Tradesight Plus Report for 11-01-21

Opening comments posted to YouTube.

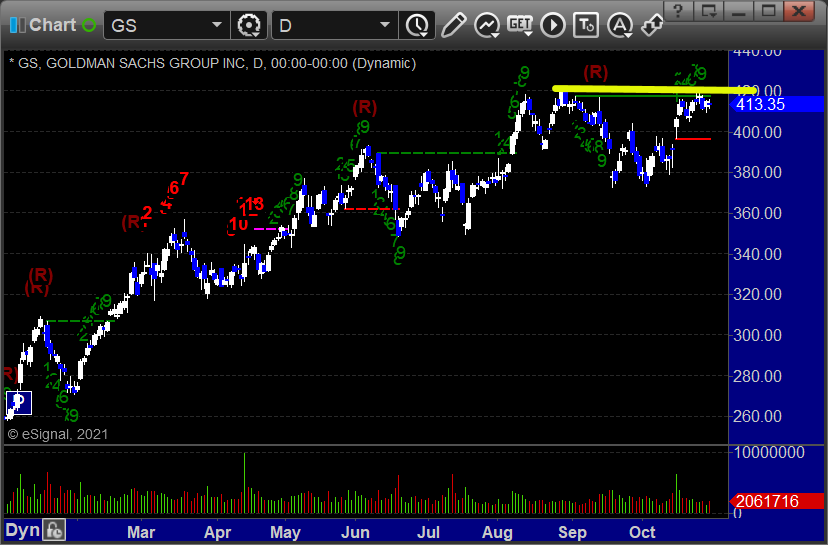

Longs first, in order of best chart construction, starting with GS > 420.76:

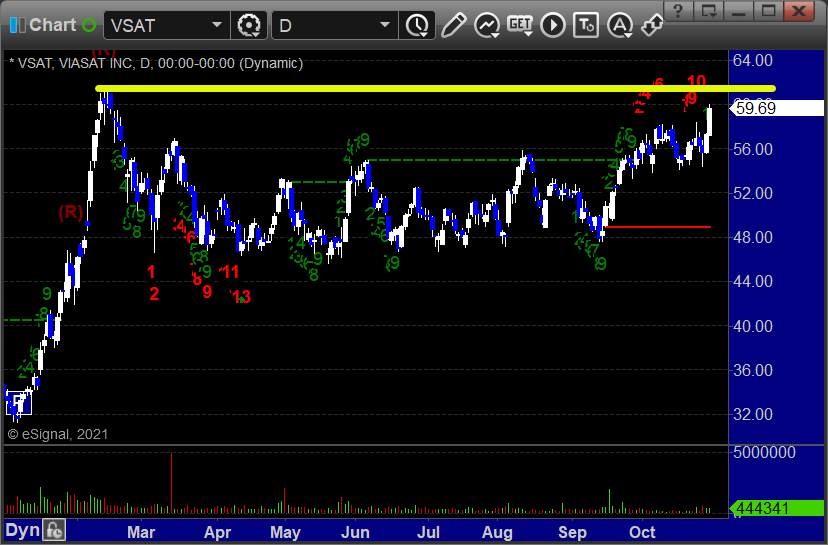

VSAT > 61.35:

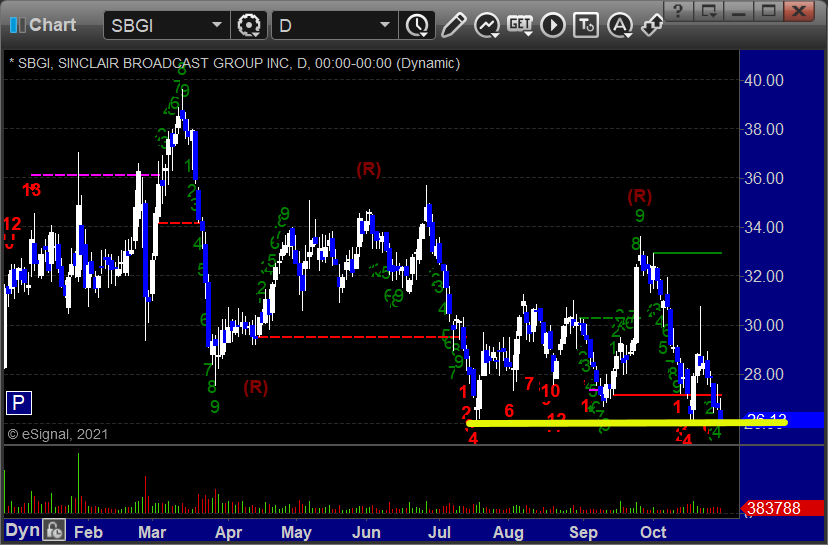

Shorts next, in order of best chart construction, starting with SBGI < 26.00:

That's it.

Tradesight Recap Report for 10/29/21

Overview

The markets gapped down, filled the gap and went higher, came back to even in the afternoon, and then rallied late for end of month statement printing on 5.3 billion NASDAQ shares.

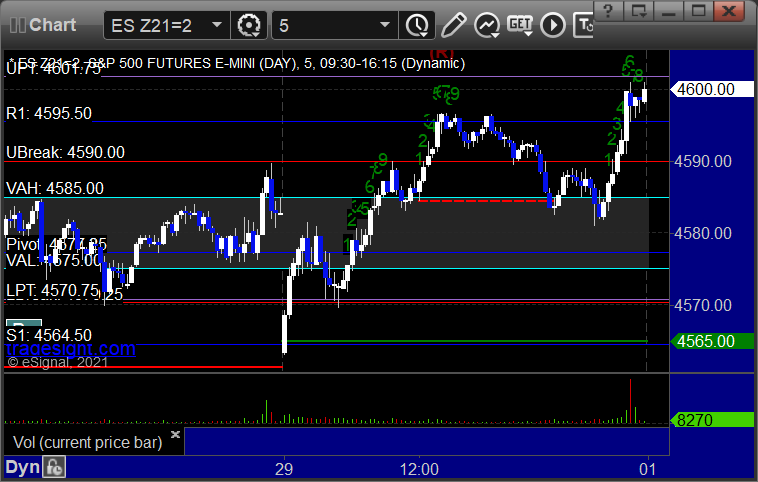

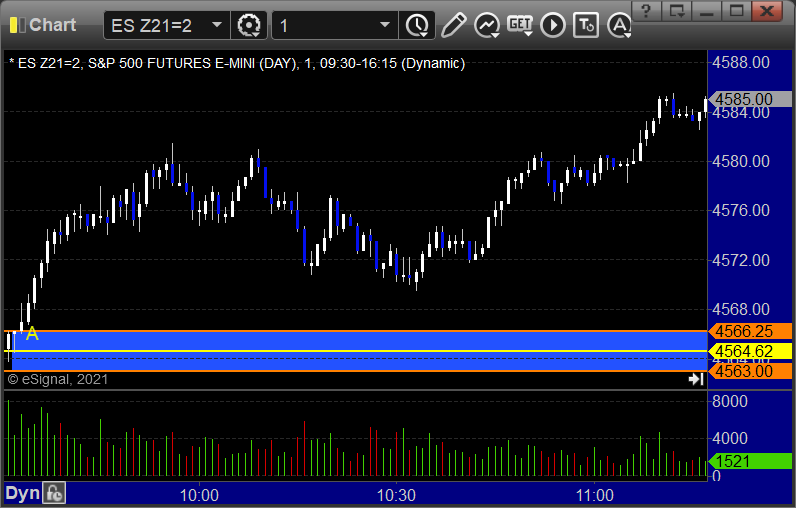

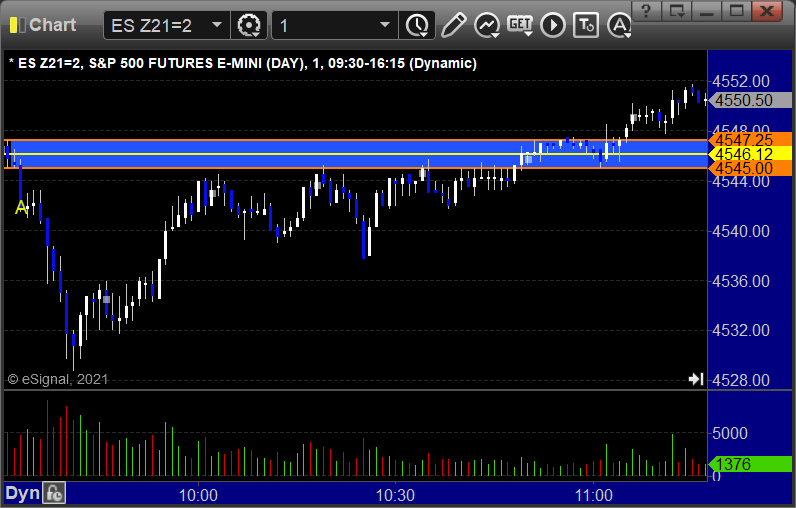

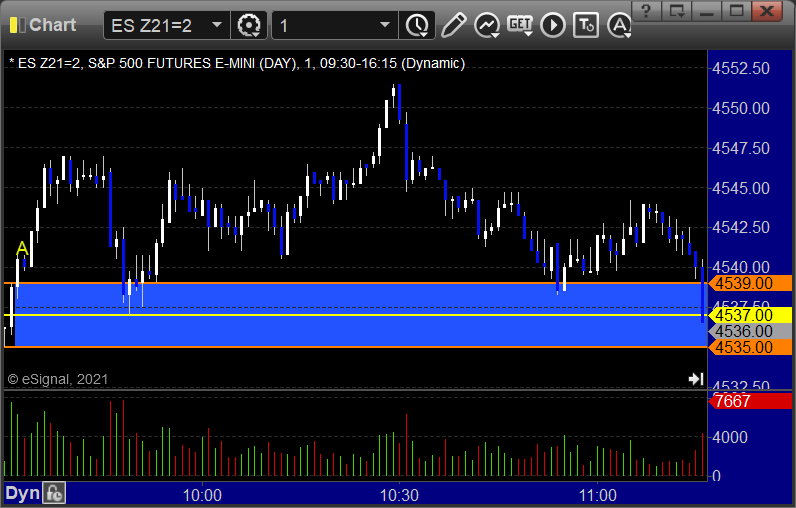

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked nice:

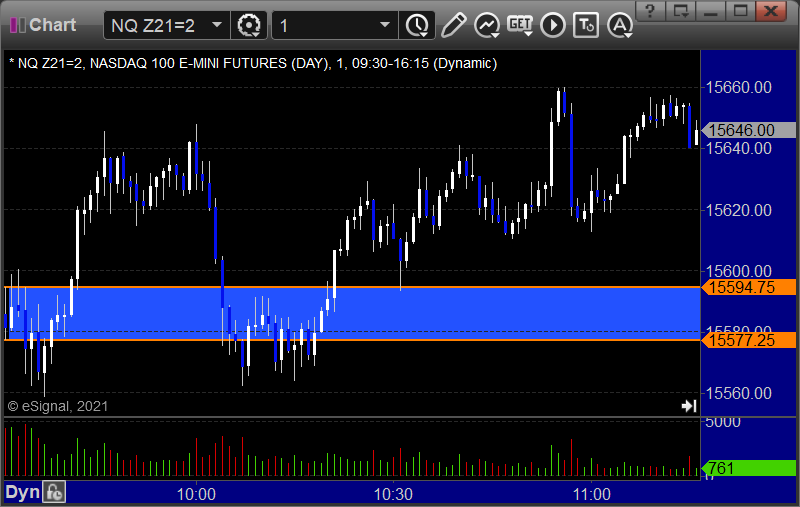

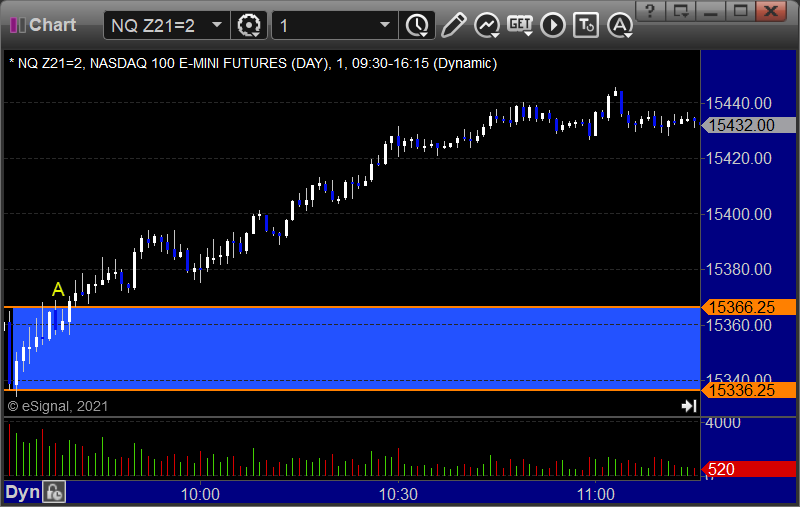

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: +18.5 ticks

Forex:

We stopped out of the second half of the prior day's trade for a net gain. New trade triggered twice.

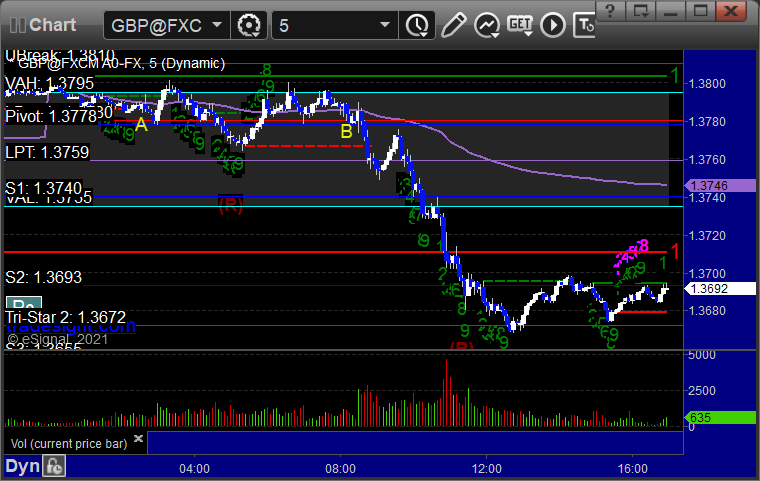

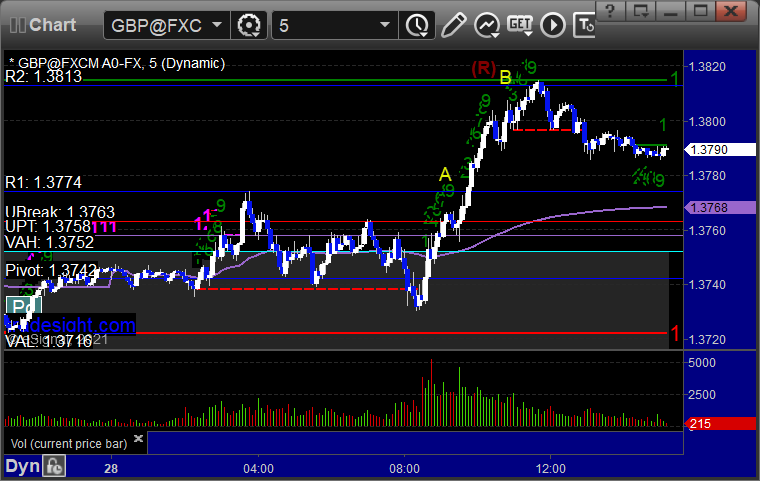

GBPUSD triggered short at A and stopped, triggered short at B, hit first target, closed at end of session for weekend:

Results: +85 pips

Stocks:

Friday end of month.

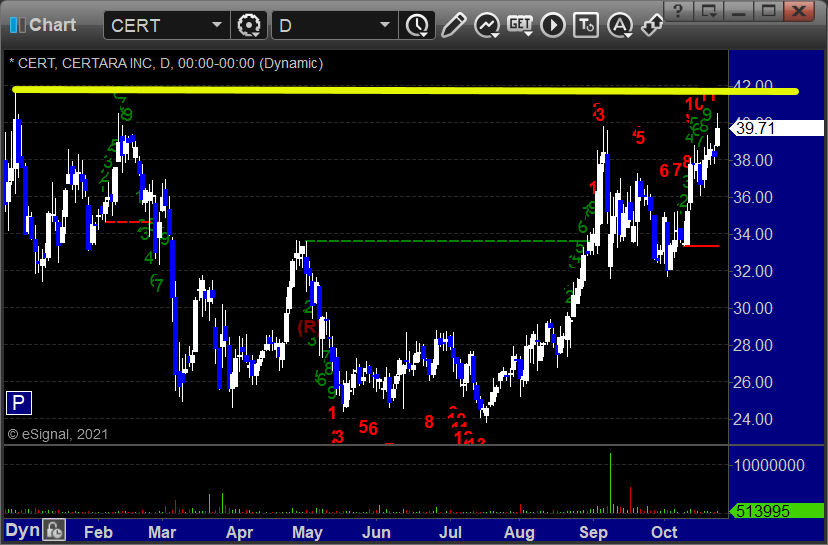

From the Tradesight Plus Report, CERT triggered long (with market support) and didn't work:

From the Tradesight Plus Twitter feed, Rich's COF triggered long (with market support) and didn't work:

COST triggered long (with market support) and didn't do enough either way to count:

PYPL triggered short (without market support) and didn't work:

That’s 2 triggers with market support, neither of them worked. Perfect end of month session.

Tradesight Recap Report for 10/28/21

Overview

The markets gapped up and didn't do much for a bit, then pushed up a little more, and then went flat for most of the rest of the day on 5.6 billion NASDAQ shares.

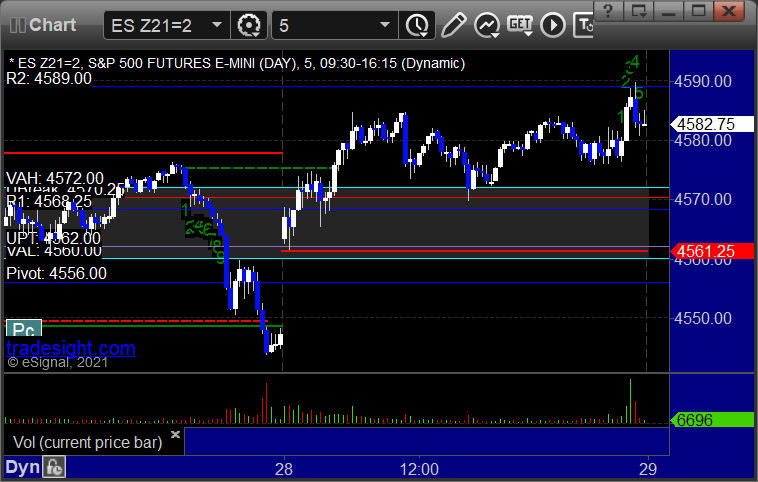

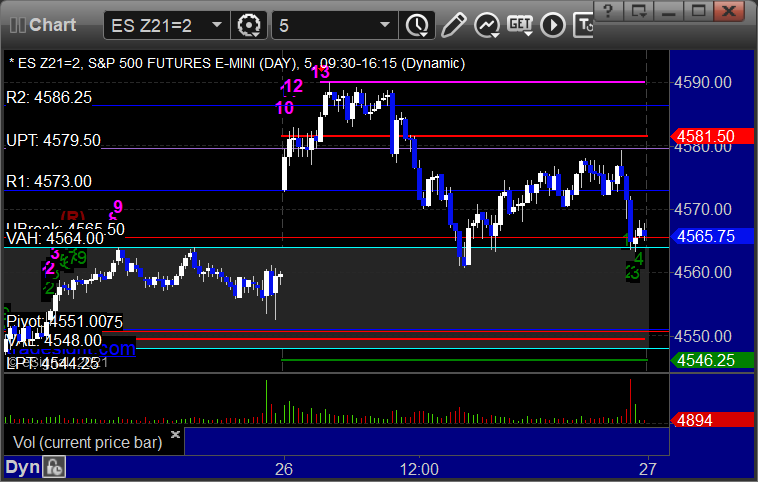

ES with Levels:

ES with Market Directional:

Futures:

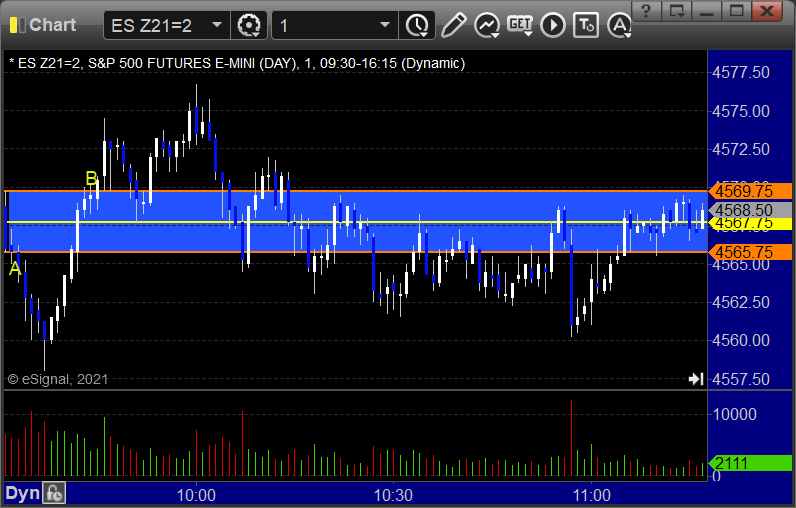

ES Opening Range Play triggered long at A and worked enough for a partial:

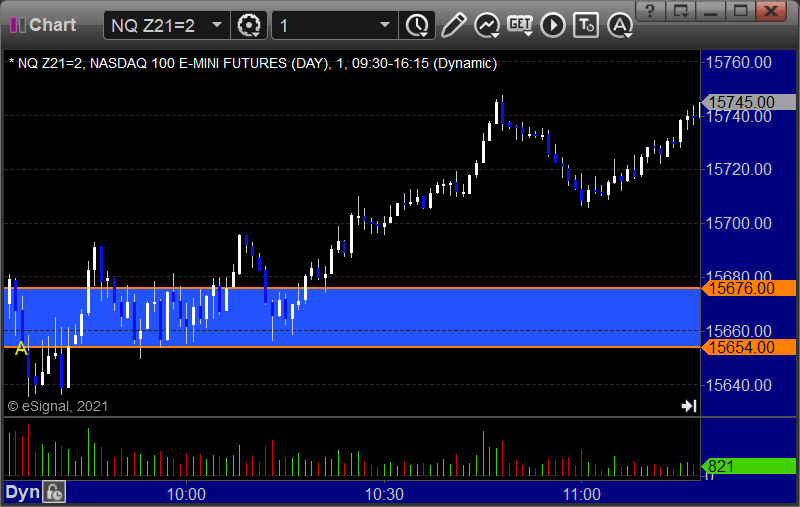

NQ Opening Range Play:

Results: +4 ticks

Forex:

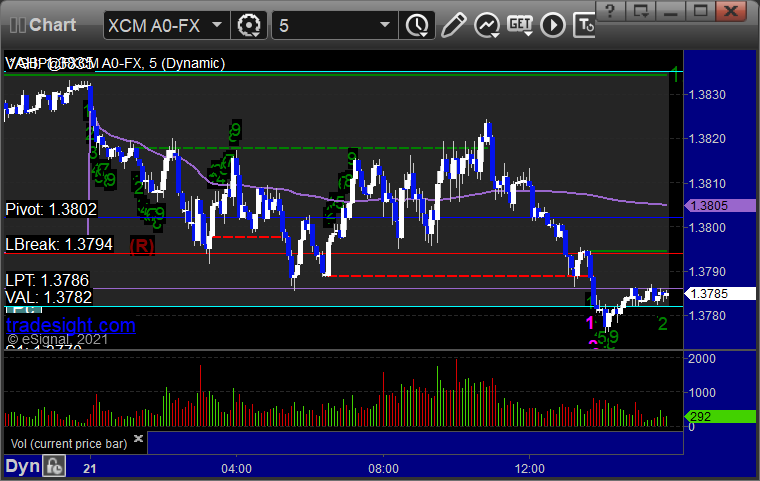

GBPUSD triggered long at A, hit first target at B, still holding second half with a stop under R1:

Results: Trade is still going

Stocks:

Another good day.

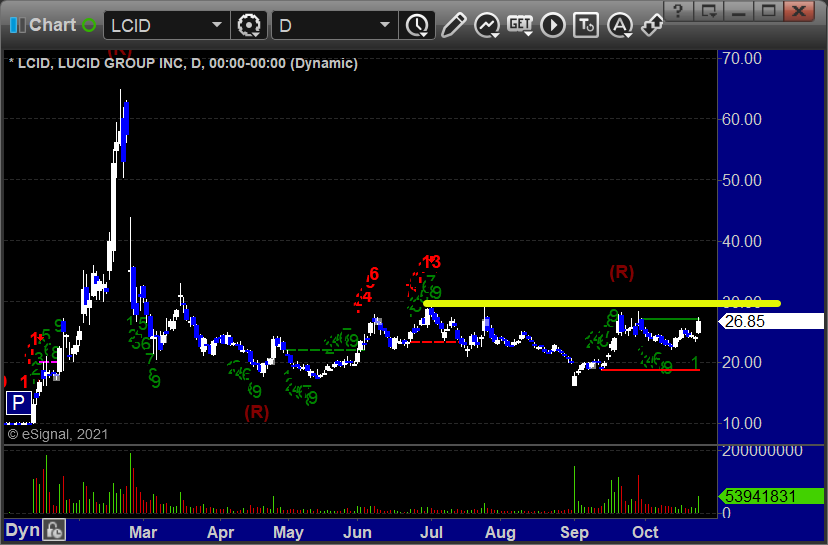

From the Tradesight Plus Report, LCID triggered long (with market support) and worked huge:

From the Tradesight Plus Twitter feed, Rich's FDX triggered short (without market support) and worked:

His FB triggered long (with market support) and worked great:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 10/27/21

Overview

Mostly a dead flat day until a late sell-off.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked, triggered long at B and worked enough for a partial:

NQ Opening Range Play both triggered too far out of range to take:

Results: +13.5 ticks

Forex:

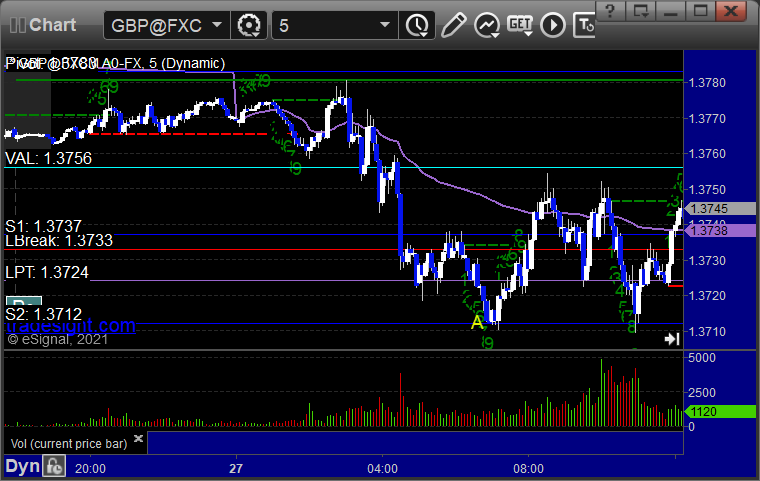

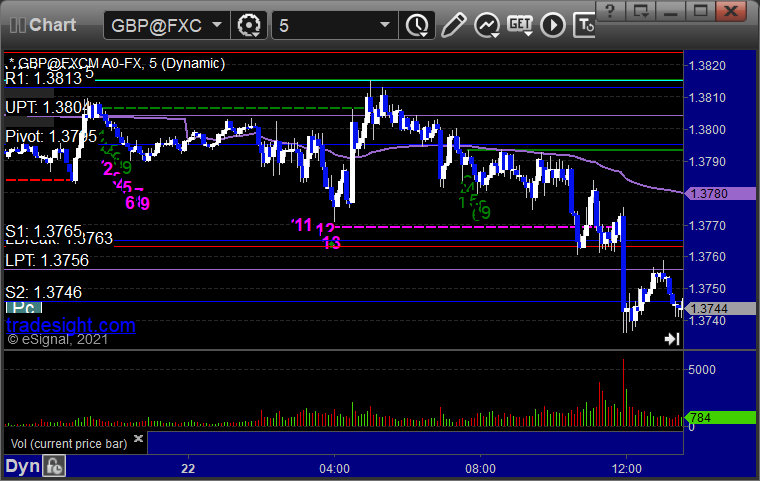

GBPUSD triggered short at A and stopped:

Results: -25 pips

Stocks:

Another day that wasn't special.

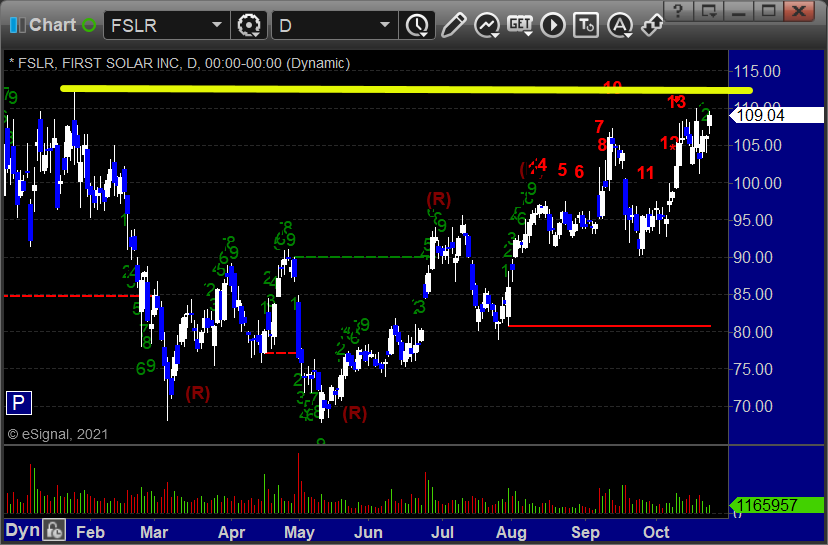

From the Tradesight Plus Report, FSLR gapped over, no play.

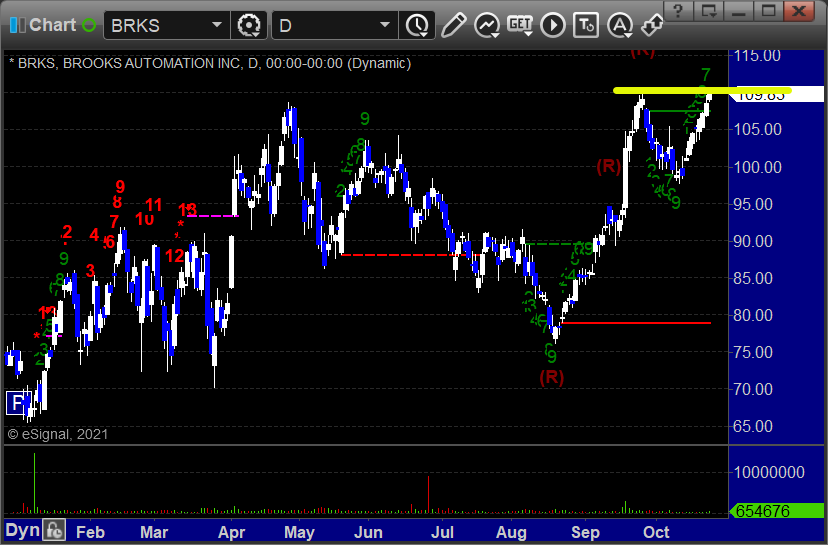

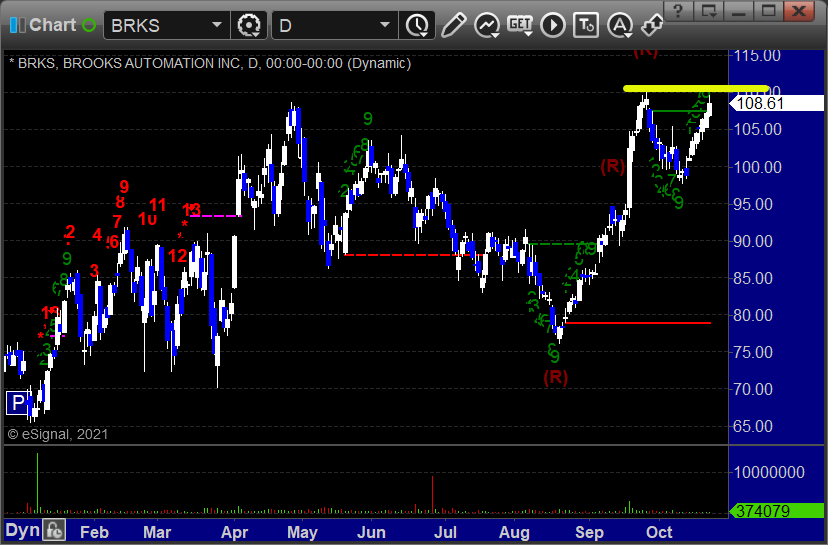

BRKS triggered long (with market support) and didn't do enough either way to count:

From the Tradesight Plus Twitter feed, Rich's PTON triggered short (with market support) and worked great:

His PYPL triggered short (with market support) and worked great:

That’s 2 triggers with market support, both of them worked.

Tradesight Recap Report for 10/26/21

Overview

The markets gapped up, went higher, ES got a Comber sell signal and that was the high, then came back to almost fill the gap and closed near the lows of the day on 6.9 billion NASDAQ shares.

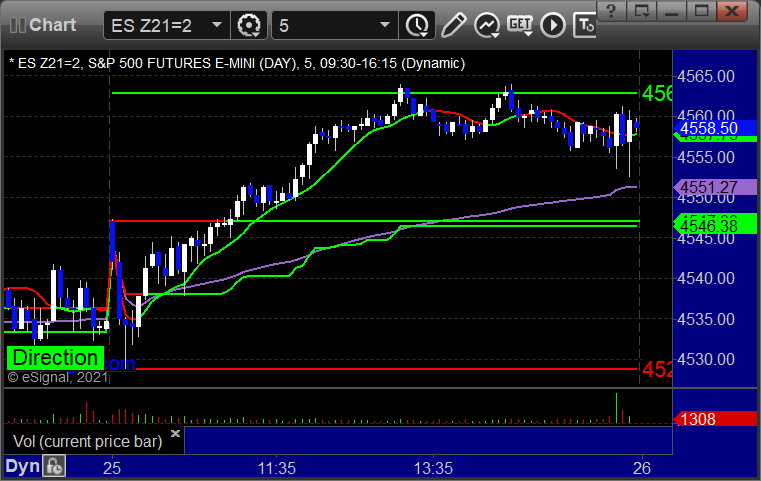

ES with Levels:

ES with Market Directional:

Futures:

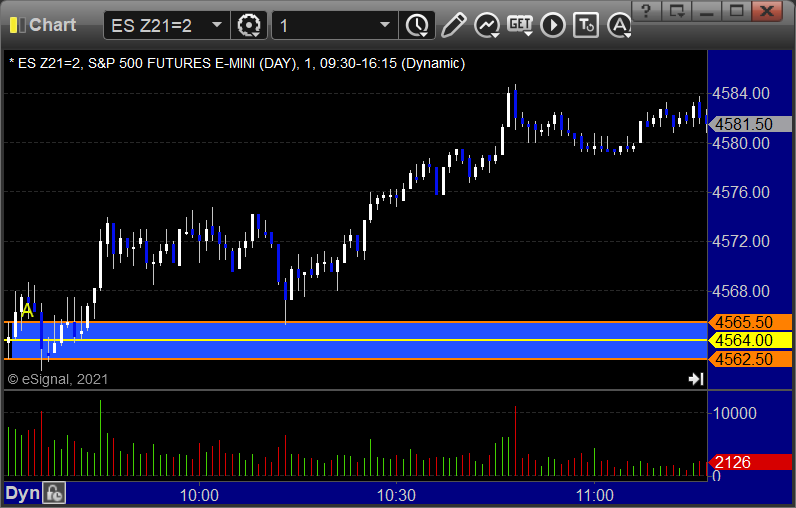

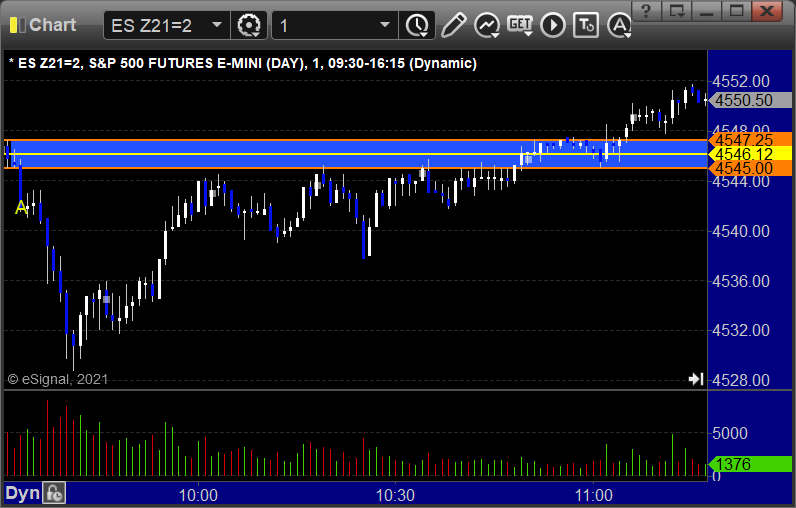

ES Opening Range Play triggered long at A and worked:

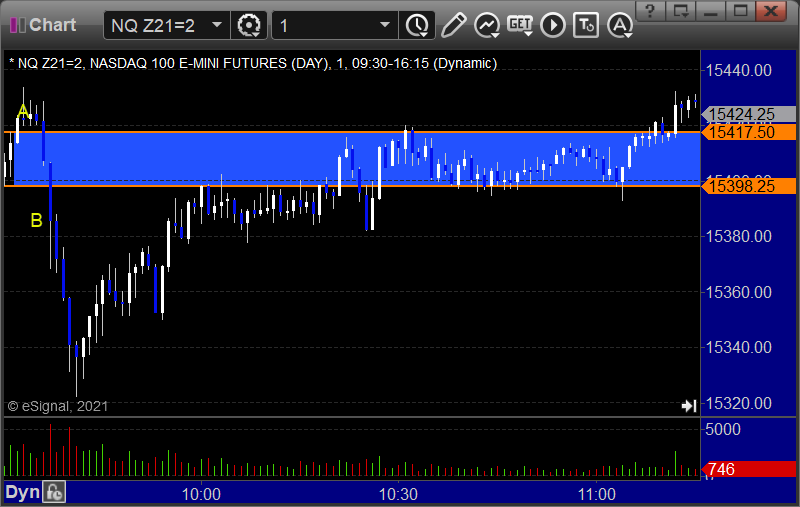

NQ Opening Range Play triggered long but too far out of range to take:

Results: +4 ticks

Forex:

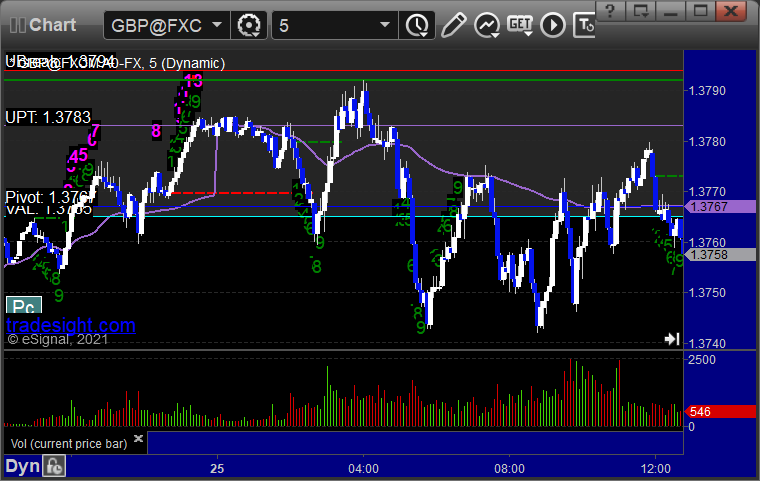

GBPUSD triggered long over the UBreak, hit first target at R2, stopped second half under entry:

Results: +10 pips

Stocks:

Not a super interesting day.

From the Tradesight Plus Report, BRKS gapped over, no play.

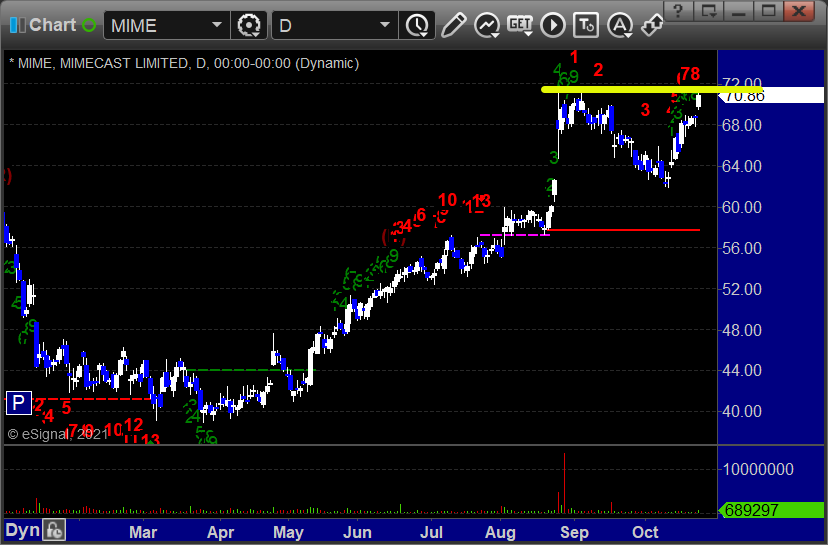

MIME triggered long (with market support) and didn't work:

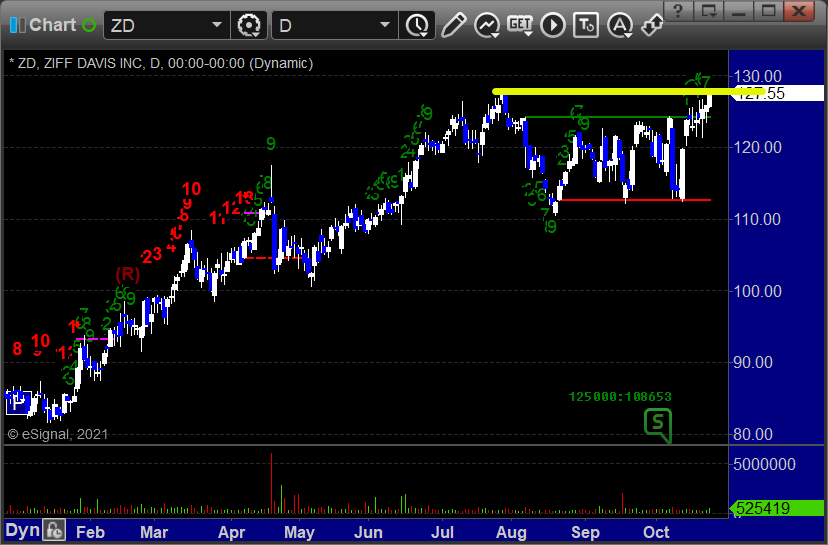

ZD gapped over, no play.

From the Tradesight Plus Twitter feed, no calls

That’s x triggers with market support, x of them worked and x didn’t.

Tradesight Plus Report for 10-26-21

Opening comments posted to YouTube.

Longs first, in order of best chart construction, starting with CERT > 41.79:

FSLR > 112.50:

BRKS > 110.40:

MIME > 71.45:

ZD > 128.08:

LCID > 29.81:

Shorts next, in order of best chart construction, starting with BMRN < 72.77:

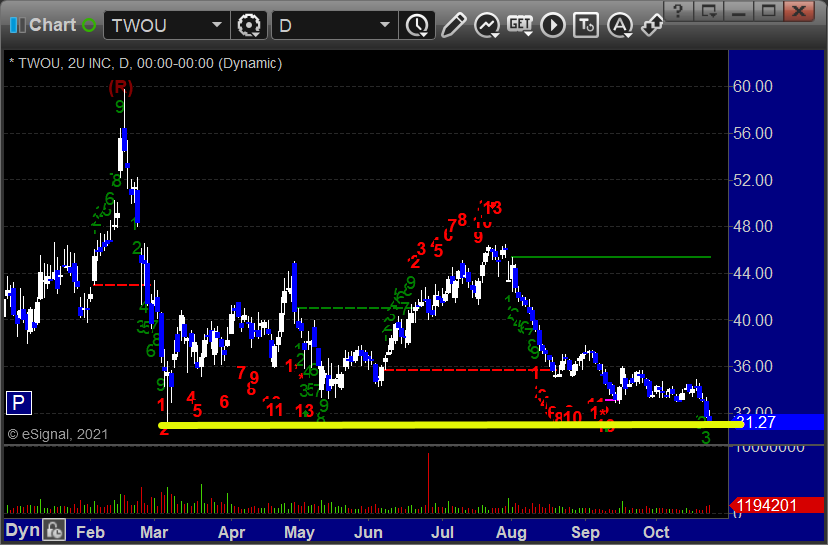

TWOU < 21.12:

That's it.

Tradesight Recap Report for 10/25/21

Overview

Markets gapped up, filled, then went higher until lunch and went flat for the rest of the day on 5.6 billion NASDAQ shares.

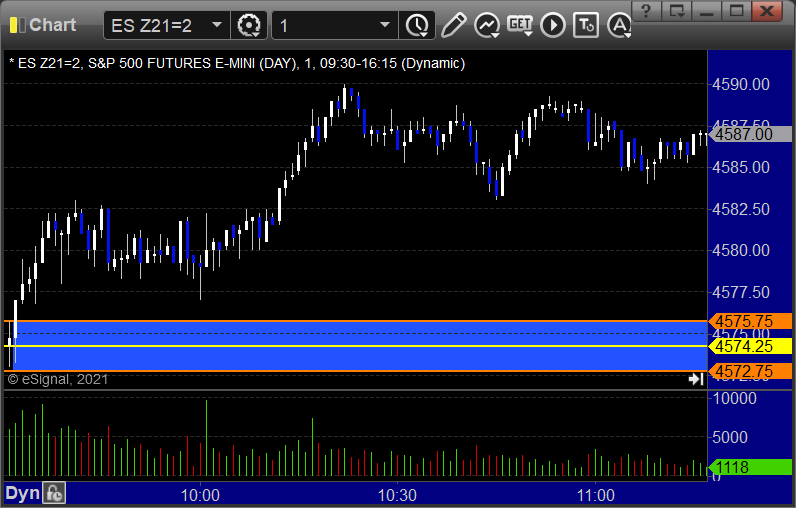

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and worked:

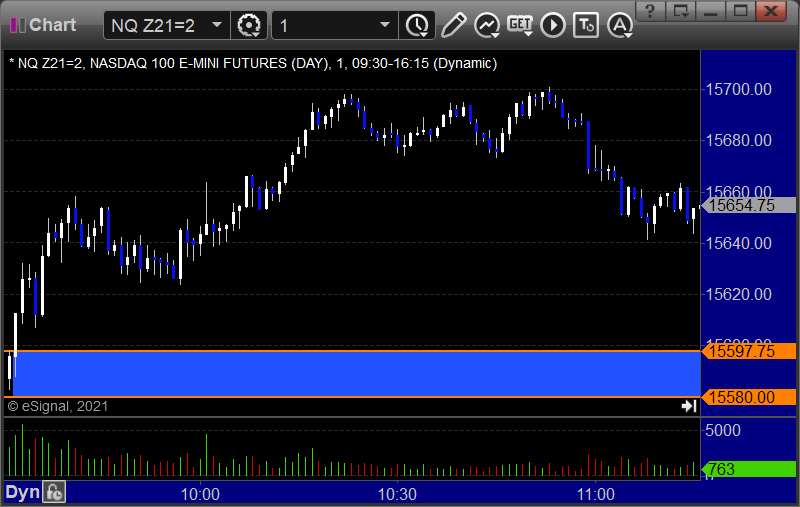

NQ Opening Range Play triggered long at A and short at B, both were two far out of range to take:

Results: +20 ticks

Forex:

GBPUSD, nothing triggered:

Results: pips

Stocks:

Not terrific but OK.

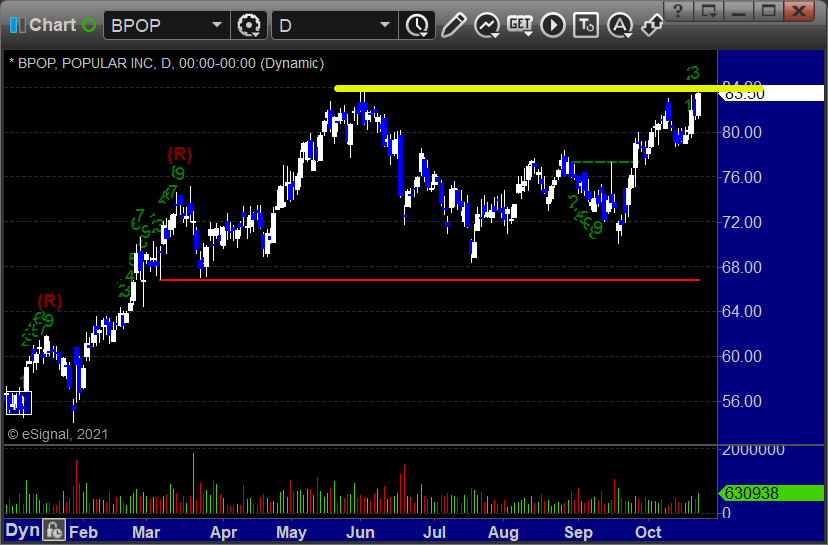

From the Tradesight Plus Report, BPOP gapped over the trigger, so no play.

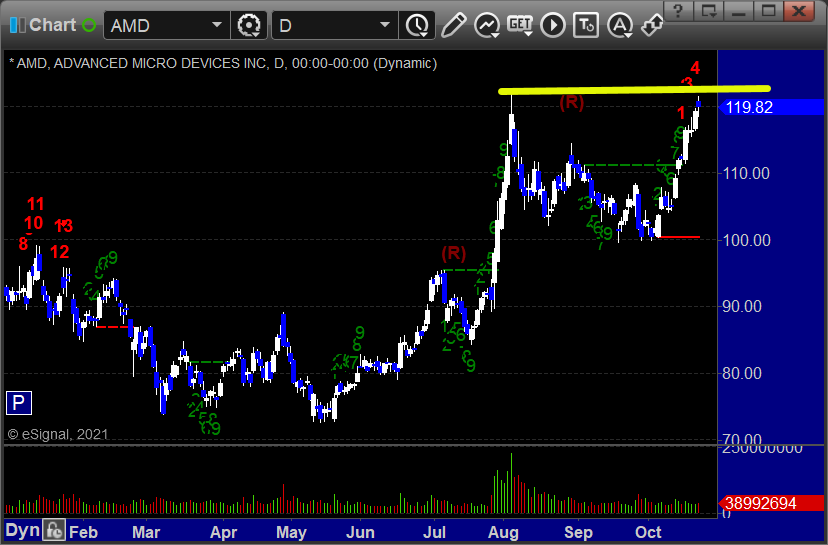

AMD triggered long (with market support) and worked a little:

TWOU triggered short (without market support) and didn't work:

From the Tradesight Plus Twitter feed, nothing triggered.

That’s 1 trigger with market support, and it worked a little.

Tradesight Plus Report for 10-25-21

Opening comments posted to YouTube.

Longs first, in order of best chart construction, starting with BPOP > 83.81:

AMD > 116.26:

BRKS > 110.40:

Shorts next, in order of best chart construction, starting with BMRN < 72.77:

TWOU < 31.21:

That's it.

Tradesight Recap Report for 10/22/21

Overview

The markets gapped down a little, filled and tried higher, sold off on Fed Powell's comments, came back, and then closed negative, although the NASDAQ was worse on 5.7 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered long at A and worked:

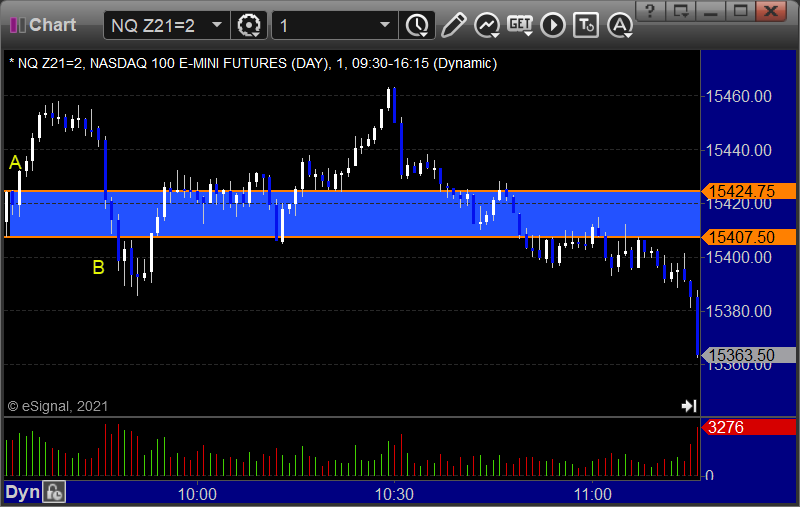

NQ Opening Range Play:

Results: +12 ticks

Forex:

GBPUSD, no calls because the spacing was so bad:

Results: pips

Stocks:

A contained day in the markets. Made money on Futures, but nothing here.

From the Tradesight Plus Report, no calls.

From the Tradesight Plus Twitter feed, nothing triggered.

That’s 0 triggers with market support.

Tradesight Recap Report for 10/21/21

Overview

The markets gapped down a little, filled, tried to go higher, came back to the lows, and went flat until after lunch, when they rallied a bit into the close on 4.6 billion NASDAQ shares.

ES with Levels:

ES with Market Directional:

Futures:

ES Opening Range Play triggered short at A and stopped, triggered long at B and worked:

NQ Opening Range Play triggered long at A but too far out of range to take:

Results: -7.5 ticks

Forex:

GBPUSD, neither trade triggered:

Results: +0 pips

Stocks:

From the Tradesight Plus Report, nothing triggered.

From the Tradesight Plus Twitter feed, UNIT triggered long (with market support) and worked:

CONE triggered long (with market support) and worked:

That’s 2 triggers with market support, both of them worked.