Futures Calls Recap for 10/31/14

I figured it would be a dull day coming in due to the Friday-End of Month-Halloween combo. Unfortunately, we got a huge gap up due to the news out of Japan, and then it was still a flat session. Since there was a big gap and the potential for some energy, I did make one call, but it didn't work. See ES below. NASDAQ volume closed at 2.2 billion shares.

Net ticks: -7 ticks.

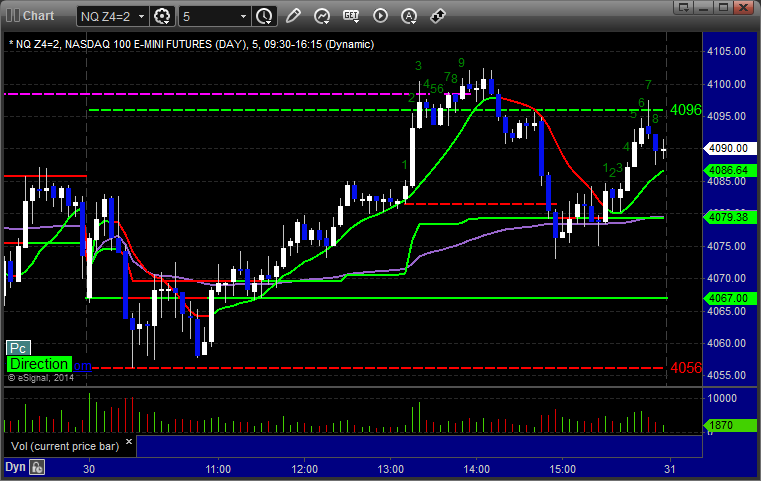

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 2004.25 and stopped:

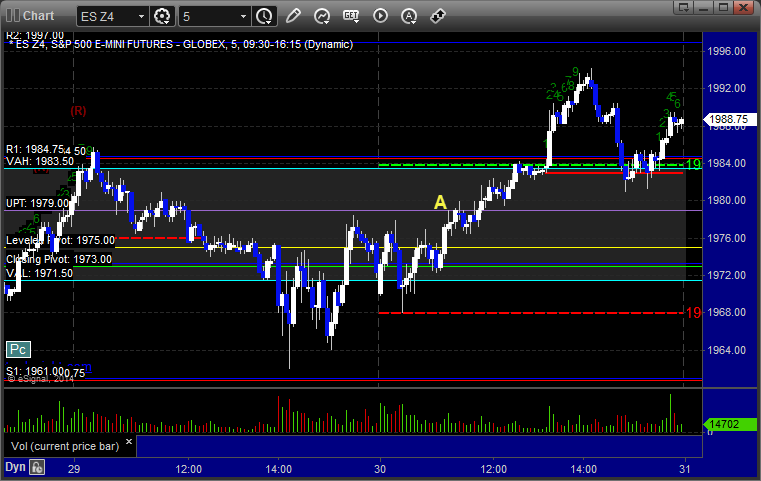

Forex Calls Recap for 10/31/14

A loser to end the week in a narrow session that ended up being focused on the JPY-related stuff because of the Bank of Japan's announcement of a QE program. See GBPUSD section below.

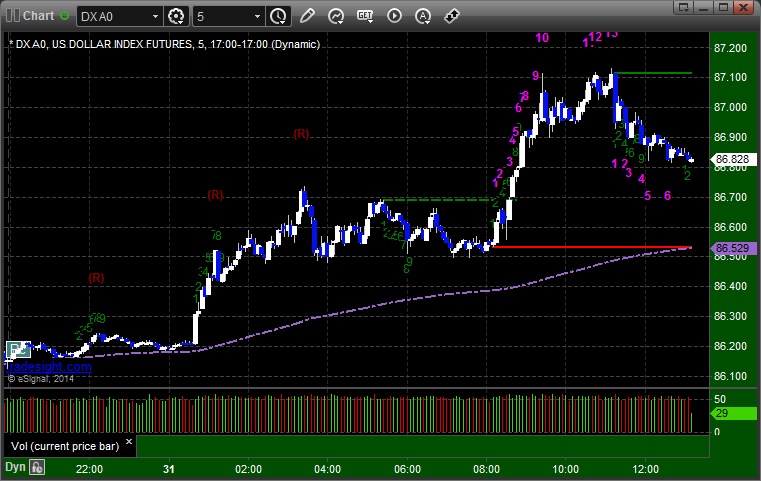

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered short at A and stopped:

Stock Picks Recap for 10/30/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PVTB triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's LOW triggered short (without market support) and worked:

LNKD triggered short (barely without market support) and worked:

Rich's X triggered short (with market support) and worked:

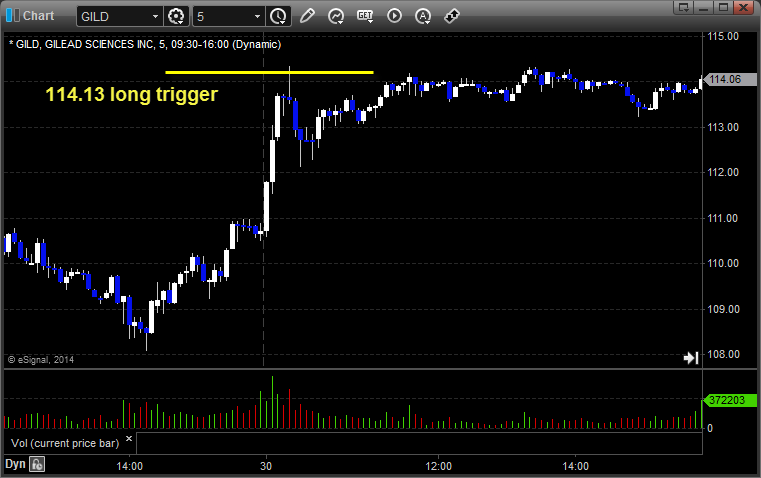

GILD triggered long (with market support) and didn't work:

TSLA triggered short (with market support) and didn't work:

TEVA triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 10/30/14

One loser and a winner on the retrigger in the ES. See that section below. The markets opened close to flat and had a very choppy opening few hours, then drifted up and popped late in the lunch hour before retreating to the VWAP for the close. NASDAQ volume closed at 1.8 billion shares.

Net ticks: +3 ticks.

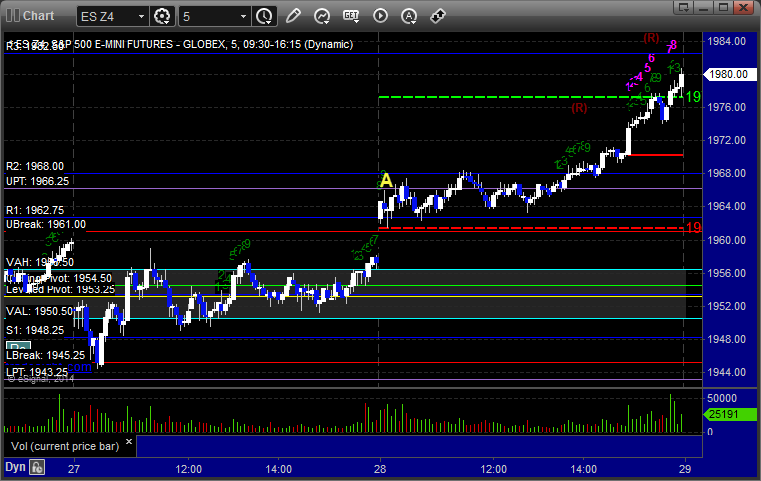

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1979.25 and stopped. Triggered again 20 minutes later, hit first target for 6 ticks, moved stop twice and stopped final piece at 1982.75 for 14 ticks:

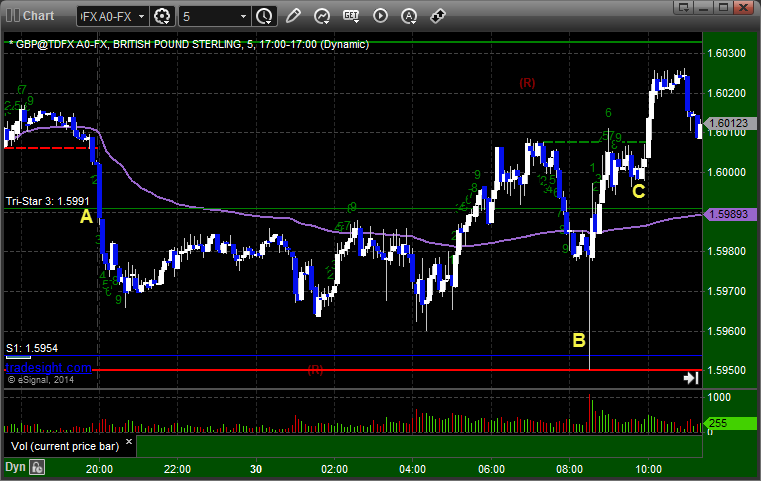

Forex Calls Recap for 10/30/14

Another winner, plus we closed out the second half of the prior day's short for 110 pips. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, closed second half in the morning at C and also closed the second half of the prior day's short for 110 pips:

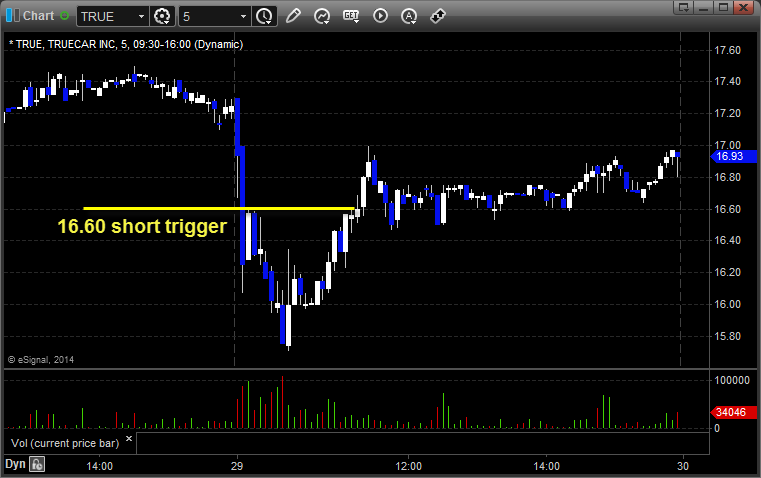

Stock Picks Recap for 10/29/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, COST triggered long (with market support) and didn't work:

TRUE triggered short (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's OII triggered long (with market support) and didn't work:

His FB triggered long (with market support) and worked enough for a partial:

His REGN triggered short (with market support) and didn't work:

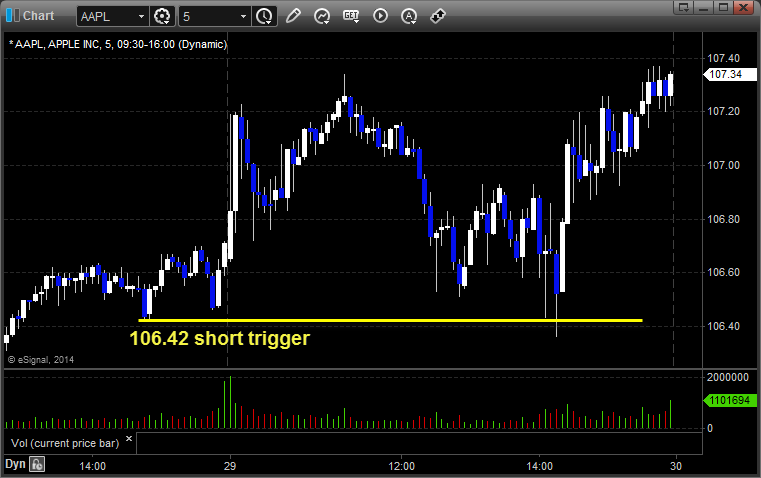

His AAPL triggered short (with market support) and didn't work:

His GLD triggered short (ETF, so no market support needed) and worked:

In total, that's 6 trades triggering with market support, 2 of them worked, 4 did not. Typical Fed meeting day.

Futures Calls Recap for 10/29/14

A slow start to the session as everyone waited for the Fed and then just a choppy mess after. NASDAQ volume closed at 2 billion shares. One winner, see the ER below.

Net ticks: +3.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

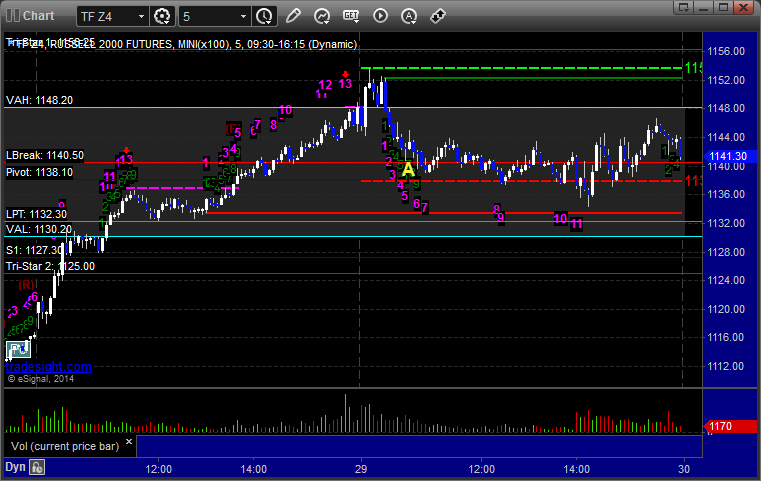

ER:

Triggered short at 1140.40 at A, hit first target for 8 ticks, stopped second half over the entry:

Forex Calls Recap for 10/29/14

We always lower size ahead of the Fed announcement, and here's a great example of why. Three stop outs and then a winner on the announcement. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A and stopped. Triggered short at B and stopped. Triggered long again at C and stopped. Triggered short again at D, hit first target at E, and holding with a stop over S2:

Stock Picks Recap for 10/28/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PCRX triggered long (with market support) and worked:

RGEN triggered long (with market support) and worked:

INCY triggered long (with market support) and worked:

PCYC triggered long (with market support) and worked:

DYAX gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's RGLD triggered long (with market support) and didn't work, worked later:

AMZN triggered long (with market support) and worked:

Rich's HAL triggered long (with market support) and worked enough for a partial:

His TWTR triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 7 of them worked, and 1 did not.

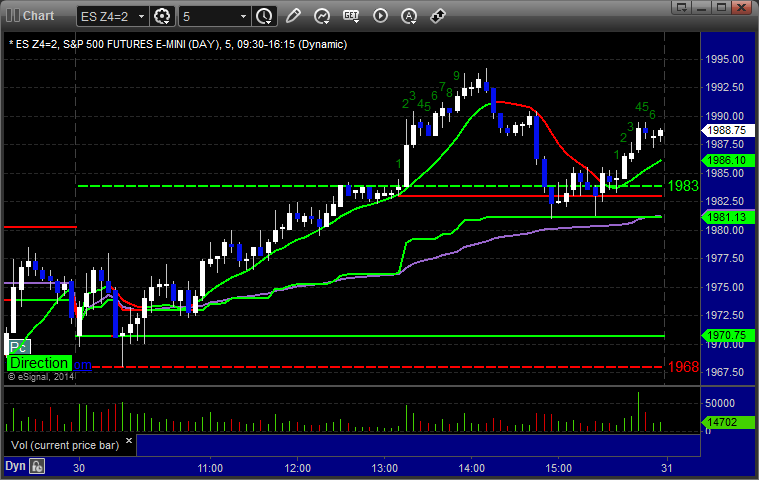

Futures Calls Recap for 10/28/14

A bad two days as the opening 90 minutes have been so slow. The volume was improved Tuesday, but the markets gapped up and were very choppy from a futures perspective early. Got stopped out of an ES trade twice and called it a day. NASDAQ volume closed at 1.7 billion shares.

Net ticks: -14 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1960.75 and stopped. Triggered again a few minutes later and stopped: