Futures Calls Recap for 12/11/14

Another nice day with the Opening Ranges plays, with the ES and NQ locking around 35 ticks each easily. Meanwhile, for regular calls, see the ES section below. We roll to the March 2015 (H5) contracts tonight for Friday. It will take a day for the market to adjust.

Net ticks: +2.5 ticks.

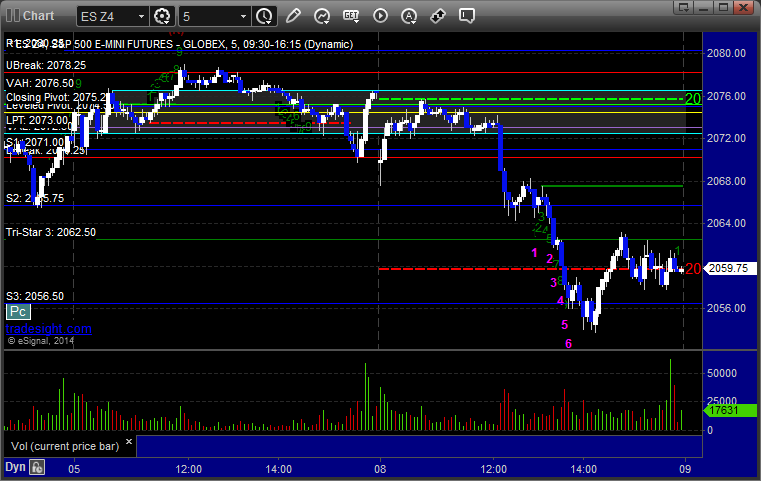

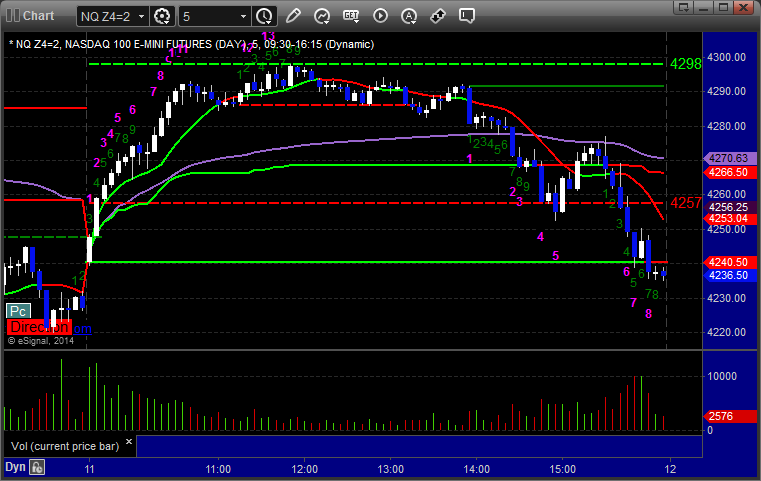

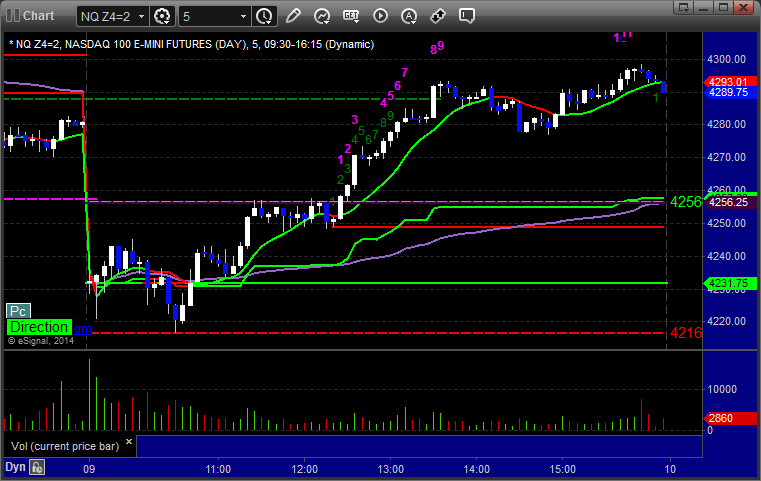

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 2046.25, hit first target for 6 ticks, and stopped second half under the entry:

Forex Calls Recap for 12/11/14

We closed out the second half of the prior day's trade in the money and then stopped two trades, which was unfortunate. See EURUSD below.

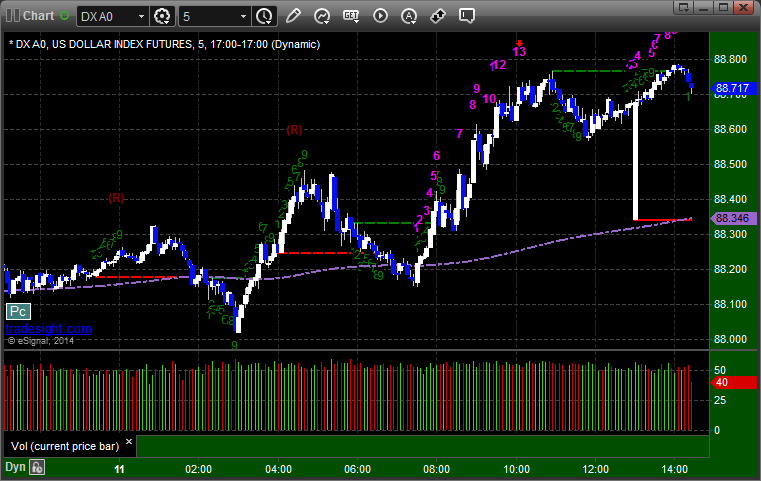

Here's a look at the US Dollar Index intraday with our market directional lines:

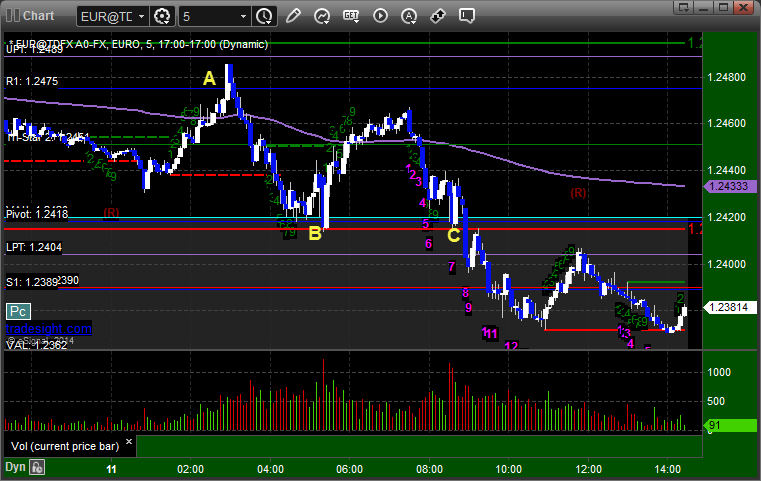

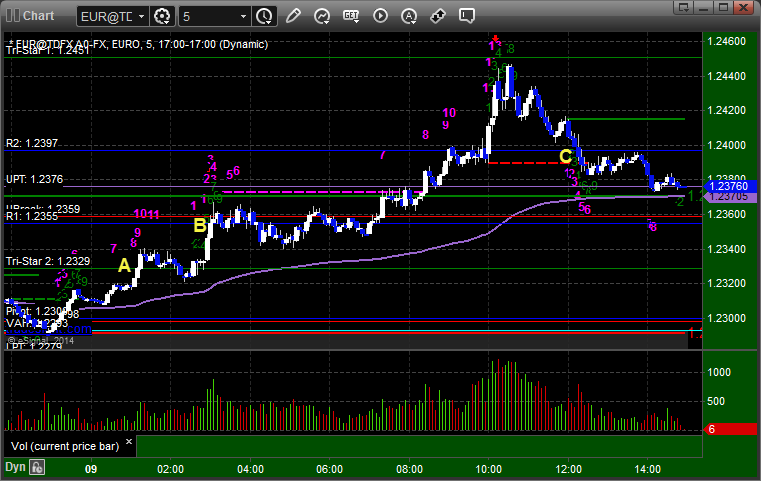

EURUSD:

Second half of the prior day's trade stopped in the money. New trade triggered long at A and stopped, then triggered short at B and stopped. Would have triggered again at C and worked but I missed it by 20 minutes waking up in the morning:

Stock Picks Recap for 12/10/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, UTHR triggered long (with market support but the stock was thin at the time) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FB triggered long (without market support) and didn't work:

His NFLX triggered short (with market support) and worked:

His HP triggered short (with market support) and didn't work:

His CLR triggered short (with market support) and worked:

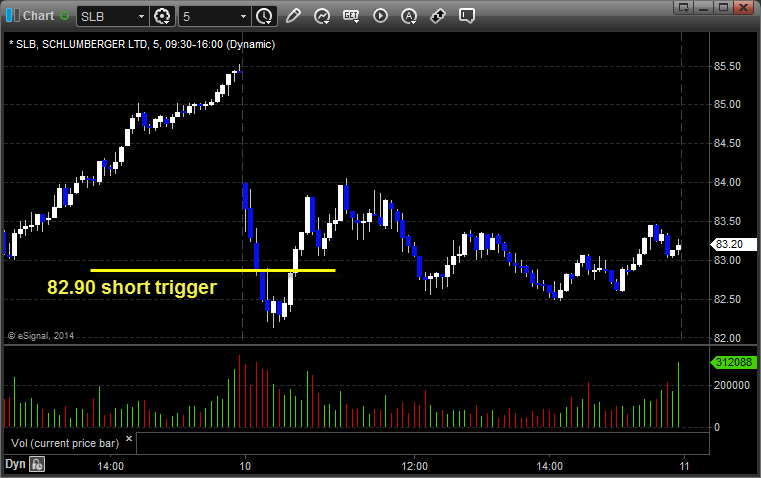

His SLB triggered short (with market support) and worked:

His RIG triggered short (with market support) and worked:

His TWTR triggered short (with market support) and worked:

His EXPE triggered short (with market support) and worked:

His GS triggered short (with market support) and didn't work the first time, worked later but we only officially count the first:

In total, that's 9 trades triggering with market support, 7 of them worked, 2 did not.

Futures Calls Recap for 12/10/14

A very light volume session with a single stop out. See the ES section below. The markets gapped down and ended up not filling the gaps, heading lower after lunch on 1.4 billion NASDAQ shares.

Net ticks: -7 ticks.

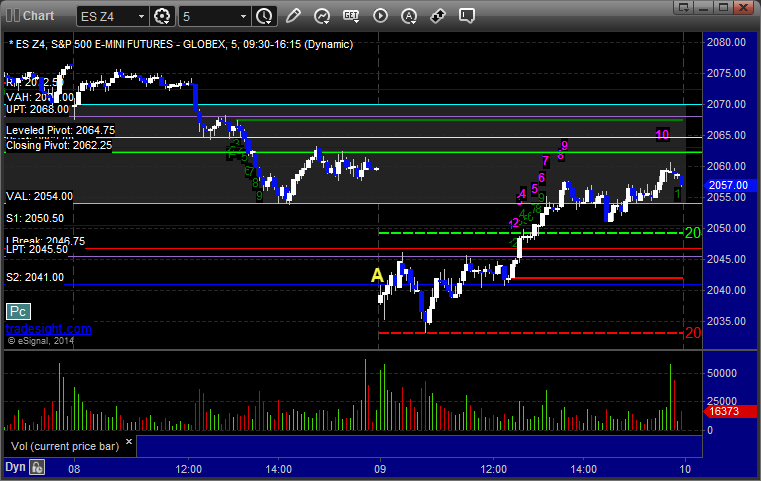

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

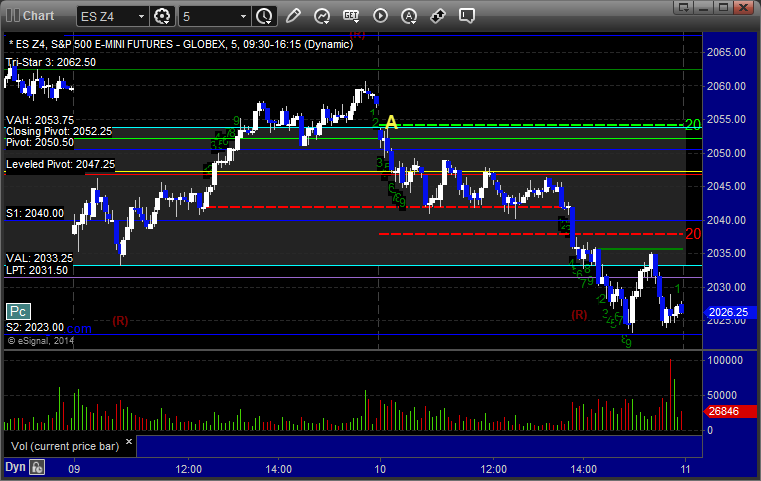

ES:

Triggered long at A at 2054.00 and stopped for 7 ticks. Did not retrigger:

Forex Calls Recap for 12/10/14

A winner (still going) after a loser in the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped at B. Triggered long again in the morning at C, hit first target at D, holding second half with a stop under VAH at E:

Stock Picks Recap for 12/9/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CTRP and NFLX gapped under their report triggers, so no plays.

From the Messenger/Tradesight_st Twitter Feed, Rich's FDX triggered short (with market support) and worked:

His GLD triggered long (ETF, so no market support needed) and worked:

His BABA triggered long (with market support) and worked:

FSLR triggered long (with market support) and worked:

NFLX triggered short (with market support) and worked:

Rich's FB triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, all 6 of them worked.

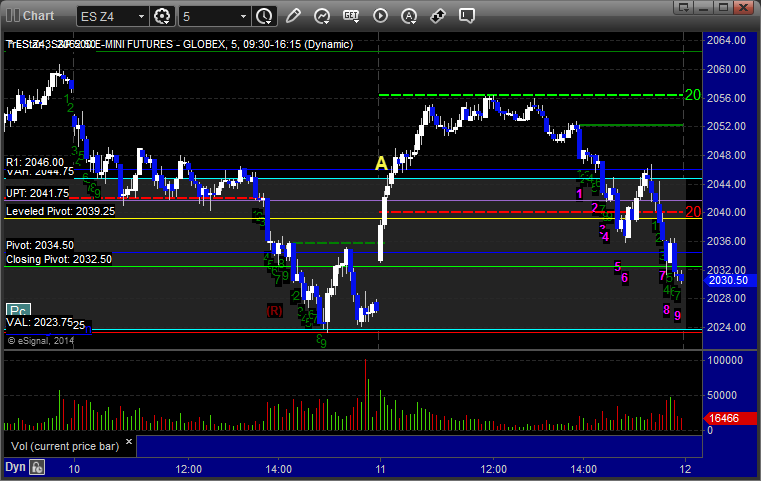

Futures Calls Recap for 12/9/14

One winner to the first target. It was also the first day in weeks that the opening range plays didn't really work great. See the ES section below.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

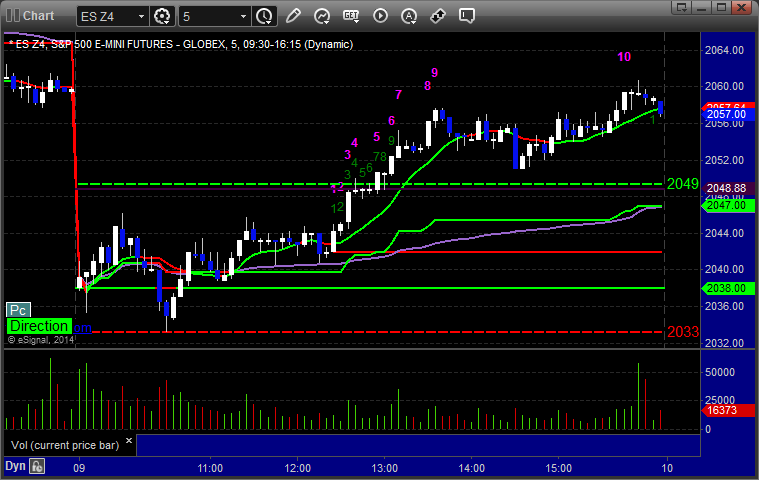

ES:

Triggered long at A at 2041.25, hit first target for 6 ticks, stopped second half under the entry:

Forex Calls Recap for 12/9/14

A winner for the session. See the EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, raised stop a few times, got a Comber 13 sell signal at the high, and closed the last half at C:

Stock Picks Recap for 12/8/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ACHN triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

GPRE triggered short (without market support) and worked:

GPOR gapped under the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's SSYS triggered short (with market support) and worked:

His FB triggered long (with market support) and worked:

His BRCM triggered long (with market support) and worked:

BIDU triggered short (without market support) and worked enough for a partial:

Rich's YHOO triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

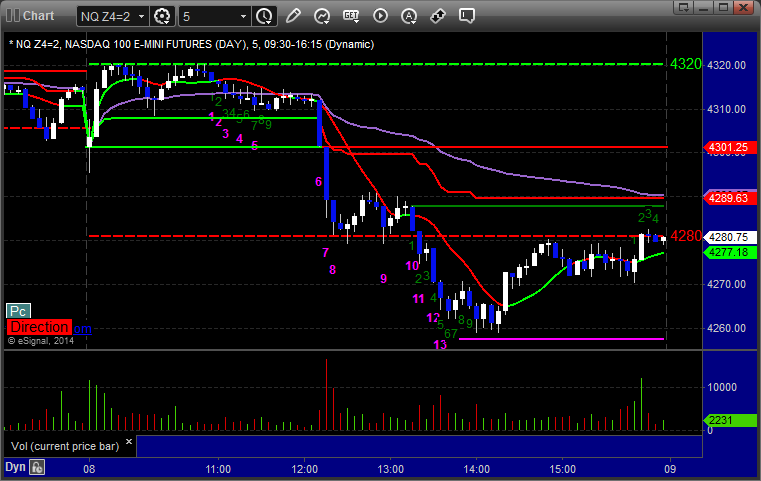

Futures Calls Recap for 12/8/14

The main trade call on the NQ didn't trigger. The opening range plays worked on the NQ and ES, and the Institutional Range plays worked too.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES: