Futures Calls Recap for 11/14/14

A boring day in the markets on 1.5 billion NASDAQ shares.

Net ticks: -7 ticks.

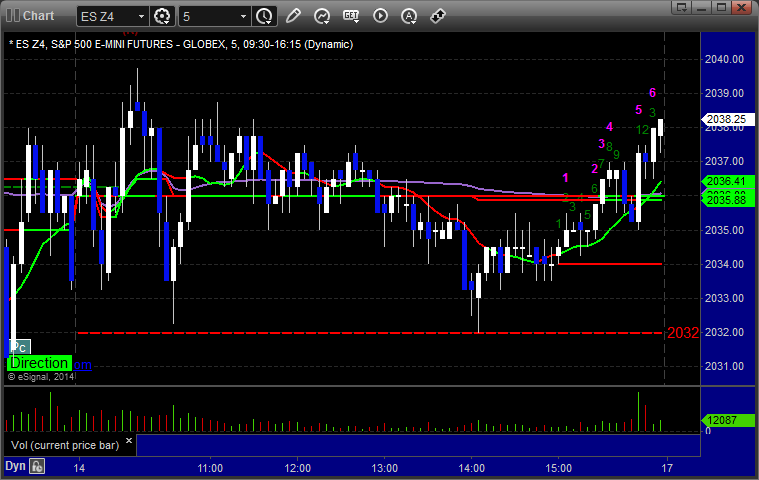

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

ES triggered short at A at 2034.00 and stopped. We did not put it back in as the market volume was poor and action was choppy:

Forex Calls Recap for 11/14/14

Couple of winners to end the week. See the EURUSD and GBPUSD sections below.

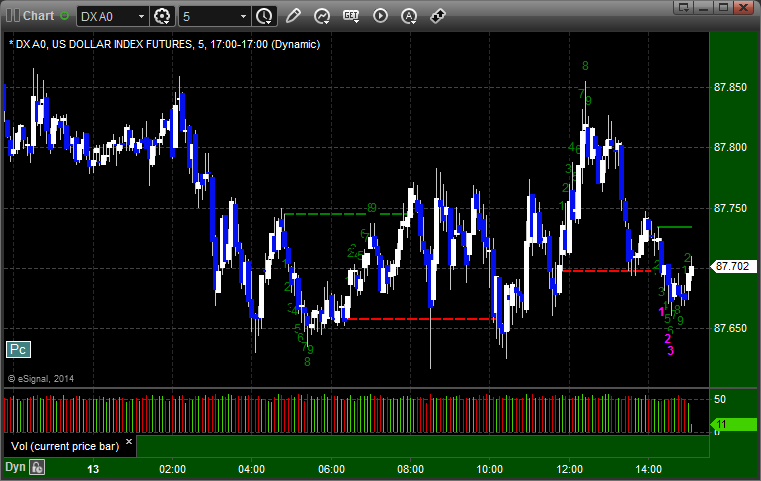

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Triggered long at A, hit first target at B, closed at C for end of week:

GBPUSD:

Triggered short at A, didn't quite stop, hit first target at B, lowered stop in the morning and stopped at C in the money:

Stock Picks Recap for 11/13/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ESPR triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's LULU triggered long (without market support due to opening 5 minutes) and didn't work:

EBAY triggered long (with market support) and worked enough for a partial:

GILD triggered short (without market support) and worked great:

Rich's TWTR triggered short (without market support) and worked great:

Mark's AMZN triggered long (with market support) and worked enough for a partial:

Rich's BABA triggered long (with market support) and worked enough for a partial:

His VRTX triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, all 5 of them worked. The other shorts that triggered without market support also worked, and worked well, which is a reflection of the market internals being weak early.

Futures Calls Recap for 11/13/14

The markets opened flat (small gap up on NQ that eventually filled). Mark's ES call triggered on the way back down and stopped once, then worked to the first target. See that section below.

Net ticks: -4.5 ticks.

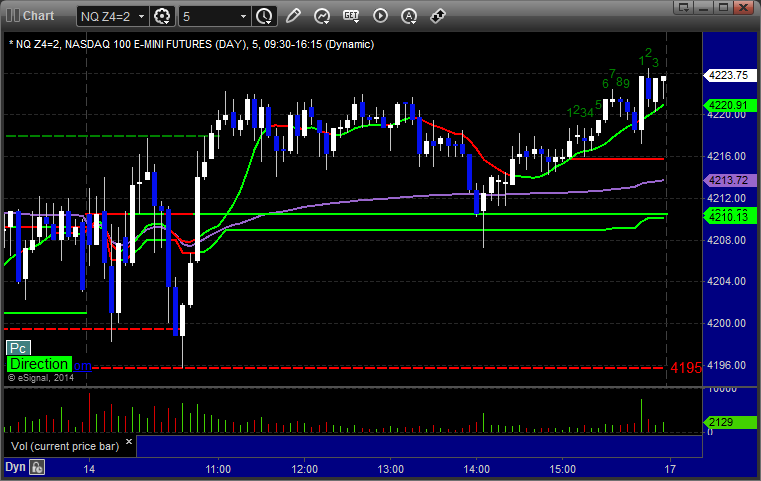

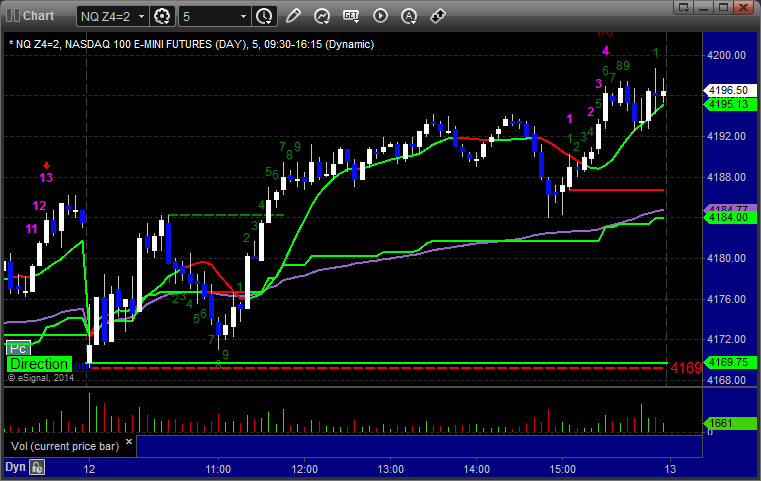

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 2036.50 and stopped, then triggered again 15 minutes later, hit first target and then stopped the second half at B before crossing the Value Area completely:

Forex Calls Recap for 11/13/14

A small winner and a bigger winner (still going) on the GBPUSD and EURUSD, respectively. See those sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short under S1 at A, got down to LPT but no further, came back up to test entry and ran out of time, so I closed it at end of chart:

Stock Picks Recap for 11/12/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IDCC triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, AAPL triggered long (with market support) and worked:

TSLA triggered long (with market support) and didn't work:

FSLR triggered short (with market support) and worked:

Rich's NTES triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

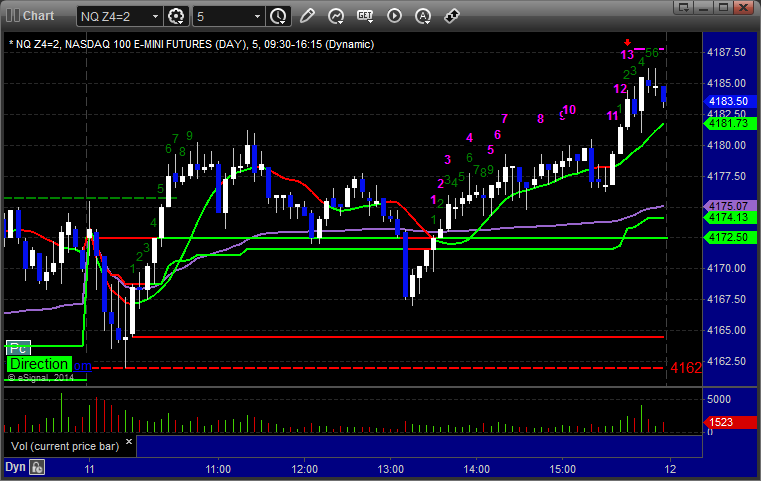

Futures Calls Recap for 11/12/14

The official call into the ES Value Area just barely didn't make it to the first target and stopped. See that section below. The markets gapped down and filled the gaps and that was it. Volume was not impressive at 1.5 billion NASDAQ shares.

Net ticks: -7 ticks.

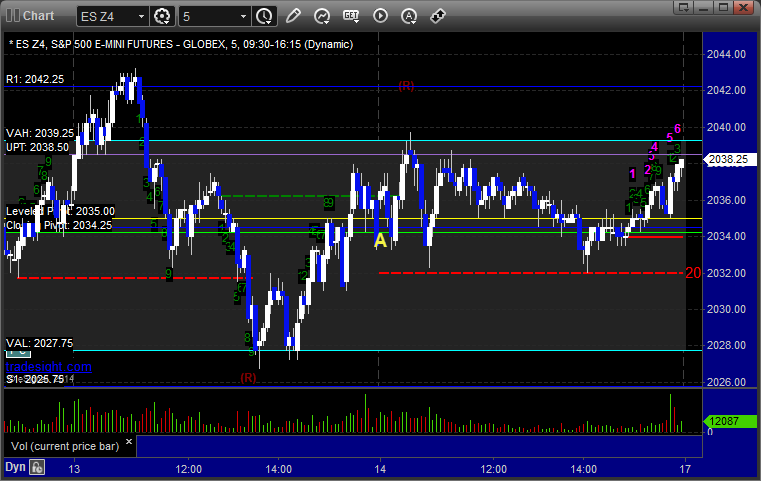

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 2033.00 and stopped:

Forex Calls Recap for 11/12/14

A good example of different results depending on where you are in the world. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Officially, that was it, but if you were elsewhere in the world and awake, you should put that back (overnight here in the States) and it worked great:

Stock Picks Recap for 11/11/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BRCD triggered long (without market support) and worked, but didn't go far. Bad day for that to finally trade:

FLWS triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's KORS triggered short (with market support) and worked enough for a partial:

Rich's TRIP triggered short (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

Futures Calls Recap for 11/11/14

No calls for Veteran's Day bank holiday in the US. Back to normal tomorrow.

Net ticks: +0 ticks.

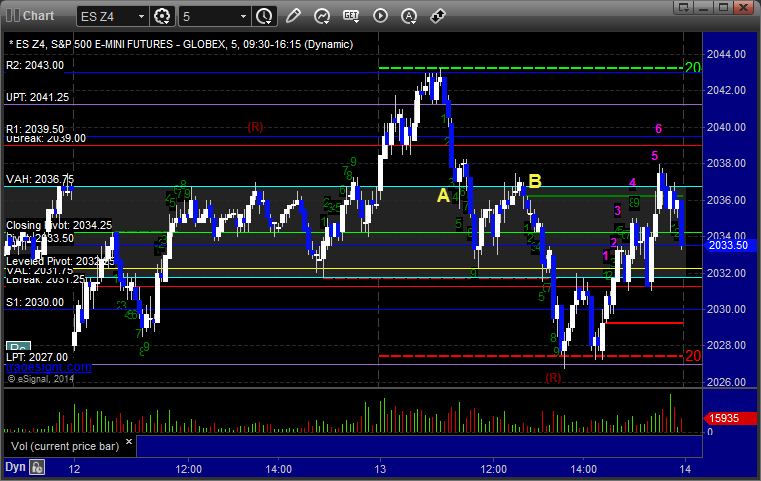

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES: