Stock Picks Recap for 12/2/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QIWI triggered short (without market support) and didn't work, worked later:

From the Messenger/Tradesight_st Twitter Feed, Rich's TWTR triggered short (without market support) and worked enough for a partial:

His AMGN triggered long (with market support) and worked:

PCLN triggered short (without market support) and worked:

Rich's FB triggered long (with market support) and didn't work:

GOOG triggered short (without market support) and worked:

Rich's FDX triggered short (without market support) and worked:

GILD triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not. Several others triggered without support but worked.

Futures Calls Recap for 12/2/14

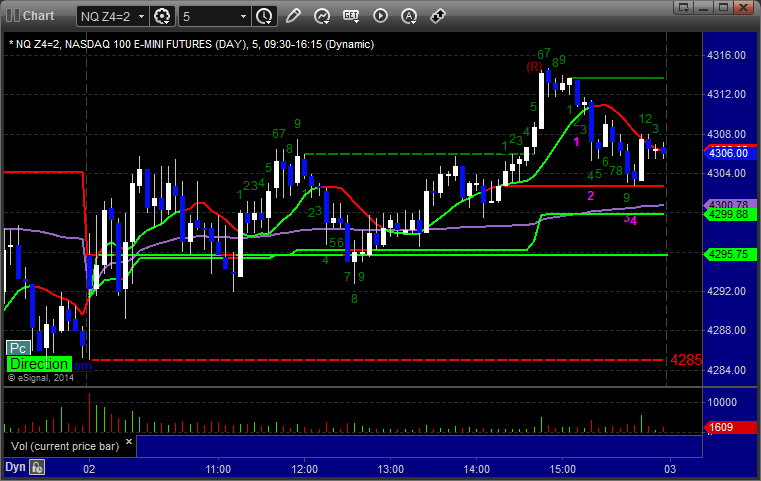

The markets gapped up, the NQ filled, and the ES didn't. We went higher from there. Our Opening Range plays worked on the NQ and ES, but we also had two calls trigger from our regular calls on the ES and work. See that section below. NASDAQ volume closed at 1.7 billion shares.

Net ticks: +10.5 ticks.

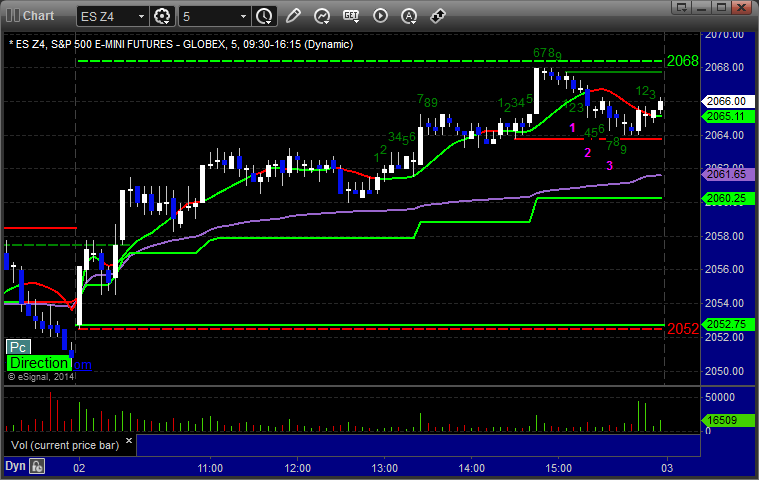

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 2058.00, hit first target for 6 ticks, and raised the stop and stopped at 2059.25. My call triggered long over UPT at B at 2059.00, hit first target for 6 ticks, and I closed the second half at 2060.00:

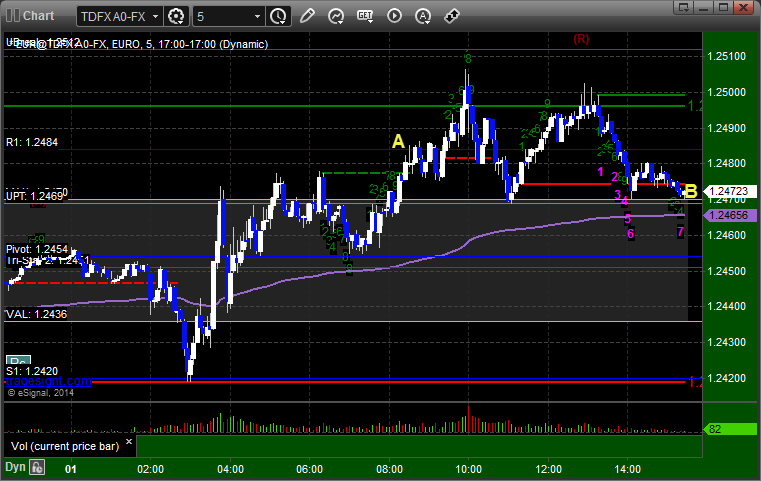

Forex Calls Recap for 12/2/14

A nice clean winner in the EURUSD for the session, with the second half of the trade still running. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over S1:

Stock Picks Recap for 12/1/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, YNDX triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's SLB triggered long (without market support) and worked:

His FDX triggered short (with market support) and worked:

GOOG triggered short (with market support) and didn't work, worked later:

Rich's AAPL triggered short (with market support) and didn't work:

His AMZN triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Futures Calls Recap for 12/1/14

Nothing triggered, although the Opening Range plays on the ES and NQ worked well again. NASDAQ volume closed at 1.7 billion, which was a good start coming back from the weekend.

Net ticks: +0 ticks.

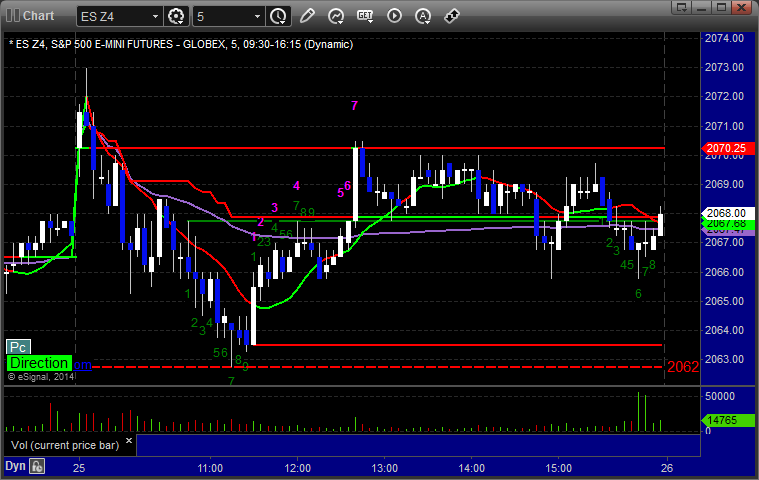

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 12/1/14

Not a very exciting session to start the week and end the official calls for November (as Sunday was still November). See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, never hit first target, closed at B:

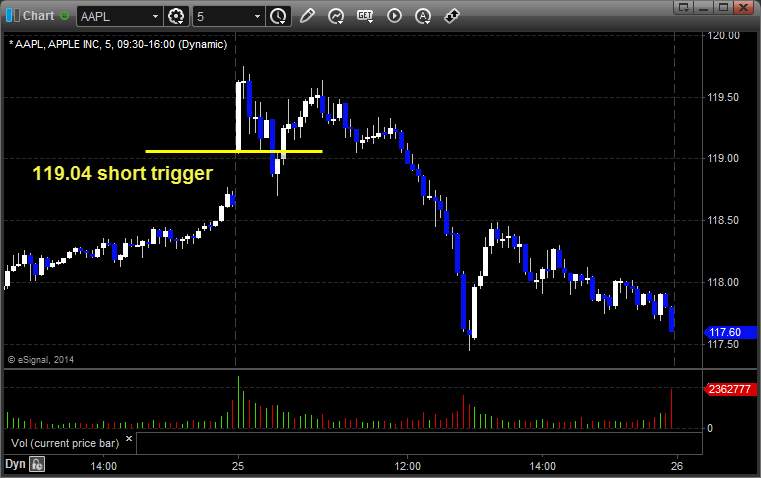

Stock Picks Recap for 11/25/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, UTIW gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's EOG triggered short (without market support) and worked great:

GOOG triggered long (without market support) and worked enough for a partial:

Rich's NFLX triggered short (with market support) and didn't work:

AMZN triggered short (with market support) and worked well, closed it right at the gap fill:

Rich's AAPL triggered short (with market support) and worked eventually:

SINA triggered short (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Futures Calls Recap for 11/25/14

Again, another example of a day where our Opening Range plays worked great, but we don't show those as regular calls. Meanwhile, on the ES call that I did post, I didn't retake it after it stopped once, and it would have worked great the second time, but volume was too light. Probably no calls Wednesday and definitely none for the half day Friday. The markets gapped up, filled the gap, went lower, and then stuck to the VWAP and closed even for the session on 1.4 billion NASDAQ shares.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 2068 and stopped for 7 ticks. Didn't put it back in but would have worked:

Forex Calls Recap for 11/25/14

Closed out the second half of the EURUSD winner from the prior session and had a new winner in GBPUSD. See that section below. One more night of calls for the short week.

Here's a look at the US Dollar Index intraday with our market directional lines:

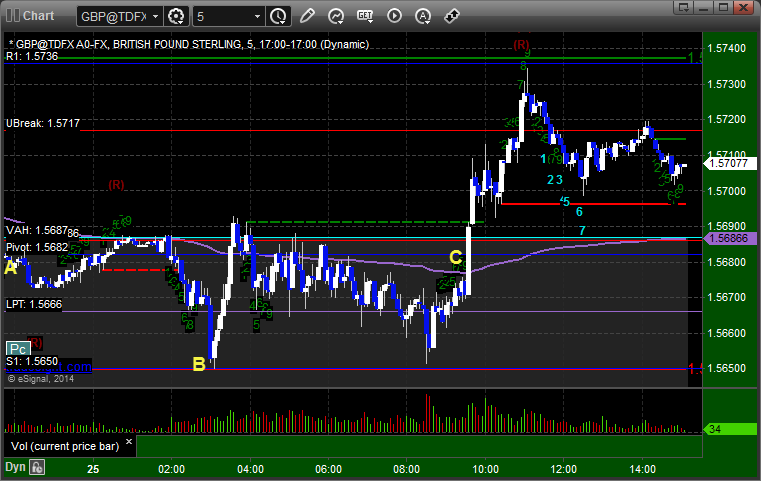

GBPUSD:

Triggered short at A, hit first target exactly at B, stopped second half at C:

Stock Picks Recap for 11/24/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NKTR triggered long (with market support) and worked:

SBUX triggered long (without market support) and didn't quite work enough for a partial:

SGMS triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, NTAP triggered long (with market support) and didn't work enough in either direction to count:

Rich's AAPL triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 of them worked.