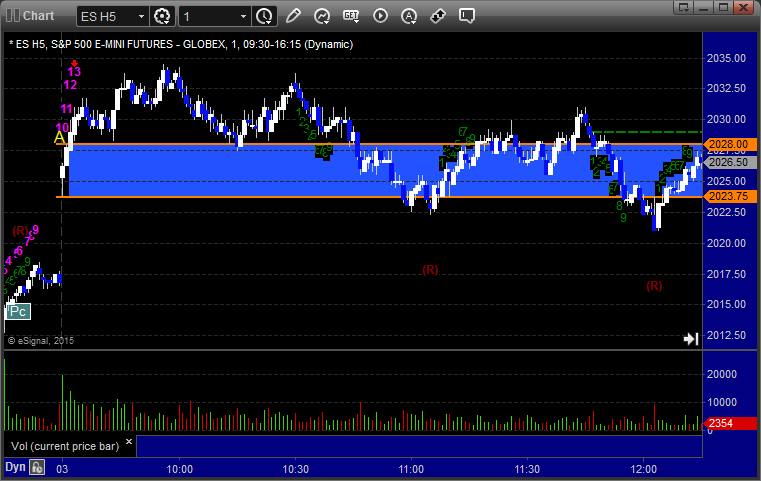

Futures Calls Recap for 2/3/15

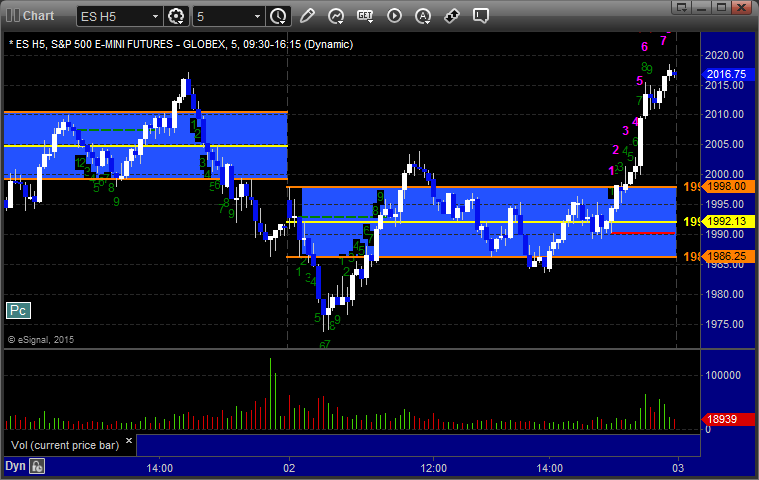

The markets gapped up and were extremely flat for over an hour, then finally turned back down a bit before heading up once again. The ES never filled the gap. Opening Range plays worked, and we had one call that stopped once before working a little.

Net ticks: -4.5 ticks.

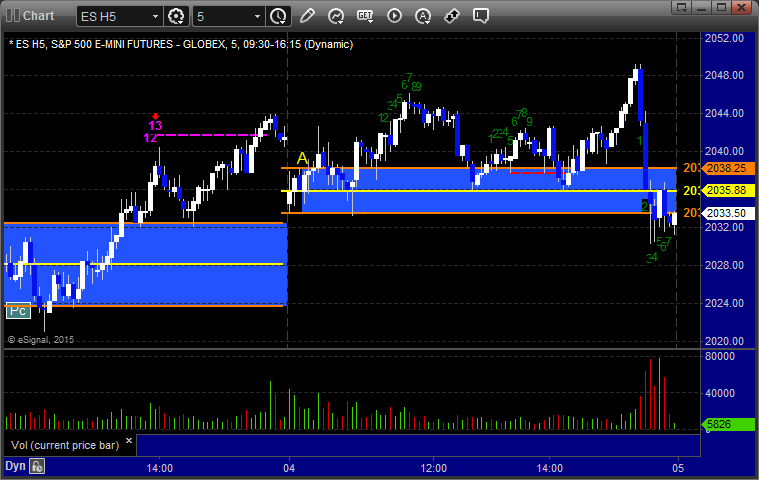

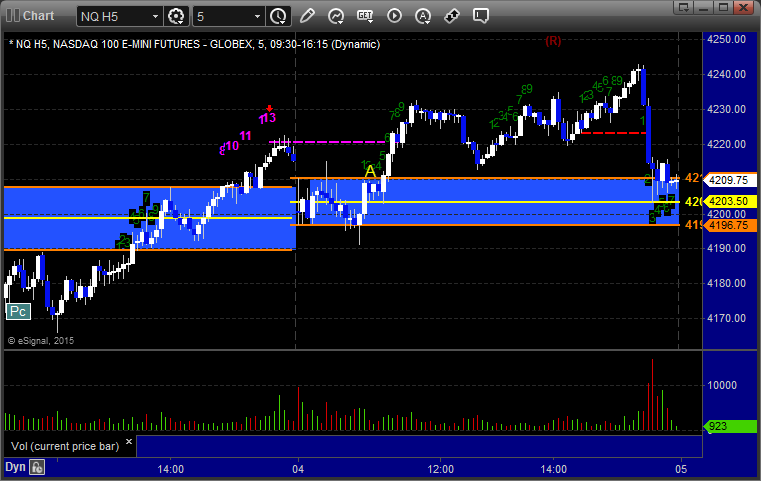

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A and worked:

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered short at A at 2023.75 and stopped. We put it back in and it triggered again, hit the first target for 6 ticks, and stopped second half over the entry:

Forex Calls Recap for 2/3/15

A stop out and a bigger winner on the GBPUSD that ended up going much further after taking us out of the trade. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

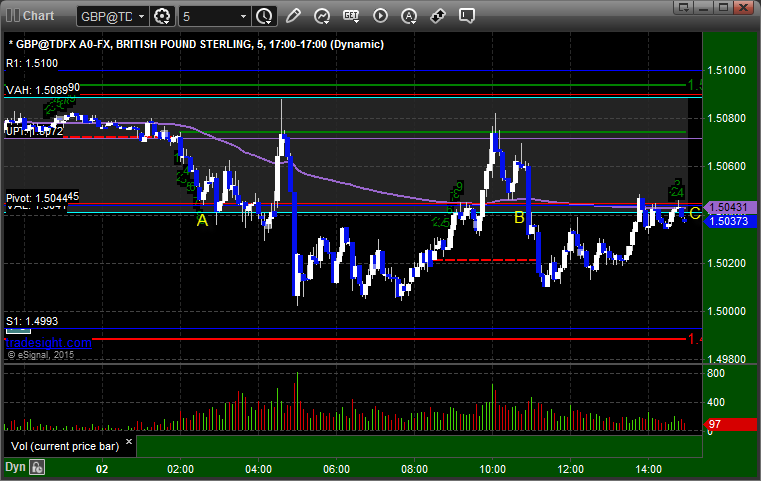

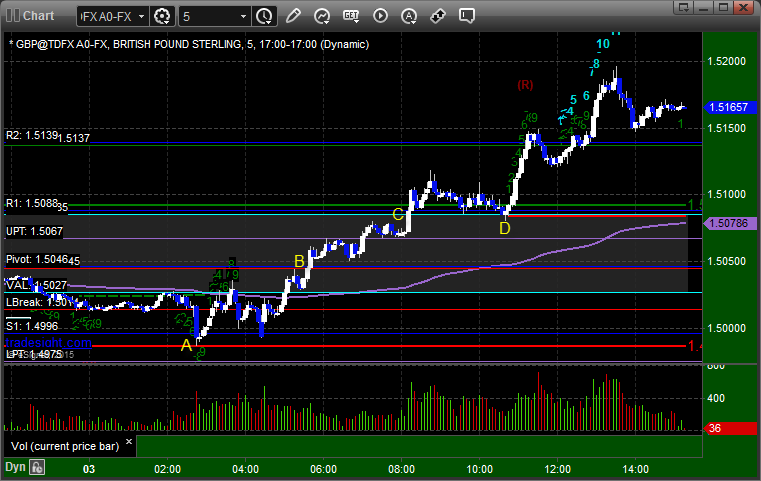

GBPUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, and closed the second half at D...to the PIP...before shooting higher. Oh well, things happen:

Stock Picks Recap for 2/2/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LPSN triggered short (with market support) and didn't work, but as we said in the Lab, the stock was way too thin at the time of the trade to trigger. Happens sometimes:

Same deal with SIGI:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAL triggered short (with market support) and worked nicely:

His DAL triggered short (with market support) and also worked:

His BABA triggered short (with market support) and also worked nicely:

TWTR triggered short (with market support) and worked enough for a partial:

Rich's AMZN triggered long (without market support) and worked enough for a partial:

His CAVM triggered short (with market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not. (We have to count the two even though we didn't take them since they were so thin).

Futures Calls Recap for 2/2/15

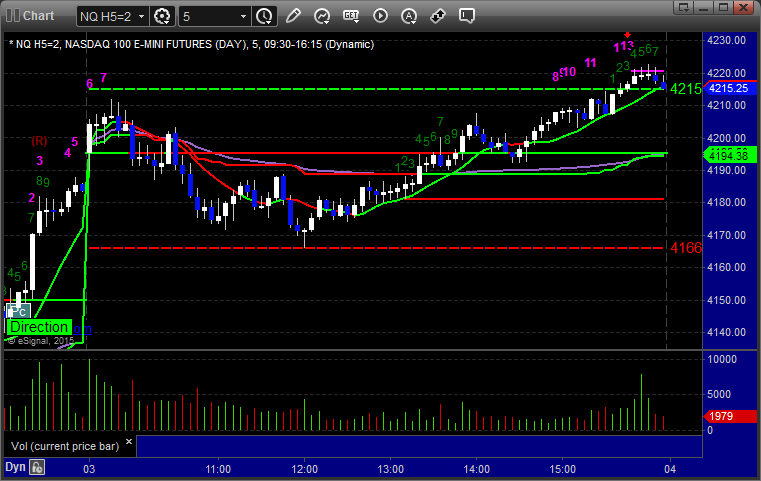

The markets opened fairly flat and filled the minor gap early, then headed sharply lower so our Opening Range plays worked. You'll note that the low of the day was a 13 Comber buy signal on the NQ and then we came back to the open. The rest of the day was flat until the last 30 minutes, when we broke out on volume. Must have been some news I didn't see. NASDAQ volume closed at only 1.8 billion shares. We had a net winner in the ES, see that section below.

Net ticks: +5.5 ticks.

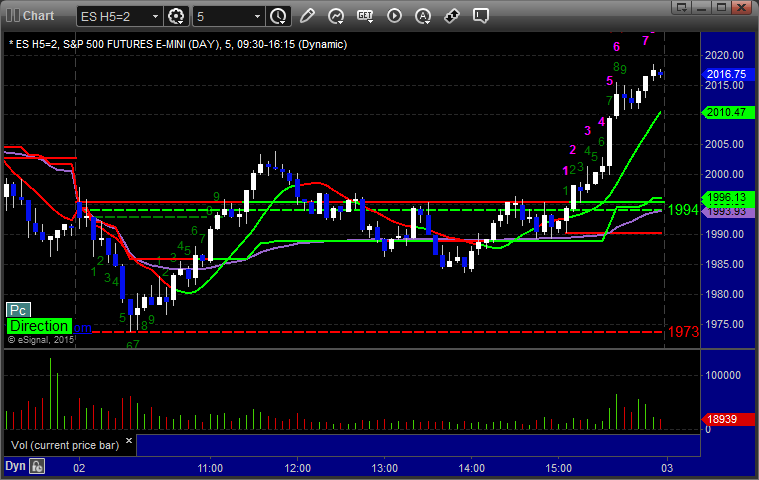

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered at A and worked:

NQ Opening Range Play triggered at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

The call triggered short at A at 1986.00 and stopped for 7 ticks. We put it back in and it triggered shortly after, hit the partial for 6 ticks, and then we lowered the stop a few times and exited the final piece for 19 ticks:

Forex Calls Recap for 2/2/15

Another dull night with little movement. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered short again in the morning at B and closed at C: