Stock Picks Recap for 1/30/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AAPL triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Mark's MCHP triggered long (with market support) and worked enough for a partial:

Rich's ALXN triggered long (with market support) and didn't work:

His SLB triggered long (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 1 of them worked, 3 did not. Pretty much as expected for an end of month.

Futures Calls Recap for 1/30/15

Pretty much what we expected. There was a gap down at the open, the NQ filled, the ES came close, and most of the day was flat. s

Net ticks: +2.5 ticks.

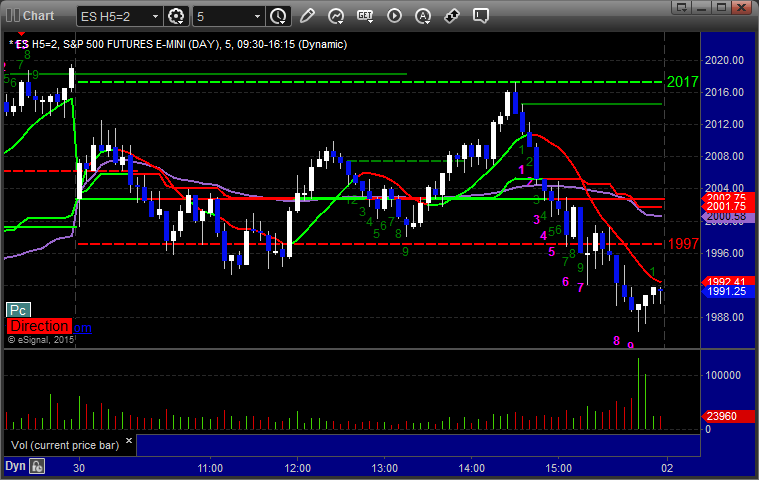

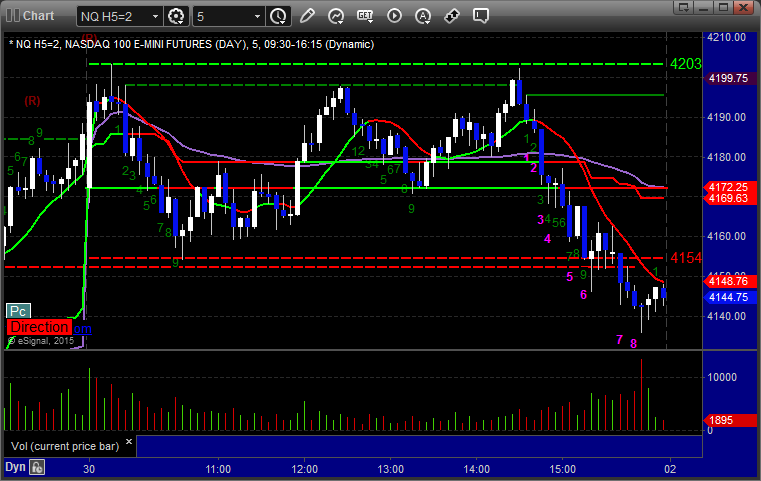

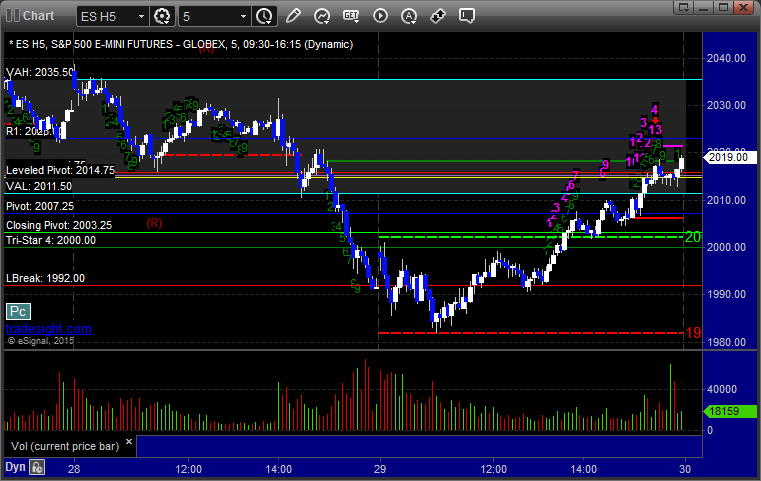

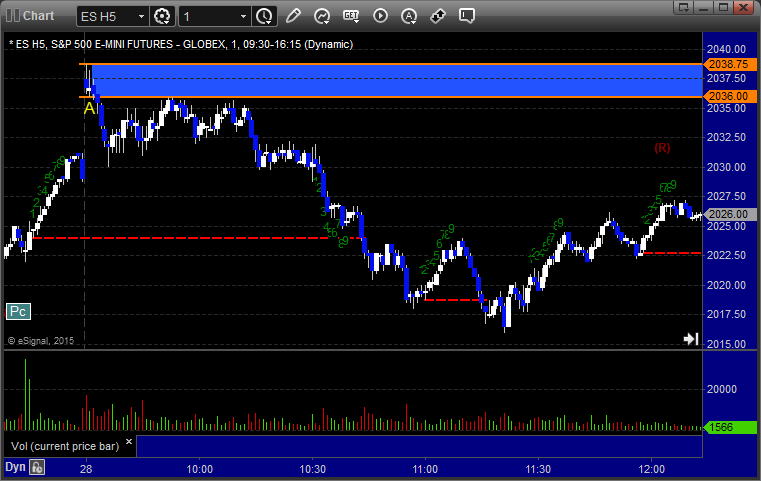

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

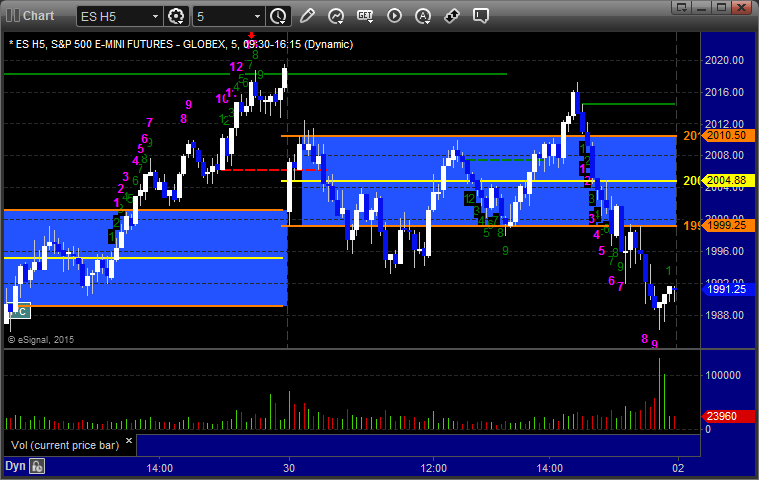

ES Opening Range Play triggered long at A and worked:

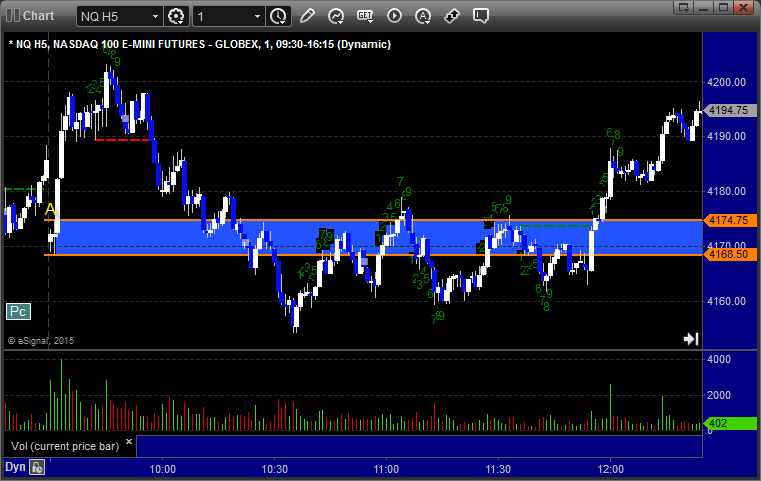

NQ Opening Range Play triggered long at A and worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Triggered long at A at 2010.25, hit first target for 6 ticks, and stopped second half under entry:

Forex Calls Recap for 1/30/15

Not a very exciting session to end a not very exciting week. See GBPUSD section below.

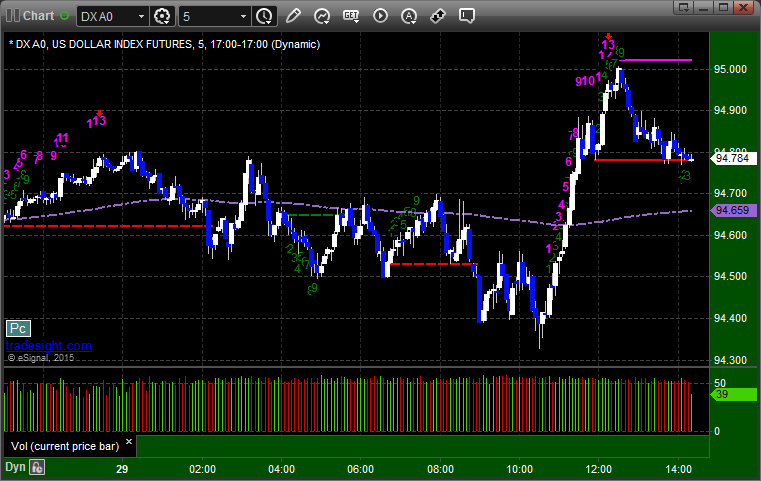

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

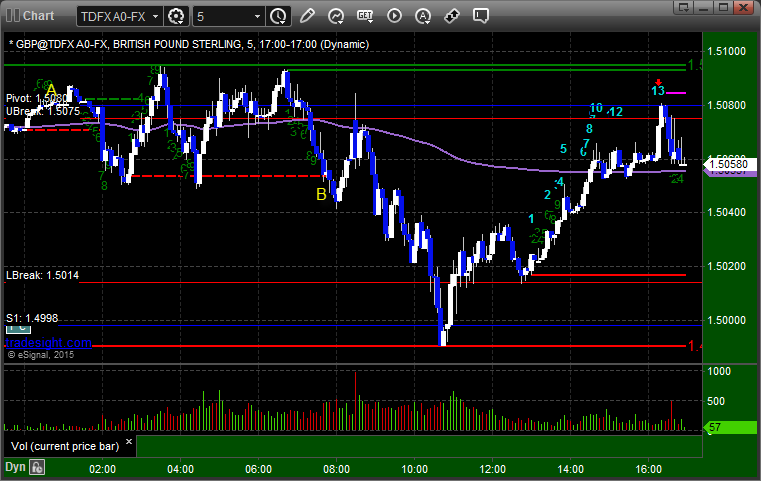

GBPUSD:

Triggered long at A and stopped. Triggered short at B and stopped. Short worked in the morning if you were up earlier than me to put it back in:

Stock Picks Recap for 1/29/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FMER triggered short (with market support) and didn't work:

KERX triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (with market support) and didn't work:

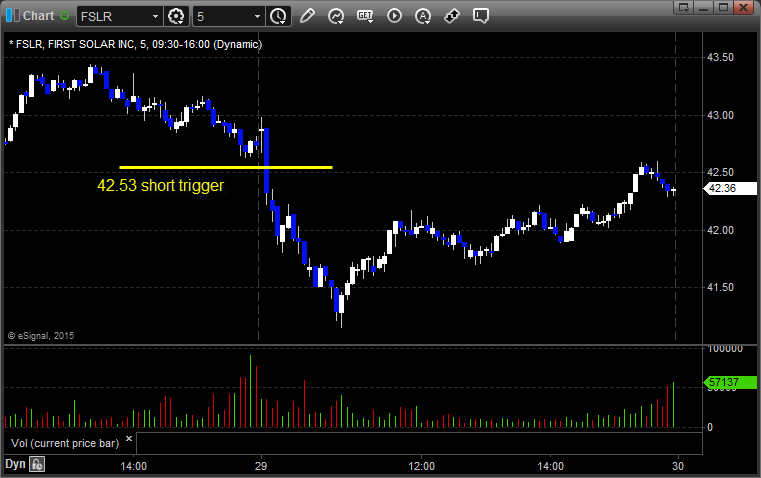

FSLR triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked:

Mark's SNDK triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Futures Calls Recap for 1/29/15

Not a very interesting session for most of the day, which wasn't a surprise on the last day of Core Earnings. No official calls, but I recapped the Opening Range plays below. The markets held dead flat for hours and finally rallied in the afternoon on 1.9 billion NASDAQ shares.

Net ticks: +0 ticks.

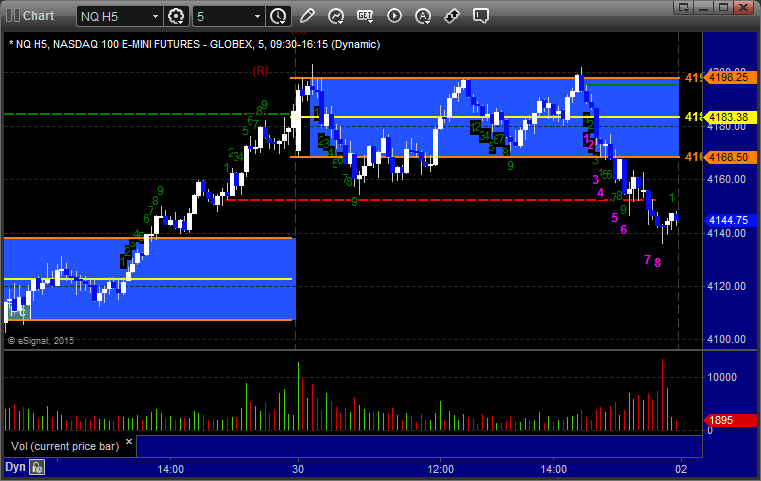

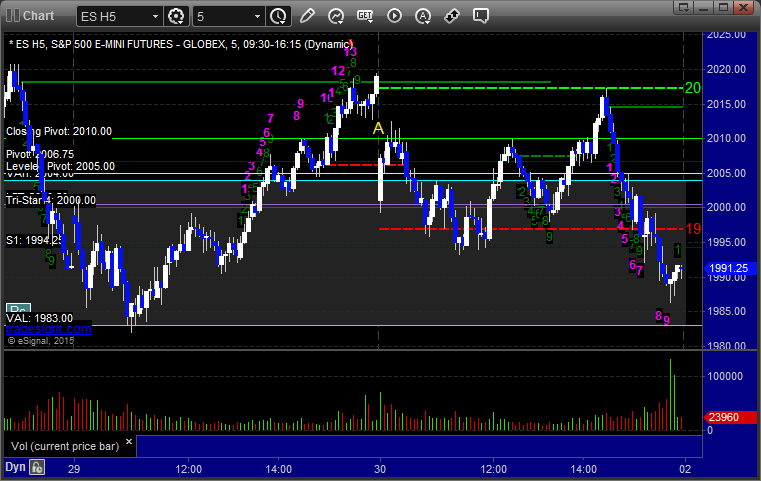

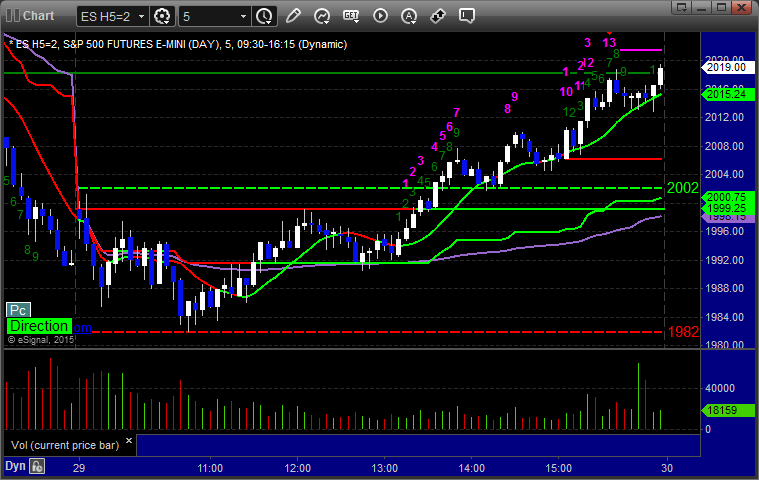

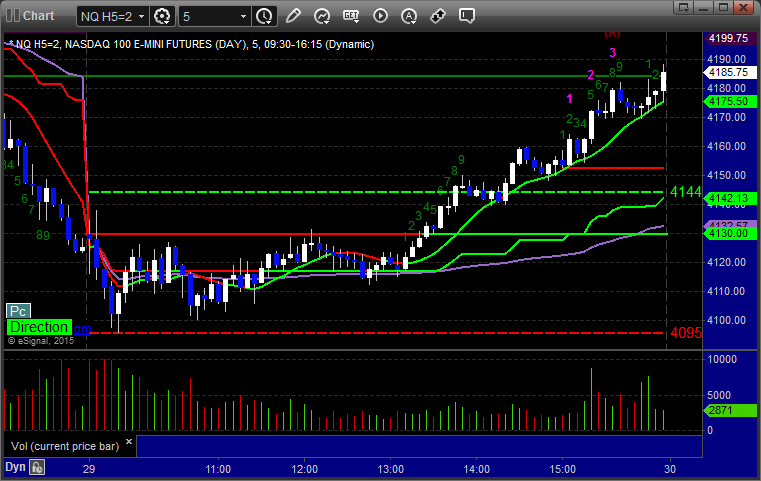

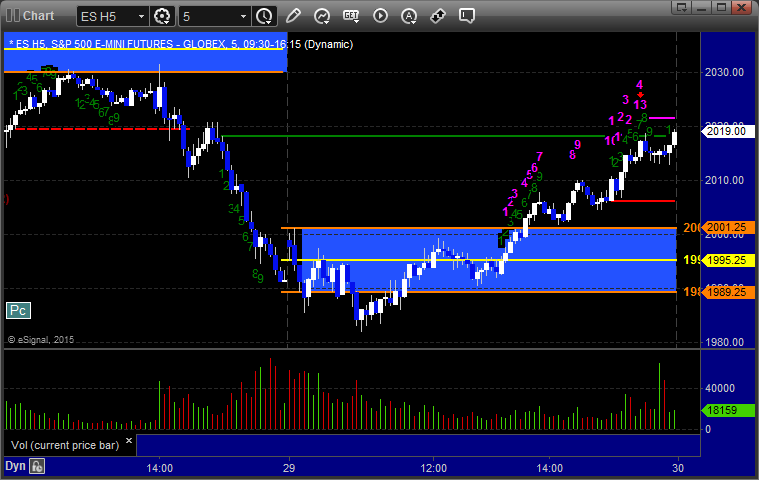

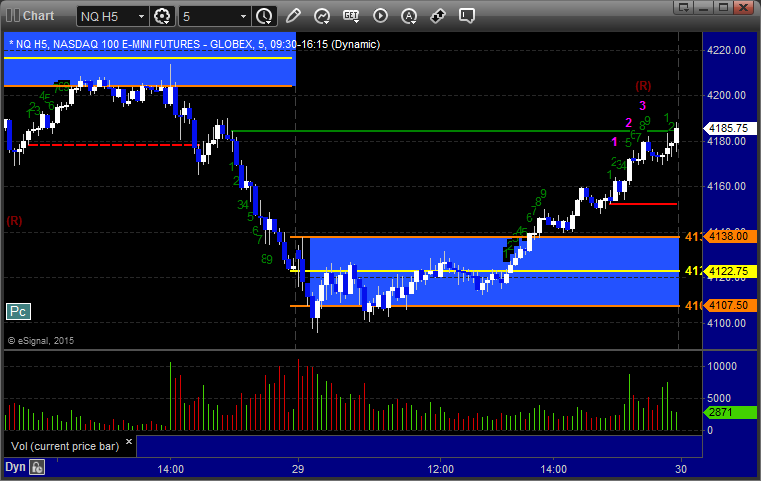

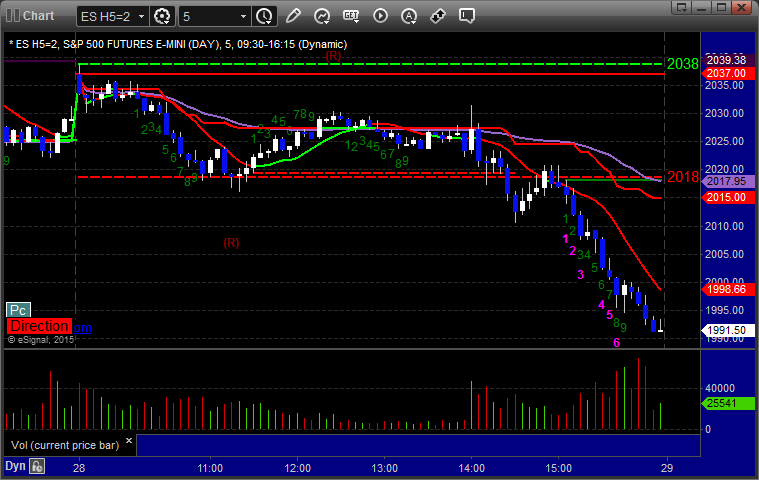

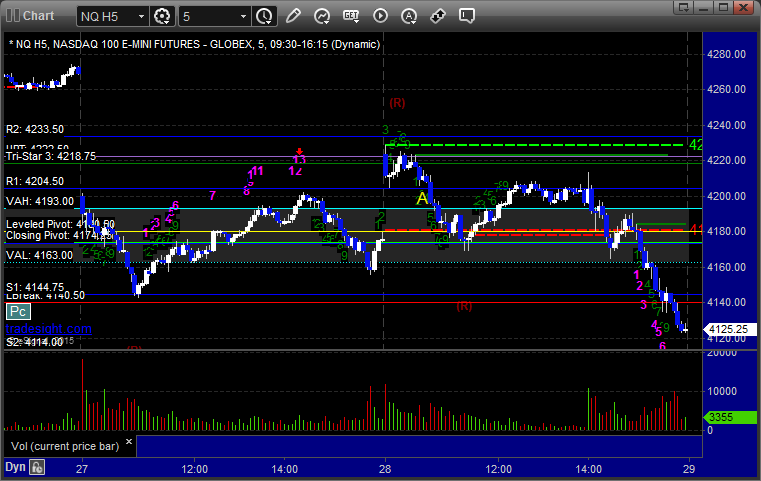

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

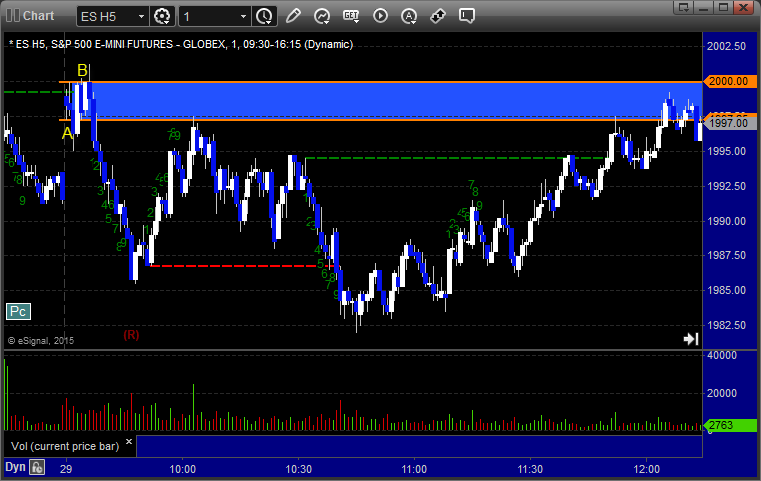

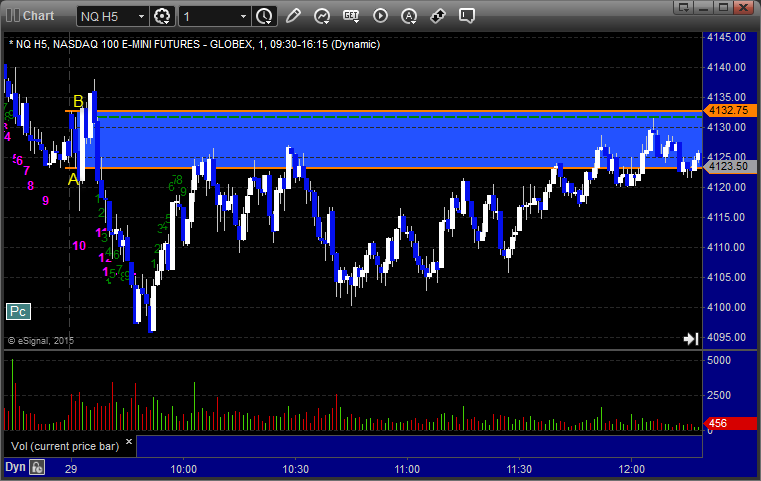

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short at A and should have stopped at B, although it never got a close above the Opening Range to trigger the long (until hours later). Ironically, if you had taken it again, it worked, and look how it used the level later:

NQ Opening Range Play, triggered short at A and stopped at B and triggered long at B and didn't work:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 1/29/15

Sometimes when we post two different pairs, we miss the easy move. The EURUSD never triggered, and part of the GBPUSD long triggered and stopped, but the GBPUSD short ended up being the move. See the GBPUSD section below.

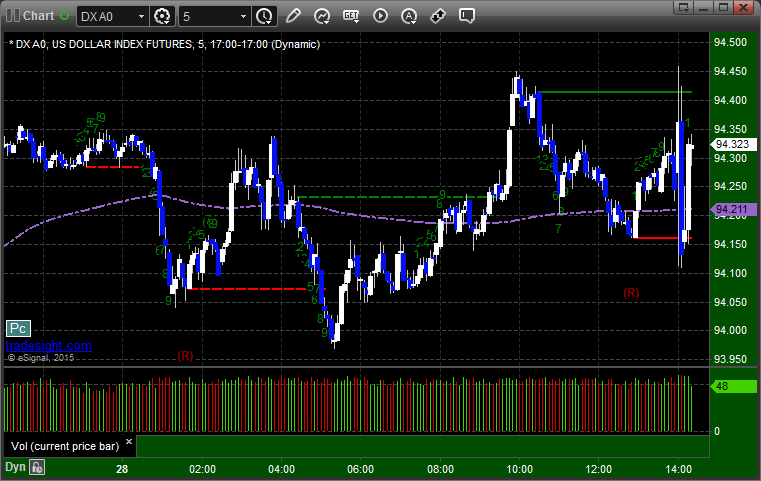

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Part of the trade triggered long at A if you follow our order staggering rules and stopped:

Stock Picks Recap for 1/28/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, UBNT triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's BABA triggered short (with market support over lunch) and didn't work:

His NFLX triggered short (with market support) and worked great:

His VMW triggered short (with market support) and worked:

His AAPL triggered long (without market support) and didn't work:

His YHOO triggered short (with market support) and worked:

TSLA triggered short (with market support) and worked:

BIDU triggered short (with market support) and worked:

Rich's FB triggered short (with market support) and worked:

CELG triggered short (with market support) and worked:

In total, that's 9 trades triggering with market support, 8 of them worked, 1 did not.

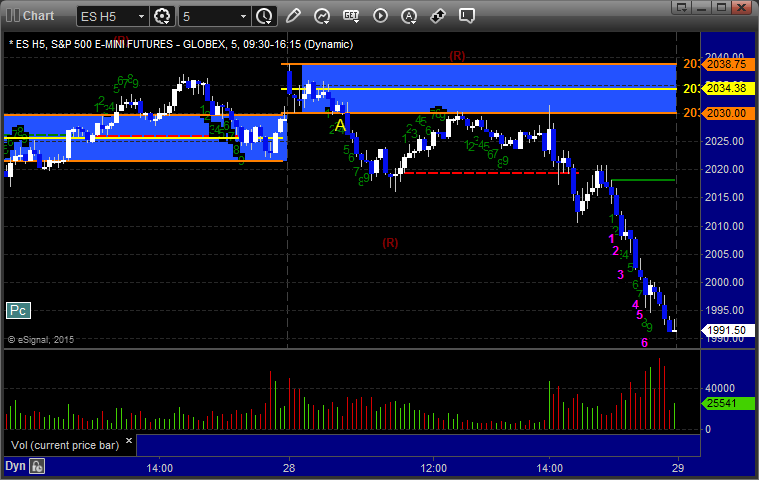

Futures Calls Recap for 1/28/15

The markets gapped up unevenly, with the ES up a couple and the NQ up a ton based on AAPL. We ended up with a pretty clean move lower to fill the gaps and caught several nice winners between the Opening and Institutional Range plays (see that section below) and the official NQ call (see that section below). The Fed announcement caused an initial spike up and then a reversal to the downside. NASDAQ volume closed at 1.8 billion shares, which is pretty good but not what you'd expect when you realize AAPL was way above its average.

Net ticks: +16.5 ticks.

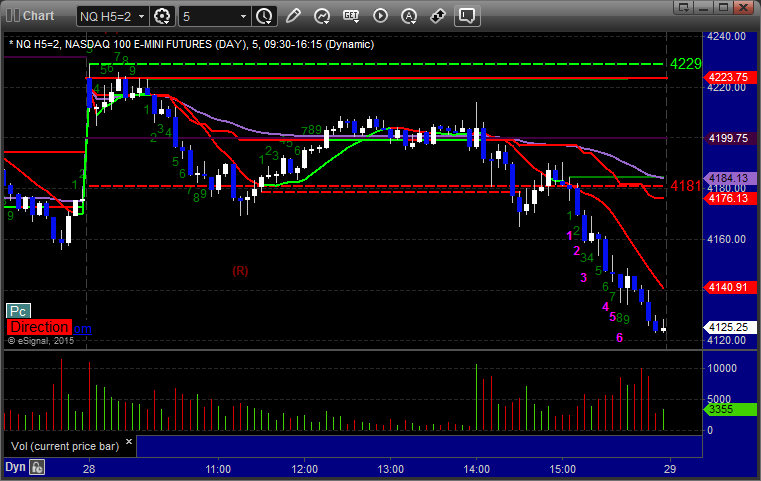

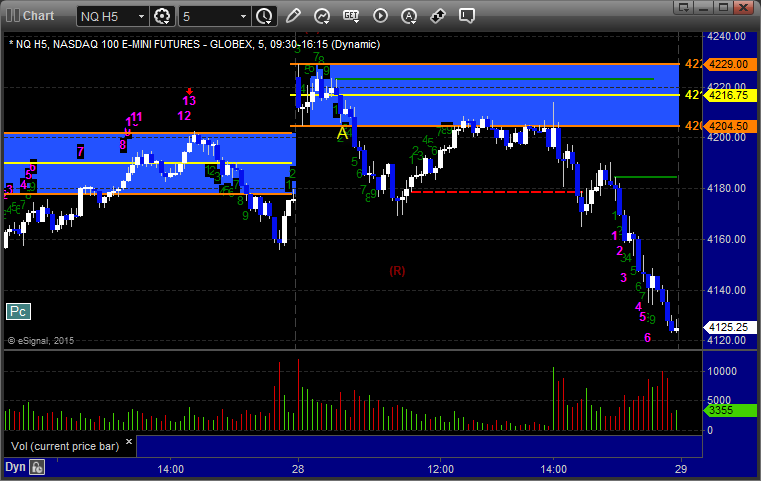

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play worked, triggered and A and no issues:

NQ Opening Range Play worked, triggered at A, hit an easy partial, and that was it:

ES Tradesight Institutional Range Play worked great, triggered short at A:

NQ Tradesight Institutional Range Play worked, triggered short at B:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 4204.00, hit first target for 6 ticks, lowered stop a couple of times and stopped final piece at 4190.50 for 27 ticks:

Forex Calls Recap for 1/28/15

There is a reason that we go half size ahead of Fed announcements. They tend to be useless days. Even the Fed announcement didn't do much. Both of the GBPUSD trades triggered (just barely), so see that section below. Back to normal size tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered long at B and stopped:

Stock Picks Recap for 1/27/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MIFI triggered long (without market support) and worked:

ANAC triggered long (with market support) and worked enough for a partial (the trigger bar was a 13 Comber sell on the 5 minute):

From the Messenger/Tradesight_st Twitter Feed, Rich's SLB triggered long (with market support) and worked enough for a partial:

His DAL triggered short (with market support) and didn't work:

His V triggered short (with market support) and worked:

His MA triggered short (with market support) and worked:

His AMZN triggered short (with market support) and worked:

FSLR triggered long (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not. Not much went far.