Stock Picks Recap for 1/15/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, UTHR triggered long (without market support due to opening 5 minutes):

TRIP triggered short (with market support) and worked enough for a partial, and later even more:

From the Messenger/Tradesight_st Twitter Feed, FEYE triggered short (with market support) and worked:

Rich's YHOO triggered short (with market support) and didn't work (worked later):

BIDU triggered short (with market support) and worked:

Rich's BBY triggered short (with market support) and worked enough for a partial:

TWTR triggered short (with market support) and worked:

Rich's PCLN triggered short (with market support) and worked:

His EOG triggered long (without market support) and didn't work:

His BABA triggered short (with market support) and worked:

His AMGN triggered short (with market support) and worked:

In total, that's 9 trades triggering with market support, 8 of them worked, 1 did not.

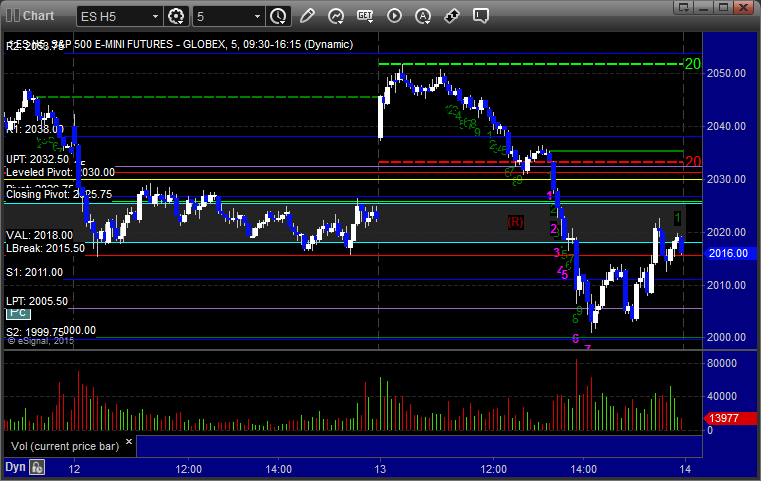

Futures Calls Recap for 1/15/15

The Opening Range plays were once again so nice that there wasn't a point in calling much else, especially since the market established most of the range for the day in the first hour and had a minor volume warning for the first time this week. In the end, NASDAQ volume closed at 1.8 billion shares.

Net ticks: +0 ticks.

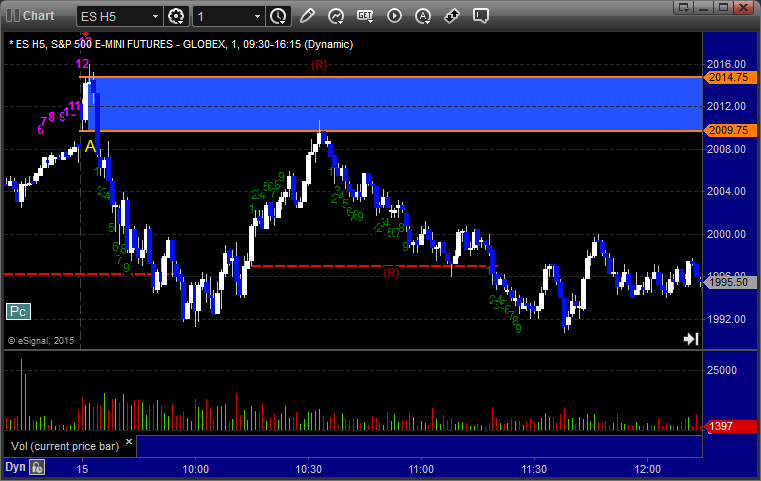

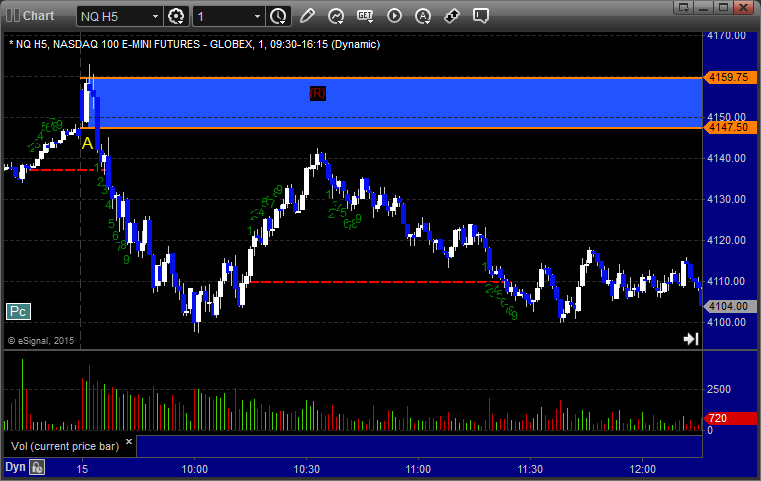

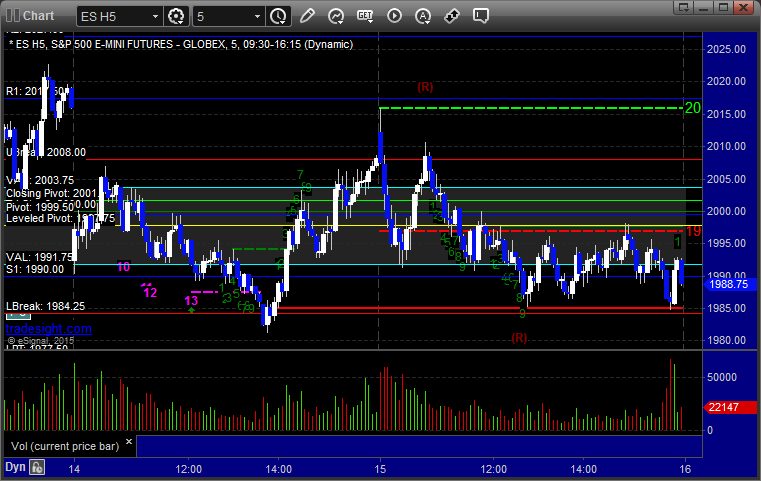

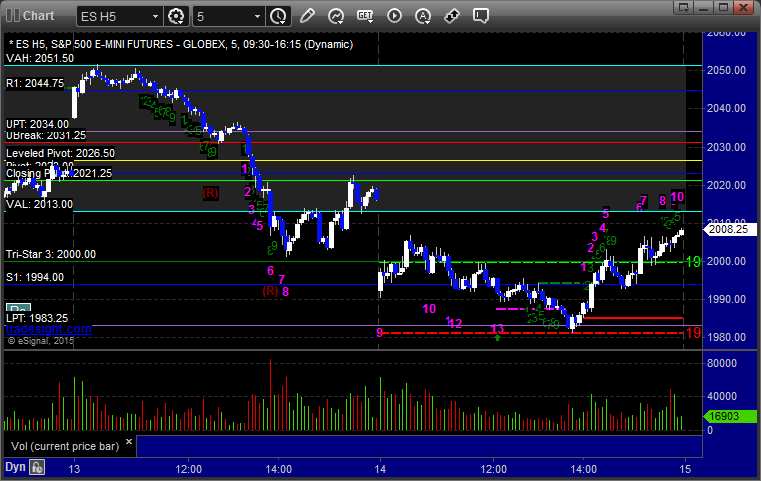

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening Range and Institutional Range Plays:

ES Opening Range Play triggered short at A and worked great again...note the Comber 13 sell signal on the 1-minute chart right before it went and also the retest of the level later:

NQ Opening Range Play triggered short at A and worked:

ES Tradesight Institutional Range Play triggered short at A and worked enough for a partial:

NQ Tradesight Institutional Range Play triggered short at A and worked enough for a partial:

ES:

Forex Calls Recap for 1/15/15

One of the craziest nights in years in Forex and a reminder of how dangerous it can be. Take a good look at the CHF-related pairs to see what a gap on news does. Literally over a 1000-pip move. The news created some spikes and generally wider spreads for a bit on the other pairs as well. Both of our calls were in the GBPUSD, which was relatively calm in comparison, but it ended up sweeping us both ways for the first double loss in a while. Given the overall craziness, no problems for us.

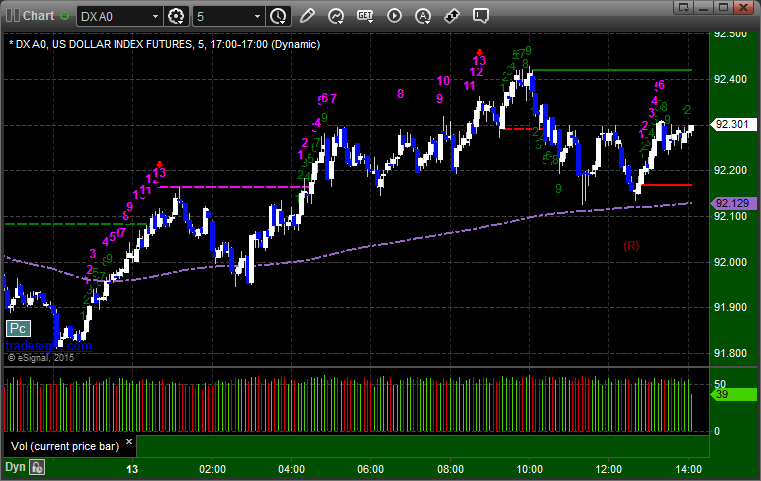

Here's a look at the US Dollar Index intraday with our market directional lines:

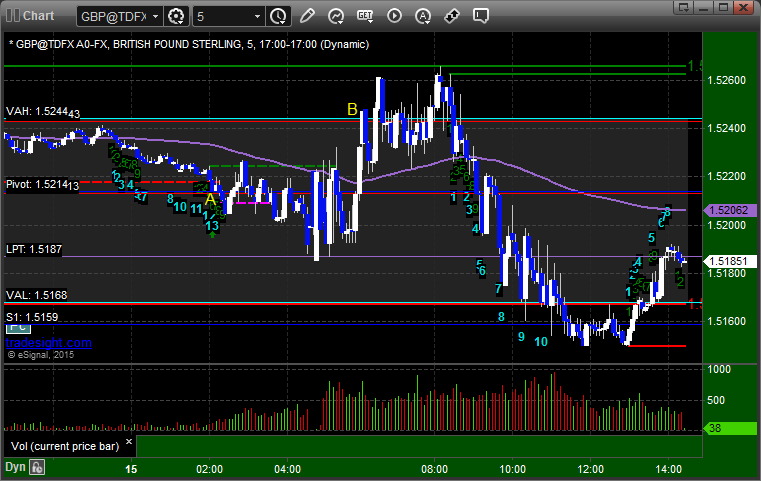

GBPUSD:

Triggered short at A and stopped. Triggered long at B and stopped:

Stock Picks Recap for 1/14/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CLVS triggered long (with market support) and worked:

SNDK gapped under the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered long (with market support) and didn't work:

His YHOO triggered short (without market support) and didn't work:

His SLB triggered long (with market support) and worked:

His BABA triggered short (without market support) and worked enough for a partial:

His AMZN triggered short (without market support) and didn't work:

EBAY triggered short (with market support) and worked:

Rich's AAPL triggered short (with market support) and didn't work:

His JAZZ triggered short (with market support) and worked:

His APA triggered long (with market support) and worked:

His PXD triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

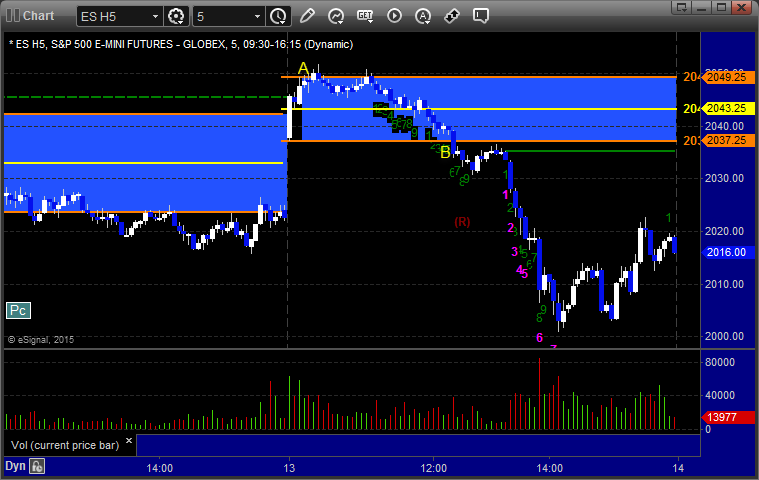

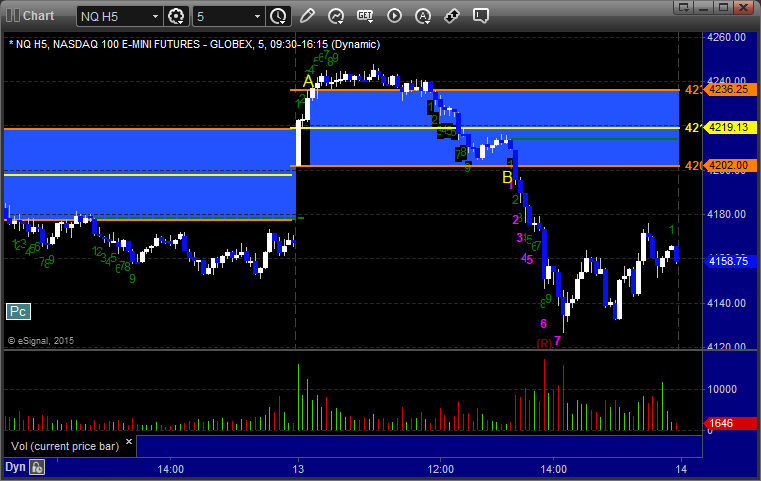

Futures Calls Recap for 1/14/15

The markets gapped down Wednesday, almost as much as they gapped up Tuesday, but this time rallied up toward the gaps out of the gate. The NQ almost made it, but the ES did not. Most of the range was established by the first 2 hours and it was a bit choppy. It looked like there was an options unraveling move to the downside after the first hour, but then the markets rallied back in the last two hours and closed at the range highs on 1.9 billion NASDAQ shares.

Net ticks: +0 ticks.

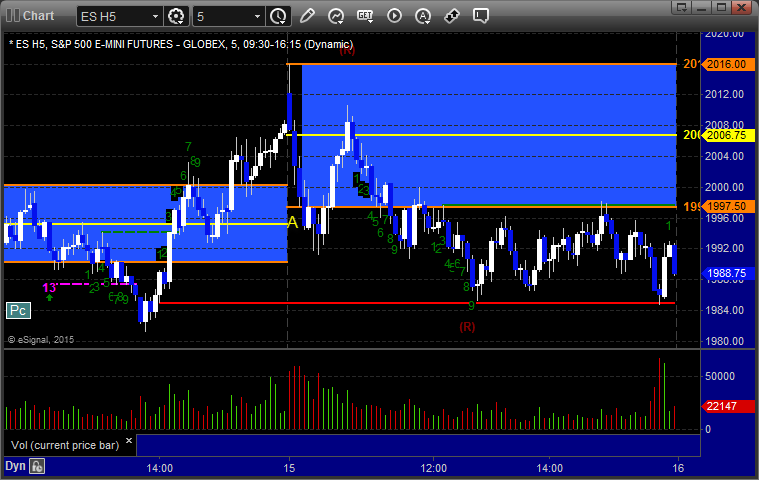

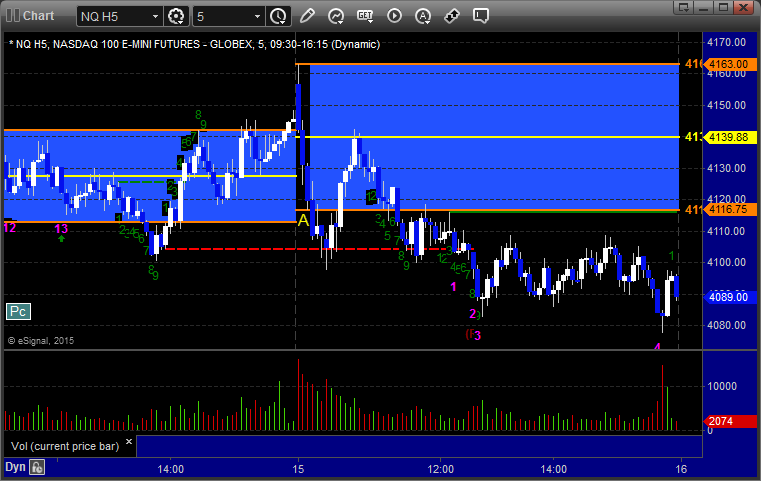

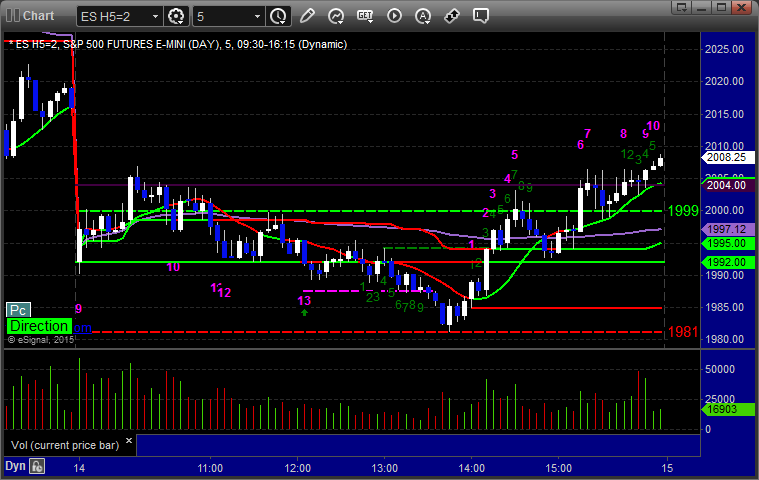

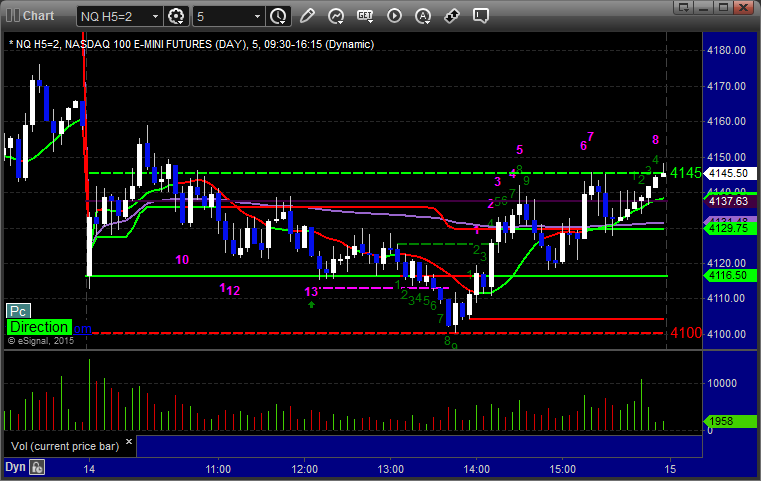

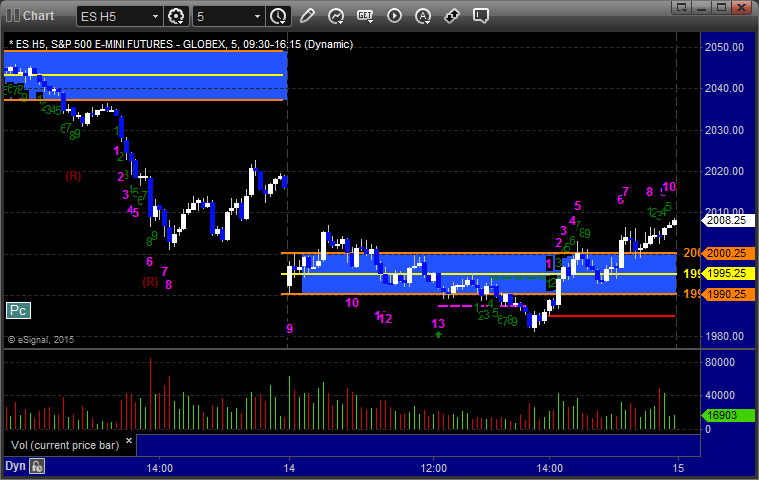

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play worked again:

NQ Opening Range Play worked again:

ES Tradesight Institutional Range Play did not work today either way:

NQ Tradesight Institutional Range Play:

ES:

|

Forex Calls Recap for 1/14/15

Finally, a loser on the Forex calls. We had a trigger on the EURUSD that stopped. It did trigger again later and worked, but before I was up here in the US. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped. Also triggered at B and hit first target at C if you were awake to put it back in:

Stock Picks Recap for 1/13/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ONNN triggered long (without market support due to opening 5 minutes) and didn't work:

KPTI triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's BRCM triggered long (with market support) and didn't work:

WYNN triggered long (with market support) and worked:

Rich's PXD triggered long (with market support) and worked:

His SDRL triggered long (with market support) and didn't work:

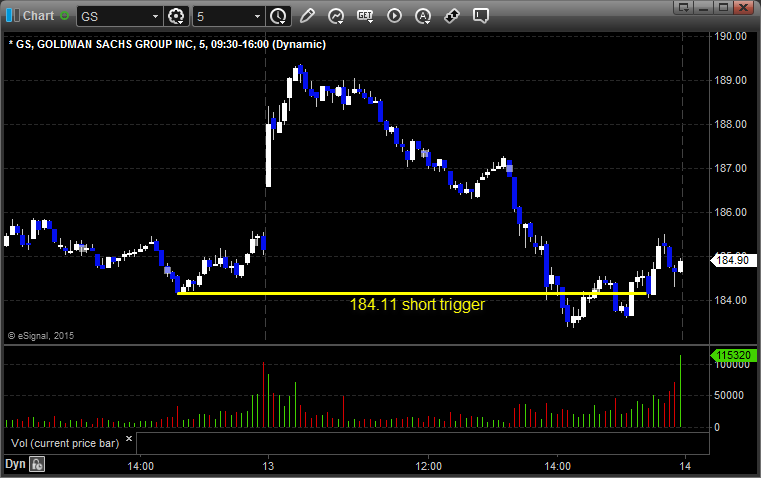

GS triggered short (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 1/13/15

The markets gapped up big and kept going early, not really giving the opportunity for a trade other than our Opening Range Plays, which worked again (see that section below). We eventually did roll over during lunch, filled the gap and more, and then recovered all the way to even on 2 billion NASDAQ shares.

Net ticks: +0 ticks.

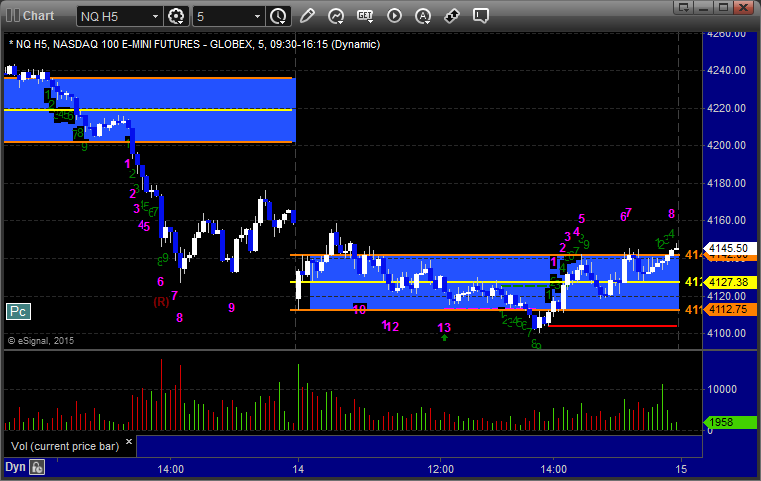

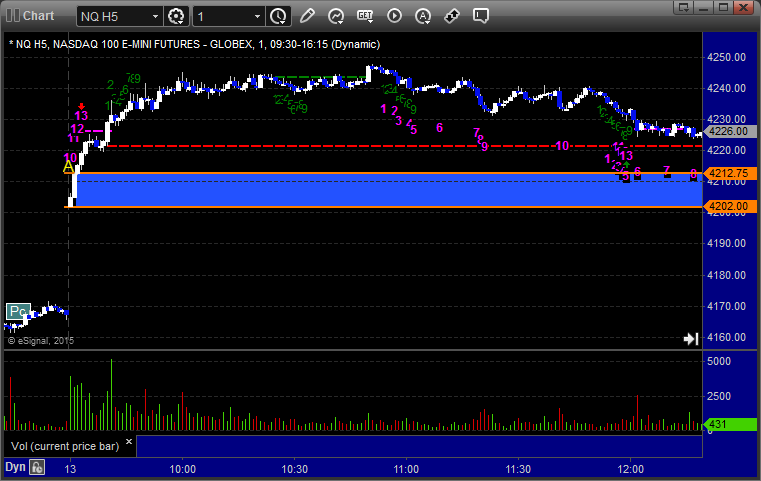

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening Range and Institutional Range Plays:

ES Opening Range Play, triggered long at A and worked:

NQ Opening Range Play, triggered long at A and worked:

ES Tradesight Institutional Range Play, triggered long at A and didn't work, triggered short at B and worked:

NQ Tradesight Institutional Range Play, triggered long at A and worked enough for a partial, triggered short at B and worked:

ES:

Forex Calls Recap for 1/13/15

A small winner for the session as we never hit the stop or first target and just closed it in the money. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, never hit stop or first target, closed at B for 20 pips for end of session:

Stock Picks Recap for 1/12/15

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FEYE triggered long (without market support) and didn't work initially, worked later:

THRX triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's YHOO triggered short (without market support due to opening 5 minutes) and worked:

GOOG triggered short (with market support) and worked enough for a partial:

AMZN triggered short (with market support) and worked:

Rich's TWTR triggered long (without market support) and worked enough for a partial:

His FB triggered short (with market support) and didn't work:

His TWTR then triggered short (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.