Forex Calls Recap for 10/13/14

No calls for the US bank holiday, and a narrow 50 pip range overnight as expected. On to normal later today.

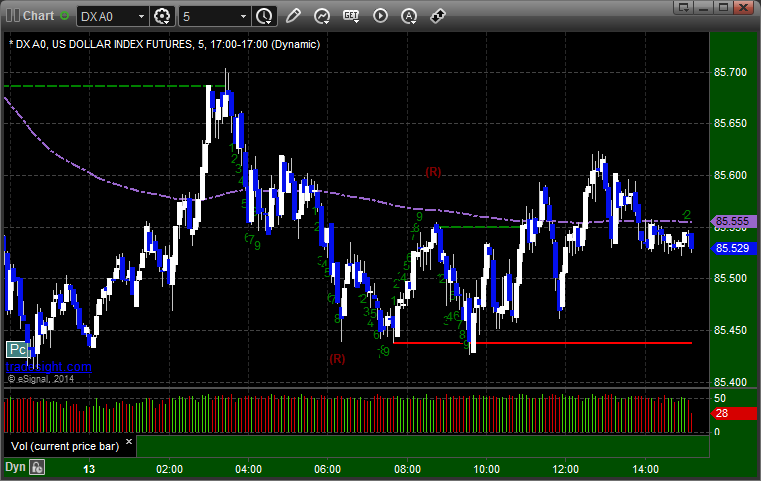

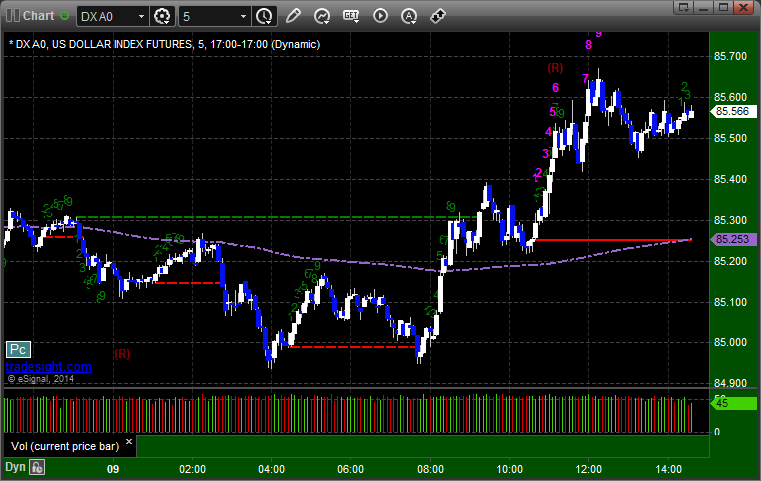

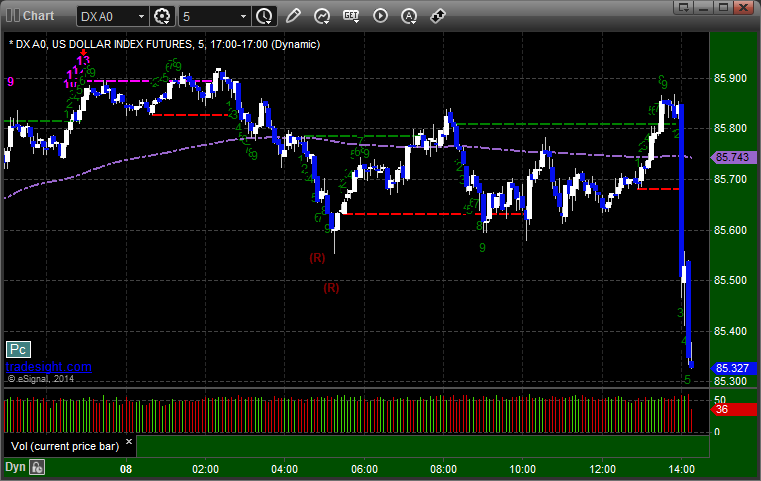

Here's a look at the US Dollar Index intraday with our market directional lines:

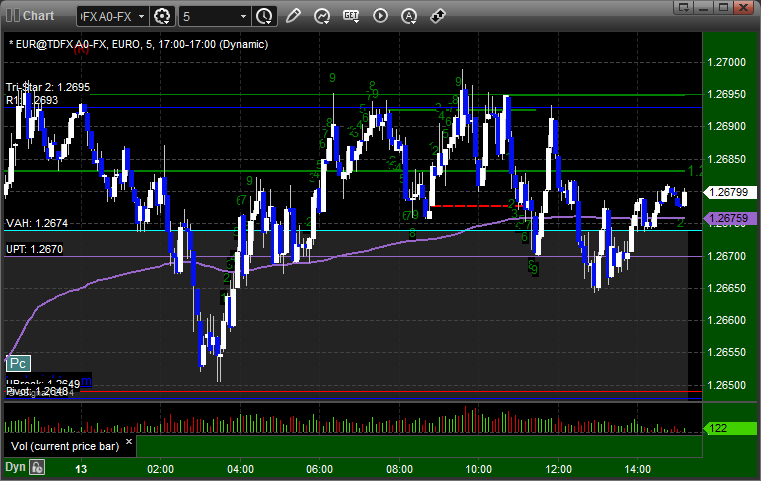

EURUSD:

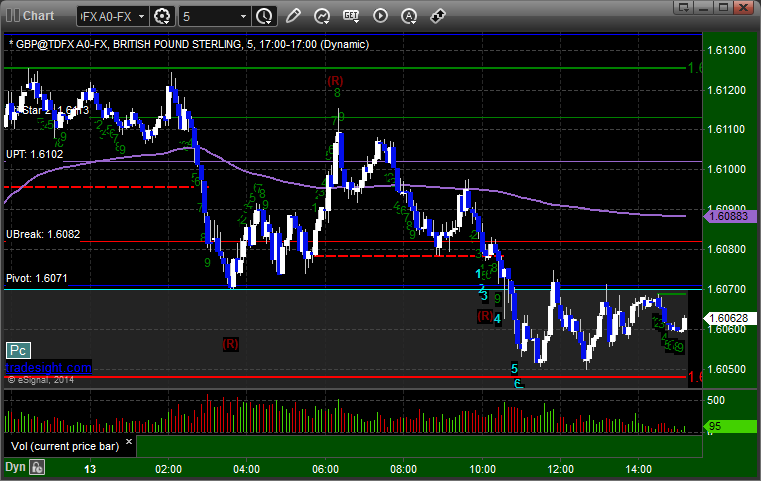

GBPUSD:

Interesting use of the Value Area:

Stock Picks Recap for 10/10/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CBOE triggered long (with market support) and worked enough for a partial and we closed the rest in the money in the Twitter feed/Messenger):

NLNK triggered short (without market support due to opening 5 minutes) and worked enough for a partial, but you had to be fast and the market gapped down big:

AMCX triggered short (with market support) and worked:

MENT triggered short (without market support in the 15 minutes of the day that direction was green) and worked:

RMBS triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, GS triggered short (without market support due to opening 5 minutes) and didn't work:

FEYE triggered short (with market support) and worked:

IACI triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, all 5 of them worked.

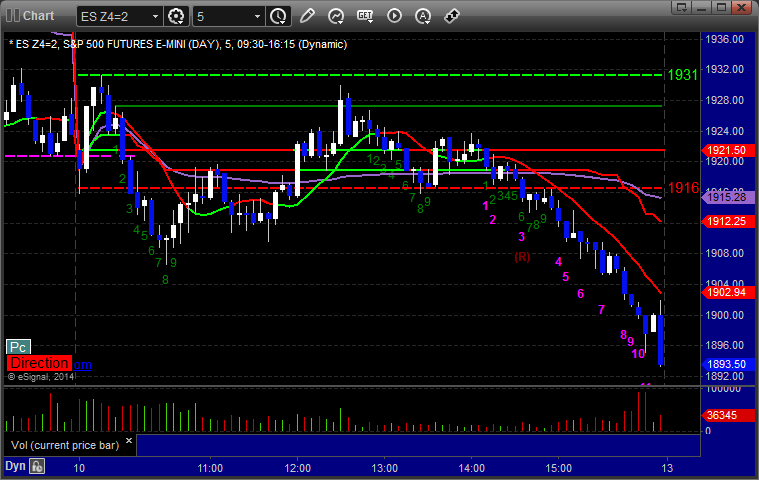

Futures Calls Recap for 10/10/14

A nice day in the markets. We got a big gap down after the global markets sold off, and we started to head lower for about 4 minutes, then reversed sharply, with the NASDAQ side recovering over 30 points in ten minutes or so. Then we rolled again and made new lows and really broke down, which was where the fun began. We then drifted over lunch and rolled again to the downside for another sell off as we expected in the Lab. Final NASDAQ volume was a solid 2.5 billion shares.

Net ticks: +26 ticks.

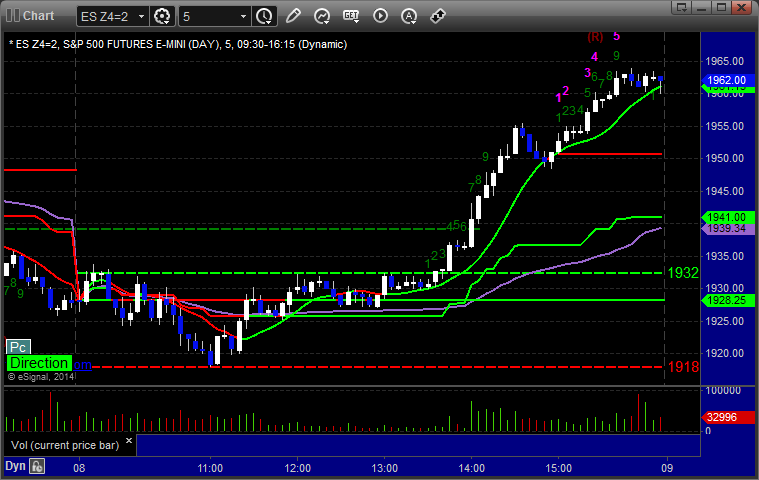

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3922.50, hit first target for 6 ticks and kept going. Lowered the stop several times and stopped final piece well in the money at 3989.50 for 46 ticks:

Forex Calls Recap for 10/10/14

Part of (but not all of) our EURUSD long triggered and stopped under our order staggering rules. The short triggered and worked fine to close out the week. See those sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

One out of three pieces of the EURUSD long triggered at A (under our order staggering rules) and stopped. The short triggered at B, hit first target at C, and closed the final half at D for end of week:

Stock Picks Recap for 10/9/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, COST triggered long (without market support) and worked:

AMGN triggered short (with market support) and didn't work, although it worked well later:

TSLA triggered long (without market support) and worked:

WYNN triggered short (with market support) and worked enough for a partial:

In total, that's only 2 trades triggering with market support, 1 of them worked, 1 did not. Ironically, the two without market support worked.

Futures Calls Recap for 10/9/14

A small winner on the NQ. The markets gapped down a little early, and the NQ filled, but the ES didn't. We got a volume warning after an hour and things were pretty choppy, but then sold off over lunch, giving back the whole rally from the prior day after the Fed minutes. NASDAQ volume closed at 2.0 billion shares, holding up all day despite the slow start.

Net ticks: +2.5 ticks.

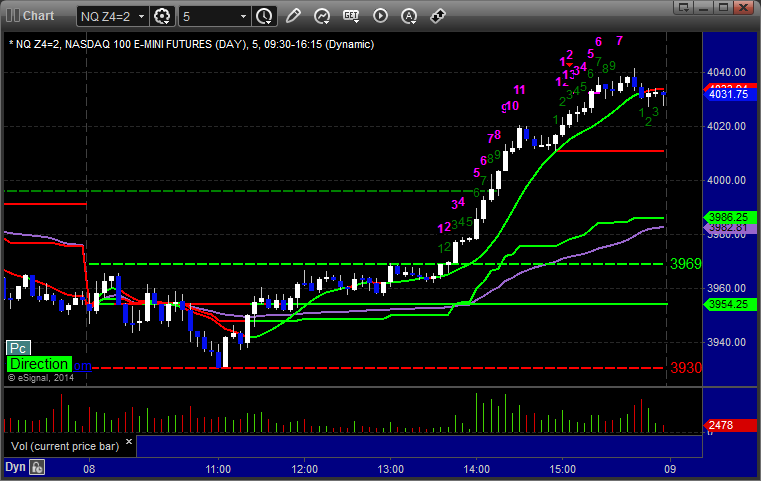

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 4008.50, hit first target for 6 ticks, and stopped second half over the entry. It did trigger again later and worked much better:

Forex Calls Recap for 10/9/14

A loser and a small winner but we are seeing better ranges again here. See the EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped. Triggered short at B, never quite hit first target, and closed at C for end of day in the money:

Stock Picks Recap for 10/8/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LPSN triggered long (without market support due to opening 5 minutes) and didn't work, but it triggered later in the day after filling the gap with market support and worked fine, but we don't count retriggers officially:

FSLR triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

ARCP triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, TSLA triggered long (with market support) and didn't work:

GOOG triggered short (with market support) and worked:

No calls in the afternoon because Rich was out for a personal matter and I was driving home to Phoenix.

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

Futures Calls Recap for 10/8/14

It started out boring, but the Fed minutes got things moving in the afternoon. Two calls for the session, a winner and a loser in the NQ. See that section below.

Net ticks: +12 ticks.

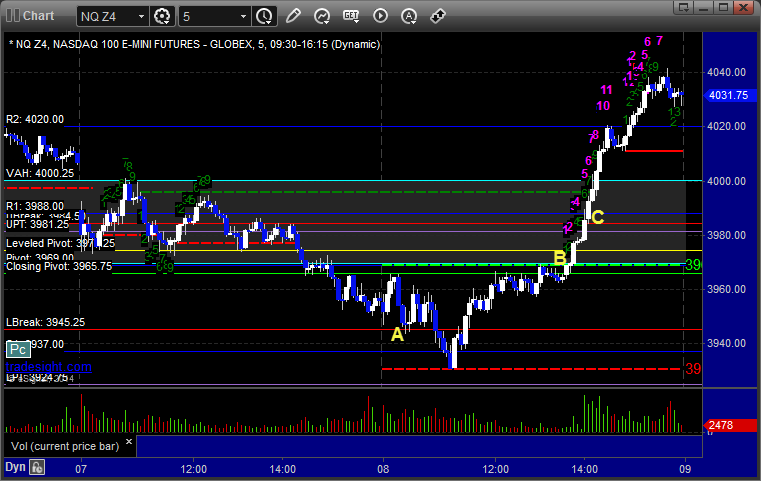

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3945.00 and stopped. I did not re-enter but it would have worked the second time. Triggered long at B at 3969.50 from my call. Mark adjusted the stop a couple of times and stopped the final piece at 3985.00:

Forex Calls Recap for 10/8/14

A loser and a flat trade for the session. See the GBPUSD below. I will be home this evening to resume regular stuff.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered short again at B, didn't do anything, closed at C even because I had to hit the road back to Phoenix. It ended up hitting first target at D before reversing hard on the Fed minutes: