Stock Picks Recap for 11/5/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AFFX and NVDA gapped over, no plays.

From the Messenger/Tradesight_st Twitter Feed, Rich's NUS triggered long (without market support) and worked:

NTAP triggered short (with market support) and worked enough for a partial:

His PXD triggered short (with market support) and worked enough for a partial:

TSLA triggered short (with market support) and worked:

COST triggered short (with market support) and worked:

BABA triggered long (without market support) and didn't work:

SLB triggered long (without market support, although it's an oil-related stock) and worked:

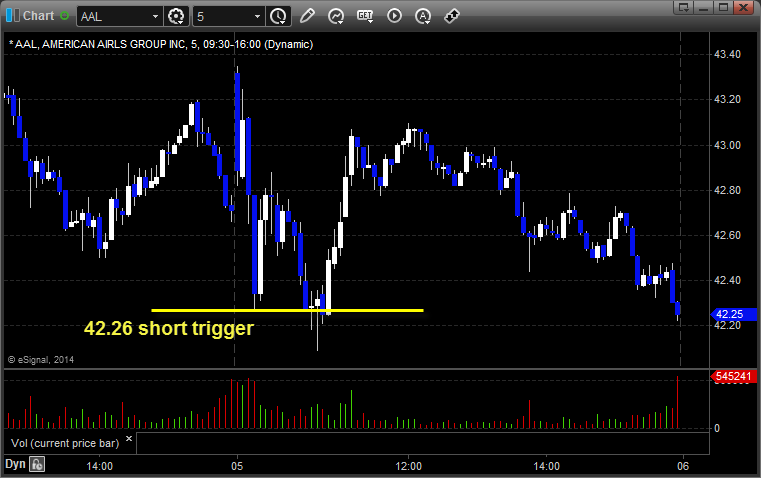

His AAL triggered short (with market support) and didn't work:

His REGN triggered short (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 11/5/14

Two winners, but only to their first targets, and a loser, so offsetting trades for the session after the markets gapped up and headed lower. The NQ's filled but the ES did not. NASDAQ volume was strong out of the gate but closed only at 1.8 billion shares.

Net ticks: -2 ticks.

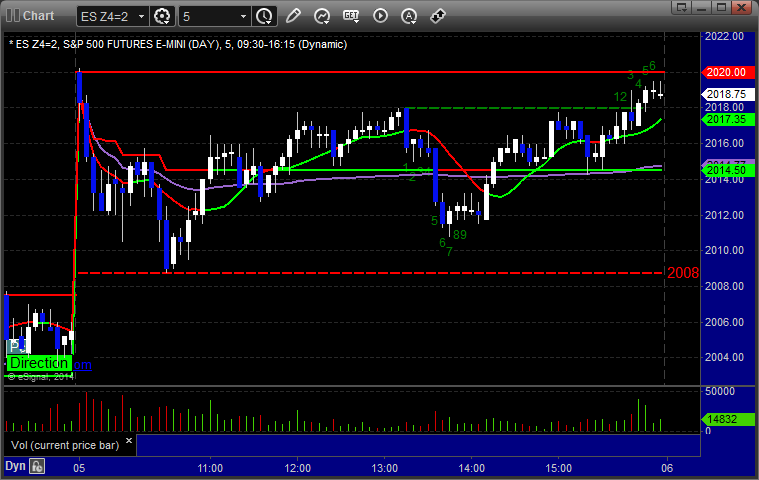

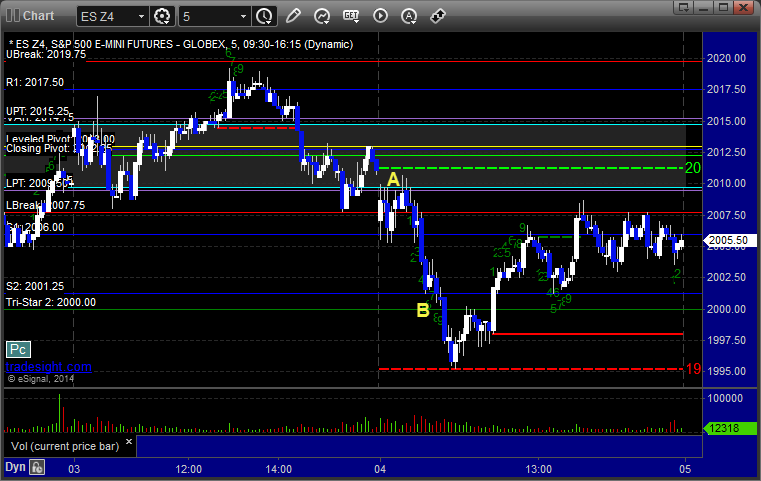

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 2011.50 and stopped for 7 ticks. Triggered short again at B, hit first target for 6 ticks, stopped second half over entry:

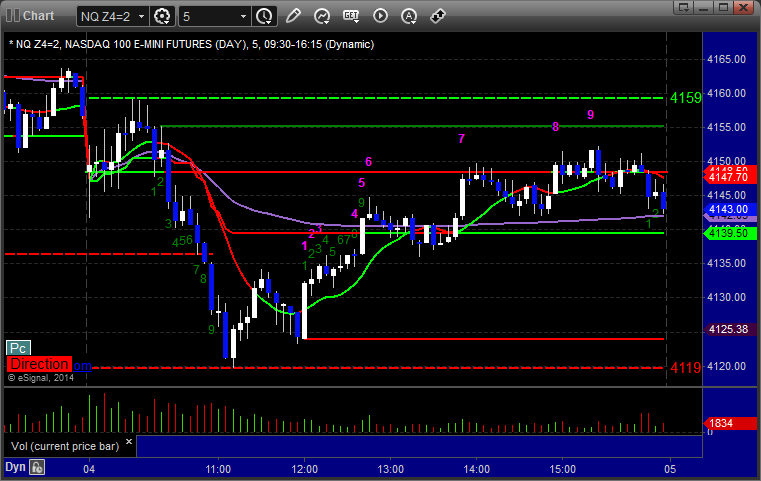

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 4154.50, hit first target, second half stopped over the entry:

Forex Calls Recap for 11/5/14

A nice winner for the session. See the EURUSD section below. NZDUSD Value Area worked too.

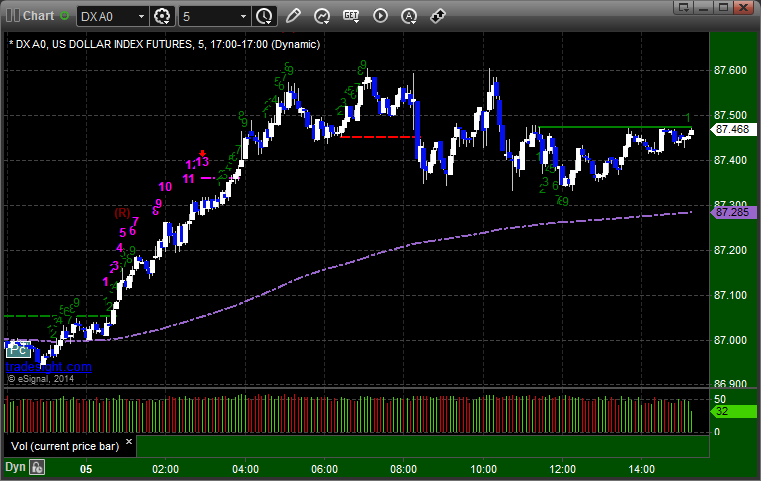

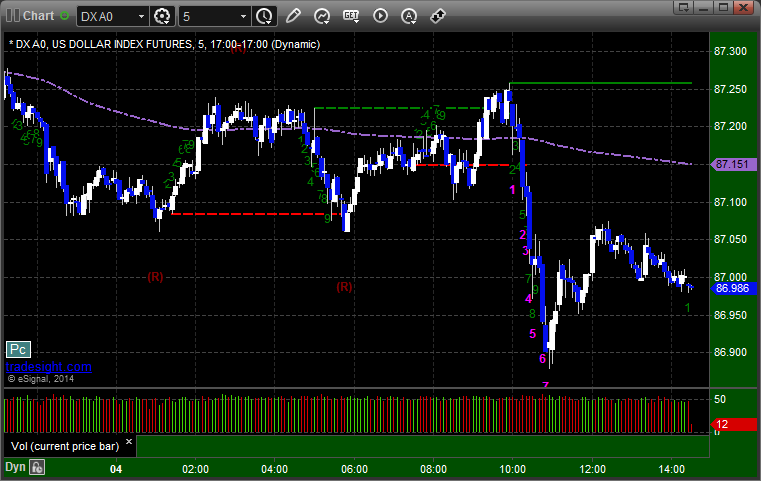

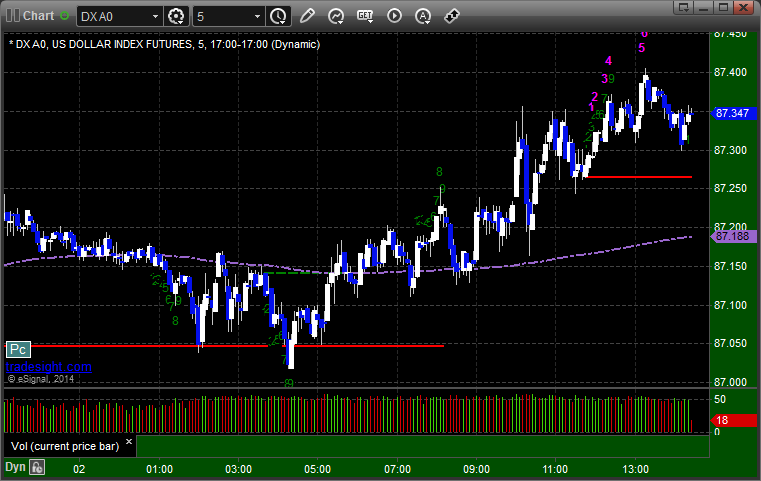

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, still holding second half with a stop over S1:

Stock Picks Recap for 11/4/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's EXPE triggered short (without market support) and worked:

His SCTY triggered short (with market support) and worked:

His TSLA triggered short (with market support) and worked:

His CAT triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 11/4/14

A small gap down that looked great for some Value Area setups heading back into the gap, but they didn't work. We then caught a short on the way down later, and that worked fine. See ES and ER sections below.

Net ticks: -6.5 ticks.

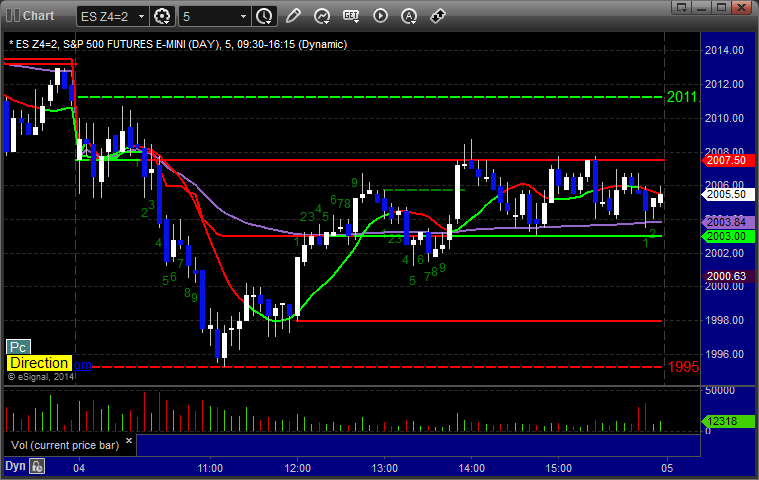

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 2010.25 and stopped. Triggered short at B at 2001, hit first target for 6 ticks and more, stopped final piece 11 ticks in the money:

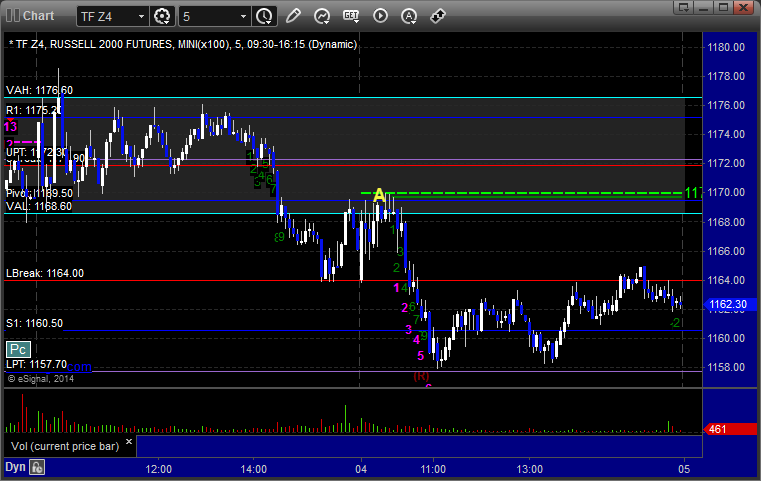

ER:

Triggered long at A at 1169.60 and stopped for 8 ticks:

Forex Calls Recap for 11/4/14

Nothing triggered on another narrow session, especially in the GBPUSD which only traded 40 pips of range, which was the pair that our sample calls were on.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 11/3/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AEIS triggered long (with market support) and I closed it even in the Twitter feed when there just was no volume on it:

From the Messenger/Tradesight_st Twitter Feed, Rich's GLD triggered short (ETF, so no market support needed) and didn't go enough either direction to count:

KLAC triggered long (with market support) and worked:

TSLA triggered long (with market support) and worked:

Rich's NUS triggered long (with market support) and worked enough for a partial:

His FFIV triggered long (with market support) and worked:

Mark's CLVS triggered short (without market support) and didn't work:

Rich's GPRO triggered long (with market support) and worked:

TWTR triggered short (with market support) and worked enough for an easy partial:

In total, that's 6 trades triggering with market support, all 6 of them worked.

Futures Calls Recap for 11/3/14

A winner and a loser for the session. The markets had a small gap up and headfaked both directions early but never got going. We closed basically on the VWAP both sides, and if you look at the NASDAQ in particular, it was dead flat to start the week. Volume was 1.85 billion shares.

Net ticks: -2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 2011.00 and stopped. Put it back in, triggered again at B, hit first target for 6 ticks, stopped second half 3 ticks in the money:

Forex Calls Recap for 11/3/14

What a boring session to start the week. The EURUSD trigger was so early, should have been half size if you were around to take it, and then it stopped and never did anything after. Some of this might be about the pairs letting the time change set into the technicals for a day or two, but this was just so boring.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short left of this chart before A and stopped around A. The trigger was so early that you should have been half size, and nothing happened in the European or US session at all as the EURUSD sat in a 40 pip range:

Stock Picks Recap for 10/31/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, there were no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered long (without market support) and worked:

COST triggered short (with market support) and worked:

In total, that's 1 trades triggering with market support, and it worked.